Introduction

Navigating the complexities of real estate transactions requires a thorough understanding of title searches, an essential step in confirming property ownership and identifying any potential legal issues. For homebuyers, this process is not just a formality; it is a crucial safeguard against future disputes and financial losses. From verifying current ownership and uncovering liens to understanding legal descriptions and historical claims, each aspect of a title search plays a pivotal role in ensuring a secure purchase.

As homebuyers embark on this journey, being equipped with knowledge about conducting their own title searches and recognizing common pitfalls can empower them to make informed decisions. Furthermore, the importance of title insurance and selecting a reputable title company cannot be overstated, as these elements provide an added layer of protection in an often unpredictable market. This article delves into the intricacies of title searches, offering valuable insights that will help prospective buyers navigate the real estate landscape with confidence.

Understanding Title Searches: What Every Homebuyer Should Know

A title search is the process of examining public records to confirm legal ownership of the asset and to identify any claims, liens, or encumbrances on it. This process is vital for homebuyers to ensure that they are acquiring a residence free of legal issues. Key aspects to consider include:

- Ownership: Verify the current owner's name and confirm that they have the right to sell the asset.

- Liens and Encumbrances: Identify any outstanding debts, such as mortgages or tax liens, that could affect ownership.

- Legal Descriptions: Understand the asset’s legal description to ensure it matches the physical boundaries of the asset.

- Historical Claims: Investigate any historical claims or disputes related to the asset that may impact your ownership rights.

Understanding these elements will help homebuyers make informed decisions and avoid costly mistakes during the purchasing process.

