Overview

Conducting a home lien search is essential for prospective homebuyers to prevent unforeseen liabilities that may arise from undisclosed claims against a property. This article delineates a comprehensive step-by-step process for performing such searches, underscoring the significance of understanding various lien types. Furthermore, it advocates for the utilization of modern tools and professional assistance to guarantee accurate and thorough investigations. Consequently, this approach ultimately safeguards buyers' financial interests.

Introduction

Navigating the intricate world of home liens can be a daunting task for both seasoned real estate professionals and first-time homebuyers alike. A lien, essentially a legal claim against a property due to unpaid debts, can significantly impact property transactions and ownership rights. In today's evolving landscape of home equity, understanding the nuances of this subject is more crucial than ever.

Recent statistics reveal a notable rise in low equity mortgages, particularly in government-backed segments, highlighting the necessity for homeowners to grasp the implications of liens on their investments. Furthermore, as home equity continues to grow, so does the need for diligence in conducting lien searches to safeguard against potential financial pitfalls.

This article delves into the essential aspects of home liens, emphasizing their types, the importance of thorough searches, and the tools available to ensure a seamless home buying experience.

Understanding Home Liens: What You Need to Know

A residential claim represents a legal assertion against a property, typically arising from unpaid debts. Creditors, contractors, or government entities can impose claims when payments are overdue. Therefore, it is essential for real estate professionals to comprehend the various types of claims and their consequences. As of early 2024, the landscape of residential property claims has evolved, with low equity mortgages significantly more prevalent in government-backed segments at 8.3%, compared to 1.5% for Enterprise acquisitions and 2.0% for Other Conventional loans.

This statistic underscores the necessity of understanding claims in the context of equity and property transactions. Dr. Selma Hepp, Chief Economist for CoreLogic, highlights that the continual rise in home prices has greatly enhanced home equity, with existing homeowners now averaging approximately $315,000 in equity—an increase of nearly $129,000 since the pandemic began. Home price growth has varied across regions, from 7.5% in the East North Central Division to 1.6% in the West South-Central Division, emphasizing the need to grasp local market dynamics.

Such equity gains can be directly influenced by existing claims, which must be resolved before any transfer of ownership. The historical context of negative equity illustrates the recovery in the housing market, with many homeowners now enjoying a positive equity position relative to their mortgage balances. Familiarizing yourself with the fundamental ideas and categories of claims—such as mortgage claims, tax claims, and judgment claims—will enable you to manage the home lien search and the claim investigation process more efficiently, ultimately promoting smoother real estate dealings.

Furthermore, understanding CoreLogic HPI Forecasts can provide valuable insights into market trends and their implications for homeowner equity.

Why Conducting a Lien Search is Crucial for Home Buyers

Conducting a thorough home lien search is essential for home purchasers aiming to protect their investments from unforeseen liabilities. Professional search firms can provide comprehensive home lien searches and investigations across various states and counties, covering a range of claims. This ensures that buyers are fully informed prior to making a purchase. Undisclosed claims can impose significant financial burdens, potentially resulting in severe consequences such as foreclosure or protracted legal disputes.

For instance, a property may carry a tax obligation due to unpaid property taxes from a previous owner, thereby making the new buyer responsible for settling that debt. Additionally, mechanic's claims, which arise from unpaid contractor services, can complicate ownership and necessitate costly remediation efforts. In 2024, it is particularly vital for buyers to take proactive measures; studies indicate that an increasing percentage of home buyers recognize the importance of this practice.

According to a recent study by the Zillow Group Population Science, which gathered over 54,500 responses, including approximately 18,500 from successful purchasers, many are acknowledging the significance of property checks in safeguarding their investments. As highlighted by Norada Real Estate Investments, 'The overall economic climate remains a cause for concern. A potential recession or other economic decline could significantly impact the housing market, making it imperative for buyers to conduct thorough investigations to protect their financial interests.'

Furthermore, a case study on down payment assistance among buyers of color reveals that these purchasers not only receive increased financial support but may also face various challenges related to undisclosed claims, underscoring the necessity for thorough investigations. Ultimately, ensuring that all claims are resolved before finalizing a transaction is not merely a matter of due diligence; conducting a home lien search is a crucial step in avoiding future financial troubles and ensuring a seamless transition into property ownership.

