Overview

Conducting a title search for liens is essential for property buyers to identify any existing claims that could affect ownership and financial responsibilities. This article outlines a systematic approach to performing this search, emphasizing the importance of thorough investigations into public records.

Understanding various types of liens is crucial, as is consulting professionals to ensure a clear title and safeguard against potential financial surprises.

Introduction

In the intricate world of real estate transactions, the significance of a title search cannot be overstated. This meticulous process serves as the backbone of property ownership, ensuring that buyers are well-informed about any claims or liens that may encumber a property. Furthermore, as the landscape of real estate evolves, understanding the nuances of title searches and the various types of liens is essential for safeguarding investments and facilitating smooth transactions. With the stakes high and potential pitfalls lurking, a thorough exploration of how to navigate these complexities becomes imperative for both buyers and real estate professionals alike.

Understanding Title Searches: The Foundation of Real Estate Transactions

An ownership review constitutes a thorough investigation of public records, encompassing a title search for liens to ascertain the legal possession of an asset and reveal any claims that may exist. This process is critical in real estate transactions, as it confirms that the seller possesses the right to sell the asset and informs the buyer of potential issues that could impact ownership. Document reviews typically involve a comprehensive examination of records such as deeds, mortgages, and tax documents, conducted by firms or real estate attorneys.

Mastering the ownership verification process is essential for safeguarding investments and ensuring seamless transactions.

Key Components of an Ownership Verification:

- Public Records: Ownership verifications fundamentally rely on public records, which contain vital information regarding ownership, existing liens, and any legal claims against the asset. The significance of these records cannot be overstated, as they form the bedrock of the ownership examination process.

- Chain of Title: This aspect pertains to the historical sequence of ownership of the estate. A clear and unbroken chain of ownership is imperative for a successful transaction; any gaps or discrepancies can lead to disputes or complications.

- Encumbrances: Identifying and resolving any encumbrances—claims against the property such as mortgages or liens—necessitates a title search for liens, which is crucial before a sale can proceed. Failing to address these concerns may expose the purchaser to financial risks.

Recent data indicates that a substantial proportion of real estate transactions involve ownership examinations, underscoring their importance in the sector. For instance, the American Land Insurance Association (ALTA) has highlighted that home buyers and regulators are increasingly scrutinizing the value and cost of insurance, particularly as providers report fewer claims compared to other insurance sectors. This trend emphasizes the necessity for thorough document reviews to mitigate risks associated with property ownership.

Additionally, expedited processing can streamline the real estate transaction process, enhancing efficiency and reducing delays.

Case studies illustrate the tangible effects of efficient property searches. For example, when providing an insurance policy for property, professionals conduct a title search for liens and diligently work to eliminate existing 'clouds'—such as judgments and easements—to minimize financial risks. If significant clouds are identified, real estate firms proactively inform prospective buyers, ensuring they are aware of potential risks before proceeding with the transaction.

This proactive approach is vital, especially considering that, according to the Federal Reserve, in 2022, 66.1% of households owned their primary residence, highlighting the significance of ownership in the examination process. Expert insights further underscore the critical role of examinations in real estate transactions. Real estate attorneys frequently assert that a title search for liens is essential in verifying property ownership and uncovering potential issues that could impact a buyer's investment.

By grasping these fundamental elements, real estate professionals can navigate the complexities of ownership investigations more effectively, ultimately leading to more secure and successful transactions. Furthermore, user activity data aids in refining products and services, indicating how title search processes are evolving and improving through technology.

Types of Liens: What You Need to Know Before Starting Your Search

Liens represent essential legal claims that can profoundly influence real estate ownership, categorized into various types, each carrying distinct implications. Understanding these categories is crucial for any stakeholder in the real estate market.

- Mortgage Claims: These voluntary claims arise when lenders provide mortgages for asset acquisition. They safeguard the lender's investment, permitting foreclosure if the borrower defaults. In 2025, it is projected that approximately 60% of assets will feature mortgage claims, underscoring their prevalence in real estate transactions. Such claims affect the asset's title and complicate the selling process, highlighting the importance of understanding these encumbrances.

