Overview

The article emphasizes the essential tools and strategies for effectively researching commercial properties, highlighting the importance of:

- Assessing local economic conditions

- Analyzing development trends

- Utilizing advanced data analytics

- Understanding legal obligations

It details specific resources such as CoStar and Parse AI, which enhance decision-making through data-driven insights. Ultimately, this guidance aids real estate professionals in making informed investment choices while ensuring compliance with legal requirements.

Introduction

Navigating the intricate landscape of commercial real estate requires more than mere intuition; it demands a strategic approach grounded in data and analysis. Real estate professionals equipped with the right tools can unlock a wealth of insights, from assessing local economic conditions to understanding emerging development trends. However, with the rapid evolution of technology and market dynamics, how can one effectively leverage these resources to make informed investment decisions? This article delves into four essential tools that empower researchers to navigate the complexities of commercial property research, ensuring they remain ahead in a competitive market.

Assess Local Economic Conditions for Informed Research

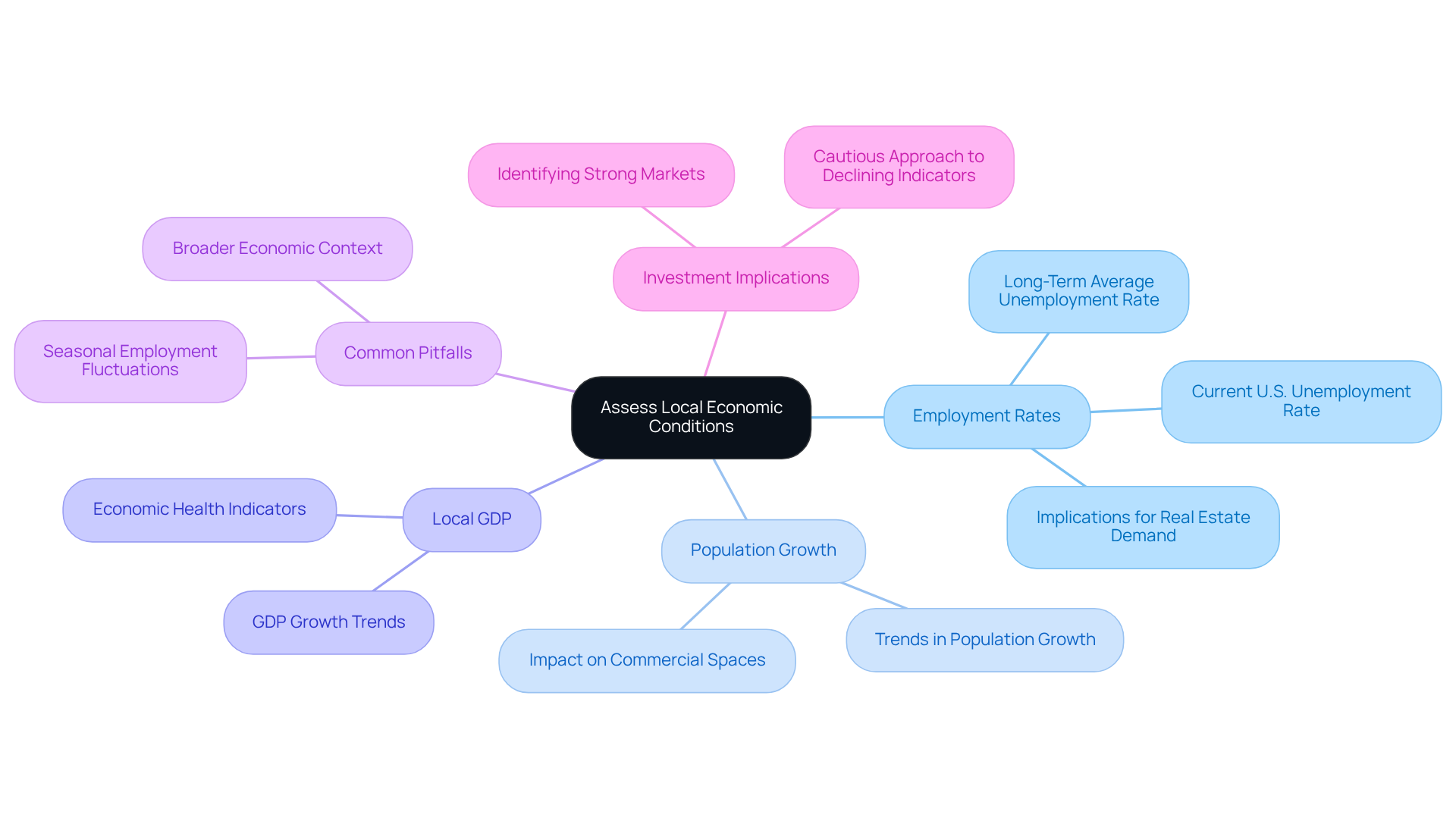

To effectively assess local economic conditions, real estate professionals must prioritize gathering data on critical economic indicators, including:

- Employment rates

- Population growth

- Local GDP

Currently, the U.S. unemployment rate stands at 4.10%, notably lower than the long-term average of 5.67%. Resources such as the U.S. Bureau of Economic Analysis and local chambers of commerce provide invaluable insights into these metrics. Furthermore, platforms like CoStar and CommercialEdge offer extensive market analysis, enabling professionals to identify trends in real estate demand and pricing.

Understanding the is essential for title researchers assessing the feasibility of commercial assets and providing informed guidance to clients. For instance, Franklin D. Roosevelt noted that land is among the most secure investments. Areas experiencing steady job creation and population growth frequently indicate strong demand for commercial spaces, making them attractive investment opportunities. Conversely, declining economic indicators may signal potential risks, necessitating a more cautious approach to property acquisition.

Common pitfalls in evaluating local economic conditions include:

- Overlooking the effects of seasonal employment fluctuations

- Failing to consider the broader economic context

This strategic analysis not only enhances decision-making but also aligns with the overarching goal of maximizing investment returns in the commercial real estate sector. A successful investment choice could be illustrated by a scenario where a researcher identified a growing market based on employment trends, leading to a profitable acquisition.

