Overview

This article examines the costs associated with title reports—essential documents that detail the legal status of a property and its ownership history. Understanding these costs is vital, as they can fluctuate significantly due to various factors, including geographic location, property type, and the complexity of ownership history. Thorough research is paramount. Furthermore, leveraging technology can optimize these processes, allowing for effective expense management. By addressing these challenges, stakeholders can navigate the intricacies of title reports with confidence.

Introduction

In the intricate world of real estate, grasping the nuances of title reports is essential for professionals seeking to navigate transactions successfully. These reports not only reveal the legal status of properties but also protect buyers from potential pitfalls that could jeopardize ownership rights. As the landscape evolves, particularly with the rising demand for streamlined online experiences among younger homebuyers, the importance of accurate and efficient title reporting has never been more pronounced.

With various factors influencing costs—from geographic location to the intricacies of title histories—real estate professionals must remain informed to make judicious decisions. This article explores the essentials of title reports, examining their costs, types, and the role of technology in enhancing efficiency and accuracy in this critical aspect of property transactions.

What is a Title Report and Why is it Important?

is a critical paper that outlines the legal status of a property, encompassing its ownership history, existing liens, and encumbrances. This document is vital for property experts, as it ensures that purchasers are fully aware of potential concerns that may affect their ownership rights. The importance of a document summary is substantial; it safeguards purchasers from unforeseen claims and provides a clear perspective of the property's legal status, essential for making informed decisions in property transactions.

In 2025, the significance of has only intensified, particularly as younger homebuyers increasingly anticipate a streamlined online purchasing experience. This transition necessitates that real estate professionals emphasize the accuracy and efficiency of documentation to meet evolving consumer needs. Statistics reveal that the average hourly wage for research specialists in Southwest New York is $31.05, underscoring the financial implications of time devoted to thorough research.

Furthermore, the risk factors for ownership defects—such as the property's history, location, and any unusual rights associated with the deed—highlight the necessity of . As noted by IBISWorld, "IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools," reinforcing the importance of reliable data in this sector. Case studies demonstrate that employing advanced technologies, such as those provided by Parse AI, can significantly enhance the speed and accuracy of research, ultimately yielding considerable savings compared to traditional methods.

By addressing these risk factors through innovative solutions, Parse AI plays a pivotal role in ensuring property ownership protection and facilitating successful transactions in the dynamic landscape of real estate.

