Overview

Automatically superior liens, including tax obligations and specific homeowners association (HOA) claims, take precedence over other encumbrances in real estate transactions. This priority significantly impacts ownership rights and creditor recovery.

It is imperative for real estate professionals to grasp the implications of these superior claims, particularly during foreclosure processes. Moreover, thorough title searches are essential for effectively identifying these claims, ensuring that professionals are well-equipped to navigate the complexities of real estate transactions.

Introduction

In the intricate world of real estate, understanding liens transcends mere legal jargon; it is a fundamental aspect that can determine the success or failure of property transactions. Liens represent legal claims against properties, often arising from unpaid debts or obligations, and their implications are profound.

As properties change hands, the presence of liens complicates ownership rights, influences marketability, and can even dictate the outcomes of foreclosure proceedings. Given that a significant portion of real estate transactions is affected by various types of liens—from property tax liens to mechanic's liens—professionals in the field must navigate this complex landscape with vigilance and expertise.

By delving into the nuances of liens, including their types, legal frameworks, and priority statuses, stakeholders can better safeguard their interests and ensure smoother transactions in an ever-evolving market.

Understanding Liens: Definition and Importance

A lien represents a legal claim or right against an asset, functioning as collateral for a debt or obligation. This mechanism enables creditors to protect their interests in the asset until is completely fulfilled. Liens can originate from various situations, such as unpaid taxes, mortgages, or court judgments.

For real estate experts, is essential, particularly which to others. This knowledge can significantly affect , ownership rights, and the capacity to sell or refinance an asset.

The existence of a claim can hinder the marketability of an asset, complicating transactions. For example, , submitted by contractors or suppliers who have not been compensated for their services, create substantial obstacles in real estate dealings. These claims must be addressed before a transaction can proceed, underscoring the importance for estate experts to be vigilant regarding any on the assets they manage.

Data indicate that a significant portion of property transactions are influenced by encumbrances, emphasizing their widespread effect within the sector. A claim can influence the property's title and complicate selling, highlighting the necessity for . In 2025, understanding which types of liens are automatically superior to others is more vital than ever, as it emphasizes the consequences of encumbrances, which not only signify financial responsibilities but also determine the rights of different parties involved in real estate transactions.

As the IRS states, "The IRS releases your claim within 30 days after you have paid your tax debt," illustrating the .

Furthermore, investors can acquire tax liens at auctions, either in person or online, where they can reduce the interest rate or increase a premium for the asset. This approach highlights the importance of and the necessity for experts to remain updated on current trends.

As the globe's largest asset category, real estate transactions necessitate a sharp understanding of claim priority and the possible issues they present. In conclusion, the significance of comprehending encumbrances in property dealings cannot be overstated. They play a crucial role in establishing ownership rights and the overall viability of real estate transactions, making it vital for professionals in the sector to remain informed and proactive regarding any claims that may impact their dealings.