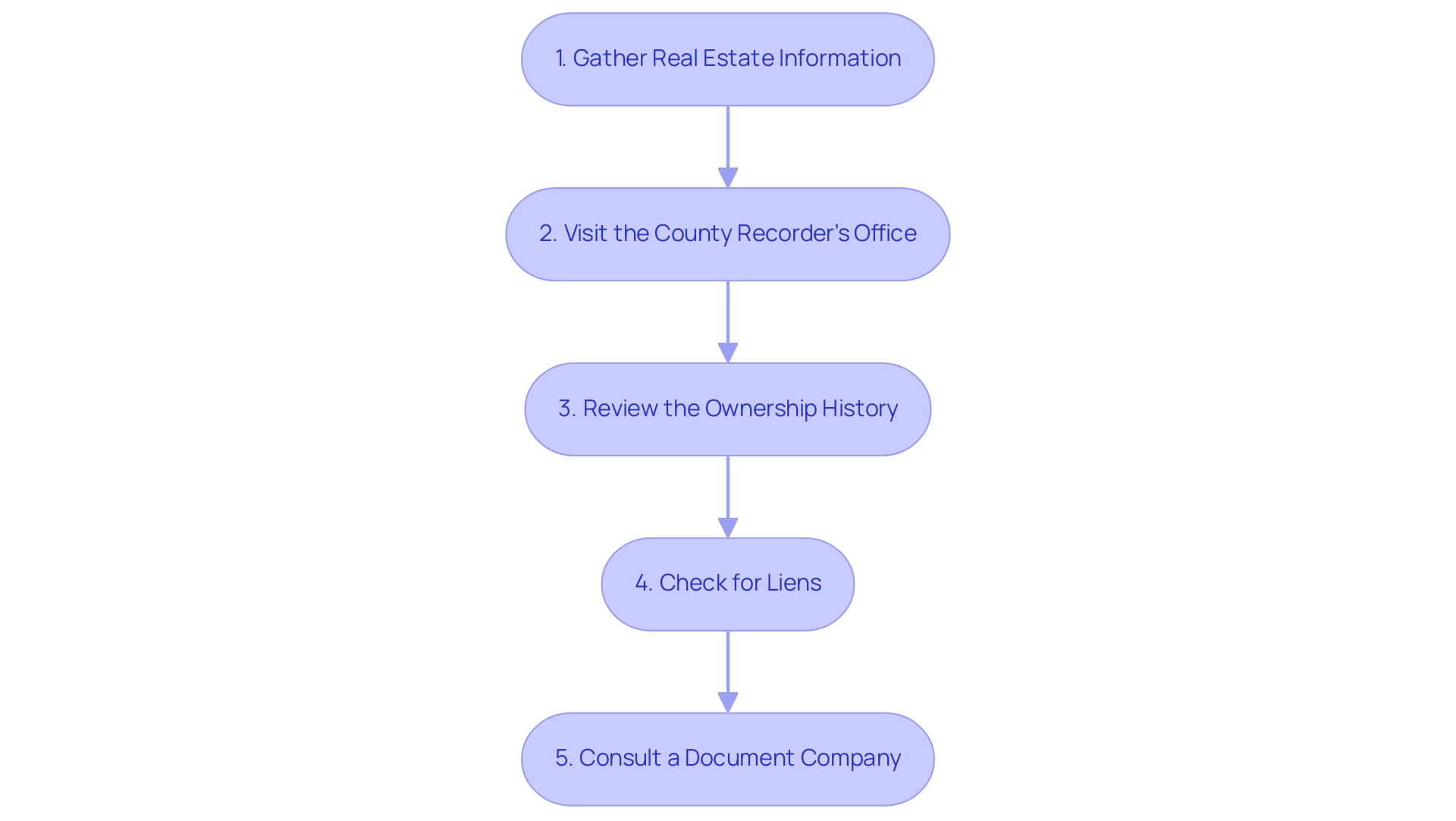

Step-by-Step Guide to Conducting Your Own Title Search

Conducting a title search can seem daunting, but following these steps will simplify the process:

-

Gather Real Estate Information: Start by collecting the location’s address, parcel number, and the current owner's name. This information is essential for locating the correct records.

-

Visit the County Recorder's Office: Head to your local county recorder or assessor's office, where real estate records are maintained. Many counties also provide online access to real estate records.

- Search Public Records: Look up the asset in the public records database. Check for the deed, which outlines the ownership history, and any liens or encumbrances.

-

Review the Ownership History: Analyze the chain of ownership to ensure that possession has been transferred correctly. Look for any breaks in the chain that may indicate issues.

-

Check for Liens: Investigate any outstanding liens against the property. This can include mortgages, tax liens, or mechanics' liens that could affect your ownership.

-

Consult a Document Company: If you face complex legal terminology or discrepancies, consider hiring a document company or attorney to aid with the investigation and ensure all paperwork is in order.

- Acquire Title Protection: After you’ve finalized your inquiry, it’s recommended to buy ownership insurance. This safeguards you from any upcoming claims or disagreements concerning the ownership's documentation.

By adhering to these steps, homebuyers can efficiently perform their own examination, attaining peace of mind and assurance in their real estate acquisition.

