Overview

To find a property lien accurately, one must adopt a systematic approach. This includes:

- Visiting the County Recorder's Office

- Searching by property address

- Utilizing online resources and title companies for comprehensive searches

Understanding different types of liens and common issues that may arise during searches is crucial. Thorough and precise searches are essential to avoid potential financial liabilities associated with unresolved claims.

Introduction

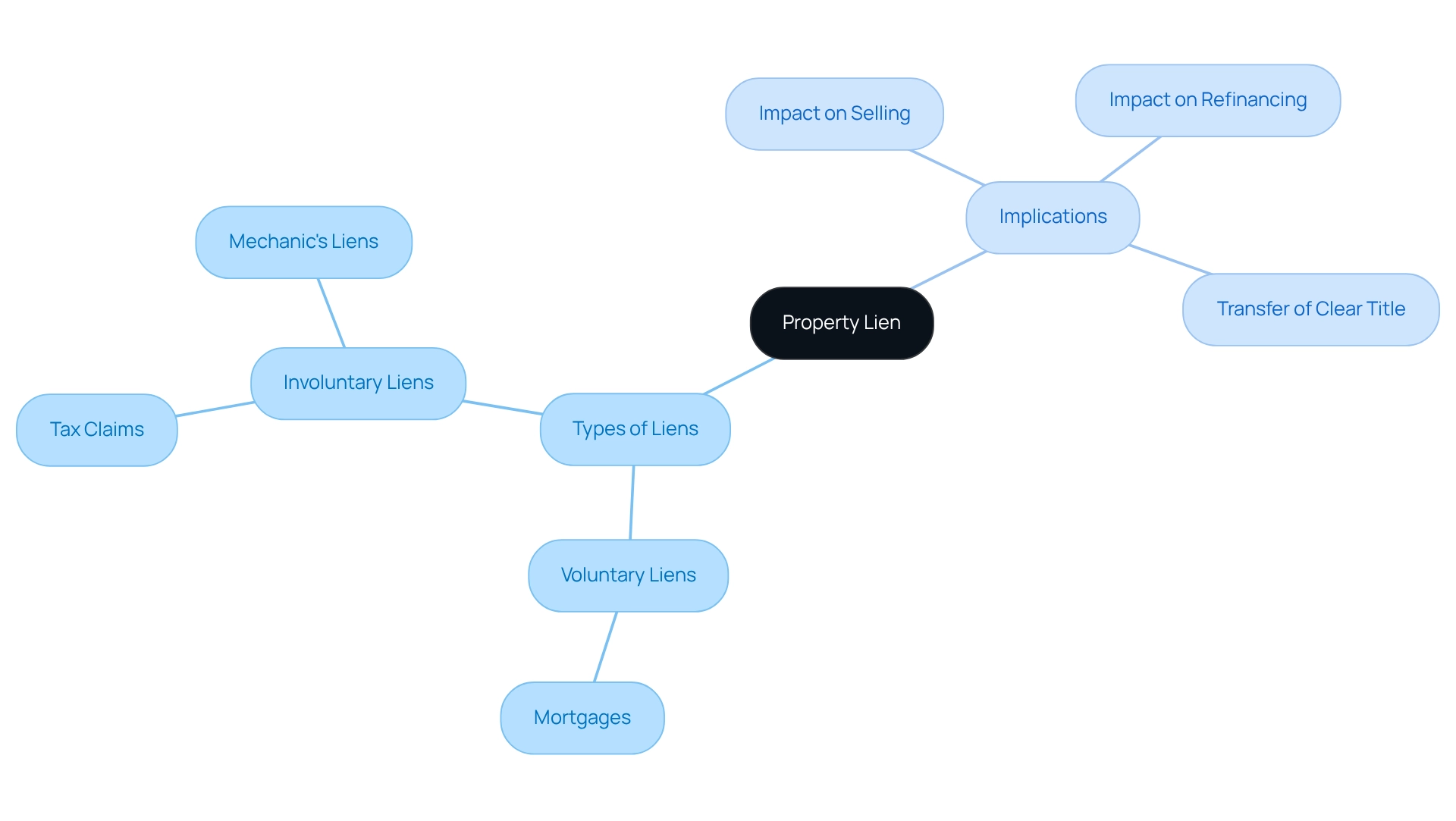

Navigating the complex world of property liens is a crucial undertaking for both buyers and sellers in the real estate market. These legal claims, often stemming from unpaid debts, can profoundly affect property transactions and ownership rights. Understanding the various types of liens—such as mortgage, tax, and mechanic's liens—is essential.

Furthermore, locating and troubleshooting issues in lien searches is vital for informed decision-making. As the landscape of property liens continues to evolve, staying informed about their implications and learning effective search strategies is imperative for safeguarding investments and ensuring seamless real estate dealings.

Understand What a Property Lien Is

A legal claim represents a formal assertion against an asset, typically arising from unpaid obligations. It serves as a security interest for creditors, granting them the right to seize the asset if the debt remains unpaid. Claims can be classified as:

- Voluntary, such as those created by mortgages

- Involuntary, like tax claims or mechanic's liens

Understanding how to find a property lien is crucial for anyone involved in real estate, as it can significantly affect the ability to sell or refinance an asset. For example, an asset burdened by an unresolved claim may prevent the owner from transferring clear title until the claim is addressed.

Identify Different Types of Property Liens

Real estate encumbrances are fundamental elements of realty law, each serving unique roles that can significantly affect ownership and transactions. Understanding these types is vital for navigating potential risks.

- Mortgage Claims: These voluntary claims arise when lenders fund a real estate asset. Should the borrower default, the lender retains the right to foreclose, underscoring the necessity for buyers to comprehend their obligations.