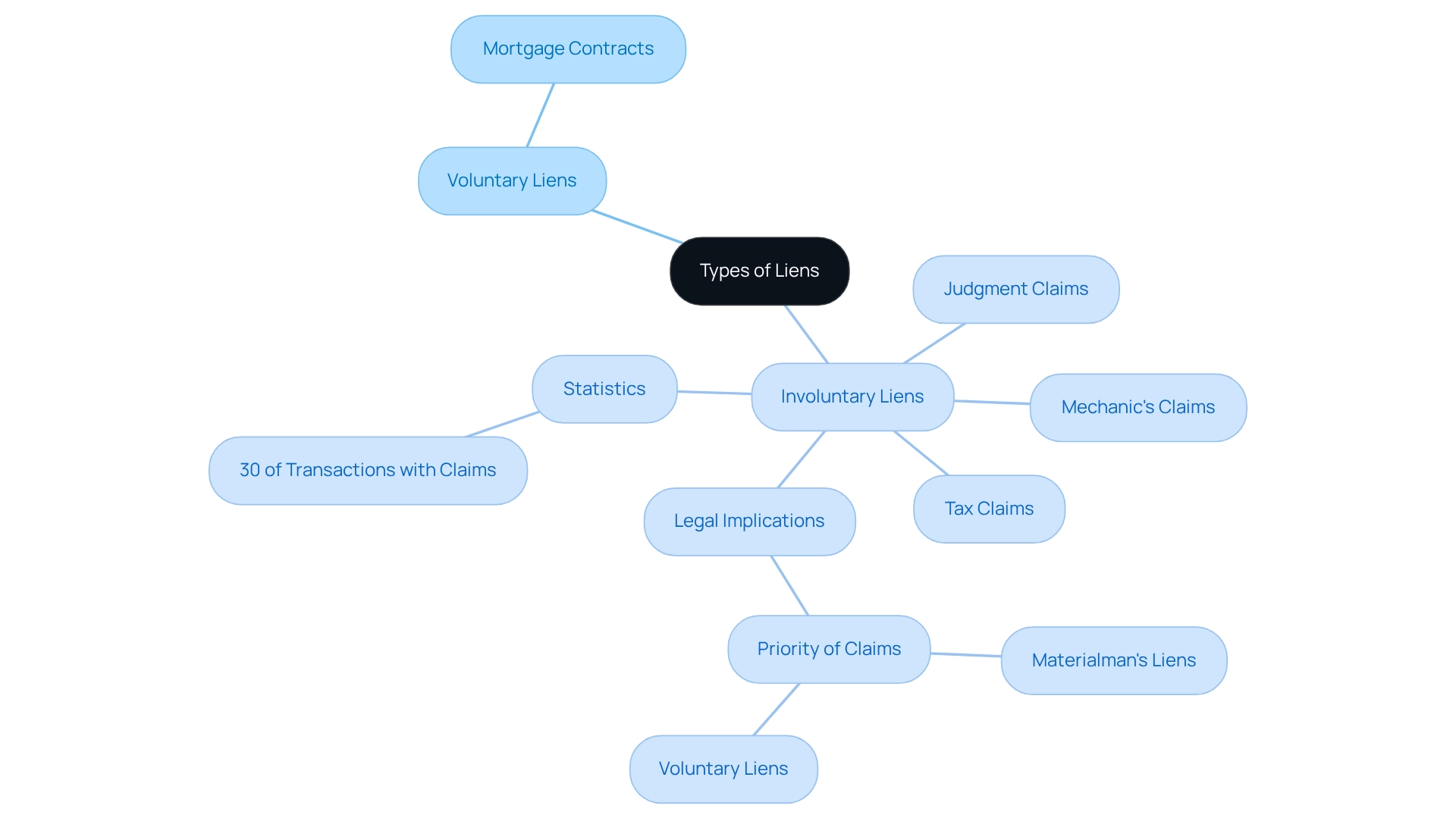

Types of Liens: An Overview

Liens in real estate are categorized into two primary types: voluntary and involuntary. with the owner's approval, often observed in mortgage contracts where the asset serves as security for a loan. In contrast, without the owner's consent, typically resulting from legal rulings or outstanding debts.

Typical instances of involuntary claims include:

- Tax claims

- Mechanic's claims

- Judgment claims

Each of these claims carries unique legal consequences and priority rankings, which can . Notably, a tax claim typically holds priority over other kinds of claims, ensuring that local authorities can collect owed taxes before other creditors.

is essential for property professionals. Statistics indicate that a substantial portion of real estate transactions involves some type of encumbrance, underscoring the necessity of thorough due diligence. Recent data reveals that nearly 30% of real estate transactions encounter unintentional claims, highlighting the importance of caution in real estate dealings.

that are automatically superior to others can greatly influence recovery outcomes in cases of default. A significant case study illustrates this point: when a landowner defaults on a loan secured by a voluntary encumbrance, a supplier's claim may take precedence if it was documented first or according to . This scenario emphasizes the need for landowners and builders to be well-informed about legal claims and their implications for real estate transactions.

As of 2025, the landscape of claims continues to evolve, with various forms of involuntary encumbrances becoming increasingly prevalent. Real estate lawyer Jane Doe emphasizes, "Comprehending the different kinds of claims and their consequences is crucial for any landowner." Ignoring potential involuntary claims can lead to significant financial repercussions. Lawyers frequently advise clients to remain vigilant regarding the possibility of involuntary claims, as they can complicate ownership and transfer processes.

What Are Automatically Superior Liens?

Claims that are automatically superior—specifically, the types of liens that hold priority over all other encumbrances regardless of their recording dates—are critical to understand. The most common instance of such a claim is the tax obligation, prioritized to ensure that governmental entities can secure essential funding. In addition to real estate tax claims, certain special assessment charges and some homeowners' association (HOA) claims may also qualify as super claims in specific jurisdictions.

This automatic dominance indicates that during , these claims are addressed first, often resulting in little or no remaining funds for subordinate claim holders.