Step-by-Step Process for Conducting a Home Lien Search

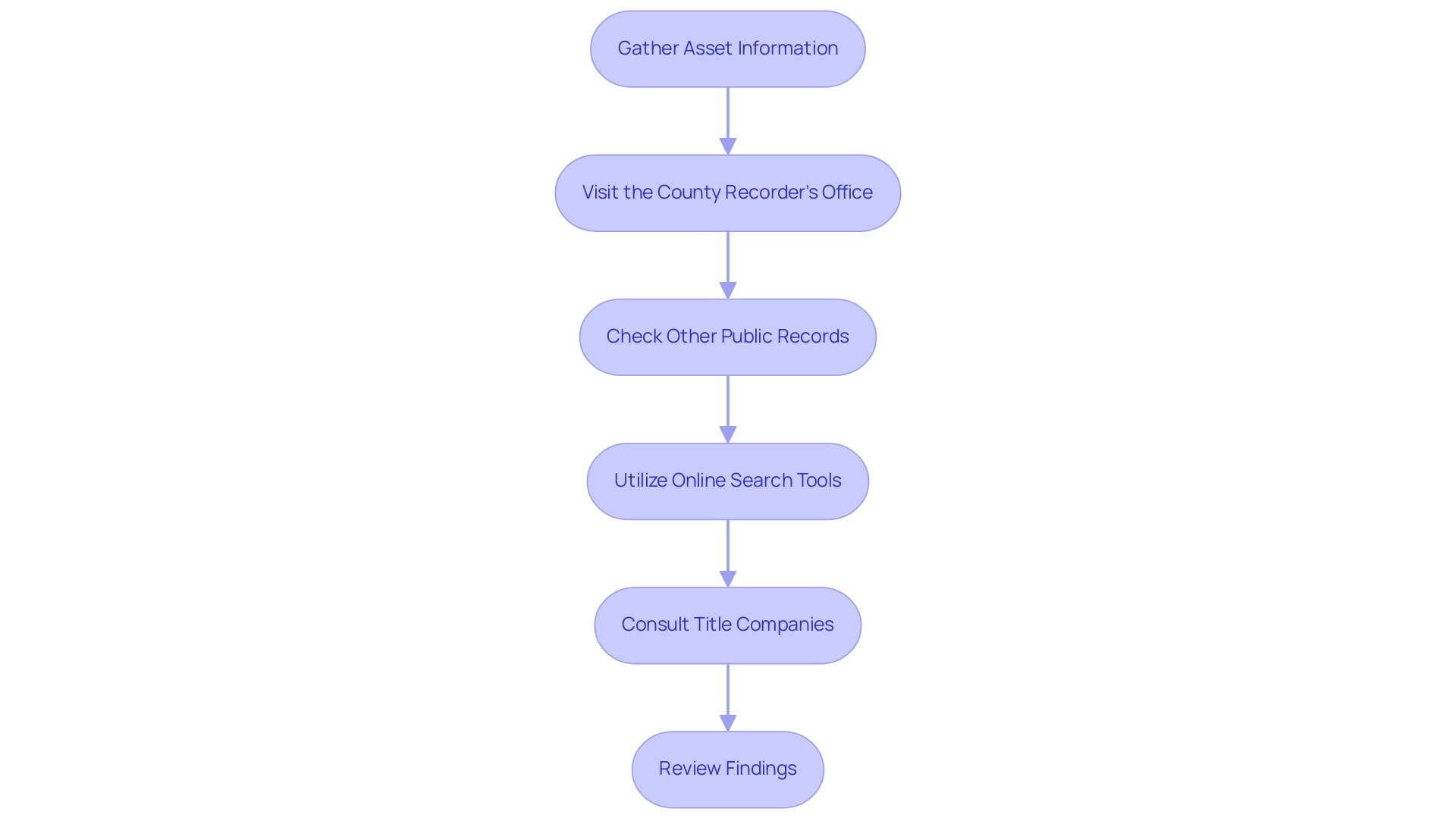

Conducting a thorough home claim search involves several key steps essential for ensuring accuracy and completeness.