- Tax Claims: These claims are enforced by governmental authorities when real estate taxes are overdue. If unresolved, they can lead to foreclosure, and they typically hold the highest priority during sales. Therefore, it is vital for potential buyers to be aware of any existing tax obligations.

- Judgment Claims: Arising from court decisions against property owners, these claims allow creditors to seize assets to satisfy unpaid debts. Understanding the implications of judgment claims is essential, as they can complicate ownership and transfer processes.

- Mechanic's Claims: Filed by contractors or suppliers who have not received payment for their services, mechanic's claims can pose significant challenges in real estate transactions if not resolved before closing. This emphasizes the necessity of ensuring all contractor obligations are fulfilled prior to finalizing a sale.

- Homeowners' Association (HOA) Claims: Imposed by homeowners' associations for unpaid fees, these claims can restrict real estate sales until the fees are settled. With the increasing number of properties managed by HOAs, awareness of these claims is crucial for prospective buyers.

Understanding these various types of claims is vital for conducting a thorough title search. A comprehensive title search for liens guarantees that potential buyers are fully informed of any encumbrances that may impact their investment, ultimately facilitating more informed decisions and smoother transactions. For example, a case study on the priority of claims illustrates that tax obligations generally take precedence over mortgage claims, reinforcing the necessity for real estate professionals to carefully evaluate the risks associated with different claims.

This understanding is imperative, as claims signify a legal entitlement to seize and sell assets if agreements are not honored.

Why Conducting a Lien Search is Crucial for Property Buyers

Carrying out a claim search is an essential step for real estate purchasers for several compelling reasons.

Preventing Financial Surprises: Unidentified claims can lead to unforeseen financial responsibilities, as purchasers may take on debts linked to the property. This includes unpaid taxes, contractor fees, or other obligations that must be settled prior to ownership transfer. Statistics indicate that a significant portion of purchasers—up to 30%—encounter issues due to unresolved claims, underscoring the necessity of comprehensive searches. Ensuring a clear title involves conducting a title search for liens, which is crucial for verifying that the title is free of encumbrances and vital for a seamless transaction. Discovering a claim after purchase can complicate ownership and may even lead to foreclosure, resulting in legal challenges for the new owner. Notably, national banks are prohibited from purchasing a delinquent taxpayer's property according to 12 USC 29, emphasizing the legal ramifications of unresolved liens.

Protecting Investment: Identifying current claims enables buyers to negotiate with sellers to address these issues before finalizing, thereby safeguarding their investment. Financial consultants emphasize that failing to understand retrieval logic may result in overlooking concealed claims, which can have severe financial repercussions. As Daniel Lias, a Transactional Business Consultant, asserts, comprehending inquiry logic is essential to avoid these pitfalls.

Legal Compliance: Many lenders require a claim investigation as part of the mortgage approval process, making it a critical step for securing financing. This requirement not only protects the lender's interests but also ensures that buyers are fully informed about the asset they are acquiring.

In 2025, the importance of conducting search inquiries cannot be overstated. They serve as a vital safeguard against potential legal and financial troubles, allowing buyers to proceed with confidence in their property transactions. Case studies have shown that banks have increasingly recognized the value of tax certificate assets, further highlighting the financial risks associated with undisclosed claims.

The Office of the Comptroller of the Currency (OCC) has updated its position, permitting national banks to obtain tax certificates under specific conditions, which reflects the evolving practices in the sector. By emphasizing a title search for liens, purchasers can avoid the pitfalls of financial surprises and ensure a smoother path to homeownership.

Step-by-Step Guide to Conducting a Title Search for Liens

Conducting a title search for liens is a crucial procedure that encompasses several key steps to ensure a clear ownership record. This guide will assist you in navigating this important task effectively:

- Gather Property Information

Begin by collecting vital details about the property, such as the address, parcel number, and the names of both current and previous owners. Understanding a real estate’s ownership pertains to the rights of the possessor rather than simply a document like the deed, which is essential for precise inquiries. As Megan Hernandez, director of marketing and public relations at the American Land Title Association, states, "A title is the term used to describe the rights of the owner." - Identify the Relevant Jurisdiction

Determine the specific county or municipality where the property is located. This step is essential, as it dictates where you will need to search for public records, which can vary significantly by location. - Access Public Records

