Introduction

Navigating the intricate landscape of real estate transactions requires a comprehensive understanding of both titles and mortgages. At the heart of property ownership lies the distinction between these two fundamental concepts: a title signifies legal ownership, while a mortgage represents the financial obligation incurred to acquire that ownership. As prospective buyers embark on their property journey, grasping the nuances of joint ownership structures, the critical role of title insurance, and the various types of mortgages available becomes essential.

Moreover, awareness of common pitfalls in the title and mortgage processes can safeguard against costly oversights. This article delves into these vital aspects, illuminating the responsibilities of a Director of Title Research and emphasizing the importance of meticulous title verification in ensuring successful real estate transactions.

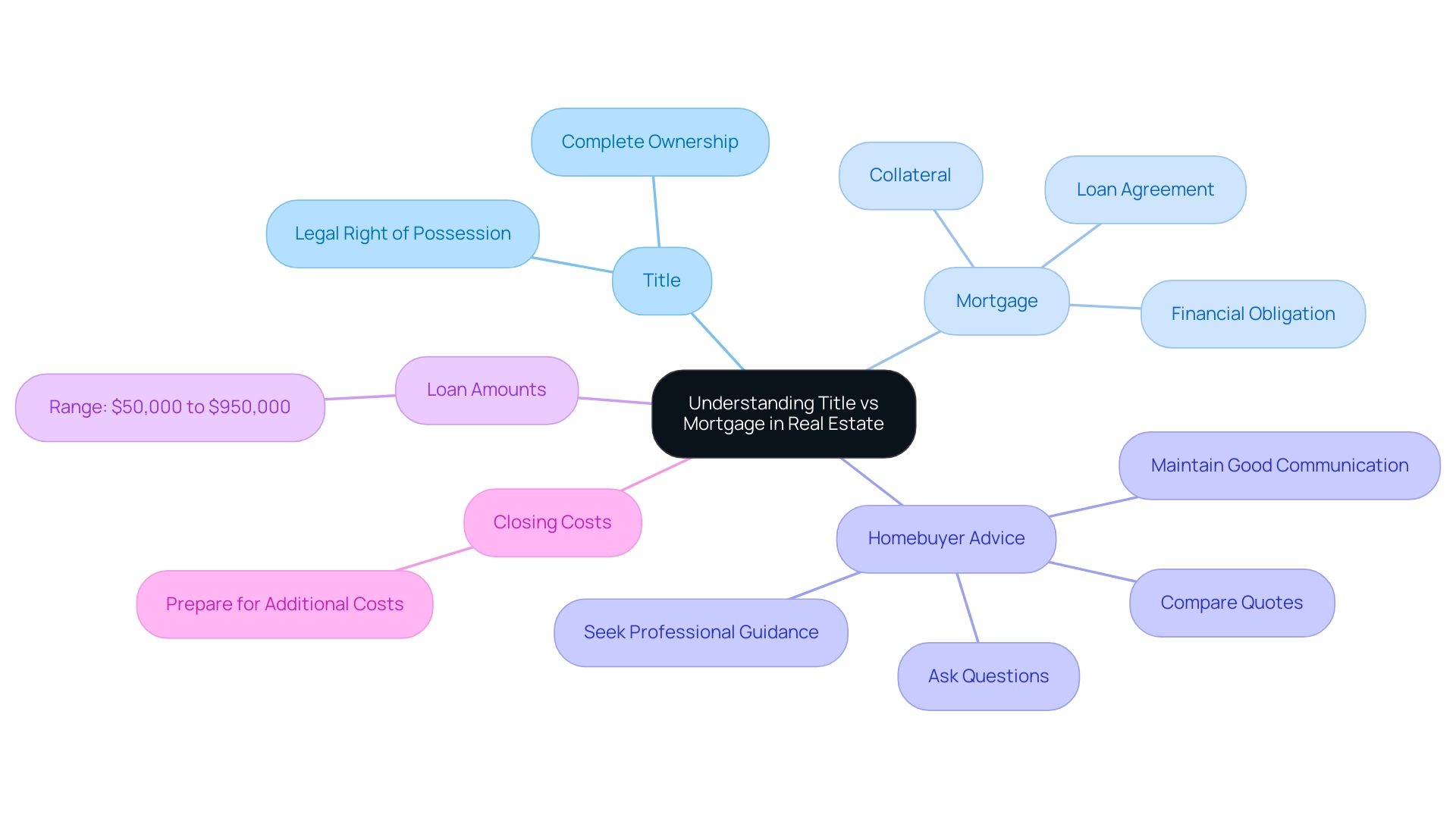

Understanding the Basics: Title vs. Mortgage

In the domain of real estate, the concept of title vs mortgage designates the legal right of possession of a residence, while a mortgage refers to funds obtained to facilitate the acquisition of that residence. Loan amounts available typically range from 950,000, illustrating the financial commitment involved. When obtaining a real estate asset, the deed is passed to you, signifying your possession, and it is usually documented with local government officials to provide legal evidence.

