Overview

Understanding lien information on property is essential for real estate professionals, as it directly impacts asset ownership and transaction processes. Various types of liens—such as mortgage, tax, and mechanic's claims—can complicate transactions, delay closings, and diminish property values. Consequently, it is imperative for professionals to remain informed and adeptly manage these complexities. This knowledge not only safeguards their interests but also enhances their ability to facilitate smoother transactions.

Introduction

In the intricate world of real estate, understanding liens is paramount for professionals navigating property transactions. A lien, essentially a legal claim against a property, can arise from various sources such as unpaid taxes, mortgages, or contractor services, directly impacting the ability to sell or refinance the property.

With approximately 10% of U.S. properties affected by some form of lien, awareness and management of these encumbrances are critical. Furthermore, the evolving landscape of property liens, coupled with insights from industry experts, highlights the necessity for real estate professionals to stay informed about current trends and best practices.

As the dynamics of property ownership and transactions shift, the implications of liens become increasingly significant, making it essential for professionals to understand their legal ramifications and implement effective strategies for lien management.

What is a Lien? An Overview for Real Estate Professionals

A legal claim signifies a right against an asset, ensuring the settlement of a debt or obligation. In the realm of property, claims can originate from various sources, such as loans, overdue taxes, or lien information related to work performed by builders. When a claim is placed on an asset, it effectively restricts the ability to sell or refinance that asset until the corresponding debt is resolved.

This limitation underscores the necessity for real estate professionals to possess an in-depth understanding of claims, particularly lien information on property, as these factors significantly influence transactions and ownership rights.

As we look ahead to 2025, the landscape of property claims is evolving, with recent statistics revealing that approximately 10% of properties in the United States are affected by some form of claim. This prevalence highlights the critical importance of awareness regarding lien information in real estate transactions. Moreover, insights from industry specialists emphasize the value of proactive tracking and communication among agents and lenders to mitigate the challenges posed by claims.

Linda Aparo, a prominent figure in the industry, stated, "I feel as if I’ve worked most of my life trying to combat this epidemic," advocating for enhanced cooperation to address the release epidemic. express frustrations due to inadequate follow-up on release documents by competitors, illustrating the urgent need for improved communication.

Furthermore, data from Maricopa County reveal trends in tax sales, including a maximum interest rate cap at 16%, further illustrating the financial implications of such claims. Notably, 18% of individuals in the sector do not utilize drones, highlighting the advancing tools and technologies in asset tracking and research.

Understanding the effects of claims and lien information on property is essential for real estate professionals, as these elements can directly affect the marketability and value of properties. By staying informed about current trends and statistics related to claims, professionals can navigate the complexities of real estate transactions more effectively and safeguard their clients' interests.