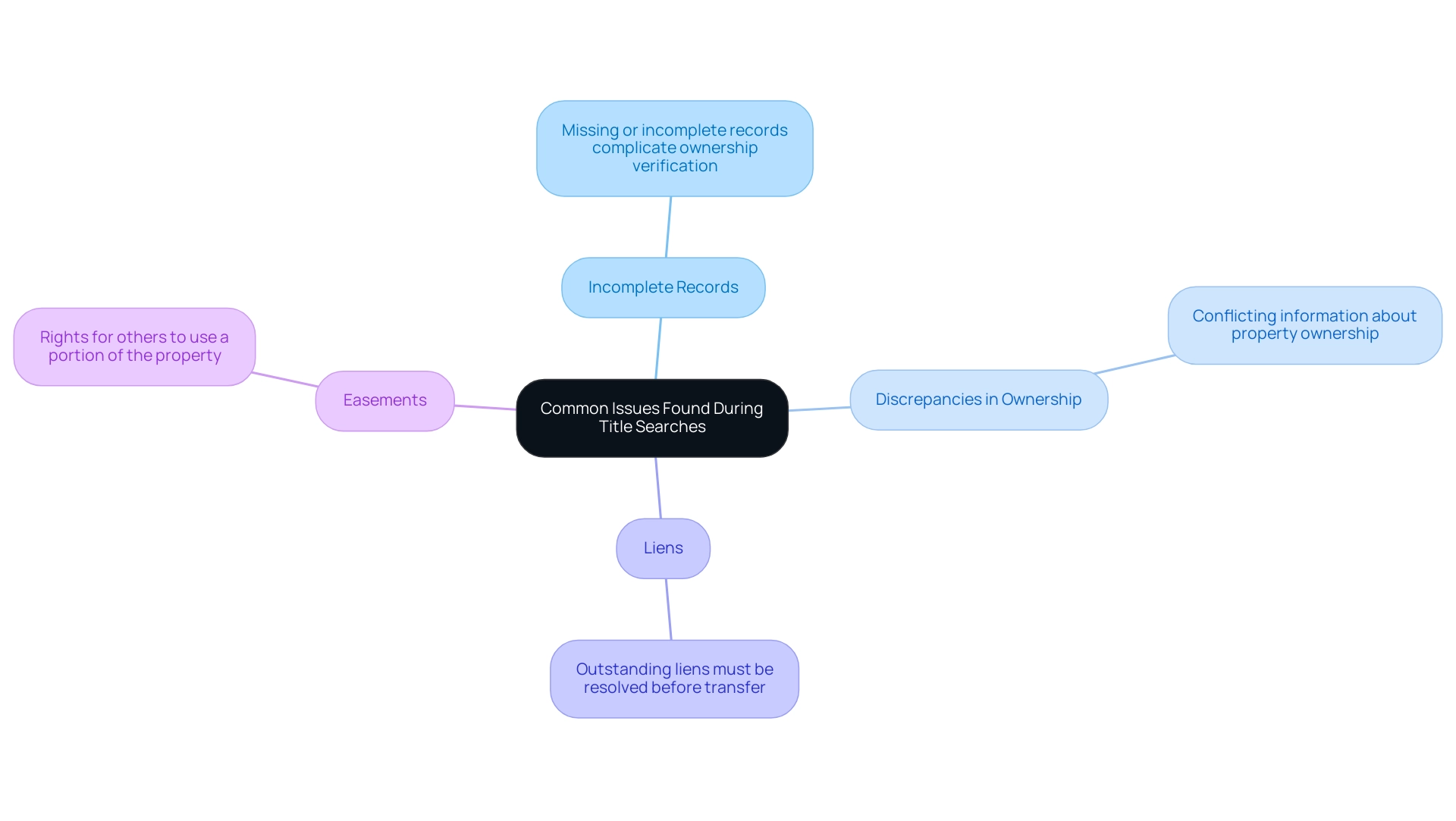

Common Issues Found During Title Searches

During a property investigation, homebuyers may encounter several common issues, including:

- Incomplete Records: Sometimes, property records may be missing or incomplete, which can complicate ownership verification.

- Discrepancies in Ownership: There may be conflicting information about who owns the property, especially if it has changed hands multiple times.

- Liens: Outstanding liens can pose significant problems, as they must be resolved before the property can be legally transferred.

- Easements: These are rights for others to use a portion of the property, which can affect the buyer's intended use of the land.

Being aware of these issues allows homebuyers to proactively seek solutions, such as consulting legal experts or property companies to resolve discrepancies.

The Role of Title Insurance in Real Estate Transactions

Title insurance is a policy that safeguards purchasers from financial loss caused by issues in the ownership that were not found during the ownership search. It serves several important functions:

- Protection Against Claims: Ownership insurance protects against claims made by third parties regarding ownership of the property.

- Coverage for Legal Fees: If a claim arises, the policy typically covers legal fees associated with defending against such claims.

- Peace of Mind: Having ownership insurance provides homebuyers with peace of mind, knowing they are protected against potential future disputes.

Homebuyers should carefully review ownership insurance policies and understand what is covered and any exclusions that may apply. Consulting with an insurance provider can help clarify any questions and ensure comprehensive coverage.

Finding a Reliable Title Company

When seeking a reliable title company, it is vital to follow these strategic tips to ensure a smooth transaction:

- Research Reviews and Ratings: Investigate customer reviews and ratings online. This will offer crucial insights into the organization’s reputation and reliability. Inspecting the credentials and evaluations of firms can uncover their quality, ethics, and professionalism.

