Overview

This article serves as a comprehensive guide for real estate professionals on checking for liens, underscoring the critical importance of thorough searches to uncover any legal claims against properties. It delineates a step-by-step process for conducting lien searches, explores various types of liens and their implications for property transactions, and emphasizes the necessity of employing diverse resources and tools. By ensuring accurate and efficient checks, real estate professionals can facilitate smoother transactions, ultimately enhancing their operational effectiveness.

Introduction

In the intricate world of real estate, understanding liens is essential for professionals navigating property transactions. A lien, serving as a legal claim against a property, can arise from various situations, including unpaid taxes or contractor fees, and its implications can significantly affect ownership and sales.

With the real estate market continuously evolving, it is imperative for agents and buyers alike to grasp the nuances of different lien types, from voluntary mortgages to involuntary tax liens. This knowledge aids in avoiding unexpected financial burdens and streamlines the transaction process, ensuring smoother dealings.

Furthermore, statistics reveal that a considerable percentage of real estate transactions encounter lien-related challenges. Consequently, it is crucial for professionals to be well-versed in conducting thorough lien searches and understanding their potential impacts.

Understanding Liens: What Every Real Estate Professional Should Know

A legal claim signifies a legal interest against a property, acting as collateral for a debt. It can arise from various circumstances, including unpaid taxes, mortgages, or contractor fees. For real estate professionals, grasping the nuances of different claim types is essential.

There are two primary categories of claims: voluntary and involuntary.

- Voluntary claims are established with the owner's consent, such as mortgages or home equity loans.

- Conversely, involuntary claims are imposed without the owner's approval, typically stemming from unpaid debts like tax obligations or mechanic's liens.

Recognizing these distinctions is crucial, as they can profoundly influence property transactions; hence, it is imperative to conduct thorough lien checks.

Recent statistics reveal that a substantial portion of property transactions is affected by encumbrances, underscoring the need for comprehensive title investigations. For instance, 2% of FSBO sellers reported challenges in attracting potential buyers, a situation often linked to obstacles posed by claims in property transactions. Numerous real estate experts have indicated encountering difficulties related to both voluntary and involuntary claims in their dealings.

Expert insights further underscore the necessity of being well-informed about various types of claims. Anju Vajja, a research officer at the FHFA, asserts, "Understanding these legal claims can prevent potential disputes and facilitate smoother transactions." This statement highlights the importance of knowledge in mitigating risks associated with claims.

Moreover, case studies illustrate the value of consulting qualified experts, such as property lawyers, when navigating claim disputes. For example, in a recent case involving asset claims disputes, the involvement of Brian Farkas, an associate lawyer at Goetz Fitzpatrick LLP, was pivotal in resolving the matter efficiently.

By familiarizing themselves with the different forms of claims and their implications, property professionals can more adeptly manage the complexities of transactions and minimize risks associated with claims. Furthermore, as the property market evolves—illustrated by the increasing use of drones, with 46% of members employing experts—staying informed about all aspects of the industry remains essential.

