Overview

When an HOA forecloses, the mortgage stands at risk of being extinguished, particularly in jurisdictions governed by 'super lien' laws that prioritize HOA claims over those of mortgage lenders. This article elucidates the legal complexities surrounding this issue, highlighting recent court rulings that can lead to substantial financial repercussions for homeowners. These repercussions may include the potential loss of equity and the lender's claim on the property, underscoring the critical importance of understanding the ramifications of HOA actions.

Introduction

In the intricate landscape of homeownership, the shadow of homeowners' association (HOA) foreclosures looms large, casting uncertainty over the financial futures of many. As associations tighten their grip on properties due to unpaid dues, the implications for existing mortgages become increasingly dire.

In some jurisdictions, the power of an HOA's lien can even eclipse that of first mortgages, leading to potentially devastating outcomes for homeowners who find themselves in the crosshairs of foreclosure. Furthermore, projections indicate that a significant percentage of mortgages could be affected by these actions.

Therefore, understanding the legal framework and consequences of HOA foreclosures is more critical than ever. This article delves into the complexities of HOA foreclosures, exploring their impact on mortgages, the legal nuances at play, and the options available to homeowners facing this daunting challenge.

Define HOA Foreclosure and Its Impact on Mortgages

An HOA repossession occurs when a homeowners' association (HOA) enforces a lien against a property due to unpaid dues or assessments, leading to concerns about if HOA forecloses what happens to the mortgage. In jurisdictions with 'super lien' regulations, an HOA's claim may take precedence over primary loans, potentially nullifying them during . A recent ruling by the District of Columbia Court of Appeals underscored that a condominium association could not execute a sale while upholding a first deed of trust lien, which highlights the complexities inherent in such scenarios.

Consequently, if HOA forecloses what happens to the mortgage, the loan provider may lose their claim, leading to significant financial repercussions for homeowners who still owe money despite losing their residence. Projections for 2025 indicate that approximately 15% of loans could be affected by HOA property seizures, underscoring the importance of understanding these dynamics.

Recent statistics reveal that California recorded the highest number of property repossession starts, with 2,915 properties flagged in October 2024, while Houston, TX, noted 1,791 starts in Q3 2024. These figures illustrate the growing concern surrounding HOA property losses and their impact on the mortgage landscape.

Moreover, in Q1 2023, there were 58,120 home retention actions aimed at helping families remain in their homes, emphasizing ongoing efforts to mitigate the effects of housing loss. As Bradley noted, 'While there are still hurdles to clear, the decision represents the most significant single victory for the lenders’ interests in the litigation.' This context makes it imperative for real estate professionals to remain informed about these developments.

Examine Legal Framework Governing HOA Foreclosures

The legal structure governing HOA property seizures is notably complex and varies significantly across states. In certain jurisdictions, property owners' associations (HOAs) can pursue non-judicial repossessions, allowing them to bypass the court system entirely. This procedure can expedite the timeline for property repossession, making it crucial for property owners to be well-informed of their rights. Conversely, other states mandate a judicial repossession process, which entails court proceedings and can provide homeowners with additional protections.

Financial insolvency is recognized as the primary cause of neighborhood decline, underscoring the necessity of comprehending HOA foreclosures and their effects on community stability. Numerous states have enacted 'super lien' statutes, which prioritize HOA liens over other claims, including primary loans. As attorney Amy Loftsgordon notes, "Often, the CC&Rs or state laws indicate that an HOA lien is subordinate to a primary loan—even if the HOA lien was placed on the property before the loan." This legal status implies that if an HOA forecloses what happens to the mortgage, it can potentially extinguish a first mortgage and any subordinate mortgages on the property. Such outcomes highlight the importance of understanding these legal distinctions, as they can significantly affect homeowners' financial stability and property rights.

A state-by-state analysis reveals that the approach to HOA property seizures is inconsistent. For instance, in states with robust super lien laws, it is crucial to understand if HOA forecloses what happens to the mortgage, as the risk of losing it due to HOA actions is elevated. Homeowners facing potential property loss due to unpaid assessments are encouraged to consult legal experts or HUD-approved housing counselors to effectively navigate these complexities. The governing documents of a homeowners association, known as the Declaration of Covenants, Conditions, and Restrictions (CC&Rs), further delineate the rights and responsibilities of and the HOA, influencing the enforcement of liens and the property repossession process. This case study illustrates how CC&Rs play a vital role in defining these rights and responsibilities, thereby affecting the enforcement of liens and repossession procedures.

