Overview

The article serves as a comprehensive guide on conducting a lien title search, underscoring its critical importance for real estate professionals in identifying claims or liens against a property that could complicate transactions. By delineating the step-by-step process, the article illustrates how meticulous searches protect buyers from unforeseen financial liabilities, ensure clear title assurance, and mitigate risks. Consequently, it highlights the necessity of such investigations in preserving the integrity of real estate dealings.

Introduction

In the intricate world of real estate transactions, the significance of conducting a lien title search cannot be overstated. This critical process involves delving into public records to uncover any claims or liens that may encumber a property, potentially complicating ownership transfers.

With various types of liens stemming from unpaid taxes, mortgages, or legal judgments, the stakes are high for buyers and sellers alike. Furthermore, as the real estate landscape evolves, understanding the nuances of lien title searches emerges as a vital skill for professionals seeking to safeguard their transactions and enhance their credibility.

This article explores the essential components, challenges, and best practices associated with lien title searches, providing a comprehensive guide for navigating this complex yet crucial aspect of real estate dealings.

Understanding Lien Title Searches: An Overview

A lien title search is an essential process that involves scrutinizing public records to uncover any claims or liens against a property. For real estate professionals, this search is vital as it determines whether a property is encumbered by financial obligations that could hinder ownership transfer. Liens may originate from various sources, such as unpaid taxes, mortgages, or legal judgments, and their presence can significantly complicate transactions, underscoring the importance of conducting a lien title search.

Mastering the fundamentals of lien title searches is crucial for facilitating smooth real estate transactions.

Key Components of a Title Search

- Public Records: Conducting a title search typically requires accessing public records held by local government offices, including the county clerk or recorder's office. These records provide a comprehensive history of the property and any related claims.

- Types of Claims: Familiarity with various types of claims, such as tax claims, mechanic's claims, and judgment claims, is important. Each type carries distinct implications for property ownership and can influence transactions differently. For instance, tax claims can lead to foreclosure if not addressed, while mechanic's claims may necessitate discussions with contractors.

- Inquiry Procedure: The inquiry procedure typically entails multiple stages: collecting relevant property details, reviewing applicable records, and assessing the results to identify any outstanding claims. This comprehensive method ensures that all potential obstacles revealed in a lien title search are considered, thereby protecting the interests of all parties involved in the deal. In 2025, the significance of claims investigations is highlighted by the fact that nearly 30% of real estate dealings encounter issues linked to undisclosed encumbrances, emphasizing the need for a lien title search. Recent statistics indicate that the typical cost for obtaining a one-page death certificate is $10, illustrating the financial implications of property dealings and the necessity for thorough inquiries. Effective property investigations, such as a lien title search, not only safeguard purchasers but also enhance the reliability of real estate experts, fostering trust and assurance in the transaction process. As noted by Closers’ Choice, a leader in providing closing and document software for over 35 years, the importance of precise property assessments cannot be overstated. As the landscape of real estate continues to evolve, staying informed about the latest advancements and best practices in property claims remains essential. Furthermore, Parse Ai's Document Processing demonstrates how machine learning and optical character recognition can streamline the document retrieval process, allowing researchers to complete abstracts and reports more swiftly and accurately, ultimately resulting in substantial cost savings compared to traditional methods.

