Overview

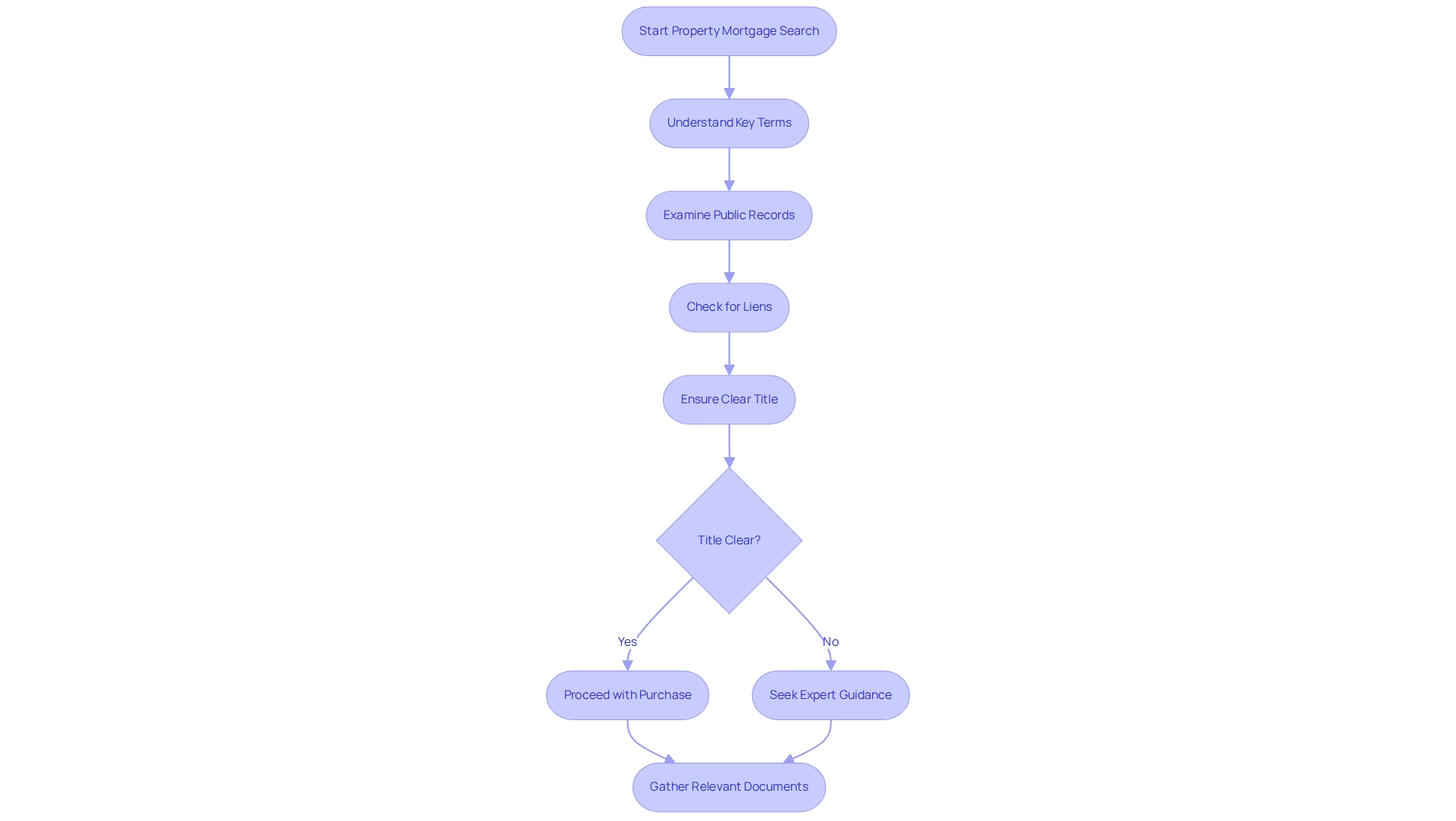

The essential steps for a successful property mortgage search begin with a solid understanding of key concepts such as title and liens. Gathering necessary resources and effectively accessing public records are crucial components of this process. Furthermore, thorough preparation combined with the use of specialized tools can significantly enhance both the efficiency and accuracy of the mortgage search. This ultimately protects buyers from potential financial risks associated with unclear property titles.