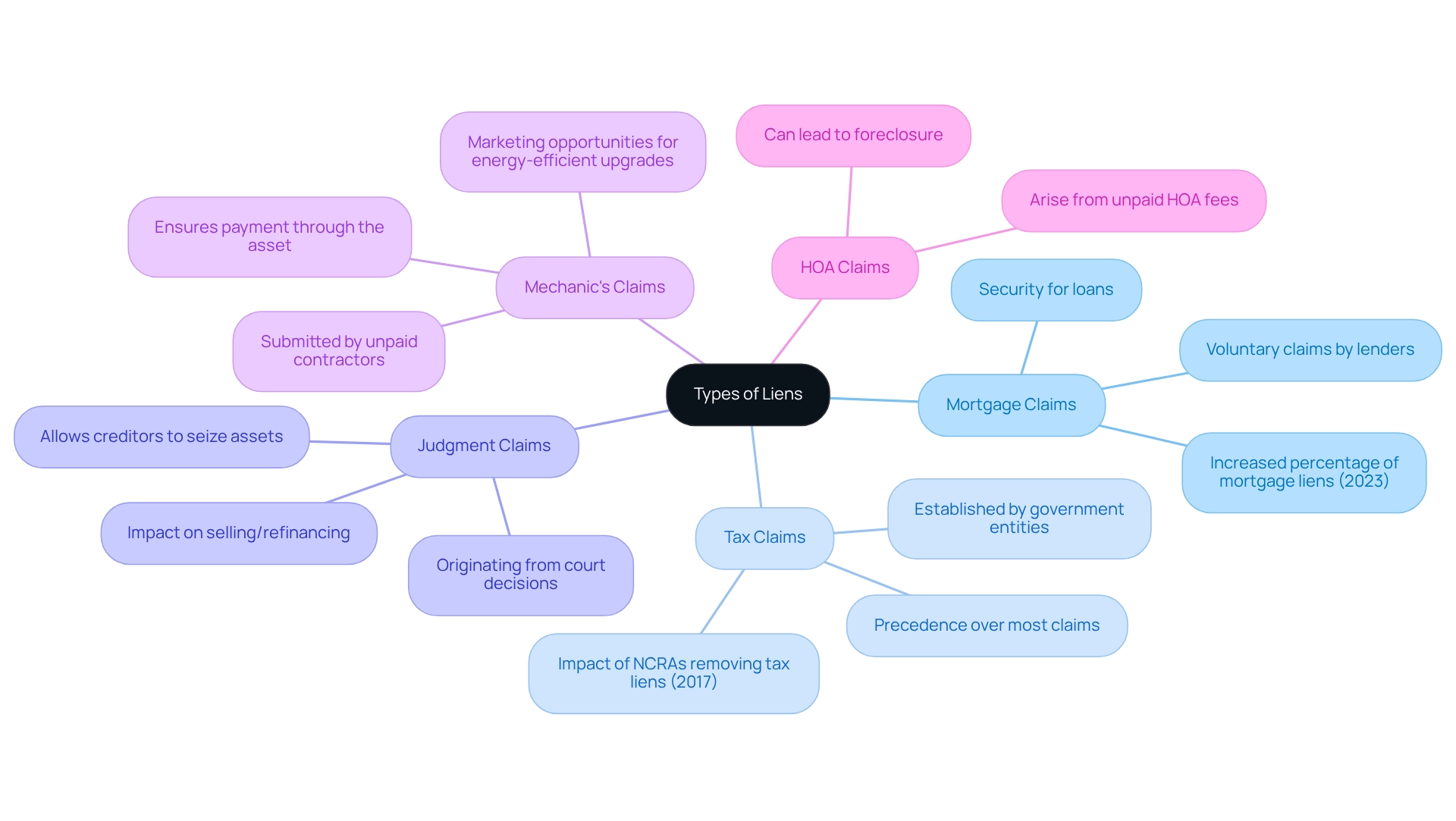

Types of Liens: Understanding the Different Categories

Liens in real estate can be categorized into several unique types, and understanding lien information on property is essential due to its specific implications for ownership. An encumbrance is defined as or legal claim against an asset that serves as collateral to fulfill a debt.

- Mortgage Claims: These voluntary claims are established by lenders when a borrower secures a mortgage. They act as security for the loan, ensuring that the lender can recover the asset if the borrower fails to meet obligations.

- Tax Claims: Established by government entities, tax claims arise from unpaid real estate taxes. These encumbrances take precedence over most other claims, indicating that the asset may be sold to settle the tax obligation. The landscape of tax encumbrances has evolved, particularly since the Nationwide Credit Reporting Agencies (NCRAs) removed most tax encumbrances from credit reports in 2017, altering the risk profile for lenders.

- Judgment Claims: Originating from court decisions against asset owners, judgment claims allow creditors to seize the asset to recover outstanding debts. This type of claim can significantly impact the owner's ability to sell or refinance the asset.

- Mechanic's Claims: Submitted by contractors or suppliers who have not been compensated for work performed on the premises, mechanic's claims ensure that these parties can pursue payment through the asset itself. This creates marketing opportunities, such as contractors targeting homes with unused PACE obligations for energy-efficient improvements.

- Homeowners' Association (HOA) Claims: These claims arise when homeowners fail to pay fees to their HOA. Similar to tax claims, HOA encumbrances can lead to foreclosure if not resolved.

