Overview

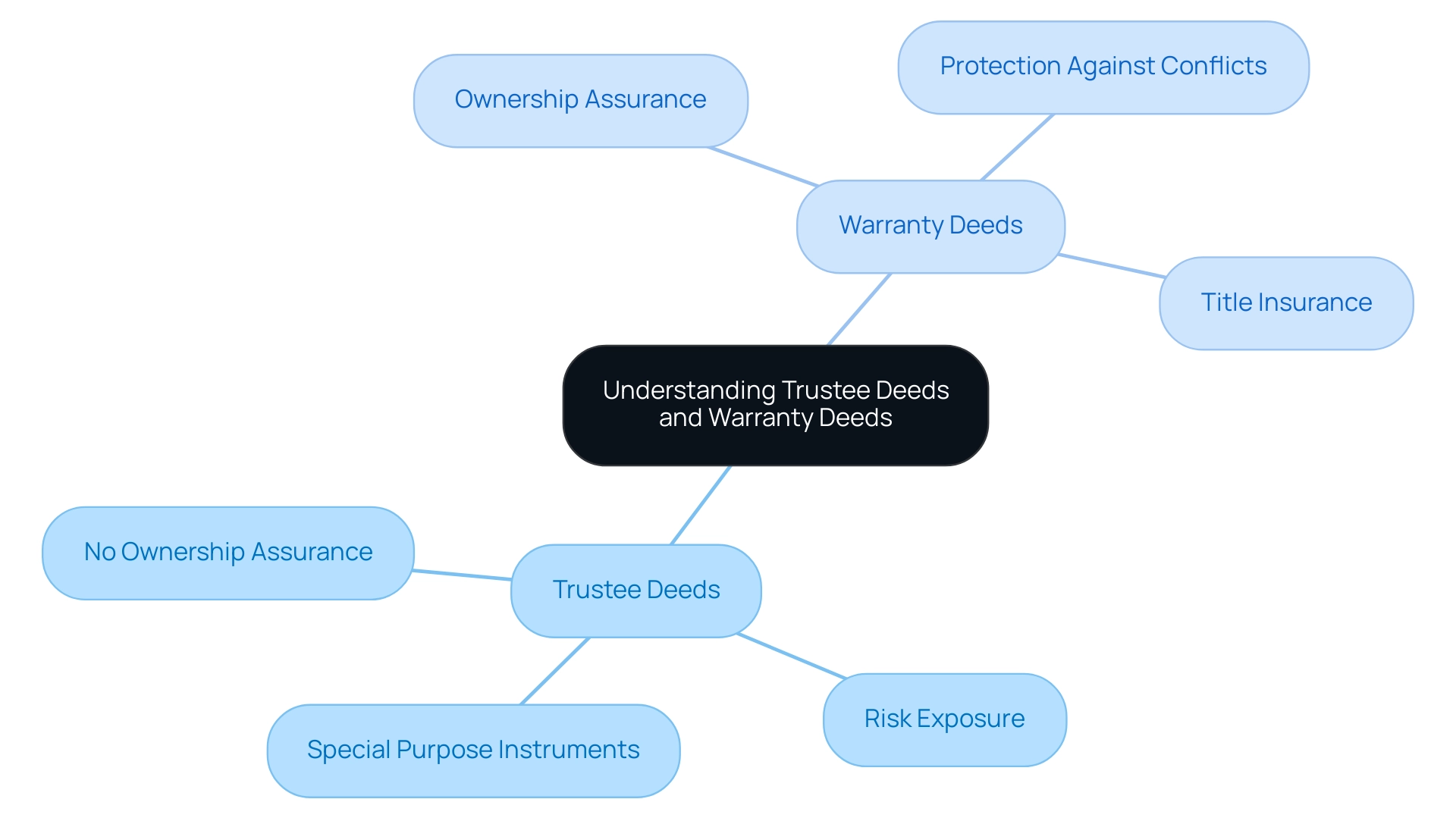

This article examines the distinctions between trustee deeds and warranty deeds, highlighting their unique features and applications in real estate transactions.