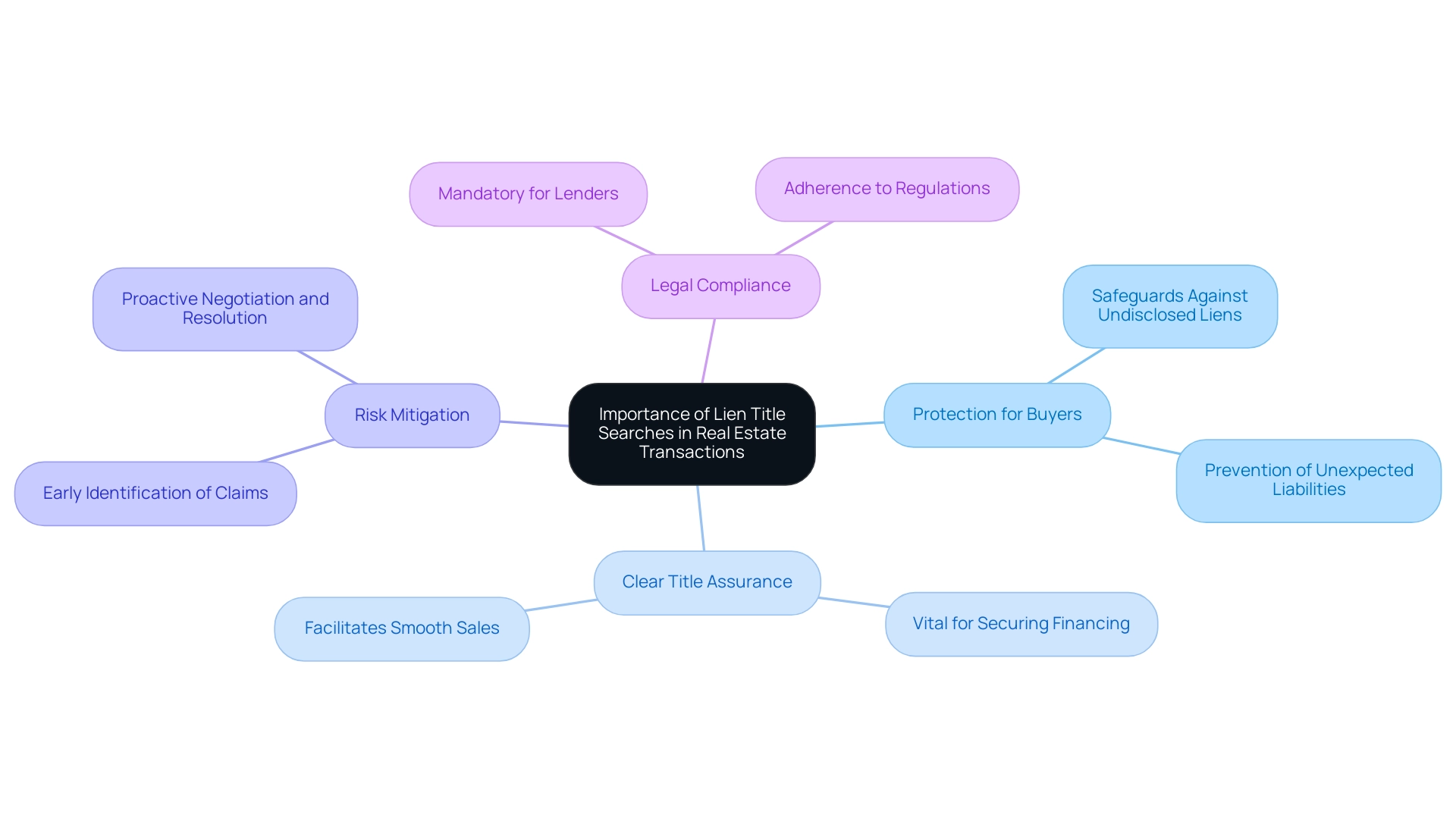

The Importance of Lien Title Searches in Real Estate Transactions

Conducting a lien title search is a critical step in real estate transactions, serving multiple essential purposes:

- Protection for Buyers: A thorough lien search safeguards buyers from acquiring properties encumbered with undisclosed liens. Such financial encumbrances can lead to unexpected liabilities or legal disputes, jeopardizing the buyer's investment.

- Clear Title Assurance: Confirming that a property has a clear title is vital for securing financing and facilitating a smooth sale. Without this assurance, buyers may encounter challenges in obtaining loans or completing the transaction.

- Risk Mitigation: Early identification of potential claims allows for proactive negotiation and resolution, significantly reducing the risk of complications during the closing process. This foresight can prevent delays and additional costs that may arise from unresolved issues.

- Legal Compliance: Numerous lenders mandate a lien title search as part of their due diligence, making it an essential step for adherence to legal and financial regulations. This requirement underscores the importance of the inquiry in upholding the integrity of real estate dealings.

