Overview

The article provides a comprehensive step-by-step guide on how to perform a free lien search on property, emphasizing its importance in avoiding unexpected financial liabilities during real estate transactions. It supports this by detailing the necessary steps, such as gathering asset information, accessing local records, and consulting professionals, all aimed at ensuring a thorough understanding of any existing claims that could affect property ownership.

Introduction

In the intricate world of real estate, understanding liens is crucial for anyone involved in property transactions. A lien, essentially a legal claim against a property, can significantly affect ownership and financial obligations.

As property owners navigate the complexities of mortgages, tax obligations, and potential judgments, the implications of these liens become increasingly evident. With recent trends showing a rise in foreclosure activity and fluctuating homeowner equity, the urgency to conduct thorough lien searches has never been greater.

This article delves into the nature of liens, the various types that exist, and the essential steps and tools needed to ensure a comprehensive lien search, empowering readers to make informed decisions in their property dealings.

Understanding Liens: What You Need to Know

A claim acts as an official assertion against an asset, usually created to guarantee a debt. This legal mechanism grants creditors the authority to take possession of the assets should the debt remain unpaid. Comprehending the essence of claims is crucial, as they can significantly impact real estate transactions.

For example, if an asset is burdened by a current claim, the new owner may discover they are accountable for the related debt. Therefore, conducting a free lien search on property before completing any real estate transaction is essential to prevent unexpected financial obligations and to guarantee the integrity of the title. Recent data highlights the significance of this diligence: in January 2025, U.S. foreclosure activity experienced an increase, a trend that underscores the necessity for vigilance in comprehending property claims and their implications.

Significantly, Maine saw the highest average national equity increases at $58,000, emphasizing the possible advantages of equity recovery in relation to claims. Furthermore, the case study titled 'Impact of Home Prices on Equity' illustrates that fluctuations in home prices can significantly affect equity positions; for example, a 5% increase in home prices could help approximately 110,000 homes regain equity. As highlighted by the Mortgage Bankers Association, 'the forecast for HPI is a drop of less than one percent by Q1 2024, with expectations of mild recovery by year-end 2024.'

This nuanced understanding of claims is critical, especially given since CoreLogic began reporting equity data in Q1 2010. With the CoreLogic HPI Forecast anticipating a 3.7% rise in home prices from March 2024 to March 2025, the dynamics of equity recovery further complicate financial considerations, making it essential for professionals in the field to stay informed.

Types of Liens: Exploring the Different Categories

A free lien search on property can reveal how various types of liens, each with unique implications, can significantly affect property ownership. The following are the primary categories:

-

Mortgage Liens: These are the most prevalent, secured by the asset itself as collateral for home loans.

They play a crucial role in real estate financing, as the lender maintains a legal claim to the asset until the mortgage is paid off. Recent case studies suggest that understanding the prevalence of mortgage claims is essential for evaluating asset value.

-

Tax Claims: Enforced by governmental bodies for outstanding taxes, tax claims can lead to severe repercussions, including asset seizure.

Their prevalence has increased, reflecting the ongoing challenges owners face in managing tax obligations. According to recent news, despite the lucrative nature of tax certificate investing, it carries inherent risks, including bankruptcy and invalidation of certificates.

Expert opinions indicate that the risks linked to tax claims can significantly affect real estate ownership, with some asserting that these claims frequently create obstacles for prospective buyers.

-

Judgment Liens: These emerge from court rulings against owners for unpaid debts.

They can complicate real estate transactions, as any existing judgment claim must be resolved before the asset can be sold. Examining rivals' backlink profiles can assist in estimating the required number of high-quality links to meet SEO objectives, which aligns with the necessity for comprehensive research in real estate transactions.

-

Mechanic's Claims: Submitted by contractors or suppliers who have not received payment for their services, mechanic's claims can obstruct real estate sales and ownership transfer if not resolved quickly.

Grasping these classifications is crucial for buyers to evaluate the potential risks linked to claims on their desired assets, which can be assessed through a free lien search on property.

As the landscape of real estate ownership changes, staying informed about the consequences of various encumbrance types, especially the growing presence of , becomes essential for making sound investments in real estate.

Incorporating perspectives from real estate specialists can further clarify the influence of these claims on asset ownership.

Step-by-Step Process for Conducting a Lien Search

Conducting on property involves a systematic approach to ensure accuracy and thoroughness. Here’s a step-by-step guide:

-

Gather Asset Information: Begin by collecting essential details, including the asset address, owner's name, and relevant parcel numbers.

This foundational information is crucial for conducting a free lien search on property.

