Overview

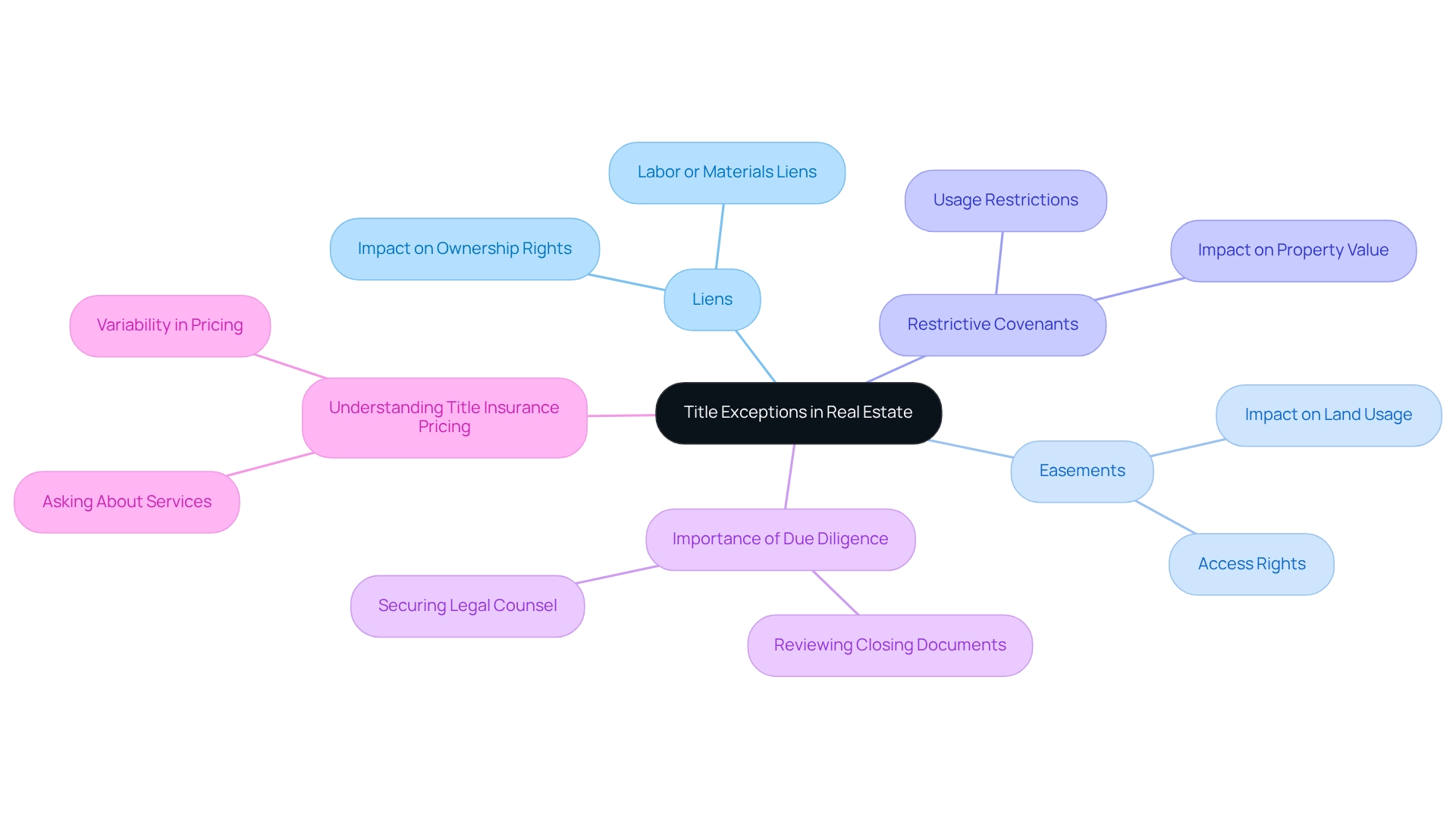

A title exception denotes specific limitations or exclusions in real estate ownership that are not encompassed by title insurance. These may include:

- Liens

- Easements

- Restrictive covenants

All of which can significantly impact ownership rights. Understanding these exceptions is crucial to mitigating risks in property transactions. Failure to address them can lead to unforeseen legal challenges and financial repercussions for buyers.

