Overview

The article titled "9 Key Insights in the Overview of Title Insurance" underscores the essential aspects and implications of title insurance within property transactions. It highlights the critical role of title insurance in safeguarding buyers and lenders from financial losses stemming from ownership disputes. Furthermore, it stresses the necessity for consumers to comprehend their coverage, enabling them to effectively navigate potential risks associated with property ownership.

Introduction

In the rapidly evolving landscape of real estate, the integration of technology is fundamentally reshaping how transactions are conducted and how risks are managed. Title insurance, a crucial component in safeguarding property investments, is undergoing a revolution propelled by innovations such as machine learning and optical character recognition. These advancements not only streamline the title research process but also significantly reduce costs and enhance efficiency for both buyers and lenders.

As the industry adapts to new technologies and regulatory changes, understanding the nuances of title insurance becomes paramount for consumers and professionals alike. This article delves into the transformative effects of these innovations, the critical role of title insurance in real estate transactions, and the future outlook of the industry as it embraces a more tech-driven approach.

Parse AI: Revolutionizing Title Research with Machine Learning

Parse AI is revolutionizing research through of machine learning and optical character recognition. This cutting-edge technology enables the rapid extraction of critical information from vast collections of document titles, allowing researchers to generate abstracts and reports with exceptional speed and accuracy. Consequently, the time and resources traditionally needed to verify property ownership are significantly minimized, thereby enhancing the efficiency of .

By 2025, the integration of these technologies is emerging as a pivotal development in the insurance sector. Case studies have illustrated that researchers employing Parse AI have achieved cost savings of up to 30% compared to conventional methods, underscoring the tangible benefits of this innovation. Furthermore, the impact of optical character recognition streamlines the research process, empowering professionals to navigate intricate documentation effortlessly.

Industry leaders emphasize that machine learning and optical character recognition are not just enhancements but essential tools for modern research, fundamentally transforming how the sector operates.

What is Title Insurance? Understanding the Basics

The overview of title insurance illustrates how title protection serves as a vital form of indemnity coverage, safeguarding property purchasers and mortgage lenders from financial losses stemming from issues in property ownership. Unlike traditional coverage that addresses future uncertainties, ownership protection confronts past problems that could jeopardize ownership rights. These issues may encompass liens, encumbrances, or ownership disputes that were not disclosed at the time of purchase. While lenders typically mandate coverage to secure their investments, it is equally prudent for purchasers to protect their interests.

In 2025, the coverage market continues to expand, with direct premiums representing the largest segment in the U.S. sector, underscoring its crucial role in . Reports indicate that in 2021, the market share for both residential and non-residential policies was significant, highlighting the importance of coverage across various real estate types. Real estate experts consistently advocate for ownership protection, providing an overview of title insurance to stress its role in mitigating risks associated with asset possession.

As a practical recommendation, real estate professionals should emphasize to clients that understanding the importance of ownership insurance can lead to more informed decisions, ultimately safeguarding their investments.

The Importance of Title Searches in Real Estate Transactions

Title searches are an indispensable component of real estate transactions, serving to verify legal ownership and identify potential issues that could jeopardize the deal. A comprehensive search of public records investigates any liens, encumbrances, or claims related to the asset. This thorough analysis is essential for guaranteeing that the designation is clear, thereby allowing purchasers and lenders to avoid expensive legal conflicts and financial setbacks.

In 2025, the importance of document searches is emphasized by the growing complexity of property transactions. Recent data indicates that failures in document searches can lead to substantial financial repercussions, with some estimates suggesting losses can reach thousands of dollars due to unresolved claims or liens. For instance, a case study highlights that homeowners have been misled by ownership protection services, which are often confused with insurance but primarily function as notification services for recording activity. Numerous counties, such as Cook and DuPage, provide complimentary alert services that can efficiently inform landowners of any filings against their assets, underscoring the necessity for awareness and proactive actions in ownership management.

Specialist views emphasize the importance of thorough document searches. Kathy Fettke, CoFounder of RealWealth, states, "We simplify the process of investing in real estate by connecting investors with vetted resources..." This viewpoint underscores that a clear ownership document not only safeguards the buyer's investment but also enhances the overall integrity of real estate transactions. As the landscape of real estate continues to evolve, the average duration required for ownership searches remains a crucial element, with efficient processes being vital for sustaining momentum in transactions. By prioritizing , stakeholders can protect their interests and ensure smoother transactions. Furthermore, employing innovative solutions such as Parse AI can offer substantial cost reductions compared to conventional research methods, additionally improving efficiency in the search process.