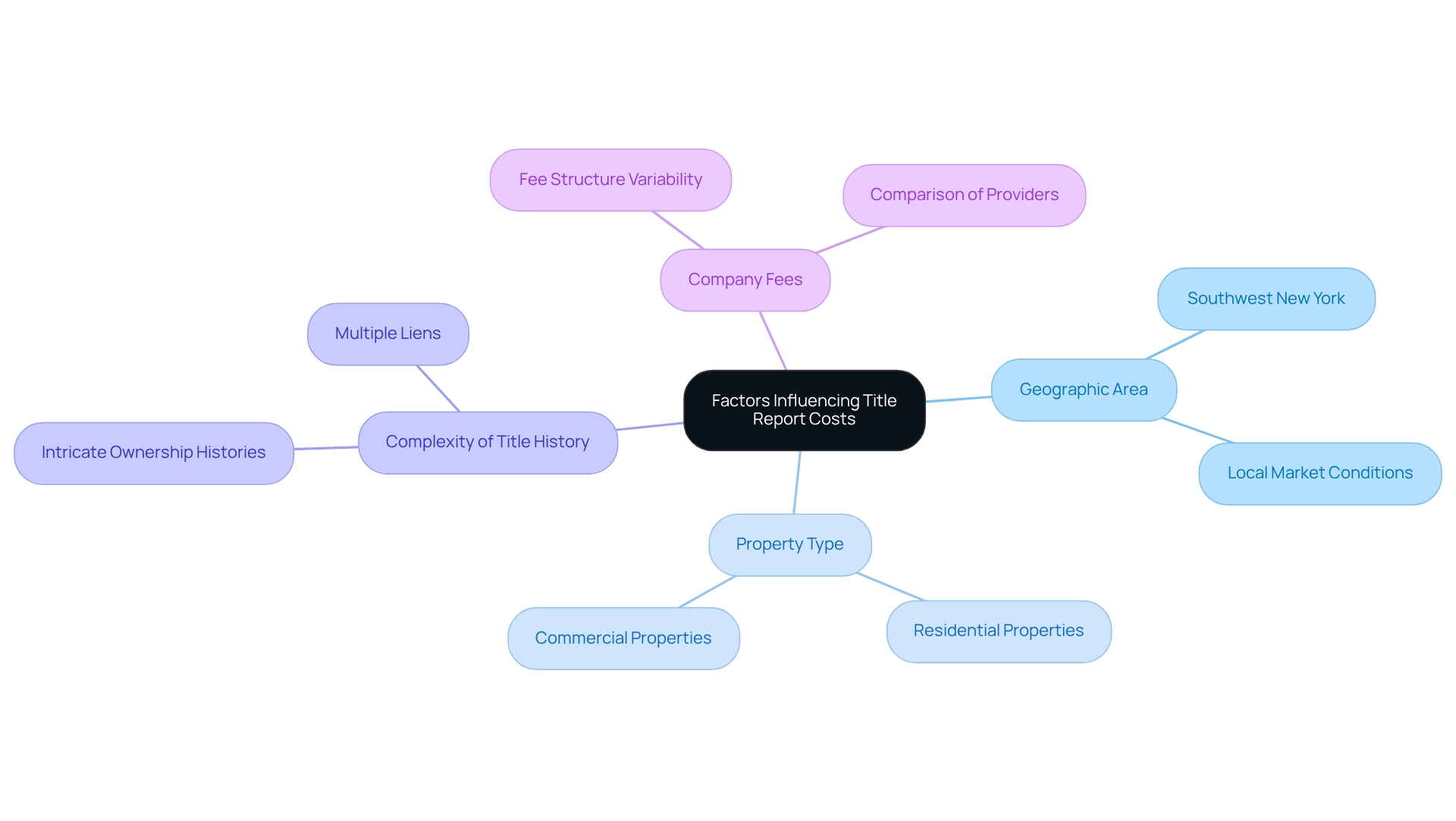

Factors Influencing Title Report Costs

The expense of ownership documents is influenced by several essential elements:

- Geographic Area: can fluctuate considerably across diverse regions, primarily due to local market conditions, regulatory demands, and the competitive environment. For instance, in the Southwest New York nonmetropolitan region, the average hourly earnings for research professionals in the field are approximately $31.05, impacting the overall pricing of services.

- Property Type: The category of property being evaluated plays a crucial role in determining expenses. Typically, residential properties incur lower documentation costs compared to commercial properties. Commercial transactions often necessitate more extensive research and due diligence, resulting in higher fees.

- Complexity of Title History: Properties with intricate ownership histories or multiple liens require more thorough investigations. This complexity can significantly increase the time and resources needed to compile a document, thereby raising the overall cost.

- Company Fees: Each company has its own fee structure, which can vary widely. These differences can influence the overall expense of the document, making it essential for property professionals to compare options and understand the pricing structures of different providers.

In 2022, 66.1% of families owned their primary home, according to the Federal Reserve's Survey of Consumer Finances, underscoring the significance of documents in property transactions. Additionally, insurance premiums can range from $500 to $3,500 depending on property value and location, highlighting the financial implications of document expenses.

Understanding these elements is vital for property professionals as they navigate the complexities of research and strive to manage expenses efficiently. By leveraging innovative solutions like Parse AI, which utilizes machine learning and optical character recognition, researchers can streamline their processes, potentially reducing expenses associated with traditional research methods. Parse AI addresses the challenges related to the time and resources required for verifying property ownership, enabling researchers to finalize abstracts and documents more swiftly and accurately, ultimately delivering substantial savings.

Types of Title Reports and Their Cost Implications

Understanding the various types of title reports is essential for real estate professionals, as each serves a distinct purpose and carries different cost implications.

- Preliminary Title Report: This initial report provides a succinct summary of the title status, making it a cost-effective choice for many. Typically, prices range from $75 to $250, influenced by the property's complexity and the region.

