Overview

The article underscores the essential steps and significance of conducting a title and lien search in real estate transactions. These searches are critical for verifying legal ownership and identifying any claims or encumbrances on a property. Consequently, they protect buyers from potential legal disputes and financial losses. This assertion is supported by statistics that highlight the increasing demand for thorough investigations in a competitive market.

Introduction

In the intricate world of real estate transactions, securing property ownership relies heavily on the essential processes of title and lien searches. These searches are far from mere formalities; they act as crucial safeguards against potential fraud, legal disputes, and financial losses. A title search meticulously examines public records to confirm ownership and uncover any claims or encumbrances. In contrast, a lien search focuses on outstanding debts that could jeopardize a buyer's investment. As the landscape of real estate evolves, grasping these processes is increasingly vital for professionals navigating the complexities of property transactions. Furthermore, with the rise of technology introducing new efficiencies, the necessity of conducting thorough searches cannot be overstated, promising peace of mind for both buyers and sellers alike.

Understanding Title and Lien Searches: Key Concepts

Investigating es is crucial in dealings, serving as the foundation for secure asset ownership. A title and lien search entails a to verify the legal ownership of a real estate asset and to identify any claims or encumbrances that may exist. This process involves examining mortgages, claims, and other legal matters that could potentially impact ownership rights.

Conversely, a claim investigation specifically focuses on outstanding debts or claims against the property, such as unpaid taxes or court judgments.

The , particularly the title and lien search, cannot be overstated, as they directly affect the legality and security of property transactions. According to recent statistics, 66.1% of families possessed their main residence in 2022, underscoring the and claim status in real estate transactions. Furthermore, 2% of FSBO sellers discovered that attracting potential buyers was challenging, highlighting the competitive environment in real estate and the necessity of comprehensive property investigations to build buyer trust.

In addition, with the recent increase in refinance transactions, the demand for effective and precise of ownership and claims has risen. This presents a significant opportunity for automation to streamline these processes, addressing the increased demand for efficiency in the current market. Specialists emphasize that , including a title and lien search of ownership and claims, are not merely procedural actions; they are crucial protections against possible legal conflicts and monetary losses.

For instance, a thorough abstract service that operates in all 50 states, including regions like Guam and the Virgin Islands, guarantees that users can effectively access vital documents and information, thus enhancing the trustworthiness of property transactions.

In conclusion, understanding the subtleties of ownership and encumbrance inquiries is vital for . These inquiries not only safeguard purchasers and vendors but also enhance the overall integrity of the real estate market. The incorporation of utilized by 46% of REALTORS® for various tasks, signifies the sector's transition towards automation, which can further enhance the effectiveness of property and claim inquiries.

Why Conducting a Title and Lien Search is Essential

Performing a is crucial for several significant reasons. Primarily, it confirms that the seller possesses the legal right to sell the asset, thereby safeguarding the buyer from potential deception. Furthermore, these inquiries unveil any existing claims or restrictions that could jeopardize the purchaser's ownership rights.

The can be severe; for instance, bankruptcy does not eliminate a debtor's claim unless it is fully resolved, which may lead to unexpected financial obligations for new property owners. Statistics reveal that a lack of thorough title and encumbrance investigations can result in substantial financial repercussions, underscoring the importance of diligence in this area.

Current trends indicate a notable increase in refinancing activity, presenting an opportune moment to leverage automation in . Expert search firms can conduct comprehensive investigations across various states and counties for all types of claims, streamlining the process and ensuring that all relevant information is accurately recorded and analyzed. A case study titled "Not All States Are Created Equal" highlights the discrepancies in how different states manage and disclose municipal charge information.

This emphasizes the necessity for buyers to familiarize themselves with local regulations to avoid , which can complicate ownership transfers. As Armstrong noted, "What can be an annoying experience for a new owner in one state can be a very scary one in another."

Real estate lawyers consistently emphasize the risks associated with inadequate [property investigations](https://blog.parseai.co/how-do-you-find-liens-on-property-steps-for-accurate-searches). They caution that failing to conduct these essential checks can lead to legal disputes and significant financial losses. Moreover, a [title and lien search](https://blog.parseai.co/how-to-conduct-an-effective-md-property-search-a-step-by-step-guide) as part of thorough property investigations plays a vital role in preventing .

