Introduction

A Title Insurance Commitment is a crucial document in real estate transactions, outlining the terms and conditions for issuing a title insurance policy. It provides a detailed analysis of the property's current title status, highlighting any encumbrances or defects that could disrupt the transaction. With the title industry experiencing a surge in home purchases and refinancing, First American Financial Corporation is leading the way in digitalizing title insurance services.

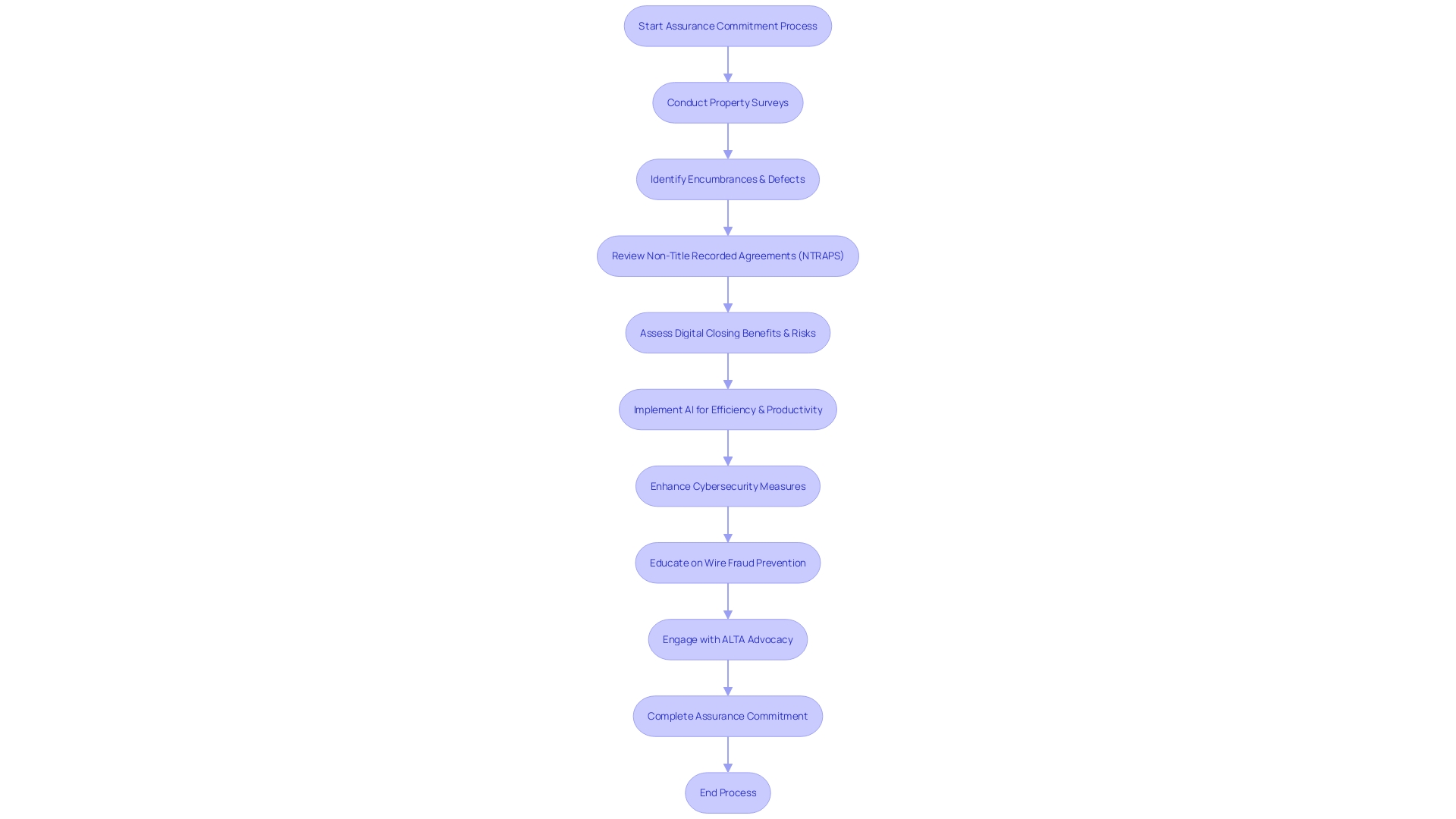

The American Land Title Association (ALTA) and Title Insurance Political Action Committee (TIPAC) advocate for awareness and solutions to combat prevalent threats like wire fraud. As professionals navigate a landscape of digital innovation and cybersecurity challenges, the commitment serves as a safeguard, ensuring secure and undisputed property rights.

