Introduction

The complexities of the real estate transaction process are multifaceted, but one of the most critical stages is the title search, which meticulously checks public records to confirm the rightful ownership of a property. This essential scrutiny is designed to bring to light any issues or defects that could affect the transfer of property ownership. With the introduction of cutting-edge proprietary title search technology, companies like Pippin are modernizing this process for the digital age, combining their advanced systems with the expertise of top-tier title searchers.

In today's fast-paced real estate market, the seamless integration of technology and human expertise is paramount. First American Financial Corporation, a leader in providing title, settlement, and risk solutions, stands as a testament to this integration with over 130 years of experience and a strong financial foundation. They have embraced innovation and lead the charge in the industry's digital transformation, earning recognition as one of Fortune Magazine's 100 Best Companies to Work For.

The title search itself casts a wide net, reviewing land records, court dockets, and more to ensure a seller's legal right to sell the property and pinpoint any liens that must be resolved before closing. Beyond the basic search, title insurance offers additional protection against unforeseen issues such as errors in public records, undisclosed liens, or fraud, covering potential legal fees and financial loss. With the commitment of organizations like the American Land Title Association (ALTA) to improve homebuyer education, the path to homeownership becomes more accessible and less daunting, honoring the American dream.

What is a Title Search?

The complexities of the are multifaceted, but one of the most critical stages is the title search, which meticulously checks public records to confirm the rightful ownership of a property. This essential scrutiny is designed to bring to light any issues or defects that could affect the transfer of . With the introduction of cutting-edge , companies like Pippin are modernizing this process for the digital age, combining their advanced systems with the expertise of top-tier title searchers.

In today's fast-paced real estate market, the seamless integration of technology and human expertise is paramount. First American Financial Corporation, a leader in providing title, settlement, and risk solutions, stands as a testament to this integration with over 130 years of experience and a strong financial foundation. They have embraced innovation and lead the charge in the industry's digital transformation, earning recognition as one of Fortune Magazine's 100 Best Companies to Work For.

The title search itself casts a wide net, reviewing land records, court dockets, and more to ensure a seller's legal right to sell the property and pinpoint any liens that must be resolved before closing. Beyond the basic search, offers additional protection against unforeseen issues such as errors in public records, undisclosed liens, or fraud, covering potential legal fees and financial loss. With the commitment of organizations like the to improve , the path to homeownership becomes more accessible and less daunting, honoring the American dream.

Why is a Title Search Important?

A is a critical component in the acquisition of property, designed to protect purchasers from inheriting any pre-existing liabilities attached to the real estate in question. It is a thorough examination that uncovers liens, encumbrances, and other claims that could potentially jeopardize the marketability of the title. The process involves a meticulous review of historical records to ensure the without , safeguarding buyers against the risk of unforeseen legal disputes and financial setbacks.

Innovations in this field have been transformative, as seen with companies like Pippin, which have harnessed proprietary technology and established networks of proficient [title search](https://blog.parseai.co/10-benefits-of-affordable-land-and-title-management-software)ers to streamline the process. This modern approach has significantly reduced the legwork traditionally associated with title searches, allowing for more efficient and reliable outcomes.

Moreover, understanding the nuances of title searches and their implications is vital, as emphasized by industry experts. For example, Diane Tomb, CEO of the American Land Title Association, advocates for enhancing homebuyer education to demystify the post-closing process and reduce barriers to homeownership.

In practice, a well-conducted title search is indispensable for transactions like the Akiya purchase cases in Japan, where clarity on title status and associated costs is paramount for clients. It's a cornerstone of due diligence that not only confirms the seller's right to transfer ownership but also identifies any specific restrictions or easements that might affect the property.

With the ongoing , as noted by First American Financial Corporation, the industry's trajectory is clear. The integration of advanced technologies and comprehensive data assets is setting new standards, leading to more informed decisions in the real estate sector. These advancements underscore the importance of a robust title search, ensuring that each transaction is grounded in certainty and transparency.

