Overview

To choose the right title search company, one should research potential firms, check their credentials and experience, evaluate customer service, and compare costs. The article outlines these steps while emphasizing the importance of selecting a reputable company to mitigate risks associated with property ownership, such as title defects and financial losses, thus ensuring a smooth real estate transaction.

Introduction

The process of title searching is a critical yet often overlooked aspect of real estate transactions, serving as the cornerstone for establishing clear property ownership. A thorough examination of public records, such as deeds and tax liens, not only safeguards buyers from potential legal entanglements but also ensures that the transfer of ownership is seamless and unencumbered.

With a staggering 25% of property transactions impacted by title defects, understanding the intricacies of title searches becomes imperative for real estate professionals and buyers alike. This article delves into the essential steps for selecting a reputable title search company, the risks associated with inadequate searches, and the financial implications involved, equipping readers with the knowledge needed to navigate this complex domain effectively.

Understanding Title Searches: What They Are and Why They Matter

A title investigation involves a meticulous examination of public records, including documents like deeds and tax liens, to ascertain legal ownership and to identify any existing claims or liens that may affect it. This process is not merely procedural; it is essential for ensuring that buyers acquire assets devoid of legal encumbrances. Title investigations can uncover major concerns such as unpaid taxes, active mortgages, or unresolved disputes related to boundaries, all of which can complicate ownership transfer.

Significantly, ownership insurance generally varies from 0.5% to 1% of the purchase cost, emphasizing the financial consequences of . According to recent industry insights, a staggering percentage of real estate transactions—estimated to be around 25%—are affected by ownership defects, underscoring the critical nature of thorough investigations. As Elena Metzger from Print Bangor aptly states,

We have relied on Rudman Winchell for years.

They have skillfully and economically assisted us with everything from our business concerns to helping guarantee that our family is safe should anything occur.

The significance of choosing a capable firm for property examination cannot be emphasized enough, as it greatly reduces risks linked to property dealings. Furthermore, the closing process is the final step in a real estate transaction where legal documents are signed, marking the official transfer of ownership from the seller to the buyer.

Understanding these dynamics is imperative for real estate professionals aiming to navigate the complexities of ownership verification effectively.

Key Steps to Selecting the Right Title Search Company

-

Research potential firms by compiling a comprehensive list of title search companies in your vicinity. Focus on firms that have garnered positive reviews and possess a strong reputation within the industry, as their track record can be indicative of reliable service. Notably, Stewart Information Services Corp, a major player in the industry, is projected to have a revenue of $2,216.0 million and a profit of $259.5 million in 2024, underscoring the importance of selecting a reputable company.

-

Check Credentials and Experience: It is essential to verify the qualifications and experience of each company on your shortlist. Ensure they have specific expertise relevant to the type of property involved, whether it be residential or commercial. This specialization can significantly influence the thoroughness and accuracy of the search for the document.

Request Quotes: Engage with various businesses to request quotes, which will provide insights into current market rates and help identify any outliers. As of 2024, standard fees generally vary from 1-2% of the sale price, including the examination of records, owner's policy, and additional expenses. This information aligns with industry standards and helps set expectations.

-

Evaluate Customer Service: Assess the responsiveness and helpfulness of each company during your initial interactions. Outstanding customer service provided by a title search company is crucial for guaranteeing a smooth inquiry process, as it indicates the degree of assistance you can anticipate during the transaction.

Ask About Turnaround Times: Inquire about the anticipated duration for the completion of the document review. Timeliness is a critical factor in ; thus, choosing an organization that can adhere to your deadlines is imperative for a smooth closing process. Furthermore, as mentioned by Stitgen, if there are current security deeds, you’ll need to acquire a release from the holder, which highlights the significance of thorough communication with the deed verification company.

Identifying Risks: What Can Go Wrong Without a Proper Title Search

The lack of a comprehensive examination exposes purchasers to significant risks that can have enduring consequences. These include:

-

Title Defects: Uncovered issues, such as undisclosed liens or competing claims against the property, are not only common but can also escalate into costly legal disputes. Nic McGrue of Polymath Legal PC highlights the importance of professional supervision, stating,

For these reasons, it is advisable to engage a title insurance firm to conduct a thorough assessment for your real estate, instead of attempting to collect the information from the County Recorder’s Office on your own.

-

Financial Loss: Assets burdened with unresolved issues can encumber new owners with unexpected expenses stemming from legal fees or repairs. Statistics suggest that insufficient document reviews can result in financial losses averaging thousands of dollars per transaction, a burden that could have been prevented with appropriate diligence. Additionally, easements are tied to the property and are enforceable against each new owner, emphasizing the significance of recognizing these rights during a property examination to avoid future conflicts.

