Overview

A home title is a legal document that verifies ownership of a property, detailing essential information such as the property's boundaries, any encumbrances, and the rights associated with ownership. The article emphasizes the importance of understanding home titles for secure real estate transactions, as they provide crucial evidence of ownership and help navigate potential disputes, thereby safeguarding both buyers and sellers in the complex property market.

Introduction

Navigating the intricate landscape of home ownership requires a comprehensive understanding of home titles, a fundamental aspect that underpins property rights and transactions. A home title not only establishes legal ownership but also reveals crucial information about encumbrances and claims that could affect the property. As the real estate market evolves, driven by shifting buyer intentions and technological advancements, the importance of grasping the nuances of home titles becomes increasingly critical.

From the various ownership structures to the protective measures offered by title insurance, homeowners and real estate professionals alike must stay informed to safeguard their investments. This article delves into the complexities of home titles, exploring their significance, the types of ownership, the role of title insurance, and the legal responsibilities that accompany property ownership, ultimately equipping readers with the knowledge necessary to navigate this vital component of real estate successfully.

Understanding Home Titles: Definition and Significance

A residence deed is what is , acting as a basic legal record that confirms possession of an estate. It includes essential information, such as the legal description of the asset, its boundaries, and any claims or encumbrances that could affect rights of possession. Understanding what is a home title is important, as the residence deed goes beyond simple possession; it serves as crucial evidence during real estate dealings, verifying the legitimate holder and disclosing any outstanding liens that may impact the asset.

Recent input from 400 residential property valuers emphasizes the complexity of these transactions, indicating that knowledge of property documents is essential for both property owners and real estate experts. Their insights reflect the challenges faced in the industry, which are further elaborated in the 2017 Voice of the Title Agent special report, providing critical context on industry performance. This understanding lays the groundwork for secure property transactions and acts as a safeguard against potential disagreements regarding possession.

Furthermore, the 'Pending Property Sales Snapshot' case study demonstrates current trends in property transactions and market activity, emphasizing the significance of clear ownership as purchasers express intentions to stay in their residences for a median of 15 years, with 25% indicating they never plan to relocate. Thus, understanding the complexities of home ownership, such as what is a home title, is essential in navigating the real estate landscape effectively.