Introduction

In the intricate world of real estate transactions, understanding the nuances of property mortgage searches is paramount for both buyers and sellers. This essential process not only verifies ownership but also uncovers any liens or encumbrances that could jeopardize a property investment. As the market evolves and homeownership becomes a long-term commitment for many, the stakes are higher than ever.

Furthermore, with the right tools, resources, and knowledge, navigating the complexities of mortgage searches can transform what may seem like a daunting task into a streamlined and informed decision-making process. This article delves into the fundamental aspects of property mortgage searches, equipping readers with the insights needed to secure their investments and avoid potential pitfalls.

Understand the Basics of Property Mortgage Searches

A real estate loan inquiry is a crucial procedure that examines a real estate's history to verify ownership and detect any liens or encumbrances. This inquiry typically involves scrutinizing public records, such as deeds, loans, and liens, to ensure the title is clear. Familiarity with essential terms is vital:

- Title: The legal right to possess, utilize, and transfer real estate.

- Loan secured by real estate: A financial advance backed by the asset itself, which can influence ownership rights.

- Lien: A legal assertion against an asset, often resulting from unpaid obligations.

Understanding these concepts is imperative, as they underscore the significance of conducting a comprehensive property mortgage search before any real estate transaction. Recent trends indicate that real estate sold through traditional channels often commands higher prices; for instance, homes sold by agents had a median price of $435,000, compared to $380,000 for For-Sale-by-Owner (FSBO) transactions, which accounted for only 6% of sales. This disparity emphasizes the potential financial repercussions of neglecting , as purchasers may miss the opportunity to secure a property with a clear title, which is essential for protecting their investment. Furthermore, as purchasers increasingly expect to reside in their homes for an average of 15 years, ensuring a clear title and understanding any existing liens or loans becomes crucial for long-term investment security. FSBO sellers, who frequently face challenges with pricing and documentation, may struggle to guarantee clear titles, underscoring the necessity for a thorough property mortgage search. In the subsequent stages, it is essential to gather all relevant documents and seek guidance from experts to navigate the complexities of the loan acquisition process effectively.