Each category of claim carries unique implications for lien information on property ownership and must be managed with diligence. For instance, as of 2023, the percentage of mortgage liens has significantly increased compared to tax liens. Understanding these dynamics is crucial for property professionals, especially considering the disparity in home equity across market segments.

As highlighted in the case study "Homeowner Equity by Market Segments," lower down payments often correlate with lower initial equity, which impacts future financial decisions. As Mark Williams, Director of Operations, emphasizes, effective decision-making and compliance are vital in navigating these complexities.

Legal Implications of Liens on Property Ownership

The lien information on property is pivotal in shaping asset ownership and real estate transactions. Legally, a claim establishes a creditor's right against an asset, which can lead to foreclosure if the underlying debt remains unpaid. For instance, if a landowner neglects to resolve a claim, the claimant may possess the legal authority to initiate a sale of the asset to recuperate the owed sum.

This procedure underscores the importance of prompt resolution to avert potential asset loss.

Moreover, claims can complicate real estate transactions, as prospective purchasers typically seek a clean title devoid of burdens. In recent years, the impact of claims on asset values has become increasingly pronounced, with statistics revealing that unpaid claims have significantly contributed to foreclosure cases. For example, during Q3 2024, foreclosure starts reached 62,380 properties, reflecting a 10% decrease from the previous year, yet still illustrating the ongoing challenges posed by unpaid debts.

Additionally, in Q1 2023, there were 58,268 documented foreclosure prevention measures, aiding approximately 6,066,666 families, which highlights the broader context of and the critical need for addressing claims promptly.

Understanding the lien information on property and the current legal ramifications of claims in property transactions is essential for industry experts. As we look to 2025, the legal landscape surrounding claims continues to evolve, necessitating that real estate professionals remain vigilant regarding modifications that could impact ownership rights. Legal specialists emphasize that a comprehensive understanding of lien information on property not only facilitates transaction management but also mitigates risks associated with real estate ownership.

As Amy Cutts observes, "a sensible timeline balances the chance to give a borrower sufficient time to make the mortgage up to date, against the losses a lender faces from accruing administrative expenses and potential decline to the asset." Furthermore, case studies indicate that federal agencies have incurred substantial expenses related to managing foreclosed assets, averaging $1,744 per asset, underscoring the broader financial implications of unresolved claims.

In summary, the legal consequences of encumbrances are intricate, affecting both property ownership and the dynamics of real property transactions. Real estate professionals must remain vigilant in comprehending these complexities to ensure successful navigation of the market.

Conducting Lien Searches: Best Practices for Title Researchers

To conduct a comprehensive lien search, title researchers must adhere to best practices that ensure accuracy and relevance in their findings.

- Gather Property Information: Begin by collecting the property's legal description, including essential details such as the lot number and block number. This foundational step is crucial for ensuring that all subsequent searches related to lien information on property are accurate and relevant.

- Search public records to find lien information on property by utilizing databases from the county clerk or assessor's office to check for recorded claims. Given that most state filings typically take about 2-5 business days and county filings can extend to 2-3 weeks, it is vital to initiate this process early to avoid delays. Significantly, under typical conditions, a regular ownership search in New York requires between 24 and 72 hours, highlighting the effectiveness of claim searches, especially when seeking lien information on property in contrast to regular ownership searches. With Parse Ai's advanced machine learning tools, researchers can expedite this process by automating document processing and leveraging full-text search capabilities.

- Review Document Reports: Analyze existing document reports meticulously for any undisclosed liens. Complex ownership searches, particularly for older real estate, can require 10 to 14 days due to the necessity for meticulous document verification, rendering this phase crucial for recognizing possible issues, including lien information on property. Parse Ai's machine learning extraction features can assist in quickly identifying critical information from title documents, enhancing the review process.

- Consult Legal Resources: Leverage legal databases to uncover any pending litigation that may impact the property. This proactive approach can help mitigate risks associated with unforeseen legal challenges related to lien information on property.

