Introduction

In the intricate world of real estate, the role of a professional title company is paramount, serving as the backbone of secure property transactions. These entities are tasked with ensuring that property titles are clear, marketable, and free from encumbrances, which is essential for both buyers and sellers.

With a comprehensive approach that includes:

- Conducting thorough title searches

- Preparing legal documents

- Facilitating the closing process

title companies significantly reduce risks associated with property ownership. As the landscape evolves, so too do the challenges, from common title issues to the ever-present threat of fraud.

Understanding the critical functions of title companies, the importance of title insurance, and how to navigate potential scams is vital for anyone involved in real estate transactions. This article delves into these key aspects, providing insights that not only enhance transactional security but also promote confidence in one of life’s most significant investments.

Understanding the Core Functions of a Professional Title Company

A qualified organization is vital in the property market, serving an important function in guaranteeing that ownership documents are both clear and marketable. With a proven history of managing approximately twelve for clients, these firms perform thorough searches to reveal any liens, encumbrances, or claims against the property. Key functions also involve preparing , facilitating the closing process, and providing insurance to safeguard against future claims.

By effectively overseeing these duties, firms significantly reduce risks for both purchasers and vendors, fostering a smooth transaction experience. As mentioned by :

They have managed around a dozen for me. Always efficient, courteous, professional and make it effortless on my part.

This testimony emphasizes the significance of a in fostering trust and efficiency within real estate transactions. Furthermore, the effective job descriptions for examiners should clearly outline responsibilities and required skills to attract qualified candidates, which is critical for maintaining high standards in the industry. Furthermore, recent advancements in search processes have streamlined operations, enhancing the overall effectiveness of examination, and reinforcing the importance of clear specifications in the hiring process, as highlighted in the case study on .

