Overview

The article serves as a comprehensive guide on conducting a property title lien search, detailing the necessary steps and considerations involved in the process. It emphasizes the significance of thorough investigations to uncover potential liens that could complicate real estate transactions. Supported by insights on the types of liens, tools for searches, and best practices, this guide ensures accuracy and efficiency in the search process.

Introduction

In the intricate world of real estate, understanding property title liens is essential for both buyers and sellers. These legal claims against a property, often arising from unpaid debts, can significantly impact ownership and financial obligations. Furthermore, as the landscape of property transactions evolves, the importance of conducting thorough lien searches cannot be overstated.

With various types of liens—from mortgage to tax and mechanic's liens—each carrying unique implications, navigating this complex terrain requires diligence and expertise. This article delves into the nuances of property title liens, offering insights on how to conduct effective searches, the challenges one might face, and the best practices to ensure a smooth real estate transaction.

Whether a seasoned investor or a first-time homebuyer, understanding these elements is crucial to safeguarding one's investment and ensuring compliance with legal obligations.

Understanding Property Title Liens: An Overview

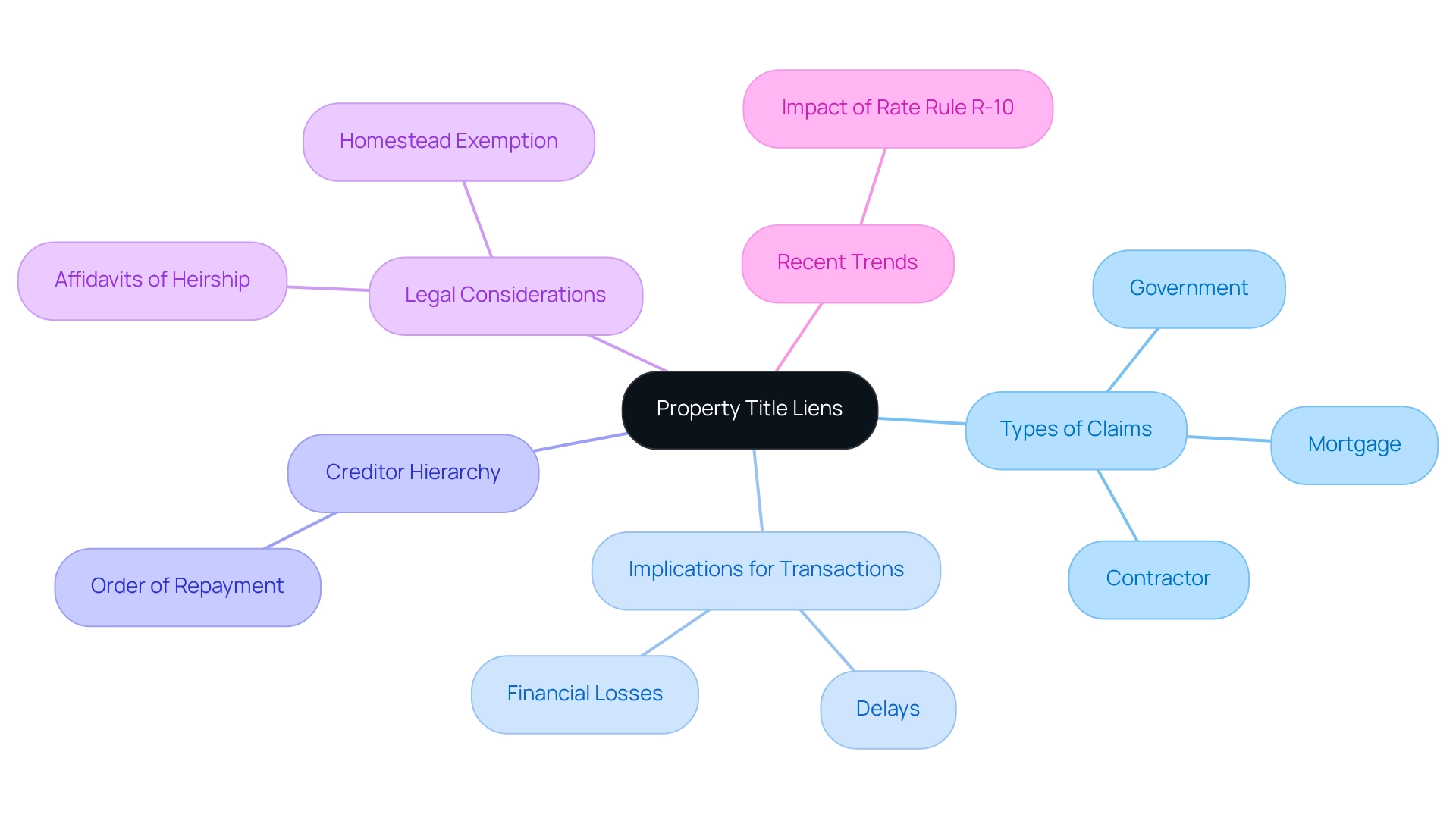

A real estate claim signifies a legal right against a piece of land, often arising from outstanding debts or responsibilities. These claims can be enforced by various creditors, including banks, contractors, or government agencies, and must be settled prior to the sale or refinancing of the asset. Understanding the implications of these claims is crucial for anyone engaged in real estate transactions, as they can significantly affect ownership and financial obligations.

In 2025, the landscape of title claims remains dynamic. Data indicates that unresolved claims can complicate transactions, leading to delays and potential financial losses. A comprehensive property title lien search is essential, as it uncovers any existing rights against the asset, equipping purchasers with the necessary information to make informed decisions. Notably, the rescindment of Rate Rule R-10, effective September 1, 2013, has influenced the processing and comprehension of claims in the current market.

For instance, consider a scenario involving a mortgage claim. When homeowners secure a mortgage or home equity loan, they agree to use their asset as collateral, resulting in a claim imposed by the lender. This claim remains until the mortgage is fully settled.

In instances where homeowners default on payments, multiple lenders may assert claims on the asset; however, a hierarchy dictates the order of repayment upon the sale of the property. Such complexities highlight the importance of conducting thorough property title lien searches to avert unforeseen legal complications. Furthermore, recent discussions in real estate circles have shed light on the relationship between divorce and asset claims, underscoring the necessity for clear documentation, such as affidavits of heirship, when dividing assets and liabilities.

