Overview

To conduct a successful mortgage search, it is essential to understand the different types of mortgages available, utilize online tools for comparison, and navigate the pre-approval and closing processes effectively. The article outlines these steps in detail, emphasizing the importance of being informed about mortgage options, leveraging technology for better decision-making, and preparing for the financial implications of closing costs to enhance the overall home-buying experience.

Introduction

Navigating the mortgage landscape can be a daunting endeavor, especially with the myriad of options available to prospective buyers today. From fixed-rate mortgages that provide stability to adjustable-rate mortgages that offer initial savings, understanding the nuances of each type is essential for making informed decisions. As market dynamics shift and interest rates fluctuate, the importance of thorough research and comparison becomes increasingly evident.

Moreover, tools such as online calculators and comparison websites have revolutionized the way individuals approach their mortgage search, empowering them to secure the best possible terms. This article delves into the various mortgage types, the significance of pre-approval, and effective strategies for comparing rates and navigating the closing process, equipping readers with the knowledge needed to confidently embark on their home-buying journey.

Understanding Different Types of Mortgages

Before starting your loan search, it is crucial to understand the different types of loans available in today’s market:

- Fixed-Rate Mortgages: These loans maintain a constant interest level and monthly payments that remain unchanged throughout the loan term. They are particularly suitable for individuals planning to reside in their homes for an extended period, offering stability amid fluctuating market conditions.

- Adjustable-Rate Mortgages (Arms): Unlike fixed-rate mortgages, Arms have interest charges that can change over time. They generally begin with lower prices compared to fixed choices, making them appealing for those looking for reduced initial payments. However, borrowers should be cautious, as rates may increase significantly in the future, affecting long-term affordability.

- Interest-Only Mortgages: This type allows borrowers to pay only the interest for a predetermined period, after which they must start paying down the principal. Although this can offer short-term monetary relief, it carries risks, particularly if property values decline. Borrowers should consider their long-term financial strategies before opting for this mortgage type.

- FHA Financing: Insured by the Federal Housing Administration, FHA financing caters to low-to-moderate-income borrowers, allowing for lower minimum down payments. These financial aids are particularly beneficial for first-time homebuyers who may struggle with larger upfront costs.

- VA Loans: Available exclusively to veterans and active-duty military personnel, VA loans require no down payment and offer favorable terms, making homeownership more accessible for those who have served in the military.

- USDA Loans: In St. Tammany Parish, Louisiana, there are currently 382 USDA loans available, illustrating the accessibility of this option for rural homebuyers seeking favorable financing terms.

Understanding these options equips you with the knowledge needed for your mortgage search. Current trends indicate a significant shift in the lending landscape, as evidenced by Freddie Mac's observation of a substantial decrease in 30-year fixed-term loan costs, with the largest one-week drop occurring on November 17, 2022, when costs fell from 7.08% to 6.61% (-0.47%). Given that 27% of consumers believe housing affordability will decrease, and 52% of homeowners would require an interest rate below 6% to feel comfortable purchasing a home, being informed about these types of loans is essential.

Additionally, as home loan originations experienced a decline from $4.51 trillion in 2021 to $2.75 trillion in 2022, with a slight rebound noted in the first three quarters of 2024, understanding the nuances of various loans is more critical than ever.

The term 'home loan' itself has an interesting historical context; it originates from the Old French 'mort gage,' meaning 'death pledge,' indicating that the loan obligation ends when the property is paid off. This etymology highlights the enduring nature of loan agreements and their implications for borrowers.

Utilizing Online Tools for Your Mortgage Search

To optimize your mortgage search, leverage an array of online tools specifically designed for this purpose:

- Mortgage Calculators: These vital tools allow you to estimate monthly payments by entering different borrowing amounts, interest percentages, and terms. Reputable platforms such as Bankrate and Zillow feature comprehensive calculators that help you visualize different financing scenarios. As the home loan market evolves, with 2,823 areas at the FHA home loan floor in 2023, these calculators become increasingly valuable in navigating your options.

- Comparison Websites: Utilize platforms like LendingTree and NerdWallet to evaluate loan terms across various lenders. These sites simplify the process of identifying the most beneficial prices, ensuring you secure the best deal available. The volatility of loan rates, as highlighted by historical fluctuations—such as the largest one-week increase in 30-year fixed-rate conventional loan rates on June 16, 2022—emphasizes the importance of using comparison tools effectively.