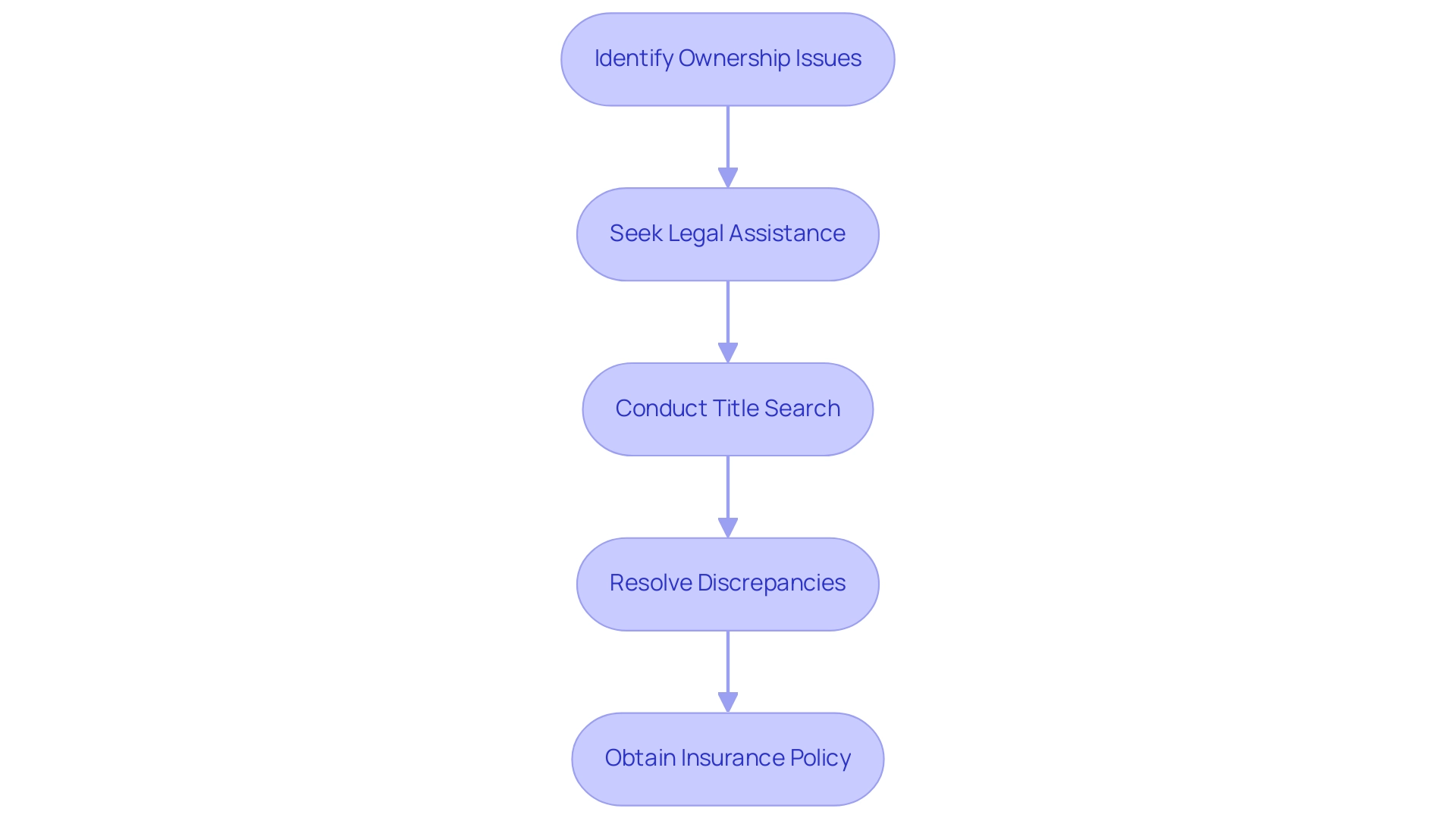

Navigating Common Title Issues in Real Estate Transactions

In the domain of , typical ownership issues often arise, including , unresolved liens, and claims made by former owners. Recent statistics show that roughly 25% of property transactions experience some kind of document inconsistency, emphasizing the significance of careful diligence. Seeking a attorney for review and negotiation assistance is recommended for purchasers dealing with these complexities.

A that specializes in is instrumental in resolving these matters by conducting meticulous searches, which involve scrutinizing public records to identify potential complications. They skillfully navigate challenges such as incomplete property records and conflicting information to clarify ownership. For instance, clerical errors in documentation can lead to .

In such situations, an owner's can offset legal expenses related to correcting these errors. As mentioned by Patriot Title Agency, Inc., 'We offer property settlement services in 13 states, issuing insurance policies underwritten by First American Title.' Their business hours are Monday to Friday from , closed on Saturday and Sunday.

This emphasizes the crucial role of that buyers can move forward with confidence, secure in their investment.

The Importance of Title Insurance in Real Estate Deals

serves an important function in the property market, providing vital safeguards for both homeowners and lenders against monetary losses arising from ownership defects. There are two main types of insurance policies: owner’s policies, which provide coverage for the buyer, and lender’s policies, designed to protect the lender’s financial interest. These policies safeguard against a range of issues, including fraud, undisclosed heirs, and inaccuracies in public records.

By addressing these potential threats, coverage insurance helps ensure that buyers are shielded from unexpected claims on their properties, thereby preserving the integrity of real estate transactions. According to industry analysis, understanding the nuances of insurance is not only vital for risk management but is also an influential factor in consumer value perceptions, as noted by expert Demetrios Berdousis, who emphasizes,

Price is a crucial factor influencing consumers' value perceptions.

Moreover, population trends significantly influence the distribution of , particularly in the West, Southeast, and Southwest regions of the US.

This context is vital for professionals at a to understand the . Additionally, as highlighted by IBISWorld, a in the industry, the is paramount, stating,

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

This makes it essential for property professionals to remain updated on the latest statistics and trends, especially with forecasts for 2024 suggesting a profit margin of 11.5% for key players like Old Republic International Corporation.

Furthermore, understanding the segmentation of insurance revenue, which includes direct insurance premiums, agency insurance premiums, and search services, provides deeper insights into the industry's revenue structure. Therefore, the significance of a professional title company in cannot be overstated, as it supports both transactional security and market confidence.

The Title Company's Role in the Real Estate Closing Process

In the real estate , firms play a pivotal role in orchestrating the transaction, aided by . These tools expedite , allowing for quicker and more accurate handling of essential documents. The is responsible for coordinating the signing of these documents, disbursing funds, and confirming that all .

This meticulous approach, enhanced by Parse Ai's and interactive labeling features, not only improves efficiency for the [professional title company](https://linkedin.com/pulse/what-happens-title-company-closing-catherine-b-hogan-p-a--ncvae) but also promotes transparency for all parties involved.

A professional title company diligently verifies the completeness and accuracy of necessary paperwork, as any oversight could necessitate a 24-hour rescheduling for a Remote Online Notary signing, especially if more than 25% of knowledge-based questions are missed. Furthermore, the professional title company enables the transfer of ownership from the seller to the buyer, ensuring that the new owner obtains a clear and marketable deed. Parse reads, labels, and extracts vital information, significantly mitigating risks and assuring compliance with all legal obligations, safeguarding both the buyer's ownership rights and the lender's interests.