Additionally, obtaining a homestead exemption on inherited assets in Texas is a critical consideration that real estate professionals should acknowledge, as it can significantly affect the management of ownership claims. This emphasizes the need for real estate experts to stay informed about current trends and legal obligations related to ownership claims, ensuring they can navigate these challenges effectively.

Types of Liens: What You Need to Know

Property documents can be influenced by various forms of claims, each carrying unique consequences for ownership and financial obligations. Comprehending these claims is crucial for anyone conducting a property title lien search. Here’s an overview of the most common types:

- Mortgage Claims: These voluntary claims are created by lenders when a borrower obtains a mortgage to acquire real estate. They represent a legal claim against the asset until the mortgage is settled, making them a primary concern for owners. Statistics reveal that mortgage claims constitute a significant portion of all real estate encumbrances in the U.S., underscoring their prevalence and importance in real estate dealings.

- Tax Claims: Enforced by governmental bodies for unpaid real estate taxes, tax claims can lead to severe outcomes, including foreclosure. Property owners must address these claims promptly to avoid losing their property.

- Judgment Claims: These encumbrances arise from court rulings against an asset owner, allowing creditors to enforce claims through wage garnishment, bank account seizure, or asset foreclosure. They can significantly affect a landowner's financial situation and capacity to sell the asset. Grasping the consequences of judgment claims is essential for asset owners to manage their financial obligations efficiently.

- Mechanic's Claims: Submitted by contractors or suppliers who have not been compensated for work done on the site, mechanic's claims can complicate real estate transactions. Removing these claims is essential for facilitating a smooth transaction.

- Homeowners' Association (HOA) Claims: These claims arise when owners do not pay dues or assessments to their HOA. They can result in foreclosure if not addressed, underscoring the significance of maintaining good standing with the association.

Insights from real estate lawyers emphasize that conducting a property title lien search and comprehending the implications of mortgage, tax, and judgment claims is crucial for owners to manage their financial obligations effectively. Furthermore, as noted by First American Data & Analytics, real estate owners can save time by working with data that is current, complete, and covers 100% of U.S. housing stock. By understanding these various forms of claims, landowners can better safeguard their investments and ensure adherence to legal responsibilities.

Additionally, Parse Ai's groundbreaking method for research demonstrates how technology can assist in comprehending and handling real estate claims, ultimately yielding considerable cost reductions compared to conventional research techniques.

Step-by-Step Process for Conducting a Lien Search

To carry out a title investigation efficiently, follow these organized steps:

- Gather Real Estate Information: Begin by collecting essential details such as the address, parcel number, and the current owner's name. This foundational information is crucial for narrowing down your search.

