Introduction

In the intricate world of title research, professionals navigate a landscape filled with legal complexities, technological advancements, and the critical need for accuracy. The National Motor Vehicle Title Information System (NMVTIS) stands as a cornerstone in protecting consumers from title fraud, while title insurance provides essential safeguards in property transactions.

As the industry evolves, understanding the nuances of accurate title searches becomes paramount, alongside the integration of cutting-edge technology that enhances research efficiency. This article delves into the vital components of title research, exploring the significance of:

- Legal considerations

- The role of technology

- The overarching importance of precision in safeguarding property ownership

By examining these elements, title professionals can better equip themselves to navigate challenges and deliver exceptional service in an ever-changing environment.

Overview of the National Motor Vehicle Title Information System (NMVTIS)

The National Motor Vehicle Information System (NMVTIS) is an essential database created to protect consumers against fraud while ensuring precise ownership information across states. This system consolidates vehicle ownership data from various jurisdictions, allowing specialists to access crucial information regarding vehicle possession, ownership status, and outstanding liens. Recently, the Department of Justice (DOJ) announced that it will designate at least three third-party organizations to share information with NMVTIS, highlighting the system's expanding network and reliability.

As a reliable source for confirming a vehicle's ownership history, NMVTIS enables experts to provide accurate national title reports during property transactions. Furthermore, sector insights, such as those from Experian Automotive, suggest that a monthly reporting requirement may be slower than current sector practices, illustrating the operational implications of NMVTIS. A comprehensive understanding of how NMVTIS operates and its pivotal role in mitigating risks related to ownership discrepancies is essential for professionals seeking to enhance their operational efficiency and reliability in the industry.

For instance, in West Virginia, concerns were raised about vehicles exempt from titling due to age and their reporting requirements to NMVTIS. The DOJ confirmed that all automobiles in state registration systems must be reported, but vehicles exempt from registration under state law need not be reported, showcasing the complexities involved in reporting.