Types of Title Insurance Policies: Owner's vs. Lender's Coverage

are primarily categorized into two types: owner's coverage and lender's coverage. The owner's coverage offers an overview of title insurance that secures the buyer's equity in real estate and provides robust defense against any claims or flaws that may arise post-acquisition. This policy serves as an overview of title insurance, remaining effective for the duration of the owner's interest in the property and ensuring ongoing security against unforeseen issues that could threaten property rights.

Conversely, the overview of title insurance shows that lender's protection is designed to safeguard the lender's investment, covering the loan amount in the event of ownership defects. While mortgage providers typically require lender's coverage, an overview of title insurance shows that owner's coverage is optional yet strongly recommended for purchasers, as it guarantees comprehensive protection.

Notably, statistics reveal that the overview of title insurance indicates owner's policies generally cost around 0.5% of the home's purchase price, rendering them a cost-effective safeguard for homeowners. Furthermore, real-world instances underscore the importance of maintaining policy documents, as they are crucial for submitting claims related to ownership defects. Homeowners are advised to store their title policy and closing protection letter in a secure location for convenient access, which offers an overview of title insurance and highlights the significance of owner's title coverage in property transactions.

As Cody Clifton asserts, the overview of title insurance indicates that title protection safeguards homeowners by addressing concealed issues like these that could otherwise cost you thousands. Additionally, the National Association of Insurance Commissioners (NAIC) provides expertise and analysis for state regulatory bodies, ensuring that the sector operates effectively and protects consumers. This regulatory oversight further underscores the necessity of obtaining owner's protection for buyers.