It emphasizes the importance of understanding these differences, as warranty deeds provide robust legal protections and assurances of ownership.

In contrast, trustee deeds fulfill specific financing roles without guaranteeing ownership.

Consequently, it is crucial for real estate professionals to discern when to utilize each type based on the context of the transaction and the desired level of protection.

Introduction

In the intricate world of real estate transactions, understanding the nuances between different types of deeds is crucial for safeguarding property investments.

Two prominent players in this arena are:

- The trustee deed

- The warranty deed

Each serving distinct purposes and offering varying levels of protection. Warranty deeds provide robust assurances of title integrity, whereas trustee deeds often come into play in financing scenarios, raising critical questions about liability and ownership rights.

As the landscape of real estate evolves—particularly with the integration of technology and shifting buyer preferences—navigating these complexities becomes essential for both buyers and professionals alike.

This article delves into the fundamental differences, benefits, and practical applications of trustee and warranty deeds, equipping readers with the knowledge to make informed decisions in their real estate endeavors.

Understanding Trustee Deeds and Warranty Deeds

A trustee document functions as a legal instrument that facilitates the transfer of property from a trust to a beneficiary or a third party, frequently utilized in real estate transactions involving trusts. Unlike guarantee documents, trustee instruments typically do not provide assurances regarding ownership, indicating that the trustee does not guarantee that the ownership is free of flaws. This absence of guarantee can expose the purchaser to potential risks associated with ownership issues.

Special Purpose Instruments may also be applicable in specific circumstances, offering varying levels of protection, which adds another layer of complexity to the discussion of instrument types.

In contrast, provides a strong assurance from the seller (grantor) that they hold clear ownership of the property and possess the authority to sell it. This type of document is designed to offer the highest level of protection to the buyer (grantee), ensuring that the property is devoid of any liens or encumbrances that could jeopardize ownership. Recent data indicates that ownership documents are involved in approximately 70% of property transactions, underscoring their appeal among purchasers seeking assurance in their investments.

Understanding the distinctions between trustee deeds and warranty deeds is crucial for real estate professionals. For instance, while warranty documents protect against ownership conflicts, legal experts recommend that clients seek assistance when navigating the complexities of warranty documents to fully grasp their implications before proceeding with transactions. This is particularly significant given the potential for misunderstandings regarding the relationship between the document and title; a document transfers title, but issues with it do not necessarily imply problems with the title.

Recent case studies illustrate the practical applications of both document types. In one notable instance, a transaction involving a guarantee document provided comprehensive protection against potential ownership conflicts, while the differences between a trustee deed and warranty deed were highlighted in a scenario where the property was transferred from a trust, showcasing the distinct functions each document serves in real property dealings. Additionally, a case study titled "Warranty Deeds vs. Title Insurance" emphasizes that while both warranty documents and title insurance offer protection in real property transactions, they fulfill different roles—warranty documents defend against ownership disputes, whereas title insurance secures financial interests if such issues arise.

As the landscape of property transactions evolves, comprehending these differences remains essential for informed decision-making. Furthermore, to combat fraud, some jurisdictions are integrating blockchain technology to establish tamper-proof digital property registries, aiming to ensure both the security and transparency of property records.

Key Features of Trustee Deeds

Trustee deeds exhibit several defining characteristics that distinguish them in :

- In comparing trustee deeds with warranty deeds, it is evident that trustee documents do not guarantee ownership free from defects, in contrast to warranty documents. The trustee acts solely as an intermediary, holding the title until specific conditions are met, which can introduce a level of risk for the involved parties.

- Three-Party Agreement: This type of document involves three essential parties: the borrower (trustor), the lender (beneficiary), and the trustee. This triadic structure is crucial for securing loans in real property transactions, as it clarifies the roles and responsibilities of each party, ensuring transparency in the lending process.