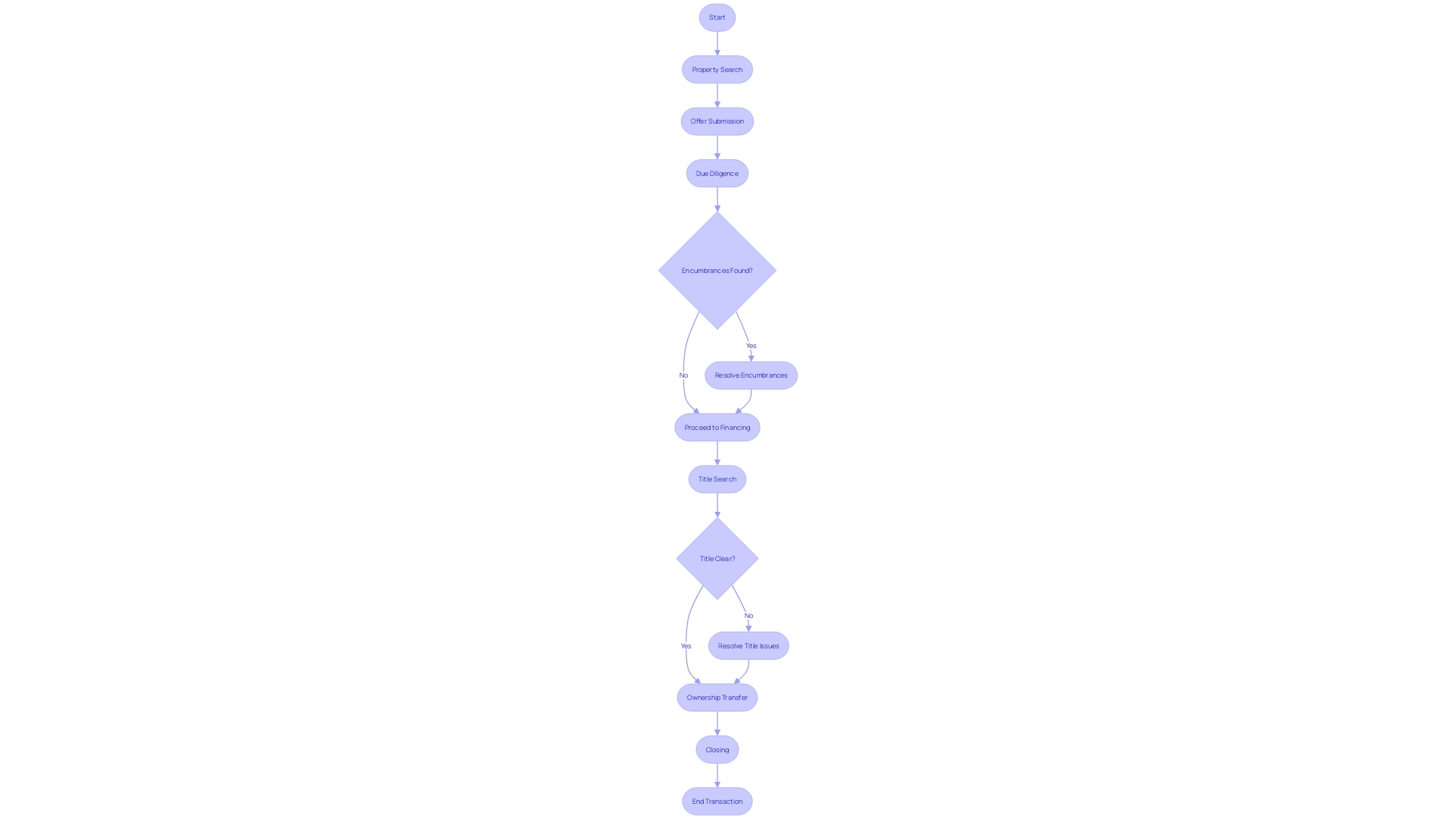

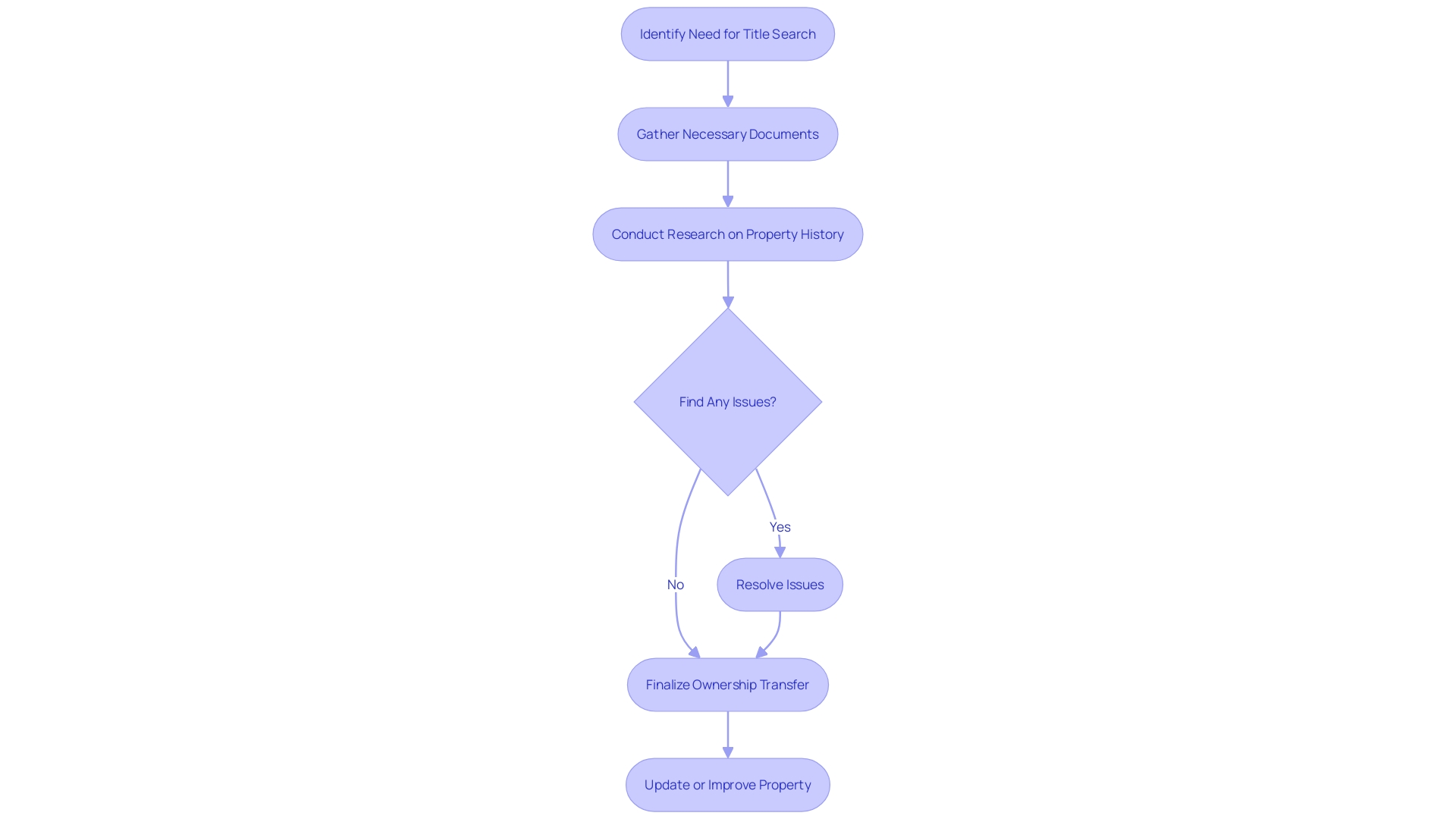

Steps Involved in a Title Search

Conducting a is an intricate process that requires meticulous attention to detail. It begins with the collating data from a myriad of sources, including public registries, tax documentation, and judicial files. This information is then meticulously examined to identify any discrepancies or potential complications that may affect the property's title. Interviews with pertinent individuals, such as past owners or financial institutions, are often integral to this phase, providing additional context and insight. Upon completion of this investigative work, the [title examiner](https://blog.parseai.co/10-essential-tools-for-managing-mineral-rights-data-effectively) compiles a , delineating their findings and articulating their professional recommendations. This report is an invaluable resource, serving as a cornerstone for ensuring that are free of encumbrances and ownership is unequivocally verified.