- Document Findings: Maintain detailed records of all searches and findings. This practice not only ensures transparency but also enhances the accuracy of reporting, which is critical for obtaining lien information on property in the real estate sector. As Carmel Woodman, a former content manager, stated, "This step can make or break your deal so it’s vital that you do your homework ahead of time."

- Utilize Available Resources: Consider using Parse AI's example manager, which enables rapid annotation of documents, improving the search process. Furthermore, Parse Ai's interactive labeling and OCR technology can enhance the digitization of real estate data, simplifying the management of documentation and boosting overall efficiency in research.

By adhering to these best practices and incorporating tools like Parse AI, title researchers can significantly enhance the efficiency and dependability of their searches, ultimately resulting in more informed decision-making in .

How to Release a Lien: Steps and Considerations

Removing a claim is a crucial procedure that entails multiple important steps to ensure adherence and safeguard ownership rights.

- Pay Off the Debt: The initial step requires the owner to completely fulfill the obligation connected with the claim. This payment must be directed to the creditor who submitted the claim, ensuring that all obligations are fulfilled.

- Obtain a Release of Claim Document: Once the debt is settled, the owner should formally request a release of claim document from the creditor. This document acts as evidence that the claim has been fulfilled and is essential for the subsequent steps in the process.

- File the Release: The release document must then be filed with the appropriate county office. This step is essential as it formally eliminates the claim from public records, thereby updating on property to ensure that future purchasers or creditors are informed that the asset is clear of burdens.

- Verify the Release: After submitting, it is important to perform a follow-up search to ensure that the claim has been successfully eliminated from the title. This verification assists in avoiding any future disputes concerning the ownership status of the asset.

- Keep Records: Finally, landowners should retain copies of all documents concerning the release of claims. Maintaining detailed documentation, especially lien information on property, is crucial for future consultation and can be extremely helpful in the event of any conflicts or inquiries concerning the title of the asset.

In 2025, optimal procedures for the release of claims stress the significance of prompt communication with creditors and compliance with local laws. For example, in North Dakota, individuals providing labor or materials must maintain a detailed record of expenses and inform landowners within designated time periods to guarantee their claims are legitimate. A mineral subcontractor must provide written notice to the property owner no later than the 10th day before submitting the affidavit, emphasizing the significance of prompt communication in the release process.

Statistics show that a notable percentage of claims are successfully released after payment, highlighting the effectiveness of adhering to these steps carefully. Furthermore, the Supreme Court of Nebraska has determined that the presence of a construction claim does not prevent an unjust enrichment or a quasi-contract recovery for work or materials encompassed by a construction claim, offering legal context to the discussion on claim releases. Recent updates in release processes also emphasize the capability for claimants to submit stop payment notices if payment is not received within five days of the due date, further safeguarding their interests.

By following these guidelines, property professionals can navigate the release process efficiently and effectively.