- Full Title Document: In contrast, a full title document offers a comprehensive analysis, detailing the ownership history and any encumbrances associated with the property. Due to the extensive research required, these documents generally incur higher costs, reflecting the depth of information provided.

- Owner's Title Insurance Policy: Although not categorized as a report, this insurance is vital for safeguarding against potential future claims on the property. It represents an additional expense that should be factored into the overall budget for service fees.

In 2025, the landscape of ownership reporting is evolving, with professionals increasingly acknowledging the importance of thorough research. While individuals can conduct DIY property searches due to the public nature of real estate records, hiring skilled researchers is often recommended. As highlighted in a case study, professional designation researchers are more efficient and knowledgeable, minimizing the risk of overlooking critical information during the search, particularly given the varying regulations across counties.

When assessing expenses, it is imperative to evaluate the implications of choosing between preliminary and complete documentation. Although initial assessments may save money upfront, they might lack the comprehensive insights necessary for informed decision-making. Conversely, complete reports, while more expensive, can prevent costly mistakes in the long run.

Furthermore, the responsibility for covering a search varies by area; it can be borne by the buyer or negotiated for the seller to cover or share the expense. This cost-benefit analysis is crucial for real estate professionals aiming to optimize their workflows and ensure thorough due diligence. As Nick Perry, a contributing writer, asserts, " is essential for avoiding future complications and ensuring a smooth transaction.

Typical Costs of Title Reports: What to Expect

In 2025, the average title report cost nationwide typically ranges from $100 to $400. However, this range is subject to fluctuations influenced by several key factors:

- Location: Title report fees are generally higher in urban areas, where demand and operational costs are elevated. Metropolitan regions often experience expenses at the upper end of the spectrum due to the competitive market and complexities involved in urban property transactions. Recent case studies illustrate these price variations across the United States. In urban areas like New York City, report fees can exceed $500, whereas in smaller communities, they might remain under $200. This disparity underscores the importance of understanding local market conditions when budgeting for title research.

- Complexity: The nature of the property significantly impacts pricing. Properties with complicated ownership histories or those requiring extensive research may incur additional fees. This complexity necessitates more thorough investigations, which can drive up costs.

- Ownership Company: Different ownership companies have varying pricing structures. It is crucial for real estate professionals to compare rates among providers, as similar services can be offered at different price points. Federal agencies must utilize negotiated rates throughout the life of the Federal award, which can influence the pricing structures adopted by various companies.

In addition to these factors, the typical expenses for ownership documents can differ significantly between urban and rural environments. For example, while urban property assessments may average around $300, rural assessments might be closer to $150, reflecting the differences in demand and operational expenses.

As Matt Schulz, chief consumer finance analyst at LendingTree, observes, "However, once that initial glow wears off and you’re still making a big monthly payment on that vehicle after five-plus years, it may not seem worth it." This perspective aids in understanding the financial implications of title report costs, emphasizing the necessity for property professionals to stay informed about and the factors affecting these prices. This knowledge is vital for effective financial planning and decision-making in property transactions. Overall, as the property market evolves, remaining aware of these expenses and their fluctuations is essential.