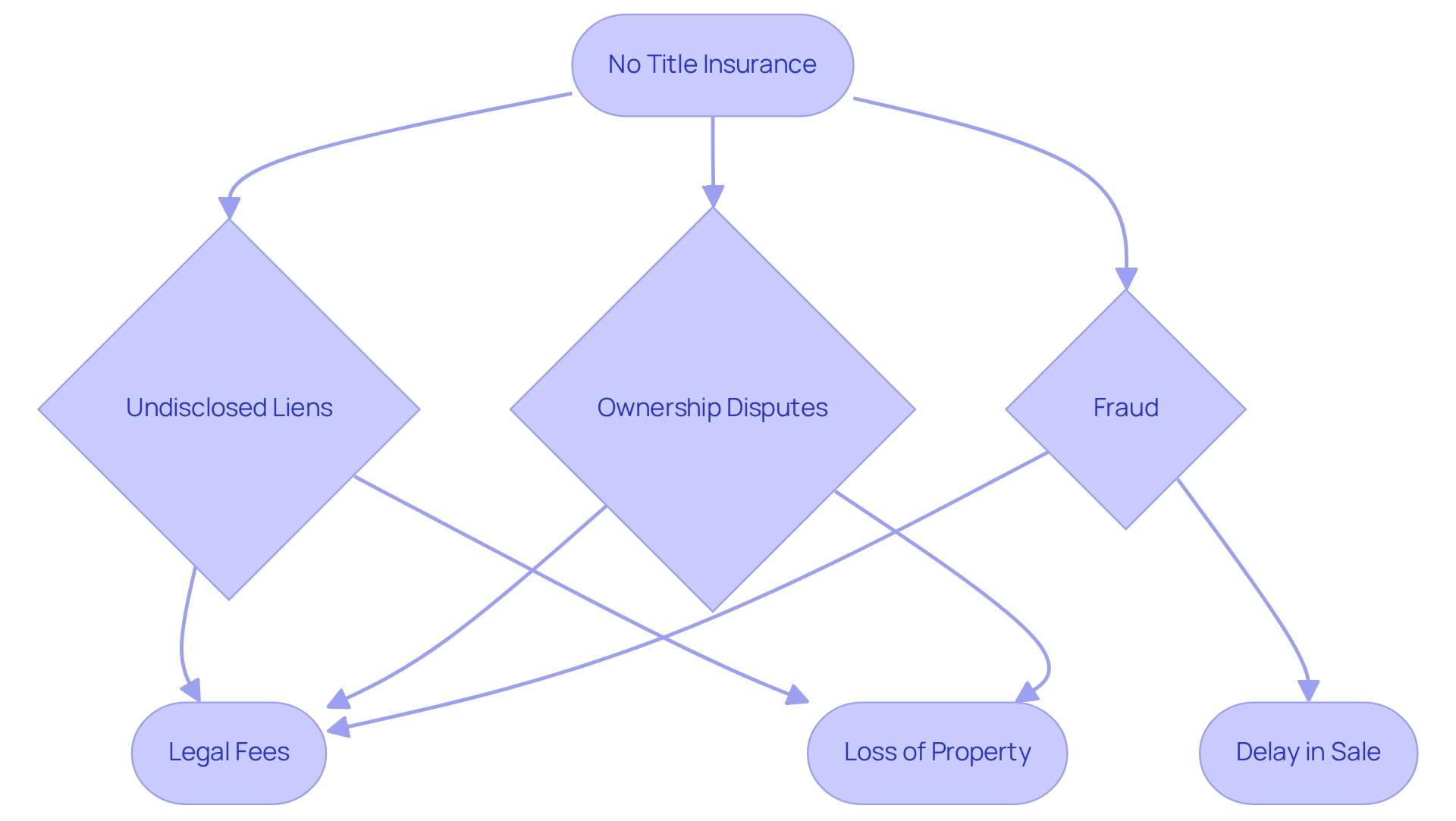

Risks of Not Having Title Insurance: What You Should Know

Forgoing title insurance exposes buyers and lenders to substantial financial risks. Without this essential protection, individuals may face unforeseen claims against their assets, including undisclosed liens, ownership disputes, or instances of fraud. Such complications can lead to expensive legal battles, potentially resulting in the loss of the property itself. In reality, consumers invest roughly $22 billion each year on coverage, underscoring its significance in protecting investments.

The financial repercussions of lacking ownership protection can be severe. Buyers may find themselves responsible for legal fees and other related expenses, which can accumulate quickly. For instance, a case study highlighted the difficulties experienced by a homeowner who discovered a concealed lien after acquiring a real estate asset without insurance for ownership. The ensuing legal dispute not only drained their finances but also delayed their ability to sell the property, illustrating the inherent risks. Furthermore, innovations from Parse AI demonstrate how technology can simplify ownership research, potentially lowering the risks associated with ownership problems.

Specialists in the real estate industry emphasize that the absence of ownership protection can lead to significant financial losses. A recent roundtable discussion by the U.S. Department of the Treasury underscored the necessity for enhanced consumer education concerning property protection, revealing that many purchasers overlook the dangers of omitting this vital coverage. Jeanette Quick, Deputy Assistant Secretary for Financial Institutions Policy, stated, "Treasury will continue to monitor the sector of title services and its role in housing affordability and explore opportunities for potential reform in this area where appropriate." Real estate experts consistently advise against forgoing coverage, as the potential expenses of legal conflicts far exceed the premiums paid for protection.

In summary, the financial dangers linked to emphasize the need for an overview of title insurance, as significant potential losses can arise from legal fees, disputes over ownership, and unexpected claims. The decision to forgo this protection can lead to dire financial consequences, making it a critical consideration for any property transaction.