Why Checking for Liens is Essential in Real Estate Transactions

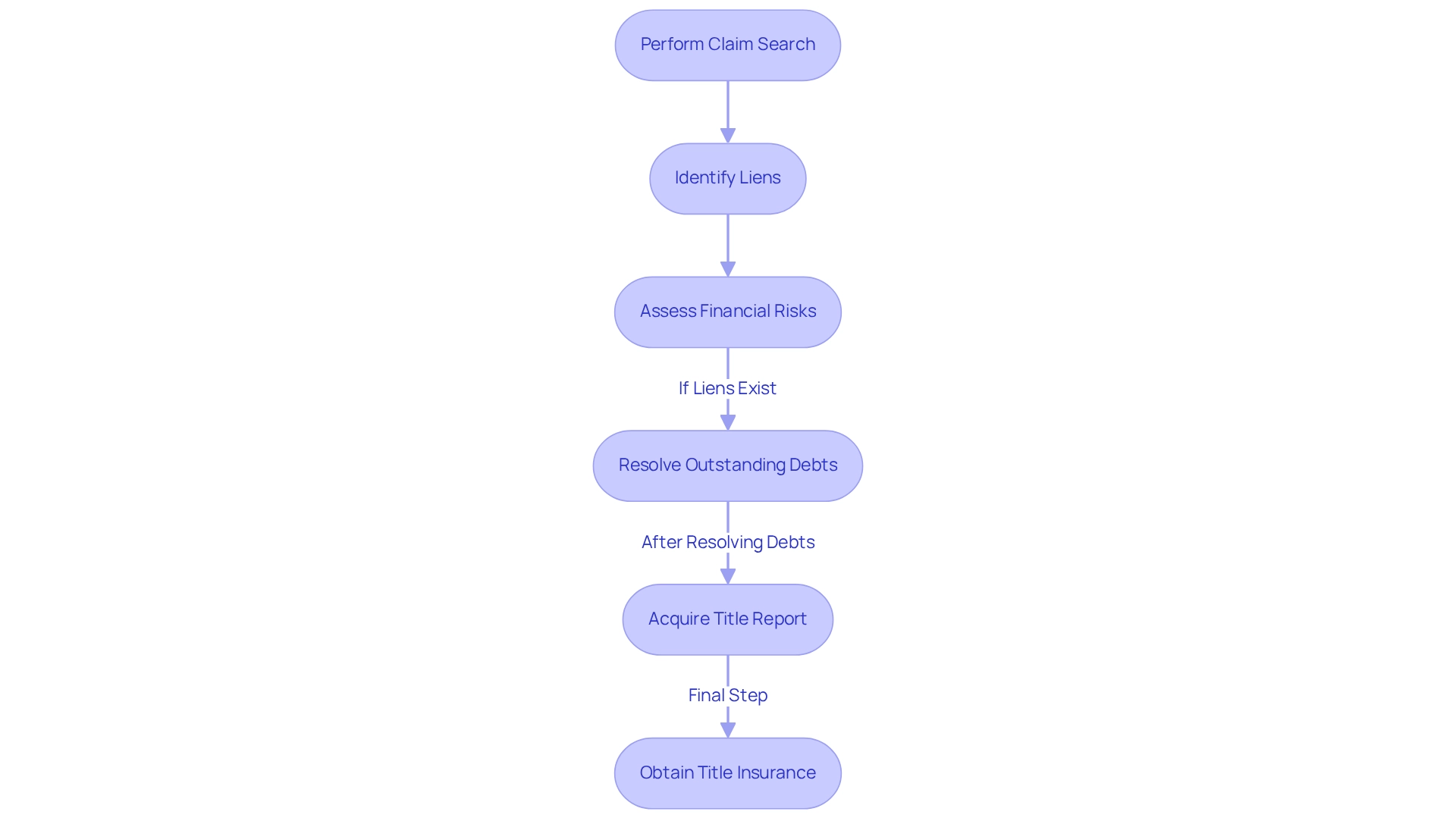

A crucial step in any real estate transaction is to perform a comprehensive claim search to check for liens. Liens can significantly complicate or even obstruct the sale of an asset, as they represent debts that must be resolved before ownership can be transferred. For instance, if an asset has an outstanding tax obligation, the purchaser may unintentionally take on this debt, potentially leading to significant financial challenges.

Statistics suggest that a creditor may demand up to $20,000 from the sale of a property valued at $200,000 if a legal claim is placed on it, highlighting the possible financial risks involved.

Realty experts must prioritize investigations to check for liens and identify any existing rights against a property. This proactive approach not only protects clients from unexpected liabilities but also streamlines the transaction process. As Bill Gassett, an experienced real estate professional, observes, "Get ready for delays: Expect that addressing claims can prolong the sale process timeline and prepare accordingly."

This underscores the difficulties that can occur when claims are present, making it essential for professionals to be ready.

In 2025, the significance of checking for liens remains paramount, as unresolved claims can lead to issues that jeopardize real estate transactions. For example, when a homeowner obtains a mortgage or home equity loan, they consent to use their asset as collateral, leading to a mortgage claim. If payments are missed, both the mortgage lender and any additional lenders can claim the home, with a hierarchy determining the order of repayment upon sale.

This situation illustrates the importance of performing property searches to check for liens and prevent potential drawbacks.

Furthermore, acquiring a title report and title insurance can assist in confirming ownership and reducing concerns about undisclosed claims. Recent trends in the housing market emphasize tactics for accelerating sales related to assets with encumbrances. Vendors are urged to resolve claims promptly, work with knowledgeable property agents, consider selling to investors, and gather required paperwork to ease discussions.

By comprehending the effects of claims on asset sales and adopting proactive strategies, housing professionals can facilitate smoother transactions and protect their clients' interests.