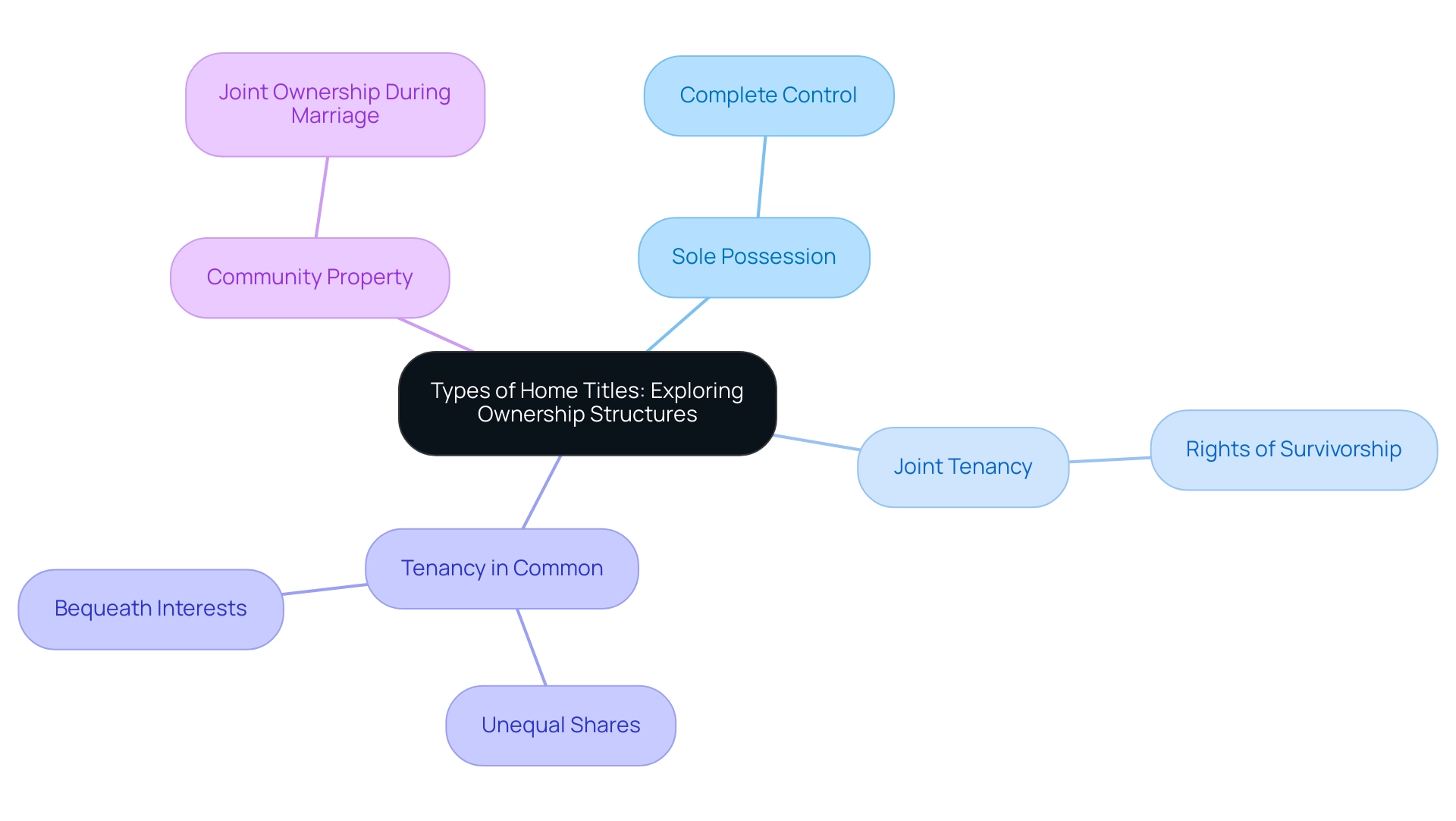

Types of Home Titles: Exploring Ownership Structures

Home ownership documents can be categorized into several distinct forms, including what is , each carrying its own set of rights and implications.

- Sole possession grants complete control to a single individual, who holds the title independently.

- In contrast, joint tenancy involves two or more individuals sharing ownership with rights of survivorship; this means that upon the death of an owner, their interest automatically transfers to the surviving co-owners.

- The tenancy in common arrangement allows multiple owners to hold unequal shares of the assets, permitting them to bequeath their interests to heirs as they see fit.

- Additionally, community property, recognized in certain states, designates property acquired during marriage as jointly owned by both spouses.

Comprehending these property structures is essential for homeowners, particularly in light of recent trends where interest rates have reached nearly 8%.

This significant rate influences purchasing decisions, making it essential for buyers to align their intentions with their financial capabilities. Furthermore, the mortgage process has become more accessible through online applications, simplifying pre-approval and financing for clients. As Zillow aptly notes,

While affordability challenges will remain, buyers should expect more homes on the market, meaning more time to consider their options and more leverage in negotiations.

These insights demonstrate the significance of grasping how technological innovations in 2024 are changing the home buying process, affecting not only the choice of residences but also the kinds of ownership arrangements that prospective homeowners might contemplate.

