Overview

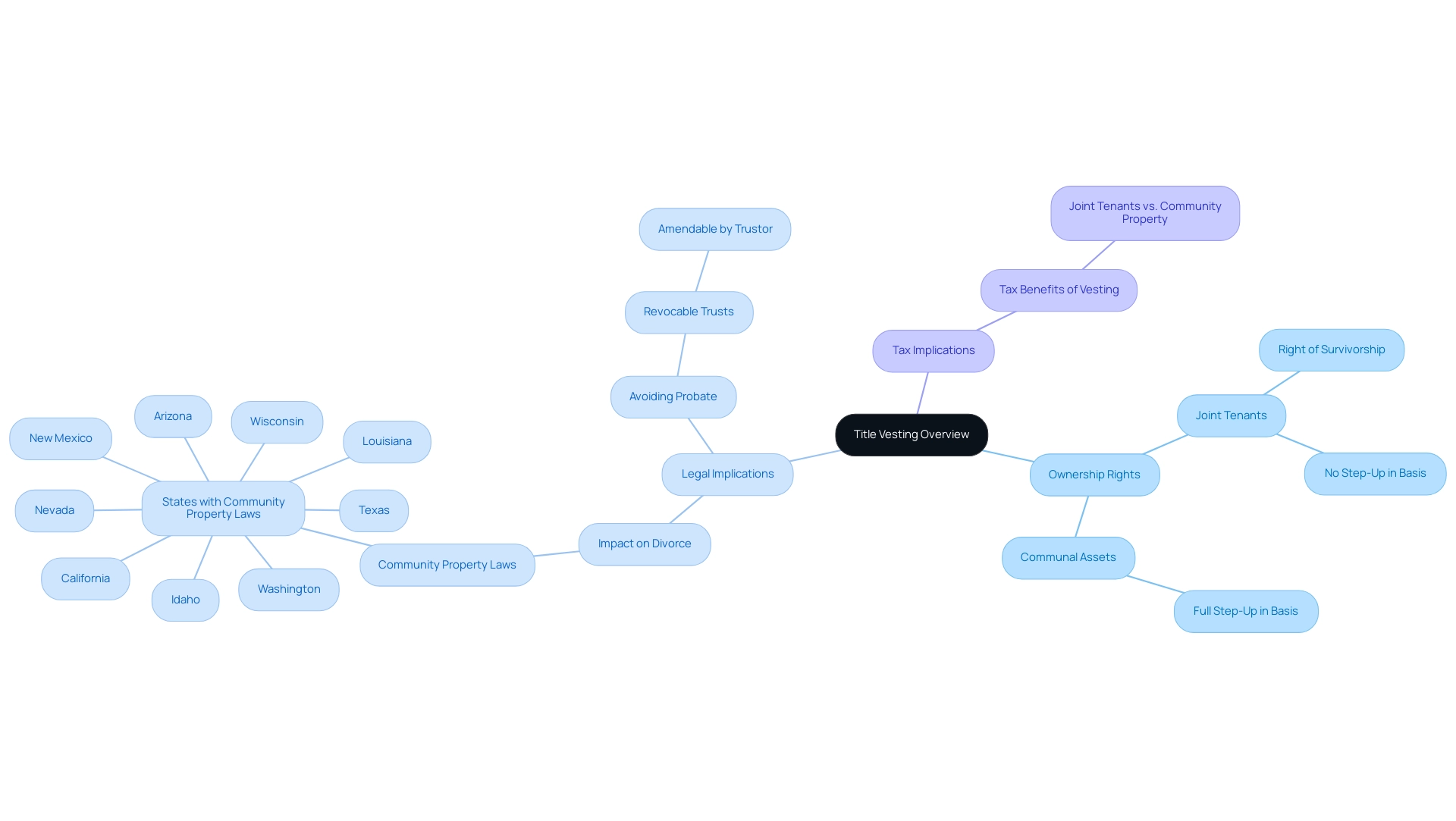

Title vesting refers to the legal allocation of property ownership, which significantly influences the rights and responsibilities of property owners. The article emphasizes that understanding title vesting is crucial for effective asset management, as different forms of ownership—such as joint tenancy and tenancy in common—carry distinct legal and tax implications that can affect estate planning and financial decisions.