After closing, document companies ensure that all papers are recorded with the appropriate government office, solidifying legal ownership and protecting lender interests. Utilizing Harbinger Land's document imaging services, agents can efficiently digitize property data, expediting the completion of research. For example, Harbinger Land utilizes imaging agents in courthouses to swiftly acquire extensive datasets, which improves the speed and precision of research.

This step not only safeguards the purchaser's ownership rights but also ensures the lender's interests in the property, emphasizing the crucial role a professional title company plays in the closing process. Additionally, Parse Ai's example manager allows users to annotate documents efficiently, improving data extraction and ensuring that all critical information is accurately captured and utilized.

Protecting Yourself from Title Company Scams and Fraud

In the domain of real estate dealings, consumers must stay highly aware of the potential scams and deceitful practices linked with these firms. Among the most common threats are phishing attempts, where harmful individuals impersonate authentic firms to extract sensitive personal information. Additionally, wire fraud poses a significant risk; reports indicate that scammers often redirect funds during the closing process, leading to substantial financial losses.

In fact, in 2018, an estimated one in 109 mortgage applications contained indications of fraud, highlighting the critical need for vigilance. To , consumers should diligently verify the legitimacy of a professional before engaging with them. Employing secure methods for transferring funds is critical, as is maintaining a healthy skepticism towards unsolicited communications.

If a homeowner suspects they are a victim of identity fraud related to , immediate action is crucial. Steps include:

- Adding fraud alerts to credit reports

- Filing identity theft reports

- Utilizing to mitigate damage

By adopting these protective measures, both buyers and sellers can significantly diminish their chances of falling victim to fraud in , thus ensuring a more secure and trustworthy experience.

Conclusion

The significance of professional title companies in real estate transactions cannot be overstated. Their multifaceted role—from conducting exhaustive title searches to preparing essential legal documents—ensures that property titles are clear and marketable. By effectively managing these responsibilities, they mitigate risks for both buyers and sellers, fostering a seamless transaction experience and building trust within the industry.

Moreover, the challenges posed by common title issues and the necessity of title insurance highlight the importance of diligence in real estate dealings. Title insurance not only protects against financial losses from title defects but also enhances consumer confidence in their investment. As the market continues to evolve, understanding the complexities of title insurance and its implications for both owners and lenders remains crucial for all stakeholders involved.

In the closing process, title companies serve as pivotal coordinators, ensuring compliance with legal requirements and facilitating a smooth transfer of ownership. Advanced tools and technologies further enhance their efficiency, enabling them to manage transactions with greater accuracy and transparency.

However, amid these safeguards, consumers must remain vigilant against potential scams and fraudulent activities. By employing secure practices and verifying the legitimacy of title companies, individuals can protect their investments and navigate the real estate landscape with confidence. The role of title companies is foundational, safeguarding both the integrity of property transactions and the interests of all parties involved.

Frequently Asked Questions

What is the role of a qualified organization in the property market?

A qualified organization ensures that ownership documents are clear and marketable, performs thorough searches for liens and claims against properties, prepares legal documents, facilitates the closing process, and provides insurance against future claims.

How do professional title companies reduce risks in property transactions?

They manage essential tasks such as conducting detailed property searches, preparing legal documents, and overseeing the closing process, which significantly reduces risks for both buyers and sellers.

What are common ownership issues encountered in property transactions?

Common issues include discrepancies in ownership records, unresolved liens, and claims by former owners, with about 25% of transactions experiencing some form of document inconsistency.

How can a professional title company help resolve ownership issues?

They conduct meticulous searches of public records to identify potential complications, navigate challenges like incomplete records, and clarify ownership, thus addressing issues that may arise.

What role does title insurance play in real estate transactions?

Title insurance protects homeowners and lenders from monetary losses due to ownership defects, covering issues like fraud and inaccuracies in public records.

What types of title insurance policies are available?

There are two main types: owner’s policies, which cover the buyer, and lender’s policies, which protect the lender's financial interest.

How do advancements in technology impact the closing process in real estate?

Advanced tools, such as those offered by Parse AI, expedite document processing and title research automation, improving efficiency and transparency during the transaction.

What steps should consumers take to protect themselves from fraud in real estate transactions?

Consumers should verify the legitimacy of title companies, use secure methods for transferring funds, and maintain skepticism towards unsolicited communications.

What actions should be taken if a homeowner suspects identity fraud related to home title fraud?

They should add fraud alerts to credit reports, file identity theft reports, and utilize credit monitoring services to mitigate potential damage.

Why is it important for professionals in the title industry to stay informed about market trends?

Understanding market dynamics and staying updated on statistics and trends is vital for maintaining competitiveness and ensuring the effectiveness of title services.