The Role of Title Insurance in Protecting Property Transactions

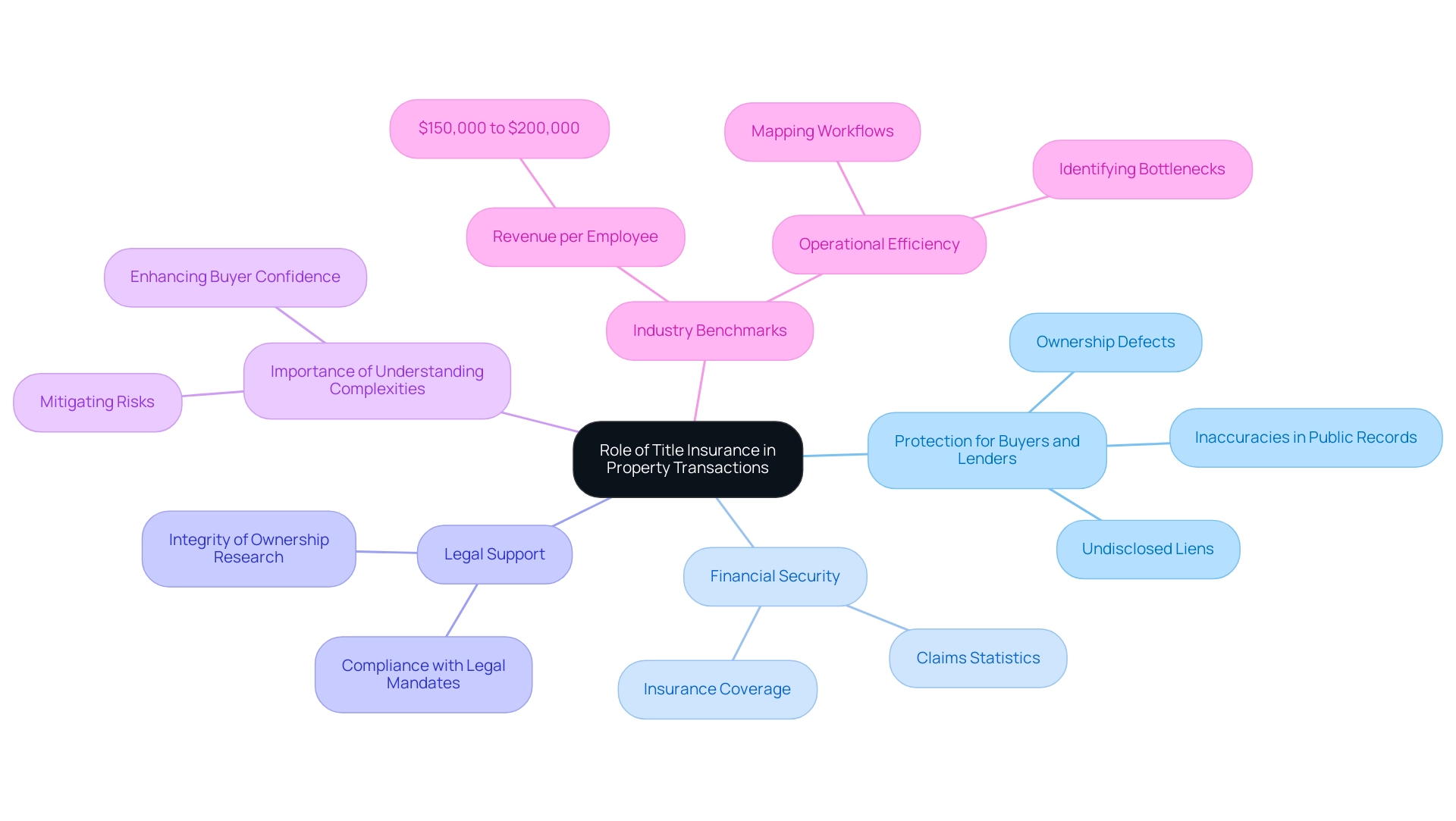

Title insurance serves as a vital safeguard for property buyers and mortgage lenders, shielding them from potential disputes regarding ownership rights. It provides financial security and legal support in cases of ownership defects, such as undisclosed liens or inaccuracies in public records. Given the significant implications of these issues, professionals in the real estate sector must grasp the complexities of insurance to effectively advise their clients.

Understanding these intricacies is crucial for mitigating risks during property transactions, enhancing buyer confidence, and ensuring compliance with legal mandates. Recent statistics indicate a notable rise in insurance claims and disputes in 2024, underscoring the importance of this coverage in contemporary real estate transactions. According to the NAIC Financial Regulatory Services Department, around 99% of all insurers are anticipated to contribute to the NAIC Financial Data Repository, highlighting the extensive coverage of insurance.

Legal experts emphasize that ownership insurance is not merely an option but a fundamental necessity for safeguarding property rights, reinforcing the integrity of ownership research processes. As Matthew Tuchband noted, 'We bring you the most recent and significant insights in an accessible format, concluding with our main takeaways — aka “And the Fox Says…” — on what you need to know.'

Furthermore, as successful companies in the industry strive for a revenue-per-employee benchmark of $150,000 to $200,000 annually, maintaining robust operational frameworks and mapping workflows, as illustrated in the case study 'Building Strong Operational Foundations,' becomes essential for navigating the complexities of insurance and protecting property transactions effectively.

The Importance of Accurate Title Searches

Precise searches of ownership documents are crucial in identifying any claims, liens, or encumbrances that could jeopardize a property's clear ownership. This intricate process entails a thorough review of public records, examination of prior transactions, and careful identification of discrepancies within ownership history. Title professionals must exercise meticulous attention to detail in their research.

A recent report emphasized that the reliability of national title reports depends on the thoroughness of these searches, which is crucial in protecting the interests of both buyers and sellers during real estate transactions. Significantly, Las Vegas possessed the lowest negative equity share at 0.6% among the 10 largest U.S. metro areas, indicating a stable market that highlights the importance of precise ownership searches in maintaining clear property rights. As Melissa Daniels, CEO of Emerald National Title, emphasizes, "Why does a closing have to feel like a transaction?

At Emerald National Title, our vision is to create a customized experience with a dedicated closing officer. So when a closing goes sideways, and you have a partner like Rexera that sends someone to the HOA office in person to help resolve the issue, that is a partner that understands that buying a home is personal, not a transaction." This reflects the understanding that the process of buying a home is deeply personal, not merely transactional.

Ensuring accuracy in searches not only mitigates risks associated with disputes but also enhances the overall client experience, thereby reinforcing the vital role of professionals in the industry. Moreover, difficulties with land surveys demonstrate actual consequences of inaccuracies in property searches; mistakes in boundary markers can result in disagreements and legal issues, underscoring the essential requirement for comprehensive investigation in the property process.

Leveraging Technology for Efficient Title Research

The incorporation of technology into document analysis processes is essential for improving both efficiency and precision. Advanced tools utilizing machine learning and optical character recognition are at the forefront of this evolution, automating the extraction and analysis of document titles. These technologies enable rapid identification of critical information and the flagging of potential discrepancies, which traditionally required extensive manual effort.

By adopting these innovations, industry experts can greatly reduce the time spent on manual investigation, thus enhancing the accuracy of their results. Significantly, 29% of worldwide IT experts assert their staff are already conserving time with new AI and automation software and tools, which highlights the efficiency improvements that can be achieved in research. Furthermore, the adoption of such technologies not only boosts productivity but also enables researchers to concentrate on higher-value tasks, ultimately streamlining the entire real estate transaction process.

However, it is essential to note that less than a third of adults have a high level of AI awareness, which may present challenges in the broader adoption of these technologies within the industry. Furthermore, the expansion of AI in the retail industry, expected to increase from $9.97 billion in 2023 to $54.92 billion by 2033, demonstrates the possible influence of AI across numerous domains, indicating a comparable path for heading analysis. McKinsey's analysis reveals that European banks implementing machine learning techniques experienced sales increases of up to 10% in new products while reducing customer churn by 20%.

