Overview

The article titled "Understanding 2nd Lien Loans: A Complete Tutorial for Real Estate Professionals" provides a comprehensive overview of the characteristics, benefits, risks, and application processes associated with second lien loans, specifically tailored for real estate professionals. It underscores that second lien loans empower homeowners to utilize their property equity to meet various financial needs. Furthermore, it accentuates the necessity of comprehending their subordinate position within the mortgage financing hierarchy, which entails both risks and strategic advantages for borrowers.

Introduction

Navigating the realm of second lien loans presents a significant opportunity for homeowners aiming to leverage their property equity while managing their primary mortgage. Often referred to as junior liens, these loans enable access to additional funds for various purposes, including home improvements and debt consolidation.

However, the complexities inherent in these financial products—such as their subordinate nature and associated risks—demand a thorough understanding from both borrowers and real estate professionals. As homeowner equity continues to rise, the importance of second lien loans becomes increasingly evident.

Therefore, it is essential to explore their features, benefits, and potential pitfalls in today’s dynamic market.

What is a Second Lien Loan?

A subordinate lien, often referred to as a 2nd lien, is a secured credit that ranks below a primary or first lien on a property. In cases of default, the primary lienholder is prioritized for repayment, rendering the position of the subsequent lienholder riskier. These credits empower homeowners to leverage their property equity while maintaining their primary mortgage, serving various purposes such as home enhancements, debt consolidation, or addressing other financial needs.

Understanding this hierarchy is essential for real estate professionals, as it directly influences the risk and return associated with these credits. Recent trends indicate a rising interest in , particularly as homeowner equity continues to increase. In 2021, the total amount of equity extracted through cash-out refinancing reached an estimated $248 billion, underscoring the growing reliance on home equity for financial flexibility.

An analysis of refinance transactions from 1998 to 2021 revealed noteworthy trends in cash-out refinancing, where borrowers extracted equity from their homes. In 2021, cash-out refinance borrowers withdrew an average of $60,214, which reflects 14.3% of their property's worth.

As of early 2023, statistics indicate that 8.3% of low equity mortgages are in the Government-backed sector, with 1.5% for Enterprise acquisitions and 2.0% for Other Conventional financing. This data highlights the evolving landscape of subordinate financing, particularly the role of 2nd lien, and its significance in the real estate market. Experts assert that subsequent secured borrowing can serve as a strategic resource for homeowners seeking to fund renovations or consolidate debts, thereby enhancing property value and economic stability.

For instance, many property owners capitalize on these financial options specifically for home enhancements, which can significantly elevate the overall worth of their estate.

Furthermore, as homeowner equity continues to rise, more financiers are introducing home equity borrowing products, reflecting the increasing interest in these financial instruments. Anju Vajja, a Research Officer at the FHFA, noted that on June 30, 2023, the FHFA released the quarterly National Mortgage Database Aggregate Statistics, encompassing outstanding first priority, closed-end residential mortgages from the first quarter of 2013 through the same period of 2023. In conclusion, subordinate financing represents a vital aspect of the real estate funding landscape, providing homeowners access to equity while presenting unique considerations for real estate professionals navigating this complex market.

Grasping these financial agreements is imperative for Directors of Title Research, as it impacts their responsibilities in title research and property ownership verification.