Analyze Development Pipelines and Emerging Trends

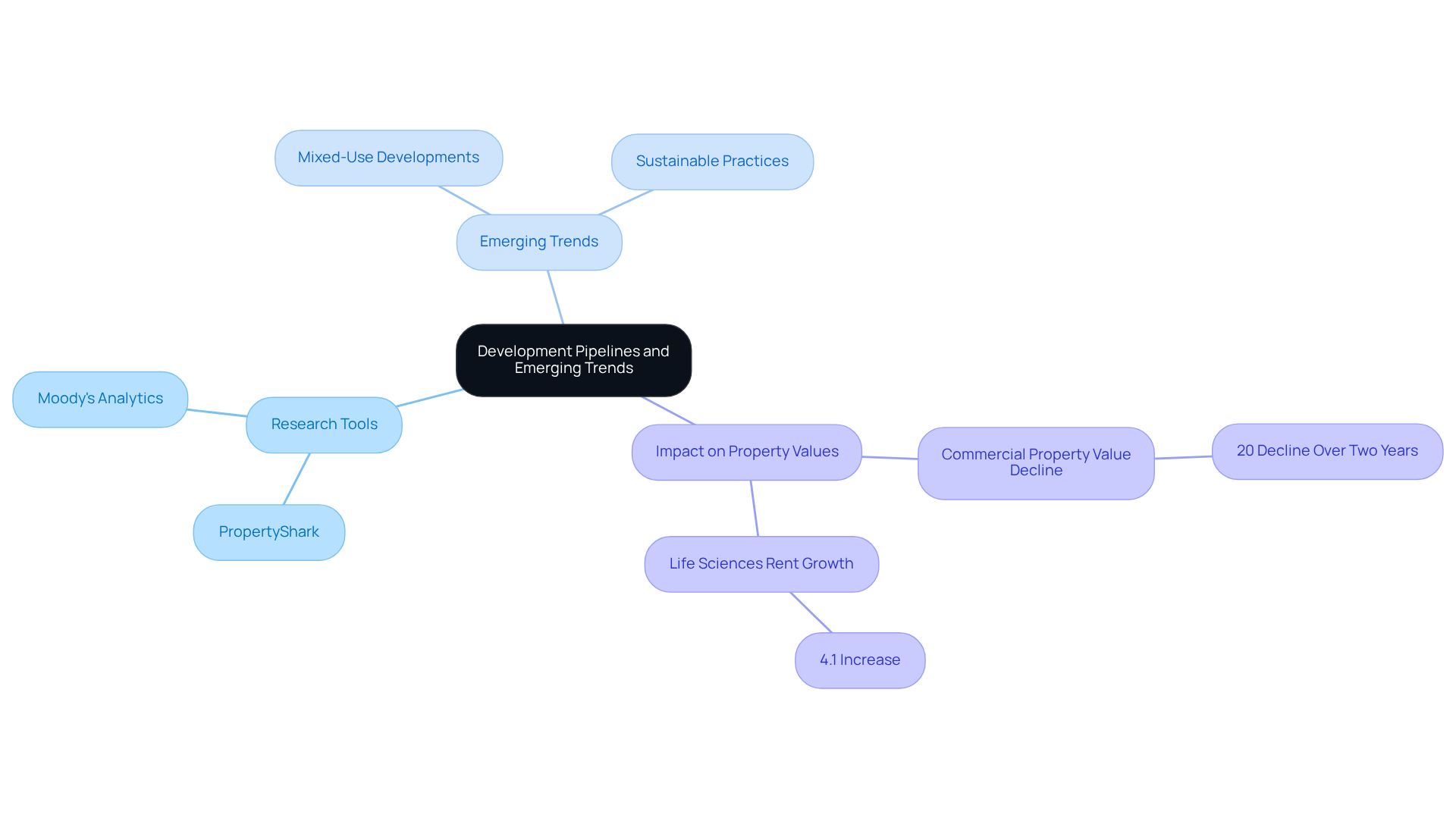

To effectively analyze development pipelines, professionals must use like PropertyShark and Moody's Analytics, which provide comprehensive insights into upcoming projects and zoning changes. Furthermore, utilizing tools for researching commercial properties can aid in monitoring local government announcements and attending planning commission meetings, yielding valuable information regarding future developments.

Emerging trends, particularly the rise of mixed-use developments and a shift towards sustainable building practices, are set to significantly impact property values. For instance, cities that plan to revitalize downtown areas often experience a surge in demand for commercial spaces, underscoring the necessity for title researchers to remain informed about these developments. According to recent data, commercial property values have declined by 20% over the past two years, while life sciences average asking rents have increased by 4.1%. By proactively analyzing these trends, professionals can better position themselves to seize new opportunities and mitigate risks associated with market fluctuations. As urban planners emphasize, mixed-use developments not only enhance community involvement but also contribute to long-term value growth in property markets. Moreover, utilizing technology such as Parse AI can assist researchers in effectively analyzing these trends and optimizing their workflows.