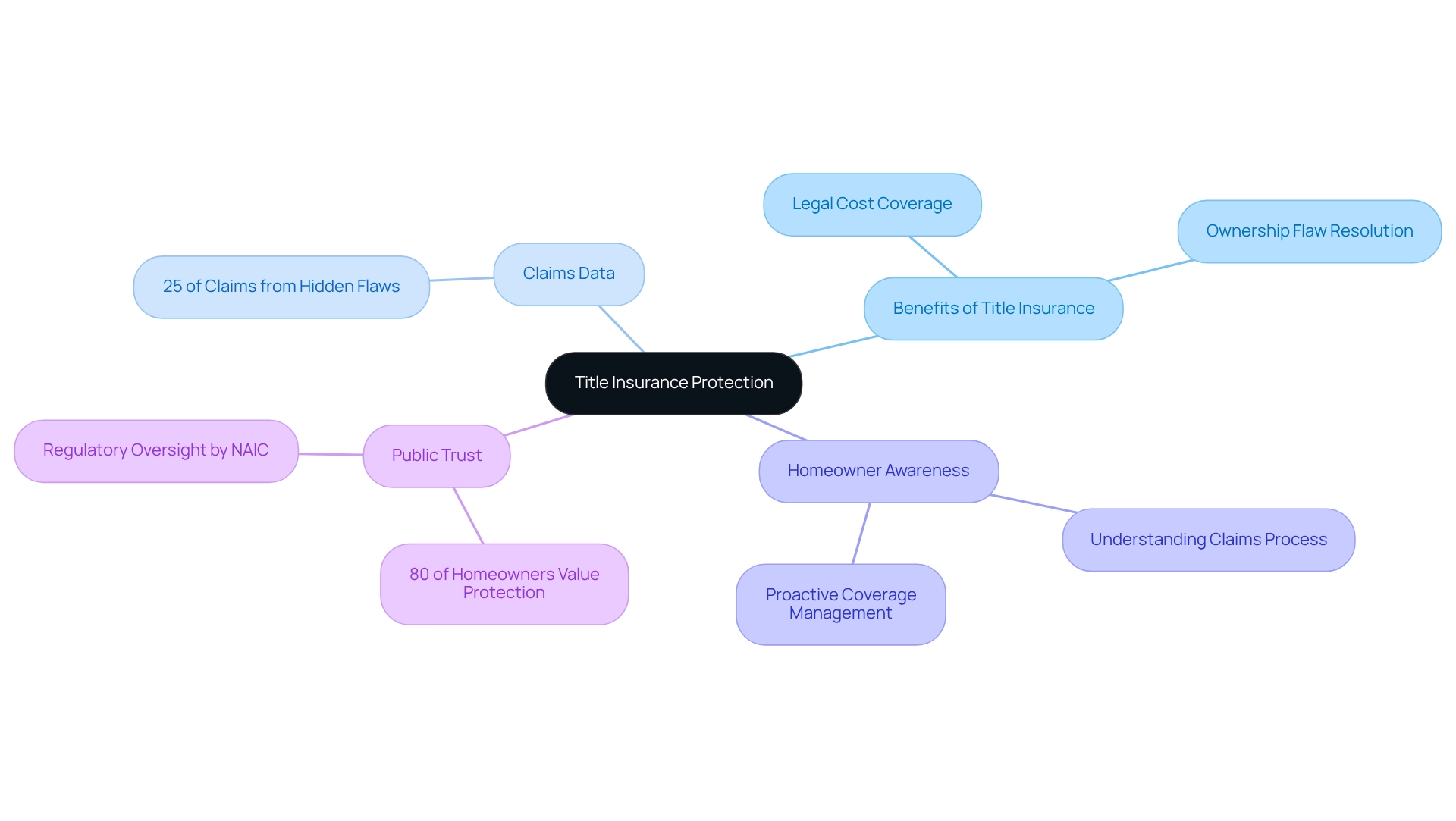

Consumer Protection: How Title Insurance Safeguards Your Investment

Title coverage serves as a vital safeguard for consumers, offering robust protection for real estate investments. It effectively addresses legal costs and potential losses stemming from ownership flaws, providing reassurance to both homeowners and lenders. In the event of a claim, coverage firms actively protect the insured's interests, facilitating effective resolution of disputes. This level of protection is particularly crucial in today’s intricate real estate market, where hidden issues may surface long after a property transaction is concluded.

In 2025, the importance of ownership coverage is underscored by data indicating that approximately 25% of claims related to ownership arise from flaws that were not apparent at the time of sale. Property owners must be thoroughly informed about their coverage agreements and the claims process, as ownership issues can emerge unexpectedly, impacting their rights. A case study illustrates that understanding the claim submission process is essential for homeowners to effectively address any ownership challenges that may occur, ensuring they remain protected under their policy. Homeowners must take a proactive approach to comprehend their coverage to adeptly manage potential obstacles.

Furthermore, public trust in property protection remains strong, with surveys revealing that over 80% of homeowners recognize its importance in safeguarding their investments. As emphasized by the National Association of Insurance Commissioners (NAIC), effective regulation and oversight of the sector, led by chief regulators from 50 states and territories, are crucial for protecting the public. This governance reinforces the role of property coverage in securing , ensuring that consumers are adequately safeguarded in their investments.