-

Access Local Records: Navigate to your local county clerk's office or their online portal to view land records.

Utilizing Parse AI’s advanced machine learning tools, including our example manager for annotating documents, you can expedite document processing and gain insights into critical documents related to the asset.

-

Search for Claims: Use the collected real estate information to pinpoint any registered claims.

Concentrate on mortgage documents, tax obligations, and judgment filings, as performing a free lien search on property can significantly affect the property’s title. Our platform empowers you to conduct full-text queries, leveraging the information extracted by our machine learning models for a more comprehensive exploration experience.

-

Review Findings: Carefully analyze the claim documents to understand their nature, priority, and potential implications on ownership. As Amanda (Rasizzi) Blooflat notes,

The outcome of these cases may have a significant bearing on the position of the debtor or the value of its assets.

This understanding is crucial, as it impacts decision-making throughout the free lien search on property process.

Parse AI's tools can assist in this analysis by providing detailed insights and summaries of the legal documents.

-

Consult with Professionals: If you encounter complex findings or need further interpretation, consult with a title company or a real estate attorney.

Their expertise can clarify the nuances and help you navigate any legal implications.

-

Consider Systematic Approaches: Similar to the case study of Yara's implementation of the Enablon system, adopting a systematic approach can enhance the efficiency and precision of your inquiry.

By automating and streamlining processes with Parse AI's tools, you can improve operational safety and avoid potential pitfalls associated with oversight.

By adhering to these steps, you will perform a comprehensive investigation, which usually requires between 10 to 14 days, particularly for older real estate. Highlighting this timeframe ensures that you are well-informed of any encumbrances that may impact the asset.

Moreover, utilizing Harbinger Land's knowledge in mineral leasing and acquisitions can offer valuable context and insights throughout the claim investigation process.

Essential Tools and Resources for Lien Searches

Carrying out a title investigation is crucial for guaranteeing unambiguous ownership, and various efficient tools and resources can simplify this procedure:

- Online Databases: Sites like PropertyShark and Zillow are essential for conducting a free lien search on property as well as obtaining and encumbrance information. Recent trends show that investments in AI tools aimed at enhancing search capabilities in such databases have reached a staggering 12.9 billion USD. This significant investment highlights the increasing importance of these tools in real estate transactions, enhancing the efficiency and precision of search processes.

- County Clerk’s Office: Local government offices are a conventional yet dependable source for preserving public records, including claims. These offices ensure that all claim information is up-to-date and accessible to the public.

- Title Companies: Collaborating with a title company can significantly improve the depth of your search for claims. Experts in this field are prepared to navigate the complexities of real estate records and often utilize advanced tools to perform a free lien search on property.

- like Nolo provide valuable guides and legal advice regarding liens and real estate transactions. Such resources not only educate property owners but also simplify the process, making it more efficient.

- Case Study: A pertinent example can be observed in South Africa, where the Companies and Intellectual Property Commission (CIPC) supervises registrations and inquiries for commercial transactions. The CIPC offers a framework for managing security interests, akin to those in the US and UK, demonstrating how organized processes can improve interest identification efficiency.

By utilizing these essential tools and resources, you can enhance both the efficiency and effectiveness of your interest identification, ensuring that all security interests are properly recognized and evaluated. As noted by Microsoft, trusted domains tend to have higher click-through rates in engines, emphasizing the value of credible resources in property research. This insight emphasizes the significance of depending on authoritative online databases for precise financial information.

Overcoming Challenges in Lien Searches: Tips and Tricks

Conducting property searches can be fraught with challenges, with incomplete records, discrepancies in ownership information, and complex legal language often complicating the process. Notably, surveys have indicated that a significant percentage of records may be incomplete, creating further hurdles. For instance, a creditor's claim of $20,000 will assert that amount from a $200,000 home sale, illustrating the financial implications of such claims.

To effectively navigate these challenges, consider the following strategies:

- Double-Check Information: Verify all asset details meticulously to avoid overlooking relevant claims. Accurate data entry is crucial for a successful search.

- Utilize Multiple Sources: Cross-referencing information from various databases can help validate your findings and uncover potential discrepancies.

- Seek Professional Assistance: Engaging with title professionals or attorneys can be invaluable, particularly when facing complex legal issues that require expertise.

- Stay Organized: Maintain a systematic record of all documents and findings to facilitate a comprehensive review of the asset’s charge history.

Additionally, it is essential to understand that mortgages and charges are registered and searched at Companies House in the same manner. As highlighted in the case study, Companies House defines a mortgage as security for a debt that passes property but not possession, while a charge does not pass property or possession. By applying these strategies and recognizing these differences, you can reduce typical obstacles and improve the effectiveness and precision of your claim investigation efforts.