Introduction

In the intricate realm of real estate, comprehending title exceptions is essential for both buyers and professionals. These exceptions denote specific limitations or encumbrances on property titles, profoundly impacting ownership rights and property usage.

- Liens

- Easements

- Restrictive covenants

illustrate the complexities of title exceptions, which can result in unforeseen challenges during property transactions. As the real estate landscape evolves, the necessity for thorough due diligence and informed decision-making becomes increasingly paramount. By exploring the intricacies of title exceptions, individuals can adeptly navigate the potential pitfalls of property ownership, ensuring a smoother transaction process that ultimately protects their investments and enhances their negotiating power.

Define Title Exception: Understanding Its Role in Real Estate

A designation limitation indicates specific restrictions or burdens on real estate ownership that are not included in ownership insurance coverage. Typical instances of these exclusions include:

- Liens

- Easements

- Restrictive covenants

All of which can significantly impact ownership rights and land usage. For real estate experts, understanding what is a title exception is essential, as it can lead to substantial difficulties in asset dealings. For instance, a policy may specifically exclude certain defects or claims, leaving buyers vulnerable to unforeseen challenges post-purchase.

Statistics reveal that claims for labor or materials created prior to the policy date commonly contribute to ownership defects, underscoring the necessity of diligent due diligence in real estate transactions. As Michael Jensen, a mortgage and finance specialist, notes, "Identifying and addressing issues with ownership documents paves the way for the property deed to be transferred and for you to gain ownership of the property."

Comprehending these irregularities not only aids in navigating the complexities of real estate dealings but also empowers buyers and agents to make informed decisions, such as understanding what is a title exception when requesting to review closing documents in advance and securing legal counsel at closing.

Furthermore, real estate agents and home purchasers must understand how to manage insurance discrepancies effectively. Additionally, grasping title insurance pricing, as detailed in the case study 'Understanding Title Insurance Pricing,' can provide valuable insights into the services offered by various companies, ensuring consumers receive optimal value in their transactions.

Contextualize Title Exceptions: Importance in Property Transactions

Title anomalies play a vital role in real estate transactions by notifying buyers and sellers of possible risks that could influence their investments. An easement granting a neighbor access to part of the property can significantly restrict the owner's ability to develop or modify the land. These exclusions are outlined in commitment documents and insurance agreements, acting as essential alerts for potential purchasers. Understanding property exclusions is not only advantageous; it is crucial for informed decision-making and successful negotiation in real estate transactions.

Recent discussions in the industry underscore what is and its implications. For example, Fannie Mae's guidance on assets with unexpired redemption periods emphasizes the importance of transparency in financing choices. Such assets can still be financed under specific conditions, which include ensuring that the buyer is aware of the redemption period and its implications. This highlights the necessity for thorough due diligence by all parties involved.

Furthermore, specialists recommend comprehensive evaluations of commitment documents. Industry expert Sarah Micle states, "It is good practice to have a lawyer conduct a thorough examination of the commitment document and associated materials so that you, as a buyer or seller, are fully aware of the issues that impact the property and would not be included in the policy after closing." This proactive approach reduces risks and fosters a safer exchange environment.

Data indicates that a notable proportion of property deals encounter ownership flaws, making it crucial for experts to understand how these irregularities can impact agreements. South Oak Title and Closing offers assistance in comprehending ownership commitments and insurance coverage, providing valuable resources for real estate professionals. By recognizing the risks associated with ownership discrepancies, real estate experts can better understand what is a title exception, allowing them to navigate the complexities of real estate dealings more effectively and ultimately leading to more favorable outcomes. Moreover, the recent introduction of Fannie Mae's AI-driven search tool illustrates the sector's shift towards technology in property research, further enhancing the significance of understanding ownership discrepancies.