Visit the local county recorder's office or their official website to access property records. Search for essential documents associated with the asset, including deeds, mortgages, and any recorded claims. Utilizing online public records databases can significantly enhance the efficiency of your search, as newer homes typically have a shorter paper trail, resulting in quicker title searches. - Search for Liens

Focus specifically on identifying any liens filed against the property. This encompasses tax claims, judgment claims, and mechanic's claims. The aim of a document examination is to uncover any issues related to the ownership of a property, which may involve a title search for liens to identify these kinds of claims. Ensure you check both current and historical records to uncover any potential issues, as highlighted in the case study titled "Common Title Issues." - Review the Chain of Title

Examine the chain of title meticulously to ensure there are no gaps or discrepancies in ownership. This review is vital for identifying any potential issues that could arise from previous owners, complicating the transaction. - Document Findings

Maintain detailed notes of any liens or encumbrances discovered during your search. This documentation is crucial for negotiations and for resolving any issues before closing the transaction. - Consult Professionals

If any liens are identified, it is advisable to consult with a title company or a real estate attorney. Homebuyers can request sellers to address ownership issues, provide compensation for resolving them, or withdraw from the agreement with a refund of the deposit. Their expertise will assist you in grasping the consequences of the claims and deciding the optimal path for resolution.

By adhering to these steps, you can efficiently perform a record investigation for claims, guaranteeing that your real estate transaction advances seamlessly and without unforeseen issues. A comprehensive examination of the property not only safeguards your investment but also enhances the overall effectiveness of the real estate process.

Tools and Resources for Effective Lien Searches

To perform efficient encumbrance investigations, a range of tools and resources is vital.

- Online Public Records Databases: Numerous counties now offer online access to property records, enabling users to conveniently look up liens and other encumbrances from their homes. This accessibility not only conserves time but also enhances the precision of the information obtained.

- Document Examination Software: In 2025, a variety of advanced software solutions exist that automate the document examination process. These tools significantly enhance the recognition of claims, thereby minimizing the time required to finalize inquiries. Parse AI provides cutting-edge machine learning tools that expedite document processing and interpretation, allowing researchers to extract essential information from ownership documents more efficiently. Notably, Parse AI's example manager enables users to quickly annotate documents, further improving the extraction process. Popular options include platforms that integrate machine learning to enhance accuracy and efficiency. For instance, Actovia's pricing ranges from $319 to $389 per user per month, reflecting the investment in technology that can bolster lien inquiry capabilities. While specific pricing for Parse AI is not disclosed, its advanced features deliver considerable value in the market.

- Professional Companies: Engaging a professional company can provide expertise and resources that individual buyers may lack. These firms conduct comprehensive investigations and offer insurance for ownership, safeguarding against unexpected issues. Statistics indicate that a title search for liens using professional title services can lead to a 30% reduction in the time spent on claims investigations, underscoring their importance in the process.

- Legal Assistance: Seeking guidance from a real estate lawyer is crucial, particularly in complex claim scenarios or disputes. Their expertise can assist in navigating legal intricacies and ensuring compliance with local laws.

- Educational Resources: Websites, webinars, and workshops focused on real estate transactions offer valuable information and best practices for conducting property investigations. These resources can deepen understanding and refine inquiry techniques.

- Technology in Real Estate: According to Matterport, a prominent 3D data platform, properties with 3D tours sell up to 31% faster and at higher prices. This highlights the significance of utilizing advanced tools and technologies in property investigations and real estate dealings. Parse AI's platform also enhances courthouse document processing with features like full-text indexing and machine learning extraction, streamlining runsheet creation for title researchers involved in lien searches.

- Cloud Solutions: Furthermore, cloud solutions provide scalability for storage capacity and improve data management efficiency with enhanced security standards, making them an essential component of modern claim investigation processes.

By leveraging these tools and resources, including the advanced capabilities of Parse AI, real estate professionals can significantly enhance the efficiency and effectiveness of their claim investigation efforts, ultimately leading to more informed decision-making and improved outcomes in real estate transactions.