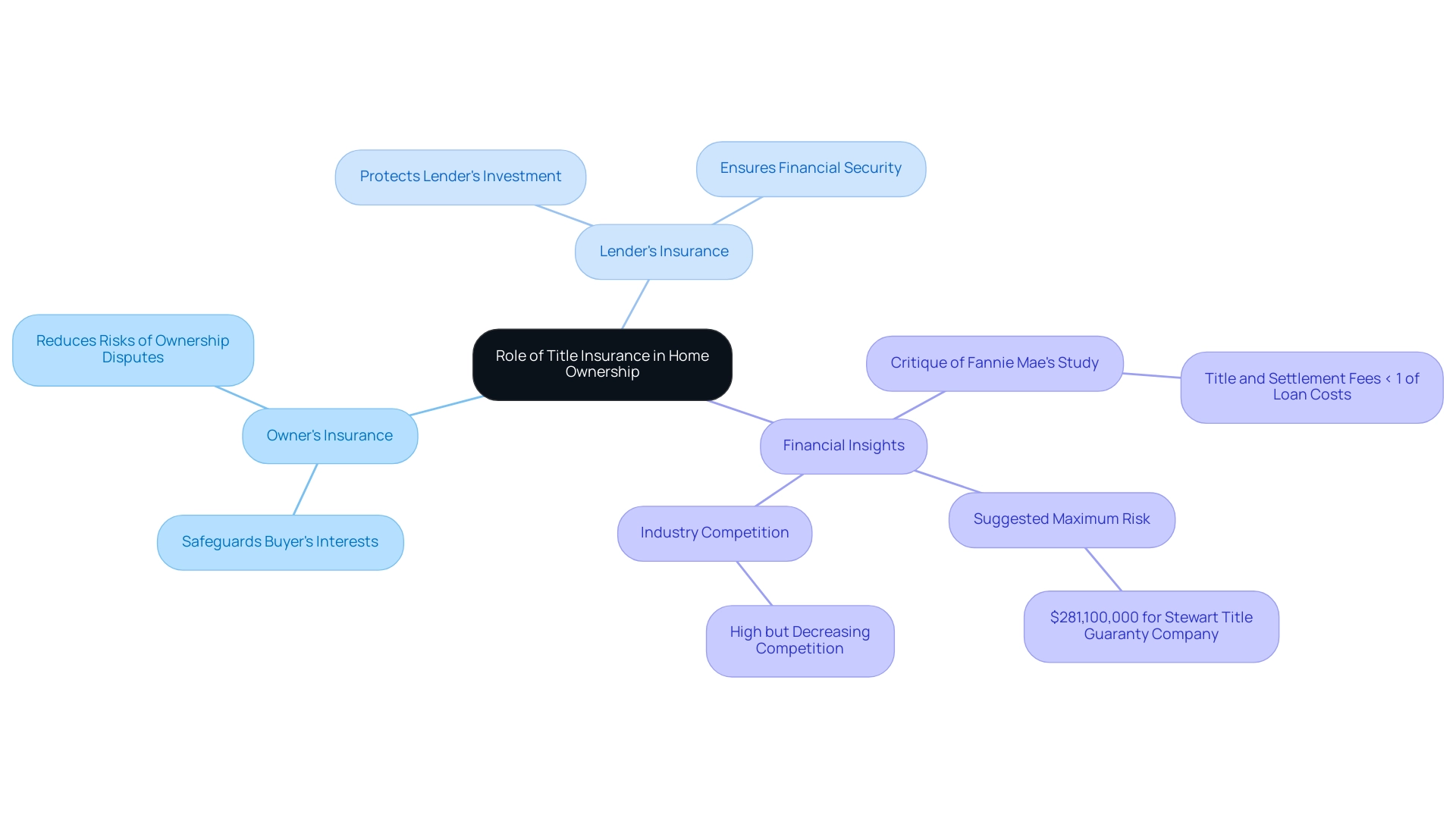

The Role of Title Insurance in Home Ownership

Insurance for property serves a critical role in protecting both homeowners and lenders from potential financial losses stemming from ownership defects, including undiscovered liens, fraud, and inaccuracies in public records. This essential coverage is typically acquired during the closing phase of a real estate transaction and remains in effect for as long as the asset is owned. There are two main kinds of insurance for ownership:

- Owner's insurance, which safeguards the buyer's interests.

- Lender's insurance, designed to protect the lender's investment.

By acquiring ownership insurance, homeowners can effectively reduce risks related to potential ownership disputes, thereby ensuring peace of mind in their property ownership. Recent analyses, including a critique of Fannie Mae's 2021 study, suggest that closing and settlement fees represent less than 1% of total loan costs, indicating that these expenses are not as significant as previously assumed. This insight emphasizes the significance of insurance for property in the home buying process.

As emphasized by industry experts, reliable data sources are essential for accurately portraying the insurance landscape; as noted by IBISWorld, 'Our analysts start with official, verified and publicly available sources of data to build the most accurate picture of each industry.' Furthermore, with a suggested maximum risk of $281,100,000 for , stakeholders must recognize the financial implications of ownership insurance. Additionally, the insurance industry is characterized by a high level of competition, which is currently decreasing, making it increasingly vital for stakeholders to understand these nuances.

Protecting Your Home Title: Risks and Safeguards

As property owners increasingly shift to digital documentation, the risks linked to ownership theft and fraud are becoming more evident. Identity theft poses a significant threat, where fraudsters may attempt to illegally transfer ownership of a property, often exploiting vulnerabilities in public records. To combat this, safeguarding personal information through strong passwords and secure online practices is essential, as these measures can help prevent identity theft that leads to home ownership fraud.

In this context, advanced machine learning tools from Parse AI, including the example manager and OCR technology, can expedite document processing and enhance research automation, providing researchers with powerful capabilities to accurately analyze and secure documents. The example manager allows for quick annotation of documents, facilitating the extraction of critical information from unstructured data. In 2023, approximately 28% of real estate firms reported encountering at least one attempt at seller impersonation fraud, underscoring the urgency of this issue.