The Impact of Liens on Real Estate Transactions

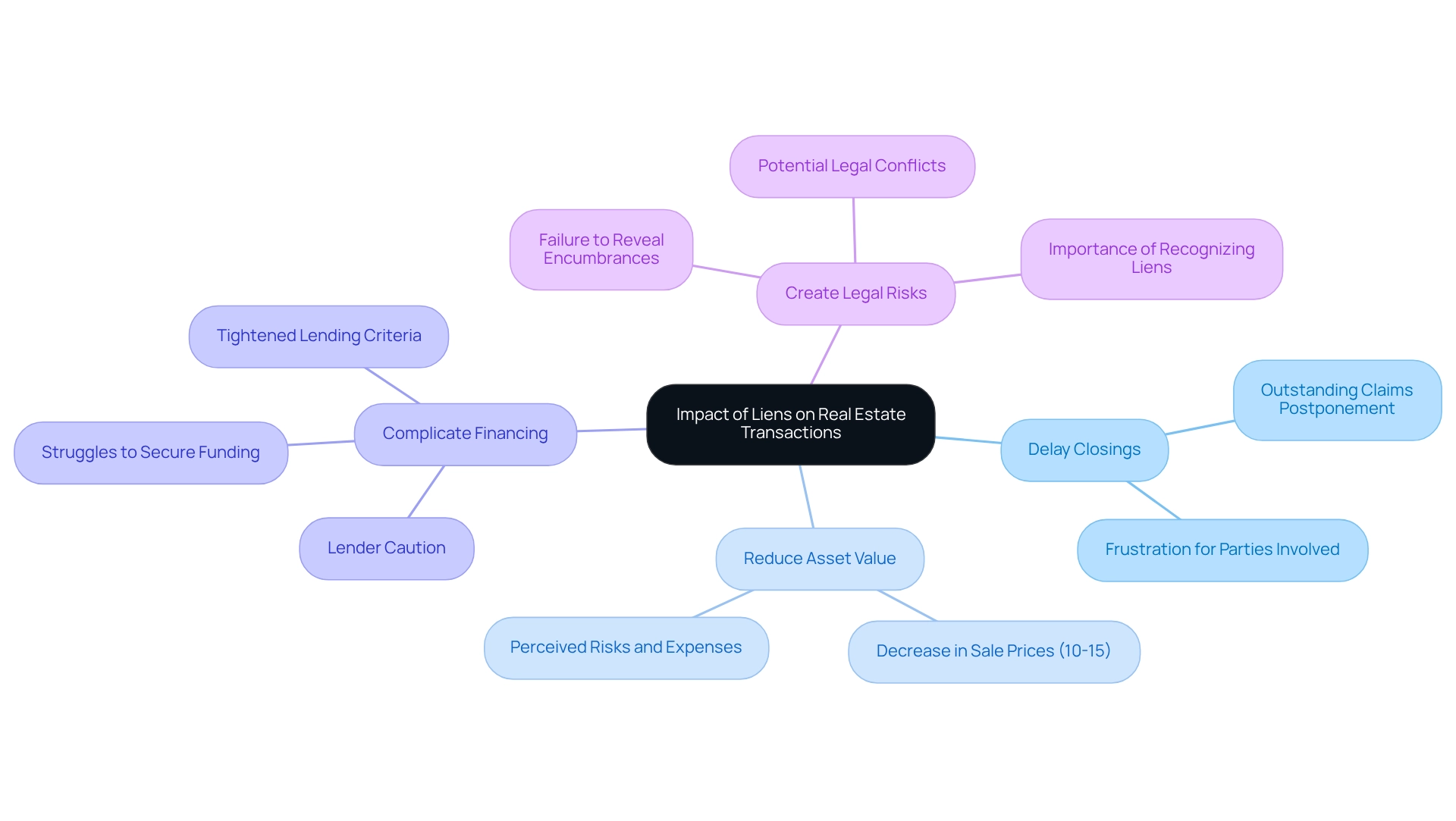

Claims can profoundly affect real estate transactions in several critical ways:

- Delay Closings: Outstanding claims can significantly postpone the closing process. If an asset has unresolved claims, the transaction cannot move forward until these matters are resolved, possibly causing frustration for all parties involved.

- Reduce Asset Value: Assets burdened by claims are frequently seen as less appealing to purchasers. This viewpoint can lead to reduced offers, as prospective purchasers consider the risks and expenses related to settling the claims. Recent market evaluations suggest that assets with claims can experience a decrease in sale prices by as much as 10-15% compared to comparable assets without such burdens.

- Complicate Financing: Lenders generally show caution when funding assets with existing claims. This hesitance complicates the sale process, as buyers may struggle to secure necessary funding, further delaying transactions. In 2025, this trend remains a major obstacle in the housing market, with numerous lenders tightening their criteria regarding assets with encumbrances.

- Create Legal Risks: The failure to reveal encumbrances can result in serious legal conflicts after the transaction is finalized. Real estate experts must be attentive in recognizing and resolving any lien information on property to reduce these risks and guarantee a seamless transaction process.

