Overview

A mortgage is a legally binding agreement where a lender provides funds for a borrower to purchase real estate, requiring repayment of the principal and interest over a specified period, with the property serving as collateral. The article elaborates on essential mortgage components, types of loans available, the application process, and the implications of mortgage insurance and escrow accounts, emphasizing the importance of understanding these factors for informed home financing decisions.

Introduction

Navigating the intricacies of home financing can be a daunting task, particularly for first-time buyers. At the heart of this process lies the mortgage—a legally binding agreement that serves as the foundation for homeownership. Understanding the essential components of mortgages, including:

- Principal

- Interest

- Repayment terms

is crucial for making informed financial decisions. With mortgage rates recently experiencing unprecedented lows, the landscape of home financing has shifted dramatically, presenting both opportunities and challenges for borrowers.

This article delves into the various types of mortgages available, the steps involved in the application process, and the critical factors that influence mortgage payments. By equipping potential homeowners with the knowledge they need, this exploration aims to demystify the mortgage process and empower individuals to navigate their financing options with confidence.

Defining a Mortgage: The Basics of Home Financing

A between a recipient and a lender, in which the lender supplies the required funds for the recipient to obtain . In exchange, the individual agrees to reimbursing the borrowed sum, along with interest, within a specified period. Mortgages are categorized as secured loans, with the asset serving as collateral.

This means that should the borrower default on payments, the lender retains the right to foreclose on the property. Comprehending the , namely principal, interest, and repayment terms, is crucial for anyone contemplating a . Recent trends have indicated a remarkable decline in loan rates, dropping below 3.00% for the first time in 2020, and reaching a historical low of 2.65% in 2021.

Examining data from the case study on loan rates from 1972 to 2024 reveals significant fluctuations, including . In 2024, approximately 20,000 reverse loans were issued, as noted by Statista, reflecting evolving borrower needs and market conditions. and ensuring informed decision-making.

Exploring Different Types of Mortgages: Options for Homebuyers

today have access to a diverse array of loan products, including a to different financial needs and circumstances. are popular for their predictability, locking in a constant interest rate throughout the term, thereby ensuring consistent monthly payments. In contrast, (ARMs) typically start with lower interest rates that can fluctuate over time, which may lead to increased costs if market rates rise.

Recent statistics indicate that the average VA financing amount is approximately $372,655, reflecting the growing demand for . These financial products, including FHA and VA options, cater specifically to first-time homebuyers and veterans, offering favorable terms that enhance affordability. Significantly, in 2023, there were 2,823 areas at the FHA financing threshold, illustrating the widespread availability of these products across various regions.

Additionally, the case study titled 'Equity in ' reveals that American households held nearly $34.9 trillion in equity, representing 72.4% of the total value of residential real estate assets in the U.S. This robust base in residential real estate highlights the significance of comprehending financing choices in the context of overall equity. The inclusion of Kittitas County, Washington, in the high-cost FHA loan limits list in 2023 exemplifies the evolving landscape of financing.

Understanding these options is crucial for homebuyers aiming to . As noted by Norada Real Estate Investments, 'The overall economic climate remains a cause for concern. A potential recession or other economic downturn could significantly impact the housing market.'

This insight emphasizes the significance of making informed choices when selecting a loan type, as the plays a vital role in shaping market trends and opportunities.

Navigating the Mortgage Application Process: Steps to Approval

The loan application process consists of several essential steps that prospective borrowers must navigate to secure financing effectively. First, individuals should assess their , including income, debts, and credit scores, to establish a suitable budget for a mortgage. Following this assessment, it is crucial to gather , which typically includes income verification, credit history, and employment records.

As reported, the (RALI) highlights trends in refinancing, specifically indicating that as of 2024, there has been a notable increase in refinance applications, reflecting broader market dynamics. Once the documentation is compiled and submitted, lenders undertake a thorough review of the application, conduct a , and perform underwriting to assess the associated risks.

Effective communication with the lender throughout this process is vital, as it allows individuals to address any concerns or fulfill additional requirements promptly. Recent updates indicate that , necessitating individuals to stay informed about the latest stipulations. As noted by experts, understanding these steps not only demystifies the application process but also empowers borrowers to navigate it more confidently.

For instance, a case study of the top counties for USDA loans in 2022, including Livingston Parish, which financed 551 loans, illustrates how . Furthermore, the statistic that 382 USDA loans were funded in St. Tammany Parish exemplifies successful local loan applications. By preparing diligently and maintaining , borrowers can streamline their experience and enhance their likelihood of approval.

Additionally, the FHFA highlights that there were 2,823 areas at the FHA mortgage financing floor, underscoring the breadth of opportunities available in the current market.