Homeowners are advised to regularly monitor and utilize identity theft protection services. Additionally, investing in ownership insurance that specifically covers fraud is a prudent measure. Dax Junker observes,

While most homeowners understand that ownership insurance shields them from financial loss due to defects, not many recognize how it also guards them against fraud.

By maintaining secure records and exercising caution with their personal information, homeowners can significantly reduce the likelihood of falling victim to ownership fraud. Furthermore, with Parse AI's interactive labeling and OCR technology, researchers can efficiently digitize property data and streamline the detection of fraudulent activities. In general, increased awareness and proactive actions, bolstered by cutting-edge technologies such as Parse AI, are essential in protecting property documents in today's digital environment.

Furthermore, shows that while residential property fraud constitutes a minor portion of the financial effect from real estate and rental schemes—totaling $350 million—it has declined by almost 20% annually, reinforcing the efficacy of heightened awareness and prevention tactics utilized by banks and realtors. This trend aligns with broader insights into the real estate market, highlighting the importance of vigilance against mortgage fraud and other related risks.

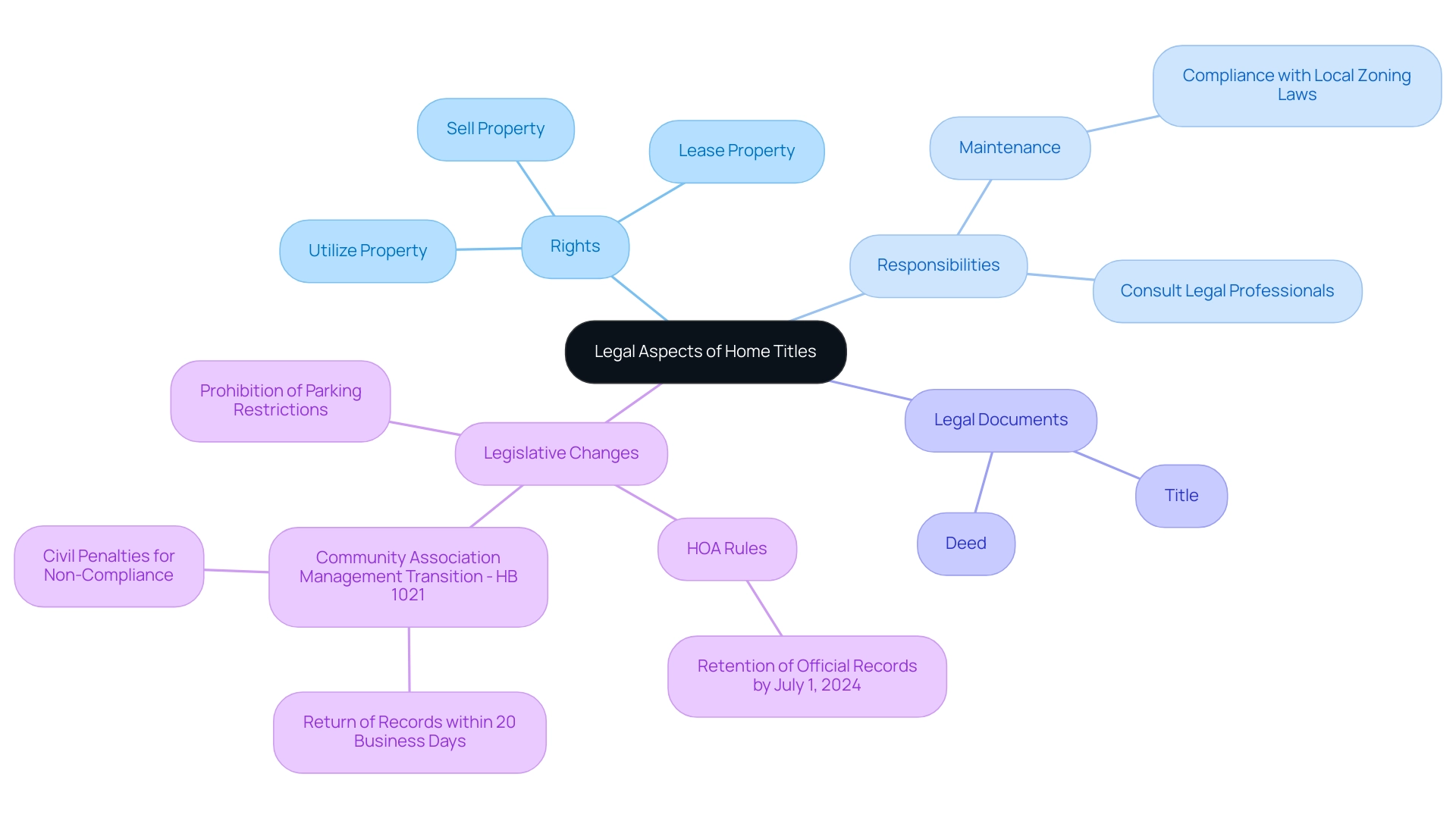

Legal Aspects of Home Titles: Rights and Responsibilities

Grasping the legal facets of home documents is crucial for homeowners, as it includes several rights and duties that directly influence real estate. A title, often referred to in discussions about what is a home title, signifies ownership of the asset, while a deed is the legal document that enables the transfer of that ownership. Homeowners possess the right to utilize, sell, or lease their belongings; however, they also bear the crucial responsibility of maintaining it in accordance with local zoning laws.

highlight the necessity for homeowners associations (HOAs) to adopt written rules governing the retention of official records by July 1, 2024, reinforcing the importance of compliance with evolving real estate laws. As Christopher L. Pope, Esq. advises, "As always, it is recommended to consult with a legal professional for advice tailored to your specific circumstances."

Moreover, a thorough comprehension of easements, liens, and restrictions is essential, as these factors can greatly affect land use and rights. For instance, the legislation regarding the Community Association Management Transition - HB 1021 mandates that community association managers return all records within 20 business days after termination of services, with failure to comply potentially leading to civil penalties. By being well-informed about what is a home title and its legal dimensions, homeowners can effectively navigate the complexities of property ownership, ensuring confidence and security in their rights.

Conclusion

Navigating the intricate landscape of home titles is essential for anyone involved in real estate, whether as a homeowner or a professional in the field. A home title serves not only as a legal document establishing ownership but also as a critical resource revealing essential details regarding encumbrances and claims that may affect property rights. Understanding the various types of ownership structures—such as sole ownership, joint tenancy, and community property—enables individuals to make informed decisions that align with their financial capabilities and long-term intentions in the evolving real estate market.

