Overview

The article delves into strategies for effectively investing in zombie properties—abandoned residential buildings entangled in the foreclosure process. It begins by highlighting the importance of understanding the characteristics of these properties. Subsequently, it evaluates the advantages and disadvantages of investing in them. Furthermore, it identifies effective strategies for locating these properties and discusses various financing options.

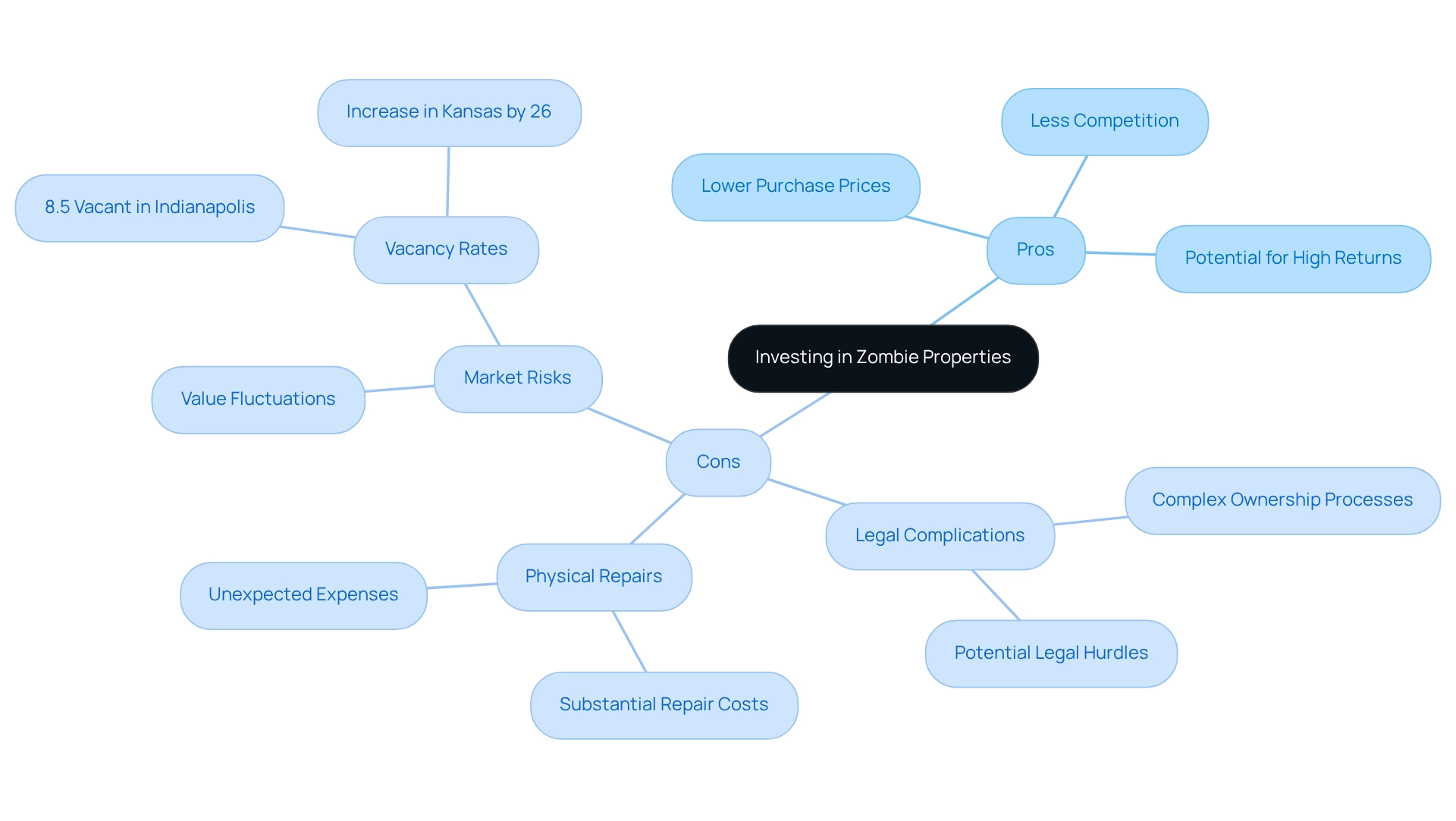

While these investments can yield substantial profit potential due to lower purchase prices and reduced competition, they also entail legal complexities and significant repair needs. Thus, careful assessment and strategic planning are imperative.