What is a Title Insurance Commitment?

An Assurance Commitment outlines the conditions and contingencies under which an assurance policy will be provided for a specific asset. It thoroughly surveys the property's current status and illuminates any discernible encumbrances or defects that could potentially disrupt the transaction. With the sector poised for a surge in home purchases and refinancing, First American Financial Corporation, a stalwart with over 130 years of experience and $7.6 billion in revenue for 2022, is at the forefront, championing the of insurance services for . The American Land Title Association (ALTA) continues to support the concerns of the field, advocating for awareness and solutions to combat prevalent threats like wire fraud. ALTA's advocacy is fortified by TIPAC, the only political action committee exclusively representing the interests of the . As industry professionals navigate an environment brimming with , the commitment provides a pivotal safeguard, ensuring that are secure and undisputed before the closing day, reflecting a tradition of trust in protecting property rights that spans over a century.

Components of a Title Insurance Commitment

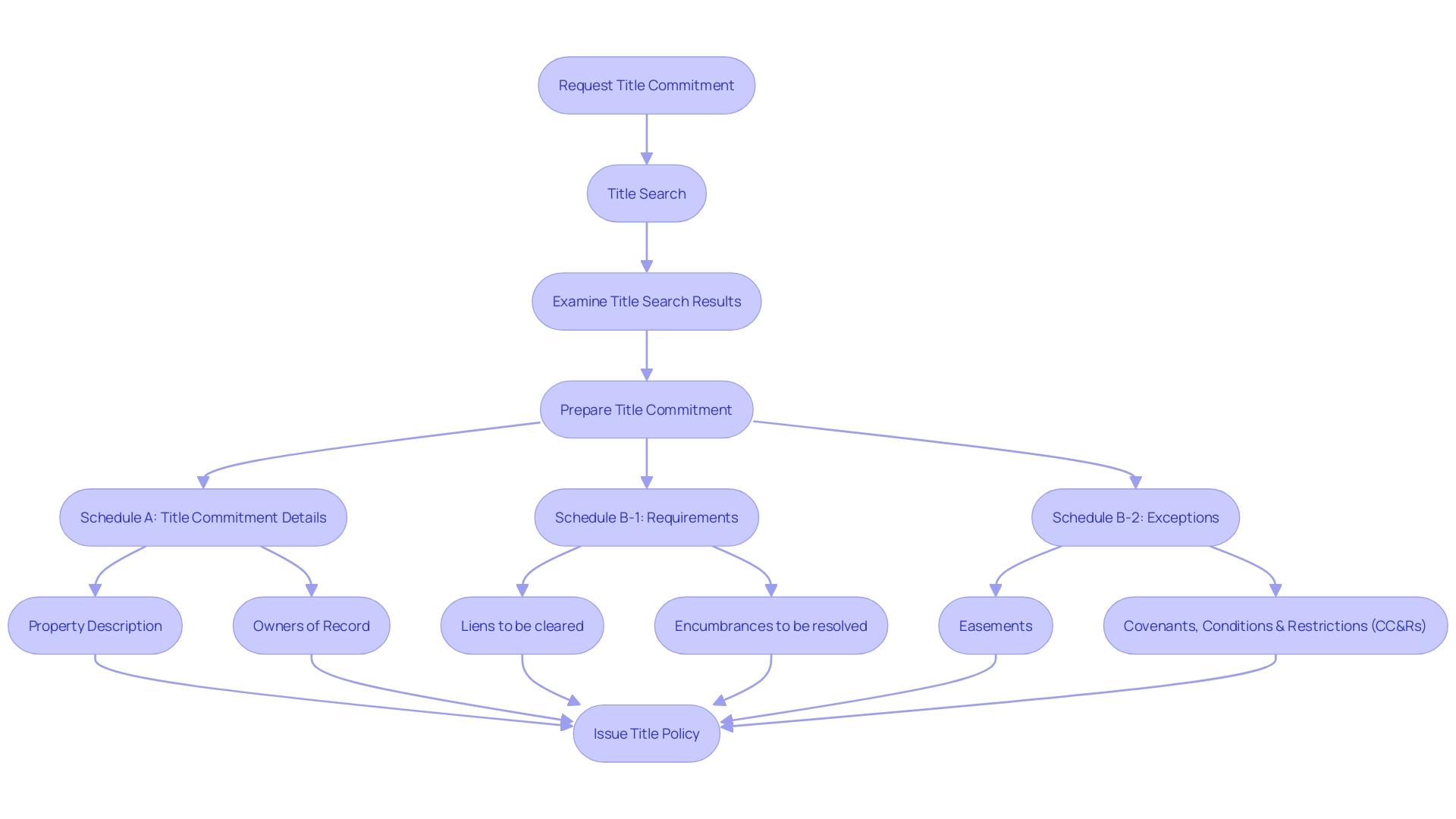

Comprehending the elements of a commitment for protecting is vital for professionals engaged in . This commitment serves as a crucial document, outlining the terms, conditions, and exclusions under which a policy for ensuring ownership rights will be issued. 'Schedule A' outlines the details of the transaction, including the names of the parties, the legal description of the premises, and the kind of insurance coverage sought. Schedule B-1 delineates the requirements that must be met before a can be issued, such as resolving any outstanding liens or encumbrances. 'Schedule B-2' lists the exceptions to coverage that will not be insured by the policy, often including standard exclusions like zoning regulations or general taxes. The careful analysis of these schedules helps to safeguard the interests of all parties involved and ensure the legitimacy of property ownership. As highlighted by industry leaders like First American Financial Corporation, which has been acknowledged for its innovation and stability, the meticulous attention to such details is what distinguishes top-tier providers in the domain of . The American Land Title Association (ALTA) and Title Insurance Political Action Committee (TIPAC) further underscore the significance of staying informed on the intricacies of land ownership coverage through continual legal analysis and advocacy. With billions in revenue and extensive service offerings, emphasize the importance of comprehensive commitments for secure real estate transactions.

Schedule A: Transaction Details

The 's is a pivotal document in , providing a detailed snapshot of the key elements of the deal. It meticulously lists the names of the transaction parties, enumerates the exact purchase price, and specifies the form of the insurance policy to be issued. Furthermore, Schedule A delineates any bespoke stipulations or prerequisites that must be satisfied prior to the policy's formal issuance, ensuring a clear understanding of the conditions that govern the transaction. This meticulous documentation is part of the sector's broader dedication to safeguarding property rights, a principle upheld by prominent institutions such as First American Financial Corporation. With a heritage spanning over 130 years and a 2022 revenue of $7.6 billion, exemplifies the sector's dedication to innovation and consumer protection. As the industry of document authentication and verification navigates a digital transformation, the emphasis on detailed and transparent reporting, as seen in Schedule A, becomes ever more crucial to maintaining trust and efficiency in real estate processes.

