Overview

The essential steps for searching a lien on a property are crucial for ensuring a successful transaction.

- Gather comprehensive real estate information.

- Visit local government offices to obtain necessary records.

- Utilize online resources to expand your search capabilities.

- If needed, consulting a title company can provide additional expertise.

Understanding the various types of liens is paramount, as unresolved claims can significantly hinder property transactions and ownership. By following a systematic approach, you can ensure thorough searches that protect your interests.

Introduction

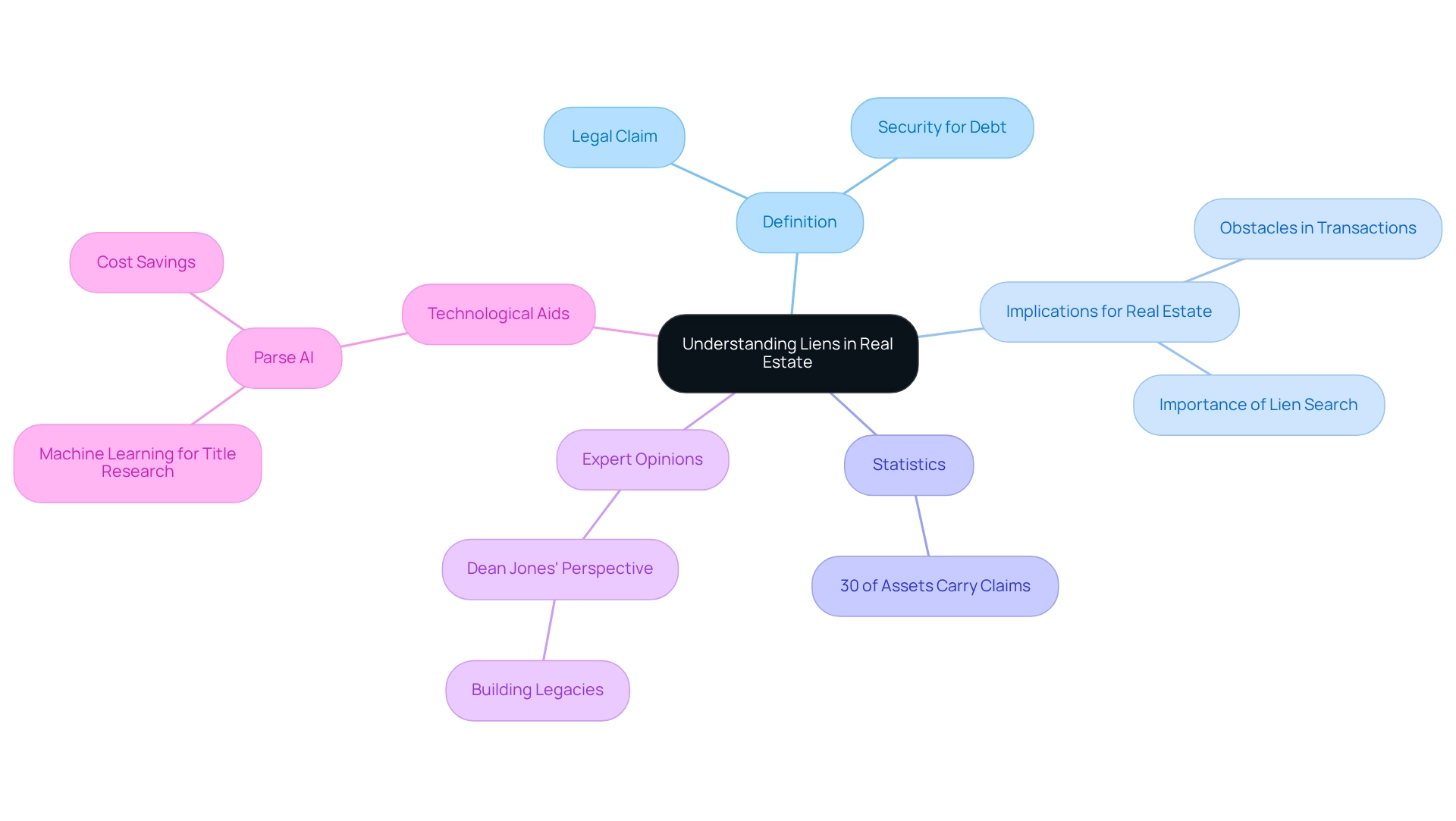

In the intricate world of real estate, liens exert considerable influence over property transactions, often determining the outcomes for buyers and sellers alike. These legal claims, arising from unpaid taxes, mortgages, or court judgments, serve as collateral for debts and can obstruct the buying or selling process if not managed effectively. Recent statistics indicate that nearly 30% of properties in the U.S. are impacted by some form of lien, underscoring the necessity for a comprehensive understanding of this pivotal aspect of property ownership for anyone engaged in real estate.