Introduction

In the realm of real estate, a unique phenomenon has emerged: zombie properties. These abandoned homes, left in limbo during the foreclosure process, present a complex landscape filled with both challenges and opportunities. As the vacancy rate for residential properties hovers around 1.3%, certain areas, particularly New York, have become hotspots for these neglected assets. Understanding the characteristics of zombie properties is crucial for investors looking to navigate this intricate market.

From the potential for significant returns to the legal hurdles that accompany such investments, this article delves into the various facets of zombie properties, offering insights into effective strategies for identification, assessment, and financing. Whether one is a seasoned investor or a newcomer to the real estate scene, the intricacies of zombie properties hold valuable lessons for anyone seeking to capitalize on this unique segment of the housing market.

Define Zombie Properties and Their Characteristics

Zombie properties refer to residential buildings that have been abandoned during the repossession process. In these cases, homeowners vacate the property after receiving a default notice, yet the bank has not yet taken control. This scenario presents a unique set of challenges and characteristics that define zombie properties:

- Vacancy: These properties are typically unoccupied for extended periods, leading to increased neglect.

- Foreclosure Status: The homeowner has received a foreclosure notice, but the foreclosure process remains incomplete, leaving the asset in a state of uncertainty.

- Ownership Limbo: The asset remains registered in the homeowner's name, resulting in a legal gray area that complicates potential transactions. This status can create significant challenges for title researchers, as it complicates the determination of clear ownership. Parse AI's innovative platform is designed to streamline this process, leveraging advanced technologies to clarify ownership and expedite title research.

- Physical Deterioration: Due to extended neglect, abandoned buildings frequently exhibit considerable physical damage, including overgrown lawns, shattered windows, and overall disrepair, rendering them less appealing to conventional buyers.

Current statistics indicate that the vacancy rate for all residential real estate in the U.S. has stabilized at 1.3% over the past three years, with the latest figure slightly increasing to 1.32%. Notably, New Hampshire and Delaware report the lowest vacancy rates at 0.4%. Furthermore, New York has emerged as a central hub for zombie properties, with a report indicating that 65 of the top 100 zip codes with the highest ratios of are situated there. This concentration underscores the urgent need for targeted policy responses to address the challenges presented by such characteristics in urban environments. As Rob Barber, CEO of ATTOM, points out, "We have every reason to believe this will persist into the foreseeable future, given high levels of equity resulting from increasing home prices and historically low supplies of homes for sale that make the few neglected real estate options available more likely to be acquired by buyers.

Evaluate the Pros and Cons of Investing in Zombie Properties

Investing in neglected real estate presents both opportunities and challenges that demand careful consideration. The key advantages and disadvantages are as follows:

Pros:

- Lower Purchase Prices: Zombie properties are often available at prices significantly below market value, enabling investors to realize substantial profit margins upon renovation and resale.

- Less Competition: The condition of these assets frequently deters numerous potential purchasers, resulting in diminished bidding rivalry and a more advantageous buying atmosphere for astute investors.

- Potential for High Returns: With strategic renovations, these assets can be revitalized into valuable resources, yielding impressive returns on investment. In fact, statistics indicate that investors who effectively renovate distressed assets can see returns that surpass typical market averages in 2025.

Cons:

- Legal Complications: The ownership and foreclosure processes associated with zombie properties can be intricate and protracted, requiring investors to navigate potential legal hurdles that may arise. As Teta from ATTOM notes, "Those markets generally sit in some of the poorer parts of the country, where homeowners are more vulnerable to foreclosure because they have less resources to keep up with mortgage payments if they lose their jobs," highlighting the challenges faced in these areas.

- Physical Repairs: Many of these assets require substantial repairs, which can lead to unexpected costs that may diminish profit margins.

