Overview

Automated systems for lien removal tracking play a pivotal role in enhancing efficiency and accuracy in managing property claims. These systems streamline workflows and significantly reduce processing times by over 50%. Furthermore, they improve compliance with legal obligations, facilitating smoother real estate transactions and ultimately leading to better customer satisfaction. By adopting such systems, stakeholders can ensure a more reliable and effective approach to property claims management.

Introduction

The complexities of lien removal tracking present significant challenges for real estate professionals, directly impacting property transactions and ownership rights. Automated systems emerge as a transformative solution, significantly enhancing efficiency and accuracy in managing these encumbrances.

Furthermore, the pressing question remains: how can organizations effectively implement these technologies to optimize their lien tracking processes and avoid common pitfalls?

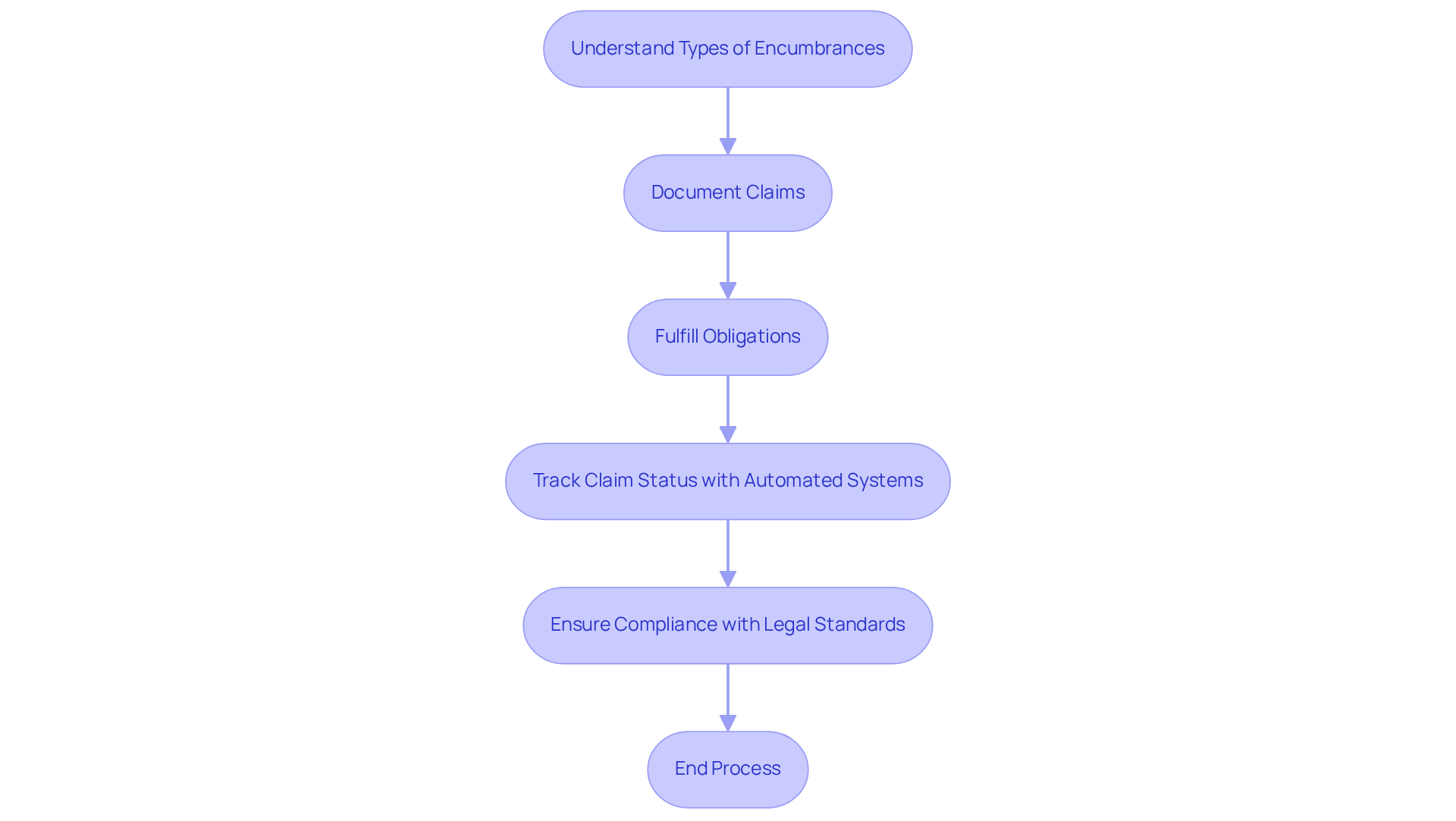

Understand Lien Removal Tracking Fundamentals

Tracking the removal of claims is essential for ensuring that encumbrances on properties are discharged promptly once the underlying obligations are fulfilled. This process necessitates a thorough understanding of various types of encumbrances, including , alongside the legal requirements for their release. Proper documentation is critical to confirm that a claim has been satisfied, aiding professionals in navigating the complexities of claim management and ensuring compliance with legal standards.

The implications of different types of claims can significantly affect property ownership. For instance, mortgage claims can hinder a homeowner's ability to refinance or sell their property, while tax claims may lead to foreclosure if left unresolved. Statistics indicate that properties with outstanding claims can experience a decline in market value by as much as 20%, underscoring the importance of effectively managing these issues for real estate professionals.

Effective debt oversight strategies involve utilizing automated systems for lien removal tracking, like reQuire, which provide real-time updates on claim status. This approach mitigates the risk of financial penalties or legal disputes arising from delayed releases. Real estate professionals have observed that the implementation of automated systems for lien removal tracking not only streamlines workflows but also enhances customer satisfaction by ensuring a clear title is delivered at closing. As the Underwriter Counsel at Fidelity National Title Group remarked, "reQuire made a believer out of me! After having trouble obtaining a release, I sent my files to reQuire. The very next morning I received word that a copy of the satisfaction was found."

This highlights the growing recognition of the importance of claim management in facilitating . To circumvent common pitfalls, professionals should ensure they are well-informed about the specific legal requirements for release documents and maintain meticulous documentation throughout the process.