Navigating Challenges: Common Pitfalls in Lien Searches and How to Avoid Them

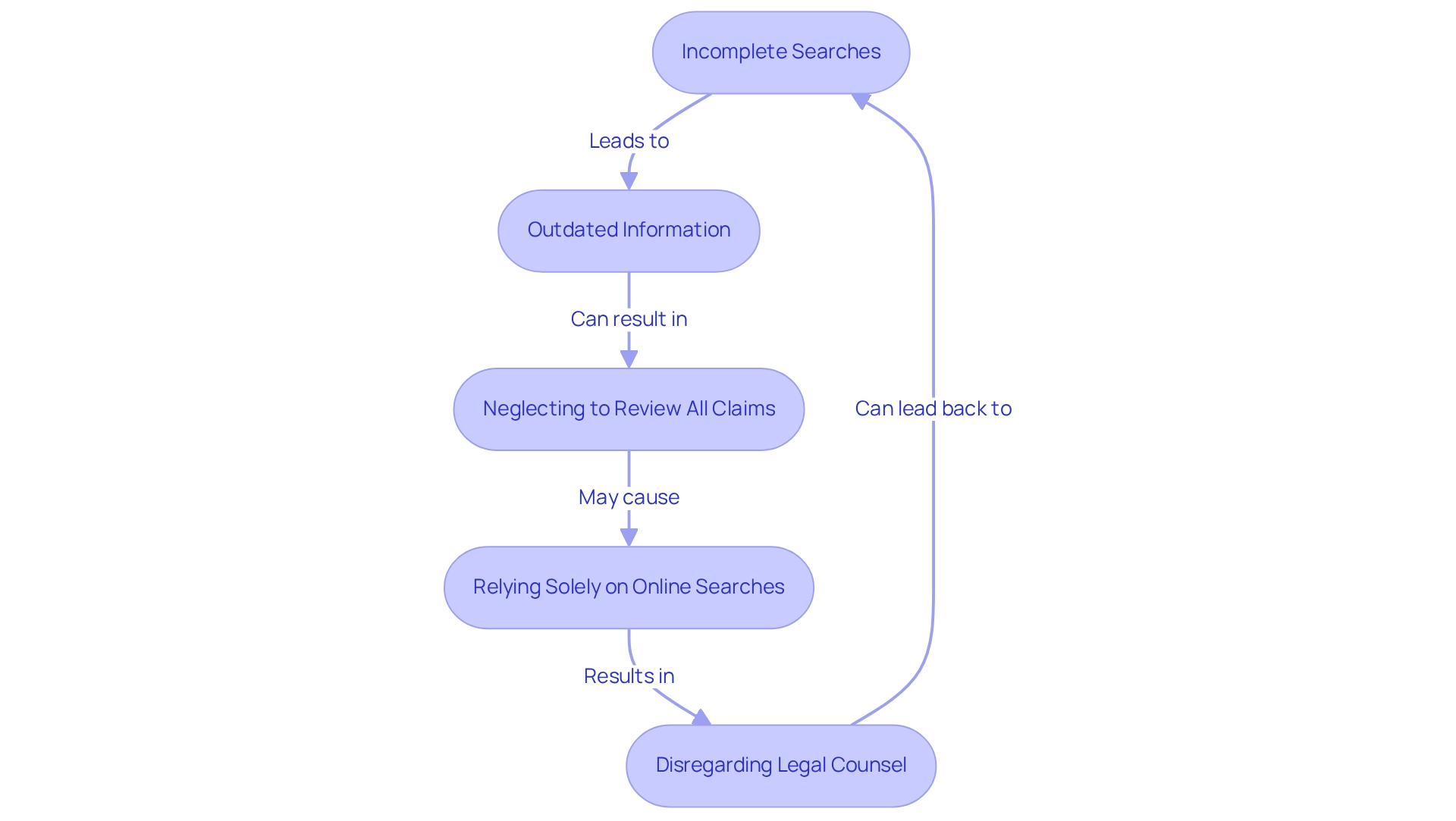

When conducting encumbrance investigations, several common mistakes can significantly impact the outcomes of asset transactions:

- Incomplete Searches: One of the most critical errors is failing to check all relevant jurisdictions. Omissions of claims can occur if inquiries are limited to a single county or area. It is essential to conduct investigations in every county where the property is located to ensure that no claims are overlooked.