Utilize Advanced Tools and Data Analytics for Title Research

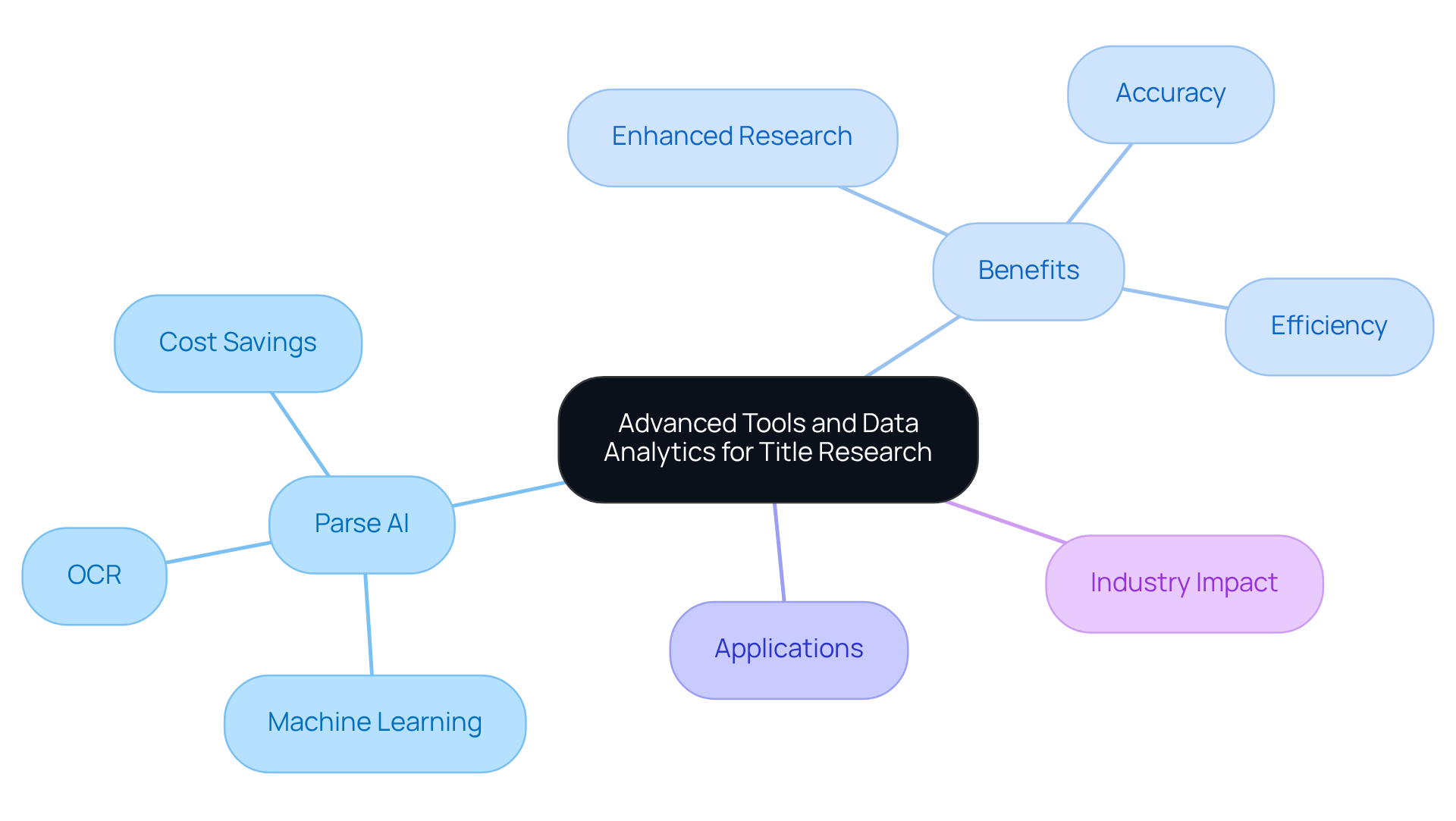

Real estate experts are increasingly leveraging advanced tools like Parse AI, which utilizes machine learning and optical character recognition (OCR) to swiftly extract critical information from ownership documents. This technology significantly enhances research capabilities by incorporating tools for , enabling researchers to reduce manual data entry and improve the accuracy of reports. For example, Parse AI can effectively identify discrepancies in ownership records, facilitating quicker resolutions and more reliable property assessments. Furthermore, the platform offers substantial cost savings compared to traditional research methods, establishing itself as an essential resource for tools for researching commercial properties in the industry.