Trace the Origins of Title Exceptions: Historical Development and Legal Framework

The origins of variations are deeply rooted in the evolution of real estate law, which has developed over centuries to address the complexities of land ownership and rights. As real estate transactions became more formalized, the need for precise definitions of ownership and associated rights led to the establishment of ownership insurance. Ownership exceptions emerged as a critical component of this legal framework, as understanding what is a title exception allows ownership insurers to delineate specific risks that their policies would not cover. This evolution has been influenced by various court decisions and legislative changes, underscoring the ongoing necessity to protect landowners while clarifying the limitations inherent in ownership insurance.

For instance, Schedule A of the ownership commitment serves as a vital reference, detailing essential information such as the commitment number, effective date, type of policy, and specifics regarding the current owner and legal description of the asset. This clarity is crucial for all parties involved, ensuring they are well-informed about the subject and provided. Furthermore, insights from legal experts highlight the importance of understanding what is a title exception within the broader context of property law, illustrating the dynamic interplay between safeguarding ownership rights and managing the risks associated with real estate transactions.

As Michael Katz, a seasoned real estate lawyer, aptly noted, "Whew! Title Insurance can be a confusing topic, even when a real estate law expert summarizes it as succinctly as possible, which we have tried our best to do for you today." Additionally, it is noteworthy that in regulated states, insurance firms often advocate for higher rates by contributing to political campaigns, which can significantly influence market dynamics surrounding coverage exclusions. Moreover, consumer publications have emphasized the benefits of purchasing property insurance, particularly following changes enacted by RESPA and the introduction of the LE, indicating a growing awareness that may impact research practices related to ownership.

Identify Key Characteristics: Types and Variations of Title Exceptions

There are two main types of title exclusions, which raises the question of what is a title exception and special exclusions. Common exclusions are widely present in and generally include matters such as unpaid taxes, easements, and claims originating from public records. These irregularities are essential, as they can influence the insurability and market appeal of an asset. For instance, assets encumbered with numerous easements may discourage prospective purchasers due to the restrictions they impose on usage.

In contrast, unique provisions are customized for individual assets and may encompass specific liens or encumbrances identified during the ownership search. Understanding what is a title exception is vital for real estate professionals, as it can significantly impact property value and buyer interest. Interacting with insurance firms can provide clarity on what is a title exception, ensuring that homeowners are knowledgeable about their coverage and any possible restrictions. As highlighted in a case study, title firms play an essential role in assisting clients to comprehend their commitments and explain what is a title exception mentioned in their policies. This proactive strategy not only enables smoother transactions but also assists in reducing risks linked to ownership defects.

Furthermore, it is essential to consider the financial implications of exceptions related to ownership. For example, the premium rate applied may be reduced if the former owner had a policy from the same company. Additionally, as Beth Ross, J.D. from UCLA School of Law, advises, "Once you have this in hand, it's a good idea to compare it with the commitment document and ensure all the information is correct and that any changes you requested during the review period were incorporated into the actual policy." This underscores the significance of precision in review processes. Moreover, expert assistance from realtors, property firms, and real estate lawyers is crucial when addressing insurance discrepancies, emphasizing the cooperative aspect of this process.

Practical Implications of Title Exceptions in Real Estate Transactions

The practical implications of what is a title exception in real estate transactions are significant and require careful consideration. Purchasers must conduct thorough due diligence to reveal any irregularities that could affect their ownership rights or the property's overall worth. Neglecting to address what is a title exception can lead to costly disputes or legal challenges after the purchase is finalized.

For instance, the requirement for a gap endorsement, as detailed in the WB-11, emphasizes the necessity for sellers to provide this assurance if the company is willing to issue it. Failing to secure this endorsement can expose buyers to unexpected claims against the property, underscoring the essential nature of due diligence in these dealings.