Key Features of Second Lien Loans

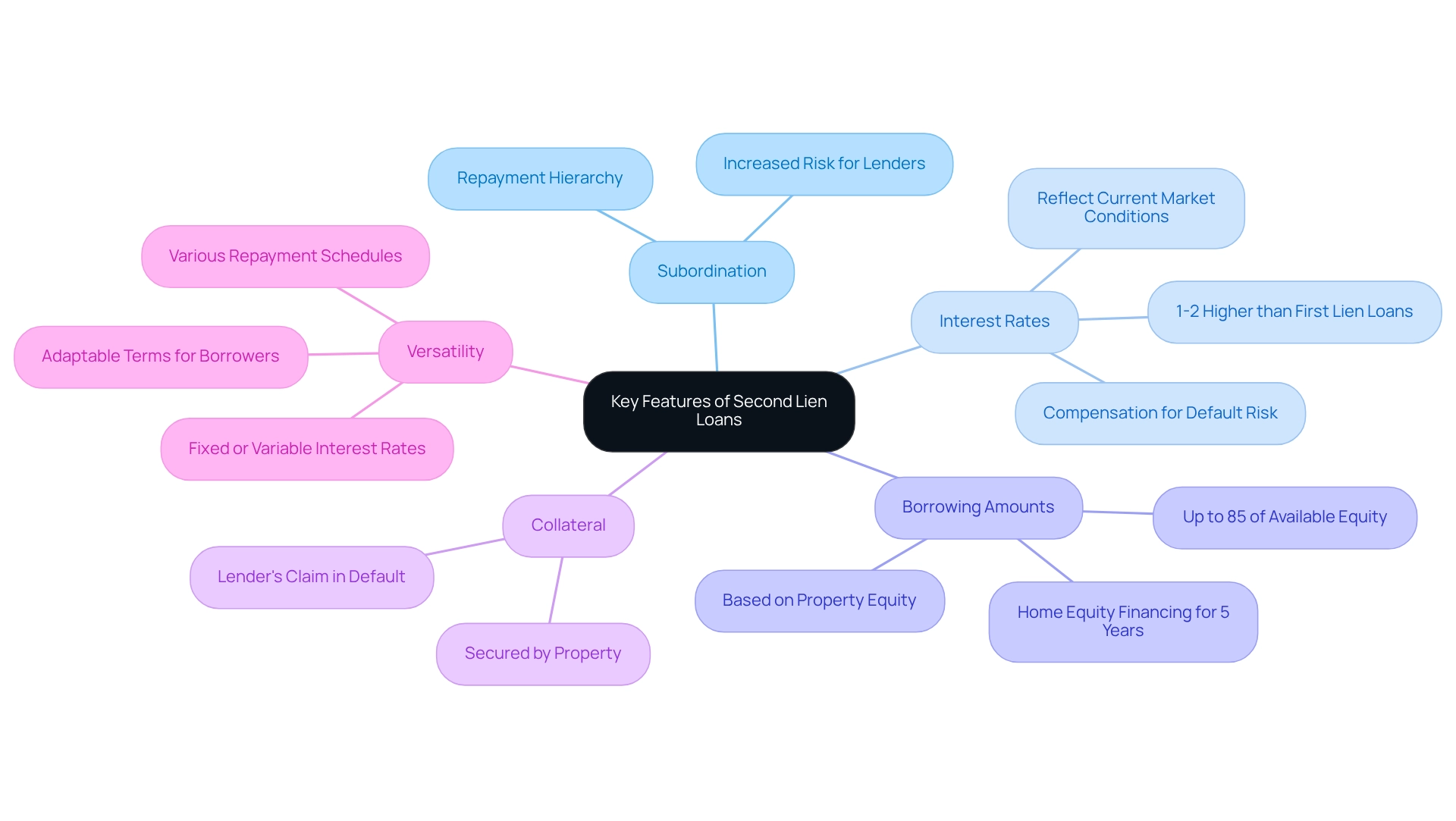

Second lien loans feature several key characteristics that set them apart from first lien loans:

- Subordination: These loans are subordinate to first lien loans, meaning that in the event of a default, second lien lenders are repaid only after first lien lenders have been satisfied. This hierarchy heightens the risk for additional secured creditors, which is evident in the conditions of the financing.

- Interest Rates: Generally, subordinate financing options have elevated interest rates compared to primary financing options. This is primarily due to the increased risk associated with their subordinate position. As of 2025, average interest rates for subordinate financing are anticipated to be roughly 1-2% greater than those for primary financing, reflecting current market conditions and lender evaluations. According to a lender, "The risk linked with subordinate financing requires elevated interest rates to guarantee that lenders are rewarded for the possible default risk."

- Borrowing Amounts: The sum accessible through an additional secured financing option is typically based on the equity in the property. This equity is calculated as the difference between the property's current market value and the outstanding balance of the first mortgage. Lenders often allow borrowing up to 85% of the available equity, providing homeowners with substantial access to funds. Significantly, home equity financing alternatives are accessible for up to 5 years, making second lien mortgage options a relevant choice for numerous homeowners.

- Collateral: is secured by the property itself, which means that lenders have a claim to the asset in case of default. This security is vital for lenders, as it reduces some of the risks linked to the subordinate nature of these financial products.

- Versatility: One of the attractive aspects of subordinate financing is its versatility. They can be structured with either fixed or variable interest rates and can offer various repayment schedules. This adaptability allows borrowers to choose terms that best fit their financial situations and goals.

In summary, understanding these defining characteristics is crucial for real estate experts navigating the intricacies of second lien financing. By recognizing the implications of subordination, interest rates, amounts borrowed, collateral, and flexibility, professionals can make informed decisions that align with their clients' needs. Furthermore, utilizing technology such as Parse AI can assist title researchers in effectively managing these finances, ultimately enhancing their workflow and decision-making process.

Advantages of Utilizing Second Lien Loans

Second lien loans offer numerous advantages for homeowners seeking to leverage their property equity.

- Access to Capital: These loans empower homeowners to access additional funds without refinancing their primary mortgage, effectively tapping into their home equity. This can be particularly beneficial for those looking to finance significant expenses.

- Reduced Interest Rates Relative to Unsecured Options: Since these secured credits are backed by the property, they typically provide lower interest rates than unsecured options. Consequently, they represent a more economical choice for borrowing, especially for larger amounts.