- Outdated Information: Public records may lag in updates, leading to reliance on outdated data. Always verify the date of the records you are examining and consider performing follow-up searches closer to the transaction date to capture any recent changes.

- Neglecting to Review All Claims: Buyers frequently overlook specific types of claims, such as municipal assessments or homeowners association (HOA) charges. Understanding the full spectrum of potential claims regarding the asset is vital to avoid unforeseen liabilities. For instance, tax claims enforced by the government when property owners fail to pay taxes can take precedence over other demands, making thorough investigations essential during due diligence to avert unexpected obligations in property transactions.

- Relying Solely on Online Searches: While online databases offer valuable information, they may not encompass all necessary details. For a more comprehensive search, visiting local offices can uncover additional claims that online resources might miss.

- Disregarding Legal Counsel: Navigating encumbrance issues without expert assistance can lead to costly errors. Engaging a title company or attorney can provide crucial insights and help address complex claim situations effectively. As Daniel W. Lias, a Transactional Business Consultant, emphasizes, expert advice is indispensable in managing these complexities.

Statistics indicate that a significant number of purchasers overlook encumbrances due to inadequate inquiries, underscoring the need for thorough due diligence. For example, a recent study revealed that nearly 30% of property transactions encountered issues stemming from missed claims, resulting in unforeseen financial burdens for buyers. Additionally, in California, there exists a 45-day notice regulation for judgment encumbrances, highlighting the legal framework surrounding these matters.

By recognizing these challenges and implementing proactive measures to mitigate them, you can ensure a more comprehensive and effective inquiry, ultimately safeguarding your interests in real estate transactions. Utilizing tools like Parse AI can yield substantial cost savings compared to traditional title research methods, enhancing both efficiency and accuracy in your workflows.