In the United States, are particularly significant, with statistics indicating they rank among the most commonly documented claims. For instance, total outstanding amounts of assessments and pre-assessed charges must be $25,000 or less for withdrawal requests under certain conditions, underscoring the financial limits that can influence priority in foreclosure situations.

Furthermore, the implications of automatically dominant claims extend beyond mere definitions; they play a vital role in . A recent case study highlights this, where Philadelphia implemented a $5.7 million data warehouse system aimed at enhancing . This system integrates financial information from various city and state departments, significantly improving the detection of delinquent taxpayers and bolstering the city's effectiveness in collecting taxes and other charges.

Such advancements position Philadelphia among major cities with sophisticated data capabilities, ultimately contributing to the reduction of tax delinquency rates. This illustrates how efficient administration of in the housing market.

As Darrell Clarke, , articulated, "We cannot become like the banks we have so often criticized and put people struggling with poverty out on the street." This perspective underscores the societal effects of tax claims and the importance of understanding their priority in estate transactions. For property experts, grasping property tax obligations is essential, particularly in foreclosure cases, raising the pivotal question of which types of liens are automatically superior to any other lien.

As the landscape of real estate transactions evolves, the importance of identifying and managing the complexities of remains paramount.

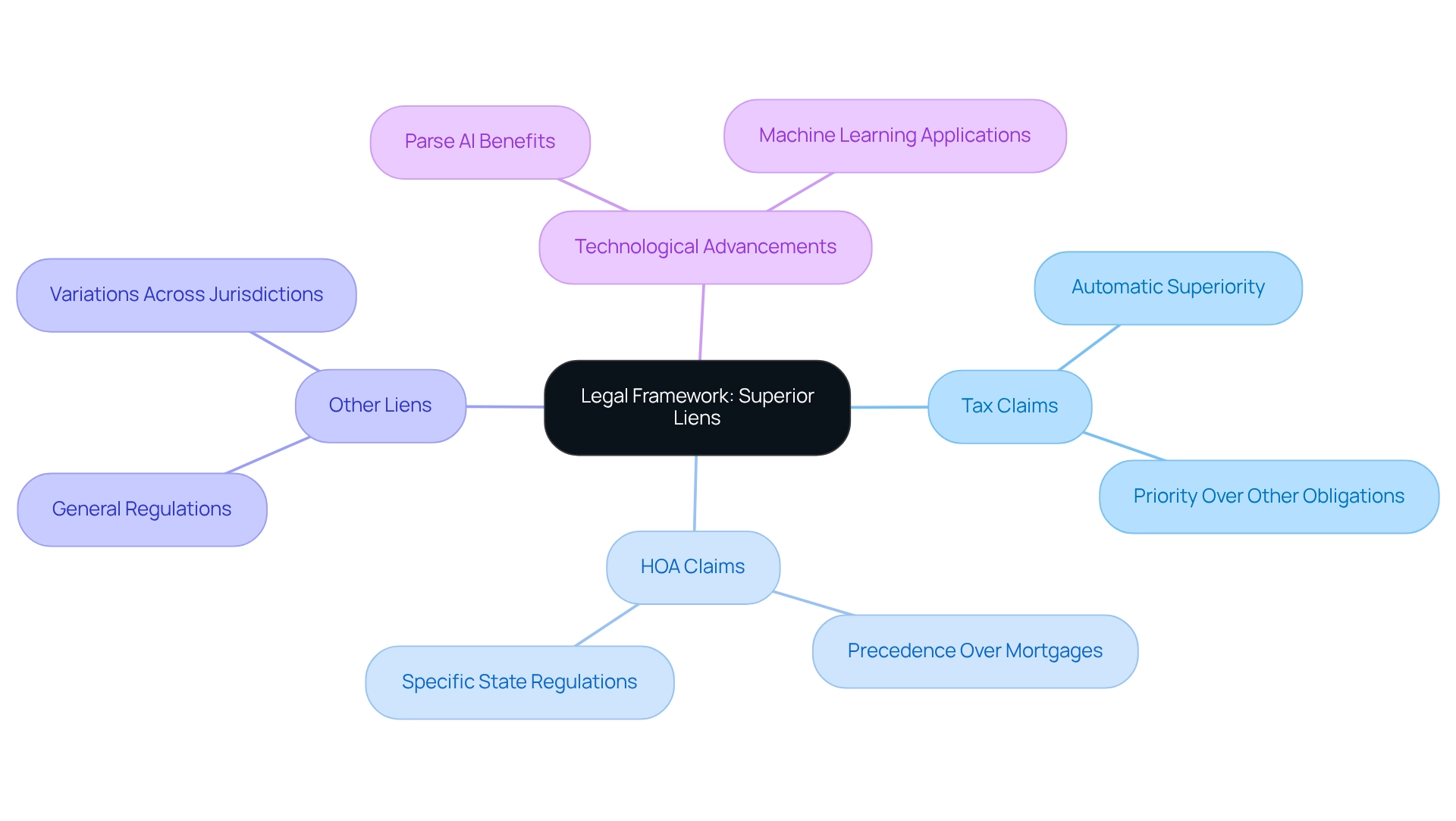

Legal Framework: Statutes Governing Superior Liens

The legal structure governing is complex and varies significantly across jurisdictions. State laws typically delineate the hierarchy of different encumbrance types, prompting the inquiry into which of the following lien types holds automatic superiority over others. Tax-related claims often achieve this precedence due to specific tax regulations. For example, in many states, it is clearly established that over other obligations, thereby allowing municipalities to recover owed taxes without delay.

Moreover, certain states have enacted regulations that categorize as automatically superior to any other lien type, granting them precedence over first mortgages under specific circumstances. This situation can pose challenges for both lenders and buyers, underscoring the necessity for to possess a thorough understanding of these statutes to safeguard their interests during transactions. Additionally, analyzing legal outcomes from superior claims disputes can provide valuable insights into the practical application of these laws, highlighting the critical need for precise and effective .

Leveraging , such as those provided by , can significantly improve the speed and accuracy of this research, ultimately resulting in substantial . By employing machine learning and optical character recognition, Parse AI addresses the challenges associated with verifying actual ownership, enabling to navigate the complexities of claim priority more effectively.

Implications of Superior Liens on Property Ownership

The presence of a dominant claim can significantly affect ownership of real estate and the entitlements of creditors. For asset owners, the existence of a higher claim necessitates that these duties be settled before selling or refinancing the asset. Ignoring these claims can result in foreclosure, allowing the creditor to take the asset to recover the owed debt.