- Flexible Use of Funds: Borrowers can utilize the funds from a second lien credit arrangement for various purposes, including home renovations, educational expenses, or consolidating higher-interest debts. This flexibility enables homeowners to address multiple monetary needs simultaneously.

- Potential Tax Benefits: In specific circumstances, the interest paid on a second lien may be tax-deductible, offering borrowers further financial advantages. This can enhance the overall cost-effectiveness of the financial agreement.

- Retaining First Mortgage Terms: Homeowners can maintain their existing first mortgage terms, which may include favorable interest rates, while still gaining access to extra funds via a second lien. This aspect is particularly appealing for those who have secured advantageous terms on their primary mortgage.

- Insurance Considerations: It is important to note that flood and/or property hazard insurance may be required for a Home Equity Line of Credit (HELOC), especially for homeowners considering a second lien loan.

- Qualification Factors: To qualify for an additional mortgage, lenders review several factors, including home equity, credit score, credit history, employment history, and debt-to-income ratio. Understanding these criteria can help homeowners prepare for the application process.

- Case Study Insight: A recent case study titled "" highlighted how a well-organized approach to securing a second lien—evaluating equity, checking credit scores, and researching lenders—can streamline the application process and improve approval chances. This demonstrates the practical advantages of subordinate financing in real-world situations.

- Home Renovation Trends: Data shows that a substantial portion of property owners employ a second lien specifically for home improvements, underscoring its appeal as a funding choice for enhancing property value. In fact, many homeowners report average savings when opting for subordinate financing instead of unsecured options, making them a financially prudent choice.

- Expert Perspective: According to A&D Mortgage, "We want to be your go-to partner, providing the resources, expertise, and support to help you grow." This underscores the significance of having an informed partner when navigating the intricacies of subordinate financing.

In summary, subordinate debt not only provides crucial access to capital but also presents a variety of advantages that can greatly enhance a homeowner's economic strategy.

Risks and Considerations of Second Lien Loans

Subordinated debt offers monetary flexibility but carries significant risks that borrowers must evaluate thoroughly:

- Increased Risk of Foreclosure: In the event of default, both primary and subordinated creditors possess the authority to initiate foreclosure actions. This dual threat heightens the risk of property loss, making it imperative for borrowers to understand the implications of taking on a 2nd lien mortgage.

- Increased Debt Load: Adding an extra mortgage, such as a 2nd lien, to existing obligations can substantially elevate a borrower's total debt burden. This situation becomes particularly precarious if income fluctuates, potentially leading to financial strain.

- Potential for Negative Equity: A decline in property values can place borrowers in a challenging position where their debts exceed the home’s value. This negative equity complicates future refinancing options and may restrict the ability to sell the property without incurring a loss, especially when a 2nd lien is involved.

- Complexity of Terms: The terms associated with subordinate financing can often be intricate and difficult to navigate. Borrowers may not fully grasp their responsibilities, resulting in unforeseen financial challenges and risks.

- Impact on First Mortgage: The presence of a 2nd lien can complicate the refinancing process for the primary mortgage. Creditors may require that the additional claim be settled or ranked lower, adding another layer of complexity to the borrower's financial strategy.

As we approach 2025, the landscape for additional claim agreements continues to evolve, with current foreclosure rates highlighting the increased risks associated with these financial products. Experts caution that borrowers should remain vigilant about their debt levels, particularly as economic conditions fluctuate. Real estate professionals underscore the importance of understanding the inherent risks, noting that borrowers can mitigate foreclosure threats by maintaining open communication with lenders and seeking financial guidance when considering .

For instance, a recent analysis revealed that the foreclosure rate for additional secured borrowing options has surged by 15% compared to last year, underscoring the necessity for borrowers to proceed with caution. Moreover, industry specialists advocate that leveraging technology, such as the services offered by Parse AI, can lead to significant cost savings compared to traditional title research methods, empowering borrowers to make more informed decisions about their financial commitments.

In conclusion, recognizing the dangers associated with subordinate financing is essential for making sound financial choices. By understanding these risks and utilizing available resources, borrowers can navigate the complexities of subordinate financing more effectively.

