Overview

This article provides a comprehensive comparison of title insurance software platforms, focusing on their features and pricing. It emphasizes the significance of accurate title research and the challenges professionals face in selecting the right software. Key functionalities—such as automation, document management, compliance tools, and integration capabilities—are examined for leading platforms like Qualia, SoftPro, and RamQuest. Furthermore, a detailed pricing overview is presented, equipping professionals with the insights needed to make informed decisions tailored to their operational requirements.

Introduction

The landscape of title insurance software platforms is rapidly evolving, driven by the necessity for efficiency and precision within the real estate sector. As professionals navigate the complexities of title research and closing processes, it becomes crucial to understand the unique features and pricing of leading platforms, such as Qualia, SoftPro, and RamQuest.

However, with a plethora of options available, how can one ascertain which software best aligns with their operational needs while ensuring cost-effectiveness?

This article delves into a comprehensive comparison of title insurance software platforms, highlighting their key functionalities and pricing structures to aid in making informed decisions.

Overview of Title Insurance Software Platforms

Title insurance software platforms are essential for streamlining the title research and closing processes that real estate professionals rely on. These title insurance software platforms differ significantly in functionality, user interface, and integration capabilities. Key market participants include:

- Qualia

- SoftPro

- RamQuest

Each offering distinct features tailored to various business sizes and requirements. For instance, Qualia is noted for its user-friendly interface and robust automation capabilities. In contrast, SoftPro provides extensive customization options ideal for larger enterprises. Understanding these distinctions is essential for professionals to select the that align with their operational needs and enhance workflow efficiency.

Key Features of Leading Title Insurance Software

Prominent title insurance software platforms offer a suite of functionalities designed to enhance efficiency and precision in research. Understanding the significance of these features is crucial for professionals in the field. Key functionalities to consider include:

- Automation: Platforms such as Qualia leverage machine learning to automate repetitive tasks, significantly reducing the time spent on manual data entry.

- Document Management: Title insurance software platforms provide robust document management systems that allow users to store, retrieve, and manage documents with ease. SoftPro stands out with its comprehensive offered through title insurance software platforms.

- Compliance Tools: Adherence to legal requirements is paramount in property research conducted through title insurance software platforms. Platforms like RamQuest, which are examples of title insurance software platforms, incorporate built-in compliance checks, guiding users through intricate regulations.

- Integration Capabilities: The ability of title insurance software platforms to integrate seamlessly with other tools and systems is essential for optimizing workflows. Qualia offers extensive API support for third-party integrations within its title insurance software platforms, enhancing adaptability.

Incorporating these features not only streamlines processes but also ensures accuracy and compliance, empowering users to navigate the complexities of property research effectively.

Benefits of Using Title Insurance Software

Utilizing provides significant advantages that can markedly improve the efficiency of title research and closing processes.

- Increased Efficiency: The automation of routine tasks empowers title researchers to concentrate on more complex issues, resulting in quicker turnaround times for title searches and closings.

- Cost Savings: By minimizing the time spent on manual processes, firms can effectively lower operational costs. For example, Parse AI demonstrates how machine learning can diminish labor expenses associated with title research.

- Enhanced Precision: Title insurance software platforms mitigate human errors through automated checks and balances, ensuring that report documents are not only more reliable but also compliant with legal standards.

- Enhanced Collaboration: Many platforms promote improved communication among team members and clients, thereby enhancing overall workflow and client satisfaction.

