Overview

The article delivers a comprehensive, step-by-step guide on conducting a property title search, underscoring the critical importance of verifying ownership and identifying any claims or liens that may impact a real estate transaction. It outlines essential steps, including:

- Gathering property information

- Accessing public records

- Reviewing the chain of title

Furthermore, it highlights the significant role of professionals and advanced technologies, such as Parse AI, in enhancing the accuracy and efficiency of title searches.

Introduction

Navigating the intricate realm of real estate transactions demands a profound understanding of title searches—a pivotal process that authenticates property ownership and reveals potential legal complications. Serving as the foundation for secure property dealings, title searches necessitate meticulous examination of public records, empowering buyers and sellers to proceed with assurance.

As the real estate landscape evolves, contemporary trends underscore an increasing dependence on technology and specialized services to bolster the accuracy and efficiency of these searches. This article explores the nuances of title searches, highlighting their importance, outlining the step-by-step process, addressing common challenges, and elucidating the essential role of title insurance, ultimately equipping readers with the knowledge required to adeptly navigate this crucial facet of property transactions.

Understanding Title Searches: What You Need to Know

A title search property is a comprehensive examination of public records designed to determine the legal ownership of an asset while recognizing any claims, liens, or encumbrances that may affect it. This title search property process is essential for anyone involved in real estate transactions, as it verifies that the seller has the authority to transfer ownership and ensures that the property is free of legal complications.

Grasping the basics of title search property investigations, including the essential documents examined—such as deeds, mortgages, and tax records—is vital for making informed choices. Current trends suggest that around 62% of firms delegate tax research, such as liens and exemptions, emphasizing the increasing dependence on specialized services to improve accuracy and efficiency in property investigations.

Furthermore, conducting a title search property plays a crucial role in revealing possible disputes or claims against a property, which could complicate or delay a sale. For instance, in 2024, For Sale By Owner (FSBO) transactions represented 6% of home sales, with sellers often facing challenges related to pricing and paperwork. The average FSBO residence was sold for $380,000, considerably less than the $435,000 for agent-supported transactions, highlighting the benefits of expert assistance in managing ownership intricacies.

As highlighted by IBISWorld, "reliable industry research is crucial for grasping market dynamics and making knowledgeable choices in estate." This emphasizes the significance of remaining informed about industry developments, like those outlined in the State of the Nation's Housing report, which examines U.S. housing markets, demographic trends, and economic conditions that may influence property assessments.

In this changing real estate environment of 2025, Parse AI is committed to improving property examination services through innovative technologies and cooperation with industry experts. By utilizing more than 50 years of collective expertise, Parse AI is dedicated to creating solutions that simplify the document examination process, ensuring precision and effectiveness. The Parse AI platform employs cutting-edge technologies like to enhance the speed and dependability of document inquiries.

The significance of conducting a title search property remains crucial, not only for ensuring smooth transactions but also for protecting against unexpected legal problems that could occur after the sale. This underscores the necessity for real estate professionals to stay informed about the latest trends and best practices in title search property.

Step-by-Step Process of Conducting a Title Search

- Gather : Initiate the process by collecting essential details about the real estate, such as its address, parcel number, and the names of both current and previous owners. This foundational information is crucial for accurately locating the relevant records and ensuring a thorough search.

- Access Public Records: Proceed to the local county recorder's office or utilize their online database. The majority of real estate records are public and can be searched using either the address or the owner's name. This step is vital as it grants access to a wealth of information regarding the asset's history.

- Review the Chain of Title: Delve into the history of ownership by examining past deeds. It is imperative to ensure that there are no gaps in the chain of title, as these gaps could signify potential legal issues that may arise during the transaction.

- Check for Liens and Encumbrances: Identify any outstanding liens, including mortgages, tax liens, or judgments against the asset. These encumbrances can significantly impact ownership rights and must be addressed prior to any sale to prevent complications.

- Verify Legal Descriptions: Confirm that the legal description of the asset aligns with the physical site being acquired. This verification involves checking land boundaries and any easements or limitations that may be relevant, ensuring that the purchaser is fully aware of what they are acquiring.

- Compile Findings: Document all findings in a comprehensive report that summarizes the ownership history, highlights any issues discovered, and provides recommendations for resolving them. This report is essential for the purchaser and any legal experts involved in the transaction, serving as a crucial reference throughout the process.