-

Loss of Ownership: In extreme cases, unresolved ownership claims can lead to a complete loss of ownership rights for buyers. This risk highlights the significance of performing a thorough ownership examination to ensure that all potential ownership concerns are addressed before closing. Engaging a reputable title search company is crucial, as their expertise allows for meticulous and accurate searches, significantly mitigating these potential problems and protecting buyers' financial interests.

Furthermore, as are increasing, vigilance in the research process is crucial to avoid becoming a victim of fraudulent schemes. Case studies, such as those revealing common issues identified during property searches—including mortgage liens and unpaid taxes—demonstrate how early identification of these challenges can facilitate smoother transactions and safeguard financial investments, ultimately preventing costly disputes.

Evaluating Title Search Companies: What to Look For

When assessing firms for inquiries regarding ownership, it is essential to take into account the following factors:

- Reputation: A firm's reputation is frequently shown in online evaluations and feedback from former clients. Research indicates that 82% of shoppers seek out negative reviews, a tendency that rises to 86% among consumers under 45 (Power of Reviews, 2016). This emphasizes the importance for organizations to uphold a positive online presence, as clients are becoming more selective. Significantly, organizations such as and Chicago possess the utmost financial strength ratings from Demotech, further boosting their reputational credibility.

- Experience: Choose firms with a strong history in the examination sector, especially those with expertise pertinent to your kind of asset. An experienced firm is likely to handle potential problems more efficiently.

- Services Provided: Ensure the organization offers a complete range of property examination services, which should include support from a title search company and title insurance in resolving any issues that occur during the examination process. This comprehensive method can greatly reduce risks linked to property dealings.

- Technology Utilization: Firms that integrate cutting-edge technology, like machine learning and optical character recognition, can greatly improve the effectiveness and precision of ownership inquiries. Technology not only streamlines processes but also reduces the likelihood of errors, thus improving overall service quality.

- Communication: Clear and prompt communication is essential for a positive experience. Select an organization that emphasizes effective communication, as it cultivates trust and guarantees that all parties are informed throughout the process.

Furthermore, case studies indicate that customers do not view reviews older than three months as significant, with 40% considering only reviews not older than two weeks to be applicable. This highlights the significance for firms to actively promote new evaluations to uphold their relevance and impact prospective clients effectively.