Schedule B-1: Requirements for Title Policy Issuance

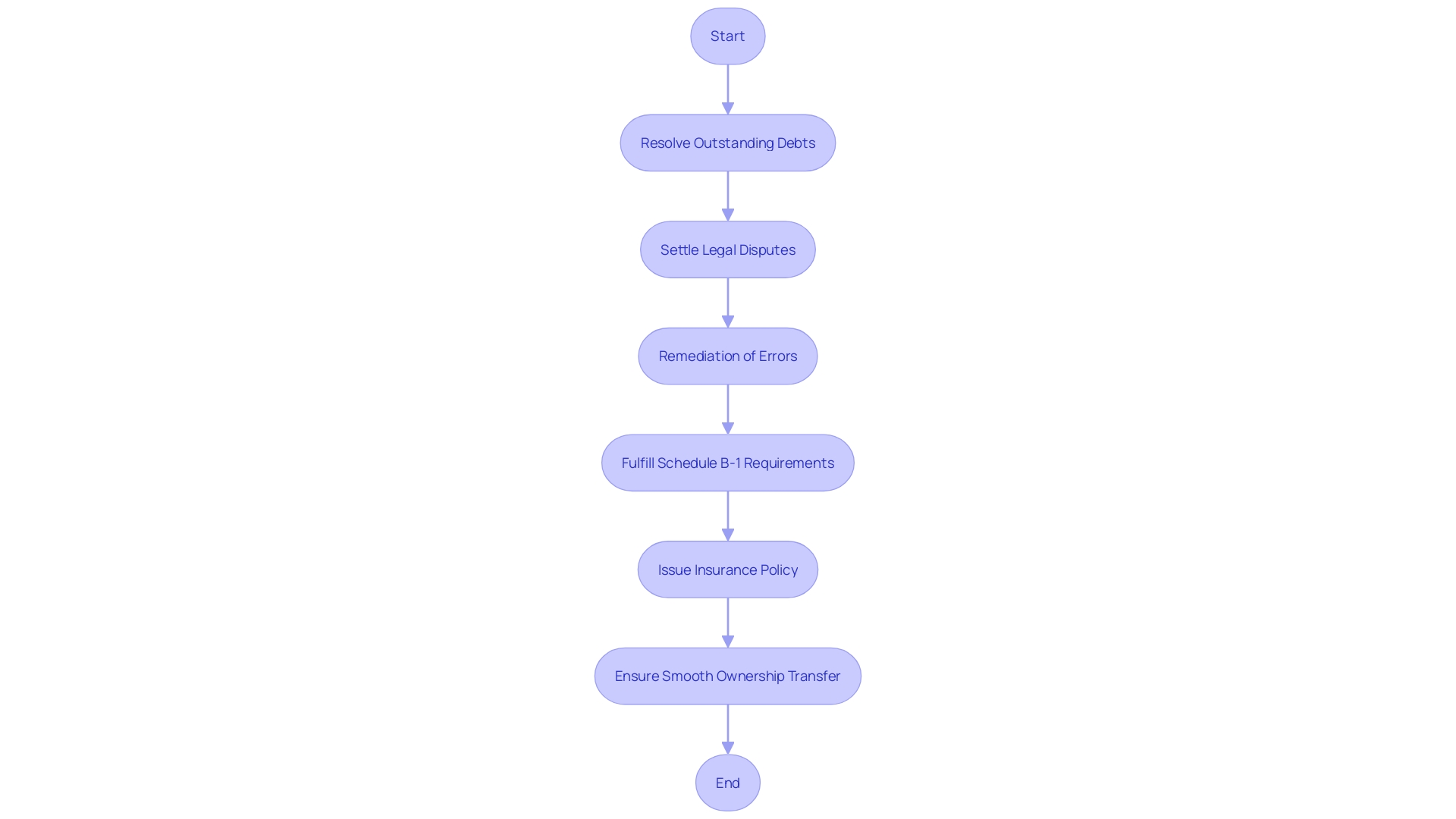

In the domain of real estate transactions, plays a crucial role in the process of protecting . This section outlines the that must be fulfilled before the issuance of an . These stipulations often include the resolution of outstanding debts such as liens or overdue taxes, the settlement of any existing legal disputes, and the remediation of errors or discrepancies found within the documentation of the property. The significance of adhering to these requirements cannot be emphasized enough, as they directly affect the validity and effectiveness of the policy, ensuring that the interests of all parties are protected and that the transaction can proceed with a clear and uncontested ownership.

