Overview

Conducting a lien search on a property is a critical process that demands a systematic approach. This involves:

- Gathering asset information

- Accessing local government records

- Consulting title companies, if necessary

The importance of thorough due diligence cannot be overstated; it is essential to avoid financial losses and legal complications associated with undisclosed claims. Such claims affect a significant percentage of real estate transactions, underscoring the necessity of accurate title research. By following these outlined steps, one can navigate potential challenges effectively and ensure a secure real estate transaction.

Introduction

In the complex realm of real estate, understanding property liens is not just beneficial—it's essential. A property lien, representing a legal claim against a property, can emerge from various sources such as unpaid taxes or mortgages, significantly influencing ownership and transferability. As the landscape of real estate transactions evolves, the necessity for thorough lien searches becomes increasingly clear.

Furthermore, statistics reveal that nearly 7% of properties in the U.S. bear some form of lien, indicating high stakes for buyers and sellers alike. This article delves into the intricacies of property liens, the critical steps for conducting effective lien searches, and the tools and technologies that can streamline the process. Consequently, this ensures informed decisions and protects investments in an ever-changing market.

Understanding Property Liens: What You Need to Know

A real estate claim represents a legal assertion against an asset, often utilized as security to guarantee a debt. These claims can stem from various sources, including unpaid taxes, mortgages, or court rulings. Understanding the complexities of claims is crucial for anyone engaged in real estate transactions, as they can significantly influence ownership and transferability.

Liens are primarily categorized into two types: voluntary and involuntary. Voluntary claims are established by the owner, such as those arising from a mortgage contract. Conversely, involuntary encumbrances occur without the owner's consent, frequently due to unpaid taxes or mechanic's claims resulting from unpaid work on the asset.

Recent statistics indicate that as of 2025, approximately 7% of real estate in the United States carries some type of claim. This underscores the necessity of conducting a lien search on a property before finalizing any real estate deal. For instance, unpaid real estate taxes can lead to tax claims, potentially resulting in foreclosure if not addressed.

Similarly, mortgage defaults can create claims that complicate the sale or transfer of real estate. Professional insights emphasize the importance of understanding property claims, particularly in the context of a lien search during real property transactions. A prominent real estate expert remarked, "Liens can be a hidden minefield for buyers and sellers alike; knowing how to navigate them is essential for a smooth transaction." Furthermore, the National Tax Association (NTLA) highlights the significance of education and training in the tax sector, advocating for the interests of various stakeholders since its inception in 1997.

In addition, recent advancements in real estate encumbrance regulations have introduced changes that affect the management and enforcement of these claims, making it imperative for professionals to stay informed. The case study titled 'Homeowner Equity by Market Segments' reveals that the percentage of low equity mortgages is higher in the Government-backed segment, which can have substantial implications for asset ownership claims.

In summary, familiarizing oneself with the various types of claims on assets, their implications, and the current legal landscape will equip you for the claim investigation process, ultimately safeguarding your interests in real estate transactions. Utilizing technology, such as Parse AI, can provide significant cost savings compared to traditional title research methods, enhancing efficiency in claim investigations.

