Introduction

Outsourcing mortgage title review services has emerged as a pivotal strategy for organizations aiming to enhance operational efficiency and accuracy in real estate transactions. By engaging external experts to scrutinize title documents, companies can not only mitigate risks associated with title defects but also ensure the integrity of property ownership records. The advantages of this approach are profound, ranging from significant cost savings to access to cutting-edge technologies that streamline processes.

As the landscape of title research continues to evolve, directors must navigate the complexities of outsourcing, from selecting the right partners to establishing effective communication channels. This article delves into the essential steps and considerations for leveraging outsourcing in title review services, empowering organizations to optimize their operations and maintain a competitive edge in a dynamic market.

Understanding Mortgage Title Review Outsourcing

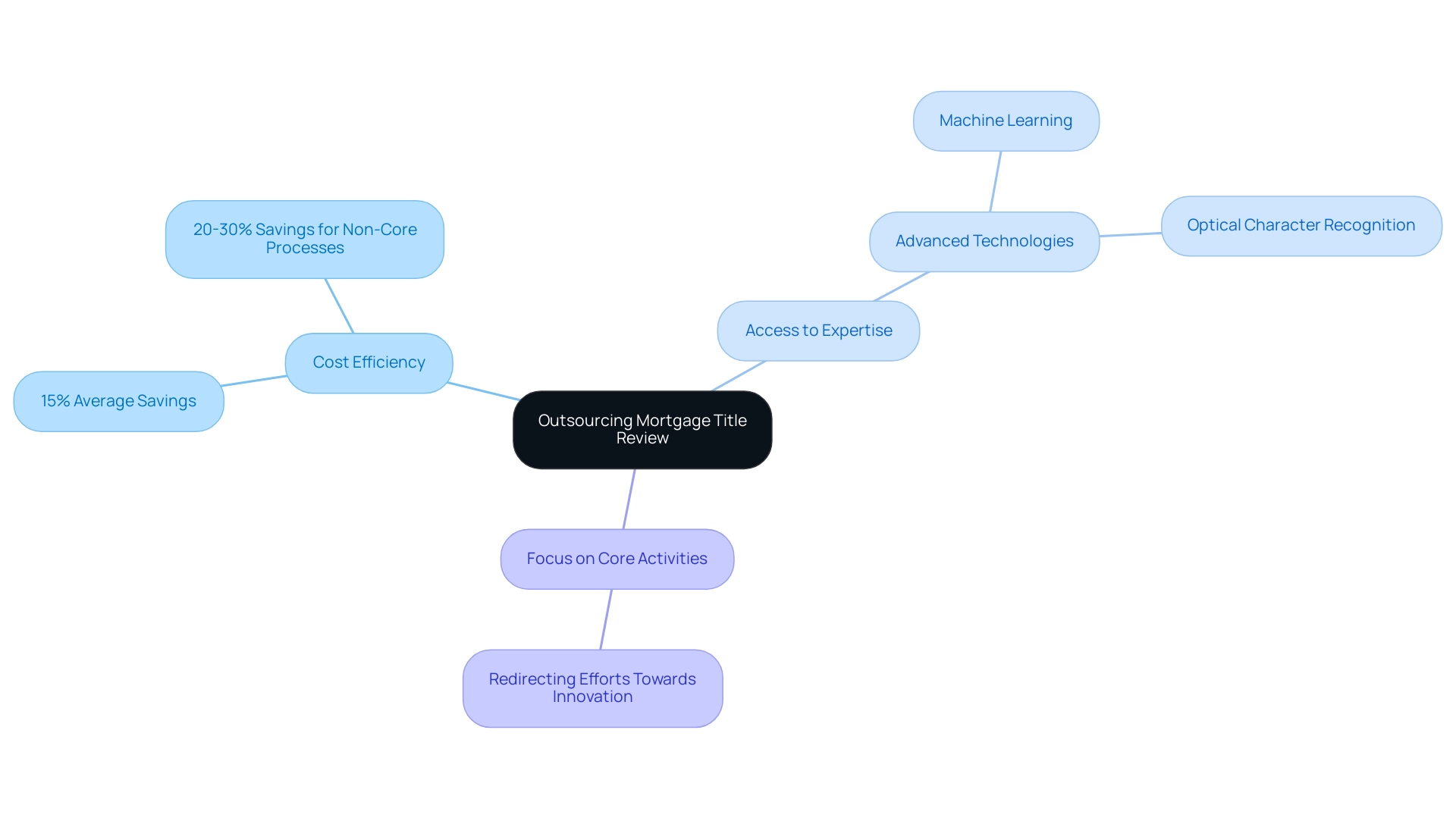

Outsourcing mortgage document review involves hiring outside experts or companies to carefully assess and confirm documentation related to real estate transactions. This critical process safeguards accurate property ownership records while mitigating risks linked to title defects. The key benefits of outsourcing are manifold:

- Cost Efficiency: Engaging third-party services can significantly lower operational costs. For instance, delegating tasks can yield an average savings of 15%, with potential reductions of 20-30% for non-core processes, as highlighted by Harvard Business Review. This statistic underscores the financial advantages of outsourcing.