- Online Dashboards: Many lenders now provide online dashboards that assist in monitoring your loan application progress. These dashboards enhance organization and transparency throughout the application process, allowing you to monitor key milestones easily. This technological advancement supports a more informed decision-making process.

- Mobile Apps: Downloading applications from established lenders provides flexibility, enabling access to financing tools wherever you are. This mobile capability supports a more dynamic search process, accommodating your schedule and preferences.

Utilizing these online resources not only enhances your mortgage search but also enables you to make timely and informed financial decisions. As noted by Dan Shepard, Editor, "The content of this article is based on the author's opinions and recommendations alone," reinforcing the subjective nature of the insights provided.

Comparing Mortgage Rates and Terms

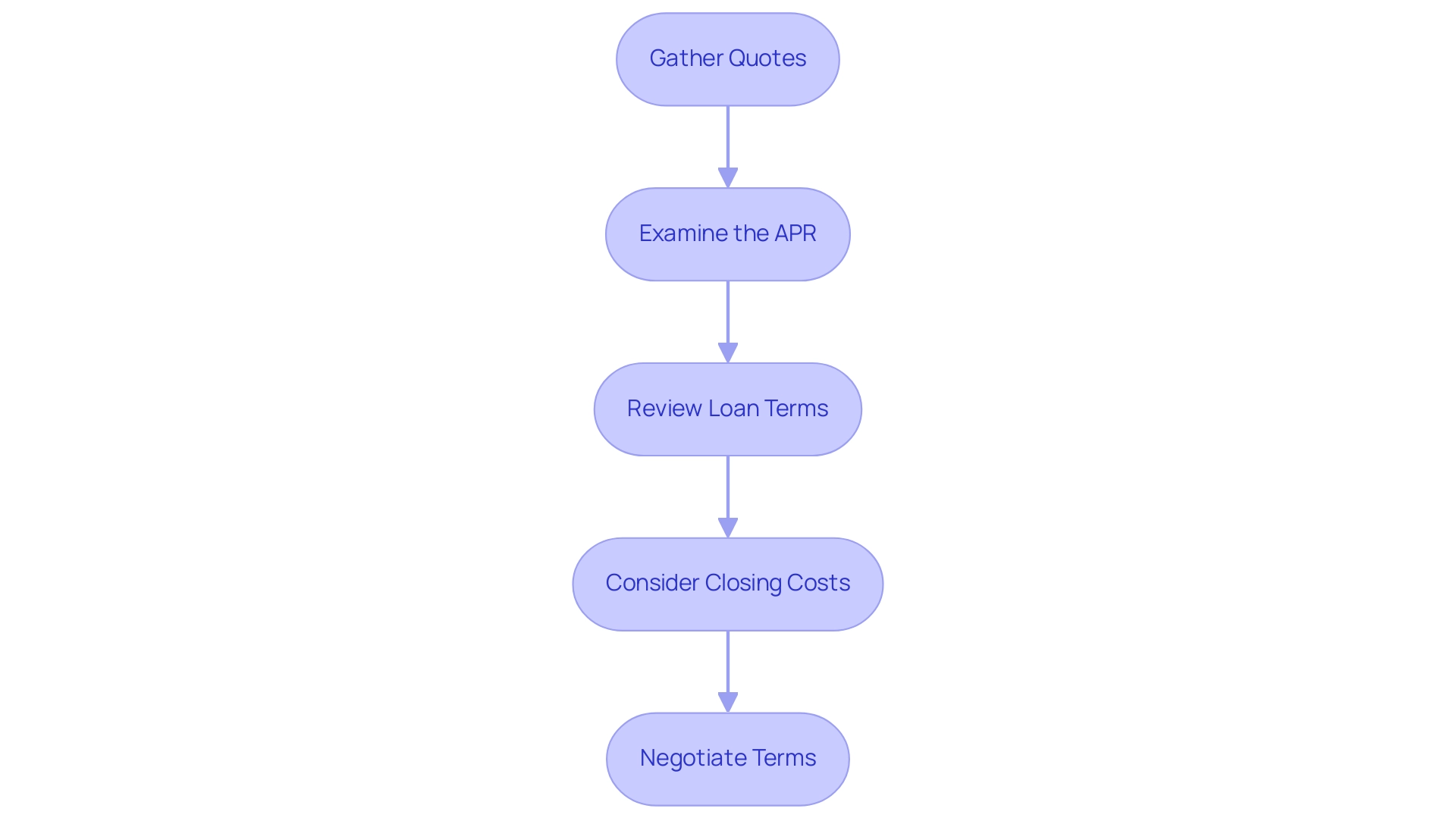

When assessing loan conditions and terms, it is essential to follow these meticulous steps:

- Gather Quotes: Begin by requesting quotes from a diverse range of lenders. Ensure that you provide identical information to each lender to facilitate an equitable comparison.

- Examine the APR: The Annual Percentage Rate (APR) is pivotal; it encompasses not only the interest rate but also additional fees, offering a more holistic view of the loan's total cost. Comprehending APR is vital, particularly considering the present housing market, which has experienced a decline of approximately $400 billion since Q2 2024, suggesting a change in lending practices that could impact your choices.

- Review Loan Terms: Analyze the length of the loan—whether it is a 15-year or 30-year term—and be mindful of any penalties associated with early repayment. These factors can affect your monetary flexibility and long-term planning. Historical context is also significant; for example, in the 1980s, the 30-year fixed loan interest peaked at 18.4 percent, emphasizing how unstable loan costs can be and the necessity for careful evaluation.

- Consider Closing Costs: Closing costs can vary markedly among lenders. It is vital to incorporate these costs into your overall analysis to understand the true financial implications of each loan option.

- Negotiate Terms: Leverage the quotes you’ve gathered to negotiate with lenders. Numerous individuals are prepared to modify charges or fees to obtain your patronage, showcasing the competitive essence of the present lending environment.

Furthermore, comprehending the Federal Reserve's current position on costs is vital. As of July 2023, the Fed has kept the federal funds level, indicating a cautious approach to reductions until inflation trends downwards. By rigorously comparing rates and terms during your mortgage search and being aware of the broader economic context, you can choose a loan that effectively aligns with your monetary objectives.

As observed by expert Jacob Channel, if trends continue, 2024 may experience a significant rise in new foreclosures, highlighting the necessity of making informed choices in today's market.