This article explores the various types of liens, emphasizes the importance of thorough searches, and addresses common issues, providing valuable insights to navigate the complexities they present.

Understand What a Lien Is

A legal claim signifies an interest in an asset, acting as security for a debt or obligation. When enforced, it grants the creditor the authority to seize the asset if the debt remains unsettled. Liens can arise from various circumstances, including unpaid taxes, mortgages, or court judgments.

For real estate professionals, understanding claims is essential, as they can significantly impact the processes of purchasing, selling, or refinancing an asset. Assets burdened by unresolved claims may face considerable obstacles in transactions, often preventing owners from selling until the claim is resolved.

Recent statistics indicate that approximately 30% of assets in the U.S. carry some type of claim, underscoring the importance of conducting a lien search on a property. Dean Jones, CEO of Realogics Sotheby’s International Realty, emphasizes that "realty is more than just assets — it’s the chance to create legacies, one home at a time," highlighting the critical role of understanding claims in asset ownership.

Furthermore, legal experts assert that a comprehensive understanding of claims is vital for managing potential conflicts and facilitating seamless property transactions. The case analysis of illustrates how technology can aid title researchers in effectively verifying ownership, further accentuating the importance of comprehending claims in the real estate sector.

Identify Different Types of Liens

Property owners and buyers must be acutely aware of several key types of liens that can significantly impact .

- Mortgage Claims: These voluntary claims arise when lenders extend a mortgage to a borrower seeking to purchase real estate. In the event of default, the lender possesses the right to foreclose on the asset, making it imperative for buyers to grasp their obligations fully.

- Tax Claims: These claims are imposed by the government for unpaid real estate taxes and can pose substantial risks to landowners. If left unresolved, they may culminate in foreclosure, thereby underscoring the critical importance of timely tax payments.

- Judgment Claims: Involuntary encumbrances that emerge from court rulings against landowners for unpaid debts, judgment claims allow creditors to secure payment by imposing a claim on the asset. This can complicate future dealings, necessitating awareness from property owners.

- Mechanic's Claims: Submitted by contractors or suppliers who have not received compensation for completed work, mechanic's claims can hinder real estate sales if not resolved. These claims serve as a poignant reminder of the necessity to settle contractor agreements promptly.

- Homeowners' Association (HOA) Claims: Imposed for unpaid dues or assessments, HOA claims can also lead to foreclosure if not addressed. Buyers should remain vigilant regarding any outstanding dues to avoid potential complications.

Understanding these types of claims is vital for anyone engaged in real estate, as they can profoundly influence a property’s marketability and the owner's financial obligations. Recent statistics indicate that mortgage claims frequently take precedence over tax claims in foreclosure scenarios, reinforcing the necessity for caution in managing these responsibilities. Furthermore, there is no limit to the number of claims that can be placed on an asset, which adds to the complexity of lien situations. Homeowners and prospective purchasers can investigate liens on a property by examining public records, employing methods such as online searches on local county websites or utilizing tools like PropertyShark. As Dean Jones, CEO of Realogics Sotheby’s International Realty, aptly stated, "Real estate is more than just real estate — it’s the opportunity to build legacies, one home at a time." This underscores the importance of understanding asset ownership and the ramifications of claims.

Conduct a Lien Search: Step-by-Step Process

To conduct effectively, it is imperative to follow these essential steps:

- Gather Real Estate Information: Collect vital details about the real estate, including the address, legal description, and names of current owners. This essential information is crucial for precise inquiries.

- Visit Local Government Offices: Depending on your jurisdiction, visit the county recorder's office, assessor's office, or clerk's office. These offices maintain public documents of claims and ownership, which are critical for your inquiry.

- Utilize Online Resources: Many counties offer online databases for claim searches. By entering the address or owner's name, you can access valuable information. Always check your local government website for these resources.

- Search for Claims: Look for documents indicating any encumbrances against the asset. Be vigilant regarding various forms of claims, such as tax claims, judgment claims, and mechanic's claims, as each can significantly affect property ownership.

- Review the Findings: After collecting encumbrance information, review it meticulously. Take note of any significant claims, their amounts, and the parties involved, as this will guide your next steps.

- Consult a Title Company: If you encounter complicated claims or require further assistance, consider reaching out to a title company. Their expertise can provide valuable insights and help address any concerns related to the claims.

By following these steps, you can perform a comprehensive claim search to identify any liens on a property, ensuring you are well-informed about potential assertions against the asset. Consistent vigilance is also crucial, as properties can accumulate new claims over time, necessitating regular assessments to protect your real estate investments. As emphasized in the case study 'Ongoing Vigilance After Searches,' regular evaluations assist in identifying new claims promptly, guaranteeing ongoing protection for your investments. It is essential to remember that municipal property investigations are vital for safeguarding investments in real estate. An Illinois Tax Claim, for instance, is valid for 20 years, underscoring the long-term implications of claims. As an industry expert noted, "It's an investment in certainty and security that far outweighs the potential costs of neglect.