By adhering to these steps, researchers can effectively conduct a property investigation, ensuring that all relevant information is collected and examined, ultimately facilitating a more seamless real estate transaction. It is critical to recognize that a document examination reveals the legal owner of an asset and any pending claims or liens against it, which may be asserted by various organizations. Moreover, certain insurance premiums can be as low as $110, making it a financially prudent choice for numerous purchasers.

According to a case study, under typical conditions, a standard property investigation in New York can be completed within 24 to 72 hours, particularly for assets with straightforward histories, while more complex inquiries may require 10 to 14 days. As Bill Gassett, a nationally recognized property authority, emphasizes, understanding the ownership review process is vital for ensuring a successful property transaction.

The Importance of Accuracy in Title Searches

Ensuring precision in title search property investigations is crucial in the real estate industry. Mistakes or exclusions can lead to serious legal and financial repercussions, including conflicts regarding ownership, unresolved liens, or even foreclosure. For instance, if a property examination overlooks an existing lien, the new owner may inadvertently take on that debt, resulting in unforeseen financial pressures that could threaten their investment.

Furthermore, inaccuracies can significantly delay the closing process, causing frustration and potential loss of trust among all parties involved.

The financial consequences of document examination mistakes are significant. Statistics suggest that legal conflicts stemming from ownership verification inaccuracies can result in expenses surpassing thousands of dollars in legal charges and possible damages. Recent legal cases have highlighted this issue, with courts ruling in favor of plaintiffs who experienced losses due to careless property investigations. Such outcomes highlight the critical need for meticulousness in this process.

As Sonya Schwartz, an Institute for , states, "Tribal AVR laws give Tribal Nations and state election officials the power to work together to significantly reduce the burden of voter registration for enrolled tribal members." This viewpoint emphasizes the wider consequences of precision in documentation procedures, including name inquiries.

To mitigate these risks, it is vital to adopt best practices, including thorough double-checking of records and leveraging advanced technologies like Parse AI. By employing machine learning and optical character recognition, experts can improve the precision and effectiveness of document examinations, ultimately protecting the interests of buyers and sellers equally. Case studies have shown that companies utilizing these technologies encounter fewer mistakes and quicker response times, emphasizing the significance of precision in document reviews in 2025 and beyond.

Recent legal cases involving errors in title search property further illustrate the real-world implications of inaccuracies, underscoring the necessity for diligence in this critical process.

Who Performs Title Searches and Their Roles

A title search property is conducted by a diverse team of experts, each contributing essential knowledge to guarantee the integrity of ownership. The key roles include:

- Title Examiners: These specialists meticulously review public records to summarize findings related to property ownership. Their main duty is to verify that the label is clear and marketable, which is essential for facilitating . With roughly 200 examiners, abstractors, and searchers working across federal, state, and local governments, their expertise is vital in preserving the accuracy of property records. The typical projected calendar days lost across the states is 1.0, emphasizing the effectiveness of these professionals in reducing delays in property transactions.

- Title Firms: Usually hired by purchasers or lenders, these firms conduct thorough ownership investigations and provide ownership insurance. This insurance protects against potential future claims, providing peace of mind to all parties involved. Their involvement is significant, as they play a pivotal role in the transaction process, ensuring that all title-related issues are addressed before closing.

- Real Estate Lawyers: In dealings that may encompass intricate legal issues, purchasers frequently choose to employ real estate lawyers to perform ownership investigations. These legal experts provide a nuanced comprehension of real estate law, ensuring that all legal aspects are thoroughly examined and addressed. As Harrison Barnes remarked, "I'm serious about enhancing Lawyers' legal careers," which highlights the significance of legal professionals in the process of examination.

- Abstractors: Specializing in gathering and summarizing real estate records, abstractors provide detailed reports on ownership history. Their efforts are crucial for developing a thorough summary of a property's ownership history, which helps in recognizing any possible concerns that may occur during the ownership examination.

Each of these roles is essential in guaranteeing that the document verification process is comprehensive and precise, ultimately protecting the interests of all parties engaged in the transaction. The partnership among professionals in the field, property attorneys, and firms improves the effectiveness and dependability of title search property, leading to more seamless transactions. Furthermore, the incorporation of technology, as shown by Parse AI, transforms research by greatly minimizing the time and expenses linked with conventional methods.