In contrast, a home loan is a financial agreement with a lender that allows you to finance the asset gradually, with the asset itself acting as collateral. This distinction of title vs mortgage is vital; possessing a title indicates complete ownership of the asset, while holding a mortgage signifies an outstanding obligation to the lender until the debt is fully repaid. Understanding these concepts is foundational for successfully navigating property purchases.

The case study titled 'Empowered Decision-Making' emphasizes that understanding the components of a loan quote is crucial for a smooth home buying process. Homebuyers are advised to:

- Ask questions

- Compare quotes

- Seek professional guidance

- Maintain good communication with their lender

Recent news highlights the significance of comprehending the elements affecting your loan estimate, including the necessity to inquire and contrast estimates, as well as preparing for extra closing expenses.

Being aware of these elements can significantly ease the process, ensuring that homebuyers are well-prepared and informed when making such significant financial decisions.

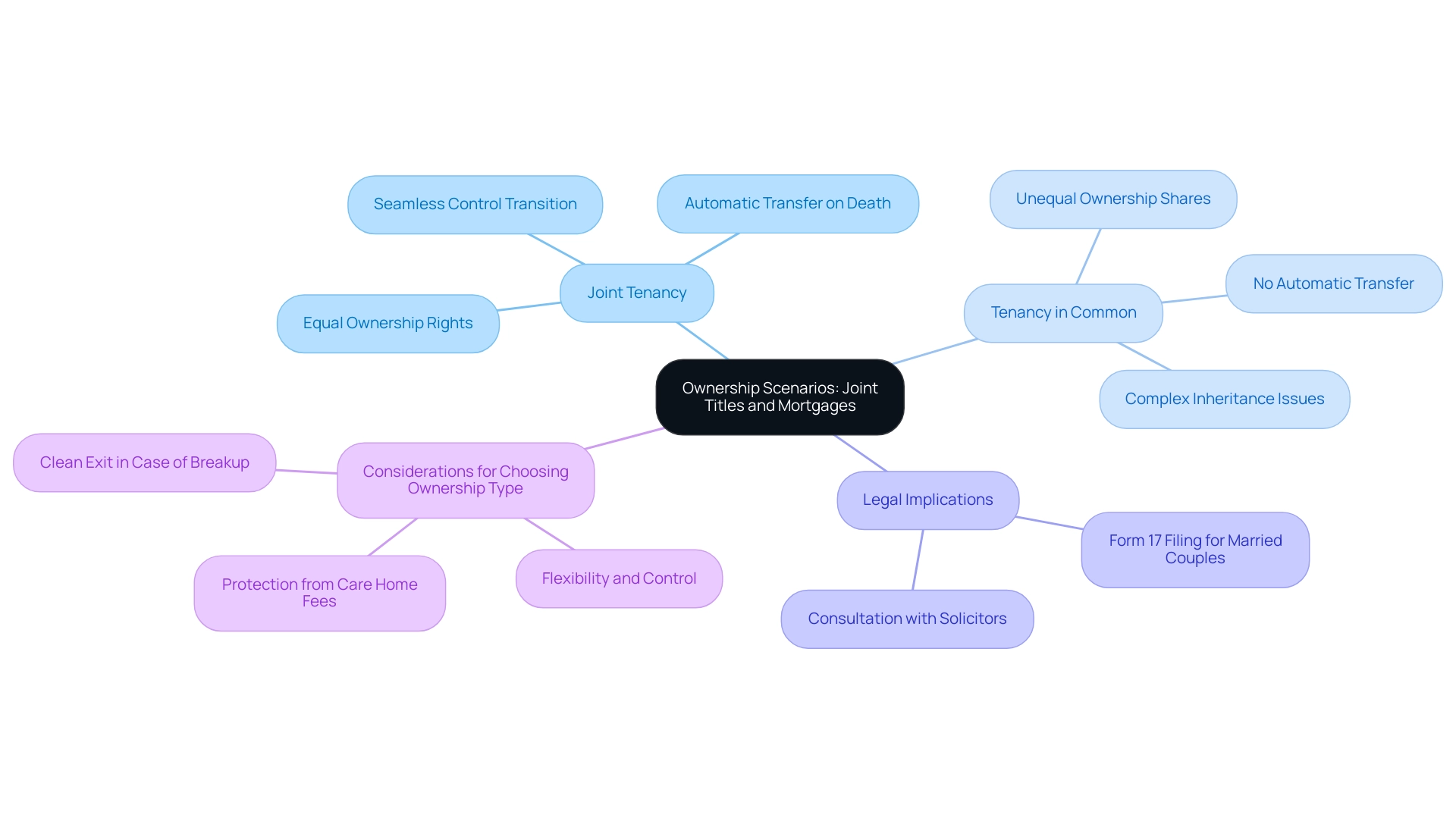

Navigating Ownership Scenarios: Joint Titles and Mortgages

When entering into a purchase of real estate with another individual, it is vital to grasp the nuances of title vs mortgage. Ownership can be structured primarily through two forms:

- joint tenancy

- tenancy in common

In , both parties possess equal rights to the property; notably, when one owner passes away, their interest in the property automatically transfers to the surviving owner, ensuring a seamless transition of control.

Conversely, tenancy in common permits unequal ownership shares, allowing individuals to specify the percentage of ownership each holds. This form does not facilitate automatic transfer upon death, which can lead to more complex inheritance scenarios.

Moreover, issues may occur when names on the document and loan differ. For example, if only one party's name appears on the mortgage, that individual may bear sole responsibility for loan repayments, despite both parties being listed as title owners. This discrepancy can result in significant disputes regarding title vs mortgage financial obligations.

It is wise to establish clear property rights and responsibilities from the outset. As one real estate attorney articulated,

If you want to ensure that if you break up, you can make a relatively clean and painless exit... then registering as tenants in common is a good idea.

For married couples, it is important to note that a Form 17 must be filed to declare shares on any rental income from the asset to HMRC, which underscores the legal implications of ownership types. Therefore, consulting with qualified solicitors during the purchasing process is essential to navigate these complexities related to title vs mortgage and protect one's interests. This is especially significant when examining the case study titled 'Considerations for Choosing Ownership Type,' which emphasizes factors affecting the decision between joint tenancy and tenancy in common, ultimately advising tenants in common for those desiring flexibility and control over their share.