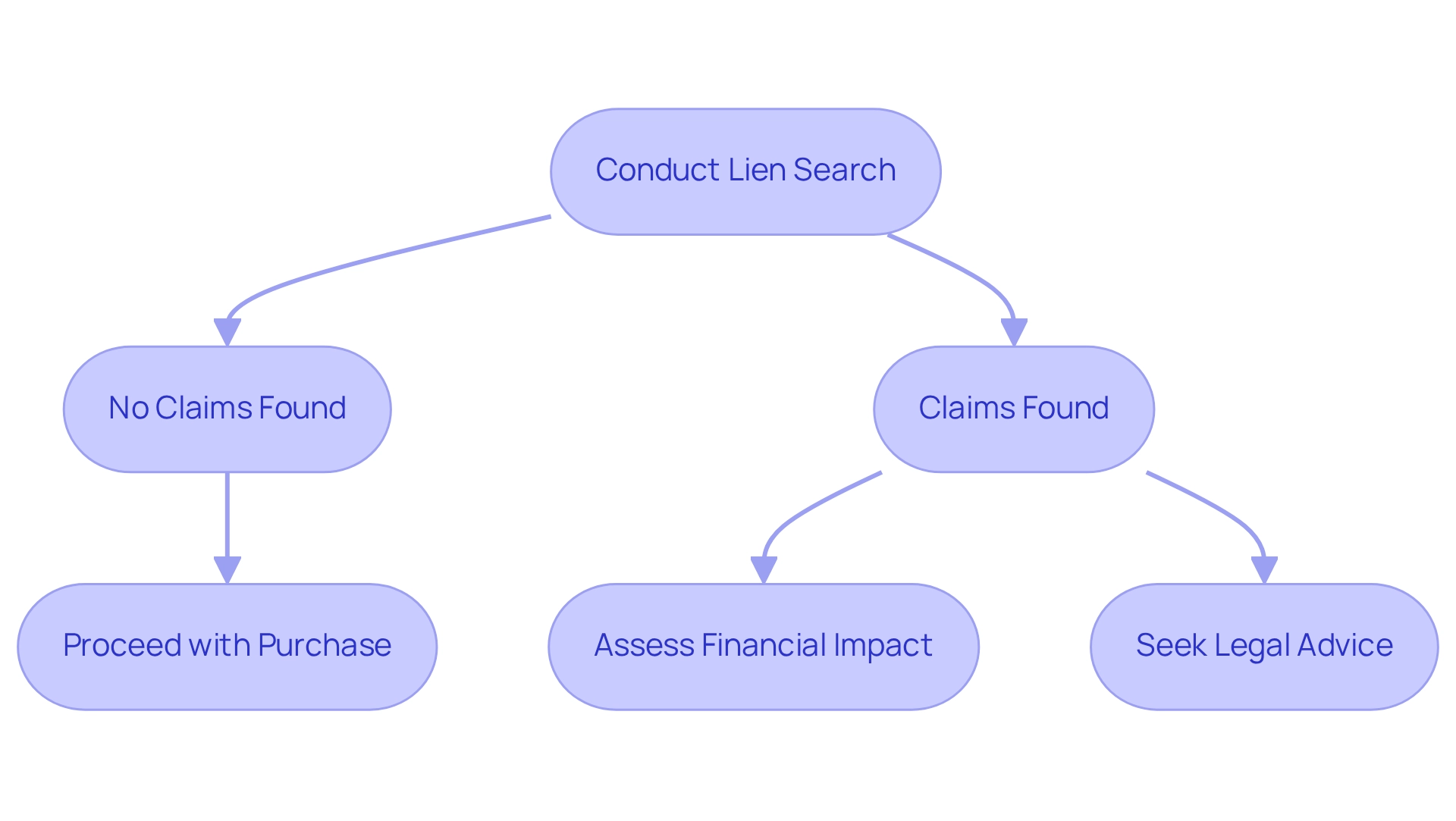

Why Conducting a Lien Search is Crucial Before Buying Property

Conducting a lien search on a property before acquiring real estate is not merely a precaution; it is an essential measure in protecting against undesired debts or legal assertions. The financial consequences of overlooking this search can be significant. Studies indicate that approximately 30% of real estate transactions are affected by undisclosed claims. For instance, if an asset has an outstanding tax obligation, the new owner may find themselves liable for that debt, potentially leading to substantial financial losses.

Furthermore, hidden claims can complicate the process of obtaining funding or insurance, creating additional obstacles for landowners. It is crucial to inform the title company promptly if a charge or claim is submitted against the asset to mitigate these risks.

Legal conflicts arising from insufficient charge investigations are not uncommon. Real estate lawyers consistently emphasize the importance of comprehensive due diligence, asserting that a lien search on a property is vital to identify existing claims and avoid costly legal disputes. In fact, financial losses from hidden claims can reach tens of thousands of dollars, underscoring the necessity of conducting a claim investigation prior to any property transaction.

Experts in the field assert that a lien search on a property is pivotal for securing a clear title and protecting your investment. As one lawyer pointed out, the risks associated with neglecting a lien search can be considerable, resulting in both monetary and legal complications that could have been easily avoided. Moreover, Parse AI's innovative approach to title research, utilizing advanced machine learning technologies and optical character recognition (OCR), significantly enhances the efficiency and accuracy of property investigations.

By automating document processing and facilitating interactive labeling through its example manager, Parse AI streamlines the entire process, enabling title researchers to complete their work more swiftly and accurately. Thus, emphasizing a thorough investigation, including a lien search on a property, is essential for any prospective real estate purchaser. As Odette Williamson, a senior lawyer at the National Consumer Law Center, articulated, 'Ending the legacy of eroding homeownership in communities of color is a crucial piece of an overall strategy to reduce the racial wealth gap,' highlighting the broader implications of ensuring clear ownership titles.