Understanding Mortgage Payments: What You Need to Know

is typically structured around four fundamental components, which are commonly known as PITI: Principal, Interest, Taxes, and Insurance. The principal refers to the original loan amount borrowed, while interest represents the cost associated with borrowing that sum. Taxes on real estate, which are imposed by local authorities, can differ considerably based on the location and market conditions of the asset.

Homeowner's insurance, on the other hand, provides essential coverage against potential damages to the property. Notably, the stands at $2,018.80, illustrating the impact of these components on overall housing costs. As stated by the National Association of Realtors, "The figures in the table below are based on March 2024 median regional existing-home sale prices reported by the National Association of Realtors (NAR)."

Understanding the intricacies of PITI is vital for homebuyers, as it enables them to accurately calculate their , which include a mortgage, and establish a . Additionally, current trends indicate that the represents the largest year-over-year rise since January 2023, underscoring the necessity for potential homeowners to stay informed about evolving financial obligations. Furthermore, the size of the loan significantly affects , with examples showing payments ranging from:

- $1,541 for a loan size of $233,920

- $3,177 for a loan size of $482,400

By considering these elements, prospective buyers can better gauge their affordability and make informed decisions in the home-buying process.

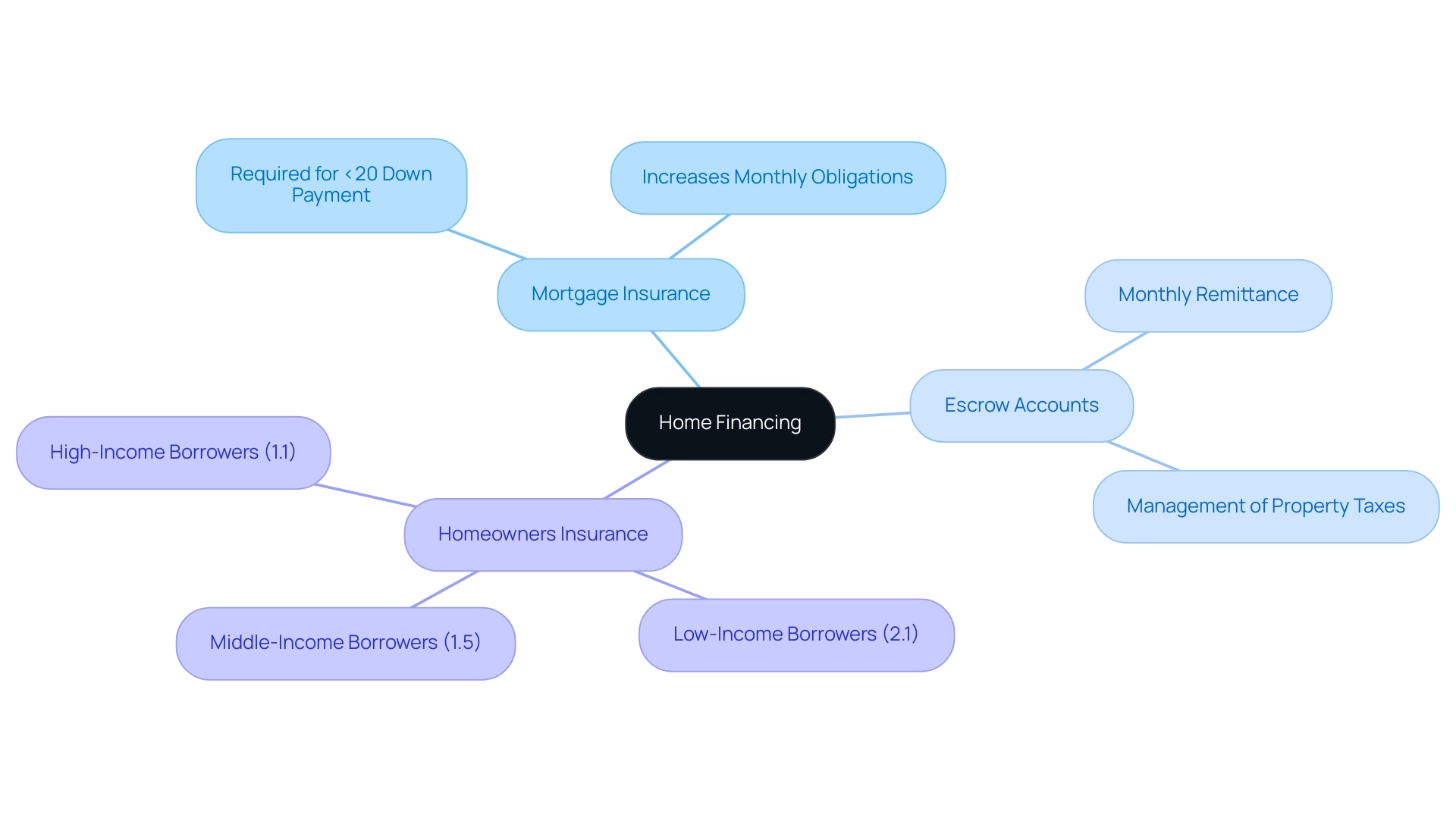

The Role of Mortgage Insurance and Escrow Accounts in Home Financing

A is typically required for individuals who contribute less than 20% of the property's purchase price as a down payment. This insurance acts as a safeguard for lenders in the event of default on a mortgage, yet it inevitably increases the of the individual who takes out a mortgage. According to the ACSI , the experiences of individuals taking loans are crucial in understanding the landscape of a mortgage insurance.

Recent statistics reveal that low-income borrowers allocate approximately 2.1% of their monthly income to , while contribute 1.5% and 1.1%, respectively. The importance of homeowners insurance is emphasized by the significant risks associated with owning a home; as noted by Statista, fire damage alone caused nearly $8 billion in structure damage in California in 2019, highlighting the necessity of adequate coverage. On the other hand, play a pivotal role in managing property taxes and insurance premiums.

Through these accounts, borrowers remit a portion of these costs monthly, which lenders then hold in escrow until payment is due. This arrangement is critical for homebuyers to understand, as it can significantly impact overall financing costs and budgeting strategies. Furthermore, as emphasized in the , although the U.S. economic forecast indicates modest growth, challenges such as elevated loan rates and inventory shortages persist in affecting the housing market.

Thus, comprehending the nuances of a mortgage, including mortgage insurance and escrow accounts, is essential for navigating the complexities of home financing effectively.

Conclusion

Understanding the complexities of home financing is pivotal for anyone considering homeownership. This article has provided a comprehensive overview of mortgages, emphasizing the importance of grasping the fundamental components such as principal, interest, and repayment terms. With mortgage rates at historic lows, the current environment presents unique opportunities, particularly for first-time buyers who must navigate a diverse array of mortgage products tailored to their financial situations.