As Despina Shields from COGENCY GLOBAL observes, grasping the legal subtleties behind claim classifications is crucial, especially since a judgment can transform into a judgment encumbrance in certain jurisdictions, but not automatically in most states. Being ready and knowledgeable will ultimately result in more successful outcomes in .

Verifying Your Lien Search Results: Ensuring Accuracy and Compliance

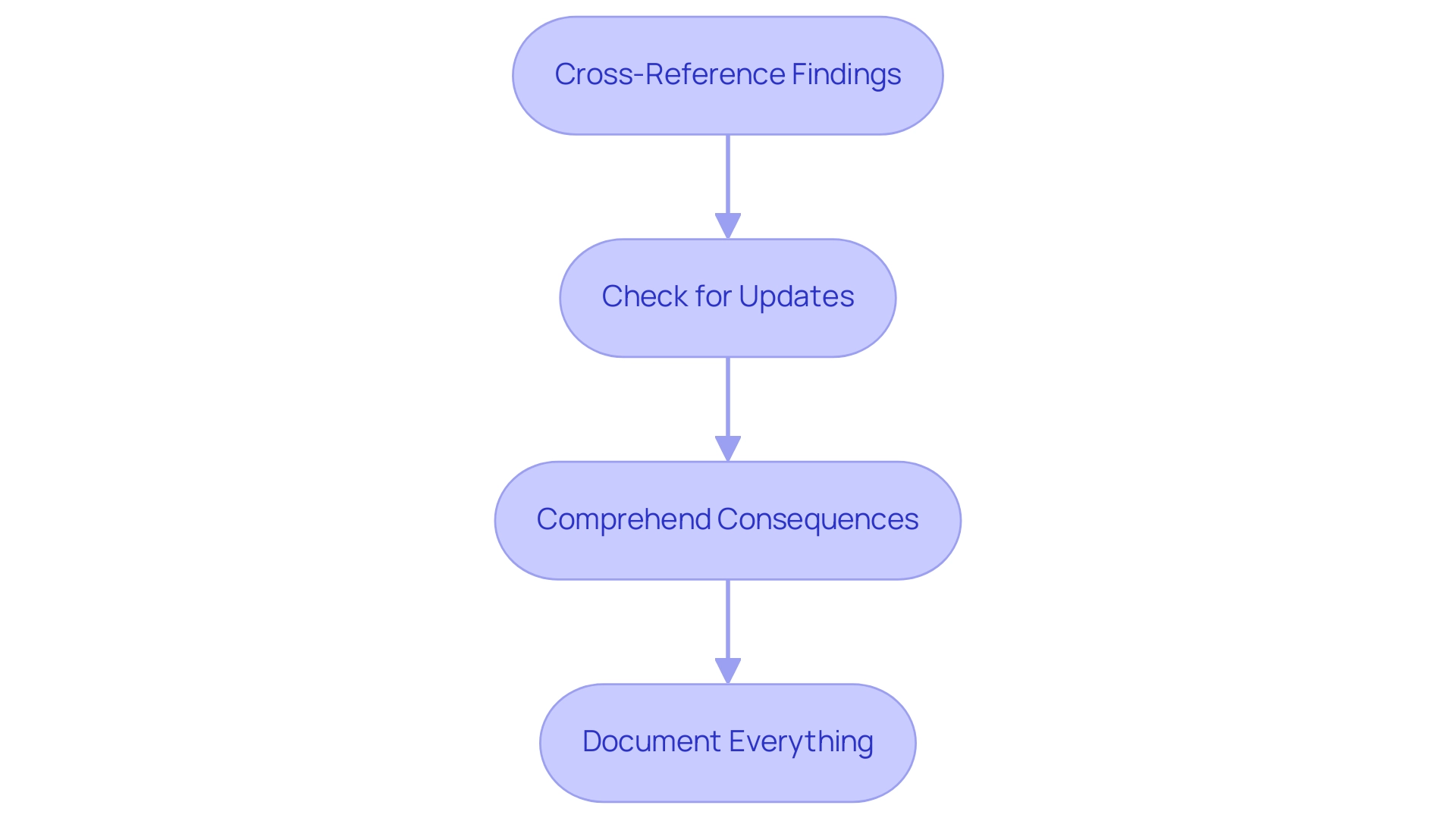

After finishing your title investigation, the confirmation of results is crucial for upholding the integrity of property transactions. Here are essential steps to ensure accuracy:

-

Cross-Reference Findings: Validate your results against official records from the county clerk’s office.