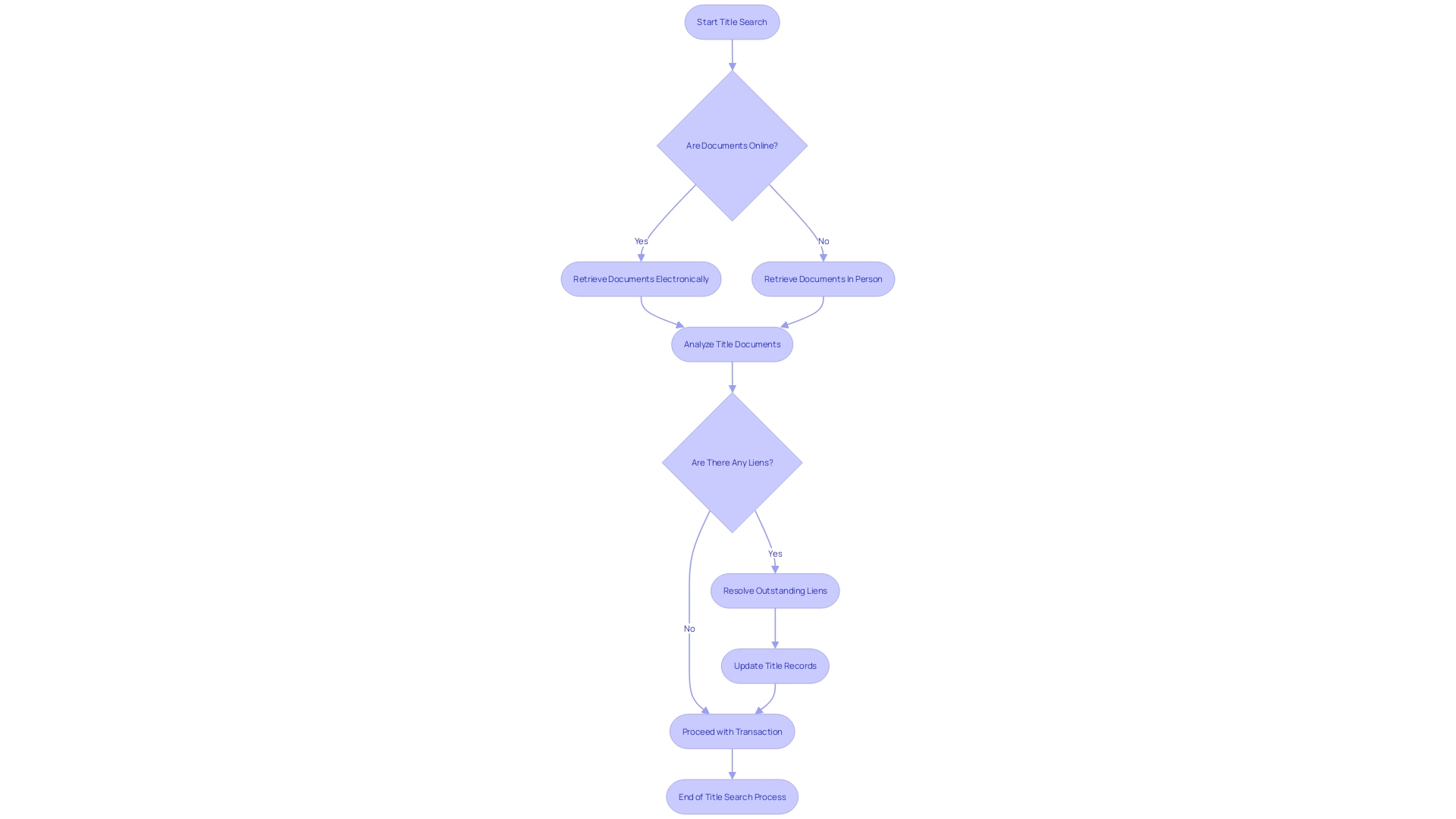

What is a Lien Search?

In the world of real estate, a is akin to uncovering the financial history of a property. It's a dive into public records to discover any existing debts that could affect the transfer of ownership, such as due mortgages, unpaid taxes, or legal judgments. Think of it as a background check for your potential new home or investment, ensuring there are no hidden surprises that could jeopardize your claim to the property. It's a critical step in due diligence, providing a clear picture of the property's and peace of mind for buyers and sellers alike.

Modern technology has significantly streamlined this process. For instance, Pippin has revolutionized the industry by integrating proprietary technology with a network of expert title searchers. This synergy has simplified the once cumbersome task, allowing clients to easily navigate the myriad of and reports that vary from vendor to vendor. Similarly, real estate professionals like Akiya Bank provide transparent and detailed guidance through complex purchases, exemplified in their case study of an American client in search of a Japanese countryside property. They prioritize client understanding at each stage, from initial property criteria to final selection.

As we approach 2024, it's worth noting the evolving landscape of real estate. The market is buzzing with optimism; a significant portion of millennials and Zoomers consider homeownership a key goal, despite the financial hurdles that still loom large. Meanwhile, industry surveys reflect a sustained interest in land acquisition, indicating a robust and balanced market ahead. Therefore, whether you're an individual seeking to secure your dream home or a professional navigating the intricacies of land transactions, a thorough lien search remains an indispensable tool in protecting your investment and ensuring a smooth property transaction.

Types of Issues Identified in Lien Searches

are a critical component of the , uncovering various claims that may encumber a property—such as unpaid mortgages, tax liens, mechanic's liens, and judgment liens. Each lien signifies a potential claim against the property, which may impede a buyer's quest for a clear title. For instance, mechanic's liens serve as a legal tool for contractors to secure payment for their services, requiring only the filing of paperwork and court affirmation. Similarly, government entities can enforce tax liens for unpaid taxes, and legal judgments can result in judgment liens that attach to property titles.