- Access to Expertise: Specialized firms are equipped with advanced technologies, including machine learning and optical character recognition, which considerably enhance the accuracy and speed of evaluations, ensuring thorough assessments.

- Focus on Core Activities: By delegating routine review tasks, internal teams can redirect their efforts towards strategic initiatives, fostering innovation and growth within the organization.

Furthermore, the case study titled ?" illustrates that actual savings depend on the extent of delegating work and adjustments made in-house, highlighting the potential financial benefits of such practices.

The significance of document verification in real estate cannot be overstated, as it is essential for ensuring that property ownership records are accurate and free from defects. As Kevin Kruse aptly notes,

You need to start paying other people to do stuff for you even before you feel you are ready.

This method is especially significant for leaders of research as they assess how outsourcing can enhance operations and improve delivery in a progressively competitive market.

Step-by-Step Process for Outsourcing Title Review Services

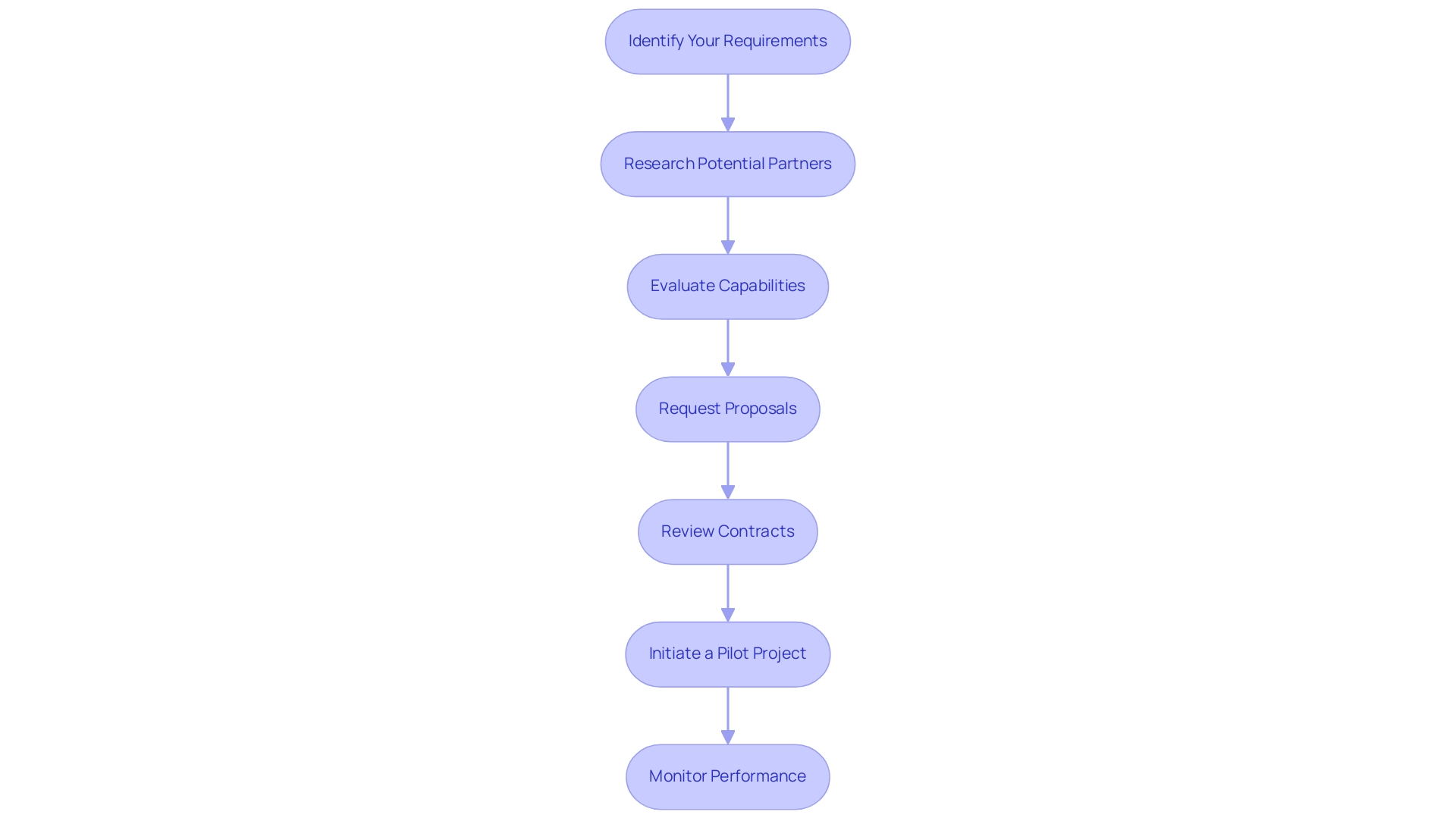

To effectively outsource mortgage document examination services, follow these steps:

-

Identify Your Requirements: Evaluate the amount and intricacy of document assessments needed. Determine if you need full-service support or specific tasks handled.