The exploration of various mortgage types, including:

- Fixed-rate options

- Adjustable-rate options

- Government-backed loans

highlights the necessity for borrowers to align their choices with their financial goals. As the housing market continues to evolve, the application process remains critical, requiring meticulous preparation and effective communication with lenders to secure favorable financing.

Moreover, understanding the structure of mortgage payments, including PITI—Principal, Interest, Taxes, and Insurance—equips potential homeowners with the knowledge needed to budget effectively. The role of mortgage insurance and escrow accounts further underscores the financial responsibilities that come with property ownership.

In summary, navigating the mortgage landscape demands informed decision-making and a proactive approach. By equipping themselves with the right knowledge, prospective buyers can confidently take the necessary steps toward securing their dream home while effectively managing their financial commitments in an ever-changing market.

Frequently Asked Questions

What is a mortgage?

A mortgage is a legally enforceable contract between a borrower and a lender, where the lender provides funds for the borrower to purchase real estate. The borrower agrees to repay the borrowed amount with interest over a specified period.

What are the main components of a mortgage?

The fundamental components of a mortgage include the principal (the amount borrowed), interest (the cost of borrowing), and repayment terms (the schedule for repayment).

What happens if a borrower defaults on a mortgage?

If a borrower defaults on payments, the lender has the right to foreclose on the property, as the mortgage is a secured loan with the property serving as collateral.

How have mortgage loan rates changed recently?

Mortgage loan rates have seen a significant decline, dropping below 3.00% for the first time in 2020, and reaching a historical low of 2.65% in 2021.

What trends have been observed in mortgage loan rates from 1972 to 2024?

There have been significant fluctuations in loan rates during this period, with notable peaks and valleys that influence the current lending landscape.

What types of mortgage products are available to homebuyers?

Homebuyers have access to various loan products, including fixed-rate mortgages, which offer a constant interest rate, and adjustable-rate mortgages (ARMs), which start with lower rates that can fluctuate over time.

What is the average financing amount for VA loans?

The average VA financing amount is approximately $372,655, reflecting the increasing demand for government-backed funding options.

How do FHA and VA loans benefit first-time homebuyers and veterans?

FHA and VA loans offer favorable terms that enhance affordability for first-time homebuyers and veterans, making it easier for them to secure financing.

What is the significance of real estate equity in the U.S.?

American households held nearly $34.9 trillion in real estate equity, representing 72.4% of the total value of residential real estate assets in the U.S., highlighting the importance of understanding financing options.

Why is it important for homebuyers to understand their financing choices?

Understanding financing options is crucial for homebuyers to align a mortgage with their financial goals, especially in the context of the current economic climate, which can impact the housing market.