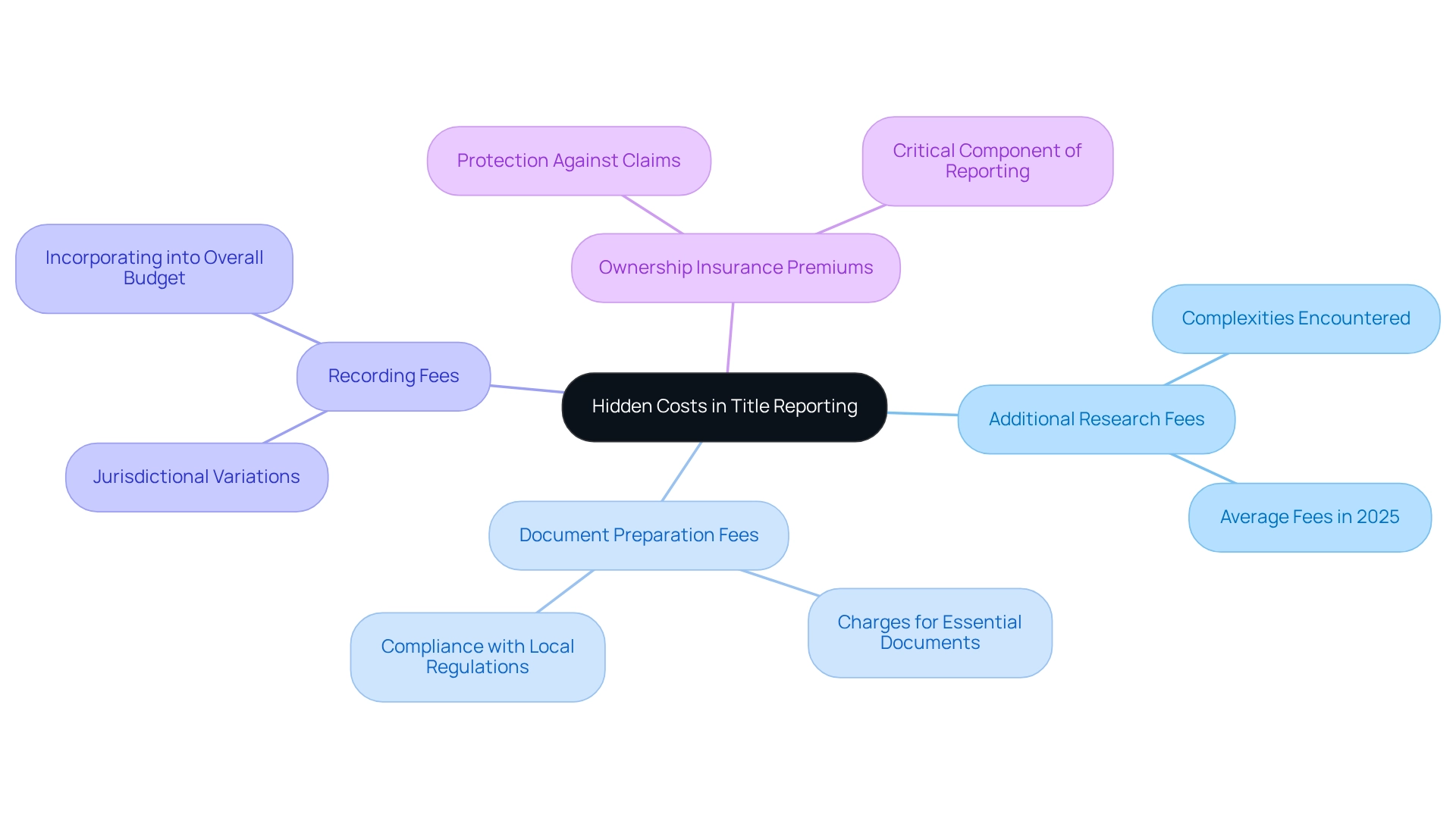

Hidden Costs in Title Reporting: What You Need to Know

Hidden costs in title report expenses can significantly impact the overall financial outlay during transactions. A comprehensive understanding of title report costs is essential for real estate professionals aiming to budget effectively. The key hidden costs include:

- Additional Research Fees: When a title company encounters complexities—such as unresolved liens or ownership disputes—further investigation may be required, resulting in additional research fees. In 2025, the average extra research fees for property reports have been observed to rise, reflecting the increasing complexities in property transactions. These fees can vary widely depending on the nature of the issues uncovered.

- Document Preparation Fees: Charges for preparing essential documents, such as deeds and affidavits, can accumulate rapidly. Often overlooked, these fees are crucial for ensuring that all paperwork is accurately filed and compliant with local regulations.

- Recording Fees: The expenses associated with documenting the transfer of ownership with local authorities can differ based on the jurisdiction. It is vital to incorporate the title report cost and these fees into the overall budget, as they can vary significantly from one location to another.

- Ownership Insurance Premiums: Frequently undervalued, ownership insurance premiums can substantially influence overall expenses. These premiums protect against potential claims on the property and should be regarded as a critical component of the reporting process.