Furthermore, real estate specialists should work closely with research analysts and legal experts to navigate these complexities effectively. By proactively identifying and addressing what is a title exception, buyers can significantly mitigate risks, ensuring a smoother transaction process and safeguarding their investments.

The final examination of the policy after closing is an essential step in this process. This review entails comparing the actual policy against the commitment and any modifications made during , ensuring that the ownership is protected as expected.

As Debbi Conrad, Senior Attorney and Director of Legal Affairs for the WRA, points out, 'Whether a specific company will offer a gap endorsement in a specific deal or for specific types of closings, such as short sales and REO sales, is essentially a business decision.' This highlights the importance of understanding the policies of different title companies.

Additionally, statistics indicate that thorough due diligence can help prevent costly mistakes in commercial real estate transactions, reinforcing the necessity of this process.

Conclusion

Understanding title exceptions is paramount for anyone involved in real estate transactions. These exceptions—such as liens, easements, and restrictive covenants—significantly influence ownership rights and property usage. The complexities surrounding these exceptions necessitate thorough due diligence; neglecting them can lead to unexpected challenges post-purchase. Real estate professionals must be well-versed in identifying and managing these exceptions to safeguard their clients' investments and ensure smooth transactions.

The historical development of title exceptions reflects the evolution of property law and the need for clarity in ownership rights. As property transactions have formalized over time, title insurance has emerged as a critical tool for delineating risks. Recognizing the types of title exceptions—standard versus special—helps buyers and sellers understand the potential impacts on property value and marketability. Engaging with title companies and legal experts can facilitate informed decision-making, making it easier to navigate the complexities of title commitments.

Ultimately, proactive management of title exceptions not only mitigates risks but also enhances negotiating power in real estate transactions. By conducting thorough reviews and seeking professional guidance, buyers can protect their investments and navigate the intricate landscape of property ownership with confidence. In an ever-evolving real estate market, being informed about title exceptions is not just beneficial; it is essential for achieving successful outcomes.

Frequently Asked Questions

What is a designation limitation in real estate?

A designation limitation indicates specific restrictions or burdens on real estate ownership that are not included in ownership insurance coverage, such as liens, easements, and restrictive covenants.

How can title exceptions impact real estate ownership?

Title exceptions can significantly impact ownership rights and land usage, potentially leaving buyers vulnerable to unforeseen challenges post-purchase if certain defects or claims are excluded from the insurance policy.

What are some common exclusions in ownership insurance coverage?

Common exclusions include liens, easements, and restrictive covenants, which can affect the owner's ability to utilize the property as intended.

Why is understanding title exceptions important for real estate experts?

Understanding title exceptions is essential for real estate experts as it helps them navigate complexities in asset dealings and informs buyers of potential risks associated with property ownership.

What role do commitment documents play in real estate transactions?

Commitment documents outline exclusions and serve as alerts for potential purchasers about risks that could influence their investments, ensuring informed decision-making.

What is the significance of due diligence in real estate transactions?

Due diligence is crucial as it helps identify and address issues with ownership documents, reducing risks and fostering a safer exchange environment for buyers and sellers.

How can legal counsel assist in understanding title exceptions?

Legal counsel can conduct thorough examinations of commitment documents and associated materials, ensuring that buyers and sellers are aware of issues impacting the property that would not be included in the insurance policy after closing.

What recent developments emphasize the importance of understanding title exceptions?

Fannie Mae's guidance on assets with unexpired redemption periods highlights the need for transparency in financing choices, reinforcing the necessity for thorough due diligence by all parties involved.

How can real estate professionals benefit from understanding ownership discrepancies?

By recognizing the risks associated with ownership discrepancies, real estate professionals can navigate complexities more effectively, leading to more favorable outcomes in transactions.

What technological advancements are influencing property research in real estate?

The introduction of Fannie Mae's AI-driven search tool illustrates a shift towards technology in property research, enhancing the significance of understanding ownership discrepancies in real estate.