- Foreclosure Use: Trustee instruments are commonly employed in non-judicial foreclosure processes, allowing lenders to reclaim property without court intervention. This efficiency can expedite the resolution of defaulted loans, making trustee documents a preferred choice in many real estate transactions.

- Limited Liability: A notable advantage of trustee agreements is that the trustee is not held accountable for any ownership defects. This feature is particularly beneficial for individuals serving in a fiduciary capacity, as it mitigates potential legal risks associated with ownership issues.

As of 2025, the prevalence of no title warranty in the context of trustee deeds versus warranty deeds has become increasingly significant, reflecting a shift in the structuring of real property transactions. Recent data indicates that a substantial portion of transactions now utilize this framework, underscoring its growing acceptance among property professionals. This trend is particularly noteworthy, as 46% of older adults have documented their healthcare preferences, yet many neglect the complexities of property planning, such as understanding the distinctions between trustee deeds and warranty deeds.

This disconnect underscores the necessity for comprehensive education on the implications of various types of agreements.

Furthermore, case studies illustrate that the utilization of trustee documents in property transactions can yield beneficial outcomes, particularly in scenarios involving three-party agreements. As individuals increasingly turn to online sources for information regarding property planning—68% of individuals consult Google before seeking advice—comprehending trustee documents becomes essential. As noted by McNeelyLaw LLP, "The contents are intended for general informational purposes only, and you are urged to consult your own lawyer on any specific legal questions you may have concerning your situation."

This statement emphasizes the importance of legal counsel in navigating the complexities of trustee documents.

As the landscape of property continues to evolve, maintaining an informed understanding of the intricacies of trustee documents will be vital for professionals navigating these transactions.

Exploring the Benefits of Warranty Deeds

Warranty deeds present several significant advantages that enhance their appeal in real estate transactions.

- Title Assurance: Warranty documents provide a robust assurance that the seller possesses clear ownership of the property. This assurance protects buyers from potential future claims or disputes, significantly mitigating the risks associated with property ownership. In contrast, numerous insurance firms are hesitant to offer coverage for properties transferred by quit claim instruments, underscoring the importance of warranty documents in securing insurance.

- Comprehensive Protection: Unlike other types of titles, warranty transfers encompass the entire ownership history of the property. This indicates that the seller is accountable for any ownership issues that may arise, including those from prior owners. Such comprehensive coverage offers an added layer of security for buyers.

- Enhanced Buyer Assurance: The existence of a warranty document instills greater confidence in buyers regarding their investment. With legal assurances against potential title defects, buyers are more likely to proceed with transactions, knowing they are safeguarded from unforeseen complications. As Amanda Dodge, , observes, 'The transparency and protection offered by title documents can considerably boost buyer assurance in their property transactions.'

- Marketability: Properties transferred via warranty documents tend to be more marketable. The reduced risk of title-related issues associated with these documents makes them more appealing to potential purchasers, facilitating smoother transactions. However, it is crucial to consider that purchasing properties with unique conveyance documents can involve risks, such as undisclosed liens and issues stemming from prior owners, which buyers should remain vigilant about.

In 2025, statistics suggest that properties sold with warranty documents not only enhance buyer confidence but also foster a more favorable market perception. Real property experts have noted that transactions involving warranty documents frequently conclude more swiftly and with fewer complications, highlighting their significance in the field. Case studies have demonstrated that utilizing warranty documents can lead to substantial cost reductions and improved outcomes for both purchasers and vendors, emphasizing their importance in property transactions.

Moreover, advancements such as those from Parse AI, which streamline the research process, further enhance the efficiency and reliability of transactions related to property agreements.

Comparative Analysis: Trustee Deed vs. Warranty Deed

When examining the differences between trustee documents and warranty documents, several critical factors emerge.