Qualifying for a Second Lien Loan

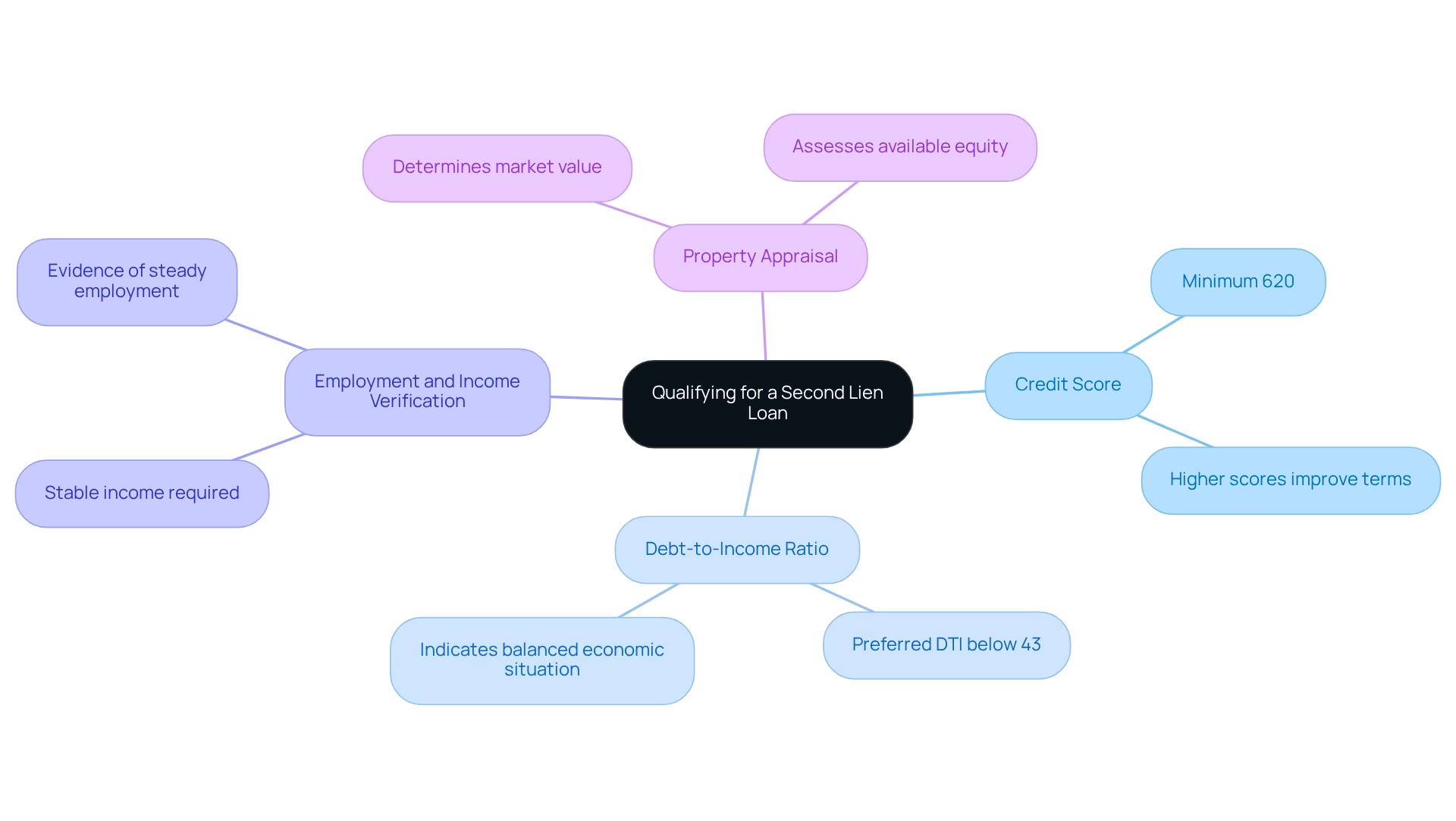

To qualify for second lien financing, borrowers must typically satisfy several key criteria:

- Credit Score: Lenders generally require a minimum credit score of around 620. However, achieving a higher score can significantly enhance borrowing conditions, making it beneficial for borrowers to maintain a strong credit profile. As Bruce Strong, CEO of Mpact Limited, emphasizes, a solid economic foundation is crucial for navigating the complexities of securing loans. A minimum equity stake of 15-20% in the property is usually necessary for obtaining . This equity serves as collateral for a second lien, thus reassuring lenders of the borrower's investment in the property. Statistics indicate that borrowers with a higher equity percentage are more likely to secure favorable financing terms, reinforcing the importance of maintaining property value.

- Debt-to-Income Ratio: Lenders evaluate the borrower's debt-to-income (DTI) ratio to assess their capacity to manage additional second lien obligations. A DTI ratio below 43% is often preferred, indicating a balanced economic situation.

- Employment and Income Verification: Demonstrating stable income and employment is crucial. Lenders need evidence of steady income to guarantee that borrowers can fulfill their repayment responsibilities.

- Property Appraisal: An appraisal may be necessary to determine the property's present market value and the equity accessible for the financing. This step is crucial for both the lender and the borrower to comprehend the economic landscape.

In 2025, the average credit score needed for additional secured borrowing remains approximately 620, indicating a steady benchmark in the lending sector. Effective applications frequently highlight borrowers who not only satisfy these criteria but also exhibit a proactive approach to managing their economic well-being. Expert advice suggests that potential borrowers should focus on improving their credit scores and maintaining a low DTI ratio to enhance their chances of approval.