With advanced machine learning tools for document processing and research automation, including features like the example manager that allows for quick annotation of documents, Parse AI streamlines the entire process. This allows researchers to finish abstracts and reports more rapidly and with greater precision, thus offering significant savings and enhancing overall efficiency. By tackling the challenges encountered by professionals in the field, Parse AI improves their functions and aids in a more efficient investigation process.

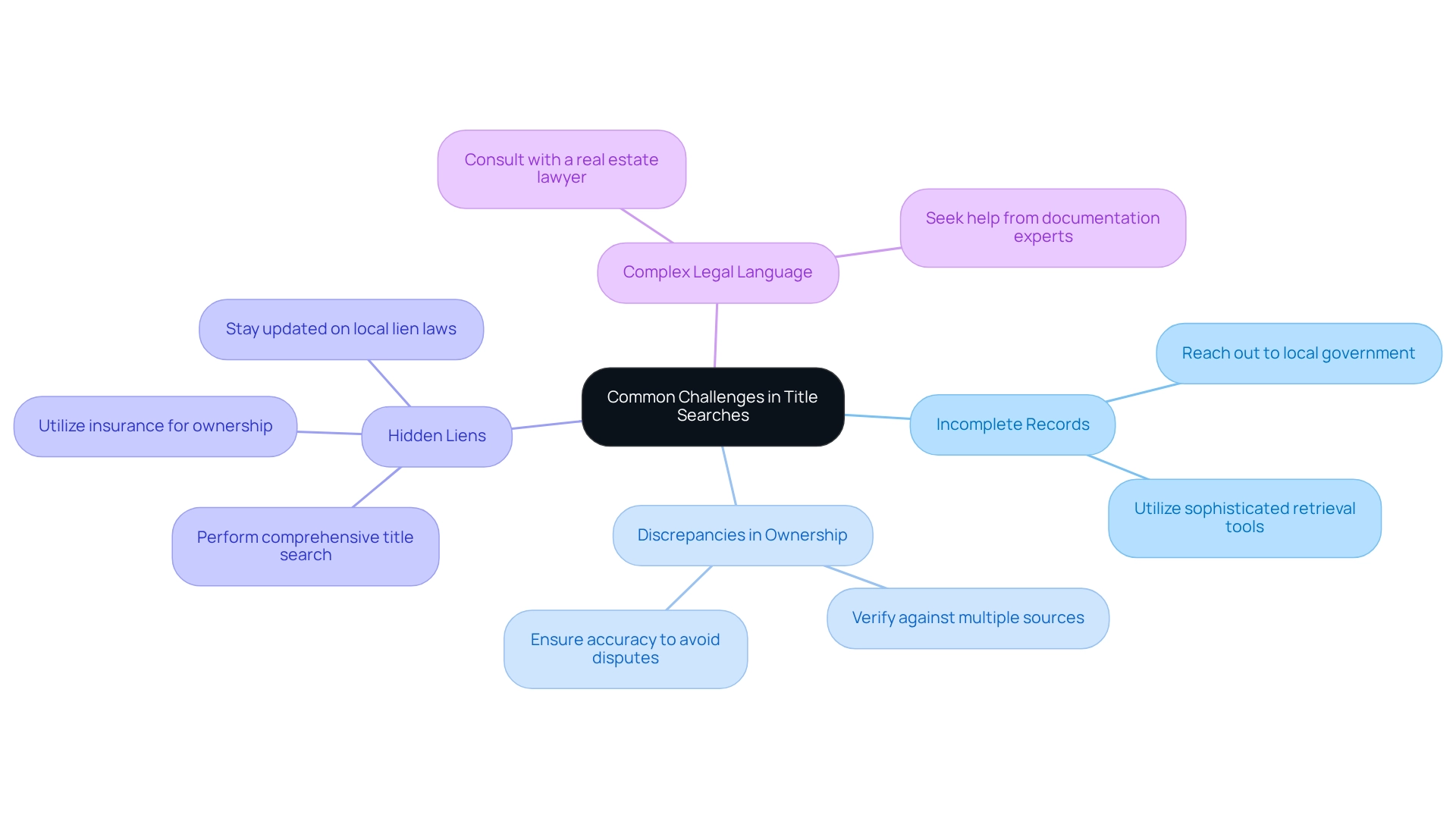

Common Challenges in Title Searches and How to Overcome Them

Conducting a title search presents several significant challenges that require careful navigation.