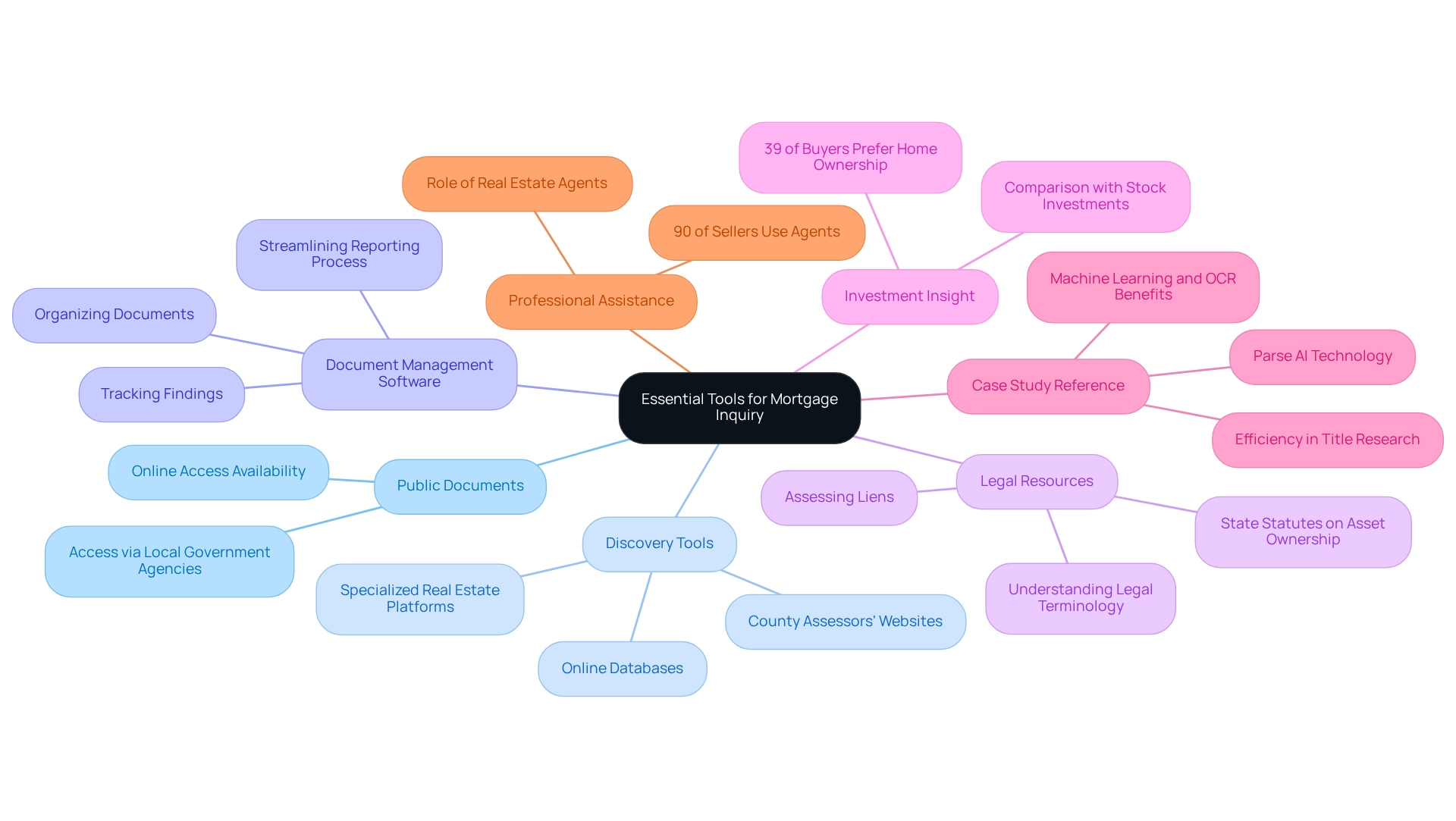

Gather Essential Tools and Resources for Your Search

To carry out a successful mortgage inquiry, several essential tools and resources are vital:

- Access to Public Documents: Property information is generally maintained by local government agencies, such as the county clerk or recorder's office. Many of these offices now offer online access, making it easier to retrieve necessary documents.

- : Utilize online databases and engines designed for property records. Resources such as county assessors' websites and specialized real estate platforms can greatly improve your efficiency in locating properties.

- Document Management Software: Implementing document management software is essential for organizing and managing the documents gathered during your inquiry. In fact, a significant percentage of title researchers utilize such software, which not only helps track findings but also streamlines the reporting process, essential for timely decision-making.

- Legal Resources: Comprehending legal terminology and resources, including state statutes pertaining to asset ownership and liens, is crucial. This knowledge enables you to interpret your findings accurately and assess their implications effectively.

- Investment Insight: It's important to recognize that 39% of buyers believe owning a home is a better investment than owning stocks. This statistic underscores the importance of comprehensive loan investigations in securing valuable real estate investments.

- Case Study Reference: The use of advanced technology, such as that provided by Parse AI, illustrates how machine learning and optical character recognition can enhance the efficiency of title research. Parse AI's platform, featuring an example manager and title research automation, allows for quick annotation and extraction of information from unstructured documents, enabling title researchers to complete abstracts and reports faster and more accurately.

- Professional Assistance: According to the NATIONAL ASSOCIATION OF REALTORS®, 90% of sellers sold with the assistance of a real estate agent. This highlights the importance of utilizing professional resources and tools in the property mortgage search process.

By equipping yourself with these tools and insights, including the advanced capabilities of Parse AI, you will be well-prepared to conduct a comprehensive property mortgage search, ultimately enhancing your efficiency and accuracy in title research.