Pricing Comparison of Title Insurance Software

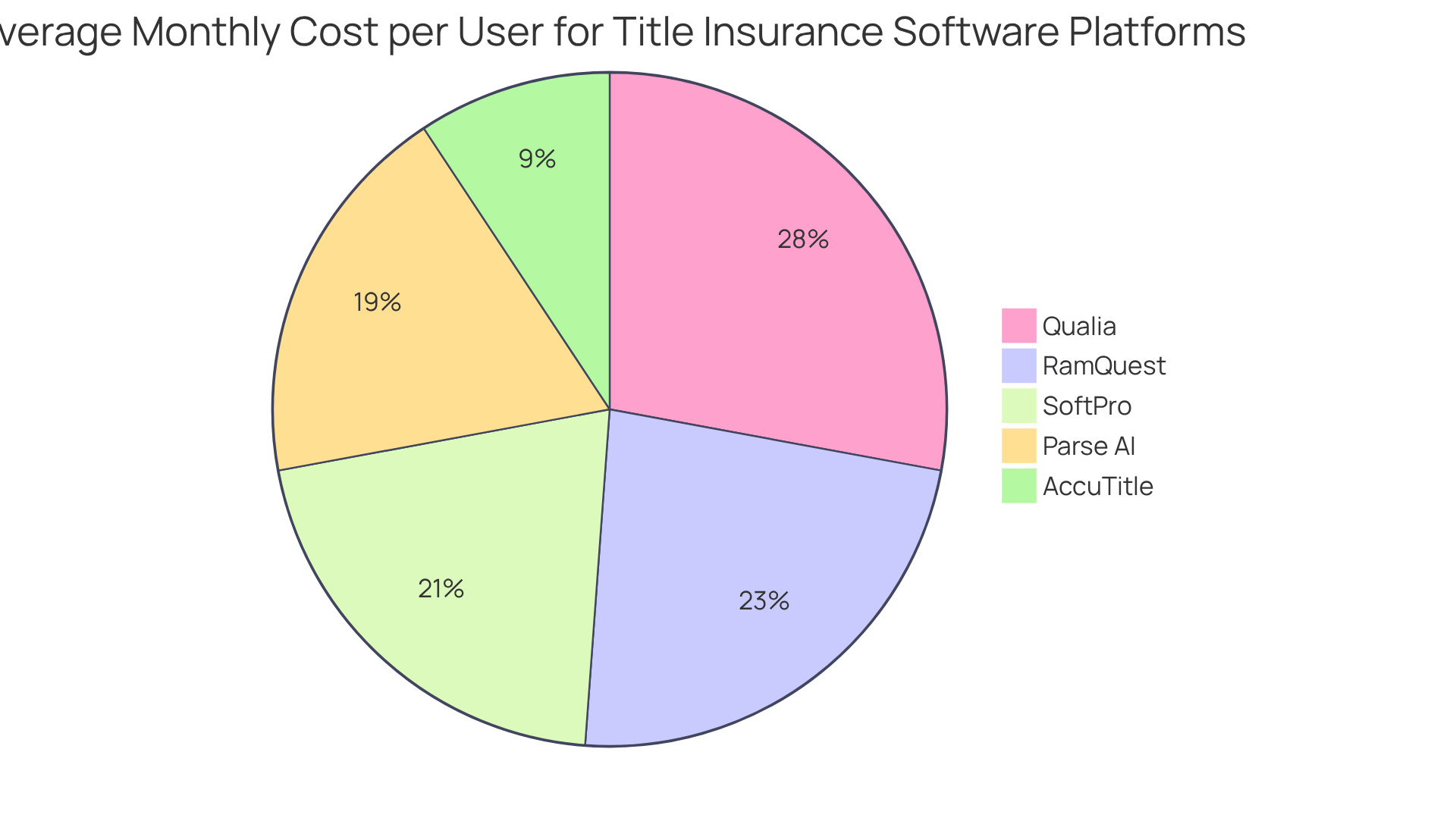

When evaluating title insurance software platforms, it is crucial to recognize that pricing models can vary significantly based on functionalities, participant count, and service tiers. Below is an overview of the pricing for some leading platforms:

- Qualia: Typically charges a subscription fee based on the number of users, with costs ranging from $200 to $400 per user per month, depending on the features selected.

- SoftPro: Provides a tiered pricing structure that can vary from $150 to $300 per individual each month, with additional expenses for advanced features and support.

- RamQuest: Pricing is generally tailored according to the specific requirements of the firm, often starting at approximately $250 per individual per month.

- AccuTitle: Known for its transparent pricing, AccuTitle offers packages beginning at $100 per user per month, making it a cost-effective option for smaller firms.

Furthermore, Parse AI offers flexible subscription options, including monthly and annual plans, as well as a pay-as-you-go model for document processing. This flexibility allows firms to select a pricing structure that best fits their operational needs. Understanding these is essential for firms to evaluate which software aligns with their budget while effectively meeting their operational requirements.

Conclusion

The exploration of title insurance software platforms underscores their critical role in enhancing the efficiency and accuracy of title research and closing processes. By understanding the unique features and pricing structures of leading platforms such as Qualia, SoftPro, and RamQuest, real estate professionals can make informed decisions that align with their operational needs.

Key insights from the article emphasize the importance of:

- Automation

- Document management

- Compliance tools

- Integration capabilities

as essential functionalities that these platforms provide. The benefits of adopting such software extend beyond mere efficiency; they encompass cost savings, enhanced precision, and improved collaboration, all of which contribute to a more streamlined workflow in the title insurance sector.

As the landscape of title insurance software continues to evolve, it is imperative for professionals to stay informed about the latest features and pricing models available. Embracing these technologies not only fosters operational excellence but also positions firms to meet the demands of an ever-changing market. Engaging with the right title insurance software can ultimately lead to a competitive advantage, making it essential to evaluate options carefully and choose a platform that best fits specific business requirements.

Frequently Asked Questions

What are title insurance software platforms used for?

Title insurance software platforms are essential for streamlining the title research and closing processes that real estate professionals rely on.

How do title insurance software platforms differ from one another?

These platforms differ significantly in functionality, user interface, and integration capabilities.

Who are the key market participants in title insurance software?

Key market participants include Qualia, SoftPro, and RamQuest.

What are the notable features of Qualia?

Qualia is noted for its user-friendly interface and robust automation capabilities.

What advantages does SoftPro offer?

SoftPro provides extensive customization options that are ideal for larger enterprises.

Why is it important for professionals to understand the differences between these software platforms?

Understanding these distinctions is essential for professionals to select the appropriate title insurance software platforms that align with their operational needs and enhance workflow efficiency.