Overview

This article serves as a comprehensive guide on conducting a property lien lookup, underscoring the critical importance of understanding various types of claims—such as mortgage, tax, judgment, and mechanic's liens—to safeguard real estate transactions. It details effective methods for conducting these searches and highlights the role of technology in enhancing efficiency. Furthermore, it emphasizes the necessity of thorough investigations to avert financial losses and ensure clear ownership in real estate dealings.

Introduction

Navigating the complex world of property liens is essential for anyone involved in real estate transactions. These legal claims against properties can significantly impact ownership, sales, and investment strategies. With various types of liens—ranging from mortgage and tax liens to mechanic's liens—understanding their implications is vital for real estate professionals aiming to safeguard their investments and ensure clear titles. Furthermore, as the housing market faces potential economic challenges, the importance of conducting thorough lien searches cannot be overstated. This article delves into the intricacies of property liens, the necessity of lien searches, effective methods for conducting them, and how technology is reshaping the landscape for real estate professionals.

Understanding Property Liens: What You Need to Know

Claims represent legal assertions against an asset due to debts owed by the owner, and they are essential for in real estate dealings. Comprehending the various types of claims is crucial for to mitigate risks and ensure seamless transactions through . The primary categories of property liens include:

- : These voluntary encumbrances are created by lenders when funding an asset. They secure the loan amount and grant the lender the right to foreclose if payments are not made.

- : Established by governmental bodies for unpaid taxes, tax claims can significantly affect ownership and sale of real estate. They hold priority over other claims, indicating they must be resolved before the asset can be sold.

- : These claims arise from court rulings against the asset's owner. If a lawsuit results in a ruling against the owner, a claim can be imposed on the asset, complicating future dealings.

- Mechanic's Claims: Submitted by contractors or suppliers who have not received payment for work performed on the site, mechanic's claims ensure that those who contribute to enhancements are compensated.

In 2025, approximately 15% of assets in the United States are expected to have some type of claim, underscoring the importance of property lien lookup in comprehensive claim investigations for real estate dealings. As highlighted by industry specialists, "Grasping real estate claims involves property lien lookup, which is not only about adherence; it's about protecting investments and ensuring unambiguous ownership for purchasers." With the current economic climate raising concerns about potential downturns, as stated by HousingWire, "The overall economic climate remains a cause for concern. A potential recession or other economic downturn could significantly impact the housing market," mortgage professionals are urged to refine their strategies and focus on customer education regarding these critical aspects of .

's innovative approach to research demonstrates how technology can simplify the lookup process, allowing professionals to manage these complexities with increased efficiency. By employing machine learning and optical character recognition, Parse AI assists in swiftly extracting crucial information from , enhancing the retrieval process to be more efficient and precise.