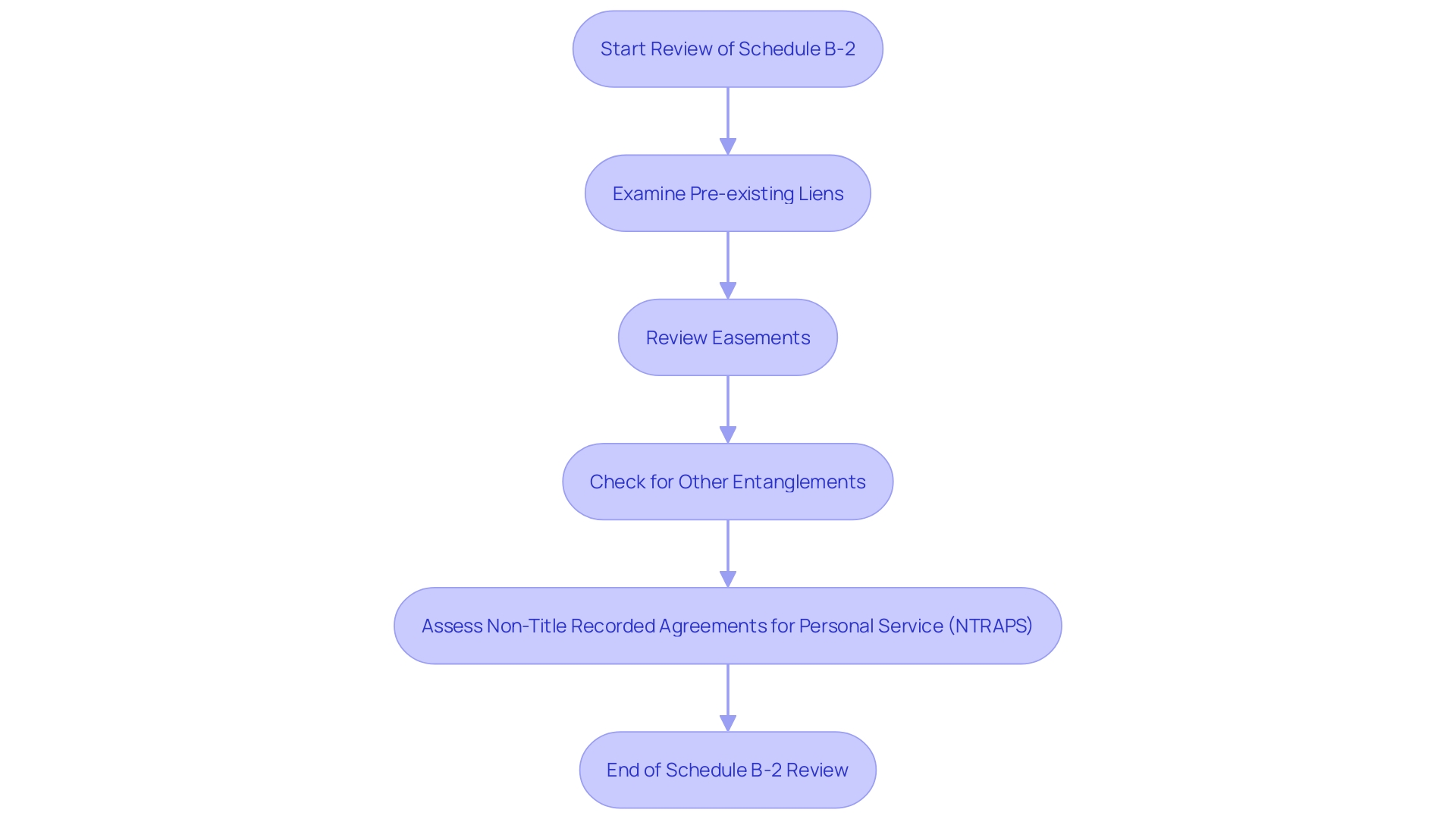

Schedule B-2: Exceptions to Title Policy Coverage

When exploring the details of insurance policies, plays a crucial role. It delineates the exceptions or exclusions to the coverage, which could encompass pre-existing liens, easements, or other entanglements that the policy does not cover. Recognizing and is fundamental to appraising the potential risks tied to the property. In fact, according to First American Financial Corporation, a leading entity in the realm of property ownership and settlement services, innovative technologies and exhaustive data resources are instrumental in navigating these complexities. Moreover, as the property sector develops, it's clear that almost one-third of all protection claims arise from problems not documented in public records, emphasizing the significance of thorough examination of Schedule B-2. Given the significance of the in safeguarding ownership rights, as emphasized by the American Land Title Association (ALTA), it is crucial for individuals involved in real estate transactions to have a thorough understanding of the intricacies of .

