Overview

Second lien mortgages allow homeowners to access their property's equity while maintaining their primary mortgage, making them a useful financial tool for various needs such as home improvements or debt consolidation. The article emphasizes the importance of understanding the benefits and risks associated with these loans, particularly in the context of the current housing market trends and the potential complexities they introduce during foreclosure scenarios.

Introduction

In the dynamic landscape of real estate financing, second lien mortgages have emerged as a pivotal tool for homeowners seeking to harness the equity in their properties. This financial instrument not only allows individuals to access additional funds while retaining their primary mortgage but also introduces a layer of complexity that necessitates a thorough understanding of its implications.

As homeowners navigate the challenges of funding renovations, consolidating debts, or addressing unexpected expenses, the relevance of second lien mortgages becomes increasingly apparent. However, with advantages come risks, particularly in scenarios involving foreclosure, where the hierarchy of claims can significantly impact financial outcomes.

This article delves into the essential aspects of second lien mortgages, comparing them to alternative financing options, outlining the benefits and risks, and providing a comprehensive guide on how to obtain these loans while emphasizing the importance of informed decision-making in today’s evolving mortgage market.

What is a Second Lien Mortgage?

A second lien mortgage serves as a financial tool that enables homeowners to utilize the equity in their property while keeping their current primary loan. This type of loan is a second lien mortgage, secured by the property itself, akin to a primary loan, yet it holds a subordinate position in the hierarchy of claims. In the case of default, the primary claim must be fulfilled before any recovery can be achieved by the subsequent creditor.

Property owners may employ additional loans, including a second lien mortgage, for various reasons such as:

- Financing home enhancements

- Consolidating debt

- Addressing substantial costs

Comprehending these loans, particularly the second lien mortgage, is crucial, especially considering current trends indicating their growing significance in the changing housing market. Furthermore, it is crucial to note that safeguards are in place to ensure that information in the NMDB database is handled in accordance with federal privacy laws and the Fair Credit Reporting Act, underscoring the importance of compliance in this sector.

Recent statistics reveal that cities like Los Angeles and Las Vegas have reported low negative equity shares at 0.7% and 0.6%, respectively, indicating a favorable environment for homeowners. Moreover, a case study on home loan delinquency rates emphasizes that the average U.S. homeowner currently has around $315,000 in equity, which acts as a safety net, especially pertinent for individuals contemplating additional borrowing.

Second Lien Mortgages vs. Other Financing Options: Key Differences

Second lien mortgage options, along with home equity lines and refinancing, represent unique strategies for accessing home equity, each with specific traits and consequences.

- A subordinate lien loan operates as a specific borrowing against the property.

- A home equity loan generally offers a lump-sum payment based on the homeowner's equity.

- In contrast, refinancing entails substituting a current loan with a new one, often at a more advantageous interest rate, to enhance economic conditions.

As highlighted by economic expert Sarah Sharkey, every monetary product has pros and cons, including additional loans. This emphasizes the necessity for homeowners to carefully evaluate their economic circumstances and objectives. In 2024, as the market evolves, understanding these distinctions is crucial, especially given that HELOC originations saw a nearly 6% increase year-over-year in the third quarter.

Additionally, after the draw period of a HELOC, there is a repayment period of 20 years, which is an important consideration for homeowners. Moreover, options like Truehold's Sell and Stay transaction enable homeowners to sell their properties while still residing in them as tenants, thus unlocking home equity without the risks linked to a conventional second lien mortgage.

Customer testimonials can also offer valuable insights into individual experiences with these products, helping homebuyers consider their options carefully to determine which path aligns best with their long-term objectives.

Benefits and Risks of Second Lien Mortgages

Second lien mortgage loans provide multiple benefits for homeowners, mainly by granting access to extra funds without the requirement of selling the property. This financial tool can also offer lower interest rates compared to unsecured loans, making it an attractive option for those needing liquidity. As of Q3 2024, subprime borrowers represented 3.5% of loan originations, while super-prime borrowers accounted for 80.6%, indicating a varied borrower landscape that can affect the availability of additional financing.

Archana Pradhan, Principal Economist at the Office of the Chief Economist, observed that home equity counts and amounts rose by 40% and 69%, respectively, year-over-year in 2024, indicating a positive environment for homeowners pursuing additional financing options. Additionally, American households possessed almost $34.9 trillion in real estate equity, highlighting the importance of home equity in relation to second lien mortgage options. However, it is essential to recognize the inherent risks involved.

If a borrower fails to make payments, the lender retains a claim against the property, which could lead to foreclosure. Furthermore, subordinate loans can complicate future refinancing choices, as they introduce multiple layers of debt that creditors must take into account. With default rates on subordinate loans historically varying, homeowners must thoroughly evaluate these risks against the possible advantages.

An understanding of these dynamics is crucial for effective financial planning, especially in a market where the average sales price of homes has reached $501,100 as of Q3 2024, following a significant increase from a low during the pandemic and a peak of $552,600 in Q4 2022.