By identifying potential encumbrances early in the transaction process, buyers can mitigate risks and facilitate a smoother transfer of ownership. In 2025, the importance of performing these inquiries is more pronounced than ever, as the landscape of continues to evolve. Ultimately, not only protect investments but also provide reassurance for all parties involved in a real estate deal.

Buyers are encouraged to collaborate with companies like DataTrace to ensure they have access to accurate and up-to-date municipal lien data. This proactive approach helps avoid surprises related to encumbrances and guarantees a seamless transfer of ownership.

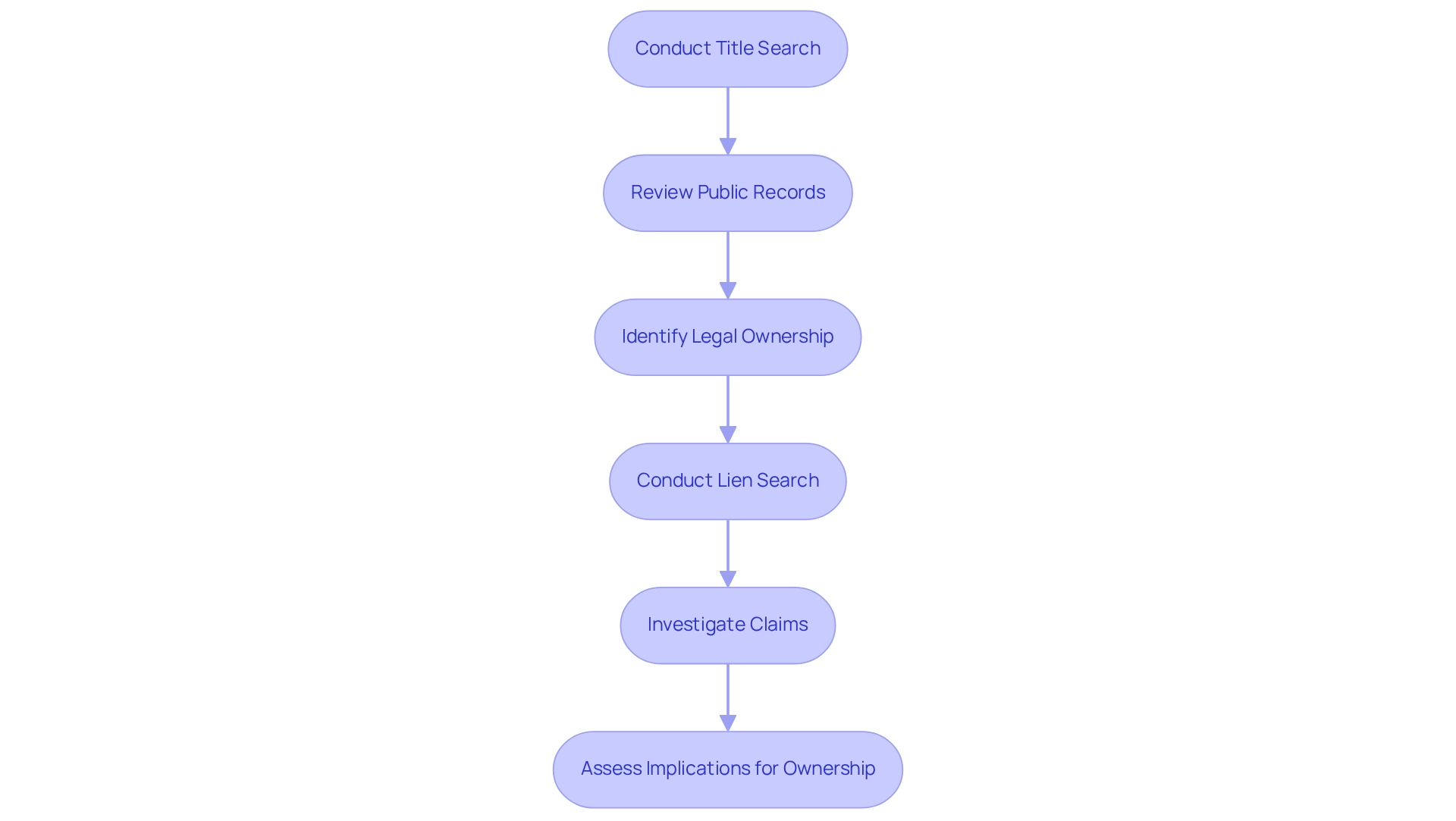

Step-by-Step Process for Conducting a Title Search

To effectively conduct , adhere to the following comprehensive steps:

- Gather Asset Information: Begin by collecting vital details about the asset, such as the address, legal description, and the name of the current owner. This foundational information is crucial for an accurate search.