Furthermore, community support initiatives, such as those facilitated by the Community Foundation, can play a significant role in helping individuals secure funding for real estate projects, thereby contributing to broader community development efforts.

Navigating the Application Process for Second Lien Loans

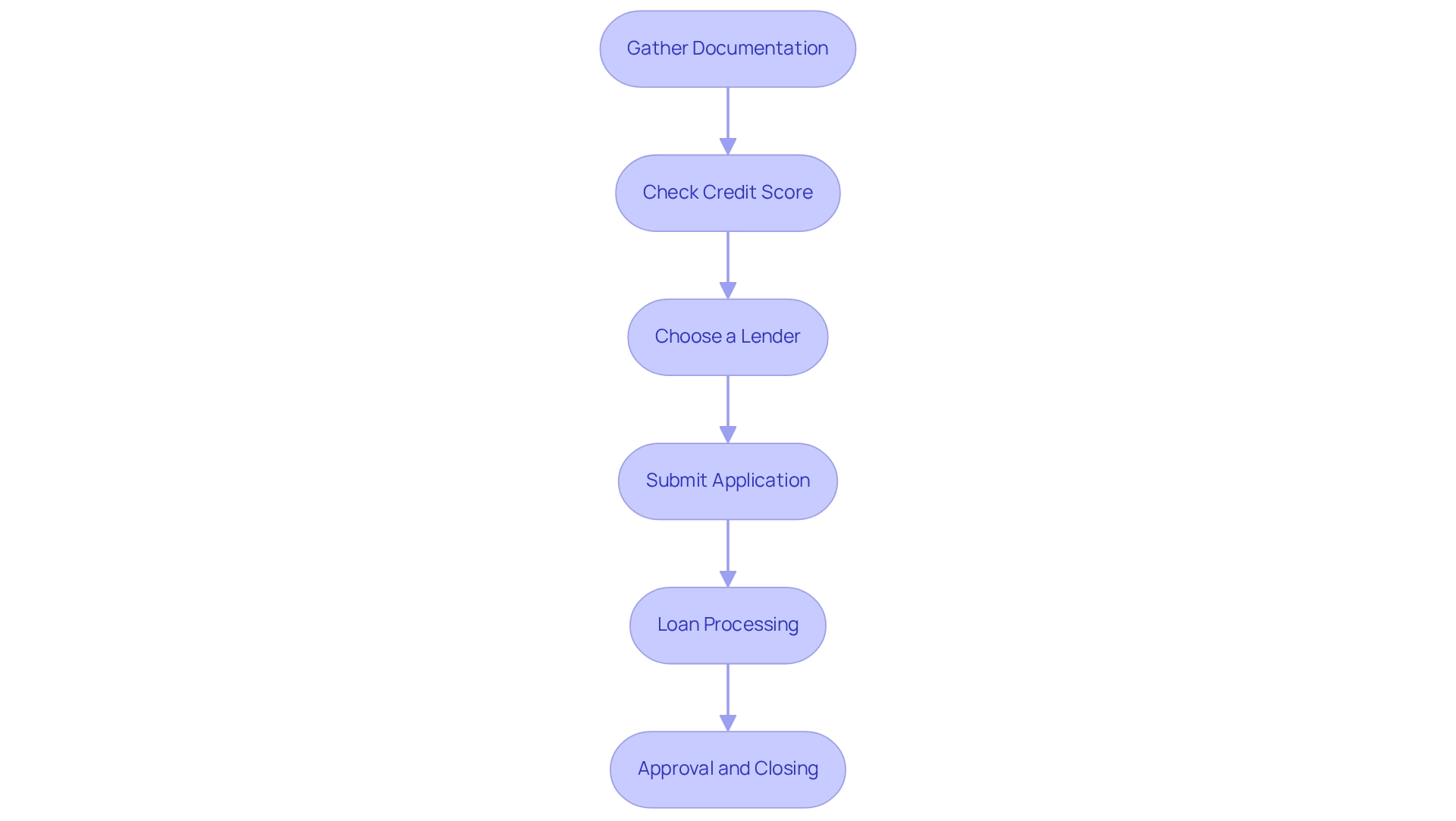

The application process for encompasses several essential steps designed to prepare both the borrower and lender for a successful transaction.

- Gather Documentation: Initiate the process by collecting vital documents, including proof of income, recent tax returns, and comprehensive details about existing debts. This documentation is crucial for demonstrating financial stability and repayment capability. Accurate documentation is paramount, as evidenced by the case study on Fee Only Facilities Reporting Criteria, which underscores the importance of compliance during the application process.

- Check Credit Score: Review your credit report for inaccuracies and ensure your credit score meets the lender's requirements. A higher credit score significantly enhances your chances of approval and may lead to more favorable financing conditions. Expert insights indicate that proactively addressing potential credit issues can facilitate a smoother application experience.