Introduction

Title vesting is a crucial element in the realm of property ownership, serving as a determinant of how legal rights and responsibilities are allocated among owners. This concept is not merely a technicality; it carries significant implications for financial planning, estate management, and legal clarity.

As property owners navigate the complexities of title vesting, they must consider various forms—ranging from joint tenancy to community property—each with its own set of advantages and challenges. Understanding these distinctions is essential, particularly in light of life events that might necessitate a reevaluation of ownership structures.

Moreover, the role of title vesting extends beyond individual ownership, impacting real estate transactions and the smooth transfer of property rights. With the potential for legal disputes and financial repercussions at stake, a comprehensive grasp of title vesting is indispensable for anyone involved in property management or real estate dealings.

Understanding Title Vesting: A Fundamental Overview

The concept of title allocation is closely related to , as it determines how ownership is legally recognized and defines who holds title and how ownership rights are distributed. This understanding is vital for owners as it not only affects their rights but also delineates their responsibilities concerning the asset. For instance, the selection of allocation can significantly impact legal and tax implications, which are critical when navigating situations like marriage, divorce, or death.

In fact, community property laws could dictate who gets what real estate in the event of a divorce in nine states:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Furthermore, as LendingTree highlights, "Selecting ownership distribution is one way to avoid probate, which involves a court deciding how to transfer ownership after the current owners pass away." Mortgage lenders typically allow ownership to be held in a revocable trust, providing flexibility as the trustor can amend or revoke the trust during their lifetime.

The selection of rights has significant legal and tax consequences, as demonstrated in the case study titled 'Implications of Rights,' which discusses how joint tenants benefit from the right of survivorship but may not receive a step-up in basis, while communal assets provide a full step-up in basis. By effectively understanding the subtleties of ownership transfer, asset holders can better maneuver through the intricacies of real estate legislation, ensuring that they make informed choices that protect their investments and align with their long-term objectives.

Exploring Different Types of Title Vesting

Property owners must navigate several types of ownership vesting, each with distinct characteristics and implications for ownership:

-

Joint Tenancy: This arrangement allows two or more individuals to co-own a property with equal rights. A defining feature of joint tenancy is the right of survivorship; upon the death of one owner, their share automatically transfers to the surviving owner(s). This aspect can simplify estate planning, as highlighted by Rebecca Waters, who noted,

Because she was concerned that illness might make her unable to attend to her affairs, she added her daughter Susan onto her bank accounts and home as Joint Tenant.

However, it’s crucial to understand that all owners must acquire their interests simultaneously to establish this type of ownership. This requirement is essential, as demonstrated in the case study titled 'Time Requirement in Joint Tenancy,' which illustrates that joint tenants must acquire their interests simultaneously through a deed for to be valid.

-

Tenancy in Common: In this case, two or more individuals possess rights to an asset, but ownership shares may vary. Unlike joint tenancy, this arrangement does not confer the right of survivorship; thus, if one owner passes away, their share is passed on to their estate. This can lead to disputes among heirs, particularly when interests are not clearly defined.

-

Shared Assets: Acknowledged in specific states, shared assets regard items obtained during marriage as co-owned by both partners, regardless of whose name is listed on the document. This can have significant tax implications and affects asset distribution upon divorce or death.

-

Tenancy by the Entirety: This form of ownership is exclusive to married couples in certain jurisdictions and acts as a protective measure against creditors. It combines the benefits of joint tenancy, including the right of survivorship, with additional legal protections, making it an advantageous option for couples.

-

Sole Ownership: The most straightforward type of ownership, sole ownership happens when one person possesses full rights to a real estate. This owner has complete authority but also takes on all related responsibilities and liabilities.

Alongside these methods of ownership transfer, enables exact control over asset distribution, tax reduction, and protection from creditors, which are essential factors in estate planning. Furthermore, as illustrated by Sandy Worthington's case, the cost basis for assets can significantly impact financial decisions; for instance, her cost basis for the painting was only $275,000 after Nick's death. Comprehending these various forms of title holding and their title vesting meaning is crucial for efficient asset management and strategic estate planning.