Understanding Costs: How Much Should You Expect to Pay for Title Searches

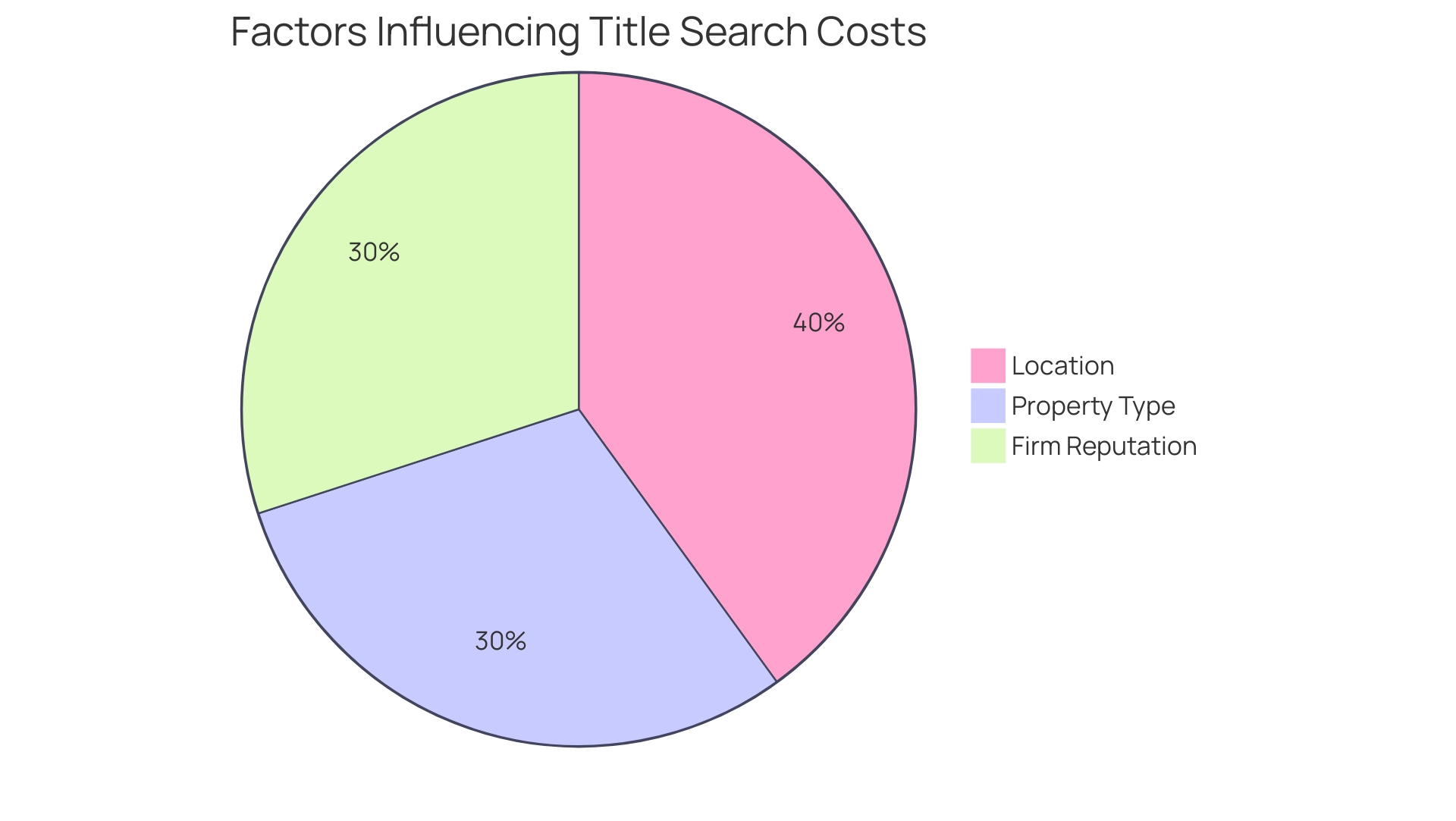

The expense of ownership investigations can vary greatly depending on several factors:

- Location: Charges differ by area, affected by the intricacy of local property laws and regulations. In Illinois, for example, average fees for firms range from roughly $2,500 to $3,500. This significant difference emphasizes the necessity for individuals to compare expenses across various regions to prevent surprises at closing.

- Property Type: The type of property also plays a vital role; residential properties generally incur lower investigation costs compared to commercial properties, which require more thorough research and documentation due to their inherent complexities.

- Reputation of Firms: Established firms with a strong standing for reliability and accuracy may charge higher fees, reflecting their expertise in navigating the intricate details of property examinations.

On average, individuals can expect to pay between $200 to $500 for a standard property examination. However, it is essential to obtain itemized fee estimates from multiple firms to effectively compare services and costs. This practice not only helps minimize costs but also ensures transparency and prevents unexpected charges at closing.

While cost is a vital consideration, the quality and accuracy of the title search should remain the primary focus. As Amanda Dodge points out,

However, if the seller is still paying off a home loan, they could have a mortgage lien on their asset; this underscores the importance of thorough research to ensure all liens are identified and addressed. Title fees encompass the costs associated with the legal transfer of property ownership, including research conducted by , document handling, and escrow services.

By carefully evaluating both costs and service quality, you can make an informed decision that best serves your interests.

Conclusion

Conducting a thorough title search is undeniably crucial in real estate transactions. As highlighted throughout the article, the title search process serves as the foundational step in ensuring clear property ownership and mitigating potential risks. By understanding the significance of this process, real estate professionals and buyers alike can better navigate the complexities of property transactions.

Selecting a reputable title search company emerges as a vital step in safeguarding against title defects and financial losses. The outlined key steps—

- researching potential companies

- checking credentials

- evaluating customer service

- understanding costs

provide a roadmap for making informed decisions. Engaging with an experienced firm not only enhances the efficiency of the title search but also ensures that any issues are identified and addressed promptly, protecting buyers from unforeseen complications.

Ultimately, the financial and legal implications of an inadequate title search can be substantial, with potential outcomes ranging from costly disputes to complete loss of ownership. By prioritizing due diligence in the title search process, stakeholders can facilitate smooth transactions and secure their investments. The importance of vigilance in this area cannot be overstated; a comprehensive title search is not just a formality but a critical safeguard in the real estate landscape.

Frequently Asked Questions

What is a title investigation?

A title investigation is a thorough examination of public records, including documents like deeds and tax liens, to determine legal ownership and identify any existing claims or liens that may affect the property.

Why is a title investigation important?

It is essential for ensuring that buyers acquire assets free of legal encumbrances, as it can uncover issues such as unpaid taxes, active mortgages, or unresolved boundary disputes that could complicate ownership transfer.

How much does ownership insurance typically cost?

Ownership insurance generally ranges from 0.5% to 1% of the purchase cost, highlighting the financial implications of conducting comprehensive ownership investigations.

What percentage of real estate transactions are affected by ownership defects?

Approximately 25% of real estate transactions are impacted by ownership defects, emphasizing the importance of thorough investigations.

How can one choose a reliable title search company?

To choose a reliable title search company, research potential firms, check their credentials and experience, request quotes to understand market rates, evaluate their customer service, and inquire about turnaround times for document reviews.

What factors should be considered when evaluating title search companies?

Consider the company's reputation, specific expertise relevant to the property type, responsiveness during initial interactions, and their ability to meet deadlines for document reviews.

What is the closing process in a real estate transaction?

The closing process is the final step in a real estate transaction where legal documents are signed, officially transferring ownership from the seller to the buyer.