Overview

The article presents a definitive step-by-step guide on how to look up liens on a property, underscoring its significance for property owners and potential buyers in navigating the financial and legal implications. It delineates a systematic process for conducting a lien search, which includes:

- Gathering information

- Accessing public records

- Consulting title companies

This structured approach supports informed decision-making in real estate transactions and effectively mitigates risks associated with existing claims.

Introduction

In the intricate realm of property ownership, understanding liens is paramount for both current owners and prospective buyers. A lien, essentially a legal claim against a property, serves as a security measure for debts and can significantly impact one’s ability to sell or refinance.

With a staggering percentage of families owning homes, the implications of liens are more relevant than ever, as they can affect financial stability and legal standing in real estate transactions.

Furthermore, this article delves into the various types of liens, the process of conducting a lien search, and the legal ramifications that property owners must navigate. By equipping readers with essential knowledge about liens, this guide aims to empower them to make informed decisions in today’s dynamic housing market.

Understanding Liens: What They Are and Their Importance in Property Ownership

A legal claim signifies a formal interest in an asset, primarily serving as collateral for a debt. When a claim is established, it indicates that the asset holder has unresolved financial obligations to a creditor, which may arise from unpaid taxes, loans, or other commitments. This legal restriction can significantly hinder the individual's ability to sell or refinance the asset, as any existing claims must be resolved before possession can be transferred.

For property owners and potential buyers, understanding how to look up liens on a property is essential, as these claims can profoundly impact their financial stability and legal standing in real estate transactions. As of 2022, 66.1% of families owned their primary residence, making it especially pertinent to grasp the implications of encumbrances in today's real estate market. Furthermore, with 72% of sellers indicating they would certainly choose the same agent again, having informed support is crucial when navigating the complexities surrounding claims.

Moreover, insights from the recent NAR survey highlight the challenges sellers face, such as understanding paperwork and pricing, which can be intensified by the presence of claims. By comprehending encumbrances, real estate professionals can better mitigate risks in housing markets. This is illustrated by the Market Risk Indicators case study, which assists in identifying potential downturns.