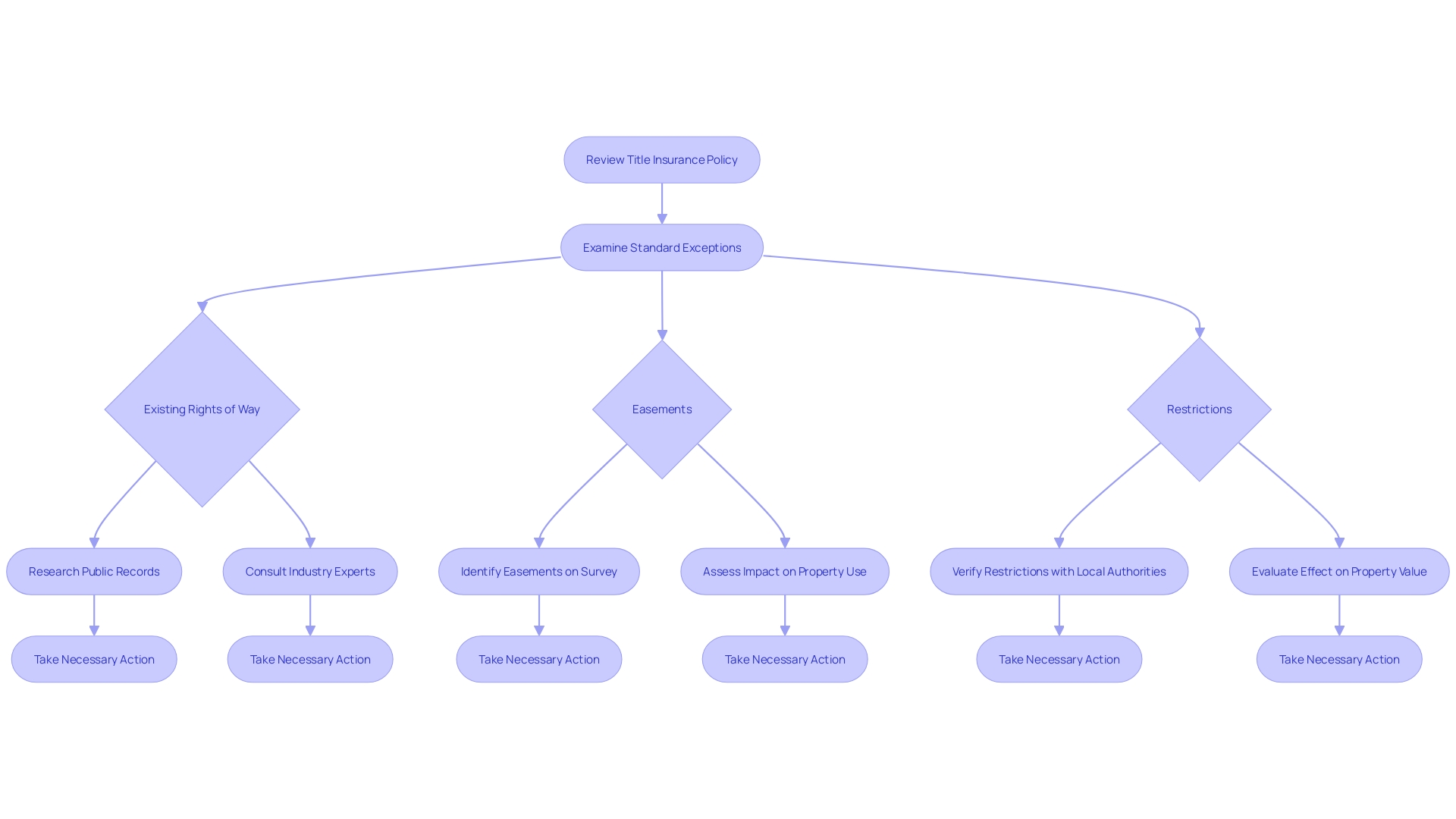

Understanding Standard Exceptions

policies often include that exclude certain items from coverage, such as existing rights of way, easements, and various restrictions that have been made public in the records. These exclusions are essential for owners to understand because they outline the restrictions and privileges that may impact the use and ownership of the premises. The American Land Title Association (ALTA) advises that careful examination of these standard exceptions is a key part of safeguarding rights in real estate transactions. In particular, easements may have a substantial impact on the property’s value and potential use, which is why understanding the specific details and implications of these standard exceptions is essential for safeguarding the interests of all parties involved in the transaction. With the real estate sector evolving and technology advancing, companies like First American Financial Corporation are at the forefront of , providing innovative solutions to the challenges of researching titles—highlighting the importance of staying informed about the intricacies of protecting property rights in an ever-changing market. As mentioned, industry experts, including individuals from First American, with its remarkable $7.6 billion revenue in 2022, highlight the importance of thorough research in examining public records and the crucial role of protecting the title in avoiding financial loss caused by . This underscores the significance of comprehending standard exceptions as a fundamental component of a robust risk management strategy in real estate transactions.

Reviewing and Addressing Requirements and Exceptions

The examination of Schedules B-1 and B-2 in an insurance commitment is essential to protect the marketability of a real estate. This meticulous process includes verifying the continuity of the ownership history, known as the , and addressing any defects. might range from unsatisfied liens to illegal property transfers, which can pose significant financial risks. plays a defensive role by offering protection against such title-related issues. The field of