Types of Liens: A Comprehensive Overview for Title Researchers

In the realm of real estate, verifying liens and understanding the various categories of claims is imperative for thorough title research. A comprehensive overview of the most prevalent claims that can impact ownership of real estate includes:

- Mortgage Claims: These voluntary encumbrances are established by lenders when financing an asset. They secure the loan and grant the lender the right to foreclose if payments are not made.

- Tax Claims: Instituted by governmental entities, tax claims arise from unpaid real estate taxes. They can significantly affect the asset's marketability and must be resolved prior to any sale. Notably, the removal of most tax claims and civil judgments from credit reports by the Nationwide Credit Reporting Agencies in 2017 has altered the landscape for lenders, increasing risk exposure when evaluating potential buyers based solely on tradeline history.

- Mechanic's Claims: Filed by contractors or suppliers who have not received payment for work performed on the premises, mechanic's claims can complicate transactions. They ensure that those who enhance the asset's value are compensated. Recent statistics indicate a rising trend in mechanic's claims, often surpassing mortgage claims in certain markets. This underscores the necessity for real estate professionals to stay informed about the latest developments in claims filings and their potential impact on transactions.

- Judgment Claims: These claims emerge from court rulings against the asset owner, frequently due to unpaid debts. They can obstruct the sale of the asset until resolved.

- Homeowners Association (HOA) Claims: Imposed by HOAs for unpaid dues, these claims can lead to foreclosure if not addressed, highlighting the importance of maintaining good standing with community organizations.

Each type of claim carries unique implications for ownership and must be meticulously assessed during title research to verify liens. Furthermore, the adjustment of CP Liens expiration to ten years after the final day of the month the original certificate was obtained, effective September 2019, provides current context on regulatory matters.

Case studies underscore the importance of transparent dispute resolution processes, enabling consumers to report inaccuracies in related information. Such transparency not only aids in maintaining accurate asset portfolios but also allows consumers to receive timely notifications for any changes affecting their holdings. This is crucial for real estate experts navigating these complexities.

In conclusion, a thorough understanding of the various types of claims is essential for real estate professionals to effectively manage transactions and mitigate risks associated with title research. As Anju Vajja, a FHFA Research Officer, noted in the quarterly National Mortgage Database Aggregate Statistics released on June 30, 2023, staying informed about mortgage data is vital for making informed decisions in this field.