The Importance of Title Vesting in Real Estate Transactions

Title ownership plays a crucial role in , fundamentally affecting how rights are transferred and the financing choices available to purchasers and vendors. Comprehending the particular form of ownership is crucial for purchasers, as it directly affects their rights and duties, including obligations related to mortgage payments and upkeep. For example, if an heir chooses to sell an asset valued at $510,000, they are responsible for capital gains tax solely on the $10,000 rise in value, demonstrating the financial consequences associated with ownership transfer.

As J.R. Duren, Editor, notes, 'Content was accurate at the time of publication,' underscoring the importance of staying informed in this dynamic field. For sellers, having accurate ownership documentation is critical to preventing disputes and ensuring a seamless closing process. Moreover, insurance firms carefully examine the kinds of vesting to assess related risks, highlighting the title vesting meaning for owners to be well-informed about their ownership arrangements.

A pertinent example is the Living Trust, a legal arrangement that outlines the management of asset interests upon the trustor's death. This case illustrates how a living trust can provide clarity on property rights and intentions for heirs, as mortgage lenders allow ownership in a revocable trust, enabling the trustor full control over the assets. Real estate agents often highlight that precise ownership documentation can simplify transactions and offer clarity on financing alternatives, emphasizing its significance in the current market environment.

Common Issues and Challenges with Title Vesting

Property owners encounter a variety of challenges when navigating the title vesting meaning, which can significantly affect their rights and responsibilities. Key issues include:

-

Discrepancies in Ownership Records: Inaccurate or incomplete ownership records can create confusion regarding possession and associated rights.

is essential to uncover any existing issues, especially considering that discrepancies in ownership records are not uncommon. Recent statistics show that a notable percentage of real estate transactions involve inaccuracies, highlighting the critical need for diligence in this area.

-

Legal Complications: The implications of various ownership types, particularly the title vesting meaning, can differ significantly, and misunderstandings can result in disputes among co-owners or challenges in estate planning.

Real estate lawyers stress that clarity in ownership registration and understanding title vesting meaning is essential, as legal conflicts can occur when parties have differing interpretations of property rights.

-

Tax Implications: Certain types of ownership, such as community property, carry specific tax consequences that property owners must be aware of to avoid unexpected liabilities. An informed understanding of these implications is crucial for effective financial planning and compliance with tax regulations.

-

Changing Ownership Structures: Life events such as marriage, divorce, or inheritance often require a reassessment of ownership arrangements. Neglecting to revise the allocation in response to these changes can lead to legal complications in the future, possibly resulting in disputes or challenges regarding ownership claims.

As highlighted in a recent case study from a national conference, named 'If Hallways Could Speak,' the significance of being proactive in addressing these changes cannot be overstated, as the real estate landscape is increasingly vulnerable to issues related to ownership security and accuracy.

In a world where cybercrime poses a growing risk to real estate transactions, with estimated industry risk exposure surpassing $1 trillion annually, being proactive in tackling these challenges is more crucial than ever.

As noted by Emerald National Title, 'Why does a closing have to feel like a transaction? At Emerald National Title, our vision is to create a customized experience with a dedicated closing officer.'

This approach underscores the necessity of understanding that buying a home is personal, not merely a transaction.

Best Practices for Title Vesting Management

To efficiently handle ownership registration, property owners should follow these best practices:

- Regularly Review Ownership Documents: It is essential to ensure that your ownership documents are precise and up-to-date, reflecting any changes in proprietorship or type of holding. Utilizing advanced machine learning tools from Parse AI, including the example manager that allows for quick annotation and extraction of information from unstructured documents, can expedite this process, ensuring thorough analysis and reducing the risk of legal complications down the line.

- Consult Legal Experts: Engaging with real estate lawyers or property professionals is essential for clarifying any questions regarding ownership implications and associated legal responsibilities. As Scott Beebe, President of Fishman Corporation, emphasizes, having a personal touch and expert guidance can prevent costly mistakes, especially given the complexities of ownership vesting.

- Educate Co-Owners: In situations of shared ownership, it is essential that all co-owners understand the nature of ownership in place and their respective rights and responsibilities. Clear communication can safeguard against misunderstandings and disputes. Leveraging Parse AI’s document processing capabilities can facilitate this educational process.

