Overview

The article emphasizes five essential compliance tools for title companies, underscoring the critical importance of adhering to regulatory standards and leveraging advanced technologies for effective compliance management. It articulates the necessity of continuous training, regular compliance audits, and the integration of tools such as machine learning and OCR, which streamline processes and ensure legal conformity. Consequently, these practices significantly reduce the risks associated with property transactions.

Introduction

Navigating the intricate landscape of compliance presents a critical challenge for title companies, particularly as regulations evolve and the stakes continue to rise. The American Land Title Association (ALTA) underscores the importance of strict adherence to legal standards; thus, the right compliance tools are indispensable for maintaining trust and mitigating risks. However, the pressing question remains: how can title companies effectively integrate these essential tools into their operations to not only ensure compliance with regulations but also enhance efficiency and reduce potential liabilities?

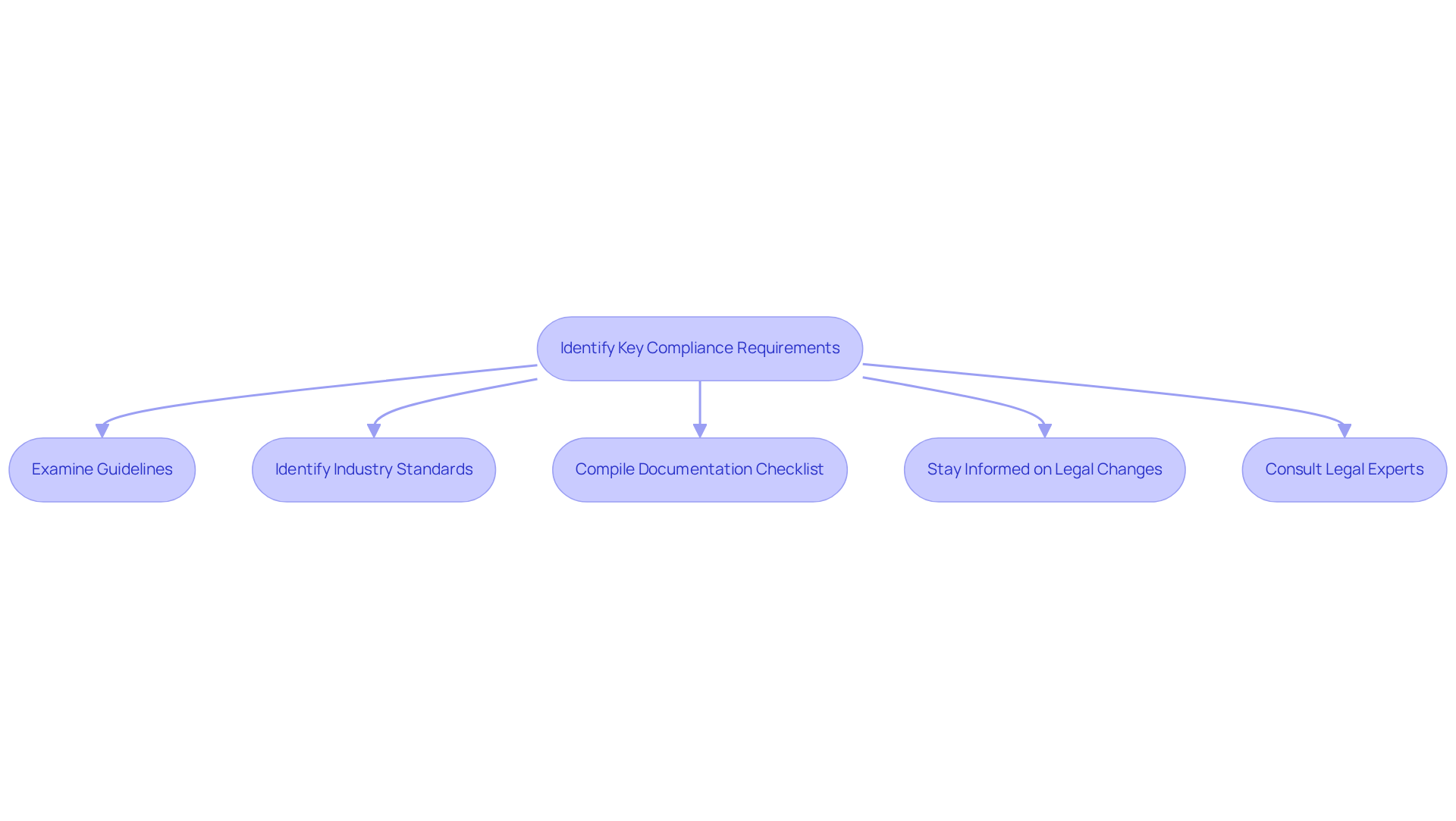

Identify Key Compliance Requirements

- Examine federal, state, and local guidelines associated with to ensure compliance with the latest . In 2025, (ALTA) underscores the significance of adhering to these regulations, which are essential for preserving trust and preventing legal consequences.

- Identify established by ALTA, which include guidelines for property insurance policies and closing disclosures. These standards are crucial for ensuring that ownership companies use to operate within the legal framework and meet stakeholder expectations.

- Compile a for property transactions, including ownership insurance policies, closing disclosures, and any additional documents mandated by . This checklist serves as a valuable resource for professionals, optimizing workflows and enhancing adherence.

- Stay informed about alterations in laws that may affect regulatory requirements. Recent updates, such as FinCEN's new reporting regulations, necessitate that property companies adapt their practices to meet evolving standards, with an estimated 800,000 to 850,000 reports required annually.

- to clarify any ambiguous regulatory issues. Engaging with experts who specialize in property law can provide valuable insights and assist in navigating intricate regulatory environments by utilizing compliance tools for title companies, ensuring compliance and effectively reducing risks. Furthermore, utilizing ALTA's TIRS State Guidance aids in navigating , emphasizing the importance of adherence in managing the reduced annually by industry professionals.