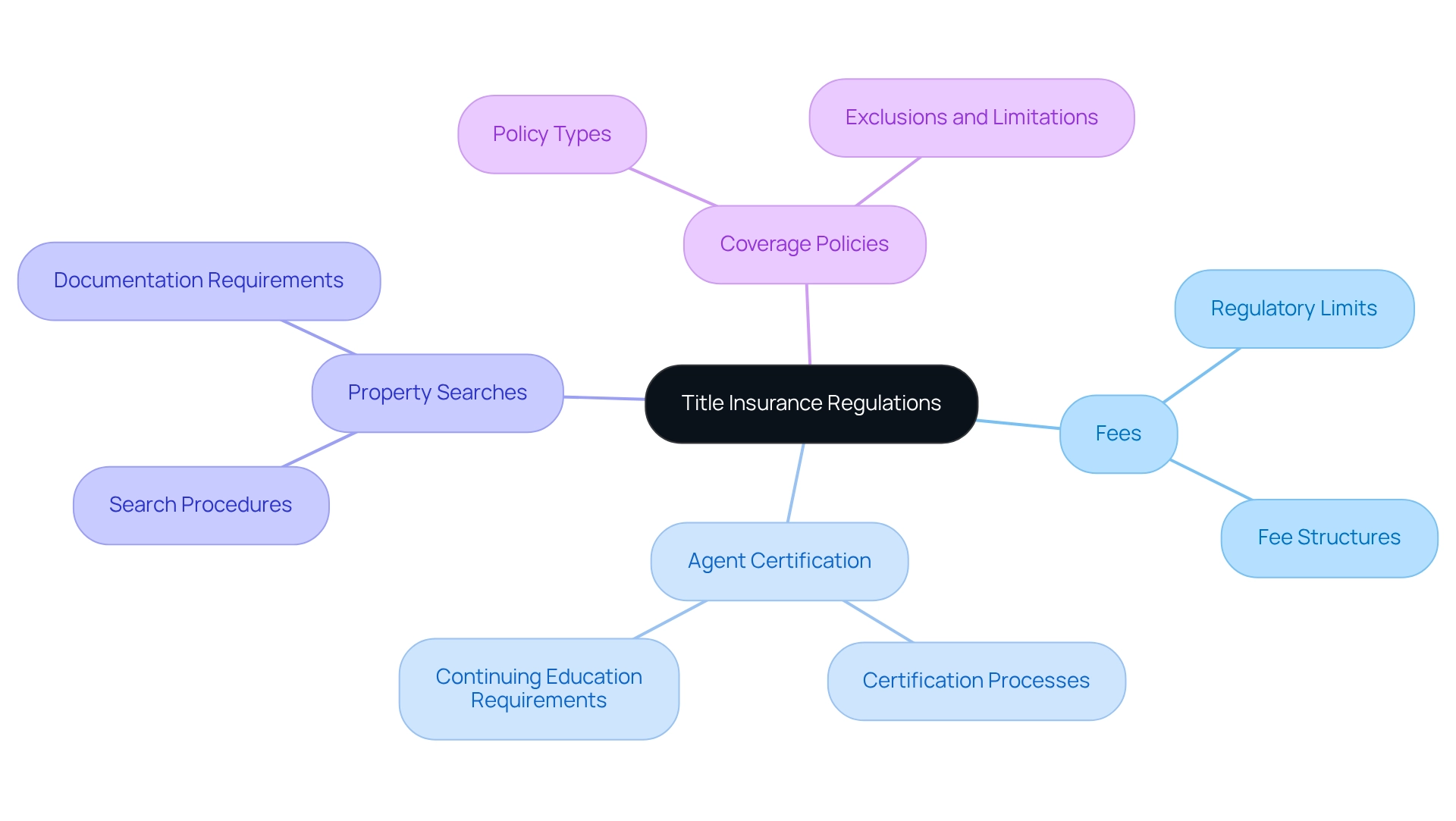

Regulatory Framework: Understanding Title Insurance Regulations

The sector of protective coverage operates within that varies by state. Rules govern the fees that property insurers may establish, the certification of property agents, and the processes related to property searches and coverage policies. These regulations are designed to protect buyers from unfair practices and ensure that ownership protection remains accessible and affordable. Understanding these regulations is crucial for both buyers and professionals in the real estate sector, as they provide an overview of title insurance that directly impacts the overall cost and availability of property protection.