expertise, supported by groups like the American Land Title Association (ALTA) and backed by political action committees such as TIPAC, is leading the way in advocating for the integrity of coverage. Companies such as First American Financial Corporation showcase leadership in the field, contributing to the digital transformation of services and influencing important legislative developments through active involvement with lawmakers. With this background of industry support and innovation, a thorough investigation of record records within becomes not only a procedural measure, but a crucial due diligence practice that supports the security of real estate transactions.

Importance of Thorough Review

Thorough examination of the commitment for insuring the ownership is crucial for discovering and reducing possible prior to completing a real estate deal. This process not only secures the property rights of the new owner but also lays the groundwork for a stable insurance coverage plan. For example, First American Financial Corporation, with its strong financial base and cutting-edge technology, showcases leadership in the field by offering comprehensive settlement, risk, and security solutions. Their success, emphasized by a $7.6 billion revenue in 2022 and recognition as one of the best companies to work for, is partly owing to their meticulous attention to detail and digital transformation of the industry.

The significance of the protection coverage is emphasized even more when taking into account the possible defects in ownership that may occur, such as outstanding claims or unauthorized ownership transfers, which have the potential to result in substantial economic hardship. Insurance differs from other insurance products in its preemptive approach to risk management—resolving issues before they manifest into claims, which is reflected in the lower claim rates for insurance compared to other insurance types. This proactive approach is vital for the Director of , whose proficiency in analyzing and interpreting intricate information about ownership is important for avoiding possible legal conflicts and financial inconsistencies in property ownership.