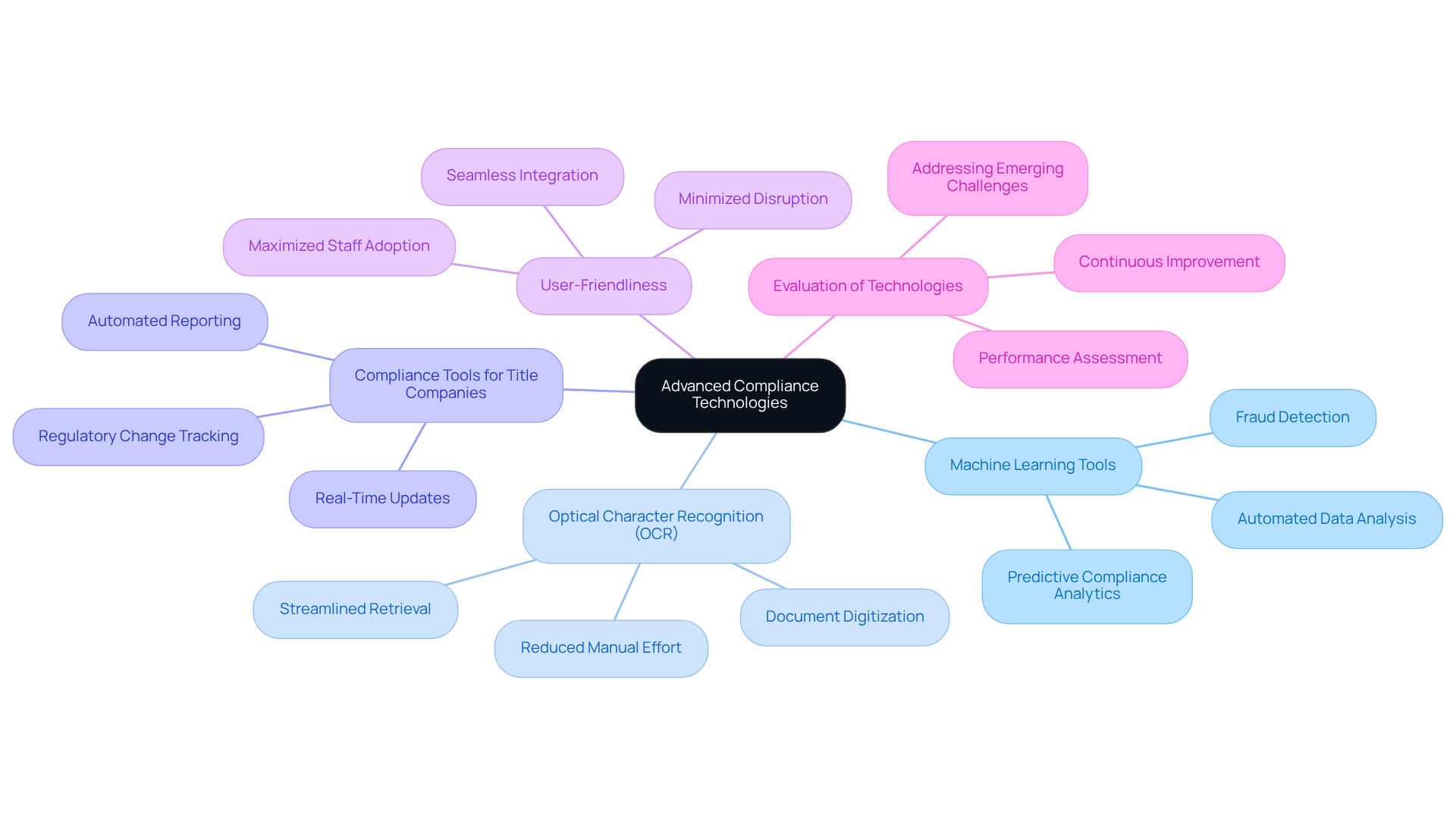

Integrate Advanced Compliance Technologies

Employ to scrutinize documents for , thereby enhancing precision and efficacy in identifying potential issues. Furthermore, leverage (OCR) to digitize and organize compliance-related documentation, significantly diminishing manual effort and improving document accessibility. Research demonstrates that OCR can streamline documentation processes, facilitating quicker retrieval and evaluation.

Additionally, explore that track regulatory changes and automate reporting, ensuring that they remain compliant with evolving regulations. These compliance tools for title companies offer and recommendations, empowering teams to stay ahead of regulatory demands.

Ensure that are user-friendly and integrate seamlessly with current workflows, minimizing disruption while maximizing staff adoption. Consistently evaluate the effectiveness of adherence technologies, making necessary adjustments to enhance performance and address any emerging challenges in management.

Establish Continuous Training Programs

- Develop a that addresses essential , ensuring it is tailored to the specific needs of the industry. Compliance training is frequently compulsory, requiring companies to ensure employees understand and adhere to laws and guidelines by utilizing compliance tools for title companies.

- Furthermore, schedule regular training sessions to keep staff informed about new regulations and emerging technologies, fostering a culture of continuous learning. ensures employees remain informed about regulations and best practices.

- In addition, incorporate case studies and real-world scenarios to illustrate , enhancing employees' understanding and application of principles in their daily tasks. This method corresponds with the perspectives from ELM Learning, which indicates that compliance tools for title companies are invaluable resources to ensure that everyone in the workplace understands their roles and responsibilities.

- Additionally, motivate employees to seek and title research, which can enhance their expertise and the overall credibility of the organization. Organizations with poor onboarding processes are twice as likely to experience , highlighting the importance of effective training in retaining skilled employees.

- Finally, create a feedback system that enables employees to discuss adherence-related challenges and solutions, fostering teamwork and ongoing enhancement in adherence practices. Parse AI's commitment to continuous improvement by collaborating with exemplifies how ongoing training can adapt to real-world challenges.