Furthermore, sophisticated technologies such as AI and extensive databases have been utilized to enhance the precision and comprehensiveness of lien searches. Such advancements aid in navigating complex cases, like patent litigations, where an exhaustive review of extensive prosecution histories and prior art is necessary. These approaches demonstrate the potential for leveraging cutting-edge tools in , aiming to identify and resolve any that might include legal or financial issues. Statistics from CoreLogic and ATTOM Data Solutions indicate the expansive coverage and depth of data available, underscoring the importance of thorough lien searches in protecting against potential financial loss from title defects. As such, understanding the complexities of liens and employing advanced search techniques are essential for professionals engaged in property transactions.

How Lien Search Findings Affect a Real Estate Closing

As the real estate industry evolves, so does the importance of as part of the title search process. Uncovering outstanding liens is crucial, as they must be resolved before the transfer of property can be completed. Resolving these liens could involve negotiations with creditors to pay off the debts or obtain lien releases. Should these issues remain unaddressed, the consequences could include delays or potential derailment of the property's closing process. Emphasizing the need for , companies like First American Financial Corporation have been instrumental in leading the digital transformation of the industry through innovative proprietary technologies. With a revenue of $7.6 billion in 2022, First American has been at the forefront of providing , demonstrating the growing significance of utilizing advanced technology to streamline title search processes. As the industry continues to shift towards digital solutions, the role of meticulous title searches and the swift resolution of any discovered liens become increasingly vital to the .