How to Obtain a Second Lien Mortgage: Steps and Requirements

To successfully secure a second lien mortgage, homebuyers should start by assessing their creditworthiness, as this plays a crucial role in the application process. It's crucial to determine the amount of equity available in the property, as the maximum Total Loan-to-Value (TLTV) ratio for a second lien mortgage and other additional loans is capped at 80%, and at 65% for manufactured homes. Repayment conditions for a second lien mortgage and other additional loans generally span from 5 to 30 years, which is a significant factor for borrowers.

Once these initial evaluations are complete, potential borrowers must gather required documents, which usually consist of:

- Income statements

- Tax returns

- Information about the existing loan

After preparing the documentation, borrowers can approach various lenders to discuss potential options for a second lien mortgage. Freddie Mac states that,

The primary goal of this proposed new product is to provide borrowers a lower cost alternative to a cash-out refinance in higher interest rate environments,

illustrating the evolving opportunities in this market.

Additionally, a Home Equity Line of Credit (HELOC) operates similarly to a credit card, allowing borrowers to access funds based on home equity during a set draw period before transitioning to repayment. Therefore, comparing offers from multiple lenders is advisable to secure the most favorable terms. The recent FHFA request for feedback on the competitive environment of these products emphasizes the significance of thorough research and knowledgeable decision-making in the subsequent charge loan application process.

Understanding Second Lien Mortgages in Foreclosure Scenarios

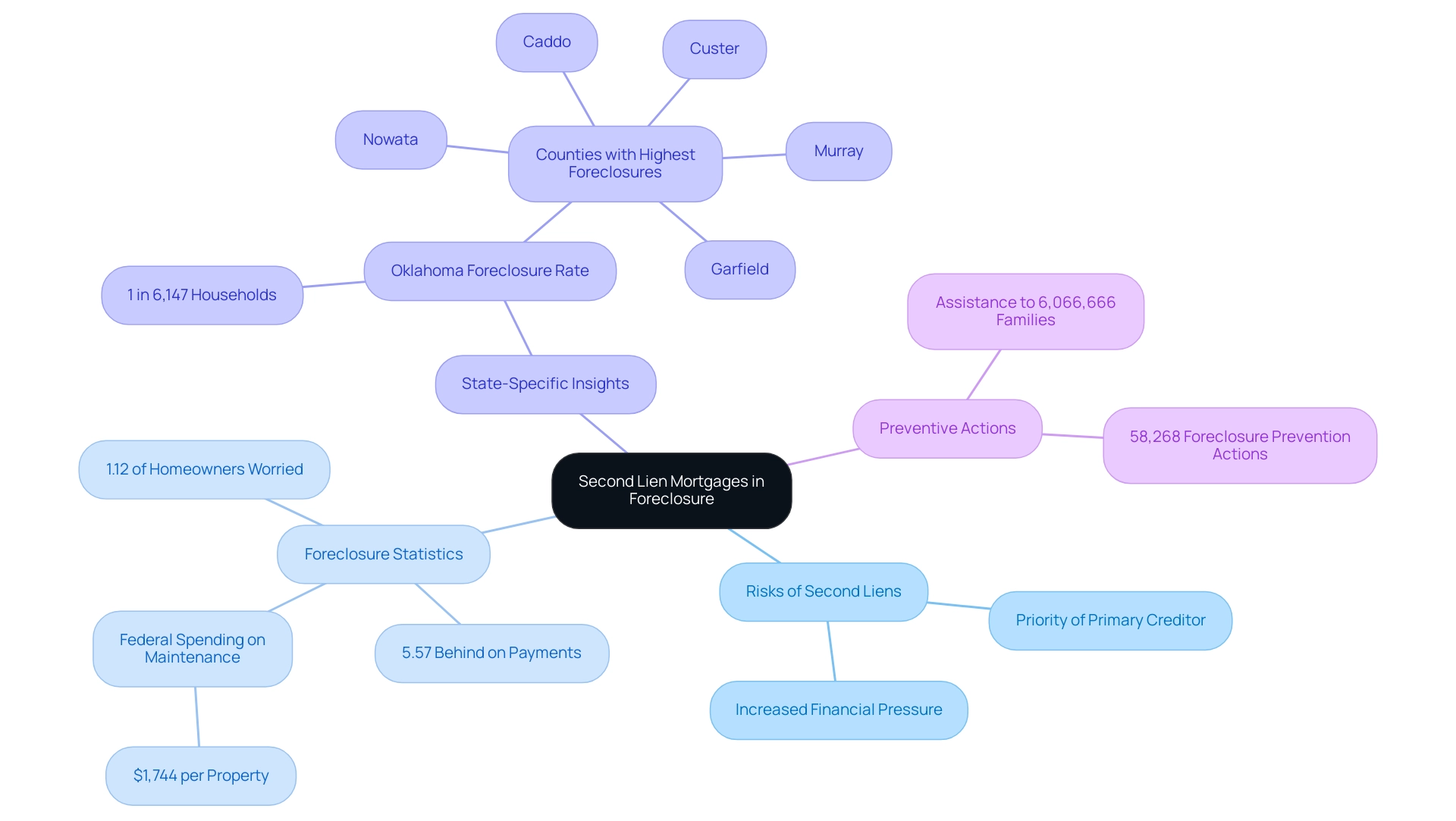

Second position loans introduce significant complexities in foreclosure situations. When a homeowner defaults, the primary creditor has priority over the proceeds from the property's sale, which often puts additional lenders at risk of losing their investment if the sale does not cover the first debt's balance. At the start of 2021, 1.12% of homeowners voiced worries about foreclosure, with 5.57% reported as being behind on loan payments, indicating a challenging environment for many.