Legal Safeguards: Warranty documents provide strong legal safeguards for buyers, ensuring that the seller assures the ownership's integrity against any claims. In contrast, when considering the trustee deed vs warranty deed, it is clear that trustee documents do not provide such assurances, leaving buyers with less recourse in the event of title disputes. This distinction is crucial, as highlighted by Patrick's 5.0 rating based on client reviews, which underscores the importance of understanding the differences between trustee deed vs warranty deed for reliable legal protections in real estate transactions.

Parties Involved: The framework of the transaction differs greatly between the two categories of documents. Warranty documents typically involve two parties—the buyer and the seller—who engage in a straightforward property transfer. Conversely, trustee documents involve three parties: the borrower, the lender, and the trustee, reflecting their role in financing arrangements and the management of the trust.

Use Cases: Warranty documents are predominantly utilized in conventional property sales, where the buyer seeks full ownership rights and protections. Trustee documents are frequently utilized in financing scenarios, such as mortgages and foreclosures, highlighting the differences between trustee deed vs warranty deed, where the document serves as a security instrument for the lender.

Responsibility: In the context of warranty documents, the seller assumes responsibility for any ownership defects that may arise, providing a layer of security for the buyer. Conversely, in trustee agreements, the trustee is not responsible for ownership problems, which can be beneficial for those overseeing trusts, as it reduces their risk of possible claims.

Comprehending the differences in trustee deed vs warranty deed is essential for , especially when maneuvering through the intricacies of property transactions. For instance, a case study comparing Special Warranty Deeds and Limited Warranty Deeds illustrates that while both provide limited assurances about ownership, the scope of protection varies significantly. In scenarios where title problems occur, like unpaid taxes, the kind of document can significantly affect the buyer's options, with General Warranty Documents providing the most extensive protection.

As the realm of property transactions changes, it is wise to seek advice from a property lawyer to ensure that all legal obligations are fulfilled and that required safeguards are established when preparing any documents. Christopher Nuneviller, Managing Partner for Philadelphia's MNB Meridian Law, Ltd., emphasizes the importance of legal guidance in these matters, stating that his focus is on assisting small and mid-sized businesses grow and thrive.

When to Use a Trustee Deed vs. a Warranty Deed

Selecting between a trustee deed and a warranty deed hinges on the unique circumstances surrounding each real estate transaction. Understanding when to employ each form of transfer can significantly influence the security and clarity of property ownership.

-

Use a Warranty Deed when:

- You are purchasing property and require assurance of a clear title, ensuring that no undisclosed claims exist.

- You seek maximum protection against future claims, as warranty deeds provide comprehensive coverage against defects that may arise after the sale.

- The seller is ready to take responsibility for any ownership defects, providing reassurance that any issues will be resolved.

-

Use a Trustee Deed when:

- You are engaged in a financing arrangement that necessitates a third party to hold the title, often seen in transactions involving mortgages or loans.

- You are dealing with property held in a trust or undergoing foreclosure, where the trustee oversees the ownership on behalf of the beneficiaries.

- You wish to limit liability regarding ownership defects, as the trustee does not guarantee the ownership, thus reducing the risk for the party holding the document.

In 2025, statistics indicate a growing preference among buyers for warranty agreements, particularly in transactions where security and assurance are paramount. This trend reflects a broader understanding of the importance of title protection in property transactions. Conversely, trustee documents are increasingly employed in funding agreements, particularly as real property experts acknowledge their usefulness in handling intricate ownership frameworks.

Expert recommendations indicate that prior to engaging in any property transaction, it is wise to seek counsel from legal experts who can offer customized advice on the most suitable form of documentation for your particular circumstances. As Robert Moore advises, "Before engaging in in Ohio, it is wise to consult with legal experts who can offer guidance on the most suitable type of document for your specific situation." This is especially pertinent in jurisdictions where the nuances of document types can significantly affect ownership rights and responsibilities.