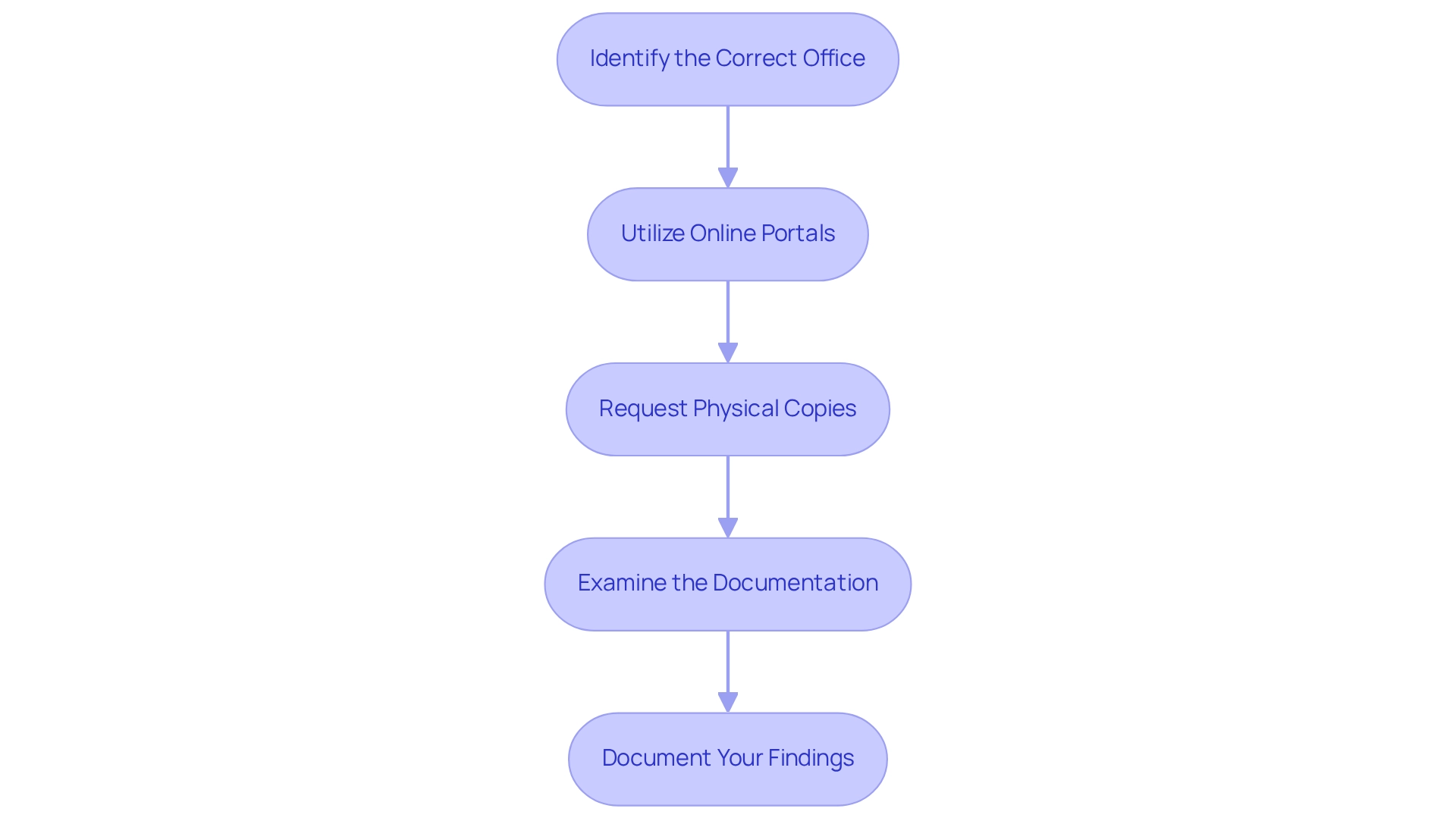

Access and Utilize Property Records Efficiently

Accessing real estate documents can be a streamlined process by following these essential steps:

- Identify the Correct Office: Start by determining which local government office is responsible for maintaining ownership files in the relevant area, typically the county clerk or recorder's office.

- Utilize Online Portals: A notable portion of counties—around 70%—now offer online databases, enabling inquiries for property information by address, owner name, or parcel number. Familiarize yourself with the search functionalities of these platforms to enhance your efficiency.

- Request Physical Copies: In cases where online access is limited, visiting the office in person may be necessary. Ensure you bring identification and any required forms to request copies of documents.

- Examine the Documentation: After obtaining access, carefully inspect the documentation for any liens, loans, or encumbrances. Pay close attention to the dates and parties involved in each document to gain a comprehensive understanding of the asset's history.

- Document Your Findings: Maintain detailed notes of your findings, including any discrepancies or issues that may warrant further investigation. This documentation is essential for upcoming transactions or legal matters.

By following these steps, you can effectively access and utilize asset files to assist your property mortgage search, ultimately improving your workflow and decision-making process. Furthermore, suggest that comprehending real estate documents is essential, particularly given the recent rise in median appraised values noted in the 2023Q4 UAD Aggregate Statistics. Precise documentation is crucial for making knowledgeable choices in the present real estate market.