- Visit the Local Land Records Office: Proceed to the county clerk or recorder's office where the real estate is located. While many records are accessible online, an in-person visit can uncover additional documents that may not be digitized.

- Search for the Current Deed: Identify the most recent deed to verify the current owner's name. This step is essential to ensure there are no discrepancies in ownership that could complicate future transactions.

- Review Previous Deeds: Trace the chain of title by examining prior deeds. This process assists in recognizing any breaks in ownership or potential issues that could impact the marketability of the asset.

- Check for Liens and Encumbrances: Investigate any recorded liens, mortgages, or other encumbrances that may impact the property. This may require checking tax records and court documents to ensure a clear ownership.

- Document Findings: Maintain detailed notes of your discoveries, including any issues that may need resolution before proceeding with a transaction. Thorough documentation is vital for transparency and future reference.

In 2025, the average duration required to perform a search has significantly reduced due to advancements in technology, with many researchers finishing inquiries in a fraction of the time compared to conventional methods. Utilizing tools like can enhance accuracy and efficiency, enabling researchers to produce abstracts and reports more swiftly. For example, 's innovative platform demonstrates how technology can simplify the research process, leading to .

As per a case study, Parse AI tackles the challenges related to the time and resources needed for verifying real estate ownership, allowing researchers to carry out their work more efficiently.

As Velany Rodrigues wisely remarked, "While it may be challenging to craft and to select suitable keywords, there is no denying the fact that it is certainly worth investing additional time to get these right." By adhering to these best practices and utilizing modern technology, can guarantee a .

How to Perform a Lien Search: A Detailed Approach

To conduct , it is imperative to adhere to the following detailed steps:

- Identify the Asset: Begin by gathering the asset's legal description and the current owner's name. This foundational information is essential for accurate searches.

- Access Public Records: Visit the county recorder's office or utilize online databases to access public records related to the asset. These documents are crucial, as they contain important details regarding any claims related to the asset.

- Search for Claims: Concentrate on identifying any claims registered against the asset. This includes tax claims, mechanics' claims, and judgment claims. Each type of claim has unique implications for ownership and can significantly influence the marketability of the asset. For instance, by binding to the debtor's assets, thus limiting the ability to sell or transfer property until the debt is fulfilled. Tax claims, enforced by the government when landowners fail to pay taxes, can lead to severe repercussions, including asset confiscation, underscoring the importance of timely tax payments.

- Check for : Be aware that unregistered claims may exist. To uncover these, consult local municipalities or agencies that may possess additional information. This step is essential, as unlogged claims can result in unforeseen .

- Document All Findings: Meticulously log all identified claims and their statuses, indicating whether they are settled or pending. This documentation is vital for understanding the financial obligations associated with the asset. Current trends suggest that an average of 2-3 claims can be found per location during investigations, emphasizing the importance of comprehensive reviews and the potential financial consequences for landowners.

By following these procedures, real estate professionals can effectively navigate the complexities of claims investigations, ensuring they are well-informed about any , particularly those revealed in a . As financial expert David Bach emphasizes, is crucial, as wealth is often determined by how much is saved rather than earned. This proactive financial management is essential in real estate transactions.

Furthermore, as Josh Billings wisely remarked, "Debt is like any other trap, easy enough to get into, but difficult enough to escape from," highlighting the importance of understanding encumbrances and their effects on ownership.

Title Search vs. Lien Search: Understanding the Differences

In the realm of , ownership evaluations and es serve essential yet distinct functions. An ownership inquiry provides a comprehensive review of a property's , revealing any claims, encumbrances, or legal matters that could impact ownership. This inquiry is typically conducted during the purchase process to ensure that the title is clear and free from disputes.

Conversely, a lien investigation is specifically designed to uncover any outstanding debts or claims against the property. This type of inquiry is particularly crucial for lenders and buyers, as it helps to identify concealed that may pose risks to their investment.

Understanding when to perform each type of inquiry, such as a , is vital for effective due diligence. For instance, a is generally advised before finalizing a sale, ensuring that the purchaser secures undisputed ownership. In contrast, a title and lien search may be conducted at various stages, especially when financing is involved, to safeguard against any undisclosed claims that could affect the asset's value.