Analyze Consequences of HOA Foreclosure on Homeowners' Mortgages

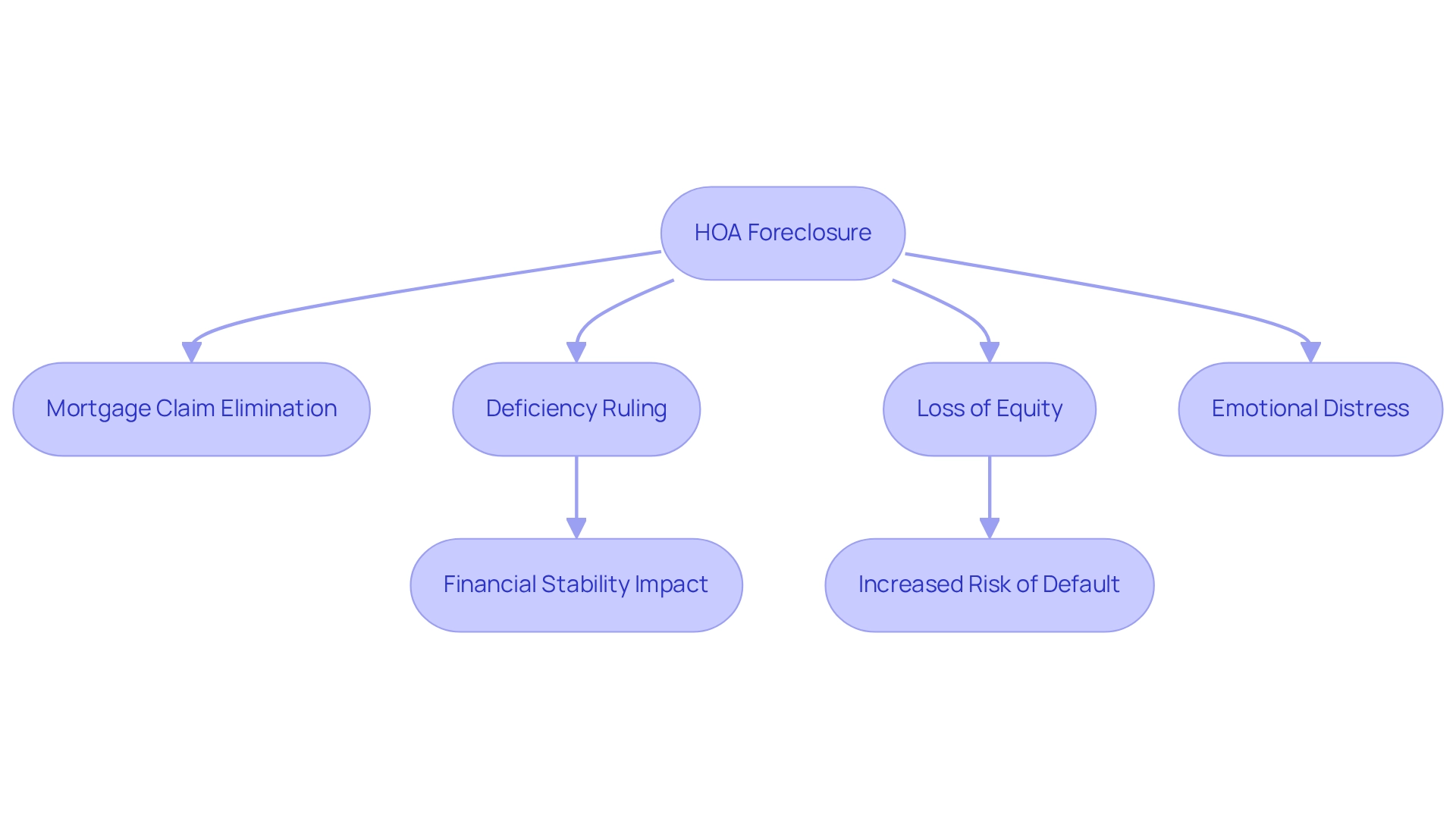

Residents may be concerned about if HOA forecloses what happens to the mortgage, as the foreclosure of a property by a community association (HOA) can have significant effects. When an HOA's lien takes priority, it can eliminate the lender's claim, which leads to concerns about what happens to the mortgage if HOA forecloses. This situation frequently leads to a deficiency ruling if the property sells for less than the remaining loan balance, which can greatly affect the property owner's financial stability. Furthermore, property owners risk losing any equity they have built in the asset, exacerbating their financial hardship.

The principle of 'first in time, first in right' underscores the legal context of these scenarios, stressing that the HOA's lien can take precedence over the mortgage lender's claim. The emotional impact of is also considerable, as residents grapple with the loss of their residence and the accompanying financial pressures. A study indicates that properties within HOAs generally sell for 5-6% higher than similar residences outside these associations, emphasizing the potential value loss for individuals facing mortgage default. In 2025, understanding what happens to the mortgage if HOA forecloses is critical, as numerous property owners remain unaware of their rights and options. As Tony Mariotti notes, while over two-thirds (71%) of new constructions in the western region belong to an HOA, only 38% belong to HOAs in the northeastern region, illustrating the varying impact of HOAs across different areas. Consequently, staying informed about HOA rules is essential for homeowners to navigate these challenges effectively and mitigate the financial impact of HOA actions.