The demand for data experts is growing at a rate of 36%, underscoring the increasing importance of data analytics in property decision-making. By integrating technologies like Parse AI into their workflows, researchers can uncover patterns and insights that inform strategic decision-making. This not only benefits clients but also elevates the overall quality of service provided in the property sector. The impact of these advancements is evident in case studies that illustrate how machine learning enhances title document analysis, resulting in significant efficiency improvements in title research.

Understand Legal Obligations and Compliance Requirements

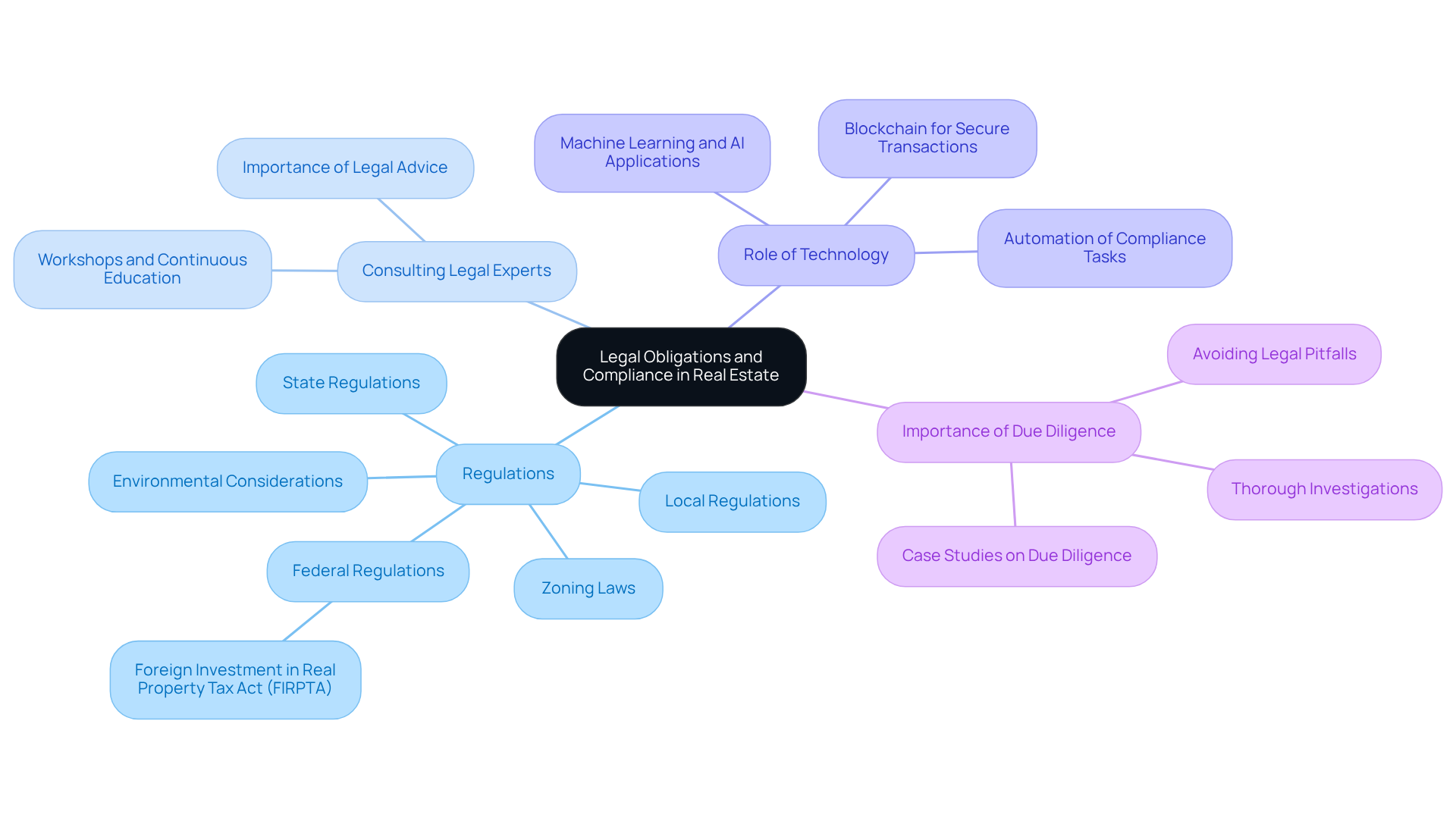

Real estate experts must remain vigilant regarding the legal responsibilities and compliance criteria that govern real estate transactions. A comprehensive understanding of local, state, and federal regulations—encompassing real estate ownership, zoning laws, and environmental considerations—is essential. Organizations such as the American Land Title Association (ALTA) provide critical guidelines and best practices for ensuring compliance.

Furthermore, professionals should regularly consult legal experts or attend workshops to stay informed about legislative changes that may affect their operations. For instance, grasping the implications of the Foreign Investment in Real Property Tax Act (FIRPTA) is vital for transactions involving foreign investors, as it can significantly influence tax liabilities and reporting requirements. As Jane Walker emphasizes, "Due diligence is not an option, it's a necessity," underscoring the importance of thorough investigation in compliance.

In addition, technology plays a pivotal role in enhancing compliance processes. The automation of compliance tasks can minimize human error and conserve time, allowing researchers to focus on more critical aspects of their work. By prioritizing compliance, title researchers not only protect their interests but also bolster the integrity of property transactions, thereby reducing the risk of legal complications. This proactive approach is crucial for in an increasingly complex real estate landscape.

Conclusion

The exploration of effective tools for researching commercial properties underscores the vital role that informed decision-making plays in the real estate sector. By leveraging advanced technologies and data analytics, professionals can navigate the complexities of the market with greater confidence and precision. Understanding local economic conditions, development trends, and legal compliance not only enhances research capabilities but also positions investors for success in a competitive landscape.