Step-by-Step Process for Conducting a Lien Search

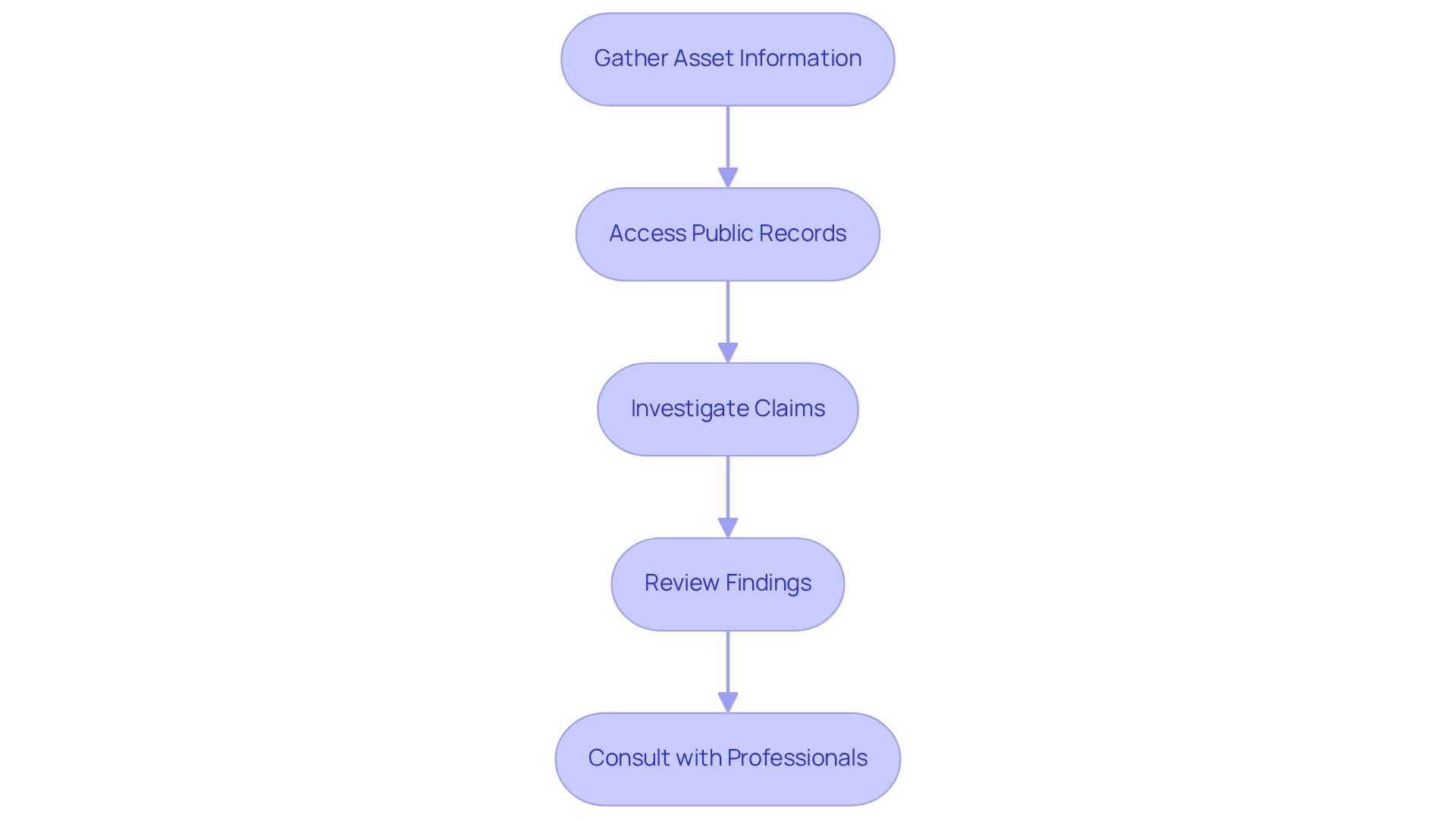

To effectively conduct a lien search, follow these detailed steps:

- Gather Asset Information: Begin by collecting comprehensive details about the asset, including its legal description, address, parcel number, and any previous owners. This foundational information is crucial for accurate searches.

- Access Public Records: Navigate to the local county clerk or recorder's office, or utilize their online database. This is where you can check for liens on documented claims, which are essential for understanding any restrictions on the asset. Be aware that local authorities can impose claims on assets for unpaid assessments, bills, and fines, which may be part of tax records or held within specific municipal departments.

- Investigate Claims: Conduct a thorough search for documents that help you check for liens against the asset. This includes not only mortgages but also tax claims and mechanic's claims, which can significantly impact ownership and the transfer of real estate.

- Review Findings: Analyze the encumbrance documents carefully to understand their nature, amount, and priority. Grasping these elements is vital, as they can affect the property's marketability and the buyer's financial obligations.

- Consult with Professionals: If you encounter complex issues or unclear documentation, it’s advisable to consult with a title company or legal expert. Their expertise can provide clarity and ensure that all potential risks are addressed. As Amanda (Rasizzi) Blooflat, Director of Marketing, states, "It is to your benefit to collaborate with a partner that provides an effective method to search federal and state tax records."

Incorporating these best practices can enhance the accuracy and efficiency of your claims searches. For instance, statistics indicate that after settling a claim, it may remain on your credit history for up to seven years, underscoring the significance of thorough searches. Furthermore, a case study titled 'Exploring Less Common Security Interests' emphasizes the importance of considering various types of claims that may not be typical but could greatly influence transactions.

By broadening the range of your searches to include less common claims, you can identify potential issues early, thereby avoiding surprises during and after transactions. This proactive approach not only saves time but also mitigates risks associated with property ownership.

Tools and Resources for Effective Lien Checks

To perform effective property checks, real estate professionals can utilize a range of tools and resources that enhance the precision and efficiency of their searches.

- County Clerk's Office: This remains the cornerstone for accessing public records, including comprehensive details on claims. Confirming ownership and any encumbrances on the asset is crucial. U.S. Title offers extensive records of assets, including ownership transfers, tax claims, judgments, bankruptcies, and foreclosure activity, making it an essential resource for realty professionals.

- Online Databases: Platforms such as PropertyChecker.com and various local government websites provide searchable databases that simplify the process of locating encumbrance information. With over 2,500,000 interviews indicating a notable increase in reliance on online databases for real estate record checks, these resources are becoming increasingly popular among industry professionals.

- Title Companies: Partnering with a title company can provide invaluable expertise in conducting thorough claims searches. These professionals are adept at navigating complex records and ensuring comprehensive due diligence. Lenders should utilize seven specific search types for a robust due diligence strategy, which title companies can facilitate.