-

Gather Asset Information: Start by collecting pertinent details such as the asset address, owner's name, and any relevant legal descriptions. This foundational information is crucial for conducting accurate searches.

-

Visit the County Recorder's Office: Access public records at the County Recorder's Office to identify any existing liens. Numerous counties now provide online databases, enabling queries by property address or owner's name, greatly enhancing the process.

-

Check Other Public Records: Expand your inquiry by exploring tax records, court documents, and local government databases. These additional sources can uncover further financial information that may affect the property.

-

Utilize Online Search Tools: Leverage modern technology by using online platforms such as Parse AI. These tools utilize machine learning to automate inquiries, swiftly recognizing claims and extracting pertinent information, thereby conserving time and effort. Note that a list from ListSource can cost as much as a year-long subscription to PropertyRadar, making it essential to weigh your options carefully when budgeting for property searches.

-

Consult Title Companies: If the inquiry process seems overwhelming or you require deeper insights, consider hiring a title company. These experts can carry out an extensive investigation, including a home lien search, and deliver a thorough report on any claims found, ensuring you have a full grasp of the asset's condition.

-

Review Findings: After gathering your results, carefully examine the findings. Pay close attention to any claims noted and consider their implications for the asset. For instance, a Notice of State Tax Lien will be issued if the debtor files any missing tax returns and pays the lien tax debt in full, highlighting the importance of staying informed about potential liens. As Carla Ayers, Section Editor for Rocket Homes and Realtor®, mentions,

If you understand how a property title investigation operates when the time arrives to obtain one, you can accurately interpret the outcomes of the investigation and know how to best proceed based on those outcomes.

This understanding is essential for making informed choices.

Additionally, consider the preferences of recent property buyers: 85% purchased previously-owned residences, with a median distance moved of 20 miles. This context demonstrates the significance of property investigations in the house purchasing process, as buyers emphasize neighborhood quality and affordability, often intending to reside in their residences for an average of 15 years. By adhering to these procedures, you can perform a successful residential claim investigation and obtain important information regarding the asset's legal status.

Types of Liens You Might Encounter in a Home Lien Search

When conducting a home lien search, it is crucial to recognize the various types of liens that may surface, each carrying distinct implications for property transactions:

- Mortgage Liens: These voluntary liens are established by lenders to secure loans used for purchasing properties. They ensure that the lender has a claim to the asset should the borrower default on the loan.

- Tax Claims: Enforced by government agencies when real estate taxes remain unpaid, tax claims can lead to foreclosure if unresolved, complicating the sale of an asset significantly.

- Mechanic's Claims: Filed by contractors or suppliers when payment for services or materials is owed, mechanic's claims can present serious obstacles for property owners. The prevalence of mechanic's liens in residential purchases is notable, particularly as fluctuations in property prices can significantly impact equity positions. For instance, a report titled "Impact of Home Prices on Equity" discusses how a 5% increase in home prices could help approximately 110,000 homes regain equity, while a 5% decline could push around 153,000 homes into negative equity. This statistic underscores the importance of ensuring all contractor payments are settled before closing.

- Judgment Liens: These arise from court rulings against a real estate owner, providing creditors a stake in the asset and potentially resulting in seizure if the debt remains unsettled. Bill Gassett, a specialist in real estate, advises,

Expect that addressing claims can prolong the sale process timeline and prepare accordingly. - Homeowners Association (HOA) Claims: Imposed by an HOA for unpaid dues or assessments, these claims can restrict the sale of real estate until the dues are cleared, adding another layer of complexity to the transaction.

Understanding these various categories of claims is essential for anyone engaged in real estate dealings, especially in markets like Las Vegas, where a home lien search indicates the lowest negative equity share of all mortgages at 0.6%. This context is crucial, as claims can greatly affect both the sale process and the overall equity standing of the owner.