- Tax Claims: Imposed by government entities for unpaid taxes, tax claims take precedence over other encumbrances, potentially leading to severe consequences for property owners. Recent statistics reveal a growing trend in tax sales, with maximum interest rates capped at 16% in regions like Maricopa County, Arizona. According to Maricopa County, these trends highlight the importance of understanding tax encumbrance implications.

- Mechanic's Claims: Submitted by contractors or suppliers who have not received compensation for completed work, these claims can complicate real estate sales if not addressed promptly. They serve as a reminder of the importance of ensuring all work is compensated to prevent future disputes.

- Judgment Liens: Arising from court rulings against landowners, these liens allow creditors to seize assets to settle debts. They emphasize the necessity for asset owners to maintain good financial standing to protect their holdings.

- Homeowners Association (HOA) Liens: These occur when landowners fail to pay HOA fees, potentially resulting in foreclosure by the association. Understanding how to find a property lien related to HOA claims is crucial for homeowners to avert losing their assets due to unpaid fees. By learning how to find a property lien, owners and purchasers can more effectively navigate the complexities of real estate dealings and mitigate related risks. Ongoing education on these matters is essential, as the landscape of property claims evolves with market trends and legal changes. The Transparent Dispute Resolution Process exemplifies the importance of maintaining accurate records and ensuring transparency in management, reinforcing the need for continuous education in this field. Furthermore, utilizing technologies such as LexID® identity linking, which guarantees 99% accuracy of linking dependability, can significantly enhance the precision of claims searches.

Locate Property Liens Using Public Records

To understand how to find a property lien, follow these steps:

- Visit the County Recorder's Office: Most claims are documented at the county level. You can visit in person or access their online database.

- Search by Property Address: Utilize the property address to look for any documented claims. Ensure you have the correct spelling and details.

- Check Tax Assessor's Records: Tax encumbrances are often recorded with the county tax assessor. Look for any outstanding tax obligations.

- Utilize Online Resources: Websites like Realtor.com and local government portals can provide access to claim information.

- Request a Title Search: If you prefer a comprehensive search, consider hiring a title company that specializes in encumbrance searches. They can provide comprehensive documents regarding any claims linked to the asset.