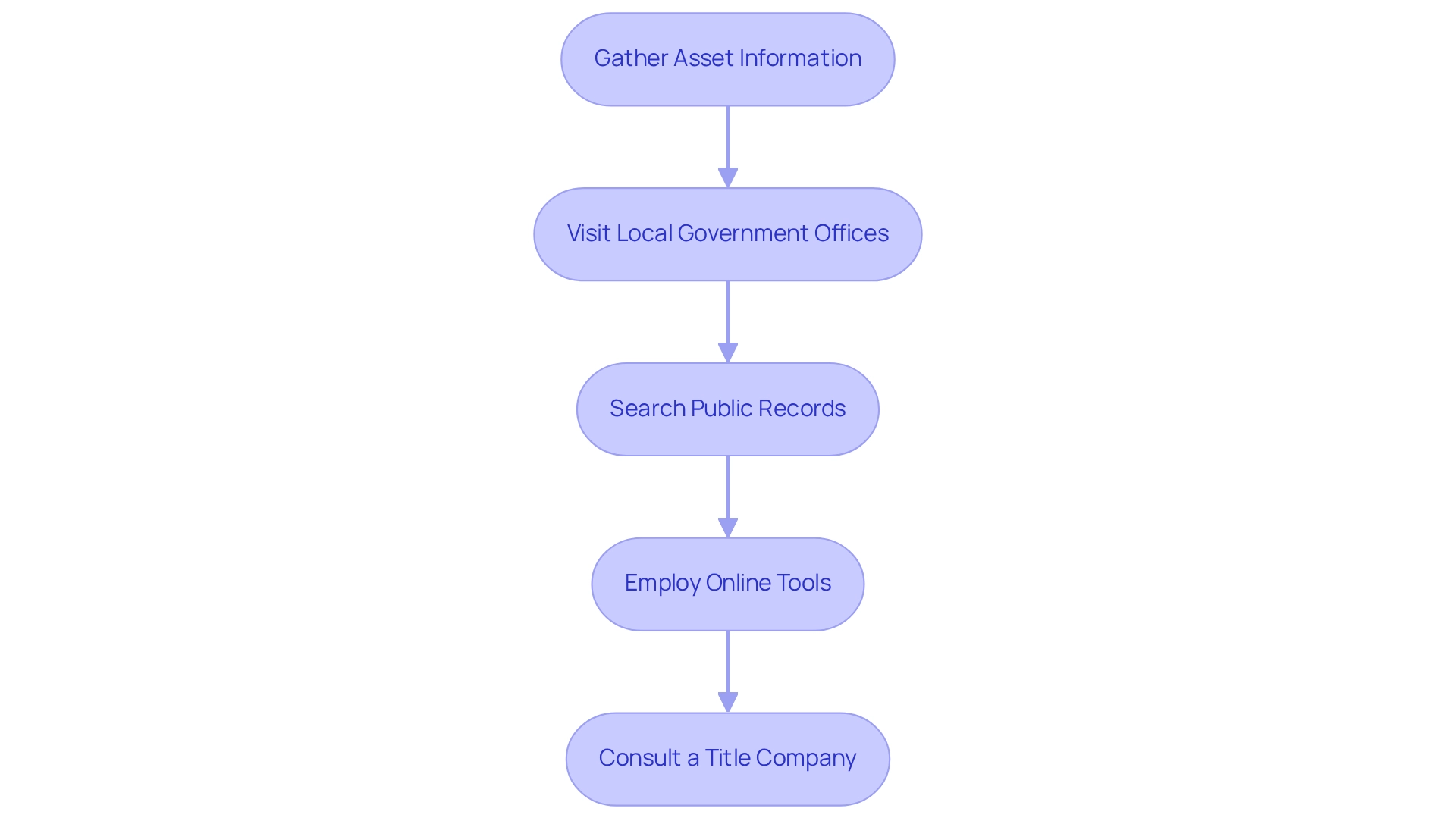

Step-by-Step Guide to Performing a Property Lien Search

To effectively conduct a property lien search, follow these detailed steps:

- Gather Asset Information: Begin by collecting essential details about the asset, including the address, parcel number, and the current owner's name. This information is vital for precise inquiries.

- Visit Local Government Offices: Access land records by checking with the county recorder, clerk, or assessor's office. Many counties offer online access to these records, allowing for convenient searches from anywhere.