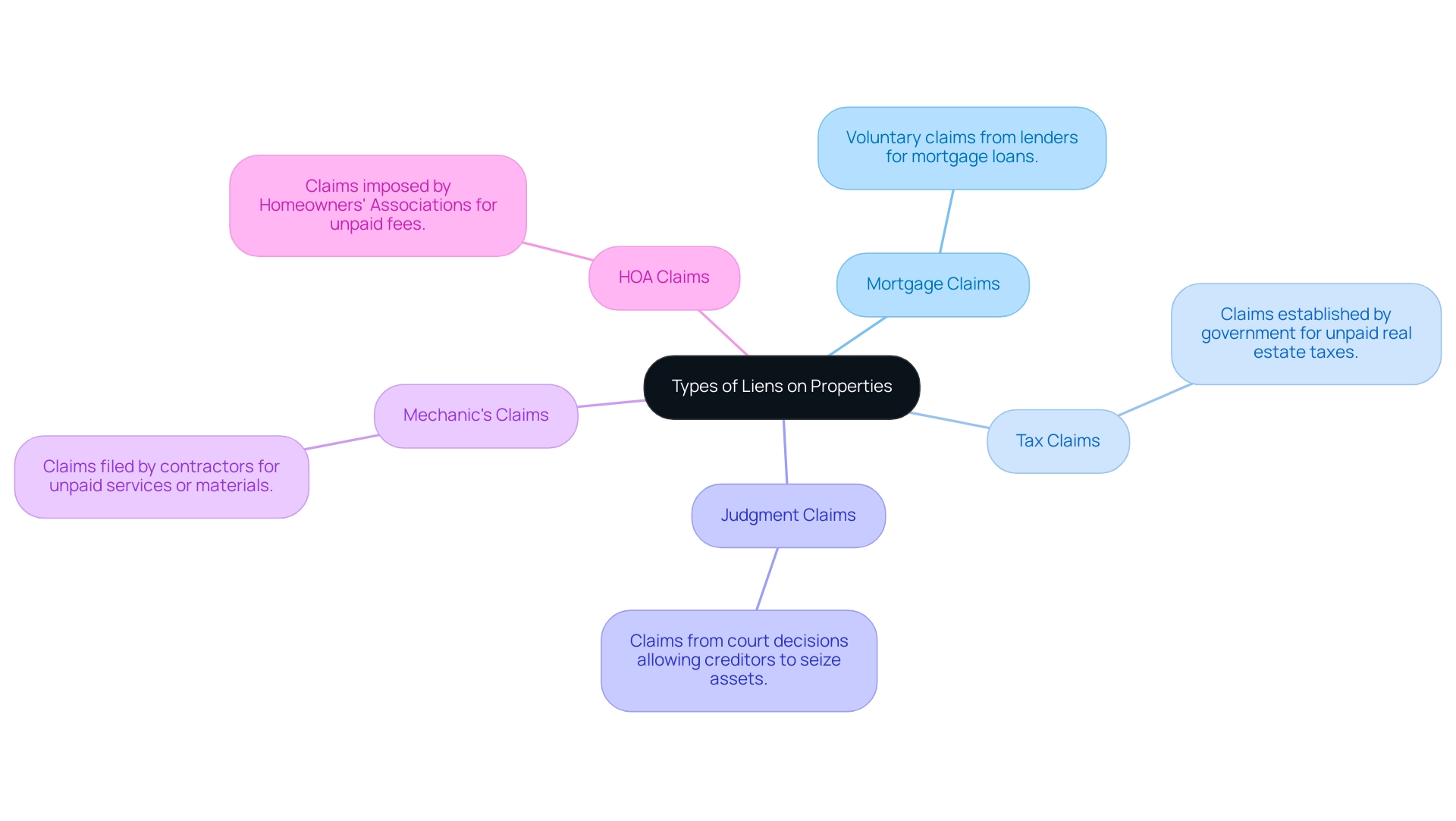

Exploring Different Types of Liens on Properties

Liens represent a critical component of real estate ownership, categorized into several distinct types, each carrying unique implications:

- Mortgage Claims: These voluntary claims arise when lenders extend a mortgage to a borrower for real estate acquisition, thereby establishing an obligation to repay the loan.

- Tax Claims: When real estate taxes remain unpaid, government entities establish these claims, which take precedence over most other demands. Thus, timely payments are essential for landholders.

- Judgment Claims: Originating from court decisions against a landowner, these claims empower creditors to seize the asset for settling unpaid debts. A comprehensive understanding of judgment claims is crucial, as highlighted by recent case studies that illustrate their significant impact on real estate ownership and asset management.

- Mechanic's Claims: These claims are filed by contractors or suppliers who have not received payment for their services or materials. If not promptly addressed, mechanic's claims can severely affect a building's marketability.

- Homeowners' Association (HOA) Claims: Imposed by an HOA for unpaid fees or assessments, these claims underscore the importance of residents adhering to community regulations.

For asset owners and prospective purchasers, understanding how to look up liens on a property is paramount in navigating potential financial obligations and legal claims against their holdings. By 2025, this knowledge will be instrumental in making informed decisions in the real estate market. As articulated by PwC, 'At PwC, our purpose is to build trust in society and solve important problems.' This perspective underscores the importance of comprehending claims on assets in fostering trust and effective problem-solving within real estate transactions.

Step-by-Step Guide to Conducting a Lien Search

Conducting a lien search is an essential process in real estate transactions. Following these steps will ensure a thorough investigation:

- Gather Land Information: Begin by collecting critical details such as the location's address, the owner's name, and the parcel number. This foundational step is vital for effective searching.

- Visit the County Recorder's Office: Access land records by visiting the local county recorder or clerk's office. Many jurisdictions provide online portals, offering convenient access to vital records.

- Search Public Records: Utilize the collected information about real estate to search for recorded claims. Focus on identifying any documents that assert a claim against the asset, as these can significantly influence ownership rights.