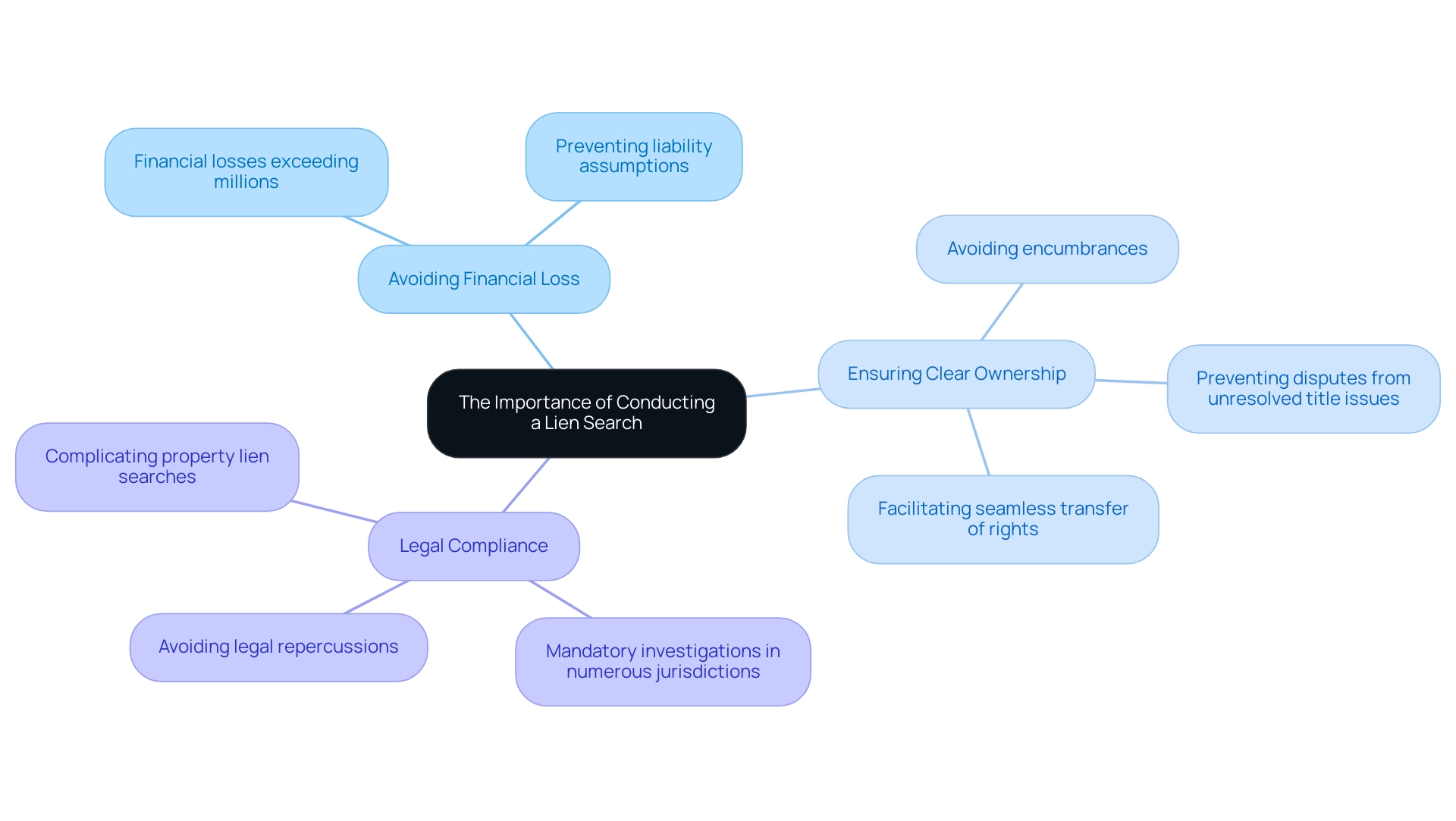

The Importance of Conducting a Lien Search

Carrying out a claim inquiry is vital for multiple important reasons:

- Avoiding Financial Loss: Recognizing current claims is necessary to prevent purchasers from assuming liabilities that could lead to . In 2025, data suggests that unrecognized claims have resulted in exceeding millions for real estate investors, underscoring the importance of .

- Ensuring Clear Ownership: A meticulous examination of claims guarantees that the asset's ownership documentation is devoid of encumbrances, facilitating a seamless transfer of rights. Unresolved title issues can arise from overlooked claims, leading to disputes that may hinder real estate transactions.

- : Numerous jurisdictions mandate claims investigations as part of the due diligence process in real estate transactions. Failing to comply with these regulations can expose purchasers to legal repercussions and complicate property lien searches for ownership.

Without conducting a , buyers risk acquiring assets burdened with unresolved issues. Such scenarios can lead to protracted legal battles, resulting not only in financial strain but also potential loss of ownership rights. For instance, a recent case study highlighted a commercial real estate sale-leaseback transaction in which undiscovered claims resulted in a costly dispute, emphasizing the necessity of in safeguarding investments.

This case illustrates the real-world consequences of neglecting a claim investigation, reinforcing the critical need for comprehensive asset evaluations and [property lien lookup](https://eia.gov/state/analysis.php?sid=RQ)s.

Methods for Conducting a Property Lien Lookup

Performing a real estate claim search is essential and can be accomplished through various efficient techniques:

- : Many counties maintain online databases that enable users to look up property records by address or owner name. Accessing these records typically requires visiting the county clerk or recorder's office website, serving as a valuable resource for acquiring information. Furthermore, leveraging and optical character recognition (OCR) features can significantly enhance the efficiency and precision of these inquiries. This technology facilitates the extraction of essential information for researchers from vast collections of document records. The example manager feature of Parse AI allows users to quickly annotate a single example, streamlining the extraction of relevant information from unstructured documents.

- : For those who prefer a more personal approach, visiting the county recorder's office or assessor's office in person can yield detailed property information. This method allows for direct interaction with officials who can assist in navigating the records.

- Hire a Title Company: Engaging a title company can simplify the process, especially for individuals who find the task daunting. Title firms possess the knowledge and tools to perform comprehensive investigations, ensuring that all pertinent claims are recognized and reported accurately.

