Overview

The article elucidates the critical distinction between title and escrow services, highlighting their unique roles within real estate transactions. Title services concentrate on verifying ownership and providing insurance against potential claims, whereas escrow services are responsible for managing funds and documents to guarantee that contractual obligations are fulfilled prior to the transfer of ownership. This differentiation is vital for real estate professionals, as it significantly enhances transaction efficiency and protects the interests of all parties involved. Notably, evidence indicates that escrow functions are prevalent in approximately 80% of transactions, underscoring the necessity of compliance and effective risk management.

Introduction

Understanding the nuances of real estate transactions is crucial for anyone involved in the industry. Title and escrow services, often mentioned together, serve distinct yet interconnected roles that can significantly impact the buying and selling process. As the real estate landscape evolves, professionals must grapple with the complexities of these services to ensure smooth transactions.

Furthermore, how can a deeper comprehension of title and escrow services not only safeguard investments but also streamline the entire process?

Define Title and Escrow Services

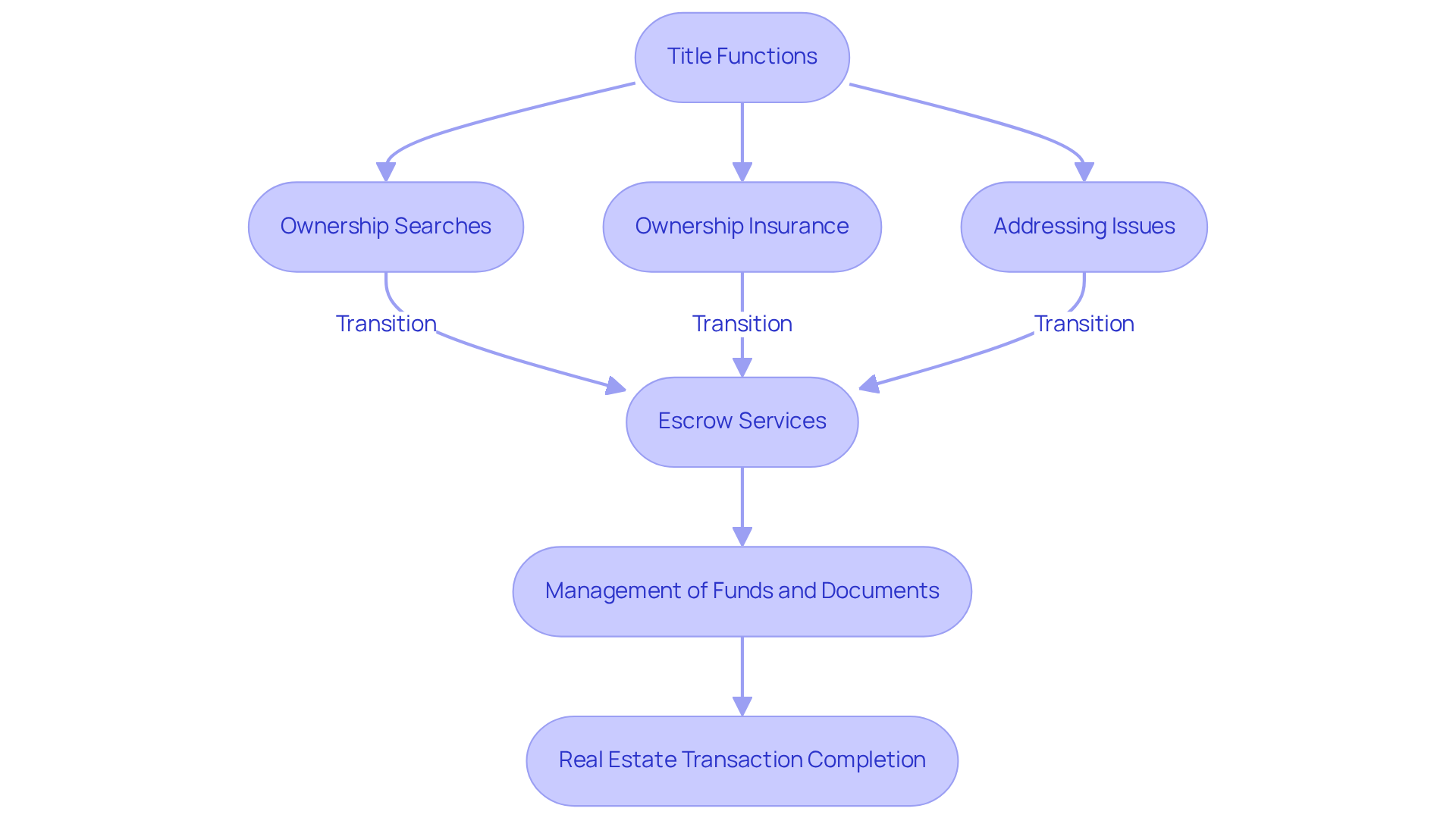