For instance, a case study on concealed expenses demonstrated that institutions that systematically gather and analyze usage data can gain a better understanding of their resources' value, leading to more informed decisions regarding research expenditures. As Bucknell noted, "Platform differences that influence the number of downloads" can also highlight the complexities involved in reporting titles. By recognizing , real estate professionals can navigate the financial landscape of reporting more effectively, ensuring preparedness for any unforeseen charges.

Choosing the Right Title Company: Cost and Quality Considerations

When choosing a company for closing services, it is crucial to consider several important factors:

- Reputation: Investigate reviews and testimonials to assess the company's reliability and service quality. A strong reputation often correlates with higher customer satisfaction, as evidenced by statistics indicating that companies with a robust Net Promoter Score (NPS) experience 1.5 times greater revenue growth than those with lower scores. As Andi Bolin, president of , advises, managers should avoid getting 'caught in paralysis of analysis' and focus on applying smart goals when evaluating potential partners. This is particularly important in understanding the title report cost to ensure the company offers clear estimates and outlines all potential fees upfront. A recent survey highlighted significant variability in closing costs across different states, underscoring the importance of comparing title companies to find the best title report cost. Businesses that prioritize pricing transparency not only establish trust but also improve customer experience, which can result in significant revenue growth over time. Furthermore, enhanced policies provide additional benefits, while special policies cater to unique situations, driving innovation in the industry.

- Experience: Seek out companies with a proven track record in managing transactions similar to yours. Experienced firms are more likely to navigate complexities effectively, ensuring smoother transactions.

- Technology Use: Consider companies that utilize advanced technologies, such as machine learning and AI. These innovations can streamline processes, lower expenses, and enhance precision in research, ultimately benefiting your workflow.

By concentrating on these criteria, real estate professionals can make informed choices when selecting a company, ensuring they collaborate with a provider that aligns with their needs and expectations.

The Role of Technology in Title Reporting and Cost Efficiency

Technology is fundamentally transforming the landscape of report generation, with several key advancements enhancing efficiency and precision. Among these, machine learning stands out as a powerful tool that automates the extraction of data from document titles. This automation significantly reduces the time and effort typically required for document searches, allowing professionals to focus on more strategic tasks.

Furthermore, Optical Character Recognition (OCR) technology enhances this process by converting scanned documents into editable and searchable formats. This capability not only improves the accuracy of data retrieval but also streamlines workflows, enabling researchers to generate documents with greater speed and precision. For instance, the incorporation of OCR has been shown to enhance report accuracy, thereby reducing the likelihood of mistakes that can lead to costly conflicts.

In addition, the advent of blockchain technology introduces a new level of security and transparency in transaction records. By providing immutable and verifiable records, blockchain can significantly decrease occurrences of fraud and errors in ownership transfers, fostering increased trust among stakeholders.

As Erik Brynjolfsson, Director of the MIT Initiative on the Digital Economy, notes, "Harnessing machine learning can be transformational, but for it to be successful, enterprises need leadership from the top." This underscores the necessity for property experts to embrace these technologies with strong leadership to fully realize their benefits.

The combined impact of these technologies results in that yields substantial savings for property professionals. A pertinent example of technology's influence on efficiency is KIA's implementation of their Facebook messenger chatbot, which led to a 21% increase in social media conversion rates. As the machine learning market continues to expand—projected to reach $2.31 billion in France by 2024—its applications in reporting are expected to grow, further enhancing operational efficiencies and reducing research-related expenses.

This evolution underscores the importance of adopting technological advancements to maintain competitiveness in the estate sector.

Key Takeaways on Title Report Costs for Real Estate Professionals

Understanding the cost of title reports is essential for property professionals aiming to navigate transactions effectively. Key considerations include:

- Importance of Title Reports: Title reports play a vital role in real estate transactions, delivering crucial information about property ownership and any encumbrances. As Diane Tomb, CEO of the American Land Title Association, asserts, "Title professionals across the country continue to navigate their businesses through this challenging and volatile real estate cycle, dedicated to serving their customers, protecting property rights, and supporting their communities despite the uncertainty of the marketplace."