- Search Public Records: Examine documented claims, mortgages, and other burdens associated with the asset. Pay close attention to the dates and types of claims, as this information can significantly influence the title of the asset. A title examination serves as a background check for the property, safeguarding both the lender and the buyer.

- Employ Online Tools: Utilize specific online repositories and services that focus on claims investigations. These platforms can streamline the process, providing comprehensive results that may not be easily accessible through traditional methods.

- Consult a Title Company: If challenges arise or a more detailed inquiry is necessary, consider enlisting the help of a title company. Their expertise and resources can uncover hidden liens, ensuring a complete understanding of the property's title status.

In competitive real estate markets, such as New York, accelerated title reviews may be crucial to meet tight closing deadlines. However, while these expedited inquiries can speed up the process, they must be approached with caution to ensure thoroughness and avoid potential legal issues. A case study emphasizes that in rapid markets, accelerated inquiries, while advantageous, involve extra expenses and dangers.

Statistics suggest that up to 10 partners can effectively employ limited data to choose pertinent content, highlighting the effectiveness that technology can provide for claims investigations. As Avenue Law Firm states, "We are dedicated to offering skilled legal services to assist you in managing your property transaction with assurance." By adhering to these steps and utilizing available resources, real estate professionals can conduct a lien search on a property and manage the property claim process with assurance and precision.

Types of Liens: What You Might Encounter in Your Search

When performing a claim search, it is crucial to identify the different kinds of claims that may emerge, each with unique consequences for asset ownership and financial responsibility.

- Mortgage Claims: These voluntary claims are created by lenders to secure loans for asset acquisitions. They represent a significant financial commitment and can lead to foreclosure if the borrower defaults. According to Anju Vajja, a Research Officer at the FHFA, the quarterly National Mortgage Database Aggregate Statistics suggest that a significant percentage of outstanding first mortgages are at risk, particularly in regions with high rates of unpaid taxes.

- Tax Claims: Imposed by government authorities for unpaid real estate taxes, tax claims can escalate into serious consequences, including foreclosure. Recent statistics indicate that a considerable percentage of assets with tax claims are at risk, especially in areas burdened by high rates of unpaid taxes.

- Mechanic's Claims: These claims are filed by contractors or suppliers who have not received payment for work done on the asset. They serve as a legal assertion against the asset until the obligation is settled, underscoring the importance of ensuring timely payment to all contractors.

- Judgment Claims: Arising from court decisions against the asset owner, judgment claims can encumber the asset until the related obligation is resolved. Understanding these claims is essential, as they can greatly influence the marketability of the asset. A case study on statutory and judgment claims illustrates how these legal assertions can impact business owners, highlighting the necessity for thorough due diligence in real estate transactions.

- Homeowners' Association (HOA) Claims: Imposed by HOAs for unpaid dues or assessments, these claims can also lead to foreclosure if not resolved. The prevalence of HOA claims has risen, particularly in neighborhoods with strict enforcement of dues.

- Municipal Utility Charges: These arise from failure to pay municipal utilities like water and electricity, adding another layer of potential financial liability for real estate owners.

Comprehending these types of claims is essential for evaluating the potential risks associated with real estate. By understanding the consequences of each claim type, real estate experts can more effectively manage the intricacies of ownership and safeguard their clients' interests. Furthermore, homeowners can eliminate a claim by either demonstrating it is invalid or compensating the creditor to obtain a release, which is vital information for those encountering such challenges.

Tools and Resources for Effective Lien Searches

To conduct an effective lien search, leveraging a variety of tools and resources is essential for enhancing accuracy and efficiency.

The County Recorder's Office serves as a foundational resource, with most counties maintaining online databases that facilitate direct searches of property records and associated liens. This accessibility is crucial for thorough lien investigations.

Title Investigation Firms specialize in conducting comprehensive title and encumbrance evaluations, delivering detailed reports that highlight potential issues. Their expertise significantly minimizes the time required for inquiries, ensuring thorough due diligence.

Furthermore, Online Claim Inquiry Services such as Proplogix and Wolters Kluwer offer advanced tools that simplify the inquiry process, conserving time while enhancing precision. These platforms aggregate data from multiple sources, proving invaluable for title researchers. Additionally, Searchbug provides free testing for its API services, allowing professionals to explore these tools with ease.

Numerous states also provide Public Records Databases, granting centralized access to claims and judgments, which are essential for comprehensive investigations.