- Plan for Future Changes: Property owners should anticipate life events—such as marriage, divorce, or the birth of a child—that may require modifications to ownership records. Proactive planning ensures that your designation accurately reflects your current circumstances, supported by insights from Parse AI’s automation tools for research.

- Consider Ownership Insurance: Acquiring ownership insurance is a wise step to safeguard against possible concerns with property vesting. This insurance offers financial protection in case of disputes or flaws in the ownership, providing reassurance for landowners.

The creators of Parse AI, boasting over 50 years of joint experience in energy, real estate, and technology, have encountered various challenges in verifying real estate ownership. Their expertise guides the creation of tools that tackle these challenges, improving management efficiency. By applying these best practices, property owners can manage the intricacies of ownership transfer with enhanced confidence and security.

The thoroughness and organization valued by the CEO of Suncoast Identification Solutions, LLC in their dealings with Brick Marketing can similarly be applied to effectively managing the title vesting meaning. For instance, just as Brick Marketing's attention to detail fostered a positive working relationship, that reflects the title vesting meaning—enhanced by the innovative solutions of Parse AI—can prevent disputes and ensure clarity in ownership.

Conclusion

Title vesting is a critical aspect of property ownership that influences legal rights, responsibilities, and financial implications. As outlined in the article, understanding the various forms of title vesting—such as joint tenancy, tenancy in common, community property, and sole ownership—is essential for property owners. Each type carries distinct characteristics that can affect everything from estate planning to tax liabilities, thus necessitating careful consideration during ownership decisions.

Navigating the complexities of title vesting is not merely an academic exercise; it has real-world consequences in property management and real estate transactions. The implications of inaccuracies in title records and the potential for disputes underscore the importance of diligence in maintaining clear and accurate documentation. Furthermore, proactive management of title vesting, including regular reviews and consultations with legal experts, can mitigate risks and enhance clarity among co-owners.

Ultimately, a comprehensive understanding of title vesting empowers property owners to make informed decisions that align with their long-term goals. By embracing best practices and remaining vigilant about changes in ownership structures, individuals can safeguard their investments and navigate the intricacies of property law with confidence. In a landscape where the stakes are high, ensuring clarity and accuracy in title vesting is not just advisable—it is essential for secure and successful property ownership.

Frequently Asked Questions

What is title allocation and why is it important?

Title allocation determines how ownership is legally recognized, defining who holds title and how ownership rights are distributed. It is important for owners as it affects their rights and responsibilities regarding the asset, and can have legal and tax implications in situations like marriage, divorce, or death.

What are community property laws and how do they affect real estate ownership?

Community property laws dictate how real estate is divided in the event of a divorce in certain states, including Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. These laws can influence who receives what property after the dissolution of a marriage.

How can ownership distribution help avoid probate?

Selecting an appropriate ownership distribution can help avoid probate, which is the court process that determines how to transfer ownership after the current owners pass away. This can streamline the transfer process and reduce complications for heirs.

What types of ownership vesting exist, and what are their characteristics?

There are several types of ownership vesting: 1. Joint Tenancy: Co-ownership with equal rights and the right of survivorship, where a deceased owner's share automatically transfers to surviving owners. 2. Tenancy in Common: Co-ownership where shares may vary, and there is no right of survivorship; a deceased owner's share goes to their estate. 3. Shared Assets: Recognizes items acquired during marriage as co-owned, regardless of whose name is on the document, affecting tax implications and asset distribution. 4. Tenancy by the Entirety: Exclusive to married couples in certain jurisdictions, combining joint tenancy benefits with additional creditor protections. 5. Sole Ownership: One person has full rights and responsibilities over a property.

What is a Revocable Living Trust and how does it relate to title vesting?

A Revocable Living Trust allows for precise control over asset distribution, tax reduction, and protection from creditors, which are important for estate planning. It provides flexibility as the trustor can amend or revoke the trust during their lifetime.

Why is understanding the implications of different ownership types important?

Understanding the implications of different ownership types is crucial for effective asset management and strategic estate planning. It helps asset holders navigate real estate legislation and make informed choices that protect their investments and align with their long-term objectives.