- Visit the County Recorder's Office: Most inquiries commence at the local county recorder's office, where real estate records are systematically preserved. It is advisable to check if these records are accessible online, as many counties have digitized their archives, streamlining the process.

- Search Public Records: Conduct a thorough examination of public records for any recorded claims against the asset. This search for a property title lien should encompass various forms of encumbrances, including tax claims, mortgage claims, and mechanic's claims, which can significantly affect ownership of real estate.

- Review Title Reports: If available, obtain a title report from a reputable title company. This report provides a comprehensive summary of any claims or encumbrances related to the property, offering insights into potential issues that could arise during the transaction.

- Consult Legal Resources: Should you encounter complex legal terminology or unclear records, it is prudent to consult a real estate attorney. Their expertise can clarify any ambiguities and ensure that you fully understand the implications of the findings.

- Document Findings: Maintain a detailed record of any claims discovered, including their nature and status. This documentation is essential for guiding your subsequent actions in the transaction and safeguarding your interests.

By adhering to these steps, you can conduct a property title lien search that ensures your interests are protected in any real estate deal. Based on industry knowledge, the typical duration to finalize a title inquiry can differ, but effectiveness is crucial. Engaging with experienced professionals can enhance success rates by ensuring that all potential liens are identified and addressed through a property title lien search.

As legal expert Sarah Stitgen points out, the investigation may extend back as far as 50 years to identify the root deed and review each subsequent transfer of the property, underscoring the importance of diligence in this process. Additionally, be aware that the costs for document services typically range from $75 to $200, which adds to the overall expenses of purchasing a home. Expedited title investigations may also be available at an additional cost, but should be approached with caution to ensure thoroughness.

Finally, consider optimizing your inquiry process based on limited data such as device type or location, which can enhance the efficiency of your investigation.

Tools and Resources for Effective Lien Searches

To conduct effective lien searches, leveraging a variety of tools and resources is essential to streamline the process and enhance accuracy:

- County Assessor's Website: Numerous counties provide online access to real estate records, enabling inquiries for claims by inputting the location address or the owner's name. This resource is invaluable for obtaining up-to-date information directly from local authorities.

- Title Search Software: Utilizing advanced platforms such as PropStream significantly automates the process of searching public records and identifying claims. These software solutions are designed to enhance efficiency and accuracy, making them a preferred choice among real estate professionals. Additionally, 'Tracers' real estate asset discovery software serves as a reliable resource for legal professionals, facilitating efficient access to public real estate records.

- Legal Databases: Accessing comprehensive legal databases that compile public records—including claims, judgments, and other encumbrances—provides critical insights into a property's legal standing. These databases are essential for thorough due diligence.

- Professional Designation Firms: Engaging a reputable company can offer expert assistance in conducting a property title lien search and interpreting complex records. Their specialized knowledge aids in navigating potential legal complexities and ensures a clear chain of ownership. It is advisable to obtain all deeds for the property for the last fifty to seventy years to ensure a clear chain of title.

- Real Estate Forums and Communities: Engaging in online groups where real estate experts share knowledge and resources related to property inquiries can be advantageous. These platforms often provide practical advice and recommendations based on real-world experiences.

- Documentation and Legal Consultation: Documenting findings and consulting a real estate attorney is recommended for navigating any encumbrances or legal complexities. This step is crucial for ensuring thoroughness and legal compliance in the investigation process.

- Case Study: An illustration of a successful claim investigation is the "Owner Verification Inquiry," which entails acquiring the latest deed to verify ownership and furnish legal real estate details. This case study illustrates the practical application of the tools and resources discussed.

In the words of Robert Reffkin, founder and CEO of Compass, "[We] help you get closer to finding your dream home by simplifying and demystifying real estate." By effectively utilizing these tools and resources, you can improve your ability to carry out comprehensive and efficient asset encumbrance investigations, ensuring that you are well-informed about any potential claims that may influence ownership.