The Importance of Title Insurance

Title insurance acts as an essential protection for buyers, shielding them from possible claims or disputes that may occur regarding the ownership of their asset. It covers a range of issues, including:

- Outstanding liens

- Legal claims

- Errors in public records that may threaten ownership rights

Upon purchasing ownership insurance, a one-time premium secures coverage for as long as the property is owned, ensuring that any ownership-related issues that surface after the transaction do not result in significant financial loss.

The necessity of ownership insurance becomes evident in real estate transactions, where it is typically required for property loans to protect against ownership defects. However, buyers purchasing outright can opt out, although it is highly recommended to maintain this protection. This highlights the importance of understanding title insurance in the discussion of title vs mortgage, particularly with updates on claims and disputes expected in 2024.

For those seeking a deeper understanding of real estate law, the University of Miami offers an online program focusing on these key concepts, providing valuable educational resources. Participating in such programs can improve your understanding and guide your choices in real estate transactions, ensuring that proactive steps have been taken to safeguard your rights as an owner.

Understanding Mortgages: Types and Terms

When it comes to financing your property, understanding the various forms of loans is crucial. The most common types include:

- Fixed-rate loans

- The interest rate remains constant throughout the loan term, making monthly payments predictable.

- Adjustable-rate loans (ARMs)

- Interest rates may change after , potentially impacting future payments.

Additionally, buyers should be aware of government-backed loans such as FHA loans, which can be beneficial for first-time homebuyers due to lower down payment requirements. Comprehending these alternatives assists purchasers in making knowledgeable choices regarding which loan type best fits their financial circumstances and future objectives.

Common Pitfalls in Title and Mortgage Processes

The complexities of the title vs mortgage processes require buyers to be vigilant in order to avoid common pitfalls. A significant oversight is the failure to conduct thorough ownership searches, which can result in unexpected discoveries of liens or claims after the transaction is completed. A clear designation is essential before finalizing any deal, as indicated by recent reports highlighting a significant percentage of buyers who neglect this crucial step.

In fact, authorities recently confiscated $1.2 million associated with a real estate agent involved in , underscoring the severe consequences of insufficient property research. Furthermore, understanding the differences in title vs mortgage terms is vital; buyers should proactively seek clarification on any unclear clauses to avoid confusion later. Additionally, budgeting for closing costs is often overlooked.