Title functions encompass the essential procedures necessary to confirm and establish legal ownership of a property. This includes conducting comprehensive ownership searches, providing ownership insurance, and addressing any related issues that may arise. Title insurance serves to protect buyers and lenders from title-related losses, such as adverse ownership claims and liens, thereby safeguarding the buyer's investment. Notably, the insurance sector for property is projected to reach $23.0 billion by 2025, underscoring the significance of these services within .

In contrast, trust accounts involve an impartial third party that manages the funds and documents during a real estate transaction. This intermediary ensures that all conditions of the sale are met before the transfer of ownership is finalized. Fundamentally, while title assistance protects against future claims on the property, recognizing the difference between title and escrow services facilitates the process itself, ensuring a seamless and secure exchange.

Importantly, a substantial percentage of real estate transactions—often cited as approximately 80%—incorporate escrow functions, highlighting their critical role in the industry. As the market evolves, understanding the difference between title and escrow services becomes increasingly vital for real estate professionals aiming to navigate the complexities of property dealings effectively.

Eugene O'Neill once asserted that land is safer than stocks and bonds, reinforcing the value of real estate as a sound investment. Furthermore, Parse AI is revolutionizing the research on ownership claims by leveraging machine learning and optical character recognition to enhance efficiency for researchers, thereby improving the operational landscape of related services.