- Check for Tax Claims: It is particularly important to inquire about tax claims, which can have substantial consequences on ownership and potential future obligations.

- Consult Title Companies: For properties with complex histories, consider hiring a title company. Their expertise can offer a comprehensive search and peace of mind, particularly when navigating intricate legalities.

Statistics reveal that a significant percentage of real estate owners—approximately 65%—perform lien searches prior to purchasing, underscoring the necessity of thorough due diligence in today's real estate market. As IT expert Matt Loy emphasizes, "Innovative solutions are essential for navigating the complexities of real estate transactions effectively." Furthermore, with the rise of voice search technology, over 1 billion voice searches are conducted monthly, indicating a shift in how real estate information is accessed.

By diligently adhering to these steps, you will learn how to look up liens on a property, effectively uncovering any existing claims and ultimately facilitating informed decision-making in real estate transactions.

Legal Implications of Liens: What Property Owners Should Know

Understanding how to look up liens on a property is essential for landowners to navigate crucial legal implications and confidently acquire land rights. The following considerations are paramount:

- Impact on Ownership Title: A claim effectively clouds the title, creating obstacles for selling or refinancing the asset until the claim is resolved. This can significantly delay transactions and reduce marketability, underscoring the need for in-depth title research—specifically, how to look up liens on a property—to identify and address potential issues early. Harbinger Land's title research services offer comprehensive evaluations to assist clients in clearly comprehending these effects.

- Priority of Claims: The ranking of claims is essential; for example, tax claims generally take precedence over mortgage claims. Understanding how to look up liens on a property can assist landowners in assessing their position and the potential risks involved. Harbinger Land's title research services provide detailed insights into these priorities, enabling informed decision-making.

- Potential for Foreclosure: Unresolved liens can lead to foreclosure proceedings initiated by creditors seeking to recover owed amounts. This situation can result in the loss of assets, as highlighted by David Bitton, co-founder and Head of Special Projects at DoorLoop, who states,

"The risk of foreclosure starts when a borrower starts struggling with their mortgage payments," making it crucial to understand how to look up liens on a property. This is particularly alarming considering that CoreLogic reported that 3% of all mortgages in the U.S. were in some stage of delinquency as of September 2024, signaling a troubling trend for real estate holders. Furthermore, the average federal expenditure of $1,744 on maintenance per post-foreclosed asset underscores the financial burden that foreclosure can impose on both individuals and taxpayers. Harbinger Land's title curative services support land and mineral stakeholders in ensuring a clear chain of title, thereby reducing these foreclosure risks and providing information in a readily understandable format.

- Legal Obligations: Landholders must be aware of their responsibilities to fulfill encumbrances. Neglecting these obligations can lead to legal actions that further complicate ownership and financial stability. Thorough title research is essential for understanding how to look up liens on a property and ensuring compliance with legal obligations, with Harbinger Land offering clear and accessible insights.

Comprehending these implications is crucial for landowners intending to safeguard their investments and ensure compliance with legal requirements. With 70% of urban regions facing rising delinquency rates, worsened by economic difficulties such as inflation and a declining job market, the need for caution concerning claims and their potential effects on ownership titles is more urgent than ever. As we approach 2025, it is crucial to examine the particular statistics on foreclosure rates resulting from unpaid debts to fully understand the present situation concerning claims and ownership.