- Market Risks: The anticipated rise in real estate value may not materialize, particularly in areas facing downturns. For instance, in Indianapolis, 8.5% of foreclosure assets are classified as vacant, underscoring the importance of comprehensive market analysis for potential investors. Furthermore, the recent increase of abandoned homes in Kansas by 26%, from 69 to 87, highlights current trends that could influence financial decisions.

Understanding the is essential for making informed financial choices. A case analysis on abandoned homes reveals that homeowners frequently vacate properties after receiving eviction notifications, mistakenly believing they must leave while still retaining ownership and responsibility. This underscores the importance of preserving neglected real estate until the foreclosure process is complete, emphasizing the necessity for thorough due diligence in any investment strategy.

Identify Effective Strategies to Find Zombie Properties

Recognizing abandoned real estate necessitates a proactive and diverse strategy. Several effective approaches can be employed:

- Local Tax Records: Engage with local tax assessors to identify properties with unpaid taxes. These records often highlight potential neglected real estate, commonly referred to as zombie properties, as owners may have abandoned them due to financial hardship.

- Neighborhood Surveys: Conduct drive-throughs in targeted neighborhoods to identify signs of neglect, such as overgrown lawns, boarded-up windows, or accumulated mail—common indicators of abandoned buildings.

- Networking: Cultivate relationships with local real estate agents, mortgage brokers, and rental managers. These professionals provide valuable insights into troubled assets that may not be publicly available.

- Online Tools: Utilize and databases focused on distressed assets. These tools streamline the search process and offer access to a broader range of potential leads.

- Public Records: Scrutinize foreclosure filings and court records to uncover assets abandoned during the foreclosure process. This information is crucial for identifying investment opportunities.

As we look ahead to 2025, the landscape of distressed real estate continues to evolve, with statistics indicating a significant number of unpaid taxes across various states. For instance, Connecticut boasts a vacancy rate of 0.56 percent, while states like Oklahoma and Kansas report higher rates, potentially linked to a rise in zombie properties. The report titled "Vacancy Rates by State" underscores these variations, illustrating the diverse housing market conditions across the U.S. By employing these strategies, real estate professionals can adeptly navigate the complexities of the market and uncover valuable investment opportunities. As Rob Barber, CEO of ATTOM, asserts, "We have every reason to believe this will persist into the foreseeable future, given high levels of equity flowing from rising home prices and historically low supplies of homes for sale that make the few neglected houses out there more likely to be acquired by buyers.

Conduct Thorough Assessments of Zombie Properties

Before investing in a zombie asset, a thorough evaluation is essential to mitigate risks and enhance potential returns.

- Physical Inspection: Conduct an on-site evaluation to assess the asset's condition. Identify critical issues, such as structural damage, mold growth, and pest infestations, which could significantly escalate repair costs.

- Title Search: Perform a comprehensive title search to uncover any existing liens, unpaid taxes, or legal disputes associated with the real estate. This step is crucial; statistics indicate that real estate in Nevada was set for foreclosure auction an average of 2.17 times, underscoring the frequency of issues linked to distressed assets and the necessity of thorough title searches.

- Estimate Repair Costs: Obtain detailed estimates from contractors for necessary repairs. Understanding the average repair expenses for troubled assets in 2025 will aid in assessing the total expenditure required and help prevent unforeseen costs. It is advisable to budget 10–20% more than anticipated for projects this year due to rising material and labor costs.

- Check Local Regulations: Familiarize yourself with local zoning laws and regulations that may impact your renovation or resale plans. Compliance with these regulations is essential for a successful investment.

- Consult Professionals: Collaborate with real estate attorneys and inspectors specializing in distressed assets. Their expertise will ensure that all facets of the asset are comprehensively assessed, providing you with a clearer understanding of the venture's viability.

By adhering to these steps, real estate experts can make informed decisions when considering zombie properties, ultimately leading to more prosperous ventures. Notably, trends in bank repossessions suggest an increase in repossessions in Q1 2024, highlighting the importance of comprehensive evaluations in identifying potential financial opportunities. Given that foreclosures are seen as a top choice for , thorough evaluations are imperative before investing in distressed assets.