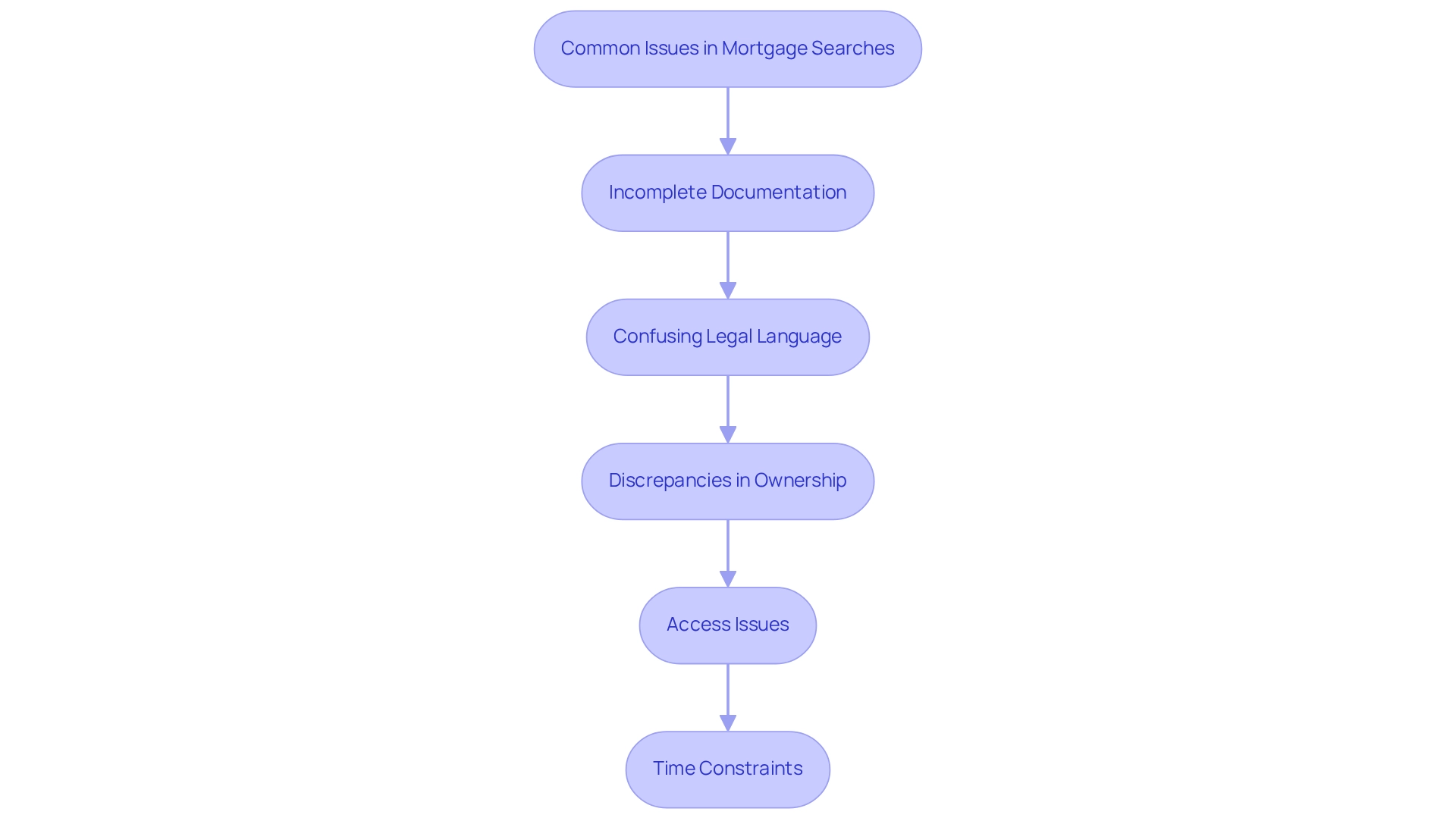

Troubleshoot Common Issues in Mortgage Searches

Conducting a property mortgage search frequently presents several challenges. Here’s how to effectively troubleshoot these common issues:

- Incomplete Documentation: When files are missing or not fully available, first check with the local office for further documents that may be stored in archives or other departments. Statistics indicate that approximately 30% of title researchers encounter incomplete records, highlighting the importance of thorough follow-up.