- Factors Affecting Expenses: The costs associated with title reports can vary significantly based on location, property type, and the complexity of the ownership history. For example, urban properties may incur higher fees due to the increased research requirements.

- Varieties of Ownership Documents: There are various types of ownership documents available, each with distinct expenses. A thorough understanding of these variations enables professionals to select the most appropriate report for their needs.

- Typical Costs and Hidden Fees: It is crucial to grasp standard pricing structures and potential hidden charges that may arise during the search process, as these can influence total transaction expenses. Notably, 72% of sellers would certainly choose the same agent again, underscoring the importance of reliable services in fostering strong client relationships.

- Choosing the Right Firm: Selecting a reputable firm is paramount. Professionals should prioritize transparency and reliability to ensure a seamless transaction process.

- Leveraging Technology: Adopting technology, such as machine learning and optical character recognition, can significantly enhance efficiency and minimize expenses related to ownership documents. For instance, platforms like Parse AI facilitate the extraction of vital information from document titles, enabling quicker and more accurate report creation. The insurance sector for property coverage faced challenges in 2022, amassing $21 billion in premiums, a 16% decline from 2021; nevertheless, professionals in the field remained committed to assisting their clients and safeguarding property rights.

- Industry Context: The American Land Insurance Association (ALTA) represents over 6,500 insurance firms and related professionals, providing a solid framework for understanding the industry's landscape.

By concentrating on these key points, can navigate the complexities of title report costs more effectively, ultimately leading to more informed decisions and improved transaction outcomes.

Conclusion

Understanding the intricacies of title reports is essential for real estate professionals; these documents play a pivotal role in safeguarding ownership rights and informing buyers of potential risks. The multifaceted nature of title reporting emphasizes the importance of thorough research and the various factors influencing costs, including geographic location, property type, and the complexity of title histories.

Furthermore, the distinction between different types of title reports—such as preliminary and full reports—underscores the need for professionals to assess the specific needs of each transaction to make informed choices. Awareness of typical costs and hidden fees is crucial, as these can significantly impact overall budgeting and financial planning in real estate transactions.

As the industry continues to evolve, leveraging technology emerges as a key strategy for enhancing efficiency and accuracy in title reporting. Innovations like machine learning and optical character recognition streamline processes, reduce costs, and ultimately improve the quality of service provided to clients. By prioritizing these insights and embracing technological advancements, real estate professionals can navigate the complexities of title reporting more effectively, ensuring smoother transactions and better outcomes for all stakeholders involved.

Frequently Asked Questions

What is a property document, and why is it important?

A property document outlines the legal status of a property, including its ownership history, existing liens, and encumbrances. It is crucial for property experts and purchasers as it helps them understand potential concerns that may affect ownership rights, safeguarding against unforeseen claims.

How has the significance of title report costs changed in 2025?

In 2025, the significance of title report costs has intensified, particularly as younger homebuyers expect a streamlined online purchasing experience. This evolution requires real estate professionals to prioritize the accuracy and efficiency of documentation.

What are some risk factors for ownership defects?

Risk factors for ownership defects include the property's history, location, and any unusual rights associated with the deed. Comprehensive ownership reports are essential to address these risks.

What are the main elements influencing the expense of ownership documents?

The main elements influencing ownership document costs include geographic area, property type, complexity of title history, and company fees. These factors can significantly affect the overall pricing of services.

How does the type of property affect documentation costs?

Residential properties typically incur lower documentation costs compared to commercial properties, which often require more extensive research and due diligence, leading to higher fees.

What impact does the complexity of title history have on costs?

Properties with intricate ownership histories or multiple liens require more thorough investigations, increasing the time and resources needed to compile a document, thereby raising overall costs.

How can innovative solutions like Parse AI assist in reducing research expenses?

Parse AI utilizes machine learning and optical character recognition to streamline research processes, potentially reducing expenses associated with traditional methods. It helps researchers verify property ownership more swiftly and accurately.

What is the range of insurance premiums related to property documents?

Insurance premiums can range from $500 to $3,500, depending on property value and location, highlighting the financial implications of document expenses.