- Incomplete Records: Public records may sometimes be missing or incomplete, complicating the establishment of a clear chain of title. To address this issue, reaching out to local government offices for assistance is advisable. Furthermore, utilizing sophisticated retrieval tools can improve the chances of discovering essential information. Notably, around 20% of document inquiries encounter problems associated with incomplete public records, emphasizing the necessity of diligence in this field.

- Discrepancies in Ownership: Errors in names or property descriptions can lead to confusion and potential disputes. To ensure accuracy, it is crucial to verify information against multiple reliable sources. This diligence can avert costly errors and streamline the process of verifying ownership.

- Hidden Liens: Certain liens may not be readily visible in public records, posing a risk to prospective buyers. Performing a comprehensive title search and utilizing insurance for ownership can assist in mitigating this risk. Regularly updating knowledge on local lien laws can also provide an added layer of protection.

- Complex Legal Language: The legal terminology found in property documents can be daunting. Consulting with a real estate lawyer or a documentation expert can provide clarity and ensure adherence to legal requirements. Their expertise can be invaluable in interpreting complex documents and navigating potential pitfalls.

By acknowledging these challenges and employing proactive strategies, individuals can manage the document retrieval process more effectively. Utilizing innovative solutions, such as those offered by Parse AI, can significantly reduce the time and costs associated with these challenges, ultimately enhancing workflow efficiency. As noted, the platform offers substantial cost reductions compared to conventional research methods, making it a beneficial tool for researchers in the field.

In the words of Vidal Sassoon, " where success comes before work is in the dictionary," underscoring the importance of diligence and effort in overcoming these challenges.