- Choose a Lender: Conduct thorough research to compare various lenders, specifically seeking those offering competitive terms and rates for second lien financing. Understanding the lender's reputation and customer service can also play a pivotal role in your decision-making process.

- Submit Application: Accurately complete the financing application form and submit it alongside the collected documentation. It is crucial to ensure that all information is current to prevent processing delays.

- Loan Processing: Following application submission, the lender will review the application, conduct a credit check, and may require a property appraisal to determine its market value. This step is essential for assessing the risk associated with the financing. According to the FR Y-14Q Schedule M.1, the prevalence of first mortgages and first lien loans provides context for the market landscape of second lien loans.

- Approval and Closing: If your application is approved, you will receive a financing proposal detailing the terms and conditions. Upon acceptance, the financing proceeds to closing, where funds are disbursed, enabling you to effectively utilize the equity in your property. The Federal Reserve Board recommends reporting disbursements, less any refunds received during the month, which is crucial when discussing the financial aspects of the application process. In 2025, the average duration for processing subordinate financing applications is noted to be approximately 30 to 45 days, contingent upon the lender's efficiency and the thoroughness of the submitted documentation. To expedite this process, borrowers are advised to prepare diligently by ensuring all required documents are readily available and maintaining a good credit standing. A study by S&P Global highlights that repeat defaults are more likely among private credit borrowers, emphasizing the importance of borrower preparedness and risk assessment. Mortgage brokers stress the significance of clear communication with lenders throughout the application to facilitate timely approvals.

Second Lien Loans in the Context of Other Financing Options

Second lien loans represent one of several financing avenues available to homeowners, each with distinct characteristics and implications.

- Home Equity Lines of Credit (HELOCs): Similar to second lien loans, HELOCs enable homeowners to tap into their equity. However, HELOCs function as a revolving credit line, allowing borrowers to withdraw funds as needed, which can be advantageous for ongoing expenses.

- First Mortgages: First mortgages generally offer lower interest rates and are prioritized in repayment, making them a more secure option for lenders. This security often translates to better terms for borrowers, particularly those with strong credit profiles.

- Personal Financing: Unsecured personal financing usually has higher interest rates in comparison to subordinate financing. While they do not require collateral, making them accessible to borrowers without significant equity, the cost of borrowing can be substantially higher.

- Cash-Out Refinancing: This method allows homeowners to refinance their first mortgage for an amount greater than what they owe, receiving the difference in cash. While it can provide substantial funds, it often comes with higher closing costs and resets the mortgage term, which may not be ideal for all homeowners.

- Mezzanine Financing: In the realm of commercial real estate, mezzanine financing serves as a bridge between debt and equity. It generally entails greater risk and return profiles than subordinate financing, making it appropriate for particular investment strategies but less prevalent for conventional residential funding.

In 2022, the average down payment on homes across the 50 largest U.S. metros was $84,983, reflecting the significant equity that homeowners can leverage through . Significantly, applications for second lien loans face a denial rate of 26 percent among Asian borrowers, with an overall purchase denial rate of 13.4 percent, emphasizing the accessibility challenges linked to these financial products. As of 2024, the landscape of subordinate financing continues to evolve, with 7,087 second lien originations reported under the Home Ownership and Equity Protection Act (HOEPA), indicating a steady interest in this financing method.

Furthermore, the case study titled "Foreclosure Trends Post-Pandemic" reveals that in 2024, there were 174,100 new foreclosures, an increase from 150,820 in 2023, yet still significantly lower than the peak during the Great Recession. This implies that the housing market is stabilizing, which may affect the demand for subordinate financing. The market portion of subordinate secured credit is becoming more competitive in relation to HELOCs and personal credit, especially as homeowners pursue adaptable financing options in a recovering housing market.

As Dan Shepard noted, "Content was accurate at the time of publication," reinforcing the reliability of the information presented.