- Employ Online Inquiry Tools: Various online platforms focus on legal claim investigations, providing access to extensive databases that can greatly enhance the property lien lookup process. These tools are particularly advantageous in 2025, as statistics indicate that over 60% of individuals currently depend on online county records for their inquiries, reflecting a growing trend towards digital solutions. It is important to note that a minimum convenience fee of $2.50 will be charged for credit card transactions when accessing these records, and mailed certified copies incur an additional cost of $1.50 per document copy.

- : This repository for publicly accessible data owned by state agencies can be a valuable resource for those seeking comprehensive information on .

By leveraging these methods, along with and machine learning extraction capabilities, real estate owners and professionals can efficiently navigate the complexities of claims investigations and streamline runsheet creation. This ensures they possess the necessary information to make informed decisions. With over 50 years of industry experience, is uniquely positioned to advance the title industry into the future.

Step-by-Step Guide to Performing a Lien Search

To effectively conduct , follow these detailed steps:

- Gather Asset Information: Begin by collecting essential details about the asset, including its legal description, parcel number, address, and the owner's name. This foundational information is crucial for precise inquiries.

- Access Online Records: Visit your county's recorder or assessor's website. Navigate to the records section, where you can obtain a wealth of information concerning claims and other encumbrances.

- Execute the Inquiry: Input the collected asset details into the fields provided on the website. This step is critical, as it enables you to identify any documented claims associated with the property.

- Review Search Results: Carefully examine the search results for any . Pay close attention to details such as the claim amount, type, and the date it was recorded. Understanding these elements can help you assess the potential impact on the property’s value and future transactions, including insights from a .

- Request Additional Documentation: If the search uncovers claims, you may need to request copies of the claim documents from the recorder's office. This documentation will offer further insights into the nature of the claims and any obligations associated with them.

- : In situations where you encounter intricate claims or discrepancies, it is advisable to consult a title professional. Their expertise can help navigate complex situations and ensure that all lien-related issues are addressed effectively.

Carrying out a comprehensive examination of claims, including a property lien lookup, is not merely a procedural step; it is a vital aspect of due diligence that should ideally be finalized during the , well before closing. This timing is crucial, as resolving municipal claims can enhance and ensure smooth future transactions, making real estate more appealing to purchasers. As emphasized in the case study 'Looking Forward: Revisiting Claims Investigation as Necessary,' vigilance in is essential, particularly for assets with frequent ownership transitions.

Proactively managing fosters long-term security for real estate investments and builds client trust.

Overcoming Challenges in Property Lien Searches

Performing a real estate encumbrance inquiry can pose various difficulties. However, comprehending these hurdles and knowing how to navigate through them is essential for success in the industry. Here are some common challenges and effective strategies to overcome them:

- Incomplete Records: A significant issue in is the prevalence of incomplete or outdated records. As of 2025, it is estimated that nearly 30% of property records in the U.S. are incomplete. To mitigate this risk, it is crucial to , including , online databases, county offices, and title companies. This multi-faceted approach ensures that you gather the most accurate and comprehensive information available.

- : Properties often span multiple jurisdictions, complicating the search process. It is essential to review documents in all relevant counties to ensure that no encumbrances are overlooked. This may require a systematic approach to property lien lookup and tracking down records across different localities, which, while time-consuming, is necessary for thoroughness.

- Legal Language: The can be daunting, making it challenging for those without a legal background to interpret the information correctly. Consulting with a legal professional or a document expert can provide clarity and ensure that you fully understand the implications of the documents you are reviewing. As Kim Armstrong, Vice President of Title Automation Services, notes, "What can be an annoying experience for a new owner in one state can be a very scary one in another," underscoring the importance of clear understanding in varying legal contexts.

- : Certain claims may not be easily visible, presenting substantial risks to borrowers, lenders, and . To uncover these concealed claims, conducting a property lien lookup is essential. Utilizing specialized tools or services, such as those offered by DataTrace, can enhance your ability to identify these encumbrances and effectively mitigate potential risks. DataTrace's municipal encumbrance investigation services are particularly beneficial, assisting companies in uncovering concealed claims and preventing encumbrance and foreclosure hazards. In fact, thousands of insurance underwriters nationwide rely on DataTrace's real estate insurance solutions daily, highlighting the importance of these services in the industry.

By addressing these challenges directly and employing strategic solutions, title researchers can enhance their efficiency and precision in real estate investigations, ultimately leading to improved outcomes for all parties involved. Furthermore, understanding the existing market dynamics, as emphasized in the case study "Price Gap Expectations," offers additional insight into the significance of comprehensive investigations in real estate transactions, particularly in light of the noted disparity between buyers and sellers.