Explore the Role of Title Services

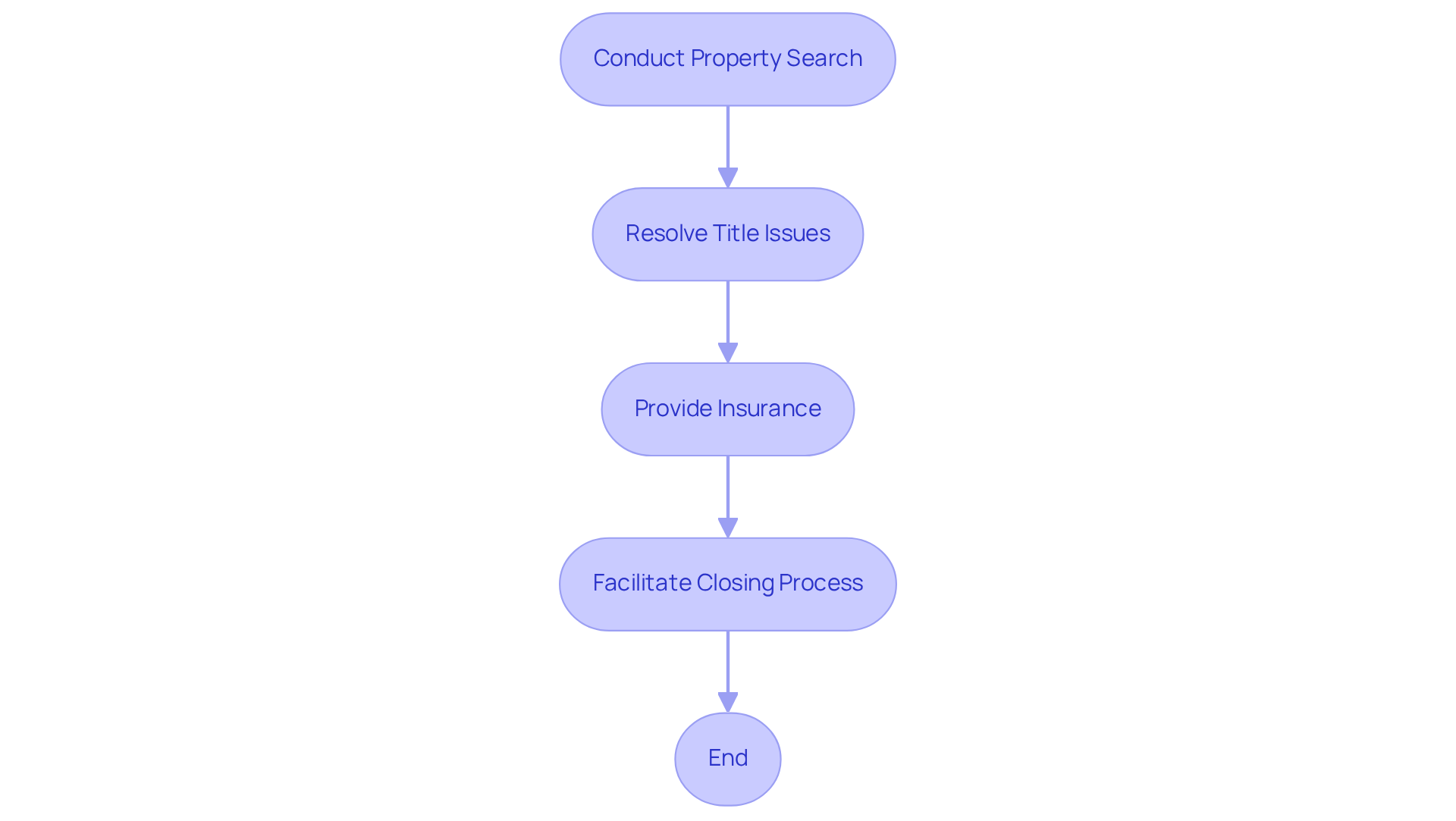

Understanding the difference between is integral to real estate transactions, encompassing several essential functions. These services include:

- Conducting comprehensive property searches to uncover any liens, encumbrances, or ownership disputes that may affect the property.

- Resolving title-related issues, which can range from a few days to several weeks, depending on the complexity of the case.

- Providing insurance, which protects both purchasers and lenders from potential future claims against the property, ensuring peace of mind throughout the process.

- Facilitating the closing process by preparing and managing all necessary documentation.

Title agents work closely with clients to address and resolve any title-related issues prior to finalizing the transaction, thereby minimizing risks associated with property ownership. A notable case involving California Best Title Company underscores the importance of compliance and ethical practices in the industry, as the company faced penalties for illegal inducement related to conflicts of interest. This situation highlights the necessity for agents to maintain integrity and transparency in their operations.

Moreover, ownership investigations can uncover significant disputes, as evidenced by numerous instances where unresolved liens or claims led to litigation. By conducting thorough investigations and providing clear title reports, title agents safeguard the interests of all parties involved in the transaction, reinforcing the critical nature of their role in the real estate process.