Comprehending lien information on property and its consequences is essential for real estate experts as they navigate the intricacies of property transactions. A case study named 'Navigating the Sale of a Home with a Claim' emphasizes how early resolution of claims and cooperation with experienced experts enabled the seller to prevent unnecessary delays, ultimately leading to a successful sale. Furthermore, during the , it is important to consider transaction details, gather reliable data, ask relevant questions, determine roles, and understand applicable state laws.

As the terrain of real estate dealings changes in 2025, being proactive about encumbrance management will remain crucial for preserving asset values and ensuring smooth closings.

Challenges in Managing Liens: Insights for Title Research Directors

Managing liens presents significant challenges for title researchers, which can be categorized into several key areas:

- Incomplete Records: Public records frequently fail to provide a comprehensive overview of all existing liens. This lack of completeness in lien information on property can lead to critical oversights, potentially jeopardizing real estate transactions and leaving researchers vulnerable to legal repercussions.

- Discrepancies in Information: Variations in property descriptions, owner names, and other relevant details complicate searches. Such discrepancies hinder the accuracy of searches and increase the risk of misidentifying or overlooking claims, which can have serious financial implications for stakeholders.

- Legal Complexity: The legal landscape surrounding liens is intricate. Various types of liens—such as tax liens, mechanic's liens, and judgment liens—each carry distinct implications. As Jocelyne A. Macelloni, partner and director of education at Barakat + Bossa, PLLC, notes, "Florida’s lis pendens laws need to be expanded upon and clarified to protect sellers from frivolous or meritless claims to property and expensive, fruitless litigation." Comprehending the nuances of lien information on property is vital for researchers. Yet, the complexity of this information can be overwhelming, necessitating continuous education and skill.

- Time Constraints: Title researchers often operate under stringent deadlines, which can compromise the thoroughness of their searches. The pressure to deliver accurate results quickly can lead to rushed decisions, increasing the likelihood of errors.

To effectively address these challenges, leveraging advanced technology is crucial. For instance, Parse AI offers advanced machine learning tools that accelerate document processing and improve research automation. The example manager enables users to swiftly annotate even a single instance to gather information from a vast collection of unstructured documents, greatly enhancing the effectiveness of searches.

The case study titled "Efficiency in Confirmation" demonstrates how Parse AI tackles the challenges related to the time and resources needed for verifying real property ownership. By employing machine learning and optical character recognition, it extracts crucial information from ownership documents. This technology significantly improves the precision of claims searches by automating data extraction from public records, thereby decreasing the time spent on manual searches. Additionally, ongoing training and clear communication with clients can help ensure that all parties are aware of potential issues and the steps being taken to mitigate them.

As the sector continues to develop, remaining updated on current matters in encumbrance management is essential. Recent statistics indicate that document researchers face increasing challenges in managing liens, with many reporting difficulties stemming from incomplete records and legal ambiguities. The real estate sector is committed to safeguarding homeowners and is ready to adapt to the contemporary property market despite the challenges encountered in past years.

By adopting innovative solutions like those offered by Parse AI and fostering collaboration among industry professionals, title researchers can navigate these complexities more effectively, ultimately safeguarding the interests of property owners and buyers alike.

Leveraging Technology for Efficient Lien Management

Technology is fundamentally transforming asset management, providing innovative solutions that streamline processes and improve accuracy. The audit procedure began in the '90s with the transition from written documents to computers, marking a significant advancement in asset management practices. Here are several effective ways to leverage technology in this field:

- Automated Searches: Implementing software that automates property searches can significantly reduce the time spent on manual processes. This efficiency allows professionals to focus on more strategic tasks, ultimately enhancing productivity.

- Optical Character Recognition (OCR): The integration of OCR technology facilitates rapid extraction of information from scanned documents. This not only accelerates the search process but also enhances accuracy, minimizing the risk of human error. Recent advancements in OCR have demonstrated that it can enhance document processing efficiency by up to 80%, making it an essential tool in claims management. For instance, Parse AI utilizes advanced machine learning and OCR to extract essential information from title documents, enabling title researchers to complete abstracts and reports more quickly and accurately, thus yielding significant cost savings compared to traditional methods. Additionally, Parse AI's example manager allows users to swiftly annotate documents, further improving the extraction process from unstructured data.