Common Challenges in Property Title Lien Searches

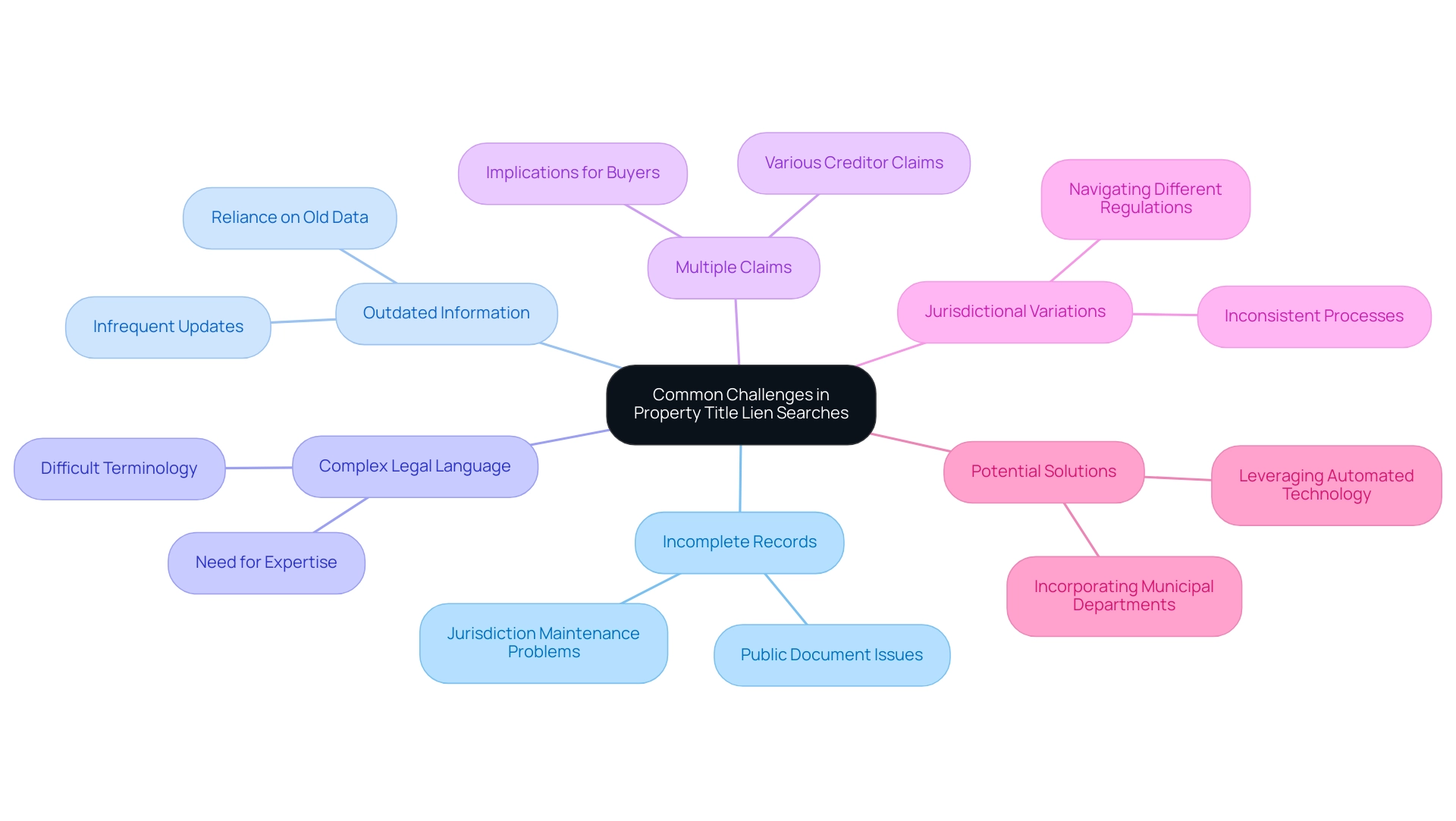

Conducting property title lien searches presents several common challenges that can significantly impact the efficiency and accuracy of the process.

- Incomplete Records: A significant portion of public documents are frequently discovered to be incomplete, hindering the identification of existing claims. This issue is compounded by the fact that many jurisdictions struggle with maintaining comprehensive and up-to-date records.

- Outdated Information: Records may not indicate the most recent condition of claims, leading to possible inconsistencies that can impact real estate transactions. This challenge is particularly pronounced in areas where updates are infrequent, resulting in a reliance on outdated data.

- Complex Legal Language: The legal terminology used in real estate documents can be intricate and difficult to interpret. This complexity necessitates additional expertise, as misunderstandings can lead to significant legal and financial repercussions. As Jane F. Bolin, Esq. warns, "Failing to discover this burden can land you in financial difficulties because you could bear the debt after the transaction."

- Multiple Claims: Properties often have several claims from various creditors, complicating the search process. Each claim may have different implications for the property owner and potential buyers, requiring thorough investigation and resolution strategies.