Understand the Escrow Process

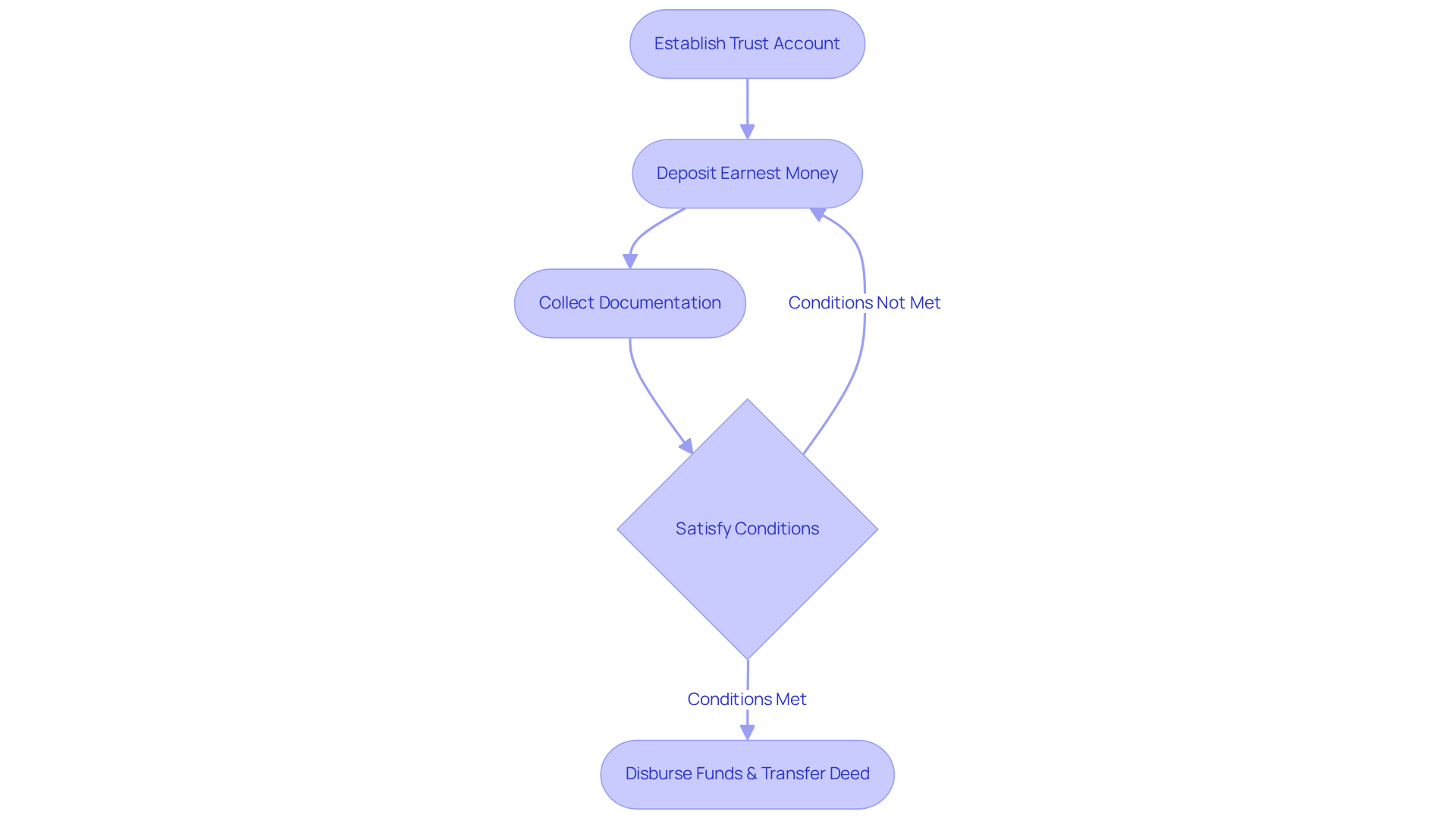

The holding process is a pivotal component of real estate transactions, encompassing several essential steps. Initially, a trust account is established once the buyer and seller reach an agreement on the sale terms. The buyer subsequently deposits earnest money into this account, signaling their commitment to the purchase. Following this, the intermediary collects all necessary documentation, including the purchase agreement and title details, ensuring that all conditions are satisfied before closing.

Data indicate that trust accounts are crucial in the majority of property sales and are often mandated by mortgage providers, underscoring their importance in facilitating seamless transactions. Once all parties fulfill their obligations, the agent disburses the funds and transfers the property deed to the buyer, thereby concluding the transaction. This structured approach not only of both parties but also cultivates trust throughout the process.