- Data Analytics: Utilizing data analytics tools empowers professionals to identify trends and patterns within claim data. This capability aids in predicting potential issues, enabling proactive management and informed decision-making.

- Cloud-Based Solutions: Adopting cloud-based platforms facilitates real-time collaboration and document sharing among team members. With AWS leading among small and medium-sized businesses at 53% usage, the competitive environment of cloud services is vital for property professionals to consider, ensuring they have access to the most up-to-date information and promoting a more unified workflow.

As we approach 2025, the influence of technology in claims management will continue to grow, with an anticipated 54% of workers requiring substantial reskilling to adapt to these digital workflows. By embracing these technological innovations, including the robust tools provided by Parse AI, can significantly enhance their efficiency and precision in managing claims, ultimately resulting in improved outcomes in their operations. Users have reported that Parse AI's solutions have transformed their workflow, enabling them to handle complex searches for lien information on property with unprecedented speed and precision.

Conclusion

Liens are pivotal in the real estate landscape, significantly influencing property transactions. A comprehensive understanding of the various types of liens—mortgage, tax, and judgment liens—is essential for real estate professionals, as each type carries distinct implications for property ownership and marketability. The legal ramifications of liens can complicate transactions, potentially delaying closings and impacting property values. Given that unresolved liens can lead to foreclosure, timely communication and proactive management are crucial for safeguarding property rights.

The necessity of conducting thorough lien searches cannot be overstated. By adhering to best practices, title researchers can identify potential issues early, facilitating smoother transactions and protecting their clients' interests. As the industry evolves, the integration of technology—such as automated searches and optical character recognition—is revolutionizing lien management, enhancing efficiency, and mitigating the risk of human error.

In conclusion, remaining well-informed about the complexities of liens and leveraging technological advancements are vital strategies for real estate professionals. By prioritizing lien awareness and management, stakeholders can adeptly navigate the intricate dynamics of property ownership and transactions, ultimately ensuring superior outcomes for themselves and their clients in an ever-evolving real estate market.

Frequently Asked Questions

What is a legal claim in the context of property?

A legal claim signifies a right against an asset, ensuring the settlement of a debt or obligation. It restricts the ability to sell or refinance that asset until the corresponding debt is resolved.

What are some common sources of claims on property?

Claims can originate from loans, overdue taxes, or lien information related to work performed by builders.

Why is it important for real estate professionals to understand claims and lien information?

Understanding claims and lien information is crucial as these factors significantly influence transactions and ownership rights, affecting the marketability and value of properties.

What percentage of properties in the United States are affected by claims?

Approximately 10% of properties in the United States are affected by some form of claim.

What are the different types of liens in real estate?

The main types of liens include: Mortgage Claims (voluntary claims established by lenders for secured loans), Tax Claims (established by government entities for unpaid real estate taxes), Judgment Claims (originating from court decisions against asset owners), Mechanic's Claims (submitted by contractors or suppliers for unpaid work), and Homeowners' Association (HOA) Claims (arising from unpaid fees to an HOA).

How do tax claims differ from other types of claims?

Tax claims take precedence over most other claims, meaning the asset may be sold to settle the tax obligation. They have evolved since 2017 when most tax encumbrances were removed from credit reports.

What challenges do title agents face regarding claims?

Title agents often express frustrations due to inadequate follow-up on release documents by competitors, highlighting the need for improved communication in the industry.

What are the financial implications of claims on property?

Claims can restrict the ability to sell or refinance properties, impacting marketability and financial decisions, particularly in relation to home equity.

How has the landscape of mortgage and tax liens changed recently?

As of 2023, the percentage of mortgage liens has significantly increased compared to tax liens, indicating a shift in the dynamics of property claims.

What role does proactive tracking and communication play in managing claims?

Proactive tracking and communication among agents and lenders can help mitigate the challenges posed by claims, enhancing cooperation to address issues effectively.