This situation is particularly concerning, as . Data indicates that specific states, such as Wisconsin, recorded of one in every 8,388 households, underscoring the potential dangers involved.

For creditors, it is crucial to understand which types of liens are automatically superior to any other lien, as this knowledge determines their position in the order of claims against the asset. Junior lienholders often find themselves at a significant disadvantage, frequently receiving minimal or no compensation in the event of a foreclosure. Expert insights highlight that comprehending these dynamics is essential for financial advisors and participants in real estate deals, particularly in recognizing which types of liens hold superiority, given the substantial financial consequences of superior claims.

Neglecting to manage higher claims appropriately raises the question of which types of liens are automatically superior to any other lien, jeopardizing property ownership and potentially resulting in significant financial repercussions for all parties involved. Case studies illustrate the consequences of disregarding higher claims, with numerous foreclosure instances demonstrating how these claims can determine the outcomes of property disputes. For instance, the situation in Wisconsin highlights how dominant claims can influence foreclosure results in particular counties, as evidenced by the documented foreclosure rate.

Additionally, as Greg Rosenberg from the CLT Academy points out, Community Land Trusts (CLTs) are nonprofit entities that utilize public and private resources to provide affordable homeownership options for low-income families. This perspective emphasizes the importance of and mitigating foreclosure effects on communities. Furthermore, ongoing discussions regarding increased funding in the CLT model further underscore the necessity for effective strategies to navigate the complexities of superior claims.

As the landscape of real estate transactions evolves, the importance of identifying and addressing superior claims cannot be overstated.

How to Identify Automatically Superior Liens

Recognizing necessitates a meticulous strategy involving extensive and a detailed examination of public records. must prioritize the examination of recorded property tax claims, special assessments, and any homeowners' association (HOA) charges that may hold super priority status. The integration of advanced technologies, such as , significantly enhances this process by rapidly extracting pertinent information from extensive collections of title documents.

Studies have demonstrated that utilizing machine learning can decrease the time dedicated to title searches by as much as 30%, enabling researchers to concentrate on more intricate elements of their tasks. Furthermore, reviewing local statutes and regulations is crucial, as these can offer vital insights into which types of liens are automatically superior to others within particular jurisdictions. By remaining updated on and using technology effectively, title researchers can enhance their precision and productivity in identifying automatically superior claims.

Professional guidance underscores the significance of ongoing education and adjustment in this area, as the environment of priority can change with shifts in laws and technology. As John Hattie observes, are essential in guaranteeing precision in this process. Additionally, the difficulties highlighted in the case study on emphasize the need for clear communication in legal contexts, particularly when identifying claims.