As one agent noted, "Maintaining an account provides peace of mind by guaranteeing a neutral third party oversees funds and documents." Furthermore, it is vital to recognize that there are two types of trust accounts in real estate: one for the buying process and another for post-purchase payments. A thorough understanding of the trust arrangement is essential for real estate professionals.

Compare Title and Escrow Services

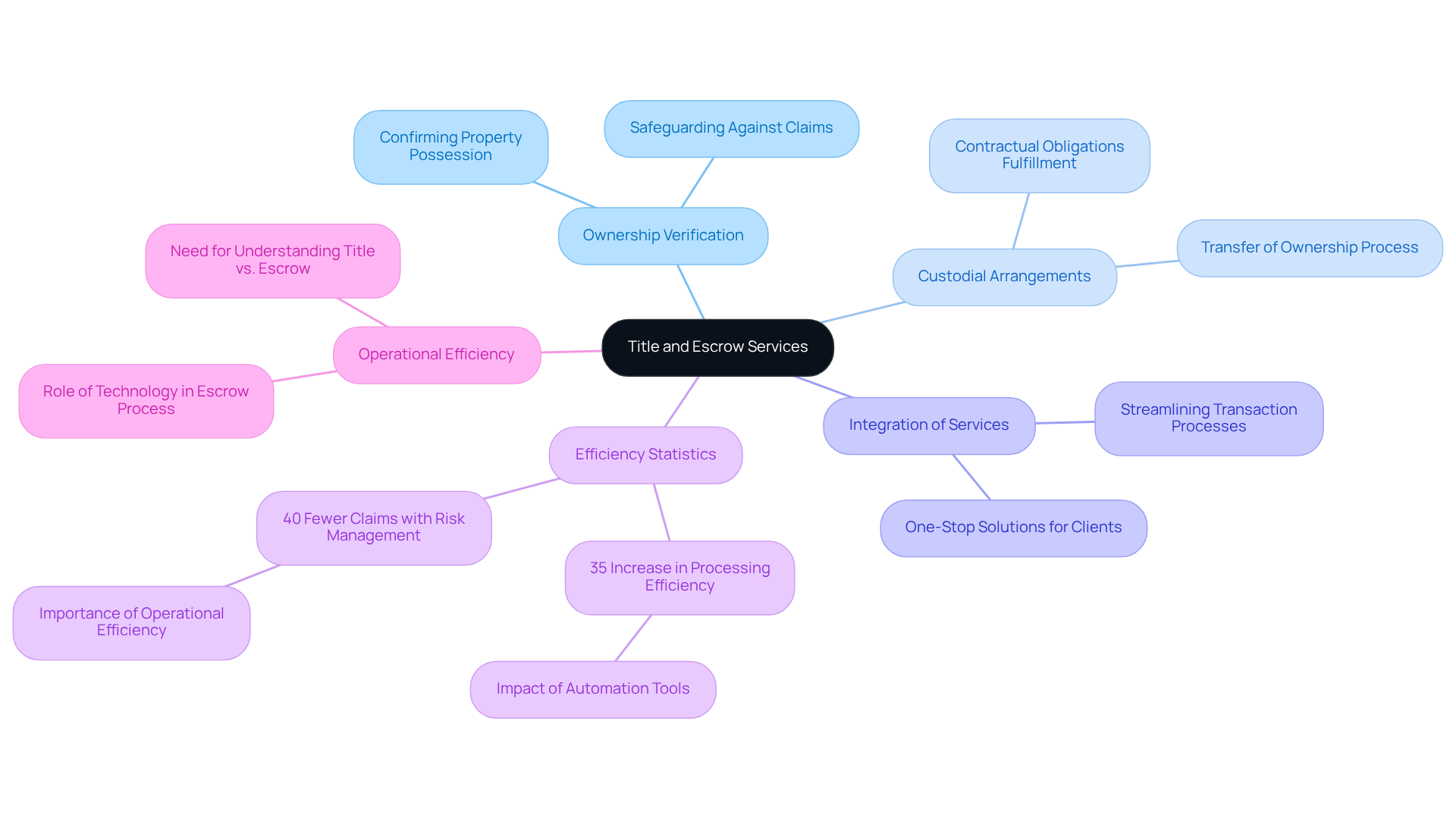

Title and trust offerings, while distinct in their roles, are intricately linked within the realm of real estate transactions. Ownership verification is fundamentally about confirming property possession and safeguarding against potential future claims, thereby ensuring that purchasers secure clear ownership of the property. Conversely, custodial arrangements oversee the process, guaranteeing that all contractual obligations are fulfilled prior to the transfer of ownership.

Additionally, numerous companies provide trust account options, offering a comprehensive, one-stop solution for both purchasers and vendors. This integration not only streamlines the transaction process but also enhances efficiency; companies that implemented in 2023 reported a remarkable 35% increase in processing efficiency.

Moreover, firms managing property transactions with established risk management protocols experience 40% fewer claims than those without, underscoring the critical nature of operational efficiency and risk management in property and settlement services. The capabilities of Parse AI in boosting efficiency for research professionals further illustrate how technology plays a pivotal role in the escrow process.

It is imperative for real estate experts to understand the difference between title and escrow services, along with other distinctions and connections, to adeptly navigate the complexities of property dealings. As one industry expert aptly noted, 'Success in the title industry starts with rock-solid operations,' which underscores the necessity of understanding the difference between title and escrow services to facilitate seamless transactions.

Conclusion

Understanding the distinction between title and escrow services is essential for navigating the complexities of real estate transactions. Title services focus on verifying ownership and protecting against potential claims, while escrow services act as a neutral intermediary that ensures all contractual obligations are met before the transfer of property ownership. Recognizing these differences not only enhances the efficiency of transactions but also provides peace of mind for all parties involved.