Explore Options for Homeowners Facing HOA Foreclosure

Homeowners facing have a variety of strategic options to consider. Open communication with the HOA is essential; many associations are willing to discuss payment plans or settlements for overdue dues, as they prefer to avoid the costly and protracted process of repossession. Consulting legal advice can also prove advantageous, as attorneys can assist property owners in examining defenses against property seizure, such as challenging the validity of the HOA's lien or the processes related to the seizure itself. In certain circumstances, filing for bankruptcy may offer temporary relief, enabling property owners to reorganize their debts and potentially halt foreclosure actions.

Statistics indicate that proactive negotiation can yield favorable results; residents who engage with their HOAs frequently observe significantly enhanced success rates in negotiations, with some reports suggesting these rates can reach as high as 70%. Furthermore, the average amount spent by property owners on HOA fees is approximately $291 monthly, totaling around $3,500 annually, underscoring the financial burden that can drive property owners to negotiate.

Moreover, case studies demonstrate that properties within HOAs tend to sell for 5-6% more than comparable homes outside these associations, highlighting the financial implications of HOA membership and how an understanding of property value can influence negotiation strategies. Additionally, the total assessments collected from property owners in 2020 were allocated for essential community services, which underscores the HOA's dependence on these funds and can inform negotiation tactics. By comprehending their rights and options, including potential legal defenses, homeowners can effectively navigate the complexities of HOA foreclosures and address the question of if HOA forecloses what happens to the mortgage to safeguard their financial interests.

Conclusion

The complexities surrounding HOA foreclosures pose significant challenges for homeowners, particularly concerning their mortgages. An HOA foreclosure can lead to the extinguishment of first mortgages in jurisdictions with 'super lien' laws, underscoring the precarious position of homeowners who may remain liable for outstanding mortgage debt despite losing their homes. The data indicates that a noteworthy portion of mortgages could be impacted by these actions, reinforcing the urgency for homeowners to comprehend the legal landscape and implications of HOA foreclosures.

Navigating the legal framework governing HOA foreclosures is essential for homeowners. The differences in state laws, especially regarding non-judicial versus judicial foreclosures, can greatly influence the protections available to homeowners. Given the potential for HOA liens to take precedence over mortgages, it is critical for homeowners to consult legal experts and familiarize themselves with the governing documents of their HOA. This knowledge empowers them to better protect their financial interests and rights in the face of potential foreclosure.

For those facing the threat of HOA foreclosure, proactive measures can substantially alter their circumstances. Maintaining open lines of communication with the HOA, exploring negotiation options, and seeking legal counsel are vital steps that can assist homeowners in mitigating the risks associated with foreclosure. Engaging in negotiations has demonstrated promising success rates, and understanding the financial implications of HOA membership can further strengthen a homeowner's position. Ultimately, staying informed and taking decisive action can significantly influence the outcome for homeowners navigating the challenging landscape of HOA foreclosures.

Frequently Asked Questions

What is an HOA repossession?

An HOA repossession occurs when a homeowners' association (HOA) enforces a lien against a property due to unpaid dues or assessments.

What happens to the mortgage if an HOA forecloses?

If an HOA forecloses, the loan provider may lose their claim on the property, which can lead to significant financial repercussions for homeowners who still owe money despite losing their residence.

What are 'super lien' regulations?

'Super lien' regulations allow an HOA's claim to take precedence over primary loans, potentially nullifying them during a property sale.

What recent legal ruling affects HOA foreclosures and mortgages?

A recent ruling by the District of Columbia Court of Appeals stated that a condominium association could not execute a sale while upholding a first deed of trust lien, highlighting the complexities in these scenarios.

How many loans are projected to be affected by HOA property seizures in 2025?

Projections for 2025 indicate that approximately 15% of loans could be affected by HOA property seizures.

Which areas recorded the highest number of property repossession starts recently?

California recorded the highest number of property repossession starts with 2,915 properties flagged in October 2024, while Houston, TX, noted 1,791 starts in Q3 2024.

What efforts are being made to help families retain their homes?

In Q1 2023, there were 58,120 home retention actions aimed at helping families remain in their homes.

Why is it important for real estate professionals to stay informed about HOA foreclosures?

Understanding the dynamics of HOA foreclosures and their impact on mortgages is crucial for real estate professionals, especially given the significant financial implications for lenders and homeowners.