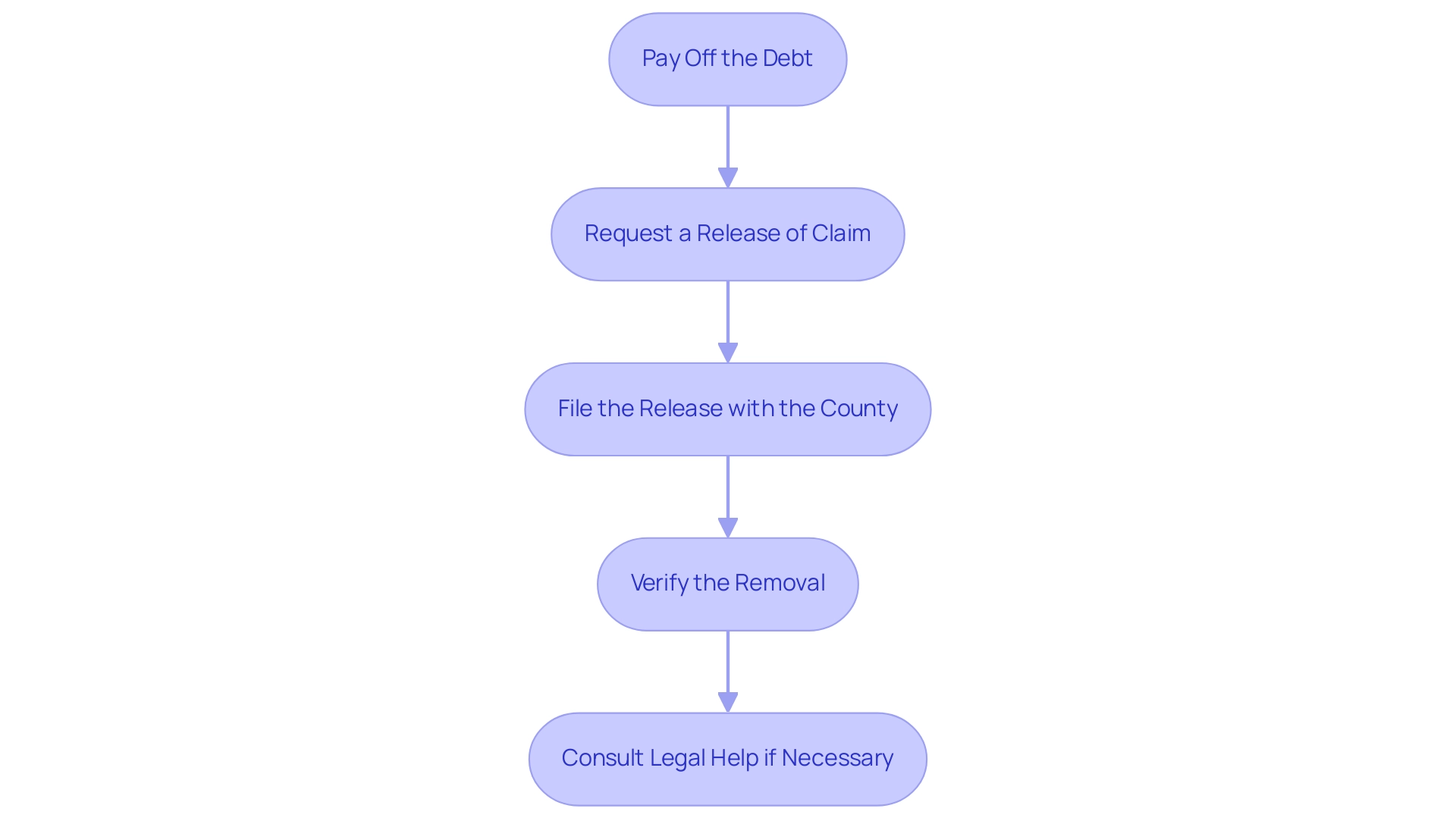

How to Remove or Release a Lien on Your Property

Eliminating or discharging a claim on your property involves a systematic sequence of actions designed to ensure clarity and adherence in ownership. This comprehensive guide will help you navigate the process effectively:

-

Pay Off the Debt: The primary action in removing the claim is to settle the debt associated with it. Ensure you receive and securely store proof of payment, as this documentation is essential for subsequent steps. Recent statistics indicate that over 80% of encumbrance removals are successfully completed after the debt is paid, underscoring the significance of this initial action.

-

Request a Release of Claim: After settling the debt, formally request a release of claim document from the creditor. This document serves as official proof that the claim has been fulfilled, marking an important phase in the process. Legal expert Emelia Fredlick emphasizes, "A well-documented process is essential for ensuring that no future claims can arise from previously satisfied debts."