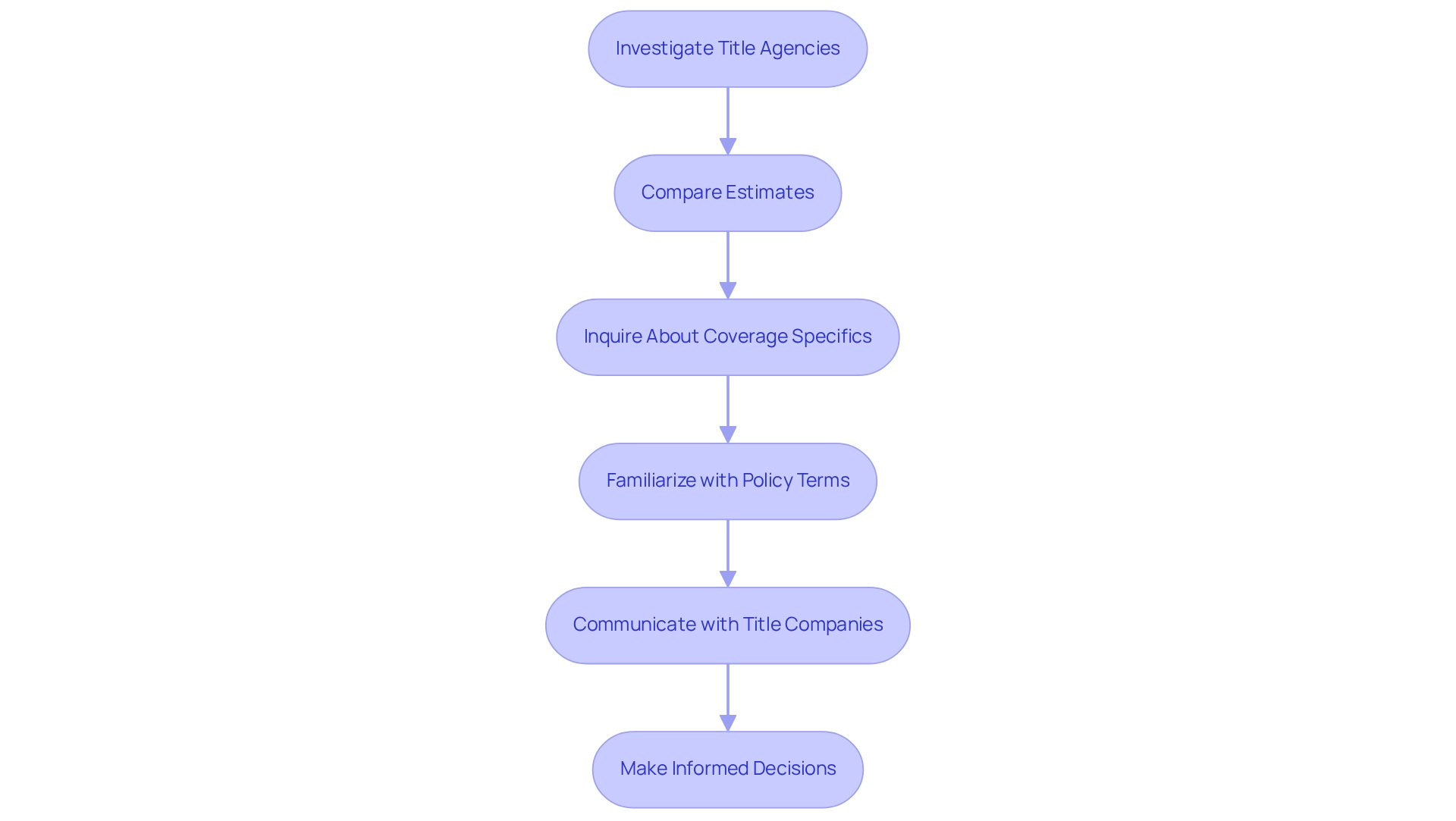

Consumer Education: Navigating the Title Insurance Process

Navigating the insurance process can be overwhelming for consumers; however, understanding the essential steps significantly simplifies the experience. Purchasers should begin by thoroughly investigating title agencies, contrasting estimates to ensure competitive rates and quality service.

It is crucial to inquire about the specifics of coverage, including any exclusions and the claims process. Familiarizing oneself with the terms of the policy is vital; seeking clarification on any confusing points empowers buyers and enhances their confidence in decision-making.

As Melissa D. Preston, CPA, states, "If you have questions about how to submit your report, please contact Ms. Preston for guidance," underscoring the importance of communication with companies handling titles. A proactive approach not only aids in making informed decisions but also guarantees sufficient protection during the transaction.

For instance, a recent case study highlighted that individuals who engaged in thorough discussions with property companies reported a 30% increase in their understanding of policy terms, resulting in more favorable outcomes. Furthermore, it is essential to note that the owner's policy remains effective as long as the buyer owns or maintains in the property, emphasizing the longevity of coverage.

Statistics reveal that nearly 60% of consumers feel uncertain about their policy coverage, highlighting the necessity for comprehensive education in this field. By prioritizing these steps, purchasers can navigate the coverage landscape more effectively and secure their investments.

Title Insurance Industry Profitability: An Economic Overview

The coverage sector has demonstrated remarkable resilience and profitability in recent years, characterized by consistent growth in premium volumes. By 2024, the Rest of is expected to reach USD 134.95 million, with a projected compound annual growth rate (CAGR) of 10.7% through 2025. This expansion is primarily driven by an increase in real estate transactions and the growing integration of technology to improve operational efficiency. Essential offerings and services, such as underwriting property coverage and search services, are pivotal to this growth.

However, stakeholders must remain vigilant, as challenges like regulatory shifts and intensified market competition could impact profitability. As Diane Tomb, CEO of ALTA, states, "As we progress, the industry remains committed to delivering outstanding service and reassurance to homebuyers and lenders." Understanding these economic dynamics is essential for guarantors, real estate professionals, and buyers as they navigate the complexities of the evolving protection landscape, which includes an overview of title insurance.