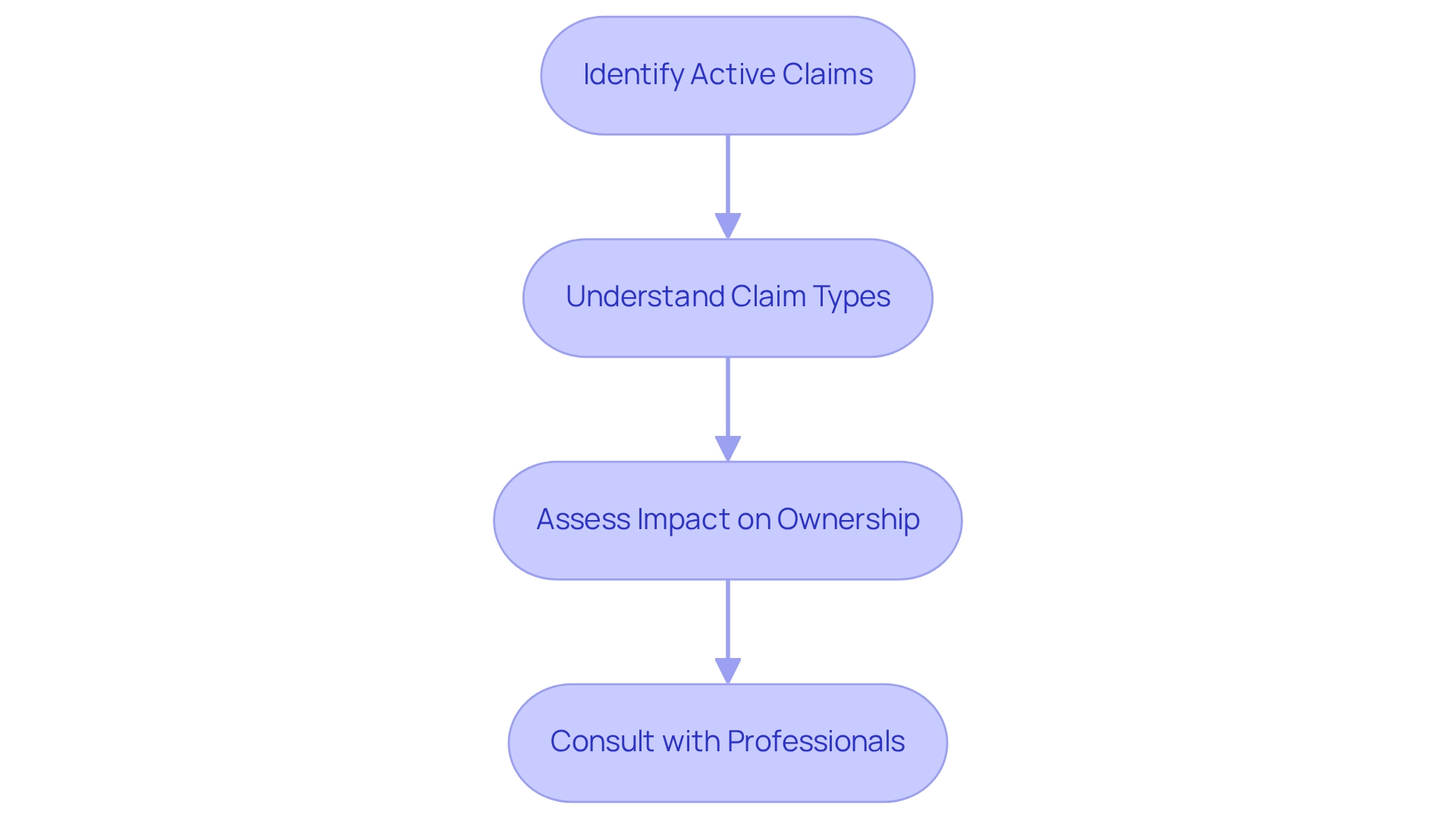

Interpreting Lien Search Results: Key Insights for Real Estate Professionals

Interpreting search results requires a meticulous approach, as each finding carries significant implications for real estate transactions.

Identifying Active Claims: It is crucial to ascertain which claims are currently active and their respective priority. The ranking of claims establishes the sequence of repayment during the sale of the property, which can greatly affect the transaction process. If several claims exist, grasping their priority can assist in planning how to tackle them efficiently.

Understanding Claim Types: Various claim types come with unique implications. A mortgage claim, for instance, is usually settled through the sale proceeds, while a tax obligation may require payment before the sale can continue. As of 2025, statistics indicate that mortgage encumbrances remain the most common, followed closely by tax encumbrances. This underscores the importance of recognizing these distinctions in searches. Based on the UCC Hub webinar regarding the enhancement of UCC workflow as of April 01, 2025, comprehending these claims is crucial for effective transaction management.

Assessing the Impact on Ownership: The influence of each claim on the purchaser's capacity to obtain a clear title to the property must be thoroughly examined. Certain claims may necessitate resolution before closing, while others could be open to negotiation. This evaluation is essential, as conducting a title search for liens can help prevent unresolved claims that complicate ownership transfer and lead to possible legal disputes. When acquiring a mortgage or home equity loan, the borrower consents to use their residence as security, leading to a claim established by the lender that is lifted only when the mortgage is completely settled. This emphasizes the significance of addressing such claims prior to finalizing a transaction.

Consulting with Professionals: In situations where claim outcomes are intricate or unclear, obtaining advice from a title company or legal specialist about a title search for liens can offer vital clarity. Experts can provide perspectives on the consequences of different claims and suggest suitable subsequent actions to reduce risks.

By precisely analyzing claim investigation outcomes, real estate specialists can furnish their clients with knowledgeable guidance, allowing them to address possible challenges in advance. This proactive strategy is crucial in ensuring smooth transactions and protecting ownership rights.