Recent statistics suggest that approximately 30% of real estate dealings necessitate a property investigation, emphasizing its commonality and significance in the sector. Furthermore, real estate attorneys assert that performing these inquiries is not merely a formality but a fundamental practice that protects both buyers and lenders.

Case studies illustrate the importance of ownership investigations, highlighting instances where undisclosed claims have disrupted transactions, resulting in costly legal disputes. For instance, title firms play a crucial role in conducting property checks, ensuring that purchasers can proceed with their acquisitions confidently, free from burdens. By identifying and resolving claims before closing, these companies help prevent future disputes, thereby safeguarding the interests of both buyers and lenders.

The case study titled 'Role of Title Companies in Protecting Buyers and Lenders' emphasizes how these companies perform title investigations to instill confidence in buyers that the property they are acquiring is free of any encumbrances.

In 2025, the significance of title investigations remains crucial, as they continue to offer substantial advantages for purchasers, including enhanced security and reassurance in their property dealings. Additionally, the Mayor of Delray Beach has openly criticized reduction or amnesty programs, stating that they diminish the effectiveness of claims for recouping payments, further emphasizing the necessity of maintaining effective claims for buyer protection. Furthermore, firms such as DataTrace have been recognized as among the most innovative technology companies in real estate for five consecutive years, highlighting advancements in the efficiency and precision of conducting title investigations.

Lien Search vs. Title Search: Key Differences Explained

In the realm of property due diligence, lien searches and title searches are both critical, yet they fulfill distinct roles:

- Lien Search: This search is specifically designed to uncover any outstanding liens against a property, which is vital for assessing the financial obligations associated with it. For instance, a lien inquiry can reveal judgment liens filed at state or local levels, ensuring that potential buyers are aware of any claims that could affect their ownership. Additionally, bankruptcy case inquiries examine legal proceedings involving individuals or businesses unable to repay debts, typically covering the past seven years, further emphasizing the importance of thorough due diligence.

- Document Search: In contrast, a document search provides a more comprehensive examination. It not only reviews the property's ownership history but also identifies existing liens and other encumbrances. This broader perspective is essential for understanding the complete legal status of the property. Professionals work to clear any existing 'clouds' on a record before issuing insurance policies, which reduces financial risks for buyers.

Key Differences

- Scope: Lien searches are focused narrowly on financial claims, while title searches cover a wider array of information, including ownership history and legal encumbrances.

- Purpose: The primary aim of a financial claim investigation is to uncover any monetary interests against the property, whereas a title examination is intended to verify ownership and identify potential legal issues that could arise.

Outcomes of Searches

The outcomes of these searches can significantly impact real estate transactions. For instance, a lien inquiry may uncover a tax lien that the IRS must refile within one year, warning buyers of possible financial risks. Conversely, a lien title search might uncover a cloud on the title that needs to be resolved before issuing insurance policies, thereby reducing financial risks for buyers.

Furthermore, a Watch List Search is required before financial activities to identify individuals on the Blocked Persons list, ensuring compliance with federal law and helping organizations avoid dealings with sanctioned individuals.

Expert Insights

Real estate professionals emphasize the importance of understanding the differences between these searches. As one specialist remarked, "A comprehensive grasp of property rights versus claims assessments is vital for reducing risks in real estate dealings." Companies House describes a charge as: 'Security for the payment of a debt or other obligation that does not transfer ‘property’ or any right to possession to the individual to whom the charge is granted,' emphasizing the consequences of claims in real estate.

Case Studies

Consider the case of an Owner Verification Search, which aims to obtain the most recent deed to confirm property ownership and provide a comprehensive legal description. This inquiry not only confirms ownership but also guarantees that all claims are considered, demonstrating the interconnectedness of claims and property investigations in real estate due diligence.

In summary, while property investigations and ownership inquiries are both essential to real estate transactions, their unique purposes and scopes require a clear comprehension to navigate the intricacies of real estate effectively.

Step-by-Step Guide to Conducting a Lien Title Search

To conduct a lien title search effectively, follow these detailed steps:

- Gather Property Information: Begin by collecting essential details about the property, including the address, legal description, and parcel number. This foundational information is crucial for precise inquiries.