Tools and Resources for Effective Lien Searches

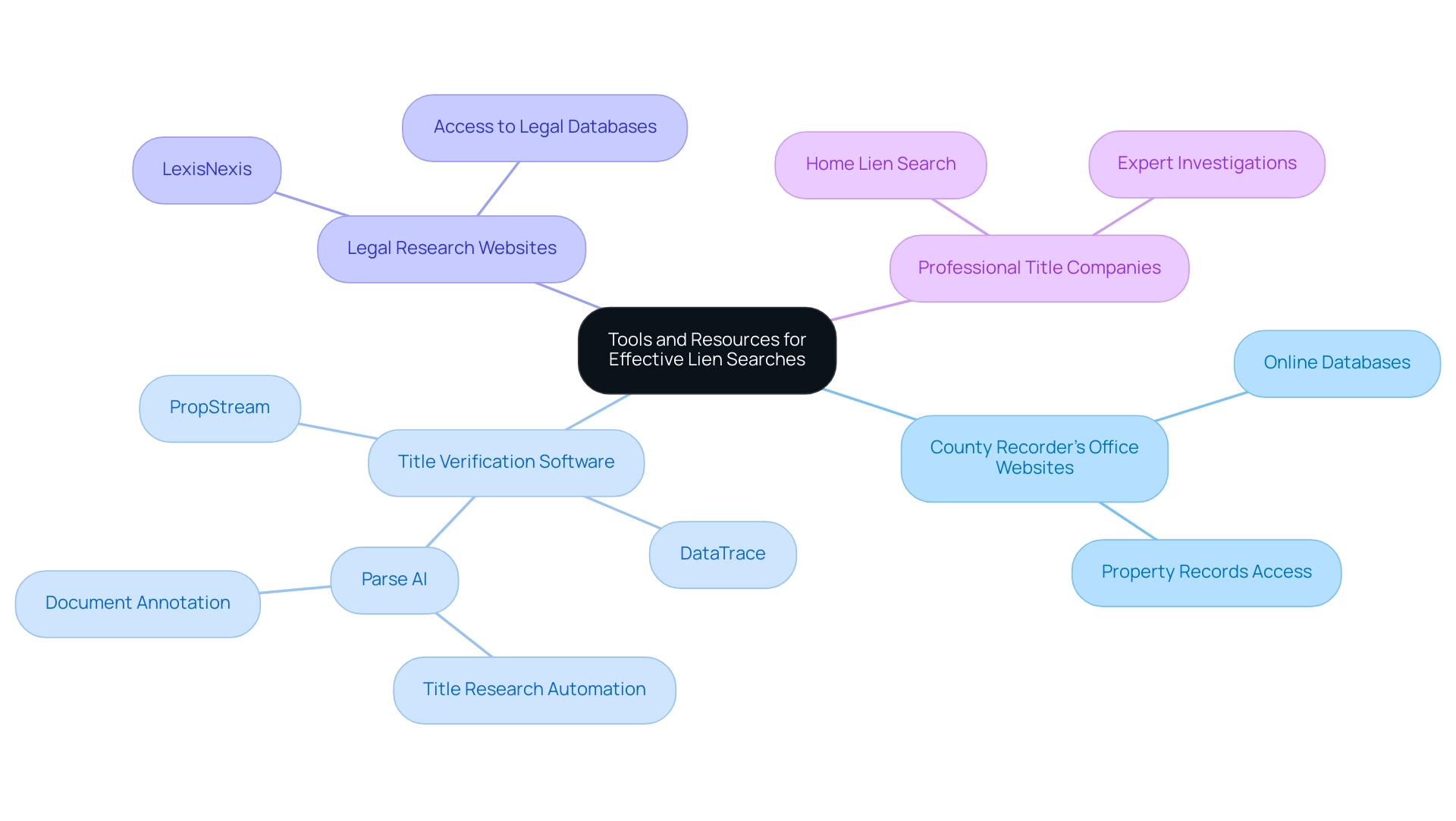

To simplify your claim investigation process, utilizing the appropriate tools and resources is essential. Here are some effective options to consider:

- County Recorder's Office Websites: Many counties provide online databases where property records, including encumbrances, can be easily accessed and explored, offering a foundational resource for encumbrance information.

- Title Verification Software: Advanced platforms like PropStream, DataTrace, and Parse AI significantly enhance efficiency by automating encumbrance retrieval processes. Parse AI's powerful title research automation and machine learning tools can quickly extract critical information from title documents, enabling quicker identification of claims that might otherwise be overlooked. Notably, Parse AI's example manager allows users to annotate documents effectively, aiding in the retrieval of information from a vast array of unstructured documents, thereby speeding up the overall document processing workflow.