These costs can include:

- Insurance for ownership

- Appraisal fees

- Legal fees

Leading to financial surprises that could have been anticipated with proper planning. The situation of a Miami-based real estate developer demonstrates the severe repercussions of insufficient ownership research, where illicit transactions intended to conceal illegal funds in property investments highlight the necessity for vigilance. As a Miami-based developer noted, 'Filing an STR is necessary to comply with AML regulations, and conducting EDD will provide a deeper understanding of the client's activities and financial background.'

By recognizing these pitfalls and preparing thoroughly, including the implementation of a centralized land registry system to enhance detection of money laundering, buyers can significantly mitigate the risk of complications during the property purchasing process.

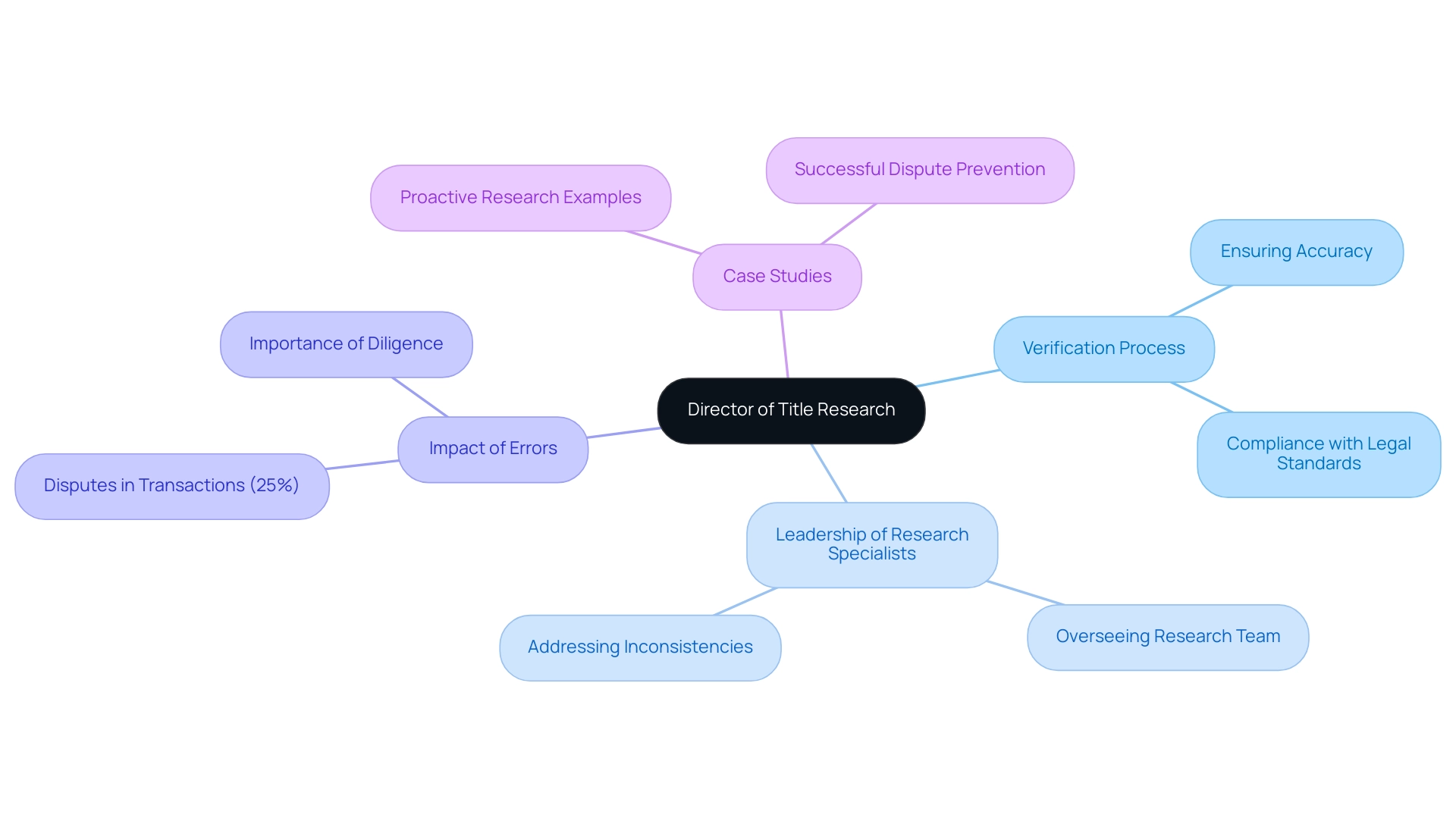

The Role of a Director of Title Research

The role of a Director of Title Investigation is integral to the success of , as they oversee the verification process, ensuring that all records are meticulously accurate and compliant with legal standards. According to recent statistics, errors in property research can lead to disputes in approximately 25% of real estate transactions, underscoring the critical nature of this role. This leadership role entails overseeing a committed group of research specialists, who together tackle any inconsistencies in property data while ensuring that all documents are meticulously complete and accurately understood.