Throughout the discussion, key insights were highlighted, including the critical functions of title services, such as:

- Conducting thorough property searches

- Providing insurance to safeguard investments

Furthermore, the escrow process was outlined, emphasizing its role in managing funds and documentation to facilitate a seamless transaction. The integration of technology and the importance of operational efficiency were also underscored, showcasing how advancements can significantly improve the overall real estate experience.

In conclusion, a comprehensive understanding of both title and escrow services is paramount for real estate professionals. By mastering these concepts, industry participants can:

- Streamline processes

- Mitigate risks

- Ultimately foster trust among buyers and sellers

Engaging with these services thoughtfully not only protects investments but also contributes to the continued evolution and success of the real estate market.

Frequently Asked Questions

What are title services in real estate?

Title services involve essential procedures to confirm and establish legal ownership of a property, including conducting ownership searches, providing ownership insurance, and addressing related issues.

What is the purpose of title insurance?

Title insurance protects buyers and lenders from title-related losses, such as adverse ownership claims and liens, thus safeguarding the buyer's investment.

What is the projected market size for property insurance by 2025?

The insurance sector for property is projected to reach $23.0 billion by 2025.

What role do escrow services play in real estate transactions?

Escrow services involve an impartial third party that manages funds and documents during a real estate transaction, ensuring that all conditions of the sale are met before the transfer of ownership is finalized.

How do title and escrow services differ?

Title services protect against future claims on the property, while escrow services facilitate the transaction process by managing the exchange of funds and documents.

What percentage of real estate transactions typically incorporate escrow functions?

Approximately 80% of real estate transactions incorporate escrow functions.

Why is it important for real estate professionals to understand the difference between title and escrow services?

Understanding the difference is vital for navigating the complexities of property dealings effectively as the market evolves.

What advancements are being made in the research of ownership claims?

Parse AI is revolutionizing research on ownership claims by using machine learning and optical character recognition to enhance efficiency for researchers.