Consulting a real estate lawyer offers critical insights into intricate claim matters, ensuring that all legal aspects are addressed during the inquiry process.

Understanding the distinctions between civil law claims and common law claims is crucial, as these differences can significantly impact enforcement and the overall investigation process. As Amanda (Rasizzi) Blooflat, Communications Director, emphasizes, 'A litigation inquiry should be a part of any comprehensive due diligence investigation and is essential to the 'discovery' process.'

Employing these resources not only enhances the precision of claims investigations but also fosters a more effective workflow. This ultimately assists real estate professionals in their due diligence activities, such as conducting a lien search on a property. Moreover, tools like Middesk's Business Verification solution can provide additional contextual information for B2B risk assessments concerning claims.

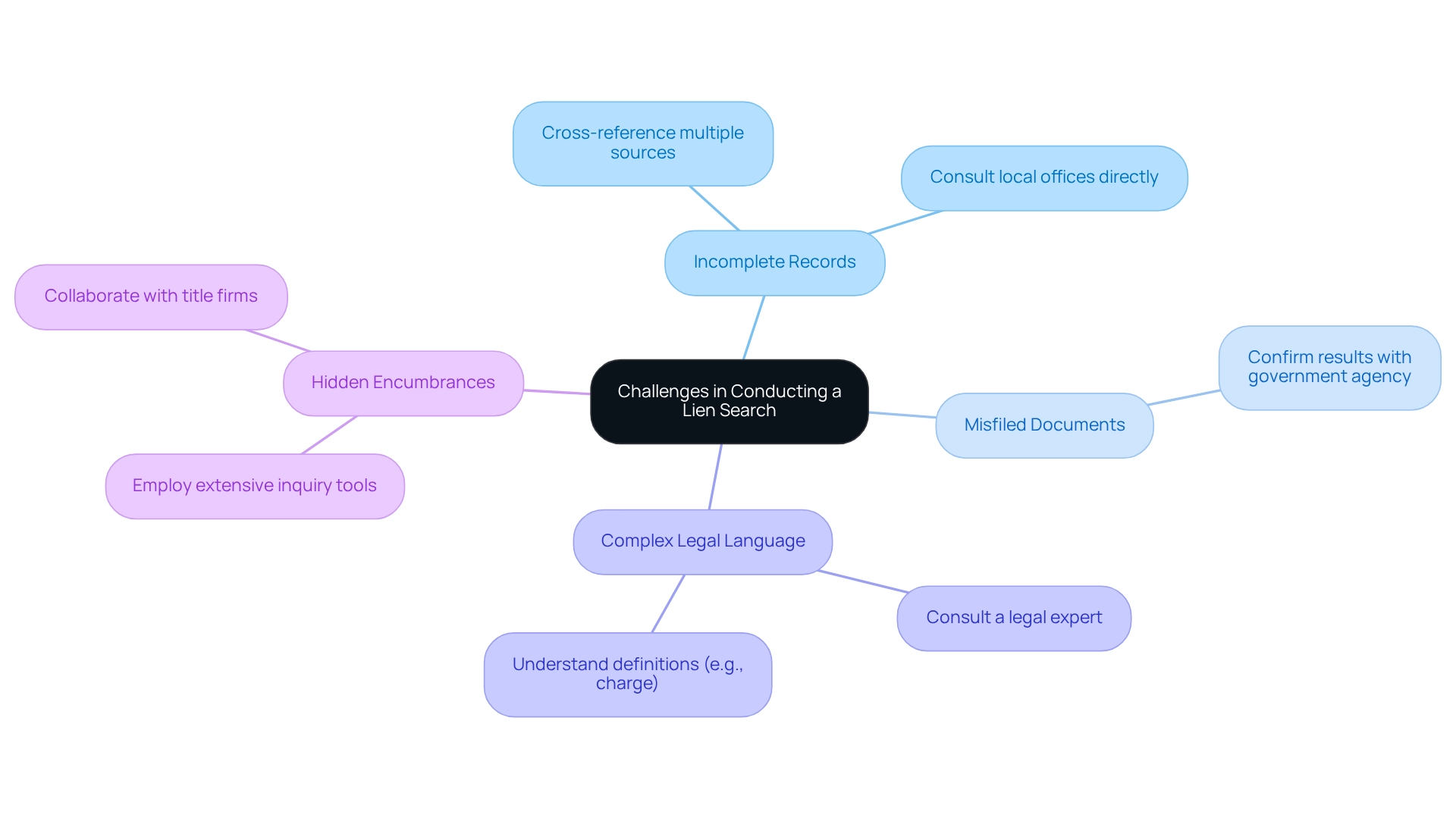

Common Challenges in Conducting a Lien Search and How to Overcome Them

Conducting a search for claims presents several challenges that require careful navigation:

- Incomplete Records: A significant percentage of public records are often outdated or incomplete, complicating the identification of all relevant claims. Statistics indicate that federal and state tax claims, along with judgment claims, can be located at the county or state level, depending on the jurisdiction. To mitigate this issue, it is advisable to cross-reference multiple sources, including county and state databases, and consult local offices directly for the most accurate information.

- Misfiled Documents: Liens may be misfiled or incorrectly recorded, leading to potential oversights. It is essential to confirm any results with the relevant government agency to guarantee precision and thoroughness in your inquiry.

- Complex Legal Language: The legal terms related to claims can be complicated and difficult to understand. According to Companies House, a charge is "Security for the payment of a debt or other obligation that does not transfer 'ownership' or any right to possession to the individual to whom the charge is granted." Consulting a legal expert can provide clarity and assist in navigating unclear terms, ensuring that all elements of the encumbrance investigation are comprehended.

- Hidden Encumbrances: Some claims may not be easily visible in public records, posing a risk to real estate transactions. Employing extensive inquiry tools and collaborating with title firms can assist in revealing these concealed claims, offering a more complete understanding of the property's claim status through a lien search on a property.

These difficulties are not uncommon in the realm of title investigation, particularly in 2025, where the framework of property ownership and claim documentation continues to evolve. For instance, the European Union's lack of a cohesive framework for secured transactions highlights the challenges arising from differing national regulations, which can significantly impact property inquiries across various jurisdictions.

Moreover, case studies such as the Transparent Dispute Resolution initiative illustrate the importance of maintaining accurate portfolios. This program allows users to report and amend erroneous claim and judgment details, fostering transparency and trust in the claim inquiry process. The initiative has yielded positive results in enhancing property claim accuracy, which is crucial for real estate professionals.

By implementing these strategies and remaining vigilant to potential challenges, real estate experts can improve their property claim procedures through conducting a lien search on a property, ultimately leading to better-informed decisions and successful transactions. Furthermore, employing platforms such as Parse AI can provide substantial cost savings compared to traditional title research methods, further streamlining the search process.