This highlights the potential of machine learning to transform document examination techniques, allowing experts to traverse an increasingly intricate environment more efficiently.

Understanding Legal Considerations in Title Research

Title professionals must possess a thorough understanding of the legal frameworks that govern their activities, encompassing property laws, regulatory compliance, and specific state regulations. Expertise in state-specific regulations regarding ownership, liens, and easements is essential for conducting thorough ownership investigations. This understanding is not merely academic; it has practical implications, particularly when discrepancies arise that could lead to legal disputes.

With the integration of advanced machine learning tools from Parse AI, title investigators can expedite document processing and enhance their ability to conduct in-depth title analysis, ensuring confident land rights acquisition. The example manager feature allows researchers to quickly annotate individual examples, facilitating efficient information extraction from a large set of unstructured documents. As emphasized in recent discussions at the Thomson Reuters Institute's 31st Annual Marketing Partner Forum, the legal landscape is evolving rapidly, with Gen AI technology poised to reshape how law firms engage with clients.

The report outlines three potential scenarios that may affect the legal field as Gen AI evolves more fully, each scenario carrying varying degrees of impact — and the potential need to change — around how law firms serve their clients and the ultimate benefit this innovative technology could bring to the legal sector. Additionally, the case study on external data sources for judicial research highlights the reliance on platforms such as LexisNexis and Lex Machina, underscoring the importance of accessing diverse sources of information for thorough judicial research. The creators of Parse AI, who bring over 50 years of professional experience, have faced numerous challenges associated with the time and capital required to confirm real property ownership.

By utilizing their knowledge and industry connections, they have created a platform capable of progressing the industry into the future. By leveraging Parse AI's capabilities and adhering to established legal standards, title researchers can significantly mitigate risks and safeguard their clients' interests in real estate transactions, thereby reinforcing the integrity of their work in an increasingly complex environment.

Conclusion

The intricate landscape of title research necessitates a comprehensive understanding of various components that ensure accuracy and reliability. The National Motor Vehicle Title Information System (NMVTIS) plays a critical role in safeguarding consumers from title fraud, consolidating essential data to empower title professionals in their decision-making processes. Coupled with the indispensable protection that title insurance provides against ownership disputes, these elements underscore the necessity of diligence in property transactions.

Accurate title searches remain paramount, as they identify potential claims and liens that could threaten property ownership. The integration of advanced technologies, such as machine learning and automation, further enhances the efficiency of these searches, allowing professionals to focus on higher-value tasks while minimizing manual errors. Understanding the legal frameworks governing title research is equally crucial, as it equips professionals with the knowledge to navigate potential discrepancies and disputes effectively.

In summary, the evolution of title research is driven by a combination of legal acumen, technological advancement, and a commitment to precision. By embracing these factors, title professionals can not only mitigate risks but also elevate the quality of service provided to clients. As the industry continues to evolve, prioritizing accuracy and embracing innovation will be vital to maintaining the integrity of title research and protecting property ownership.

Frequently Asked Questions

What is the National Motor Vehicle Information System (NMVTIS)?

NMVTIS is a database created to protect consumers against fraud and ensure precise ownership information across states by consolidating vehicle ownership data from various jurisdictions.

How does NMVTIS benefit vehicle ownership verification?

NMVTIS allows specialists to access crucial information regarding vehicle possession, ownership status, and outstanding liens, enabling them to provide accurate national title reports during property transactions.

What recent changes have been announced regarding NMVTIS?

The Department of Justice (DOJ) announced that it will designate at least three third-party organizations to share information with NMVTIS, expanding its network and reliability.

What complexities exist in reporting vehicles to NMVTIS?

In West Virginia, it was confirmed that all automobiles in state registration systems must be reported to NMVTIS, but vehicles exempt from registration under state law do not need to be reported, illustrating the complexities involved.

Why is title insurance important in property transactions?

Title insurance protects property buyers and mortgage lenders from potential disputes regarding ownership rights, providing financial security and legal support in cases of ownership defects, such as undisclosed liens or inaccuracies in public records.

What are the implications of recent statistics on title insurance claims?

There has been a notable rise in insurance claims and disputes in 2024, highlighting the importance of title insurance coverage in contemporary real estate transactions.

What is the anticipated contribution of insurers to the NAIC Financial Data Repository?

Around 99% of all insurers are expected to contribute to the NAIC Financial Data Repository, reflecting the extensive coverage of insurance.

Why is ownership insurance considered a necessity?

Legal experts emphasize that ownership insurance is fundamental for safeguarding property rights and reinforcing the integrity of ownership research processes.

What operational benchmarks are successful companies in the insurance industry striving for?

Successful companies aim for a revenue-per-employee benchmark of $150,000 to $200,000 annually, highlighting the importance of maintaining robust operational frameworks and workflows.