- Legal Databases: Accessing legal databases is essential for identifying judgment claims and other legal interests against assets. These resources can reveal hidden liabilities that may not be apparent through standard searches.

- Mobile Apps: The rise of mobile technology has led to the development of applications that empower users to check real estate records on-the-go. This adaptability is particularly advantageous during property showings, enabling industry experts to conduct prompt evaluations and make informed decisions.

By leveraging these resources, professionals can enhance their due diligence practices and verify any claims that may impact property dealings. As Carolina Dulin emphasizes, the importance of thorough due diligence cannot be overstated in today's fast-paced real estate market. Furthermore, the case study on Parse AI illustrates how technology is revolutionizing title research, enabling faster and more precise checks, ultimately delivering substantial cost savings compared to traditional methods.

Overcoming Challenges in Lien Searches: Tips for Success

Performing property searches can present several challenges; however, with the right strategies, these obstacles can be effectively managed. Here are essential tips to enhance your claim search process:

- Incomplete Records: To ensure comprehensive information, verify the completeness of records by consulting multiple sources. This includes both online databases and physical records, as relying on a single source may lead to missing critical information.

- Misfiled Documents: Misfiled documents are a common issue in public records. Be prepared to search under various names or variations of the property owner's name. This flexibility can help you uncover all relevant documents that may otherwise be overlooked.

- Outdated Information: Public records are dynamic; claims can be filed or released at any time. Regularly check for updates to ensure that the information you are working with is current. This diligence is essential, as other municipalities may take up to 20 business days to finalize a municipal search, potentially delaying your transactions.

- Complex Legal Language: Acquainting yourself with typical legal terminology concerning claims can greatly enhance your comprehension of the documents you face. For example, a charge is described as: “Security for the payment of a debt or other obligation that does not transfer ‘ownership’ or any right to possession to the individual to whom the charge is granted.” This knowledge will enable you to navigate intricate legal terminology and make well-informed choices.

- Consult Experts: When uncertainties arise, do not hesitate to consult with title professionals or legal experts. Their insights can elucidate claim implications and assist you in sidestepping possible pitfalls in your transactions.

By applying these strategies, real estate experts can maneuver through the intricacies of claim searches more efficiently and check for liens to ensure that assets are clear of encumbrances prior to closing. Understanding different forms of municipal claims—such as property tax claims, utility claims, and code enforcement claims—can further assist in recognizing potential financial obligations and legal problems that may impact property ownership. Additionally, understanding the importance of tax transcripts in loan underwriting can be crucial, as these documents may be required for certain transactions.