Moreover, the rising rate of policy premiums over the past five years underscores the industry's robust performance, while expert evaluations highlight the importance of adapting to economic factors that drive growth and profitability in this sector. Additionally, organizations like IBISWorld offer valuable insights into market trends, enabling businesses to strategize effectively in a competitive environment.

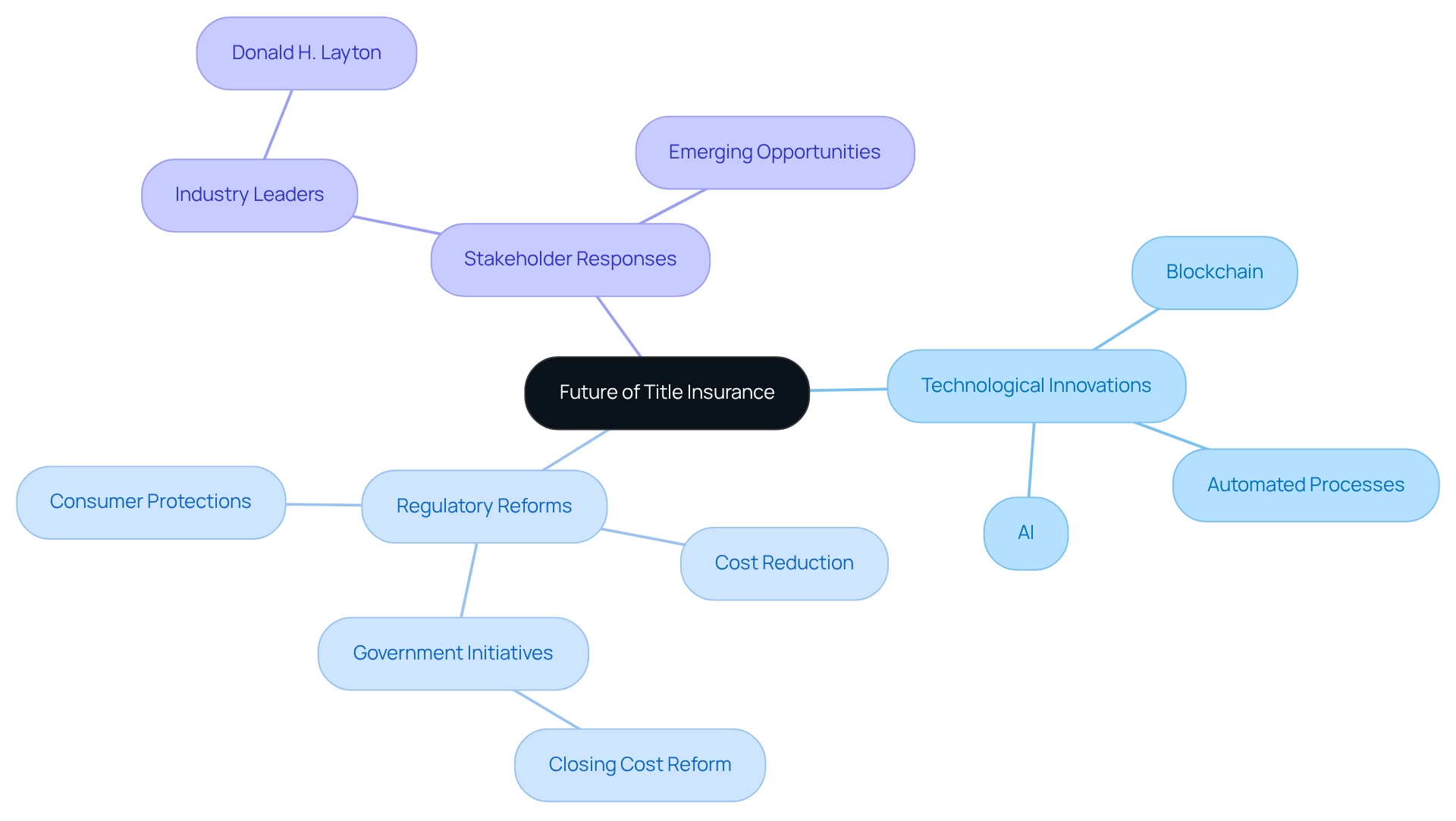

Future of Title Insurance: Exploring Potential Reforms and Innovations

The future of property protection stands at the precipice of a significant transformation, propelled by technological advancements and shifting consumer demands. Innovations such as blockchain, artificial intelligence, and automated processes are set to substantially enhance efficiency and transparency in property transactions. For example, blockchain technology is already being harnessed in various transactions, streamlining processes and mitigating the risk of fraud. Reports indicate a rising adoption of technology within the property protection sector, with a considerable number of firms integrating AI to bolster operational efficiency.