- Access Public Records: Visit the local county clerk or recorder's office, or utilize their online databases to search for property records. Many jurisdictions now offer digital access, significantly expediting the process.

- Search for Claims: Investigate any recorded claims against the property, including federal tax liens, mechanic's liens, and judgment liens. Conducting a thorough lien title search is vital for uncovering ownership issues, ensuring the seller has the legal right to sell the property. This step is essential for identifying potential legal complications that may influence the deal.

- Review Findings: Carefully analyze the results of your search to identify outstanding claims and understand their implications for the property. Unresolved claims can complicate transactions and lead to legal disputes. The case study titled "Title Search and Inspection" highlights the necessity of this process to ensure properties are free of liens and legal issues that could impact ownership.

- Document Your Findings: Maintain a detailed record of your results, including any relevant documents or notes. This documentation serves as a valuable reference for future transactions and can optimize the process for later inquiries.

- Consult with Experts: If you encounter intricate problems or ambiguous information, consider seeking help from a company specializing in documentation or a legal expert. Their expertise can provide clarity and ensure that all potential risks are addressed. RLS tackles challenges in property inquiries, such as outdated public records and misunderstood legal terminology, by utilizing expertise and technology for precise outcomes.

By adhering to these steps, real estate experts can enhance their lien title search procedures, ensuring more seamless dealings and clearer ownership. The significance of comprehensive inquiries cannot be overstated; specialists agree that understanding the document examination and assessment process is vital for both purchasers and vendors to enable successful real estate dealings. As Daniel W. Lias, a Transactional Business Consultant, states, "To learn more about how CT Corporation can assist with your strategy, contact a CT representative.