Best Practices for Documenting Lien Information

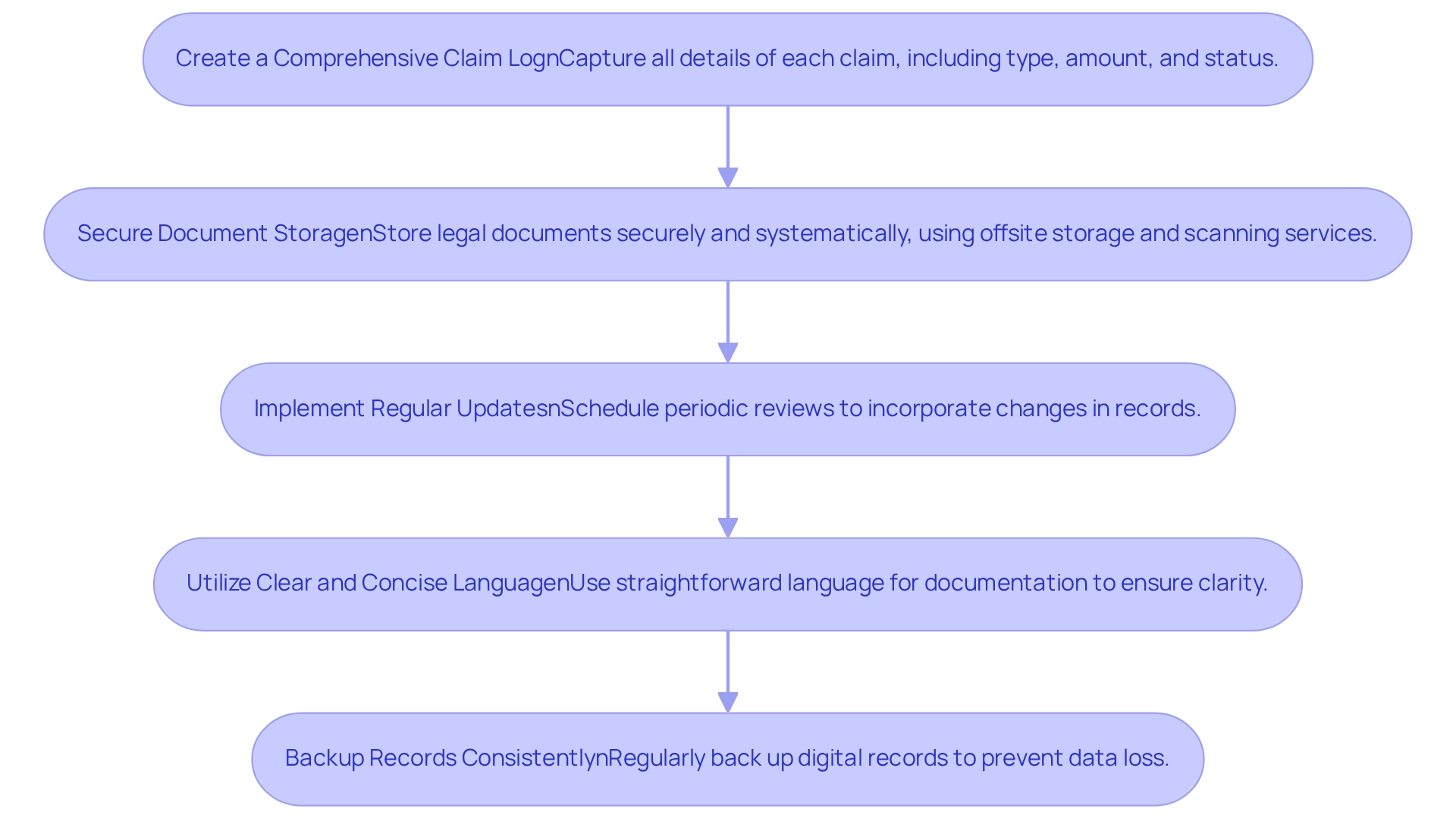

To effectively record encumbrance information, adhere to the following best practices:

- Create a Comprehensive Claim Log: Develop a detailed log that captures all pertinent details of each claim, including its type, amount, and current status. This log serves as a fundamental instrument for monitoring claim activity and ensuring precision in reporting. Real estate experts advise concentrating on high-value claim data to maximize the utility of the log.

Secure Document Storage: Ensure that all legal documents are stored securely and organized systematically, whether in digital formats or physical files. According to Armstrong, utilizing offsite file storage and document scanning services can enhance the security and accessibility of sensitive information, facilitating easy retrieval when needed. - Implement Regular Updates: Schedule periodic reviews of record holdings to incorporate any changes, such as releases or new filings. Maintaining up-to-date records is essential, as public documents can often change, affecting the status of claims. Guidance for URI strategy and implementation has been developed for government agencies to enhance public sector data publishing, emphasizing the importance of accurate documentation.

- Utilize Clear and Concise Language: When documenting findings, employ straightforward language that is easily understood by all stakeholders. Clarity in communication helps prevent misunderstandings and ensures that critical information is accessible. As noted by Dave Reynolds from Epimorphics, meticulous documentation is vital for effective data management.

- Backup Records Consistently: Regularly back up digital records to safeguard against data loss due to technical failures. This proactive action is crucial for preserving the integrity of claim information. Statistics show that organizations that keep current record files experience a 30% decrease in processing time for related inquiries, highlighting the importance of regular backups.

In 2025, real estate experts stress the significance of these practices, pointing out that efficient log management can greatly improve operational efficiency. Furthermore, case studies reveal that agencies concentrating on high-value datasets for publication have enhanced their data reuse and application effectiveness, further illustrating the advantages of meticulous documentation in asset management.