Data indicates that ownership reviews are conducted more frequently than lien examinations, underscoring their critical role in the transaction process. The cost of a record examination typically ranges from $75 to $200, reflecting the financial commitment necessary for ensuring asset security. Real estate professionals emphasize the importance of these inquiries; as noted by industry specialists, understanding the mechanics of a title and lien search enables buyers and sellers to accurately interpret outcomes and make informed decisions.

Case studies illustrate the practical impacts of these inquiries. For example, transactions that adhered to best practices in conducting s have shown significantly reduced rates of post-sale disputes. The optimal methods for utilizing a Power of Attorney (POA) in real estate transactions further highlight the importance of thorough inquiries in mitigating risks.

Neglecting to conduct a title and lien search can lead to unforeseen financial obligations, accentuating the importance of these investigations in protecting investments. By comprehending the nuances between ownership and encumbrance inquiries, real estate professionals can enhance their due diligence processes and minimize potential risks.

Common Challenges in Title and Lien Searches and How to Overcome Them

Frequent obstacles encountered during significantly impact the effectiveness and precision of the process. Understanding these challenges is crucial for professionals aiming to enhance their inquiry methods. Here are some of the most prevalent issues and strategies to overcome them:

- Incomplete Records: , complicating the tracing of ownership and identification of liens. Notably, 22% of eviction records contain ambiguous information or misrepresent a tenant's eviction history, underscoring the prevalence of inaccuracies in public records. To address this, it is advisable to consult a variety of sources, including local government offices, online databases, and historical records. Engaging with multiple resources can help fill in the gaps and provide a more complete picture.

- Complex Legal Language: The found in documents can be daunting and difficult to interpret. As , emphasizes, understanding legal nuances is crucial in navigating these complexities. To facilitate this, consider enlisting the help of a title professional or attorney who can conduct a to clarify confusing terms and ensure that all legal nuances are understood. This collaboration can prevent costly misunderstandings down the line.

- Time Constraints: Conducting thorough inquiries can be a time-intensive process, particularly when dealing with non-digitized records. To alleviate this challenge, it is essential to prepare in advance and allocate sufficient time for each inquiry. Establishing a systematic approach can streamline the process and enhance overall efficiency.

- Hidden Claims: Not all claims are documented in public databases, which can lead to unforeseen liabilities. A case study titled "Factors Predicting Inaccuracies in Eviction Cases" indicates that the presence of legal representation can significantly affect the accuracy of records. To minimize the chance of encountering concealed liens, conduct thorough investigations that encompass inquiries with local agencies and other relevant organizations. This proactive approach can uncover additional information that may not be readily available in standard records.

Furthermore, the National Association of Realtors (NAR) has developed (MSA) profiles detailing demographics and traits of home buyers in the U.S., which highlights the significance of precise ownership investigations in real estate transactions.

By understanding these challenges and applying effective strategies, professionals in the field can enhance their inquiry processes, ultimately resulting in more precise and dependable outcomes in real estate transactions.

Leveraging Technology for Efficient Title and Lien Searches

The integration of technology into property inquiries has revolutionized the efficiency and precision of . Tools such as Parse AI leverage advanced to rapidly extract pertinent information from extensive collections of document titles. This innovation not only accelerates the retrieval process but also significantly reduces the likelihood of human error, yielding more reliable outcomes.

Furthermore, the advent of online databases and digital record-keeping systems has transformed access to public records, empowering researchers to conduct inquiries remotely and effectively. This shift towards is not merely a trend; it signifies a fundamental evolution in the approach to , particularly in title and lien searches, with technology enabling researchers to conserve considerable time and costs.

Current statistics underscore the efficacy of machine learning in this domain, with studies revealing that compared to traditional methods. For instance, the application of machine learning frameworks, such as Microsoft's , has achieved an accuracy rate of 62% in predicting stock market fluctuations, suggesting that similar advancements in property research could yield equivalent benefits.

As we approach 2025, , especially in title and lien searches, is expected to expand further, with ongoing advancements fostering even greater efficiencies. Expert opinions emphasize that adopting these technological innovations is crucial for professionals in the field, as they not only streamline workflows but also confer a competitive advantage in an increasingly data-driven landscape. The future of ownership research is undeniably intertwined with technological progress, making it imperative for industry leaders to adapt and effectively utilize these tools.