Furthermore, ongoing discussions regarding regulatory reforms are poised to reshape the landscape, with the objective of strengthening consumer protections and reducing costs. Industry leaders, including Donald H. Layton, have underscored the urgent need for reforms, noting that current market dynamics have inflated coverage costs dramatically. It is estimated that this distortion in market competitiveness has escalated prices for coverage by as much as tenfold. The government's focus on providing an overview of title insurance aims to decrease closing expenses, particularly in property coverage, representing a crucial step toward making home purchasing more equitable and budget-friendly, especially for first-time buyers. A recent case study titled "Government's Role in " illustrates how governmental initiatives are addressing high closing costs to enhance housing affordability.

As stakeholders navigate these transformative changes, it is imperative that they remain informed and proactive to seize emerging opportunities. Regular data updates are vital for keeping research relevant in this rapidly evolving industry. The integration of technology not only aligns with consumer expectations for expedited and transparent services but also positions the industry for future innovations. By embracing these advancements, the property protection sector can enhance its value proposition and more effectively respond to the evolving demands of real estate professionals. It is also noteworthy that closing costs typically range from 2 to 5 percent of the mortgage amount, highlighting the importance of addressing title insurance expenses.

Conclusion

The integration of technology in the title insurance industry represents a pivotal moment, significantly enhancing the efficiency and accuracy of title research and transactions. Innovations such as machine learning and optical character recognition are not just advancements; they are reshaping the landscape by reducing costs and expediting processes. As illustrated by the case studies presented, employing tools like Parse AI can yield substantial savings while improving the overall quality of title searches.

Understanding the critical role of title insurance is essential for both buyers and lenders. It provides vital protection against potential title defects and legal disputes that may arise post-transaction. The risks associated with lacking title insurance can be severe, leading to costly legal battles and financial losses. Therefore, ensuring adequate coverage through both owner's and lender's policies is imperative for safeguarding investments.

As the industry continues to evolve, maintaining consumer education about title insurance is crucial. Buyers must be proactive in understanding their policies and the claims process to effectively navigate potential challenges. Furthermore, as regulatory frameworks adapt and new technologies emerge, the title insurance sector must remain vigilant in addressing market dynamics, ensuring that the protection it offers continues to meet consumer needs.

In conclusion, the future of title insurance is set for transformation, driven by technological advancements and a focus on consumer protection. By embracing these changes and prioritizing education, stakeholders can navigate the complexities of real estate transactions with confidence, ultimately enhancing the integrity and reliability of the title insurance industry.

Frequently Asked Questions

What is Parse AI and how does it benefit research?

Parse AI utilizes machine learning and optical character recognition to rapidly extract critical information from large collections of document titles, enabling researchers to generate abstracts and reports quickly and accurately. This technology significantly reduces the time and resources needed for verifying property ownership, enhancing the efficiency of real estate transactions.

What impact is Parse AI expected to have on the insurance sector by 2025?

By 2025, the integration of machine learning and optical character recognition technologies is anticipated to be a pivotal development in the insurance sector, with case studies showing that researchers using Parse AI have achieved cost savings of up to 30% compared to traditional methods.

Why is title insurance important in real estate transactions?

Title insurance provides vital indemnity coverage that protects property purchasers and mortgage lenders from financial losses due to past issues in property ownership, such as liens or ownership disputes. It is essential for safeguarding ownership rights and is often mandated by lenders to secure their investments.

What trends are currently observed in the title insurance market?

The title insurance market is expanding, with direct premiums representing the largest segment in the U.S. sector. Reports from 2021 indicate significant market share for both residential and non-residential policies, highlighting the importance of ownership protection across various real estate types.

How do title searches contribute to real estate transactions?

Title searches are crucial for verifying legal ownership and identifying potential issues that could jeopardize a real estate deal. A comprehensive search of public records helps ensure that the ownership designation is clear, allowing purchasers and lenders to avoid costly legal conflicts and financial setbacks.

What are the financial risks associated with inadequate document searches in real estate?

Inadequate document searches can lead to substantial financial repercussions, with estimates suggesting losses can reach thousands of dollars due to unresolved claims or liens. Misleading ownership protection services can further complicate matters, emphasizing the necessity for thorough searches.

What role does Parse AI play in improving the title search process?

Parse AI offers innovative solutions that can significantly reduce costs and improve efficiency in the title search process compared to conventional research methods, thereby enhancing the overall integrity and speed of real estate transactions.