Implications of Liens on Property Ownership and Transactions

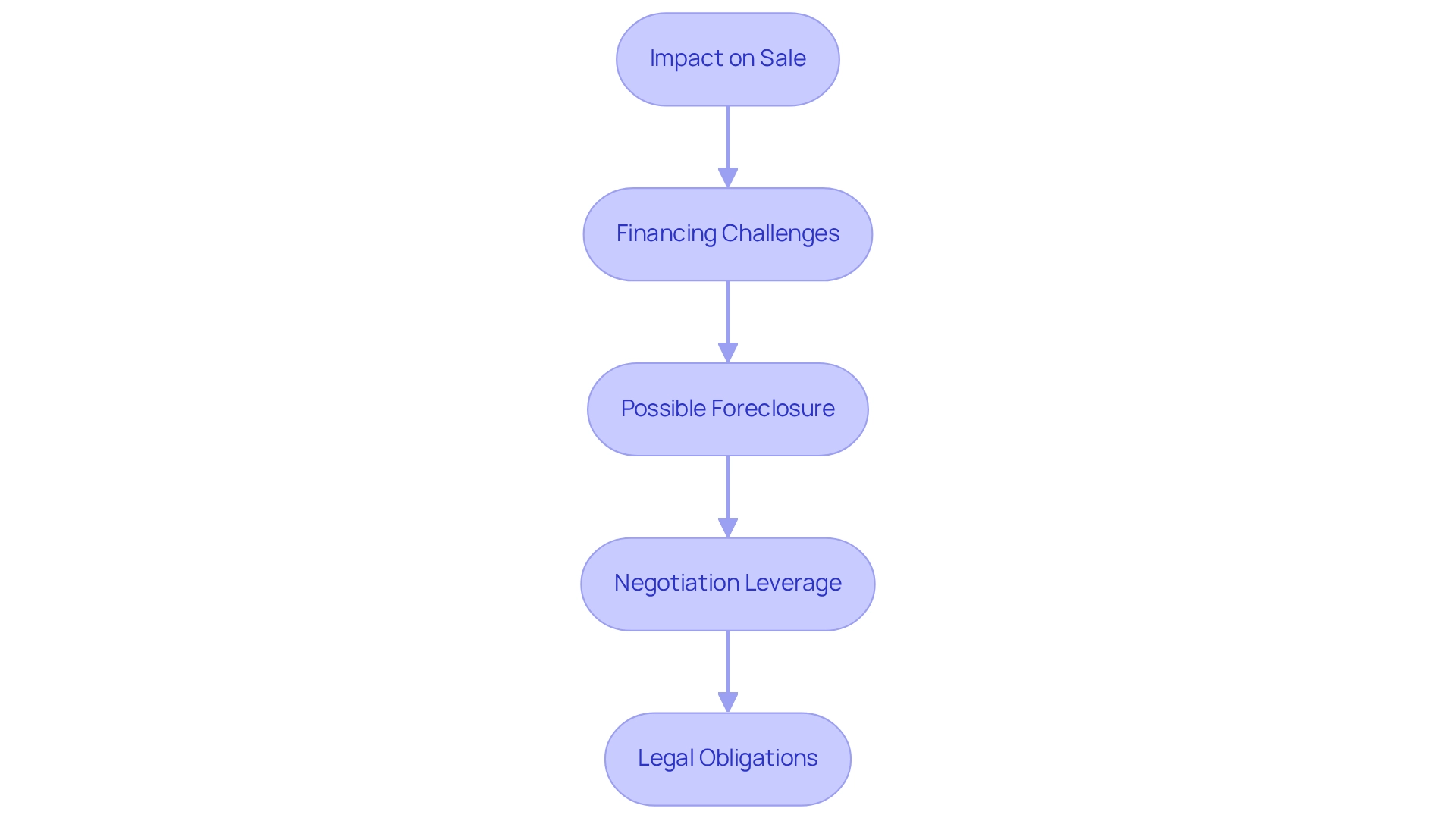

Liens can significantly impact property ownership and transactions in various ways:

- Impact on Sale: Properties burdened by outstanding claims often face challenges in the market, as buyers typically seek clear titles. In fact, assets with outstanding claims can experience a decline in sale success rates, making it essential for real estate experts to check for liens and perform comprehensive claim searches prior to listing an asset.

- Financing Challenges: Lenders frequently hesitate to finance properties encumbered with current claims, complicating the purchasing process. This hesitance can lead to increased scrutiny during the underwriting process, potentially delaying or derailing transactions altogether.

- Possible Foreclosure: Unsettled debts can prompt creditors to initiate foreclosure actions, jeopardizing the owner's investment. Understanding the timeline for redemption is crucial; failing to redeem within the designated period can terminate the original owner's rights, affecting any mortgage or claim holders involved. In tax deed states, for instance, the purchaser of a tax deed may be able to clear title to the property after waiting for the prior owner’s redemption rights to expire.