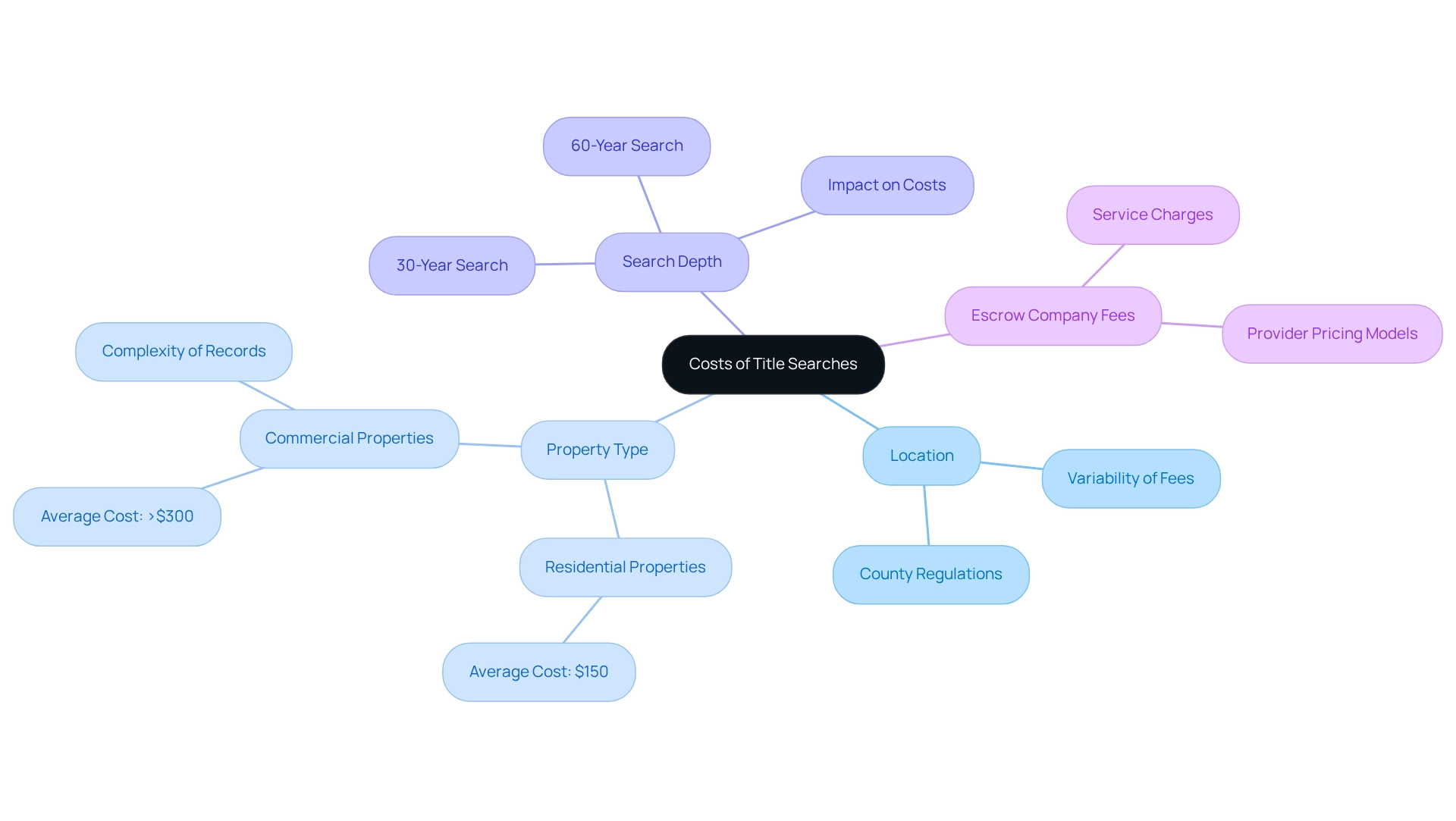

Understanding the Costs of Title Searches

The cost of a title search can fluctuate significantly due to several key factors.

- Location plays a critical role; fees for accessing public records can differ markedly between counties, reflecting local regulations and administrative costs.

- Property Type is another determinant. Generally, residential properties incur lower inquiry costs compared to commercial properties. This disparity arises from the complexity and volume of records associated with commercial transactions, which often require a title search property that involves more extensive research.

- Search Depth also impacts pricing. The duration of the search for ownership—whether it spans 30 years or 60 years—can affect costs. More thorough investigations generally require elevated charges due to the additional labor and resources involved.

- are another consideration. Involving an escrow company brings extra service charges, which can differ depending on the provider's pricing model and the particular services provided.

In 2025, the typical expense of document examinations falls between $100 and $250, though this can fluctuate significantly depending on the aforementioned factors. For instance, in urban areas with higher demand, costs may trend toward the upper end of this spectrum. It is advisable to obtain quotes from multiple providers for a title search property to ensure competitive pricing and account for regional variations.

Recent insights suggest that property investigation expenses for residential units are typically less than those for commercial units. Statistics reveal that residential inquiries can average around $150, whereas commercial inquiries might surpass $300. Furthermore, as the property market develops—especially in reaction to shifting housing conditions and economic factors—companies are progressively investing in digital systems and data extraction solutions to improve efficiency and lower expenses related to title search property. This proactive approach is essential for navigating the unpredictable landscape of the real estate industry.

Moreover, escrow firms must prioritize the safeguarding of sensitive client and transaction information as cyber threats increase in 2025. States also oversee insurance rates through various methods, which adds important context to the discussion of costs and pricing structures. As emphasized in a recent case study, the property and ownership sectors encounter an uncertain future, requiring swift adjustment to evolving market dynamics.

Investing in digital systems and data extraction solutions is essential for companies to pivot effectively in response to these changes. As Erik J. Martin points out, "Ownership of property is merely its possession status; the deed is the document employed to transfer the possession," highlighting the importance of comprehending ownership in the context of ownership searches.

The Role of Title Insurance in Real Estate Transactions

is crucial in real estate dealings, as title insurance safeguards against potential flaws in ownership claims that may arise post-acquisition. This insurance encompasses several key protections:

- Legal Fees: Should a claim arise against ownership, insurance can cover the legal expenses incurred in defense, ensuring that the property owner is not financially burdened by unforeseen legal challenges.

- Financial Losses: Insurance protects against financial losses stemming from issues such as undisclosed liens, fraudulent claims, or errors in public records. For instance, if a concealed lien emerges after acquisition, the policy can cover the expenses related to resolving the issue, thus safeguarding the buyer's investment.

- Assurance: With ownership insurance, purchasers and lenders can confidently proceed with transactions, knowing they are protected from unexpected ownership issues. This assurance is particularly vital in a market where approximately 80% of property transactions involve title search property insurance, underscoring its importance in the sector.

Typically, lenders require ownership insurance as a condition for funding. However, it is prudent for purchasers to conduct a title search property and obtain their own policies for enhanced security. The cost of insurance policies varies, generally reflecting the complexity and value of the asset involved. Additionally, recording fees—averaging around $125—are associated with filing deeds and official documentation, further highlighting the financial considerations in real estate transactions.

As noted in a case study, these fees are essential for legally documenting the transfer of ownership, ensuring that the transaction is officially recognized by local authorities.