Best Practices for Conducting Title and Lien Searches

To ensure thorough and effective title and lien searches, it is essential to adhere to the following :

- Be Thorough: Gather extensive details concerning the asset and its ownership history. This foundational step is crucial for identifying any potential issues that may arise during the transaction process. As noted by Erik J. Martin, "; the deed is the document used to transfer the ownership." Understanding this distinction is vital for effective research.

- Use Multiple Sources: . This practice not only enhances accuracy but also helps uncover hidden claims that could impact property transactions. Thorough preparatory efforts, as shown in the case study 'Gathering Essential Information for Municipal Lien Searches,' ensures that the inquiry concentrates on the appropriate records and aids in identifying any discrepancies in ownership.

- Stay Organized: . An organized approach facilitates future reference and informed decision-making, ensuring that all relevant information is easily accessible.

- Consult Experts: When confronted with complicated matters, do not hesitate to seek help from professionals or legal specialists. Their expertise can provide clarity and guidance, significantly .

- Embrace Technology: Utilize , such as those provided by Parse AI, to . Employing machine learning and optical character recognition can significantly improve the speed and precision of research on documents, as emphasized in the case study ',' facilitating faster completion of abstracts and reports.

By implementing , title researchers can enhance their efficiency and effectiveness, ultimately leading to more successful outcomes in their searches.

Conclusion

Title and lien searches are essential components of real estate transactions, acting as a protective barrier against potential risks that could threaten property ownership. A thorough examination of public records through a title search not only confirms legal ownership but also reveals any claims or encumbrances. In parallel, a lien search identifies any outstanding debts that may impact a buyer's investment. The importance of these searches is highlighted by statistics showing a significant percentage of homeowners facing challenges in attracting buyers, illustrating the competitive nature of the real estate market.

As technology advances, so does the efficiency and accuracy of these searches. Automation and sophisticated tools, including machine learning and optical character recognition, streamline the processes, delivering quicker and more reliable results. This technological evolution not only bolsters the integrity of property transactions but also assures all parties involved of a seamless transfer of ownership.

In conclusion, the importance of conducting comprehensive title and lien searches cannot be overstated. These processes safeguard both buyers and sellers, reinforcing the overall integrity of the real estate market. As the industry evolves alongside modern advancements, it is crucial for real estate professionals to adopt best practices and leverage technology to effectively navigate the complexities of property transactions. By prioritizing these searches, stakeholders can ensure peace of mind and protect their investments, making them a fundamental step in any real estate endeavor.

Frequently Asked Questions

What is a title and lien search in real estate?

A title and lien search is a comprehensive review of public records to verify the legal ownership of a real estate asset and to identify any claims or encumbrances that may exist, such as mortgages or other legal matters that could affect ownership rights.

Why are title and lien searches important?

These searches are crucial as they confirm the seller's legal right to sell the property and reveal any existing claims or restrictions that could jeopardize the buyer's ownership rights, thus safeguarding against potential deception and financial repercussions.

What is the difference between a title and lien search and a claim investigation?

A title and lien search verifies legal ownership and identifies encumbrances, while a claim investigation specifically focuses on outstanding debts or claims against the property, such as unpaid taxes or court judgments.

What are the potential consequences of neglecting title and lien searches?

Neglecting these inquiries can lead to severe financial ramifications, including unexpected obligations for new property owners, as bankruptcy does not eliminate a debtor's claim unless fully resolved.

How has the increase in refinancing activity affected the demand for title and lien searches?

The increase in refinancing transactions has heightened the demand for effective and precise title and lien search examinations, creating opportunities for automation to streamline these processes.

What role does technology play in title and lien searches?

Technology, such as automation and the use of drones, is being incorporated into property investigations to enhance efficiency and effectiveness in conducting title and lien searches.

What should buyers do to avoid hidden liens during property transactions?

Buyers should familiarize themselves with local regulations and collaborate with companies that provide accurate and up-to-date municipal lien data to avoid surprises related to encumbrances.

What are the risks of inadequate property investigations?

Inadequate investigations can lead to legal disputes, significant financial losses, and increased vulnerability to real estate fraud, making thorough title and lien searches essential.

How can comprehensive ownership and claim investigations benefit buyers and sellers?

These investigations protect investments, provide reassurance to all parties involved in a real estate deal, and facilitate a smoother transfer of ownership by identifying potential encumbrances early in the transaction process.