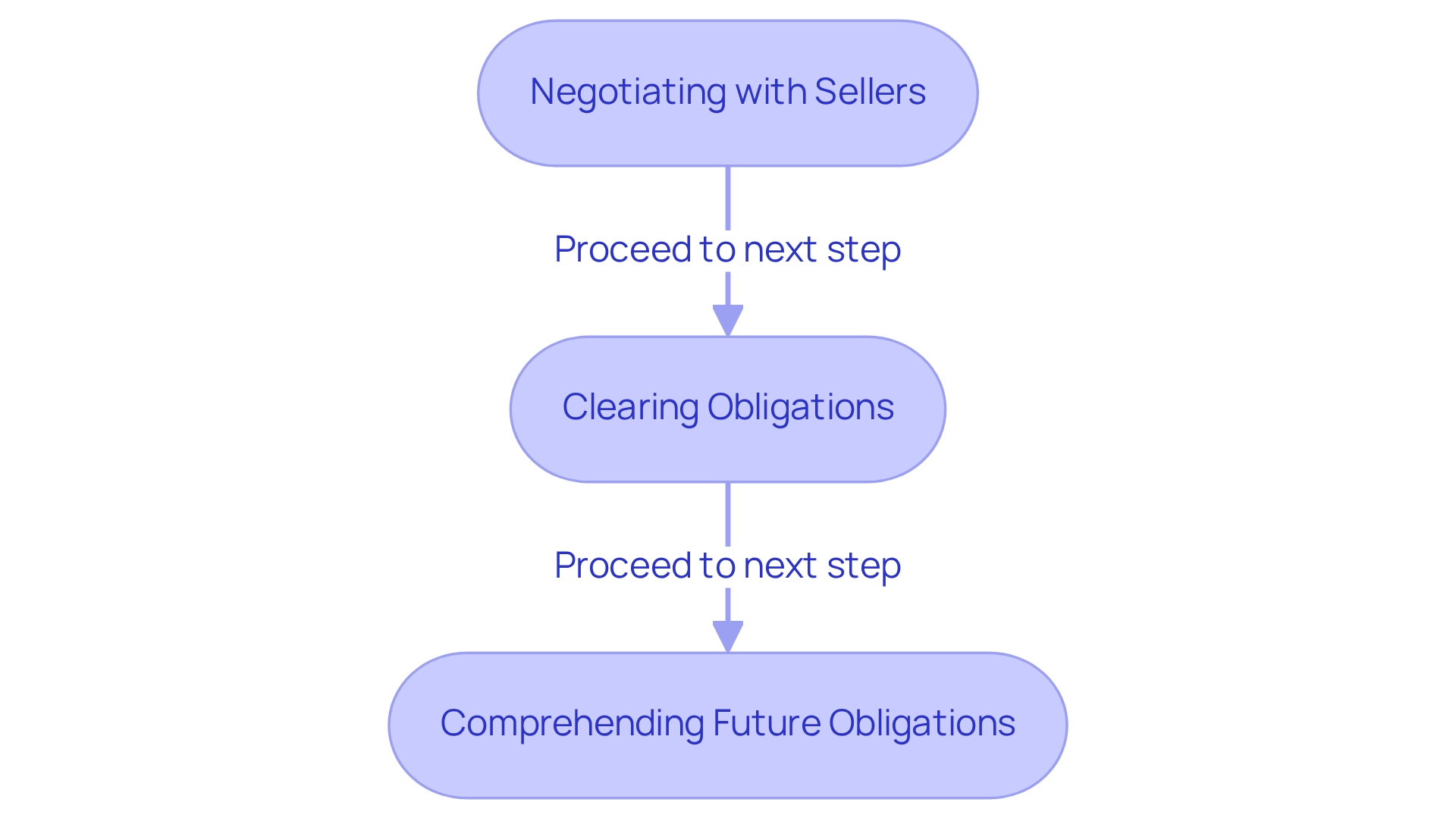

After the Search: Understanding the Implications of Liens on Property Ownership

After performing a claim search, it is essential to understand the consequences of any claims found.

Negotiating with Sellers: When claims are identified, buyers frequently recognize the importance of engaging in discussions with sellers to resolve these matters prior to closing. This negotiation may involve the seller agreeing to pay off the claim or adjusting the sale price to reflect the claim's impact on the property's value. Effective negotiation strategies, bolstered by emotional intelligence and an understanding of individual differences, can significantly influence the outcome of these discussions. Notably, research indicates that expressing pride can negatively affect negotiation performance, underscoring the importance of emotional awareness in these interactions. As William J. Becker points out, their research is distinctive as it examines theories in both simulated and real environments, offering valuable insights into negotiation dynamics.

Clearing Obligations: It is essential for buyers to confirm that any active obligations are resolved prior to concluding the transaction. This process generally involves collaboration with title firms or legal experts who can assist in clearing encumbrances, ensuring a seamless transfer of ownership. Furthermore, the influence of favorable characteristics, such as self-efficacy, has been demonstrated to forecast negotiation success, highlighting the significance of mindset in these conversations.