Debunking Myths About Second Lien Loans

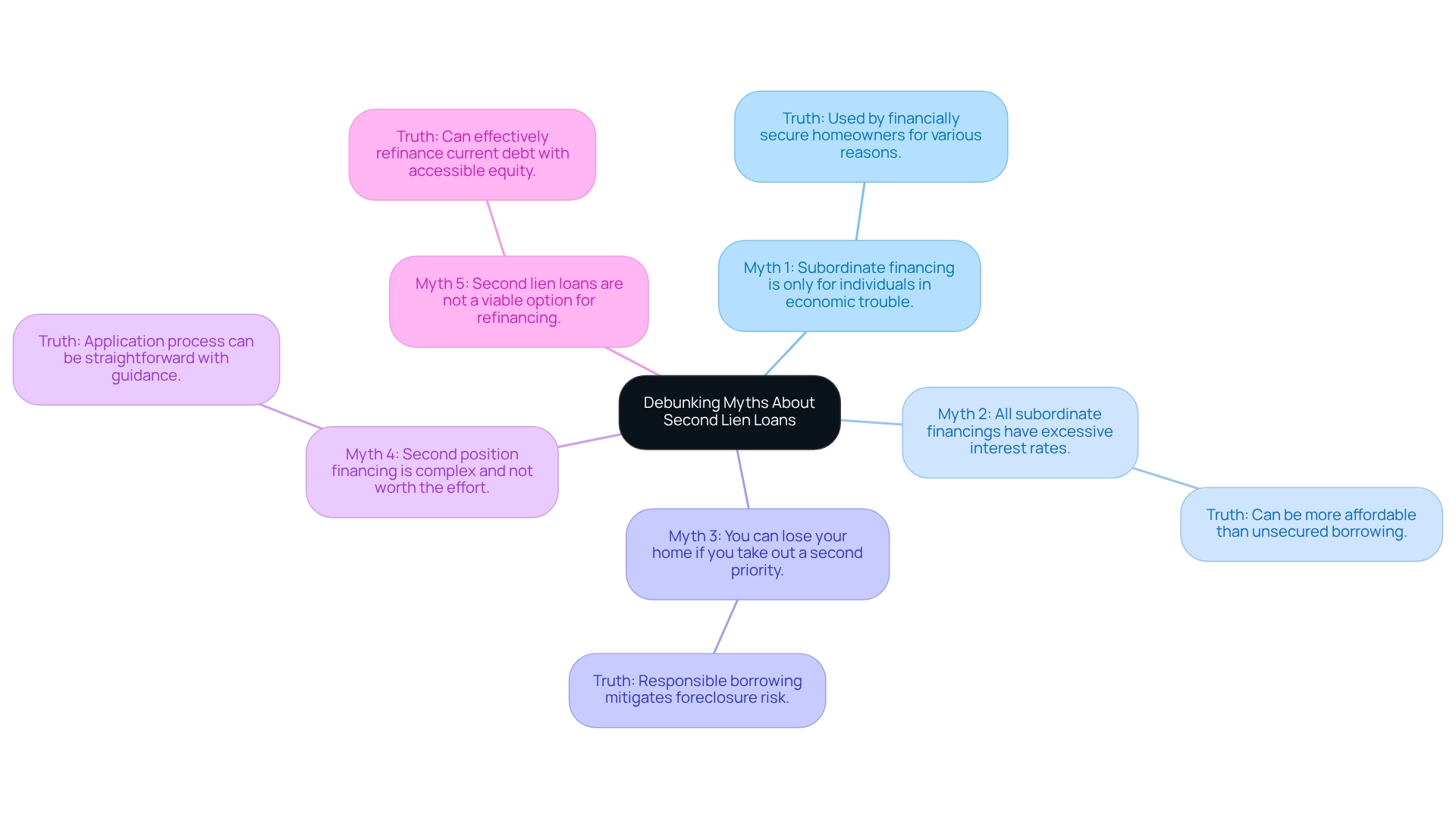

Many misconceptions regarding subordinate financing can mislead borrowers, causing confusion about their actual characteristics and possible advantages.

Myth 1: Subordinate financing is only for individuals in economic trouble. Contrary to this belief, many financially secure property owners utilize additional financing to access their home equity for various reasons, including home enhancements or debt consolidation. In fact, a significant portion of borrowers mistakenly believes that subordinate financing is exclusively for those facing monetary hardship.

Myth 2: All subordinate financings have excessive interest rates. While it is true that second lien financing typically carries higher interest rates than first priorities, they can still be more affordable than unsecured borrowing, making them a viable option for many borrowers.

Myth 3: You can lose your home if you take out a second priority. Although there is a risk of foreclosure if payments are not made, responsible borrowing and timely repayment significantly mitigate this risk, enabling homeowners to manage their debt effectively. As Mark J. Wolfson observes, the act provides specific 'checks and balances' that pertain to the involved parties, often necessitating court oversight of a creditor’s security enforcement actions.

Myth 4: Second position financing is complex and not worth the effort. With appropriate guidance, the application process can be straightforward, and the potential benefits often outweigh the perceived complexities. The transition rule ensuring that existing judgment liens are perfected under the new law as of October 1, 2023, further simplifies the landscape for borrowers.

Myth 5: Second lien loans are not a viable option for refinancing. Indeed, they can serve as an effective instrument for refinancing current debt, particularly when ample equity is accessible, offering borrowers increased monetary flexibility through a second lien. The case study of Parse AI illustrates how technology can streamline , assisting real estate professionals in guiding clients through these choices.

Comprehending these myths and the truths behind them enables borrowers to make informed decisions regarding their monetary options. By dispelling these misunderstandings, real estate experts can more effectively assist their clients in navigating the intricacies of subordinate financing. The material in this discussion has been reviewed by human editors to ensure credibility, underscoring the significance of precise information in understanding complex monetary products.