- Jurisdictional Variations: The processes for documenting and retrieving encumbrance information can differ significantly between counties and states. This inconsistency can create confusion and delays, as researchers must navigate different systems and regulations.

Grasping these challenges is essential for formulating effective strategies when conducting a property title lien search during a claim investigation. For instance, properties with unresolved municipal fines or code violations can delay the closing process and require buyers to address these issues before proceeding. Incorporating municipal departments like building code enforcement and zoning offices in searches can uncover outstanding violations or fines early in the process, thus preventing delays in finalizing transactions.

Furthermore, leveraging automated technology is available to help overcome loan origination complexities and increase efficiency in addressing the complexities associated with incomplete records and outdated information. By proactively addressing these common issues, title researchers can streamline their workflows and mitigate potential risks.

What to Do If You Discover a Lien on Your Property

If you discover a lien on your property, it is crucial to take the following steps to effectively manage and resolve the situation:

- Verify the Claim: Begin by confirming the validity of the claim. Review all related documentation to ensure it is properly recorded and accurately reflects the amount owed.

- Contact the Lienholder: Reach out to the creditor or lienholder directly. This correspondence is crucial to address the details of the claim, including the total sum due and any possible consequences for your assets.

- Negotiate Payment Terms: Engage in negotiations with the lienholder to explore payment options or settlement agreements. Many lienholders may be open to negotiating terms, which can lead to a more manageable resolution.

- Obtain a Release of Claim: After settling the debt, it is vital to request a formal release of claim document from the holder. This document is crucial for clearing the title and ensuring that the encumbrance no longer impacts your property.

- Consult Legal Assistance: If the claim is disputed or presents complexities, seeking guidance from a real estate attorney can be invaluable. A lawyer can offer specialized guidance on managing the legal elements of claim resolution and assist in safeguarding your interests.

It is important to note that multiple claims can exist on an asset, with a hierarchy determining the order of repayment upon sale, typically favoring the mortgage lender first. By following these steps, you can effectively address and resolve any claims on your property through a property title lien search, ensuring a smoother path to ownership and minimizing potential financial impacts. In 2023, the average duration to resolve a claim after discovery was reported to be approximately 30 days, highlighting the importance of prompt action.

Furthermore, real estate professionals emphasize the significance of negotiating with lienholders, as successful settlements can lead to substantial cost savings and improved relationships with creditors. As mentioned by the National Tax Lien Association (NTLA), "The NTLA plays a vital role in the industry, providing education and training for professionals and advocating for the interests of various stakeholders in the tax sector." Additionally, advancements in technology, such as LexID® identity linking technology, ensure 99% precision in linking consumer identities to records, aiding in risk evaluation and management.