- Legal Research Websites: Resources like LexisNexis provide access to extensive legal databases, enabling thorough inquiries that can uncover critical claim information and ensure adherence to legal standards.

- Professional Title Companies: Partnering with a reputable title company ensures careful attention to detail in performing investigations, such as conducting a home lien search. Their experience can prove invaluable, especially in complex cases.

In a recent study analyzing the performance of various title search software, it was noted that tools leveraging statistical analysis enhance decision-making processes across sectors. This aligns with the broader trend of incorporating statistical tools into organizational strategies, highlighting the effectiveness and necessity of modern technology in identifying claims. Furthermore, the Case Evaluator Report Builder in Westlaw enhances the services provided by Parse AI by generating reports on jury verdict data, which can be crucial in comprehending the context of claims in legal matters. As Brian Dean aptly noted,

We found that titles with a positive sentiment improved CTR by approximately 4%

reflecting the significance of well-managed and efficient title queries in driving business outcomes. Moreover, an examination of more than 160k keywords spanning 400 websites suggests that branded keywords yield superior results across the internet, highlighting the significance of efficient tools such as Parse AI in related queries.

Common Challenges in Home Lien Searches and How to Overcome Them

Conducting home searches presents several common challenges that can complicate property transactions; however, with the advanced machine learning tools offered by Parse AI, addressing these obstacles becomes significantly more manageable.

- Incomplete Records: Public records often suffer from incompleteness or outdated information. Reports indicate that approximately 30% of public documents concerning claims are incomplete, leading to unforeseen liabilities for homebuyers. To mitigate this issue, it is crucial to cross-reference data with multiple sources and validate findings against tax records. Parse AI's automated document processing capabilities streamline this process, ensuring comprehensive data verification.

- Unrecorded Claims: Certain claims may evade public databases, remaining unrecorded and hidden. Engaging directly with local authorities or utility companies can uncover these claims, making a home lien search essential to identify potential encumbrances before transactions proceed. Parse AI's powerful title research automation assists in extracting critical information, significantly reducing the risk of overlooked claims.

- Complex Legal Language: The legal terminology found in claim documents can be daunting. Engaging a real estate attorney to navigate these complexities provides clarity and prevents misunderstandings that may arise from misinterpreted legal language. Skyline Title Support emphasizes, "Contact Skyline Title Support today to ensure a comprehensive municipal inquiry that safeguards your investment," underscoring the importance of professional assistance in these matters. Moreover, real estate lawyer Jane Doe states, "It’s essential for purchasers to comprehend the consequences of claims and to seek expert guidance to prevent expensive errors."

- Time Constraints: The diligence required for investigating claims can be time-consuming. Utilizing automated tools like those provided by Parse AI or hiring professionals can expedite the process, allowing for a more efficient and effective inquiry. Furthermore, homebuyers should allocate funds to cover potential payments, including back taxes and unpaid utilities, as part of their due diligence. By employing these strategies and utilizing Parse AI's advanced technology, sellers and buyers can mitigate potential delays or issues frequently encountered in real estate transactions.

Alongside these features, Parse AI's example manager enables users to swiftly annotate a single instance to gather information from a vast collection of unstructured documents, further improving the effectiveness of property assessments. The platform was developed by a team of experts with over 50 years of combined experience in energy, real estate, and technology, ensuring a profound understanding of the challenges faced in confirming real estate ownership. By leveraging Parse AI's innovative solutions, users can anticipate enhanced precision and speed in their inquiry processes.

Ensuring Accuracy in Your Home Lien Search

To attain precision in your home title investigation, it is imperative to implement the following best practices:

- Double-Check Information: Verifying details of the real estate, including the legal description and owner's name, against multiple reliable sources is essential. Discrepancies can lead to significant problems in the future.

- Stay Informed: Given that claim information can change rapidly, conducting your inquiry as close to the purchase date as feasible is recommended. This approach ensures that you are working with the most current data available. Notably, the duration of a lien on a property can vary, with some lasting several years or until resolved, underscoring the importance of a timely home lien search.