Staying informed about the latest news and legal analyses in the field is also vital, as emphasized by the American Land Title Association (ALTA), which advocates for the on both national and state levels. Regular updates on industry trends, court decisions, and regulatory changes are essential for maintaining the highest standards of research and ensuring the integrity of .

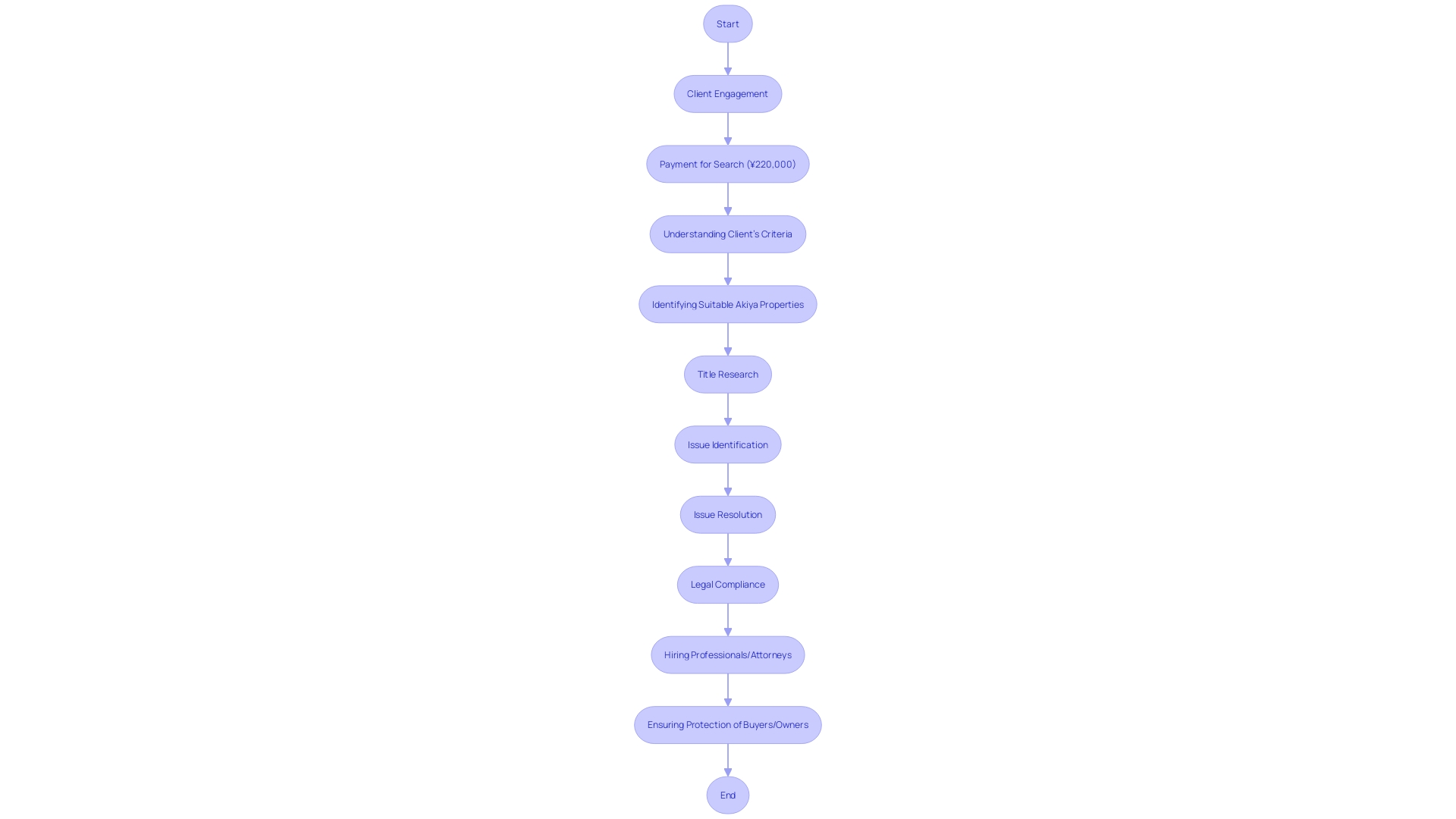

Navigating Complexities with Professional Help

Comprehending the commitments related to protecting real estate transactions is a vital aspect. Having expertise in this particular domain is crucial, as the insurance intended to safeguard the owner against potential defects in the title that could cause financial loss. These defects can range from unresolved legal or financial issues to improper transfer of the property. Hiring a knowledgeable professional or attorney is not only advised but crucial for navigating these complex matters effectively. They bring a wealth of knowledge to the review and resolution process, ensuring that any potential issues are identified and addressed before they can escalate into claims. Their role is significant in streamlining the , which is particularly important given that approximately one-third of all . By enlisting the services of these professionals, property buyers and owners can ensure compliance with legal standards, while also benefiting from the expertise that has been honed by industry leaders, such as First American Financial Corporation, which has a longstanding history of over 130 years in the field and has been recognized for its workplace excellence and innovation.