The Role of Title Insurance in Protecting Against Liens

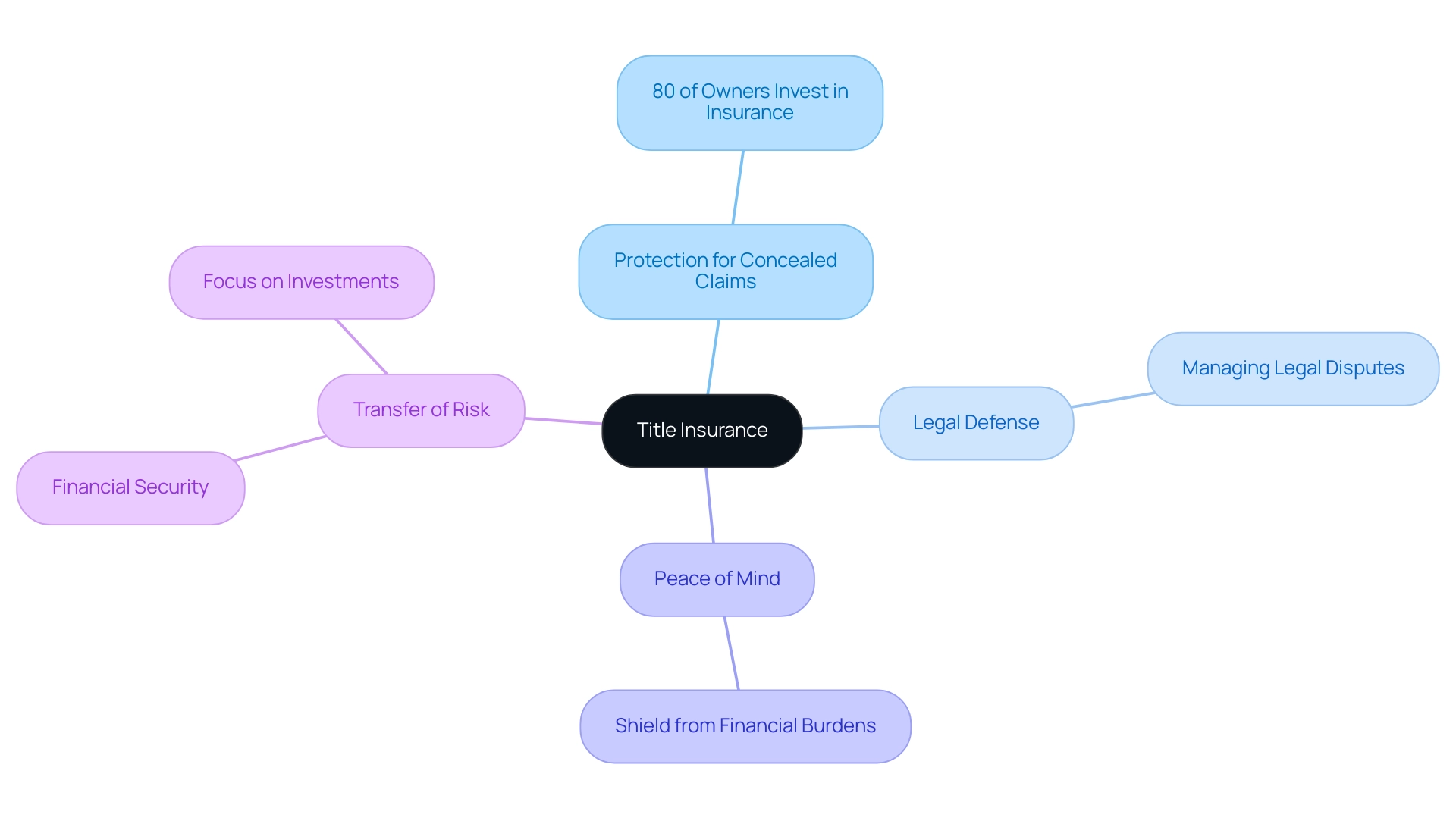

Ownership insurance serves as a vital safeguard for landowners, protecting them from financial losses associated with encumbrances and other ownership defects. Below is a comprehensive examination of its key functions:

- Protection for Concealed Claims: Title insurance provides coverage for losses stemming from undisclosed claims that may not have been uncovered during the initial property search. This protection is particularly significant, as approximately 80% of real estate owners invest in ownership insurance to mitigate such risks.

- Legal Defense: In the event of a claim against an asset due to a lien, ownership insurance ensures legal defense. Property owners can depend on their insurer to manage legal disputes, which can often be both costly and complex.

- Peace of Mind: The reassurance that accompanies ownership insurance is invaluable. Property owners can confidently proceed with their investments, knowing they are shielded from potential financial burdens arising from unforeseen liens. This makes conducting a property title lien search essential to prevent substantial expenses.

- Transfer of Risk: By obtaining ownership insurance, landowners effectively transfer the risk of ownership defects to the insurance firm. This shift not only offers financial security but also allows owners to concentrate on their investments without the persistent anxiety of hidden issues.

The importance of insurance for property ownership is underscored by recent statistics indicating that Texas, Florida, California, New York, and Pennsylvania were the leading states for premiums in Q2 2023. Additionally, First American Title Insurance Co. commands a notable 21.5% market share as the largest individual underwriter, illustrating the competitive nature of the industry. Experts assert that ownership insurance will be crucial for buyers in 2025, as it protects against the complexities inherent in real estate transactions.

As one analyst remarked, "Price is a crucial factor influencing consumers' value perceptions," suggesting that insurers can enhance their offerings by customizing products to address unique risk needs.

Real estate case studies highlight the role of ownership insurance in claims related to encumbrances, demonstrating how conducting a property title lien search has effectively shielded landowners from unforeseen legal challenges. Collaborative initiatives among industry stakeholders are also in progress to improve consumer education regarding insurance, ensuring that buyers are well-informed about the coverage available to them.

In conclusion, investing in ownership insurance is a prudent decision for anyone purchasing real estate, as it provides robust protection against unexpected challenges that may arise from existing claims.