- Consult Professionals: Should uncertainty arise regarding your findings or the home lien search process, it is advisable to seek guidance from title agents or real estate attorneys. Their expertise can clarify complex situations and enhance the accuracy of your results.

- Utilize Technology: Employing advanced technologies, such as machine learning tools like Parse AI, can significantly streamline the process. These tools assist in automating inquiries and reducing human error, enabling a thorough examination of all relevant documents. Additionally, consider performing a reverse UCC inquiry, which gathers UCCs using the secured party's name rather than the debtor's name, offering a broader perspective on potential claims.

With approximately 4.6 million individuals possessing more than one claim or judgment on record, the significance of comprehensive verification becomes increasingly evident. As Chien notes,

It is not only important to have the board’s attention in DQ improvement, but also for it to be a sustainable practice. Periodically communicating the benefits of these best practices to stakeholders can further reinforce their value in maintaining accurate and reliable information.

Furthermore, the case study titled 'Holistic Risk Evaluation in Credit Decisions' illustrates how integrating a home lien search into credit decisions throughout the customer life cycle can lead to more competitive offers and strengthen customer relationships, emphasizing the relevance of diligent lien searches in broader financial contexts.

Conclusion

Understanding home liens is essential for anyone involved in real estate transactions, whether seasoned professionals or first-time buyers. Liens represent legal claims against properties, often arising from unpaid debts, and can significantly affect ownership rights and property values. As the housing market evolves, the prevalence of low equity mortgages and the rising home equity underscore the need for a comprehensive understanding of the types of liens and their implications.

Conducting thorough lien searches is not merely a precaution; it is a critical step in protecting investments and ensuring a smooth home buying experience. Undisclosed liens can lead to severe financial repercussions, including foreclosure and costly legal disputes. The importance of utilizing tools and resources for effective lien searches cannot be overstated, as they enhance accuracy and efficiency, helping to identify potential encumbrances before transactions proceed.

In summary, navigating the complexities of home liens is vital for safeguarding property investments and ensuring informed decision-making in real estate transactions. By familiarizing oneself with the different types of liens, leveraging advanced search tools, and engaging professionals when necessary, buyers and sellers can mitigate risks and secure their financial interests. As the housing market continues to change, being diligent about lien searches will remain a key component of successful property transactions.

Frequently Asked Questions

What is a residential claim?

A residential claim is a legal assertion against a property that typically arises from unpaid debts, imposed by creditors, contractors, or government entities when payments are overdue.

Why is it important for real estate professionals to understand residential claims?

It is essential for real estate professionals to comprehend the various types of claims and their consequences, as they can significantly impact property transactions and ownership.

How has the landscape of residential property claims changed as of early 2024?

As of early 2024, low equity mortgages are more prevalent in government-backed segments at 8.3%, compared to 1.5% for Enterprise acquisitions and 2.0% for Other Conventional loans.

What is the average home equity for existing homeowners?

Existing homeowners now average approximately $315,000 in equity, which has increased by nearly $129,000 since the pandemic began.

How do home price growth rates vary across regions?

Home price growth has varied across regions, with increases ranging from 7.5% in the East North Central Division to 1.6% in the West South-Central Division.

What types of claims should real estate professionals be familiar with?

Real estate professionals should be familiar with fundamental ideas and categories of claims such as mortgage claims, tax claims, and judgment claims.

Why is conducting a home lien search important for home purchasers?

Conducting a thorough home lien search is essential for protecting investments from unforeseen liabilities, as undisclosed claims can lead to significant financial burdens and legal issues.

What are some examples of claims that can affect property ownership?

Examples of claims include tax obligations due to unpaid property taxes from previous owners and mechanic's claims arising from unpaid contractor services.

How are buyers recognizing the importance of property checks?

A study by the Zillow Group Population Science indicates that an increasing percentage of home buyers acknowledge the significance of conducting property checks to safeguard their investments.

What should buyers ensure before finalizing a property transaction?

Buyers should ensure that all claims are resolved before finalizing a transaction to avoid future financial troubles and ensure a smooth transition into property ownership.