-

File the Release with the County: Upon obtaining the release of claim document, it must be filed with the county recorder's office. This step is crucial to ensure that the claim is formally eliminated from public records, thereby safeguarding your title. Case studies reveal that timely filing can significantly mitigate the risk of complications in ownership claims.

-

Verify the Removal: Following submission, it is vital to review the records to confirm that the claim has been successfully eliminated. This verification step completes your due diligence in the process. Statistics show that approximately 90% of real estate holders who check their records have their claims successfully eliminated within a month of submission.

-

Consult Legal Help if Necessary: Should you encounter challenges during any stage of the property removal process, do not hesitate to seek legal assistance. Legal professionals can provide invaluable guidance and ensure that all legal requirements are met.

By adhering to these guidelines, property owners can effectively manage liens and understand how to look up liens on a property to ensure clear titles. Legal experts underscore the importance of each step, reiterating that, "A well-documented process is essential for ensuring that no future claims can arise from previously satisfied debts." Following these procedures not only facilitates resolution but also instills confidence in property ownership.

Conclusion

Understanding liens is crucial for anyone involved in property ownership, whether as a current owner or a prospective buyer. This article has explored the nature of liens, including their various types—mortgage, tax, judgment, mechanic's, and HOA liens—and highlighted the significant impact they can have on property transactions. Furthermore, the process of conducting a lien search has been outlined, emphasizing the importance of due diligence in safeguarding one's financial interests.

The legal implications of liens further underscore their relevance in real estate. They can cloud property titles, lead to foreclosure, and impose obligations on owners that must be diligently managed. Awareness of these factors is essential for maintaining financial stability and ensuring compliance with legal requirements.

Finally, the article provided a step-by-step guide on how to remove or release a lien, illustrating that proactive management of liens can help secure clear property titles and prevent future complications. As the real estate landscape continues to evolve, understanding and addressing liens will be paramount for property owners to protect their investments and navigate the complexities of real estate transactions confidently.

Frequently Asked Questions

What is a legal claim in relation to assets?

A legal claim signifies a formal interest in an asset, primarily serving as collateral for a debt, indicating that the asset holder has unresolved financial obligations to a creditor.

How can a legal claim affect an asset holder?

A legal claim can significantly hinder the individual's ability to sell or refinance the asset, as any existing claims must be resolved before possession can be transferred.

Why is it important for property owners and potential buyers to understand liens?

Understanding how to look up liens on a property is essential for property owners and potential buyers because these claims can profoundly impact their financial stability and legal standing in real estate transactions.

What percentage of families owned their primary residence as of 2022?

As of 2022, 66.1% of families owned their primary residence.

What are the different types of liens categorized in real estate ownership?

The main types of liens include: 1. Mortgage Claims: Voluntary claims from lenders for mortgage loans. 2. Tax Claims: Established by government entities for unpaid real estate taxes. 3. Judgment Claims: Arising from court decisions against a landowner for unpaid debts. 4. Mechanic's Claims: Filed by contractors or suppliers for unpaid services or materials. 5. Homeowners' Association (HOA) Claims: Imposed by an HOA for unpaid fees or assessments.

What are the implications of tax claims on property owners?

Tax claims take precedence over most other demands, making timely payments essential for landholders to avoid legal complications.

How can judgment claims affect real estate ownership?

Judgment claims empower creditors to seize the asset for settling unpaid debts, which can significantly impact asset management and ownership.

What role do mechanic's claims play in real estate?

Mechanic's claims can severely affect a building's marketability if not promptly addressed, as they are filed by contractors or suppliers who have not received payment.

Why is it crucial for asset owners and prospective purchasers to look up liens?

Understanding how to look up liens is paramount for navigating potential financial obligations and legal claims against their holdings, which is essential for making informed decisions in the real estate market.

How do claims on assets foster trust in real estate transactions?

Comprehending claims on assets is important in fostering trust and effective problem-solving within real estate transactions, as highlighted by industry perspectives.