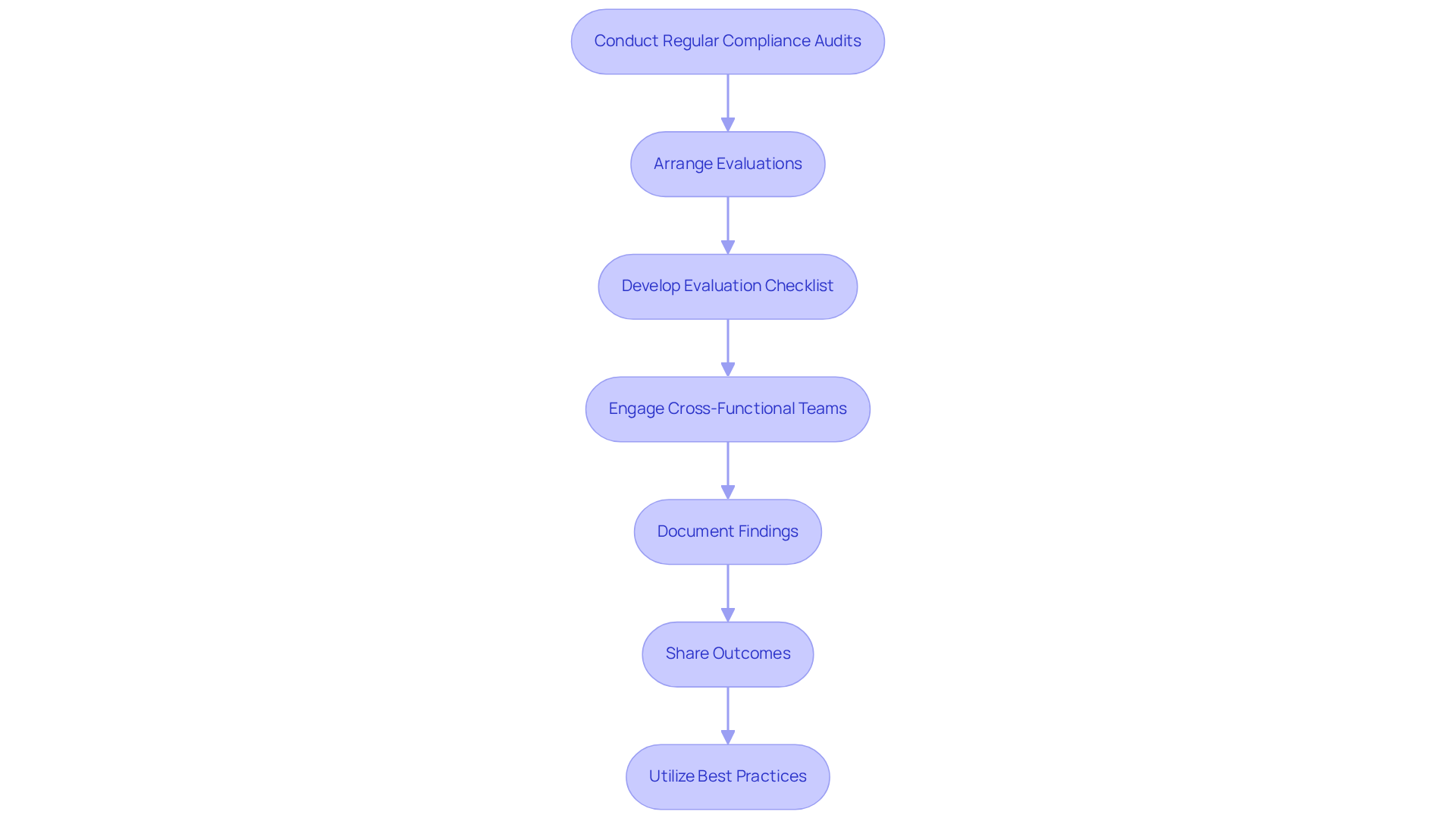

Conduct Regular Compliance Audits

- Arrange conformity evaluations at least once a year, or more frequently if necessary, to ensure alignment with evolving regulations and standards.