This comparison ensures that the data aligns and identifies any discrepancies. Utilizing advanced machine learning tools from Parse AI, including our example manager, can assist in providing comprehensive searches across various types of claims, allowing you to quickly annotate and extract information from large sets of unstructured documents, adding credibility to your verification process.

-

Check for Updates: Given that claims can frequently change, it is vital to verify that you are working with the most recent information available.

Parse AI's automated document processing abilities improve efficiency in remaining informed, reducing the risk of missing new claims that could influence your title. Considering that over 50% of inquiries in the US occur on mobile devices, ensuring that your verification processes are accessible and mobile-friendly can further streamline your work.

-

Comprehend Consequences: Consulting a real estate lawyer can offer insight into the consequences of any claims discovered during your investigation.

Their knowledge is essential in understanding the implications these claims may have on your transaction.

-

Document Everything: Maintain comprehensive records of your findings and all communications with professionals involved.

This documentation acts as an important reference for future inquiries and strengthens your position should any disputes occur.

Conducting a free lien search on property is vital to verify search results, prevent potential legal issues, and guarantee . The practice of thorough verification, including a free lien search on property, not only protects your interests but also upholds the reputation of real estate professionals, especially in an era where undiscovered liens can severely impact lender positions. As Brian Dean notes, titles with positive sentiment have a higher organic click-through rate, emphasizing the importance of clear and positive communication throughout the verification process.

Conclusion

Navigating the complex landscape of property transactions necessitates a thorough understanding of liens and their implications. As outlined in the article, liens serve as legal claims against properties, impacting ownership and financial responsibilities. The rise in foreclosure activity and fluctuating homeowner equity underscores the importance of conducting diligent lien searches before finalizing any real estate deal.

Understanding the different types of liens—mortgage, tax, judgment, and mechanic's liens—equips property buyers with the knowledge to assess potential risks associated with their investments. With each category carrying unique consequences, being informed allows for better decision-making in the face of complex legal and financial landscapes.

The step-by-step process for conducting a lien search emphasizes the need for accuracy and thoroughness. Utilizing essential tools and resources, such as online databases and professional assistance from title companies, can significantly enhance the efficiency of the search process. Moreover, strategies for overcoming common challenges, such as verifying information and maintaining organized records, are crucial for achieving reliable results.

Ultimately, the significance of verifying lien search results cannot be overstated. By ensuring accuracy and compliance, property owners can safeguard their investments and maintain clear titles. As the real estate market continues to evolve, staying informed and proactive about liens will empower individuals to make sound decisions, paving the way for successful property transactions in an increasingly complex environment.

Frequently Asked Questions

What is a claim in the context of real estate?

A claim is an official assertion against an asset, created to guarantee a debt. It allows creditors to take possession of the asset if the debt remains unpaid.

Why is it important to understand claims in real estate transactions?

Understanding claims is crucial because they can significantly impact property ownership. If an asset has a current claim, the new owner may become responsible for the related debt.

What is a free lien search and why is it necessary?

A free lien search reveals any existing claims on a property, helping potential buyers avoid unexpected financial obligations and ensuring the integrity of the title before completing a real estate transaction.

What recent trend has been observed in U.S. foreclosure activity?

In January 2025, there was an increase in U.S. foreclosure activity, highlighting the importance of being vigilant about property claims.

How can fluctuations in home prices affect equity positions?

Changes in home prices can significantly affect equity positions; for instance, a 5% increase in home prices could help approximately 110,000 homes regain equity.

What are the primary categories of liens that can affect property ownership?

The primary categories of liens include: 1. Mortgage Liens: Secured by the asset as collateral for home loans. 2. Tax Claims: Enforced by government bodies for unpaid taxes, which can lead to asset seizure. 3. Judgment Liens: Result from court rulings for unpaid debts and must be resolved before selling the asset. 4. Mechanic's Claims: Filed by contractors or suppliers for unpaid services, which can obstruct real estate sales if unresolved.

How do tax claims impact real estate ownership?

Tax claims can create significant obstacles for property owners, including potential asset seizure, making it essential for buyers to be aware of any outstanding tax obligations.

What is the forecast for home prices according to the Mortgage Bankers Association?

The forecast indicates a drop of less than one percent in home prices by Q1 2024, with expectations of mild recovery by the end of 2024.

Why is it essential for real estate professionals to stay informed about claims and liens?

Staying informed is vital due to the complexities of the fluctuating homeowner equity landscape and the implications of various claims on property ownership, which can affect investment decisions.