Case studies demonstrate the practical uses of these actions. For example, a unique title document, which ensures protection against ownership flaws solely established by the grantor, is less frequently utilized in specific areas, like Wisconsin, where standard purchase forms generally necessitate a title document. This underscores the significance of comprehending local practices and legal frameworks when choosing the suitable document type.

In fact, special warranty instruments are not widely used in Wisconsin, emphasizing regional differences in document usage.

Additionally, some jurisdictions are integrating blockchain technology to create tamper-proof digital property registries, enhancing the security and transparency of ownership records. This trend reflects the evolving landscape of real estate transactions and the increasing importance of secure property record management.

In summary, the choice between a warranty deed and a trustee deed should be informed by the specific context of the transaction, the level of protection desired, and the legal implications involved.

Conclusion

Understanding the differences between trustee deeds and warranty deeds is essential for anyone involved in real estate transactions. Trustee deeds primarily serve in financing scenarios and do not provide warranties regarding title integrity, which can expose buyers to potential risks. In contrast, warranty deeds offer robust assurances that the seller holds clear title to the property and assumes liability for any defects, making them a popular choice for buyers seeking security in their investments.

This comparative analysis underscores that warranty deeds are best suited for conventional property sales where buyers require comprehensive protection against future claims. Conversely, trustee deeds are more appropriate in situations involving trusts or foreclosure processes, where the focus is on managing the title rather than guaranteeing it. As the real estate landscape continues to evolve, particularly with the integration of technology and changing buyer preferences, the importance of understanding these distinctions cannot be overstated.

Ultimately, making informed decisions regarding the type of deed to use is crucial for safeguarding property investments. Consulting with legal professionals can provide valuable insights tailored to specific circumstances, ensuring that all parties involved are adequately protected. By navigating these complexities with knowledge and expertise, buyers and real estate professionals can foster confidence and security in their transactions, paving the way for successful property ownership.

Frequently Asked Questions

What is a trustee document?

A trustee document is a legal instrument that facilitates the transfer of property from a trust to a beneficiary or a third party, commonly used in real estate transactions involving trusts.

How does a trustee document differ from a guarantee document?

Unlike guarantee documents, trustee instruments typically do not provide assurances regarding ownership, meaning the trustee does not guarantee that the ownership is free of flaws, which can expose the purchaser to potential ownership risks.

What is the role of special purpose instruments?

Special purpose instruments may be applicable in specific circumstances, offering varying levels of protection, adding complexity to the discussion of different types of legal instruments.

What is a title document and how does it differ from a trustee document?

A title document provides strong assurance from the seller that they hold clear ownership of the property and the authority to sell it, designed to protect the buyer from liens or encumbrances. In contrast, a trustee document does not guarantee ownership free from defects.

Why is it important for real estate professionals to understand the distinctions between trustee deeds and warranty deeds?

Understanding these distinctions is crucial because warranty documents protect against ownership conflicts, and legal experts recommend seeking assistance to navigate the complexities of warranty documents to fully grasp their implications.

What is the significance of the relationship between the document and title?

A document transfers title, but issues with the document do not necessarily imply problems with the title itself, highlighting the importance of understanding these concepts in property transactions.

How are trustee documents used in foreclosure processes?

Trustee instruments are commonly used in non-judicial foreclosure processes, allowing lenders to reclaim property without court intervention, which can expedite the resolution of defaulted loans.

What are the advantages of trustee agreements?

A notable advantage is that the trustee is not held accountable for any ownership defects, which mitigates potential legal risks for individuals serving in a fiduciary capacity.

What recent trends have emerged regarding the use of trustee deeds versus warranty deeds?

There has been a growing acceptance of no title warranty frameworks in property transactions, reflecting a shift in how real property transactions are structured.

Why is legal counsel recommended when dealing with trustee documents?

Legal counsel is advised to navigate the complexities of trustee documents and to ensure individuals understand the implications of various types of agreements in property planning.