Ethical guidelines related to participant confidentiality and informed consent further reinforce the importance of thorough title searches. Ultimately, employing these strategies not only simplifies the title search process but also improves the overall dependability of claim identification.

Key Takeaways on Automatically Superior Liens

In property transactions, understanding which to others is crucial. Automatically superior claims, such as tax obligations and certain homeowners association (HOA) charges, hold significant influence due to their . For and real estate experts, grasping the various categories of claims, their , and the regulations governing them is essential. This knowledge not only protects clients' interests but also facilitates smoother navigation through the complexities of property ownership.

Recognizing these claims early is of utmost importance. A case study highlights the necessity of conducting thorough as part of due diligence, illustrating that discovering a claim after initiating a sale can lead to considerable complications. Prompt identification allows sellers to address outstanding debts and secure release documents, ultimately .

Furthermore, the integration of , such as , significantly enhances the effectiveness and accuracy of identifying exceptional claims. By automating the extraction of critical information from extensive title documents, professionals can expedite their workflows, ensuring they remain informed about priority claims. Statistics indicate that a lender's security interest in inventory and receivables acquired more than 45 days after the NFTL is filed is subordinate in priority to the federal tax claim, underscoring the importance of understanding claim hierarchies for .

As Robert Rafii, Esq. aptly states, "Meanwhile, you owe thousands of dollars and have days or months to pay the supplier," highlighting the urgency of addressing debts swiftly. As we move through 2025, insights from property specialists reiterate the necessity of comprehending which types of liens are automatically superior to any other lien.

The evolving landscape of real estate transactions necessitates that title researchers remain informed about these developments to provide optimal service. In this context, the role of technology in title research becomes increasingly vital, offering substantial benefits in terms of time and cost savings while enhancing overall accuracy.

Conclusion

Understanding and navigating the complexities of liens is crucial for anyone involved in real estate transactions. Liens, whether voluntary or involuntary, can profoundly impact property ownership, marketability, and the overall feasibility of sales. The presence of liens necessitates diligent research and awareness, especially considering that a significant percentage of transactions are influenced by them.

The distinction between automatically superior liens, such as property tax liens and certain HOA liens, underscores the importance of prioritizing these claims in any transaction. These liens take precedence over others and can dramatically affect the outcomes of foreclosure proceedings, thereby influencing the rights of both property owners and creditors. Failure to address superior liens can lead to severe financial repercussions, making it imperative for real estate professionals to remain vigilant and informed.

Furthermore, technological advancements, including the use of machine learning and optical character recognition, have emerged as powerful tools in identifying and managing liens effectively. By streamlining the title search process and enhancing accuracy, these technologies provide a significant advantage in navigating the complexities of liens. As the real estate landscape continues to evolve, the importance of understanding and addressing lien implications cannot be overstated. Stakeholders must prioritize due diligence, proactive communication, and the integration of technology to safeguard their interests and ensure smoother transactions in an increasingly intricate market.

Frequently Asked Questions

What is a lien?

A lien is a legal claim or right against an asset, serving as collateral for a debt or obligation. It allows creditors to protect their interests in the asset until the debt is fully paid.

What are the different types of liens in real estate?

Liens in real estate are categorized into two primary types: voluntary liens, which are created with the owner's approval (such as mortgage contracts), and involuntary liens, which are placed without the owner's consent (such as tax claims and mechanic's claims).

What are some examples of involuntary claims?

Typical examples of involuntary claims include tax claims, mechanic's claims, and judgment claims.

Why is understanding lien priority important for real estate professionals?

Understanding lien priority is crucial because it can significantly affect ownership rights and the ability to recover debts in cases of default. Certain liens, like tax claims, typically have priority over others, impacting the order in which creditors can collect owed amounts.

How do liens affect real estate transactions?

Liens can hinder the marketability of an asset and complicate transactions. They can influence the property’s title and require resolution before a transaction can proceed, making thorough due diligence essential.

What percentage of real estate transactions encounter unintentional claims?

Recent data indicates that nearly 30% of real estate transactions involve some type of unintentional claims.

What should landowners and builders be aware of regarding liens?

Landowners and builders should be well-informed about legal claims and their implications for real estate transactions, as ignoring potential involuntary claims can lead to significant financial repercussions.

What advice do legal specialists give about liens?

Legal specialists advise clients to remain vigilant regarding the possibility of involuntary claims, as these can complicate ownership and transfer processes. Understanding the different types of claims and their consequences is crucial for any landowner.