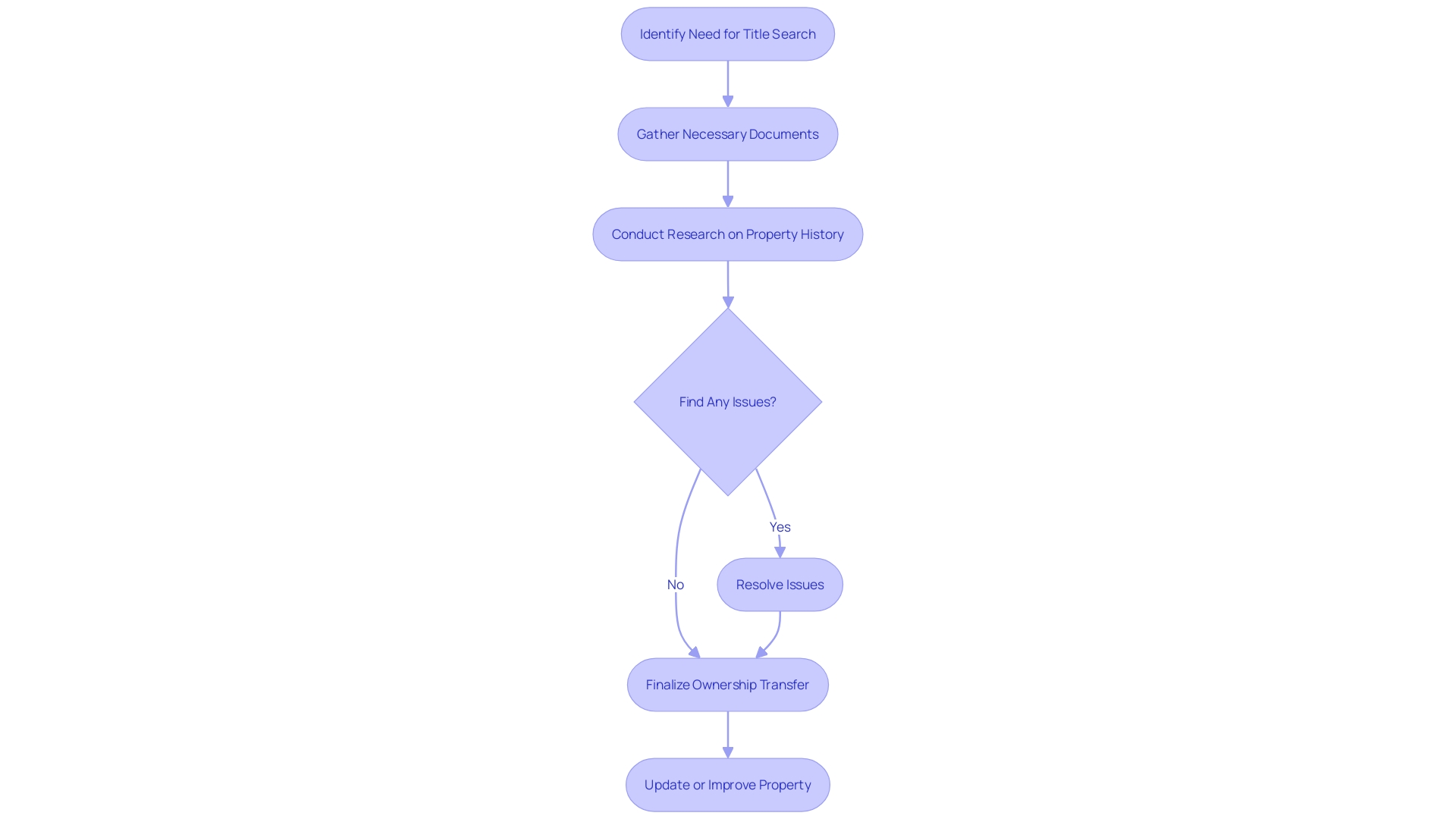

Key Components of Determining Clear Title

The intricacies of establishing a encompass multiple critical elements. One must meticulously verify the to ensure that there are no gaps or omissions. Each transaction in the ownership history is akin to a link in a chain, and just like a blockchain, the integrity of the entire chain is compromised if any single link is weak or broken. Moreover, it is essential to confirm that all pertinent documents have been correctly recorded in the public record.

Equally important is the verification of the absence of outstanding liens or encumbrances that could jeopardize the property's clean title status. This step is akin to conducting a thorough background check to unearth any hidden claims or disputes that may be lurking in the shadows, ready to emerge post-purchase.

In a world where authenticity can significantly amplify the value of assets, from works of art to real estate, the role of becomes paramount. Through title insurance, one can safeguard against unforeseen defects or claims that might arise, offering a protective shield similar to how a might protect token holders in the realm of tokenized real estate. This insurance serves as a contingency measure, providing peace of mind in the increasingly complex and digitized landscape of property ownership, where risks such as fraud or technological failures must be meticulously managed.

One must not forget the revolutionary impact of technology on title searches and verification processes. Innovations like fingerprinting technology for artworks can be analogously envisioned for real estate, linking physical assets to verified digital records, thereby enhancing the security and reliability of title information.

In the digital age, ensuring clear title is not just about checking off items on a closing checklist; it's about employing a combination of traditional diligence and cutting-edge technology to establish a fortress of legal certainty around property ownership.