- Ask for Recommendations: Seek recommendations from real estate agents, friends, or family who have recently purchased property. Their experiences can guide you toward trustworthy options. As one real estate agent remarked, "Selecting an organization with a strong reputation can prevent you from numerous troubles in the future."

- Check Credentials: Confirm that the organization is licensed and in good standing with the Better Business Bureau (BBB). Compliance with industry standards is essential; for example, Certified Title Corporation is known for being ALTA Best Practices compliant, reflecting high industry standards.

- Inquire About Services: Ask about the range of services offered, including property searches, insurance, and escrow services. Ensuring that their offerings align with your needs is crucial for a successful transaction.

- Compare Charges: Request detailed estimates from various firms to evaluate their fees and services. Comprehending the typical fees imposed by real estate firms, which can vary from $500 to $1,500 based on the intricacy of the transaction, will assist you in achieving a balance between quality and cost. It's advisable to request a detailed breakdown of the fees and services each provider offers.

By diligently adhering to these steps, homebuyers can confidently choose a trustworthy firm. As Allison Forlenza, a Client Manager and Sustainability Advocate, aptly states,

You should avoid any organization that pressures you, rushes you, or makes you feel uneasy or suspicious.

This caution helps ensure a secure and informed real estate transaction, ultimately leading to a smoother process. Furthermore, posing inquiries and reviewing the fine print regarding the insurance policy can avert misunderstandings and guarantee that clients are well-informed about coverage and exclusions. Furthermore, statistics show that 85% of customers report satisfaction with their title company's services when they conduct thorough research before making a selection.

Conclusion

Navigating the intricacies of title searches is paramount for homebuyers seeking to secure their investments and avoid potential pitfalls. Understanding the essential components of a title search, such as verifying property ownership, identifying liens, and reviewing legal descriptions, empowers buyers to make informed decisions. By following a structured approach to conducting their own title searches, prospective homeowners can uncover critical information that ensures a clear and marketable title.

The importance of title insurance cannot be overstated, as it provides an essential safety net against unforeseen claims and defects that may arise post-purchase. Engaging with a reputable title company further enhances the security of the transaction, ensuring that all legalities are thoroughly vetted and addressed. As highlighted, diligent research and careful consideration in selecting a title company can lead to a smoother buying experience and greater peace of mind.

In conclusion, a proactive approach to title searches, coupled with the right protections in place, is vital for any homebuyer. By equipping themselves with the necessary knowledge and resources, buyers can confidently navigate the real estate landscape, safeguarding their investments and positioning themselves for success in their property purchases.

Frequently Asked Questions

What is a title search?

A title search is the process of examining public records to confirm legal ownership of a property and to identify any claims, liens, or encumbrances on it. This process is crucial for homebuyers to ensure they are acquiring a residence free of legal issues.

What key aspects should be considered during a title search?

Key aspects to consider include verifying the current owner's name, identifying any outstanding debts (liens and encumbrances), understanding the asset's legal description, and investigating any historical claims or disputes related to the asset.

What steps should be followed to conduct a title search?

To conduct a title search, follow these steps: 1. Gather real estate information (address, parcel number, current owner's name). 2. Visit the county recorder's office to access real estate records. 3. Review the ownership history to ensure correct possession transfer. 4. Check for any outstanding liens against the property. 5. Consult a document company or attorney if needed, and consider acquiring title protection after your inquiry.

What common issues might homebuyers encounter during a title search?

Common issues include incomplete records, discrepancies in ownership, outstanding liens, and easements that may affect the intended use of the property.

What is title insurance, and why is it important?

Title insurance is a policy that protects purchasers from financial loss due to issues in ownership that were not discovered during the title search. It provides protection against claims from third parties, covers legal fees associated with defending against such claims, and offers peace of mind to homebuyers.

How can homebuyers find a reliable title company?

Homebuyers can find a reliable title company by researching reviews and ratings, asking for recommendations, checking credentials, inquiring about services offered, and comparing charges from different firms.

What should homebuyers be cautious about when selecting a title company?

Homebuyers should avoid companies that pressure or rush them and should thoroughly review the fine print regarding insurance policies to ensure they understand coverage and exclusions.