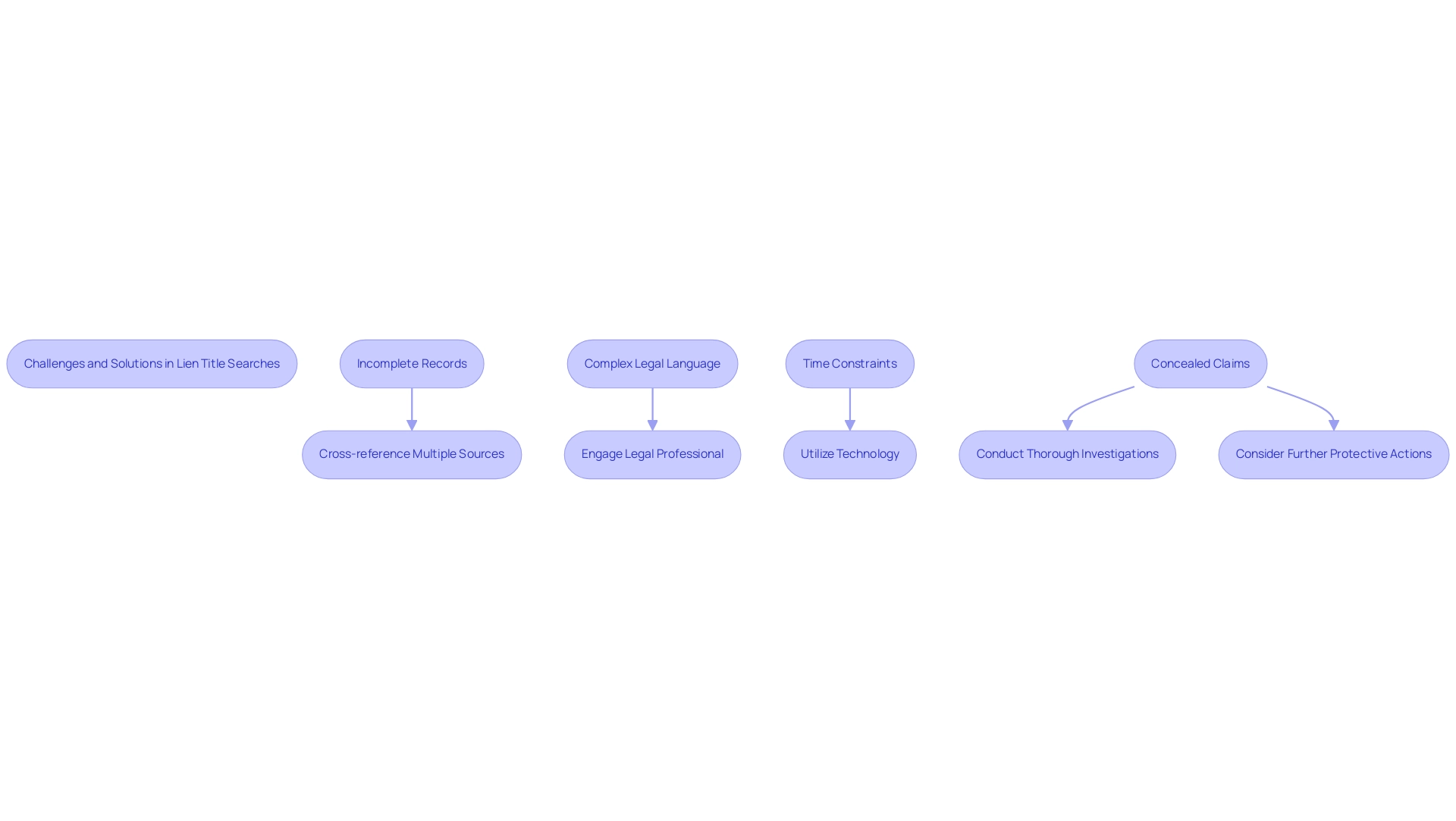

Common Challenges in Lien Title Searches and How to Overcome Them

Conducting a lien title search is a critical step in real estate transactions, presenting several challenges that professionals must navigate.

First, incomplete records can often be outdated or lack comprehensive information, complicating the identification of all existing claims. To mitigate this issue, cross-referencing multiple sources, including local government databases, and consulting with local authorities is advisable to ensure a thorough review.

Second, the complex legal language found in documents can be daunting. Engaging a legal professional or a title expert provides clarity on confusing terms and ensures accurate interpretation of the documents involved.

Additionally, time constraints pose a challenge, as the procedure of performing claims investigations can be prolonged. Utilizing technology, including automated tools and machine learning solutions, significantly streamlines the inquiry process, enhancing efficiency and reducing the time required to accomplish investigations.

Moreover, concealed claims may not be documented or could be easily missed during inquiries. To tackle this risk, thorough investigations, including a lien title search, are crucial, alongside considering further protective actions, such as acquiring insurance, which can shield against undisclosed claims.

As Jane F. Bolin, Esq., notes, "The prospect of owning a home is a significant milestone in your life," underscoring the importance of efficient processes in the homebuying journey, particularly for younger consumers who expect a more streamlined experience.

In 2025, the environment of municipal inquiries continues to evolve, with 75% of professionals opting to outsource local assessments to improve efficiency. Furthermore, a significant portion of closing agents—21.5%—handle only 1-5 closings per month, indicating a need for improved processes to manage workloads effectively. Holds in acquiring necessary paperwork, such as property investigations and ownership inquiries, can obstruct operations.

Building strong relationships with reliable vendors and establishing clear expectations is vital. By implementing service-level agreements (SLAs) with trusted vendors and transitioning to digital document management systems, professionals can overcome common challenges and improve client satisfaction. These proactive actions not only tackle the intricacies of property inquiries but also align with the expectations of younger buyers seeking a more efficient home purchasing experience.

Leveraging Technology for Efficient Lien Title Searches

Technology is revolutionizing the efficiency of lien title search investigations, offering innovative solutions that streamline processes and enhance precision. Consider the following key advancements:

- Automated Search Tools: The implementation of automated software significantly accelerates the retrieval process, providing rapid access to public records. This advancement minimizes manual workload and reduces the potential for human error, enabling researchers to concentrate on more complex tasks.

- Optical Character Recognition (OCR): Integrating OCR technology transforms the extraction of relevant information from scanned documents. By converting various document formats into machine-readable text, OCR enhances both the speed and accuracy of data retrieval, which is vital for maintaining the integrity of lien title searches.

- Machine Learning Algorithms: Utilizing machine learning allows for the analysis of patterns within lien data, which can be crucial in identifying potential risks. This predictive capability streamlines decision-making, enabling professionals to act swiftly and confidently in their assessments.