Such diligence is essential in preventing potential disputes over possession that could arise during transactions. As real estate continues to evolve, the significance of thorough ownership research cannot be overstated. Expert opinions from highlight that their involvement not only enhances the accuracy and efficiency of this critical process but also serves to protect buyers’ interests, reinforcing their confidence in the transaction.

For instance, a recent case study demonstrated how proactive research on property rights prevented a significant dispute, illustrating the practical implications of their responsibilities. By upholding the highest standards of title verification, Directors play a pivotal role in safeguarding the integrity of property ownership.

Conclusion

Understanding the distinctions between titles and mortgages is essential for anyone navigating the real estate landscape. The article has highlighted that a title represents legal ownership of a property, while a mortgage signifies the financial obligation to acquire that ownership. This foundational knowledge is crucial for prospective buyers, as it sets the stage for informed decision-making throughout the property purchasing process.

The complexities of joint ownership structures, such as joint tenancy and tenancy in common, further emphasize the need for clarity and legal guidance. Misunderstandings regarding ownership rights can lead to disputes, underscoring the importance of establishing clear agreements from the outset. Additionally, the role of title insurance cannot be overstated, as it offers vital protection against potential claims or disputes that may arise post-transaction.

Moreover, recognizing the various types of mortgages available and the common pitfalls in the title and mortgage processes equips buyers with the tools necessary to navigate their property journeys successfully. Engaging in thorough title searches and understanding mortgage terms are critical steps that can prevent costly oversights.

Ultimately, the responsibilities of a Director of Title Research play a pivotal role in ensuring that real estate transactions are executed with accuracy and integrity. By prioritizing meticulous title verification and fostering a comprehensive understanding of the related processes, stakeholders can confidently approach property ownership, safeguarding their investments and promoting a smoother transaction experience.

Frequently Asked Questions

What is the difference between title and mortgage in real estate?

Title refers to the legal right of possession of a residence, indicating complete ownership of the asset. In contrast, a mortgage is a financial agreement with a lender that facilitates the acquisition of the property, with the property itself acting as collateral for the loan.

What are the typical loan amounts for mortgages?

Loan amounts for mortgages typically range from $50,000 to $950,000, reflecting the financial commitment involved in purchasing real estate.

What does obtaining a deed signify when purchasing a property?

Obtaining a deed signifies possession of the property and is usually documented with local government officials to provide legal evidence of ownership.

What are the two primary forms of ownership when purchasing real estate with another individual?

The two primary forms of ownership are joint tenancy and tenancy in common. Joint tenancy allows equal rights to the property, with automatic transfer of ownership upon one owner's death, while tenancy in common permits unequal ownership shares without automatic transfer upon death.

What complications can arise when names on the title and mortgage differ?

If only one party's name appears on the mortgage, that individual may be solely responsible for loan repayments, even if both parties are listed as title owners, potentially leading to disputes regarding financial obligations.

Why is it important to establish clear property rights and responsibilities at the outset of a real estate purchase?

Establishing clear property rights and responsibilities helps prevent disputes and ensures that both parties understand their obligations, especially in cases of separation or death.

What is title insurance and why is it important?

Title insurance protects buyers from claims or disputes regarding ownership of their property, covering issues like outstanding liens and errors in public records. It is typically required for property loans and is recommended even for outright purchases.

What types of loans are common for financing property?

Common types of loans include fixed-rate loans, which have constant interest rates, and adjustable-rate loans (ARMs), which may change after an initial fixed period. Government-backed loans, such as FHA loans, are also available for first-time homebuyers.

What are common pitfalls buyers should avoid in the title vs mortgage process?

Common pitfalls include failing to conduct thorough ownership searches, neglecting to clarify unclear loan terms, and overlooking budgeting for closing costs, which can lead to unexpected financial surprises.

What role does a Director of Title Investigation play in real estate transactions?

The Director of Title Investigation oversees the verification process to ensure that all property records are accurate and compliant with legal standards, helping to prevent disputes over ownership and protecting buyers' interests.