- Develop a comprehensive that encompasses all critical areas of conformity, including risk management, data protection, and , thereby streamlining the review process.

- Engage cross-functional teams in the evaluation process to leverage diverse perspectives and expertise, enhancing the thoroughness of the review.

- Diligently document findings and devise actionable strategies to address any identified regulatory deficiencies, ensuring that corrective measures are implemented effectively.

- Share evaluation outcomes with team members to cultivate a culture of accountability and continuous improvement, underscoring the within the organization.

- In 2025, the emphasis on routine evaluations will be paramount, as 61% of corporate risk and regulatory professionals prioritize staying informed about regulatory changes, reflecting the dynamic nature of compliance.

- Utilize examples of effective inspection checklists from industry leaders to inform the development of your regulatory framework, ensuring alignment with best practices. Statistics indicate that organizations with can reduce legal costs and resolution times for regulatory issues by 63%, highlighting the financial benefits of regular evaluations. Moreover, organizations with high rates of nonconformity incur average breach costs of $5.05 million, underscoring the critical necessity for regular .

- Consider insights from the case study on 'Technology Adoption in Compliance,' which demonstrates how the integration of new technologies can streamline processes and enhance compliance efforts.

Conclusion

Ensuring compliance within title companies transcends mere regulatory obligation; it stands as a crucial pillar for maintaining trust and integrity in property transactions. This article underscores the necessity of employing essential compliance tools that not only align with current regulations but also adhere to industry best practices. By prioritizing legal standards, integrating advanced technologies, and fostering a culture of continuous training, title companies can adeptly navigate the complexities of compliance and mitigate associated risks.

Key insights from this discussion highlight the importance of:

- Remaining vigilant regarding regulatory changes

- Utilizing machine learning and optical character recognition for efficient document management

- Conducting regular compliance audits

Collectively, these strategies empower companies to streamline operations, enhance accuracy, and adopt a proactive stance towards compliance. Furthermore, the emphasis on ongoing training ensures that employees possess the knowledge and skills required to uphold the highest standards of regulatory adherence.

In conclusion, the compliance landscape for title companies is in constant flux, necessitating a comprehensive approach that integrates technology, training, and regular evaluations. By prioritizing these elements, title companies not only shield themselves from potential legal pitfalls but also position themselves as trustworthy partners within the real estate industry. Embracing these essential compliance tools will ultimately foster a more efficient, transparent, and accountable operational framework, paving the way for sustained success amidst regulatory challenges.

Frequently Asked Questions

What are the key compliance requirements for property ownership research?

Key compliance requirements include examining federal, state, and local guidelines to ensure adherence to legal standards, as emphasized by the American Land Title Association (ALTA) in 2025.

What specific compliance standards does ALTA establish?

ALTA establishes industry-specific compliance standards that include guidelines for property insurance policies and closing disclosures, which are essential for title companies to operate legally and meet stakeholder expectations.

What documentation is required for property transactions?

Required documentation includes ownership insurance policies, closing disclosures, and any additional documents mandated by state and federal regulations. A checklist of these requirements can help professionals optimize workflows and enhance compliance.

How can property companies stay informed about changes in regulatory requirements?

Property companies should stay informed about alterations in laws, such as FinCEN's new reporting regulations, which require adaptation of practices to meet evolving standards, with an estimated 800,000 to 850,000 reports needed annually.

Why is it important to consult legal experts regarding regulatory issues?

Consulting legal experts can clarify ambiguous regulatory issues and provide valuable insights, helping navigate complex regulatory environments and ensuring compliance while reducing risks.

How does ALTA's TIRS State Guidance aid in compliance?

ALTA's TIRS State Guidance helps navigate state-specific regulations, emphasizing adherence to manage the estimated $600 billion in risk exposure reduced annually by industry professionals.