- Online Databases: The emergence of comprehensive online databases has transformed property record access. These platforms consolidate extensive data, facilitating thorough inquiries from virtually any location. This accessibility not only saves time but also empowers real estate professionals to make informed decisions based on the most current data.

- Current Trends in Technology: As of 2025, the trend towards integrating advanced cybersecurity measures, such as multi-factor authentication and encryption, is increasingly significant in the documentation review process. Title service providers are investing in these measures to safeguard sensitive information and enhance trust among stakeholders in property dealings.

- Case Studies: Companies like Orchestrate Mortgage and Title Solutions, LLC, exemplify the effective use of technology in lien assessments. Their commitment to innovation has resulted in heightened speed, precision, and security in property searches, particularly in conducting lien title searches, ultimately streamlining real estate processes for all parties involved. As noted by Orchestrate, "Whether you are a homebuyer, a lender, a real estate agent, or anyone involved in a property transaction, you can rely on Orchestrate to simplify the process and provide the peace of mind you deserve."

- Expert Opinions: Industry leaders assert that adopting technology in property research is not merely beneficial but essential for maintaining competitiveness. The consensus is clear: embracing these advancements leads to substantial improvements in operational efficiency and client satisfaction. For instance, Rynoh has been utilized for over 10 years in managing escrow accounts, demonstrating the reliability of technology within the industry. Furthermore, RynohLive has significantly enhanced accounting processes for users who previously faced challenges.

By leveraging these technological innovations, real estate experts can refine their property ownership investigation methods, ensuring they remain at the forefront of the industry.