In this context, it’s essential for prospective homebuyers to understand the consequences of assuming an additional loan. As pointed out by foreclosure experts, the risks linked to additional claims can worsen monetary pressures during foreclosure, frequently resulting in adverse outcomes. For instance, in Oklahoma, a state with a foreclosure rate of one in every 6,147 households, the counties of Nowata, Caddo, Garfield, Custer, and Murray faced the highest foreclosure instances.

Moreover, federal agencies may allocate as much as $1,744 for upkeep per foreclosed property, emphasizing the economic consequences of foreclosure beyond merely loan amounts. As David Bitton, co-founder & Head of Special Projects of DoorLoop, emphasizes, understanding these complexities is vital for homeowners. Additionally, during the first quarter of 2023, there were 58,268 recorded foreclosure prevention actions, helping approximately 6,066,666 families and individuals, showcasing ongoing efforts to mitigate foreclosure risks.

Such statistics illustrate the heightened vulnerability that homeowners with a second lien mortgage may experience during financial distress, making it imperative for buyers to approach second lien mortgages with caution.

Conclusion

Accessing the equity in a home through second lien mortgages can provide homeowners with much-needed financial flexibility. These loans allow individuals to fund renovations, consolidate debts, or manage unexpected expenses while still maintaining their primary mortgage. However, understanding the nuances of second lien mortgages is essential, particularly in light of their subordinate position in the event of foreclosure. Homeowners must be aware of the risks involved, as failure to meet payment obligations can lead to significant financial repercussions.

Comparing second lien mortgages with other financing options, such as home equity loans and refinancing, reveals unique advantages and disadvantages. Each option caters to different financial needs and circumstances, emphasizing the importance of thorough evaluation and informed decision-making. As the market continues to evolve, so too do the opportunities available for leveraging home equity, making it crucial for homeowners to stay informed about their options.

Navigating the process of obtaining a second lien mortgage involves careful assessment of creditworthiness and understanding the necessary documentation and requirements. By comparing offers from multiple lenders and being aware of market trends, borrowers can secure favorable terms that align with their financial goals. Ultimately, a well-informed approach to second lien mortgages can empower homeowners to effectively manage their finances while minimizing potential risks, particularly in challenging scenarios like foreclosure. As the landscape of real estate financing continues to change, knowledge and preparedness will remain key components for homeowners considering this valuable financial tool.

Frequently Asked Questions

What is a second lien mortgage?

A second lien mortgage is a financial tool that allows homeowners to use the equity in their property while maintaining their existing primary loan. It is secured by the property but holds a subordinate position in the hierarchy of claims, meaning the primary loan must be repaid first in the event of default.

What are some common reasons homeowners might use a second lien mortgage?

Homeowners may use a second lien mortgage for various purposes, including financing home enhancements, consolidating debt, and addressing substantial costs.

Why is it important to understand second lien mortgages in the current housing market?

Understanding second lien mortgages is crucial due to their growing significance in the changing housing market, as well as the need for compliance with federal privacy laws and the Fair Credit Reporting Act regarding information handling.

What recent statistics indicate the equity situation for homeowners in cities like Los Angeles and Las Vegas?

Recent statistics show that Los Angeles and Las Vegas have low negative equity shares at 0.7% and 0.6%, respectively, indicating a favorable environment for homeowners. Additionally, the average U.S. homeowner currently has around $315,000 in equity, which serves as a safety net for those considering borrowing.

How do second lien mortgages compare to other home equity options?

Second lien mortgages, home equity loans, and refinancing are different strategies for accessing home equity. A second lien mortgage is a subordinate loan against the property, a home equity loan provides a lump-sum payment based on equity, and refinancing replaces an existing loan with a new one, often at a better interest rate.

What is a Home Equity Line of Credit (HELOC) and what should homeowners know about it?

A HELOC is a line of credit secured by home equity that allows homeowners to borrow as needed. After the draw period, there is a repayment period of 20 years, which is an important consideration for homeowners.

What alternative options exist for accessing home equity?

Alternatives like Truehold's Sell and Stay transaction allow homeowners to sell their properties while continuing to live in them as tenants, thus unlocking home equity without the risks associated with traditional second lien mortgages.

How can customer testimonials be beneficial for homeowners considering these financial options?

Customer testimonials can provide valuable insights into individual experiences with second lien mortgages and other financial products, helping homeowners make informed decisions that align with their long-term objectives.