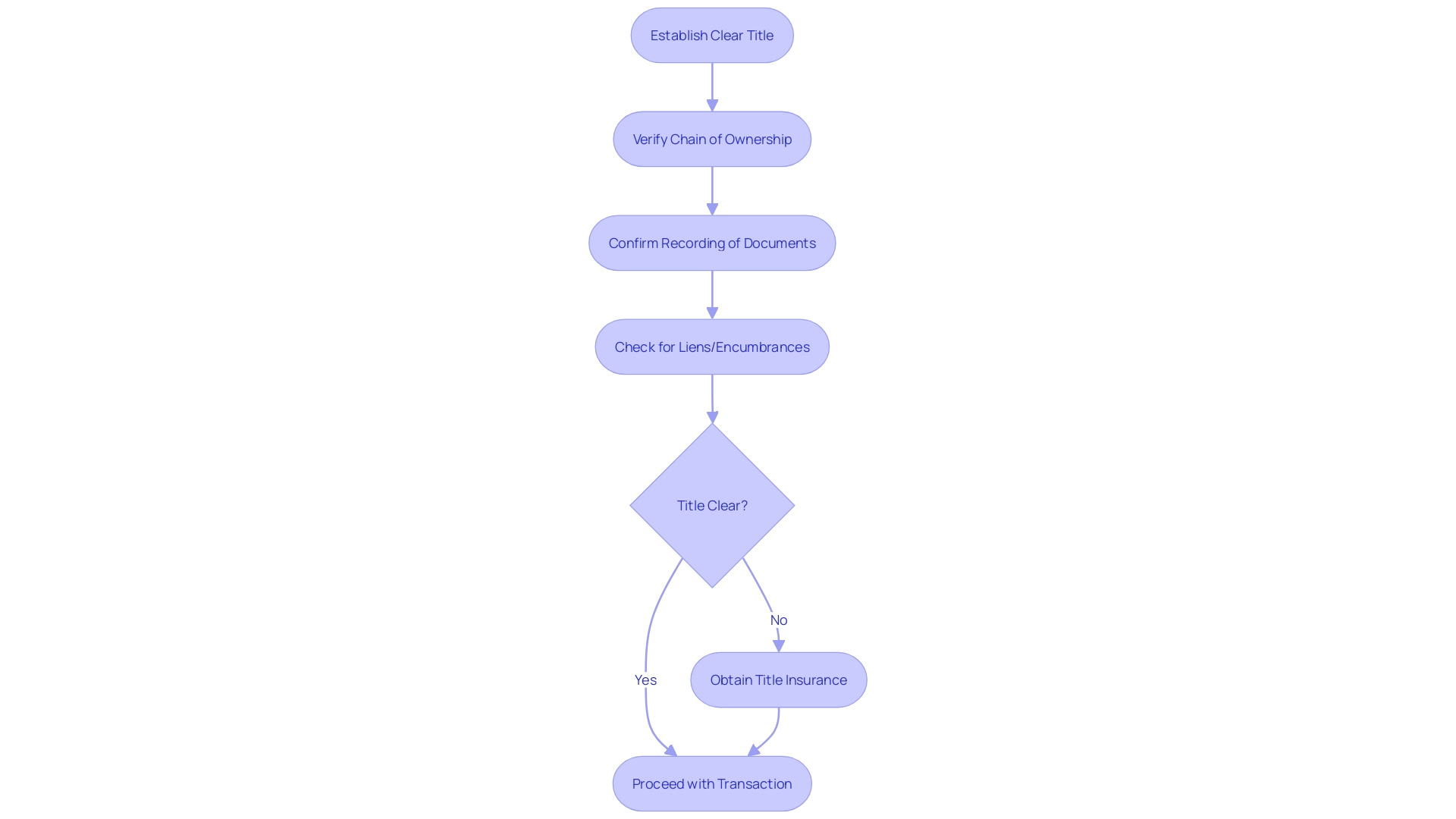

The Role of Title Insurance

The lien and es are essential to securing a property's legal status and ensuring the rightful ownership. It is where becomes a game-changer, safeguarding both purchasers and financial institutions from unforeseen or claims that may not surface during the initial investigation of public records. The insurance policy kicks in to cover financial damages when issues over the title's validity emerge after the property's acquisition. Pioneering companies like First American Financial Corporation, commanding a robust financial foundation and leveraging innovative technologies, are at the forefront of modernizing these searches. They deliver , reflecting their $7.6 billion revenue in 2022. Addressing the industry's intricacies, firms like Pippin integrate cutting-edge title search technology with expert networks, streamlining the traditionally complex title search process. Such advancements underscore the sector's evolution, providing a more efficient, reliable, and interpretable system for managing the essential task of title searches.

Resolving Title Defects and Liens

When delving into property transactions, the discovery of can be a stumbling block that necessitates a meticulous resolution process. It's not merely about identifying these issues; it's about navigating a path to clear them effectively. Strategies to resolve such title issues often include the procurement of releases or discharges from the appropriate parties, settling outstanding obligations, or even engaging in legal actions to rectify the discrepancies.

For instance, in the case of Wills Printing, where a neighboring property's change of hands led to complications, it underscores the importance of having a clear and undisputed title. Moreover, recent news has highlighted the consequences of mortgage fraud conspiracies on , shedding light on the critical need for vigilance in title searches to protect businesses from potential legal entanglements.

With the real estate market's dynamics and the intricacies of property ownership, it's essential to understand the . Holding a title signifies legal ownership, which is separate from the physical deed—a legal document listing the property's owner. It is this title that confirms one's legal claim to a property, without which, ownership is not legally recognized.

To navigate the complex legal landscape, particularly when faced with title defects or liens, enlisting the expertise of a is invaluable. As highlighted by the insights from experienced legal professionals, the expertise in real estate law, contract review, and negotiation that an attorney brings to the table can be the linchpin for a secure and successful property transaction.

Furthermore, the digital transformation of the title and settlement industry, as demonstrated by First American Financial Corporation with its substantial revenue of $7.6 billion in 2022, illustrates the evolution of risk solutions in real estate transactions. This evolution emphasizes the importance of leveraging innovative technologies and comprehensive data assets to ensure accuracy in title searches and the overall integrity of property transactions.

The Importance of Professional Assistance

The intricacies of lien and title searches are significant hurdles in real estate transactions, often requiring expert navigation. are indispensable in this regard due to their adeptness in sifting through complex legal documents and conducting exhaustive searches. They are equipped with the and a network of seasoned title searchers, which is paramount in clarifying ownership, easements, and any encumbrances that might complicate a property's title. These professionals work diligently behind the scenes, ensuring that the legalities of title transfer are meticulously adhered to, thereby safeguarding the interests of all parties in the transaction.

Recent advancements in the title search industry, as highlighted by First American Financial Corporation, have significantly elevated the efficiency and accuracy of these searches. Their innovative approach, combining financial stability and proprietary technologies, has revolutionized the title search process, which is reflected in their $7.6 billion revenue in 2022. Such developments are crucial in the current landscape, where the need for precision and speed in real estate transactions cannot be overstated.