Best Practices for Managing Second Lien Loans

To effectively manage second lien loans, real estate professionals must adopt the following best practices:

- Educate Clients: It is crucial to ensure that clients fully comprehend the terms, risks, and benefits associated with second lien loans. Providing clear, comprehensive information empowers clients to make informed decisions. Recent data indicates that effective client education significantly reduces misunderstandings regarding borrowing conditions, leading to improved monetary outcomes.

- Evaluate Economic Well-being: Assist clients in assessing their financial situation to determine if an additional secured borrowing option aligns with their needs. This assessment should encompass a thorough review of their income, expenses, and existing debt obligations. A case study involving Marcy's Foods, Inc. underscores the necessity of financial assessments; the company faced operational challenges that demanded meticulous financial planning to navigate successfully.

- : Staying informed about fluctuations in interest rates and property values is vital, as these factors can greatly influence the viability of subordinate financing. Regularly reviewing market trends enables professionals to advise clients more effectively. Recent news highlights that interest rates are anticipated to fluctuate, potentially impacting the attractiveness of subordinate debt. Encourage responsible borrowing by advising clients to borrow only what they can comfortably repay, including any potential second lien, while considering their overall debt load. This approach mitigates the risk of economic strain and promotes sustainable borrowing practices. As investment consultant Claire Marcy aptly states, 'Responsible borrowing is essential to sustaining economic well-being, particularly when evaluating second lien debts.'

- Review Financing Terms Regularly: Urge clients to periodically revisit their financing terms and explore refinancing options, particularly if market conditions become more favorable. This proactive strategy can lead to superior financial outcomes.

By implementing these best practices, real estate professionals can enhance their clients' understanding and management of second lien loans, ultimately fostering a more responsible borrowing environment.

Conclusion

Second lien loans present homeowners with a significant opportunity to leverage their property equity while retaining their primary mortgage. By comprehending their distinct features, benefits, and potential risks, borrowers can make informed decisions tailored to their financial needs. These loans not only facilitate access to capital for home improvements and debt consolidation but also offer advantages such as lower interest rates compared to unsecured loans and potential tax benefits.

However, it is essential to acknowledge the risks associated with second lien loans, which include a heightened likelihood of foreclosure and an increased debt burden. Borrowers must approach these financial products with caution, ensuring they fully understand their obligations and the ramifications of incurring additional debt.

As the market for second lien loans continues to evolve, real estate professionals play a pivotal role in educating clients and guiding them through the application process. By dispelling myths and advocating for responsible borrowing practices, they can assist homeowners in navigating this complex landscape effectively. Ultimately, grasping the nuances of second lien loans empowers homeowners to utilize their equity strategically, thereby enhancing their financial flexibility and stability in today’s dynamic market.

Frequently Asked Questions

What is a subordinate lien?

A subordinate lien, or 2nd lien, is a secured credit that ranks below a primary or first lien on a property. In the event of default, the primary lienholder is prioritized for repayment, making the position of the subsequent lienholder riskier.

What are the purposes of obtaining a subordinate lien?

Homeowners can use subordinate liens to leverage their property equity for various purposes, including home enhancements, debt consolidation, or addressing other financial needs.

Why is understanding the hierarchy of liens important for real estate professionals?

Understanding the hierarchy of liens is essential for real estate professionals as it directly influences the risk and return associated with these credits.

What recent trends have been observed in 2nd lien financing?

There has been a rising interest in 2nd lien financing, particularly as homeowner equity continues to increase. In 2021, cash-out refinancing reached an estimated $248 billion, indicating a growing reliance on home equity for financial flexibility.

What is the average amount withdrawn by cash-out refinance borrowers in 2021?

In 2021, cash-out refinance borrowers withdrew an average of $60,214, which reflects 14.3% of their property's worth.

What statistics are available regarding low equity mortgages as of early 2023?

As of early 2023, 8.3% of low equity mortgages are in the Government-backed sector, with 1.5% for Enterprise acquisitions and 2.0% for Other Conventional financing.

What are the key characteristics of second lien loans?

Key characteristics include subordination to first lien loans, generally higher interest rates, borrowing amounts based on property equity, being secured by the property, and offering versatility in terms of structure and repayment schedules.

What advantages do second lien loans offer homeowners?

Advantages include access to capital without refinancing the primary mortgage, reduced interest rates compared to unsecured options, flexible use of funds, potential tax benefits, retaining favorable first mortgage terms, and insurance considerations.

What factors do lenders consider when qualifying for a second lien loan?

Lenders review several factors, including home equity, credit score, credit history, employment history, and debt-to-income ratio.

How do homeowners typically use second lien loans for home renovations?

A substantial portion of property owners use second lien loans specifically for home improvements, which can enhance property value and provide average savings compared to unsecured borrowing options.