Troubleshoot Common Issues in Lien Searches

Conducting on a property presents various challenges that necessitate meticulous attention. Below are crucial troubleshooting tips to help you navigate these common issues:

- Incomplete Records: Public records can often be outdated or incomplete. To achieve comprehensive results, it is vital to consult multiple sources, including online databases and local government offices, as this approach can reveal missing information. By leveraging Parse AI's advanced document processing tools, you can expedite the retrieval of these records, ensuring access to the most accurate and current information.

- Misspelled Names: Errors in spelling can lead to overlooked claims. Always confirm the spelling of names and consider searching with variations to capture . This is particularly important given that approximately 20% of properties in Florida harbor unrecorded issues, often arising from such errors. Parse AI's interactive labeling features can effectively assist in identifying and rectifying these discrepancies.

- Jurisdictional Differences: Each jurisdiction may impose unique procedures for documenting claims. Acquainting yourself with the specific requirements in your area can mitigate confusion and streamline your search. Parse AI's platform can facilitate the research process by automating tasks and adapting to various jurisdictional mandates seamlessly.

- Unregistered Claims: Certain claims might not be visible in public databases. If you suspect the existence of unregistered claims, it is prudent to consult a title company or legal expert for a comprehensive lien search. Recent trends indicate that municipalities are increasingly enforcing claims for unpaid utilities and code violations, underscoring the necessity of utilizing Parse AI's robust title research automation to uncover these concealed claims effectively.

- Complex Legal Language: Legal documents frequently contain intricate language that can be challenging to navigate. Should you encounter such complexities, seeking assistance from a professional can clarify the information and ensure accurate comprehension. Parse AI's machine learning extraction capabilities can simplify the interpretation of these documents, aiding in the navigation of legal terminology.

By recognizing these prevalent challenges and employing these strategies, including the utilization of Parse AI's innovative solutions, you can significantly enhance your search process. Engaging with Parse AI's services not only addresses the hurdles of unrecorded liens and public record inaccuracies but also positions title companies to remain competitive in the dynamic real estate market.

Conclusion

Understanding liens is crucial for anyone involved in real estate, as they can significantly impact property transactions and ownership. This article has delved into the definition of liens, highlighting their role as legal claims that can arise from various circumstances, including unpaid taxes and mortgages. A comprehensive understanding of the different types of liens—such as mortgage, tax, judgment, mechanic's, and HOA liens—is essential for both property owners and buyers to navigate the complexities of real estate transactions effectively.

Conducting a thorough lien search is a vital step in ensuring that potential issues are identified and addressed before proceeding with any property transactions. The article outlines a step-by-step process for conducting these searches, emphasizing the importance of gathering accurate information and utilizing both local government resources and online databases. Furthermore, troubleshooting common issues that arise during lien searches, such as incomplete records or jurisdictional differences, can enhance the effectiveness of this process.

In conclusion, the significance of understanding and managing liens cannot be overstated in the realm of real estate. With nearly 30% of properties in the U.S. affected by some form of lien, vigilance and proactive measures are necessary to safeguard investments and facilitate smooth transactions. By prioritizing comprehensive lien searches and remaining informed about the implications of various lien types, property buyers and owners can navigate the intricate landscape of real estate with confidence and security.

Frequently Asked Questions

What is a legal claim in the context of assets?

A legal claim signifies an interest in an asset, serving as security for a debt or obligation. It allows the creditor to seize the asset if the debt remains unpaid.

What are some common circumstances that can lead to a lien?

Liens can arise from various circumstances, including unpaid taxes, mortgages, or court judgments.

Why is it important for real estate professionals to understand claims?

Understanding claims is essential for real estate professionals as they can significantly impact the processes of purchasing, selling, or refinancing an asset. Assets with unresolved claims may face considerable obstacles in transactions.

What percentage of assets in the U.S. carry some type of claim?

Approximately 30% of assets in the U.S. carry some type of claim, highlighting the importance of conducting a lien search on a property.

What does Dean Jones emphasize about real estate and claims?

Dean Jones, CEO of Realogics Sotheby’s International Realty, emphasizes that realty is more than just assets; it’s about creating legacies, underscoring the critical role of understanding claims in asset ownership.

How can understanding claims help in property transactions?

A comprehensive understanding of claims is vital for managing potential conflicts and facilitating seamless property transactions.

How can technology assist in understanding claims in real estate?

Technology can aid title researchers in effectively verifying ownership, which illustrates the importance of comprehending claims in the real estate sector.