By following these steps, you will understand how to find a property lien that may affect the property in question.

Troubleshoot Common Issues in Lien Searches

When conducting lien searches, several common issues may arise that can complicate the process:

- Incomplete Records: Missing or incomplete records can obstruct your inquiry. If you suspect this, reach out directly to the county office for clarification. Comprehensive searches covering municipal departments are essential, as they can reveal potential red flags early in the process. Utilizing Parse AI's advanced machine learning tools, including the example manager, streamlines this process by efficiently processing and interpreting large sets of unstructured documents.

- Incorrect Real Estate Information: Accurate addresses and owner details are crucial. Mistakes in this information can result in overlooked claims, possibly making purchasers responsible for any debts associated with the asset. As the Chief Operations Officer warns, "Skipping it could leave a buyer liable for any debt attached to the property in question." Parse AI's platform enhances accuracy by automating title research, ensuring that the information you rely on is both comprehensive and precise.

- Unrecorded Claims: Not all claims are documented in public databases. To uncover mechanic's claims, consider consulting local contractors or suppliers who may have relevant information. Furthermore, utilizing the knowledge of search firms can offer valuable insights into local procedures and requirements. With Parse AI's advanced title research automation, you can extract essential information from title documents, facilitating the identification of possible unrecorded claims.

- Outdated Information: Public records can become outdated. Always verify the date of the last update on the records you are reviewing to ensure you are working with the most current information. A significant case in 2017 emphasized the necessity of careful scrutiny of recorded dates because of a decision that permitted tax claims to stretch retroactively for as long as ten years. This highlights the necessity of consulting lien investigation companies for accurate analysis and prioritization of liens. Parse AI's digital interface enables comprehensive text queries and advanced extraction features, guaranteeing you have access to the latest data.

- Legal Language Confusion: Legal documents often contain complex terminology. If you encounter terms that are unclear, seek assistance from a real estate attorney or a title professional to navigate these complexities. Remember, comprehensive investigations are essential for protecting investments and avoiding potential pitfalls. With Parse AI's interactive labeling and OCR technology, you can simplify the document review process, making it easier to understand and manage legal language.

By recognizing these challenges and knowing how to address them, you can enhance the thoroughness and effectiveness of your lien searches.

Conclusion

Understanding property liens is essential for anyone engaged in real estate transactions. These legal claims can arise from various sources, including mortgages, unpaid taxes, and contractor disputes, each with distinct implications for property ownership. Recognizing the different types of liens and their potential impact allows buyers and sellers to navigate the complexities of real estate more effectively.

Locating property liens through public records is a critical step in safeguarding investments. By utilizing county resources and online databases, individuals can uncover any liens associated with a property, ensuring informed decision-making. Furthermore, being aware of common issues that may arise during lien searches—such as incomplete records or outdated information—can further enhance the accuracy and reliability of the search process.

Ultimately, staying informed about the evolving landscape of property liens is vital for successful real estate dealings. Continuous education and the use of advanced technologies can empower individuals to manage liens proactively, minimizing risks and protecting their investments. By equipping themselves with the knowledge and tools to navigate property liens, both buyers and sellers can ensure a smoother transaction process and secure their real estate interests.

Frequently Asked Questions

What is a legal claim in the context of assets?

A legal claim is a formal assertion against an asset, typically arising from unpaid obligations, and serves as a security interest for creditors, allowing them to seize the asset if the debt remains unpaid.

What are the two main types of claims?

Claims can be classified as voluntary, such as those created by mortgages, and involuntary, like tax claims or mechanic's liens.

Why is it important to understand property liens in real estate?

Understanding how to find a property lien is crucial for anyone involved in real estate, as it can significantly affect the ability to sell or refinance an asset.

How can an unresolved claim affect property ownership?

An asset burdened by an unresolved claim may prevent the owner from transferring clear title until the claim is addressed.