-

Research Potential Partners: Look for reputable title review firms with experience in the mortgage sector. Evaluate their expertise in using advanced technologies like Parse AI.

-

Evaluate Capabilities: Assess the firm’s ability to handle your specific requirements, including turnaround times, accuracy rates, and compliance with legal standards.

-

Request Proposals: Contact chosen firms to ask for detailed proposals outlining their offerings, pricing structures, and methodologies.

- Conduct Interviews: Schedule discussions with top candidates to gain insights into their processes and ensure they align with your expectations.

-

Review Contracts: Carefully examine contracts for terms, conditions, and level agreements (SLAs) to ensure they meet your operational needs.

- Initiate a Pilot Project: Before fully committing, consider starting with a pilot project to evaluate the firm's performance and compatibility with your workflow.

-

Monitor Performance: Once the partnership is formed, continuously assess the quality of support offered, ensuring it meets your standards and expectations.

By following these steps, directors of research can effectively outsource their mortgage document examination tasks, leveraging external expertise to enhance efficiency and accuracy in their operations.

Selecting the Right Outsourcing Partner

When choosing an outsourcing partner for , it is essential to assess several key criteria to guarantee a successful partnership:

- Industry Experience: Prioritize firms that have a solid track record in the mortgage sector, showcasing a deep understanding of review processes. An experienced partner brings valuable insights that can streamline operations and mitigate risks.

- Technological Capabilities: Assess whether the partner employs advanced technologies like machine learning and optical character recognition. These tools significantly enhance efficiency and accuracy, allowing for quicker turnarounds and reduced errors in title processing.

- Reputation and References: Investigate the firm’s reputation within the industry. Look for client references and case studies that showcase their capabilities and quality. As Mercy, a small business owner, emphasizes, I needed assistance with my payroll and finances, so I sought guidance from feedback. I focused on firms that had positive testimonials and a strong reputation. Additionally, industry experts suggest, a well-chosen partner not only meets immediate needs but also aligns with the long-term vision of the business.

- Scalability: Opt for a partner that can adjust their services to meet your evolving needs, whether during periods of growth or fluctuations in volume. This adaptability is essential for maintaining operational efficiency.

- Compliance and Security: Confirm that the partner complies with industry regulations and implements robust data security measures to protect sensitive information. Given the increasing scrutiny on data handling, ensuring compliance can prevent future liabilities.

By meticulously assessing these criteria, directors of title research can select the most suitable partner, thereby fostering a productive and efficient title review process. This strategic approach not only alleviates stress but also supports long-term business growth. Significantly, Support Adventure can reach up to 60% lower expenses compared to in-house hiring, highlighting the possible financial advantages of external hiring. Organizations are encouraged to prioritize value over mere cost savings when making decisions regarding external services. As demonstrated in the case study titled 'Prioritizing Long-Term Value,' concentrating exclusively on cost can result in unfavorable contracting decisions. It's crucial to find a partner who can adapt to growth and add genuine value to the business.

Establishing Clear Communication Channels

For optimal communication with , consider implementing the following strategies:

- Set Regular Check-Ins: Establish a routine of scheduled meetings to review progress, address potential concerns, and recalibrate strategies as necessary. Regular engagement ensures alignment and fosters a proactive approach to problem-solving. As Søren Rinnov Østergaard, CEO of Fujitsu Denmark, emphasizes, maintaining consistent communication is vital for retaining customers and ensuring high levels of support.

- Utilize Collaborative Tools: Leverage modern project management and communication platforms such as Slack and Trello. These tools facilitate real-time updates, enhance collaboration, and ensure that all team members are synchronized in their efforts. The support facility in Roseville, California, which accommodates over 200 engineers and technicians, exemplifies the need for effective communication in managing large teams.

- Define Roles and Responsibilities: Clearly delineate the roles and responsibilities of both your internal team and the external partner. This clarity minimizes confusion and sets clear expectations, ultimately leading to a more efficient workflow.

- Establish Feedback Mechanisms: Implement systematic processes for providing and receiving feedback on performance. Regular feedback loops can significantly enhance service quality and responsiveness over time, ensuring that expectations are consistently met. A case study on accounting procurement delegation illustrates that effective communication and feedback can lead to significant operational cost reductions and improved accuracy in financial reporting.