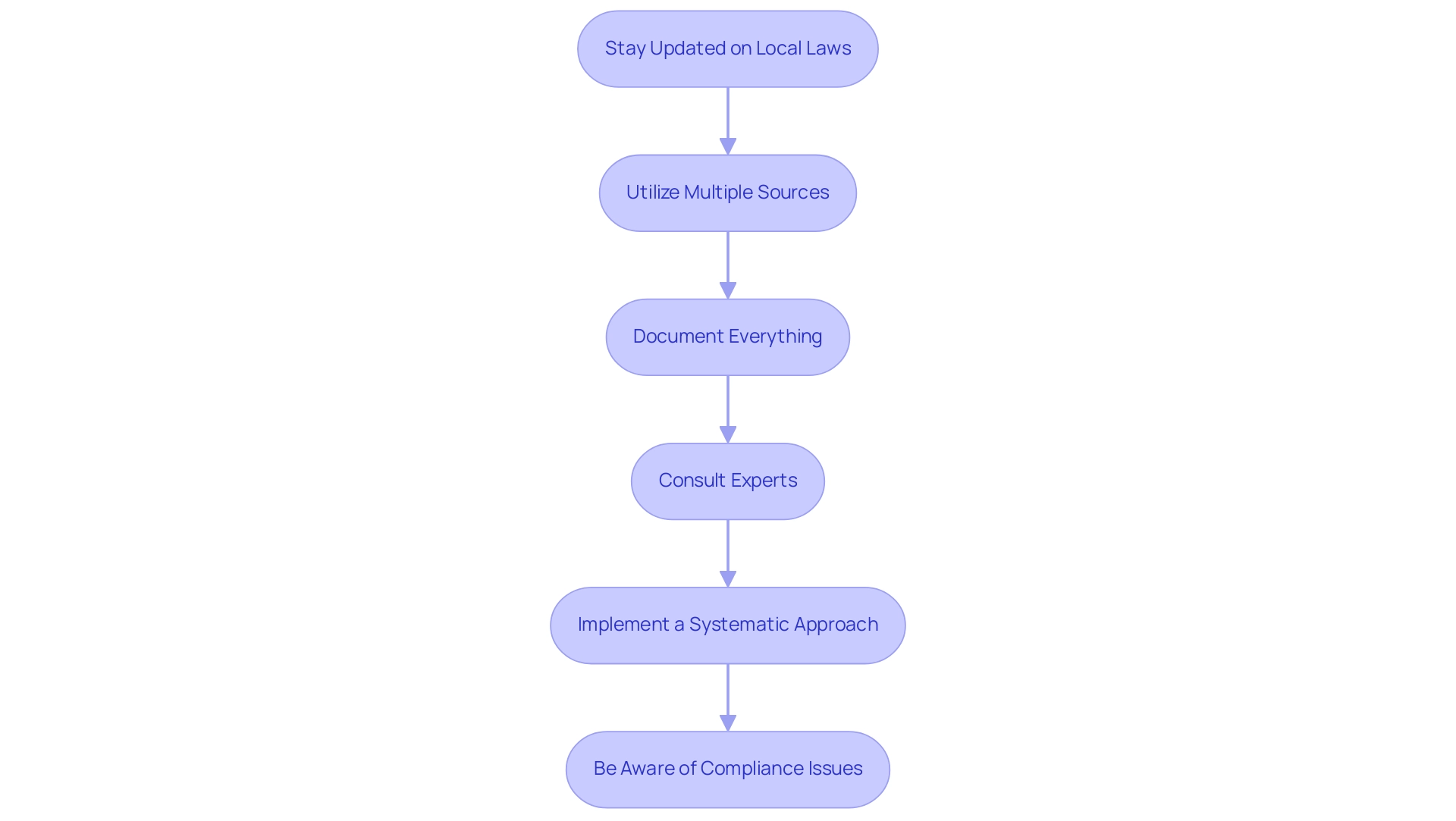

Best Practices for Accurate and Compliant Lien Title Searches

To guarantee precise and compliant title investigations, adopting best practices is essential:

- Stay Updated on Local Laws: Regularly review and familiarize yourself with local regulations governing lien title searches and property records. This knowledge is crucial for maintaining compliance and avoiding potential legal complications.

- Utilize Multiple Sources: Enhance the accuracy of your findings by cross-referencing information from various public records and databases. This multi-faceted approach helps to confirm the validity of the data and reduces the risk of oversight.

- Document Everything: Maintain meticulous records of your investigation process, findings, and any communications with local authorities or professionals. Keeping a detailed log not only provides an audit trail but also aids in reviews or disputes, ensuring transparency and accountability.

- Consult Experts: When faced with complex issues, do not hesitate to seek guidance from title companies or legal professionals. Their expertise can clarify intricate matters and ensure that your inquiry is thorough and compliant.

- Implement a Systematic Approach: Consider adopting a structured methodology for conducting claims investigations, such as creating a checklist of claim types and combining online inquiries with in-person record examinations. This systematic approach can significantly enhance the thoroughness of your investigation, as highlighted in case studies that emphasize the importance of detailed documentation.

- Be Aware of Compliance Issues: Stay informed about common compliance challenges in property assessments, particularly as many municipalities have begun to impose charges for unpaid utilities and code violations since 2016. The Mayor of Delray Beach has condemned reduction or amnesty programs, arguing that they weaken the effectiveness of claims for recouping payments. Comprehending these trends can assist you in steering clear of possible obstacles.

By adhering to these optimal methods, real estate experts can ensure that their title investigations, including the lien title search, are not only precise but also aligned with current regulations, ultimately protecting their dealings and enhancing their professional reputation. Furthermore, leveraging technology like Parse AI can streamline the search process, improve accuracy, and help maintain compliance, making it an invaluable tool for real estate professionals.

Implications of Undisclosed Liens in Real Estate Transactions

Undisclosed liens can significantly impact real estate transactions in various ways:

- Financial Liabilities: Buyers may unknowingly inherit financial obligations related to undisclosed claims, leading to unexpected costs and potential legal disputes. For instance, tax obligations enforced by the government for unpaid taxes take precedence over other claims, creating substantial financial burdens for new owners. A case study highlights that tax claims complicate property dealings, necessitating awareness of debtor locations for efficient searches.

- Transaction Delays: The late identification of a claim can halt closing, resulting in delays that jeopardize the agreement. Statistics indicate that undisclosed claims frequently cause delays in transactions, with many agreements collapsing due to unresolved issues arising at the last moment.