Moreover, the cannot be understated. As Diane Tomb, CEO of the American Land Title Association, emphasizes, educating homebuyers and navigating them through the closing process is central to the mission of reducing homeownership barriers. The importance of this guidance is also echoed by real estate experts who advocate for the vital role of attorneys in real estate transactions, ensuring due diligence is maintained and risks are mitigated.

In sum, the collaboration between cutting-edge technology and experienced professionals has become the cornerstone of conducting thorough title searches, offering peace of mind, and fostering in an industry that is continually evolving.

Conclusion

In conclusion, the title search process is a critical stage in real estate transactions, ensuring rightful ownership and identifying any issues or defects. Companies like Pippin and First American Financial Corporation lead the industry's digital transformation, combining cutting-edge technology with expert title searchers.

Title searches review land records, court dockets, and more to confirm legal rights and pinpoint liens. Title insurance provides additional protection against unforeseen issues, covering legal fees and financial loss.

Conducting a title search requires meticulous attention to detail, compiling data and conducting interviews to verify ownership and ensure clear titles.

Lien searches uncover existing debts that could affect property ownership. Streamlined by technology, companies like Pippin simplify the process and provide transparent guidance.

Thorough lien searches identify various claims, such as unpaid mortgages and tax liens. Advanced technologies enhance precision and aid in resolving title defects.

Resolving outstanding liens is crucial in the real estate closing process. First American Financial Corporation leads the digital transformation, providing comprehensive solutions.

Establishing a clear title involves verifying ownership, recording documents accurately, and confirming the absence of liens. Title insurance safeguards against unforeseen defects or claims.

Resolving title defects and liens requires expertise and may involve negotiation or legal action. Real estate attorneys play a vital role in navigating complexities.

Professional assistance from title researchers and real estate professionals is indispensable in lien and title searches. Their expertise, combined with technology, enhances efficiency and accuracy.

In summary, the integration of technology and human expertise is paramount in the title search process. Thorough searches and resolution of issues ensure successful real estate transactions.

Get professional assistance from Parse AI for efficient and accurate lien and title searches.

Frequently Asked Questions

What is a title search in real estate?

A title search is a detailed examination of public records to verify the legal ownership of a property and to discover any issues or defects that could affect the transfer of the property ownership.

Why is a title search important?

A title search is important because it protects purchasers from inheriting pre-existing liabilities attached to the real estate, such as liens, encumbrances, and other claims that could jeopardize the marketability of the title.

Who performs title searches and how are they modernized?

Companies like Pippin and First American Financial Corporation perform title searches by integrating proprietary technology with the expertise of top-tier title searchers to modernize and streamline the process.

What steps are involved in a title search?

A title search involves collecting data from various sources such as public registries, tax documentation, and judicial files, examining this information to identify discrepancies, and compiling a comprehensive report of the findings.

What is a lien search?

A lien search is a part of the title search process that specifically looks for any existing debts, such as due mortgages, unpaid taxes, or legal judgments, which could affect the transfer of a property's ownership.

What types of issues can be identified in lien searches?

Lien searches can uncover various claims against a property, including unpaid mortgages, tax liens, mechanic's liens, and judgment liens.

How do lien search findings affect a real estate closing?

Outstanding liens found during a lien search must be resolved before the property transfer can be completed. Failure to address these issues can lead to delays or cancellation of the property's closing process.

What are the key components of determining a clear title?

Determining a clear title involves verifying the chain of ownership, ensuring all documents are correctly recorded in the public record, and confirming the absence of outstanding liens or encumbrances.

What is the role of title insurance?

Title insurance protects purchasers and financial institutions from unforeseen title defects or claims that may not be evident during the initial public records investigation, covering financial damages if issues arise after the property's acquisition.

How are title defects and liens resolved?

Resolving title defects and liens can involve obtaining releases from involved parties, settling outstanding obligations, or engaging in legal actions to correct discrepancies.

Why is professional assistance important in title searches?

Professional assistance is important due to the complexities of legal documents and the need for exhaustive searches. Title researchers and real estate professionals are equipped with the latest technology and expertise to ensure accurate and efficient title searches.

How have recent advancements impacted the title search industry?

Recent advancements have increased the efficiency and accuracy of title searches, as companies have adopted innovative technologies to streamline the process and provide more reliable outcomes.

What is the role of attorneys in real estate transactions involving title searches?

Attorneys play a vital role in real estate transactions by providing expertise in real estate law, contract review, and negotiation, ensuring due diligence is maintained and risks are mitigated throughout the process.