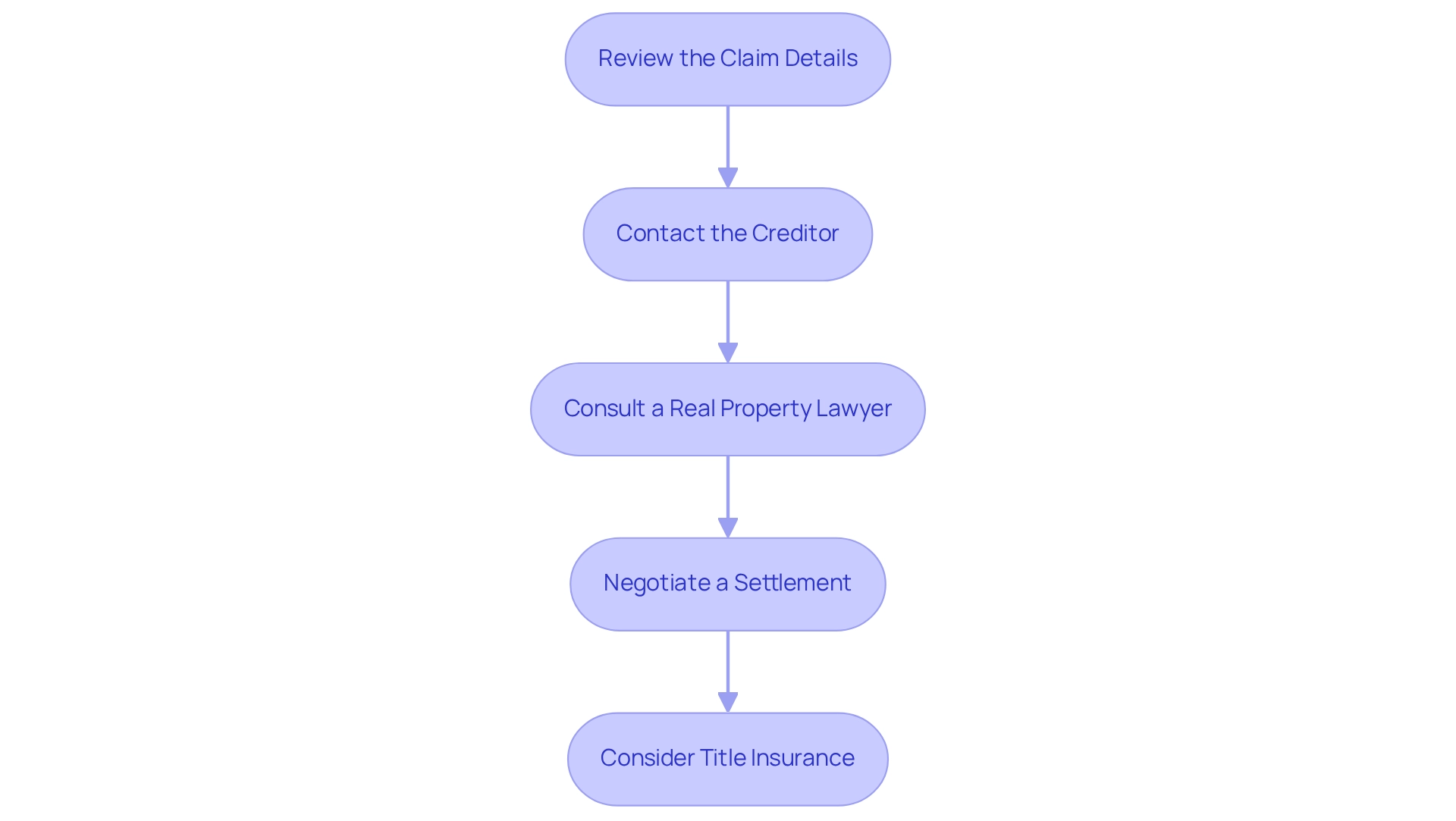

What to Do If You Discover a Lien After Buying Property

If you discover a claim following a lien search on a property, it is crucial to act swiftly and thoughtfully. Navigate the situation effectively by following these steps:

- Review the Claim Details: Begin by comprehensively understanding the claim's specifics, including the amount owed, the nature of the claim, and the creditor involved. This information is vital for informed decision-making.

- Contact the Creditor: Reach out to the creditor to discuss the lien. Open communication can often lead to a better understanding of your options and may facilitate a resolution. Numerous creditors are open to negotiating settlements, as evidenced by case studies where owners successfully reduced their owed amounts through effective communication.

- Consult a Real Property Lawyer: Involving a real property lawyer is essential. As legal professionals assert, "Consulting a real estate lawyer ensures you are well-informed about your rights and responsibilities regarding the claim, which is crucial for navigating the complexities of ownership." Their expertise can provide clarity on the legal implications of the claim.

- Negotiate a Settlement: If feasible, negotiate a settlement with the creditor. Many creditors are willing to collaborate with property owners to settle debts, particularly if it enables them to recover part of the owed sum. This approach not only addresses the claim but also mirrors strategies seen in customer loyalty programs, where effective engagement yields improved outcomes.

- Consider Title Insurance: If you possess title insurance, contact your insurer. They may assist in addressing the claim or cover related expenses, providing an additional layer of security in this scenario. Utilizing advanced technology, such as Parse AI, can also lead to significant cost reductions compared to traditional title research methods, enhancing the claims search process.

By adhering to these steps, you can adeptly manage the complexities of a claim identified after acquisition, which involves performing a lien search on a property to mitigate potential interruptions to your asset ownership. Just as 51% of online shoppers are likely to leave a negative review if shipping issues remain unresolved, addressing claims promptly is essential to maintaining satisfaction in real estate ownership.

Leveraging Technology for Efficient Lien Searches

Technology is fundamentally transforming the effectiveness of claims investigations, enabling real estate experts to navigate intricate asset records with unparalleled speed and precision. Key innovations include:

- Machine Learning Tools: These advanced systems process extensive datasets rapidly, pinpointing potential liens and inconsistencies in property records. By employing algorithms that learn from historical data, these tools enhance the accuracy of claim identification, significantly reducing the time required for thorough investigations. According to Statista, the adoption of machine learning technologies has led to a 30% improvement in efficiency in real estate record inquiries.