Key insights from the article emphasize the importance of assessing economic indicators, such as:

- Employment rates

- Population growth

to identify lucrative investment opportunities. Furthermore, the analysis of development pipelines and emerging trends, including:

- Mixed-use projects

- Sustainable practices

underscores the necessity for real estate professionals to stay ahead of market shifts. In addition, utilizing advanced tools like Parse AI streamlines title research, ensuring accuracy and efficiency in property assessments.

Ultimately, the integration of these research strategies and tools is crucial for real estate professionals aiming to make informed investments and foster long-term growth. By prioritizing comprehensive research and compliance, stakeholders can enhance their operational effectiveness and contribute to the overall integrity of the commercial real estate market. Embracing these best practices not only facilitates successful transactions but also empowers professionals to navigate the evolving landscape of real estate with agility and foresight.

Frequently Asked Questions

What are the key economic indicators to assess local economic conditions?

Key economic indicators include employment rates, population growth, and local GDP.

What is the current U.S. unemployment rate?

The current U.S. unemployment rate stands at 4.10%, which is lower than the long-term average of 5.67%.

Where can real estate professionals find data on local economic conditions?

Real estate professionals can find data from resources such as the U.S. Bureau of Economic Analysis, local chambers of commerce, and platforms like CoStar and CommercialEdge.

Why is understanding the economic environment important for title researchers?

Understanding the economic environment is essential for title researchers as it helps them assess the feasibility of commercial assets and provide informed guidance to clients.

What factors indicate strong demand for commercial spaces?

Areas with steady job creation and population growth often indicate strong demand for commercial spaces, making them attractive investment opportunities.

What are some common pitfalls in evaluating local economic conditions?

Common pitfalls include overlooking the effects of seasonal employment fluctuations and failing to consider the broader economic context.

How can strategic analysis of economic conditions enhance decision-making in real estate investment?

Strategic analysis enhances decision-making by aligning investment choices with economic trends, ultimately maximizing investment returns in the commercial real estate sector.