Best Practices for Conducting Property Title Lien Searches

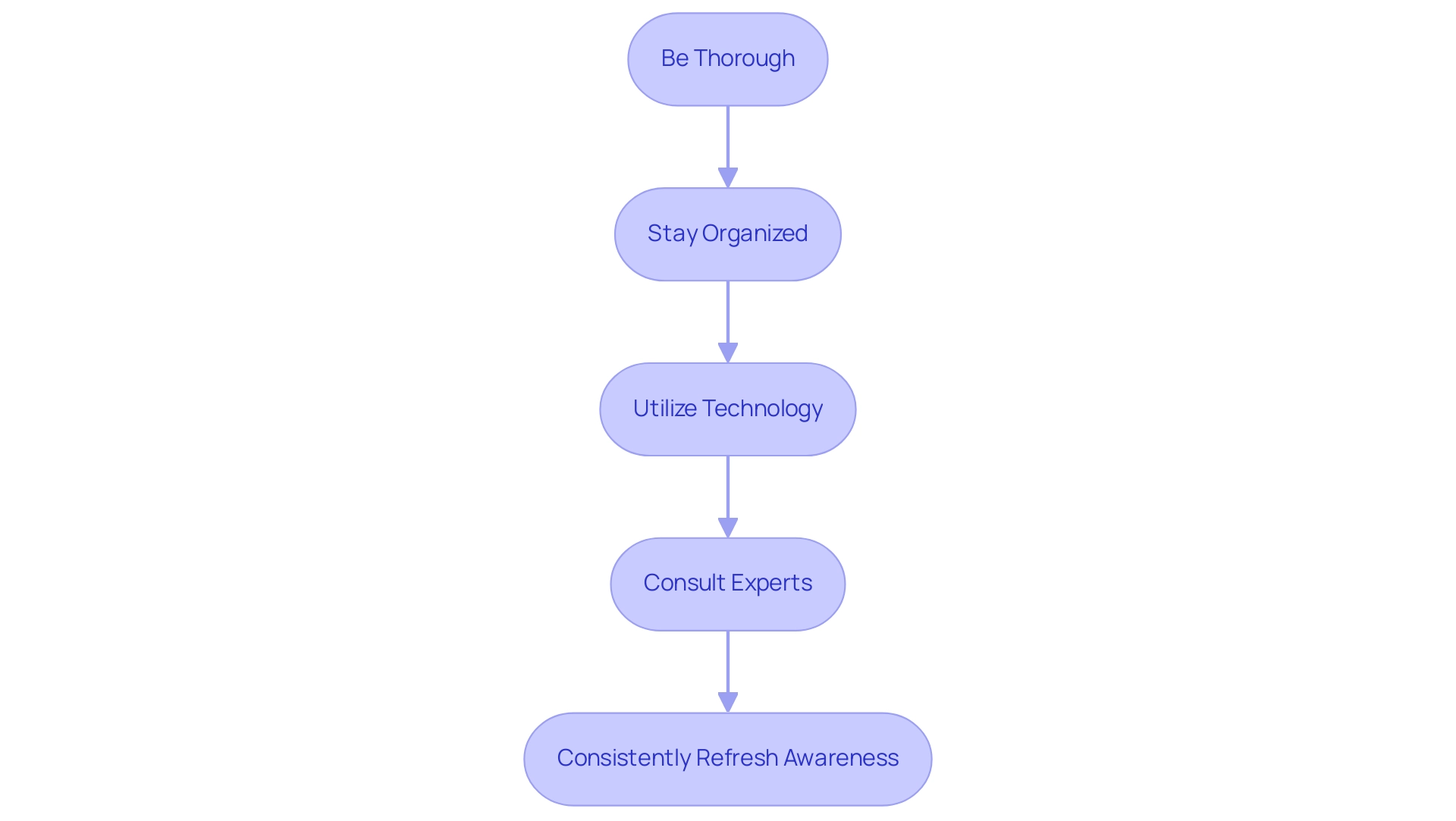

To conduct effective property title lien searches, it is essential to adhere to best practices that enhance accuracy and safeguard interests in real estate transactions.

- Be Thorough: Conduct comprehensive inquiries across multiple sources and records. Non-consensual claims can be filed under various names, which may differ from the Uniform Commercial Code (UCC) requirements. This complexity necessitates thorough investigations to recognize all possible claims, as ignoring them can lead to serious financial consequences. For instance, the case study titled "Federal and State Tax Encumbrances: Legal Precedents" illustrates how tax encumbrances may be submitted under different titles than those mandated by UCC regulations, underscoring the importance of comprehensive inquiries.