Explore Financing Options and Investment Strategies

When financing zombie property investments, several options can be considered:

- Hard Money Loans: These short-term loans are particularly advantageous for investors aiming to swiftly acquire and renovate properties. They primarily depend on the asset's value, which enables faster access to funds without the stringent credit evaluations typical of conventional financing. Notably, offers a maximum loan amount of $5 million, significantly aiding investors in their endeavors. Conventional loans may be available; however, they often require that the asset is in good condition, presenting a barrier for distressed assets like zombie properties.

- Private Investors: Collaborating with private investors can provide the necessary capital with fewer restrictions than conventional banks, making it a flexible option for many investors.

- Renovation Loans: Programs such as the FHA 203(k) loan allow investors to finance both the purchase and renovation costs within a single mortgage, streamlining the funding process.

- Cash Purchases: If feasible, acquiring real estate outright with cash can simplify transactions and enhance the appeal of offers to sellers, particularly in competitive markets.

In 2025, the landscape for funding troubled real estate is evolving. Hard money loans are gaining popularity due to their favorable terms and accessibility. As highlighted in the case study titled "Impact of Competition on Borrowers," the competitive environment among hard money lenders is expected to benefit borrowers by providing more favorable loan conditions. Consequently, investors are encouraged to research and compare multiple lenders to secure the best loan conditions, as this trend is likely to yield more borrower-friendly options. As noted by Propel Real Estate Capital, emphasizing the speed advantage of hard money loans can position brokers as problem solvers for their clients. This trend is supported by a growing number of successful case studies showcasing the effective use of hard money loans in real estate investments, particularly for properties classified as zombie properties that require significant rehabilitation.

Conclusion

Zombie properties represent a unique segment of the real estate market, characterized by their abandoned state during the foreclosure process. These properties present both challenges and opportunities for investors, making an understanding of their characteristics essential. With the vacancy rate for residential properties remaining low, particularly in hotspots like New York, the urgency to address the issues surrounding zombie properties is evident.

Investors can benefit from the lower purchase prices and reduced competition typically associated with these properties, allowing for the potential of high returns through strategic renovations. However, the legal complexities, extensive repair needs, and market risks cannot be overlooked. Thorough assessments and proactive identification strategies are crucial in navigating this intricate landscape.

Effective strategies for finding zombie properties, such as leveraging local tax records and conducting neighborhood surveys, can uncover valuable investment opportunities. Additionally, understanding financing options—including hard money loans and renovation financing—can further empower investors to make informed decisions.

In conclusion, while investing in zombie properties requires careful consideration and due diligence, the potential for significant profits exists for those willing to engage with the complexities of this niche market. By equipping themselves with the right knowledge and strategies, investors can turn these neglected assets into lucrative opportunities.

Frequently Asked Questions

What are zombie properties?

Zombie properties are residential buildings that have been abandoned during the repossession process. Homeowners vacate the property after receiving a default notice, but the bank has not yet taken control, resulting in a unique set of challenges.

What characteristics define zombie properties?

Key characteristics include prolonged vacancy, incomplete foreclosure status, ownership limbo where the property remains registered in the homeowner's name, and physical deterioration due to neglect.

How does the vacancy rate for residential real estate in the U.S. relate to zombie properties?

The vacancy rate for all residential real estate in the U.S. has stabilized at 1.3%, with a slight increase to 1.32%. Certain areas, like New York, have a high concentration of zombie properties, indicating a need for targeted policy responses.

What are the advantages of investing in zombie properties?

Advantages include lower purchase prices, less competition from other buyers, and the potential for high returns through strategic renovations.

What challenges do investors face when dealing with zombie properties?

Investors may encounter legal complications related to ownership and foreclosure processes, substantial physical repair needs, and market risks where anticipated property value increases may not occur.

Why is it important for investors to conduct due diligence when considering zombie properties?

Due diligence is crucial because homeowners often vacate properties under the misconception that they no longer retain ownership, leading to complexities in the investment process. Thorough analysis helps mitigate risks and informs financial decisions.