- Impact on Financing: Lenders often hesitate to provide funding for properties burdened by unresolved claims. This reluctance complicates the purchase process, as buyers may struggle to secure necessary funding, further complicating their ability to complete the transaction.

- Legal Complications: Undisclosed claims can lead to significant legal challenges, affecting the buyer's ability to obtain a clear title and enjoy full ownership rights. Real estate lawyers emphasize that understanding the various types of claims and their implications—particularly through a lien title search—is essential for reducing potential delays or complications during the selling process. Bill Gassett, owner and founder of Maximum Real Estate Exposure, states, "By recognizing the types of claims and their implications for the selling process and employing effective resolution strategies, sellers and buyers can mitigate potential delays or complications, ensuring a smoother transaction process."

Recent instances have underscored the dangers linked to hidden claims, highlighting the significance of conducting a lien title search during comprehensive ownership examinations. An owner's title policy can provide protection against hidden risks, such as fraudulent claims or boundary discrepancies, offering lifetime protection with a one-time purchase. This is particularly relevant in 2025, as the landscape of real estate transactions continues to evolve, making the implications of undisclosed liens a critical consideration for buyers and sellers alike.

Furthermore, a lender's policy protects the lender's financial interests, further emphasizing the importance of understanding these financial liabilities.

Conclusion

Conducting a lien title search is an essential aspect of real estate transactions that protects both buyers and sellers from potential pitfalls. By meticulously examining public records, professionals can uncover any claims or liens that may encumber a property, thereby preventing unexpected liabilities and legal disputes. The significance of this search cannot be overstated; it not only ensures clear title assurance but also mitigates risks associated with financial obligations.

As the real estate landscape evolves, understanding the nuances of lien title searches becomes increasingly vital. The integration of technology—such as automated search tools and machine learning—enhances the efficiency of these searches, allowing for quicker and more accurate results. Furthermore, adhering to best practices while remaining informed about local regulations further strengthens the credibility of real estate professionals.

Ultimately, the implications of undisclosed liens underscore the necessity of thorough due diligence in property transactions. By prioritizing comprehensive lien title searches, stakeholders can foster trust and confidence in the real estate process, ensuring smoother transactions while protecting their investments. Emphasizing these practices not only benefits individual transactions but also elevates the integrity of the real estate industry as a whole.

Frequently Asked Questions

What is a lien title search and why is it important?

A lien title search is a process that involves examining public records to identify any claims or liens against a property. It is crucial for real estate professionals as it reveals whether a property is burdened by financial obligations that could impede ownership transfer.

What are the key components of a lien title search?

The key components include accessing public records from local government offices, understanding various types of claims (such as tax claims, mechanic's claims, and judgment claims), and following a structured inquiry procedure that involves collecting property details, reviewing records, and assessing results for outstanding claims.

What types of claims can be identified during a lien title search?

Types of claims include tax claims, mechanic's claims, and judgment claims. Each type has different implications for property ownership and can affect transactions in various ways, such as leading to foreclosure or requiring discussions with contractors.

How does a lien title search protect buyers?

A thorough lien search protects buyers by ensuring they do not acquire properties with undisclosed liens, which could lead to unexpected liabilities or legal disputes, thus safeguarding their investment.

What role do title companies play in lien title searches?

Title companies conduct property checks to confirm that properties are free of encumbrances, helping to prevent future disputes and ensuring that buyers can proceed with their acquisitions confidently.

Why is clear title assurance important in real estate transactions?

Clear title assurance is vital for securing financing and facilitating smooth sales. Without it, buyers may face challenges in obtaining loans or completing transactions.

What is the significance of conducting a lien title search according to recent statistics?

Recent statistics indicate that nearly 30% of real estate dealings encounter issues related to undisclosed encumbrances, highlighting the commonality and importance of conducting a lien title search.

How does a lien title search contribute to legal compliance?

Many lenders require a lien title search as part of their due diligence to comply with legal and financial regulations, ensuring the integrity of real estate transactions.

What advancements have improved the efficiency of lien title searches?

Technologies such as machine learning and optical character recognition have streamlined the document retrieval process, allowing for quicker and more accurate completion of title investigations, leading to cost savings compared to traditional methods.