Leveraging Technology for Efficient Lien Searches

Technology is revolutionizing the realm of property lien lookup, presenting innovative solutions that significantly enhance both efficiency and precision. Here’s how you can capitalize on these advancements:

- Machine Learning Tools: Leverage platforms that employ to rapidly analyze and extract relevant data from extensive property records. This technology not only accelerates the retrieval process but also improves the accuracy of the information obtained, empowering more informed decision-making. Notably, , underscoring the increasing acceptance of AI technologies within the industry.

- : Implement OCR technology to convert scanned documents into searchable text. This capability greatly streamlines the identification of claims, enabling users to quickly locate relevant details within vast amounts of documentation, thereby minimizing the time spent on manual inquiries.

- : Investigate that can generate detailed reports in a fraction of the time required by traditional methods. These services utilize advanced algorithms to ensure thoroughness and reliability, making them an invaluable asset for real estate professionals.

- Data Analytics: Employ to assess trends and patterns, which can aid in identifying potential risks associated with specific assets. By analyzing historical data, professionals can gain insights into market dynamics and make proactive decisions to mitigate risks.

The integration of these technologies is not merely a trend; it signifies a broader transformation within the industry. As noted by MLCommons, "the launch of Illuminate marks a significant step in measuring the safety of large language models," highlighting the critical need for adopting cutting-edge technology in real estate research. Furthermore, with the AI avatars market projected to expand at a CAGR of over 30% from 2024 to 2032, the push for technological adoption in title investigations is irrefutable.

By embracing these tools, professionals can reshape their workflows, enhancing both efficiency and precision in property investigations. As emphasized in the case study " in the Workplace," AI has the potential to evolve from a productivity tool into a transformative partner that amplifies human agency, aligning seamlessly with the demand for efficiency in property lien lookup.

Conclusion

Understanding property liens and their implications is essential for anyone involved in real estate transactions. The various types of liens—mortgage, tax, judgment, and mechanic's liens—each carry unique risks that can significantly affect ownership and investment strategies. Conducting thorough lien searches is not merely a regulatory requirement; it is a crucial step in safeguarding investments and ensuring clear property titles.

The importance of lien searches cannot be overstated. They help avoid financial losses, ensure clear title transfers, and maintain legal compliance. With an increasing percentage of properties burdened by liens, real estate professionals must prioritize these searches to avoid the pitfalls associated with undiscovered claims. Utilizing various methods, including online county records and specialized title companies, can streamline the search process and enhance accuracy.

Technology plays a pivotal role in transforming how lien searches are conducted. Advances in machine learning, optical character recognition, and automated search services are making it easier for professionals to navigate the complexities of property liens efficiently. By leveraging these tools, real estate professionals can enhance their workflows and make more informed decisions.

In conclusion, a proactive approach to conducting lien searches, coupled with the integration of innovative technologies, is vital for ensuring successful real estate transactions. As the market evolves, staying informed and utilizing the right resources will be key to protecting investments and fostering trust among clients. Emphasizing the significance of thorough due diligence in lien searches will ultimately contribute to a more stable and transparent real estate landscape.

Frequently Asked Questions

What are claims in the context of real estate?

Claims represent legal assertions against an asset due to debts owed by the owner, and they are essential for property lien lookup in real estate dealings.

Why is understanding different types of claims important for real estate professionals?

Comprehending the various types of claims is crucial for real estate experts to mitigate risks and ensure seamless transactions through property lien lookup.

What are the primary categories of property liens?

The primary categories of property liens include: 1. Mortgage Claims: Voluntary encumbrances created by lenders to secure loan amounts. 2. Tax Claims: Established by governmental bodies for unpaid taxes, which hold priority over other claims. 3. Judgment Claims: Arising from court rulings against the asset's owner, complicating future dealings. 4. Mechanic's Claims: Submitted by contractors or suppliers for unpaid work performed on the site.

What percentage of assets in the U.S. is expected to have claims in 2025?

Approximately 15% of assets in the United States are expected to have some type of claim in 2025.

What are the reasons for conducting a claim inquiry?

Conducting a claim inquiry is vital for: Avoiding Financial Loss: To prevent purchasers from assuming liabilities that could lead to financial difficulties. Ensuring Clear Ownership: To guarantee that the asset's ownership documentation is free of encumbrances. Legal Compliance: To comply with regulations that mandate claims investigations as part of the due diligence process.

What risks do buyers face if they do not conduct a property lien lookup?

Buyers risk acquiring assets burdened with unresolved issues, which can lead to protracted legal battles, financial strain, and potential loss of ownership rights.

How can technology assist in the property lien lookup process?

Technologies like machine learning and optical character recognition can simplify the lookup process, allowing real estate professionals to extract crucial information from ownership documents more efficiently and precisely.