- Confusing Legal Language: Legal documents can be intricate and filled with jargon. If you come across terminology that is difficult to decipher, consult a real estate attorney or utilize online legal resources to clarify these terms. Jeanette McBride, Richland County Clerk of Court, emphasizes the importance of comprehending legal terminology to prevent misinterpretations that could affect real estate transactions.

- Discrepancies in Ownership: Conflicting information regarding real estate ownership can arise. To address this, confirm details with various sources, including tax documents and prior deeds. This may require additional research, but it is crucial for ensuring accurate ownership verification. Similar to the complexities faced in accurately reporting opioid-related healthcare utilization, verifying property ownership requires robust methodologies to ensure accuracy.

- Access Issues: If you encounter difficulties accessing online databases or physical records, reach out to the office directly for assistance. They may offer alternative methods for obtaining the information you need, ensuring that access barriers do not hinder your search.

- Time Constraints: When time is limited, prioritize your investigation by focusing on the most critical documents first, such as the current deed and any existing liens. Leveraging automated tools or services can significantly expedite , allowing for more efficient completion of property mortgage searches. By proactively addressing these common issues, you can enhance both your efficiency and effectiveness in conducting property mortgage searches.

Conclusion

Property mortgage searches are indispensable for both buyers and sellers in real estate transactions. This process not only ensures ownership verification but also identifies any liens or encumbrances, confirming a clear title—crucial steps for safeguarding investments. Understanding key terms such as title, mortgage, and lien is fundamental to navigating potential risks in property transactions.

Equipping oneself with the right tools and resources significantly enhances the efficiency of mortgage searches. Accessing public records, utilizing specialized search tools, and seeking professional assistance streamline the process. Furthermore, advanced technologies, including document management software and platforms like Parse AI, optimize searches by improving organization and expediting reporting.

Accessing property records can be simplified by identifying the appropriate local office and leveraging online databases. However, challenges such as incomplete records or perplexing legal language may arise. Proactively addressing these issues—by consulting legal resources or verifying information across multiple sources—enhances the effectiveness of the search.

In conclusion, thorough property mortgage searches are vital for securing real estate investments. By grasping the basics, leveraging available resources, and effectively troubleshooting common challenges, buyers and sellers can make informed decisions. As the real estate landscape evolves, diligence in these searches empowers stakeholders to navigate complexities confidently and protect their investments.

Frequently Asked Questions

What is a real estate loan inquiry?

A real estate loan inquiry is a procedure that examines a property's history to verify ownership and detect any liens or encumbrances. It typically involves scrutinizing public records, such as deeds, loans, and liens, to ensure the title is clear.

Why is it important to understand essential terms related to real estate?

Understanding essential terms such as title, loan secured by real estate, and lien is vital because they underscore the significance of conducting a comprehensive property mortgage search before any real estate transaction.

What is a title in the context of real estate?

A title is the legal right to possess, utilize, and transfer real estate.

What does it mean when a loan is secured by real estate?

A loan secured by real estate is a financial advance backed by the asset itself, which can influence ownership rights.

What is a lien?

A lien is a legal assertion against an asset, often resulting from unpaid obligations.

What are the financial implications of neglecting a thorough property mortgage search?

Neglecting a thorough property mortgage search can lead to missing the opportunity to secure a property with a clear title, which is essential for protecting an investment. This can result in potential financial repercussions.

How do traditional real estate sales compare to For-Sale-by-Owner (FSBO) transactions in terms of price?

Homes sold through traditional channels often command higher prices; for instance, the median price for homes sold by agents was $435,000, compared to $380,000 for FSBO transactions, which accounted for only 6% of sales.

Why is ensuring a clear title important for long-term investment security?

Ensuring a clear title and understanding any existing liens or loans is crucial for long-term investment security, especially as purchasers increasingly expect to reside in their homes for an average of 15 years.

What challenges do FSBO sellers face regarding clear titles?

FSBO sellers frequently face challenges with pricing and documentation, which may hinder their ability to guarantee clear titles, highlighting the necessity for a thorough property mortgage search.

What should one do in the subsequent stages after a property mortgage search?

In the subsequent stages, it is essential to gather all relevant documents and seek guidance from experts to navigate the complexities of the loan acquisition process effectively.