In a recent statement, Sarah Wolak, a staff writer, emphasized that the CFPB is closely examining closing costs and fees consumers may encounter throughout the mortgage process, highlighting the importance of understanding insurance expenses. Furthermore, it is essential to recognize that rate regulation varies by state, which can affect insurance costs and implications for purchasers and lenders.

To summarize, insurance is not merely another expense; it is a vital protection that shields both purchasers and lenders from potential financial risks, ensuring that title search property ownership is secure and legally recognized. Recent changes in insurance policies further underscore the necessity for buyers and lenders to remain informed about their options and protections.

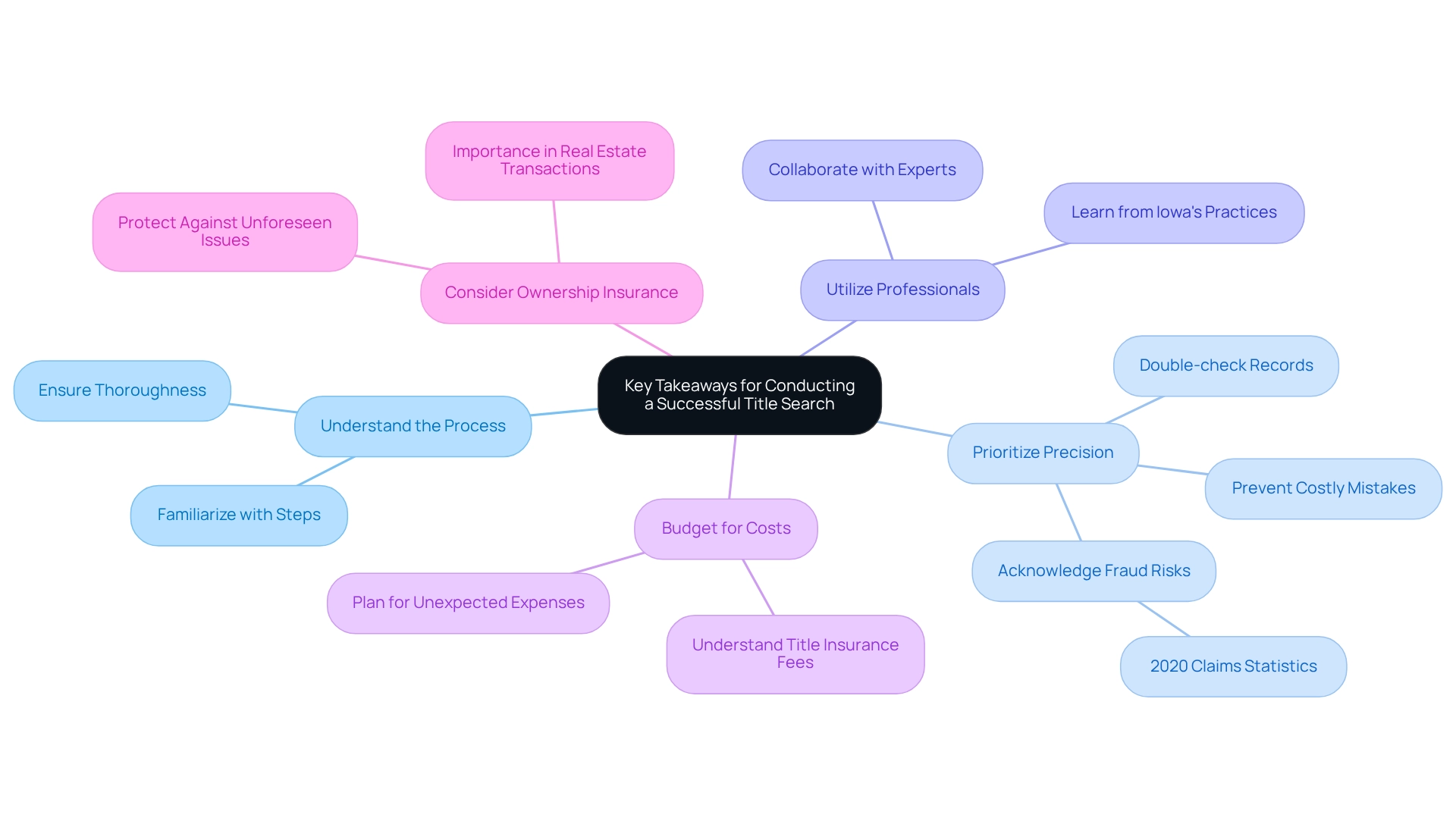

Key Takeaways for Conducting a Successful Title Search

To execute a successful property investigation, consider the following essential points:

- Understand the Process: Familiarize yourself with the comprehensive steps involved in a property examination. This knowledge is crucial for ensuring thoroughness and minimizing the risk of overlooking important details.