- Document Everything: Maintain meticulous documentation of all communications, agreements, and modifications to ensure accountability and transparency. Comprehensive records serve as a reference point for both parties, fostering trust and clarity in the partnership.

By establishing these clear communication channels, directors of research can cultivate a productive relationship with their outsourcing partners. This method not only improves delivery but also aids in better results and increased overall satisfaction in processing.

Assessing and Optimizing Performance

To effectively evaluate and enhance the performance of outsourced document assessment functions, it is essential to undertake the following steps:

- Define Key Performance Indicators (KPIs): Establish specific KPIs that align with your organizational objectives. Key metrics may include turnaround time (e.g., average time taken to complete a title assessment), accuracy rates (e.g., percentage of evaluations completed without errors), and customer satisfaction levels (e.g., feedback scores from clients), all of which are vital for gauging performance.

- Collect Data Regularly: Consistently gather data on these performance metrics to identify trends and pinpoint areas requiring improvement. Regular data collection is crucial for maintaining an accurate overview of effectiveness.

- Conduct Performance Assessments: Schedule periodic evaluations with your outsourcing partner to assess results, address challenges, and explore opportunities for enhancement. This collaborative approach can drive meaningful improvements in service delivery. Emphasizing the importance of these reviews ensures that both parties remain aligned and committed to achieving optimal outcomes.

- Solicit Feedback from Internal Teams: Encourage internal teams who engage with the external partner to provide feedback. Their insights will be invaluable in understanding the efficacy of the partnership and identifying potential enhancements.

- Implement Continuous Improvement Initiatives: Based on the findings from performance assessments, collaborate with your partner to implement strategies that enhance efficiency and quality. This dedication to ongoing enhancement is crucial for adjusting to the swift transformations in the external service landscape.

Case Study Example: A recent case study showcased how a review firm increased its accuracy rates by 15% through the adoption of . This not only improved service quality but also considerably decreased turnaround times.

By routinely evaluating and optimizing performance, directors of title research can ensure their partnerships remain effective and aligned with strategic goals. As the global HR outsourcing market is projected to exceed $45 billion by 2027, leveraging emerging trends such as AI and automation will further empower these partnerships to achieve superior results.

Conclusion

Outsourcing mortgage title review services presents a strategic opportunity for organizations to enhance their operational efficiency and accuracy in real estate transactions. By engaging external experts, companies can substantially reduce operational costs while gaining access to specialized technologies and expertise that improve the accuracy and speed of title reviews. This enables internal teams to concentrate on core activities, fostering innovation and growth.

The process of successful outsourcing involves careful planning, from identifying specific needs to selecting the right partners and establishing effective communication channels. By following a structured approach to outsourcing, organizations can mitigate risks associated with title defects and ensure compliance with industry standards. The emphasis on establishing clear communication and performance assessment mechanisms further strengthens these partnerships, leading to improved service delivery and satisfaction.

Ultimately, leveraging outsourcing for title review services not only streamlines operations but also positions organizations to thrive in a competitive marketplace. As the landscape of real estate transactions continues to evolve, embracing this approach equips directors of title research with the tools necessary to navigate complexities and maintain a competitive edge, ensuring the integrity of property ownership records and fostering long-term business growth.

Frequently Asked Questions

What is outsourcing mortgage document review?

Outsourcing mortgage document review involves hiring external experts or companies to assess and confirm documentation related to real estate transactions, ensuring accurate property ownership records and mitigating risks associated with title defects.

What are the benefits of outsourcing mortgage document review?

The key benefits include cost efficiency, access to expertise, and the ability to focus on core activities. Engaging third-party services can lower operational costs by an average of 15%, with potential reductions of 20-30% for non-core processes. Specialized firms use advanced technologies to enhance accuracy and speed, allowing internal teams to concentrate on strategic initiatives.

How can organizations effectively outsource mortgage document examination services?

Organizations can follow these steps: 1. Identify requirements for document assessments. 2. Research potential partners with experience in the mortgage sector. 3. Evaluate the capabilities of the firms. 4. Request proposals and conduct interviews. 5. Review contracts for terms and conditions. 6. Initiate a pilot project to test performance. 7. Monitor performance continuously.

What criteria should be assessed when choosing an outsourcing partner for mortgage document examination?

Key criteria include industry experience, technological capabilities, reputation and references, scalability, and compliance with industry regulations and data security measures.

What strategies can enhance communication with an outsourcing partner?

Strategies include setting regular check-ins, utilizing collaborative tools, defining roles and responsibilities, establishing feedback mechanisms, and documenting all communications to ensure accountability and transparency.

How can organizations evaluate and enhance the performance of outsourced document assessment functions?

Organizations can define key performance indicators (KPIs), collect data regularly, conduct performance assessments, solicit feedback from internal teams, and implement continuous improvement initiatives based on findings from evaluations.