- Negotiation Leverage: A thorough understanding of the encumbrance situation can empower buyers during negotiations. Awareness of current claims enables purchasers to check for liens and negotiate more favorable terms or prices, potentially leveraging the implications of the claims to their advantage.

- Legal Obligations: Real estate professionals must navigate the legal landscape surrounding encumbrances to ensure compliance with relevant laws. This diligence safeguards clients from possible legal issues that could arise from undisclosed claims or improper management of claim-related matters, underscoring the importance of checking for liens.

In the realm of tax investment, successful outcomes hinge on comprehensive research and due diligence. As Rachel Seidensticker notes, "Delve into the world of tax sale investing in Illinois, where high returns meet legal intricacies." Engaging with certified tax lien professionals can enhance investment opportunities, as demonstrated by case studies like Firstrust, which has leveraged over a decade of experience to support investors in effectively navigating this complex market.

As the landscape evolves, staying informed about local tax sale procedures and monitoring legislative changes is vital for safeguarding real estate interests.

Conclusion

Understanding liens is paramount for real estate professionals, as they can significantly influence property transactions and ownership. This article highlights the various types of liens—voluntary and involuntary—and underscores the importance of conducting thorough lien searches to avoid unforeseen financial liabilities. With a notable percentage of transactions encountering lien-related issues, being well-informed about the implications of these legal claims is essential for ensuring smooth dealings.

The necessity of proactive measures, such as obtaining title insurance and engaging with qualified professionals, emerges as a crucial theme throughout the discussion. Not only does this protect clients, but it also streamlines the transaction process, mitigating risks associated with liens. Furthermore, with the ongoing evolution of the real estate landscape, including advancements in technology that enhance lien checks, staying updated on best practices and utilizing available resources is vital for success in this field.

Ultimately, a comprehensive understanding of liens and their implications empowers real estate professionals to navigate complexities effectively, safeguard their clients' interests, and facilitate successful property transactions. As the market continues to change, the ability to manage lien-related challenges will remain a cornerstone of effective real estate practice.

Frequently Asked Questions

What is a legal claim in relation to property?

A legal claim signifies a legal interest against a property, acting as collateral for a debt. It can arise from various circumstances, including unpaid taxes, mortgages, or contractor fees.

What are the two primary categories of claims?

The two primary categories of claims are voluntary claims and involuntary claims. Voluntary claims are established with the owner's consent, such as mortgages or home equity loans, while involuntary claims are imposed without the owner's approval, typically stemming from unpaid debts like tax obligations or mechanic's liens.

Why is it important to recognize the distinctions between claim types?

Recognizing the distinctions between claim types is crucial as they can profoundly influence property transactions. Conducting thorough lien checks is imperative to avoid complications.

What do recent statistics reveal about property transactions and claims?

Recent statistics indicate that a substantial portion of property transactions is affected by encumbrances. For instance, 2% of For Sale By Owner (FSBO) sellers reported challenges in attracting potential buyers, often linked to obstacles posed by claims.

How can understanding legal claims benefit real estate professionals?

Understanding legal claims can prevent potential disputes and facilitate smoother transactions, helping real estate professionals manage the complexities of property transactions and minimize associated risks.

What is the significance of consulting qualified experts in claim disputes?

Consulting qualified experts, such as property lawyers, can be pivotal in resolving claim disputes efficiently, as illustrated by case studies highlighting successful interventions by legal professionals.

What is a crucial step in any real estate transaction regarding claims?

A crucial step is to perform a comprehensive claim search to check for liens, as they can significantly complicate or obstruct the sale of an asset, representing debts that must be resolved before ownership can be transferred.

What financial risks are associated with legal claims on properties?

Statistics suggest that a creditor may demand up to $20,000 from the sale of a property valued at $200,000 if a legal claim is placed on it, highlighting the possible financial risks involved.

How can real estate professionals protect their clients from unexpected liabilities?

Realty experts should prioritize investigations to check for liens and identify existing rights against a property, which protects clients from unexpected liabilities and streamlines the transaction process.

What is the importance of acquiring a title report and title insurance?

Acquiring a title report and title insurance can assist in confirming ownership and reducing concerns about undisclosed claims, thereby facilitating smoother transactions.

What strategies can housing professionals adopt to facilitate smoother transactions?

Housing professionals can adopt proactive strategies such as resolving claims promptly, working with knowledgeable property agents, considering selling to investors, and gathering required paperwork to ease discussions.