The Role of Mortgage Pre-Approval

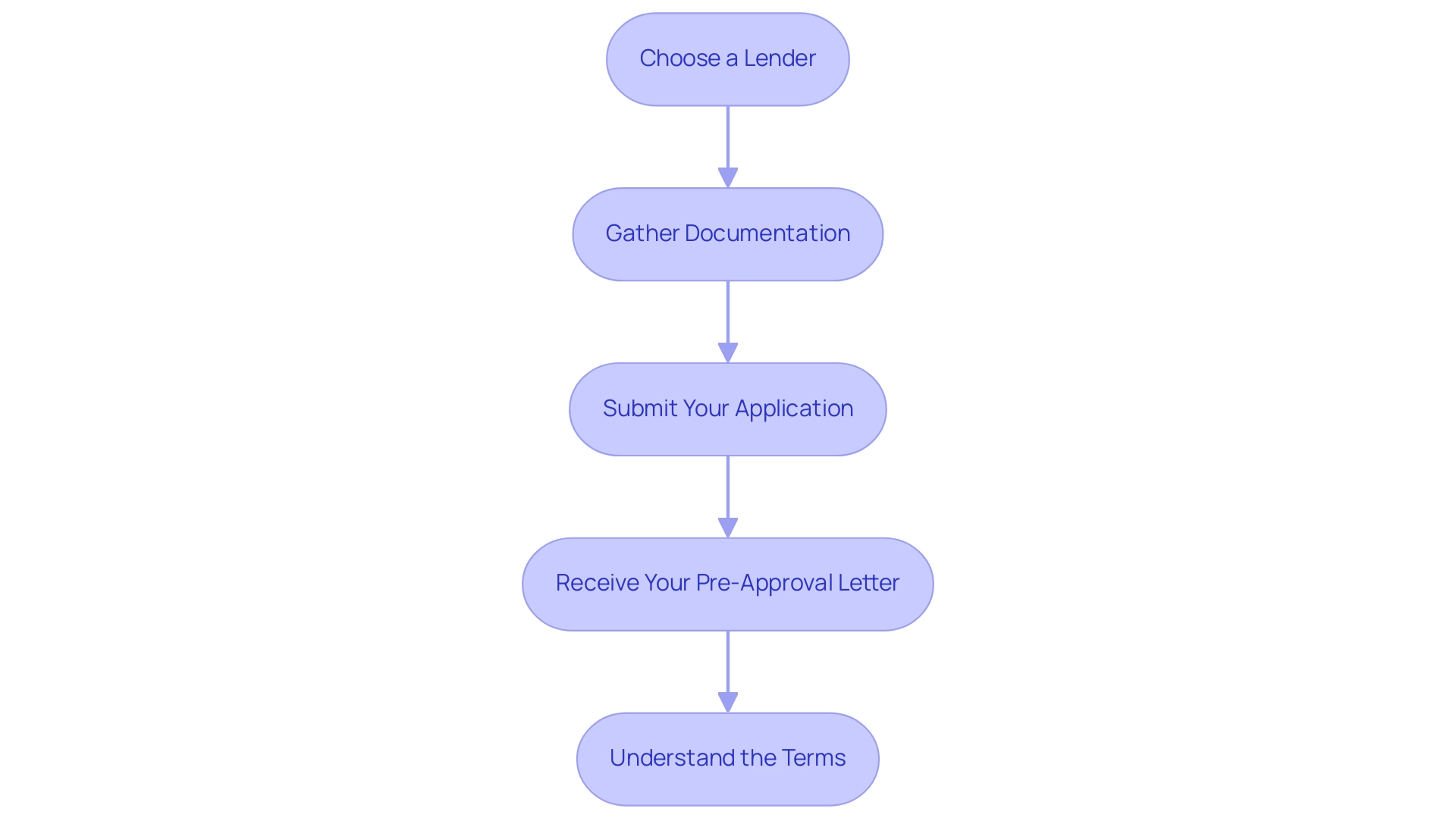

Securing a mortgage search for pre-approval is an essential milestone in the home-buying journey. It not only strengthens your position as a buyer but also streamlines the purchasing process. Here’s a methodical approach to obtaining your pre-approval:

- Choose a Lender: Begin by researching lenders that offer comprehensive pre-approval services. Opt for institutions with strong reputations and competitive interest rates, as these factors can significantly influence your monetary commitment.

- Gather Documentation: Assemble the necessary documentation, including proof of income, tax returns, and a complete credit history. Lenders require this information to evaluate your financial standing accurately.

- Submit Your Application: Complete the mortgage pre-approval application thoroughly, ensuring all information is precise. This attention to detail facilitates a smoother assessment process.

- Receive Your Pre-Approval Letter: Upon successful evaluation, you will receive a pre-approval letter outlining the amount for which you qualify. This document is crucial for a mortgage search when presenting offers on properties, as it signals to sellers that you are a serious buyer.

- Understand the Terms: Carefully review the conditions of your pre-approval, including its validity period and any stipulations that must be fulfilled to maintain your approval status.

The word 'mortgage' comes from the Old French term 'mort gage,' meaning 'death pledge,' which refers to the idea that the obligation ends, or “dies”, when the debt is paid off or the property is taken. Having a pre-approval letter not only enhances your negotiating power but also equips you to effectively navigate the competitive real estate market during your mortgage search.

In 2024, grasping the nuances of the loan pre-approval process is more critical than ever, especially as non-QM loans have seen a notable increase, accounting for approximately 10% of total loan originations this year, up from 7% in 2023. This trend indicates a shift in the lending landscape, emphasizing the need for prospective buyers to be well-prepared and informed. As brokers prepare for 2025, they are focusing on potential rate shifts, economic volatility, and regulatory updates to guide clients, highlighting the importance of being proactive in securing a loan pre-approval.