Conclusion

In conclusion, a Title Insurance Commitment is a crucial document in real estate transactions, providing a detailed analysis of the property's current title status and highlighting any encumbrances or defects that could disrupt the transaction. With the title industry experiencing growth, companies like First American Financial Corporation are leading the way in digitizing title insurance services.

The commitment serves as a safeguard, ensuring secure and undisputed property rights. The American Land Title Association (ALTA) and Title Insurance Political Action Committee (TIPAC) advocate for awareness and solutions to combat threats like wire fraud.

Understanding the components of a title insurance commitment is crucial for professionals involved in real estate transactions. It details the terms, conditions, and exclusions for issuing a title insurance policy, safeguarding the interests of all parties and ensuring the legitimacy of property ownership.

Standard exceptions in title insurance policies exclude certain items from coverage, such as existing rights of way and easements. Recognizing these exceptions is fundamental for protecting property rights and assessing potential risks tied to the property.

The scrutiny of Schedules B-1 and B-2 in a title insurance commitment is crucial for safeguarding the marketability of a property. Verifying the chain of title and addressing any defects ensures the security of real estate transactions.

Diligent analysis of the commitment is pivotal for uncovering and mitigating potential title-related risks before finalizing a property transaction. Staying informed about industry trends and legal analyses is essential for maintaining the highest standards of title research.

Navigating the complexities of title insurance commitments is best done with the help of qualified professionals or attorneys. Engaging their services ensures compliance with legal standards and streamlines the title research process.

In summary, understanding and analyzing title insurance commitments is crucial for safeguarding real estate transactions and protecting property rights. The commitment serves as a vital safeguard, ensuring secure and undisputed property rights in a digital and cybersecurity-focused landscape. Industry leaders like First American Financial Corporation exemplify the importance of comprehensive title insurance commitments in facilitating secure real estate transactions.

Frequently Asked Questions

What is an Assurance Commitment?

An Assurance Commitment outlines the conditions and contingencies under which an assurance policy will be provided for a specific asset. It assesses the property's current status and identifies any encumbrances or defects that could disrupt the transaction.

Why is it important to understand the Assurance Commitment?

Understanding the Assurance Commitment is crucial for safeguarding property rights and ensuring legitimate ownership. It helps identify potential risks and protects all parties involved in the transaction.

What are the key components of an Assurance Commitment?

The key components include: Schedule A (details of the transaction), Schedule B-1 (requirements for issuing a title policy), and Schedule B-2 (exceptions to coverage).

What information is included in Schedule A?

Schedule A provides a snapshot of the transaction, including the names of the parties involved, the purchase price, and the form of insurance policy to be issued, along with any specific conditions that must be satisfied.

What does Schedule B-1 entail?

Schedule B-1 lists specific requirements, such as resolving outstanding debts or legal disputes, that must be fulfilled before a title insurance policy can be issued.

What is covered under Schedule B-2?

Schedule B-2 outlines exceptions to coverage, such as existing liens or easements, which are not covered by the title insurance policy. Understanding these exceptions is essential for assessing potential risks.

Why are standard exceptions important in title insurance?

Standard exceptions outline restrictions and privileges that may impact property ownership and use. Recognizing these exceptions helps protect the interests of all parties in the transaction.

How do companies like First American Financial Corporation contribute to the assurance commitment process?

First American Financial Corporation, with over 130 years of experience, emphasizes innovation in the title insurance sector. Their expertise helps ensure that property rights are secured through thorough examination and digital transformation of services.

What role does the American Land Title Association (ALTA) play in this context?

ALTA advocates for the title field, addressing industry concerns like wire fraud and supporting legal analysis to enhance awareness and solutions for property ownership challenges.

How can professionals ensure compliance with these commitments?

Hiring knowledgeable professionals or attorneys is crucial for navigating the complexities of real estate transactions. They help identify and resolve potential issues before they escalate into claims.

Why is continuous education and awareness important in the title insurance field?

Staying informed about industry trends, legal changes, and potential risks is vital for maintaining the integrity of real estate transactions and ensuring compliance with evolving standards.