- Prioritize Precision: Precision is paramount in document investigations. Meticulously double-check all records and information to prevent costly mistakes that could jeopardize the transaction. In 2020, insurance firms for property transactions disbursed approximately $312 million in claims, primarily due to fraud, forged signatures, and human errors, underscoring the dangers associated with inaccuracies.

- Utilize Professionals: Collaborating with insurance companies or real estate lawyers can prove invaluable, particularly when navigating complex issues. Their expertise can clarify uncertainties and streamline the process. For instance, discussions regarding Iowa's coverage practices indicate that modifying such methods could benefit other states, highlighting the significance of expert opinions.

- Budget for Costs: Be cognizant of the potential expenses related to searches, which can vary significantly. The for a title search property typically amounts to a one-time fee ranging from 0.5% to 1% of the home's purchase price or loan amount. Organizing your budget effectively will aid in managing costs and preventing unexpected issues.

- Consider Ownership Insurance: Protect your investment by obtaining ownership insurance. This safeguards against unforeseen issues that may arise post-purchase, such as fraud or human errors. Notably, direct title insurance premiums constitute the largest segment of the Title Insurance industry in the US, emphasizing its importance in real estate transactions.

By adhering to these guidelines, you can facilitate a smoother and more secure real estate transaction, ultimately enhancing your success in the field.

Conclusion

Navigating the complexities of title searches is a crucial step in ensuring secure real estate transactions. This article has illuminated the essential components of title searches, detailing the step-by-step process of conducting them, the critical role of accuracy, and the involvement of various professionals. By understanding the significance of title searches, prospective buyers and sellers can effectively mitigate risks associated with property ownership and legal complications.

Furthermore, the discussion around the importance of title insurance has underscored its protective benefits, offering peace of mind against potential future claims. As the real estate landscape continues to evolve, leveraging technology and expert services will be paramount in enhancing the efficiency and reliability of title searches. Embracing these advancements not only streamlines the process but also safeguards the interests of all parties involved.

Ultimately, a thorough understanding of title searches and the associated challenges empowers individuals to make informed decisions. By prioritizing accuracy, utilizing professional expertise, and considering title insurance, one can navigate the intricate realm of real estate with confidence, ensuring a successful transaction and secure property ownership.

Frequently Asked Questions

What is a title search property?

A title search property is a comprehensive examination of public records to determine the legal ownership of an asset and identify any claims, liens, or encumbrances that may affect it.

Why is conducting a title search important in real estate transactions?

Conducting a title search is essential as it verifies that the seller has the authority to transfer ownership and ensures that the property is free of legal complications, thus protecting buyers from unexpected legal issues after the sale.

What documents are typically examined during a title search?

Essential documents examined during a title search include deeds, mortgages, and tax records.

What trends are currently observed in the title search property process?

Current trends indicate that around 62% of firms delegate tax research, such as liens and exemptions, to specialized services to improve accuracy and efficiency in property investigations.

How does a title search help in identifying potential disputes?

A title search can reveal possible disputes or claims against a property, which could complicate or delay a sale, ensuring that buyers are aware of any issues before proceeding.

What challenges do For Sale By Owner (FSBO) sellers face?

FSBO sellers often encounter challenges related to pricing and paperwork, and they typically sell their homes for less than those represented by agents.

How does Parse AI aim to improve property examination services?

Parse AI aims to enhance property examination services through innovative technologies and collaboration with industry experts, utilizing over 50 years of collective expertise to simplify the document examination process.

What is the typical timeframe for completing a property investigation?

A standard property investigation in New York can typically be completed within 24 to 72 hours for straightforward histories, while more complex inquiries may take 10 to 14 days.

What are the financial implications of conducting a title search?

Certain insurance premiums for title searches can be as low as $110, making it a financially prudent choice for many purchasers.

What is the significance of remaining informed about industry developments in real estate?

Staying informed about industry developments is crucial for understanding market dynamics and making knowledgeable choices in real estate transactions.