Comprehending Future Obligations: Buyers must remain vigilant, as some claims may not be promptly settled and could result in future obligations. A comprehensive understanding of the terms and conditions related to any existing claims is crucial to prevent unforeseen financial obligations following the acquisition. The principles of justice in negotiation, as reviewed by Daniel Druckman and Lynn M. Wagner, can also provide valuable insights into how fairness and equity influence these discussions, especially when conducting a title search for liens to safeguard against any undiscovered claims that may surface post-purchase. This insurance serves as a protective measure, offering peace of mind and financial security in the event of unforeseen issues.

By comprehensively understanding these implications, buyers can make informed decisions and take proactive steps to protect their investment in the property.

Conclusion

Navigating the complexities of title searches and liens is essential for anyone involved in real estate transactions. A comprehensive understanding of the title search process not only ensures that buyers are informed about the legal ownership of a property but also underscores the importance of identifying any existing claims or liens that could affect ownership. By meticulously examining public records, comprehending the chain of title, and recognizing various types of liens—such as mortgage, tax, and judgment liens—buyers can effectively safeguard their investments and avert unexpected financial burdens.

The necessity of conducting a diligent lien search cannot be overstated. It serves as a crucial safeguard against potential legal and financial troubles, empowering buyers to negotiate effectively and confirm a clear title before closing. Furthermore, leveraging the appropriate tools and resources, including professional assistance and advanced technology, can significantly enhance the efficiency and accuracy of lien searches, resulting in smoother transactions.

Ultimately, a proactive approach to understanding and addressing liens equips buyers to navigate the real estate landscape with confidence. By prioritizing thorough title searches and remaining vigilant about potential encumbrances, individuals can protect their investments and facilitate successful property ownership transitions. As the real estate market continues to evolve, the knowledge and strategies surrounding title searches will remain indispensable for both buyers and real estate professionals alike.

Frequently Asked Questions

What is an ownership review in real estate?

An ownership review is a thorough investigation of public records, including a title search for liens, to confirm the legal possession of an asset and identify any claims that may exist.

Why is ownership verification critical in real estate transactions?

Ownership verification is essential because it ensures that the seller has the right to sell the asset and informs the buyer of potential issues that could affect ownership.

What are the key components of ownership verification?

The key components include public records, chain of title, and encumbrances. Public records provide vital information about ownership and claims, the chain of title traces the historical ownership, and encumbrances identify any claims against the property.

What role do public records play in ownership verification?

Public records contain crucial information regarding ownership, existing liens, and legal claims against the asset, forming the foundation of the ownership examination process.

What is the chain of title, and why is it important?

The chain of title refers to the historical sequence of ownership of the estate. A clear chain is vital for a successful transaction, as any gaps or discrepancies can lead to disputes.

What are encumbrances, and why must they be resolved before a sale?

Encumbrances are claims against the property, such as mortgages or liens. Identifying and addressing these claims is crucial to avoid exposing the purchaser to financial risks.

How do recent trends in real estate transactions emphasize the importance of ownership examinations?

Recent data shows that a significant number of real estate transactions involve ownership examinations, highlighting the need for thorough document reviews to mitigate risks associated with property ownership.

What impact does expedited processing have on real estate transactions?

Expedited processing can enhance efficiency and reduce delays in the real estate transaction process.

How do case studies illustrate the importance of title searches in real estate?

Case studies demonstrate that conducting title searches helps identify and eliminate existing 'clouds' on property titles, such as judgments and easements, which minimizes financial risks for buyers.

What types of liens are important to understand in real estate?

Important types of liens include mortgage claims, tax claims, judgment claims, mechanic's claims, and homeowners' association (HOA) claims. Each type carries distinct implications for property ownership and sales.

Why is it essential for potential buyers to be aware of existing tax obligations?

Existing tax obligations can lead to foreclosure if unresolved and typically hold the highest priority during property sales, making it crucial for buyers to be informed.

How can understanding different types of claims facilitate smoother transactions?

A comprehensive understanding of various claims helps potential buyers make informed decisions, ensuring they are aware of any encumbrances that may impact their investment.