- Optical Character Recognition (OCR): OCR technology revolutionizes access to historical documents by converting scanned images into searchable text. This capability allows title researchers to quickly locate pertinent encumbrance information within vast archives of property records, streamlining the research process and minimizing manual effort. Industry experts note that the integration of OCR has decreased the time spent on document retrieval by up to 40%.

- Online Lien Search Platforms: Platforms such as Parse AI utilize sophisticated algorithms to optimize the lien search process. By automating data extraction and analysis, these services provide precise and timely results, empowering real estate professionals to make informed decisions faster than ever before. Tim Yalich, Head of Motor Vehicle Strategy for Wolters Kluwer, asserts, "Embracing digital transformation is no longer an option but a necessity for credit unions committed to growth and excellence in member service," underscoring the broader trend in the industry.

- Mobile Applications: The rise of mobile technology has prompted many counties to develop applications that enable on-the-go access to property records. These applications enhance convenience, allowing users to conduct property inquiries anytime and anywhere, thereby improving overall access to essential information.

The integration of these technologies not only enhances efficiency but also addresses the increasing demand for lien searches in the real estate sector. As the industry continues to evolve, the adoption rates of such technologies are projected to rise, reflecting a broader trend towards digital transformation in property research. However, the technology sector grapples with a skills gap, as fewer than half of potential candidates possess the high-demand tech skills required for job postings, which could hinder the pace of this transformation.

Conclusion

Understanding property liens transcends mere legal compliance; it is a cornerstone of informed real estate transactions. This article has illuminated the various types of liens—mortgage, tax, mechanic's, and judgment liens—and their potential implications for property ownership. Recognizing the distinction between voluntary and involuntary liens is crucial for both buyers and sellers, as it directly impacts the transferability and marketability of properties.

The necessity of conducting comprehensive lien searches before finalizing a property purchase has been underscored throughout this discussion. With approximately 30% of real estate transactions affected by undisclosed liens, the financial repercussions of neglecting this critical step can be severe. Utilizing advanced tools and resources, such as Parse AI and specialized online platforms, can significantly enhance the efficiency and accuracy of these searches, safeguarding investments and ensuring clear titles.

Moreover, the challenges associated with lien searches—including incomplete records and complex legal language—highlight the importance of due diligence and the potential value of legal assistance. By following the outlined steps for conducting lien searches and leveraging technology, real estate professionals can navigate this intricate landscape with confidence.

In conclusion, staying informed about property liens and the tools available for effective searches is essential for protecting interests in real estate transactions. As the market evolves, so do the strategies and technologies that can streamline the lien search process, ultimately fostering a more secure and informed environment for buyers and sellers alike.

Frequently Asked Questions

What is a real estate claim?

A real estate claim is a legal assertion against an asset, often used as security to guarantee a debt. Claims can arise from unpaid taxes, mortgages, or court rulings.

What are the two main types of liens?

The two main types of liens are voluntary and involuntary. Voluntary liens are established by the owner, such as through a mortgage contract, while involuntary liens occur without the owner's consent, often due to unpaid taxes or mechanic's claims.

What percentage of real estate in the U.S. carries some type of claim?

As of 2025, approximately 7% of real estate in the United States carries some type of claim.

Why is it important to conduct a lien search before finalizing a real estate deal?

Conducting a lien search is crucial to identify any existing claims on a property, as these claims can significantly affect ownership and transferability. Unpaid taxes or mortgage defaults can complicate the sale or transfer of real estate.

What financial consequences can arise from not conducting a lien search?

Failing to conduct a lien search can lead to significant financial losses, as approximately 30% of real estate transactions are affected by undisclosed claims. New owners may become liable for outstanding debts, resulting in unexpected financial burdens.

How can hidden claims impact funding or insurance for landowners?

Hidden claims can complicate the process of obtaining funding or insurance, creating additional obstacles for landowners and potentially leading to legal conflicts.

What do real estate lawyers recommend regarding lien searches?

Real estate lawyers emphasize the importance of comprehensive due diligence, asserting that a lien search is vital to identify existing claims and avoid costly legal disputes.

What are some technological advancements in conducting lien searches?

Parse AI offers an innovative approach to title research by utilizing machine learning technologies and optical character recognition (OCR) to enhance the efficiency and accuracy of property investigations.

What broader implications are associated with ensuring clear ownership titles?

Ensuring clear ownership titles is crucial for reducing the racial wealth gap and addressing the legacy of eroding homeownership in communities of color, as highlighted by legal experts.