Navigating the Closing Process and Costs

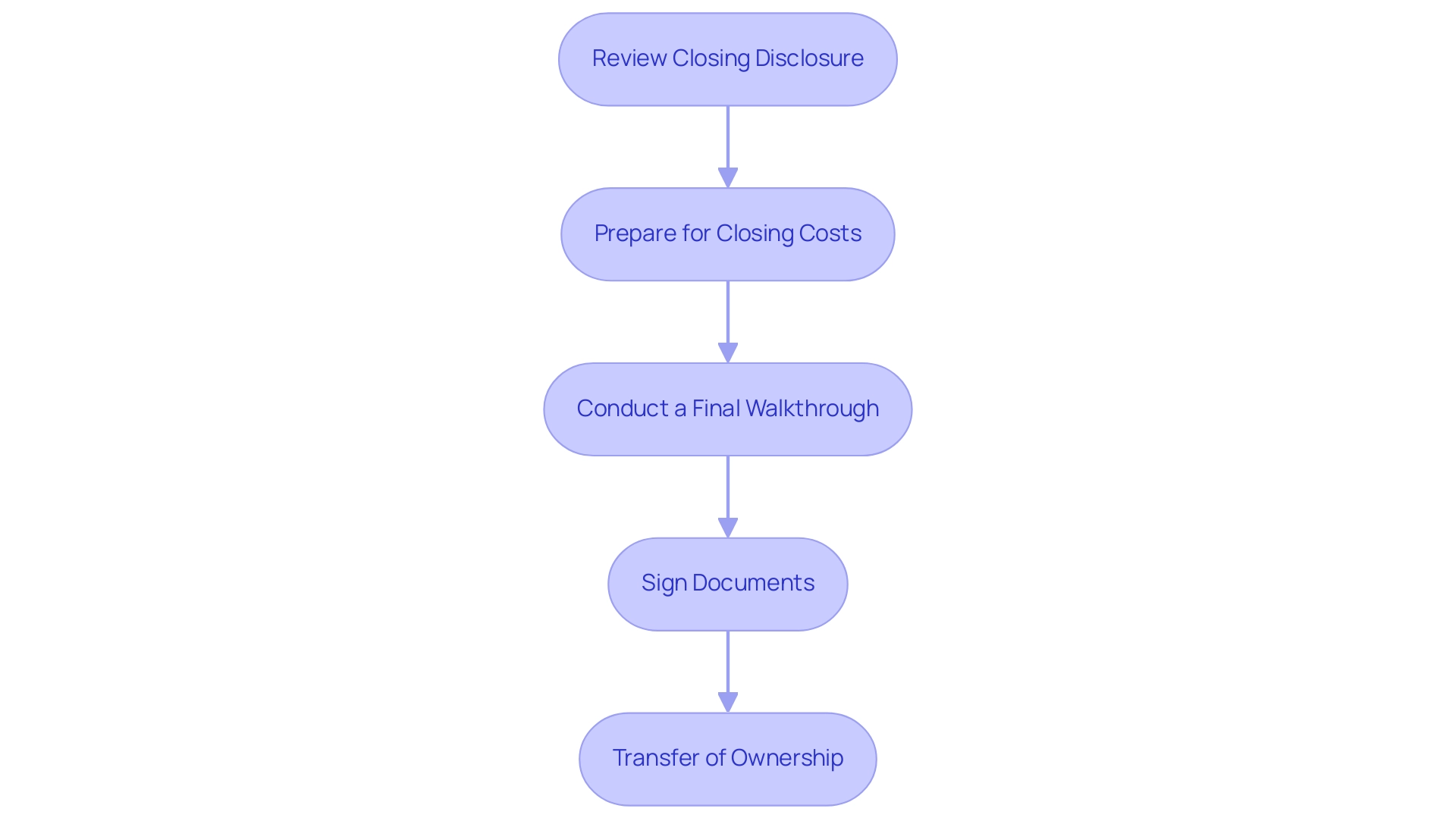

Navigating the closing process is crucial for a successful mortgage search, and understanding its intricacies can empower buyers. Here’s a comprehensive look at the steps involved:

-

Review Closing Disclosure: A few days prior to the closing date, you will receive a Closing Disclosure that outlines the final terms of your financing along with the related closing costs.

It is imperative to review this document meticulously to ensure all details align with your expectations.

-

Prepare for Closing Costs: Closing expenses can vary significantly, generally ranging from 2% to 5% of the borrowed amount. In 2024, it's important to anticipate these expenses, which can encompass fees for services such as appraisal, title search, and attorney representation.

Notably, for USDA loans, anticipate an upfront insurance fee of 1% of the loan amount. On average, closing costs generally represent approximately 3% of the loan amount, so budgeting accordingly is essential.

-

Conduct a Final Walkthrough: Prior to closing, performing a final walkthrough of the property is essential.