- Stay Organized: Maintain meticulous notes and documentation of your findings. This practice not only aids in referencing later but also ensures that all relevant information is easily accessible, which is crucial in the fast-paced real estate environment.

- Utilize Technology: Embrace advanced software and online tools to streamline the exploration process. Technologies such as machine learning and optical character recognition can significantly enhance the efficiency and precision of document inquiries, enabling faster identification of essential information. For example, platforms like Skyline allow users to perform online searches by accessing official government websites, saving time and minimizing the risk of overlooking critical details.

- Consult Experts: When faced with intricate problems, do not hesitate to seek assistance from property companies or legal professionals. Their expertise can provide valuable insights and help navigate complex legal environments, ensuring that all possible claims are considered. As Lindsey Gordon, Director of Communications at PropLogix, emphasizes, employing video and digital media to educate the real estate industry is vital for understanding these complexities.

- Consistently Refresh Awareness: Stay informed about changing regulations and processes related to property claims and title investigations. Ongoing education is crucial, as shifts in regulations can impact how claims are filed and searched.

By implementing these best practices, you can significantly enhance the effectiveness of your property title lien search, thereby safeguarding your interests in real estate transactions and ensuring a smoother buying process.

Conclusion

Understanding property title liens is crucial for anyone involved in real estate transactions, whether as a buyer or seller. This article has explored various aspects of property title liens, including their definition, types, and the importance of conducting thorough lien searches. From mortgage and tax liens to mechanic's and judgment liens, each type carries unique implications that can substantially affect ownership and financial responsibilities.

The process of conducting a lien search has been outlined step-by-step, emphasizing the importance of gathering accurate property information, utilizing county resources, and consulting legal experts when necessary. The challenges inherent in these searches, such as incomplete records and complex legal language, highlight the need for diligence and expertise in navigating the real estate landscape. Furthermore, the role of title insurance emerges as a vital safeguard, providing protection against unforeseen liabilities and offering peace of mind to property owners.

In summary, being well-informed about property title liens and executing effective searches is indispensable for safeguarding investments and ensuring compliance with legal obligations. By adopting best practices and leveraging available resources, individuals can mitigate risks associated with liens and facilitate smoother real estate transactions. As the market continues to evolve, staying educated and proactive about these legal claims will empower buyers and sellers alike to make informed decisions, ultimately leading to successful property ownership experiences.

Frequently Asked Questions

What is a real estate claim?

A real estate claim signifies a legal right against a piece of land, often arising from outstanding debts or responsibilities. These claims can be enforced by various creditors, including banks, contractors, or government agencies, and must be settled before the sale or refinancing of the asset.

Why is it important to understand real estate claims?

Understanding real estate claims is crucial for anyone engaged in real estate transactions, as they can significantly affect ownership and financial obligations.

What impact do unresolved claims have on real estate transactions?

Unresolved claims can complicate transactions, leading to delays and potential financial losses.

What is a property title lien search?

A property title lien search is a comprehensive examination that uncovers any existing rights against the asset, providing purchasers with the necessary information to make informed decisions.

How has the rescindment of Rate Rule R-10 influenced real estate claims?

The rescindment of Rate Rule R-10, effective September 1, 2013, has influenced the processing and comprehension of claims in the current market.

What are mortgage claims?

Mortgage claims are voluntary claims created by lenders when a borrower obtains a mortgage to acquire real estate. They represent a legal claim against the asset until the mortgage is fully settled.

What happens if homeowners default on mortgage payments?

If homeowners default on payments, multiple lenders may assert claims on the asset, and a hierarchy dictates the order of repayment upon the sale of the property.

What are the different types of real estate claims?

The common types of real estate claims include: 1. Mortgage Claims: Claims from lenders against the asset until the mortgage is settled. 2. Tax Claims: Claims enforced by governmental bodies for unpaid real estate taxes, which can lead to foreclosure. 3. Judgment Claims: Claims arising from court rulings against an asset owner, allowing creditors to enforce claims through various means. 4. Mechanic's Claims: Claims from contractors or suppliers for unpaid work. 5. Homeowners' Association (HOA) Claims: Claims arising from unpaid dues or assessments to an HOA.

How can property owners manage financial obligations related to claims?

Conducting a property title lien search and understanding the implications of mortgage, tax, and judgment claims is crucial for owners to manage their financial obligations effectively.

What role does technology play in handling real estate claims?

Technology, such as Parse Ai's research methods, can assist in comprehending and managing real estate claims, ultimately yielding considerable cost reductions compared to conventional research techniques.