The role of title insurance in safeguarding investments cannot be overstated. By protecting against financial losses from title defects and fraud, title insurance provides peace of mind to homeowners and lenders alike. As the industry faces increasing risks associated with digital documentation and identity theft, proactive measures are necessary to protect home titles. Utilizing advanced technologies and maintaining awareness of potential threats can significantly mitigate the risks of title fraud, reinforcing the importance of vigilance in today’s digital age.

Moreover, a comprehensive understanding of the legal aspects surrounding home titles equips homeowners with the knowledge to navigate their rights and responsibilities effectively. With legislative changes shaping the landscape of property ownership, staying informed about these developments is crucial. By embracing both the complexity of home titles and the protective measures available, individuals can confidently engage in real estate transactions, ensuring the security of their investments and the integrity of their property rights.

Frequently Asked Questions

What is a residence deed?

A residence deed is a legal document that serves as a home title, confirming possession of an estate. It includes essential information such as the legal description of the property, its boundaries, and any claims or encumbrances that may affect possession rights.

Why is understanding home title important?

Understanding home title is crucial because it serves as evidence during real estate transactions, verifying the legitimate holder of the property and disclosing any outstanding liens that could impact the asset.

What insights have property valuers provided regarding home ownership documents?

Recent input from 400 residential property valuers highlights the complexity of property transactions and emphasizes the importance of knowledge regarding property documents for both owners and real estate professionals.

What types of ownership arrangements exist for home titles?

Home ownership documents can include several forms: Sole possession grants complete control by a single individual; Joint tenancy involves shared ownership with rights of survivorship; Tenancy in common allows multiple owners to hold unequal shares; Community property designates property acquired during marriage as jointly owned by both spouses in certain states.

How do current interest rates affect home buying decisions?

With interest rates nearing 8%, it influences purchasing decisions, making it essential for buyers to align their intentions with their financial capabilities.

What advancements have been made in the mortgage process?

The mortgage process has become more accessible through online applications, simplifying pre-approval and financing for clients.

What trends are influencing the real estate market?

There are expectations for more homes on the market, providing buyers with more time to consider their options and leverage in negotiations, despite ongoing affordability challenges.