This step ensures that the property meets the conditions agreed upon in the contract, allowing you to address any discrepancies before finalizing the transaction.

-

Sign Documents: During the closing meeting, you will sign multiple documents, including the loan agreement and various disclosures.

It’s crucial to read each document carefully before signing to fully understand your obligations and rights.

-

Transfer of Ownership: Once all documents are signed, ownership of the property is officially transferred to you, and you will receive the keys.

This pivotal moment signifies the culmination of your home-buying journey.

Real estate agents play a vital role throughout this process, assisting with negotiations to secure optimal terms and ultimately reducing overall expenses. As highlighted in the case study 'The Agent's Role,' an experienced agent can guide clients through negotiations and smooth the complexities of the closing process.

Additionally, as noted by Molly Grace, a Mortgage Reporter for Business Insider, there is usually an origination fee of 0% to 1.5% of the loan amount that contributes to the lender's costs of underwriting and preparing your mortgage.

By grasping the closing process and associated costs involved in your mortgage search, you can approach this final step with confidence and clarity.

Conclusion

Understanding the mortgage landscape is essential for prospective homebuyers seeking to make informed financial decisions. This article has explored the diverse types of mortgages available, including:

- Fixed-rate

- Adjustable-rate

- Specialized loans like FHA and VA options

Each mortgage type has distinct advantages and potential drawbacks, highlighting the importance of aligning choices with individual financial situations and long-term goals.

The significance of utilizing online tools in the mortgage search process cannot be overstated. Mortgage calculators, comparison websites, and mobile applications enhance the ability to evaluate options effectively, ensuring that buyers can navigate the complexities of the market with greater ease. Moreover, comparing rates and terms is a critical step that empowers buyers to secure favorable financing, especially in a fluctuating economic environment.

Securing a mortgage pre-approval is another pivotal element that strengthens a buyer's position in a competitive market. It not only provides clarity on financial eligibility but also enhances negotiating power when making offers. Understanding the closing process, including reviewing the Closing Disclosure and preparing for closing costs, ensures that buyers approach this final stage with confidence.

In summary, a thorough understanding of the mortgage process, combined with strategic use of available tools and resources, equips buyers to navigate their home-buying journey successfully. As the mortgage landscape continues to evolve, remaining informed and proactive will enable prospective homeowners to seize opportunities and make sound financial decisions.

Frequently Asked Questions

What are the different types of mortgages available in the market?

The main types of mortgages include Fixed-Rate Mortgages, Adjustable-Rate Mortgages (ARMs), Interest-Only Mortgages, FHA Financing, VA Loans, and USDA Loans.

What is a Fixed-Rate Mortgage?

A Fixed-Rate Mortgage maintains a constant interest rate and monthly payments throughout the loan term, providing stability for those planning to stay in their homes long-term.

How do Adjustable-Rate Mortgages (ARMs) work?

ARMs have interest rates that can change over time, typically starting with lower initial rates. However, borrowers should be cautious as rates may increase significantly, affecting long-term affordability.

What are Interest-Only Mortgages?

Interest-Only Mortgages allow borrowers to pay only the interest for a specific period, after which they must begin paying down the principal. While this offers short-term relief, it carries risks, especially if property values decline.

What is FHA Financing?

FHA Financing is insured by the Federal Housing Administration and is designed for low-to-moderate-income borrowers, allowing for lower minimum down payments, making it particularly beneficial for first-time homebuyers.

Who can apply for VA Loans?

VA Loans are available exclusively to veterans and active-duty military personnel, requiring no down payment and offering favorable terms for homeownership.

What are USDA Loans?

USDA Loans are designed for rural homebuyers and provide favorable financing terms. In St. Tammany Parish, Louisiana, there are currently 382 USDA loans available.

Why is it important to understand the different types of loans?

Understanding the various loan types equips borrowers with the knowledge needed for their mortgage search, especially given current trends in the lending landscape and significant fluctuations in loan costs.

What historical context does the term 'home loan' have?

The term 'home loan' originates from the Old French 'mort gage,' meaning 'death pledge,' indicating that the loan obligation ends when the property is paid off.

What online tools can help optimize the mortgage search?

Useful online tools include Mortgage Calculators, Comparison Websites, Online Dashboards, and Mobile Apps, which help estimate payments, compare loan terms, monitor applications, and provide access to financing tools.