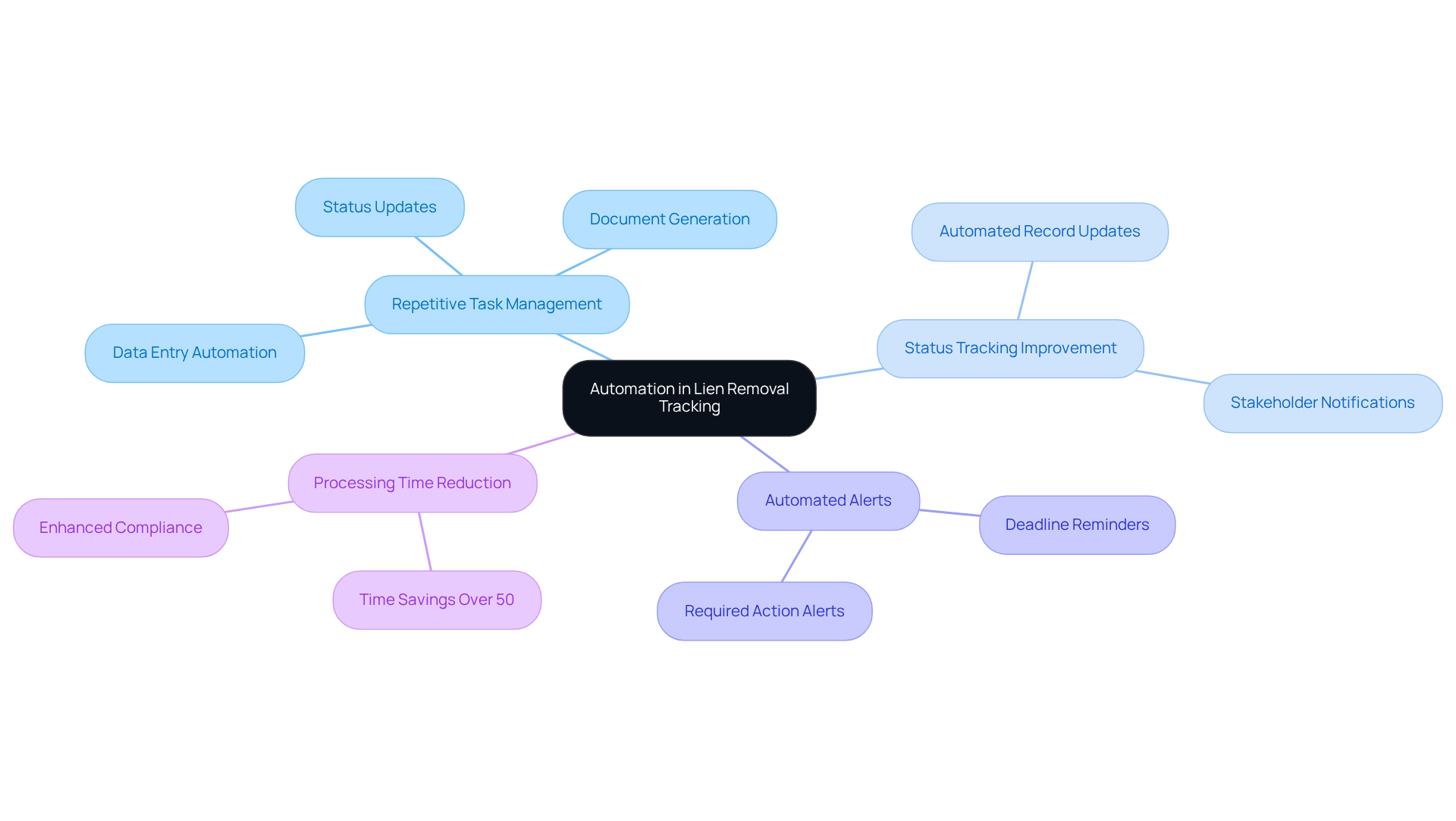

Leverage Automation for Enhanced Efficiency and Accuracy

Introducing mechanization in the removal monitoring process significantly enhances both effectiveness and precision. Automated systems for excel in managing repetitive tasks such as data entry, document generation, and status updates, which allows professionals to focus on more strategic initiatives. For instance, Robotic Process Automation (RPA) improves status tracking by automatically updating records and notifying stakeholders of any changes.

Furthermore, the integration of automated systems for lien removal tracking, which includes automated alerts for upcoming deadlines or required actions, helps prevent delays and ensures compliance with legal obligations. Companies leveraging these technologies have reported processing time reductions exceeding 50%, underscoring the substantial benefits of automation in this domain.

As the industry evolves, the implementation of automated systems for lien removal tracking in claim management is poised to transform operational efficiency and precision, establishing it as a critical strategy for real estate experts.

Integrate Advanced Technologies for Optimal Tracking

To achieve optimal tracking of claims, integrating advanced technologies is essential. can examine historical data to forecast potential problems with release documents, enabling organizations to proactively tackle them. Furthermore, employing optical character recognition (OCR) can automate the extraction of pertinent information from legal documents, minimizing manual data entry mistakes.

Platforms that provide extensive claim oversight solutions, including automated systems for lien removal tracking and reporting features, can further enhance tracking capabilities. For instance, businesses that have implemented AI-driven claim handling systems report enhanced precision and quicker response times, resulting in better overall results in claim resolution.

The efficiency of OCR in handling claims is highlighted by its capability to simplify procedures, with research showing that mechanization can result in a decrease in processing duration by as much as 40%. Additionally, the OCR market was valued at USD 13.95 billion in 2024 and is anticipated to attain USD 46.09 billion by 2033, underscoring the increasing significance of implementing OCR technology in management of claims.

![]()

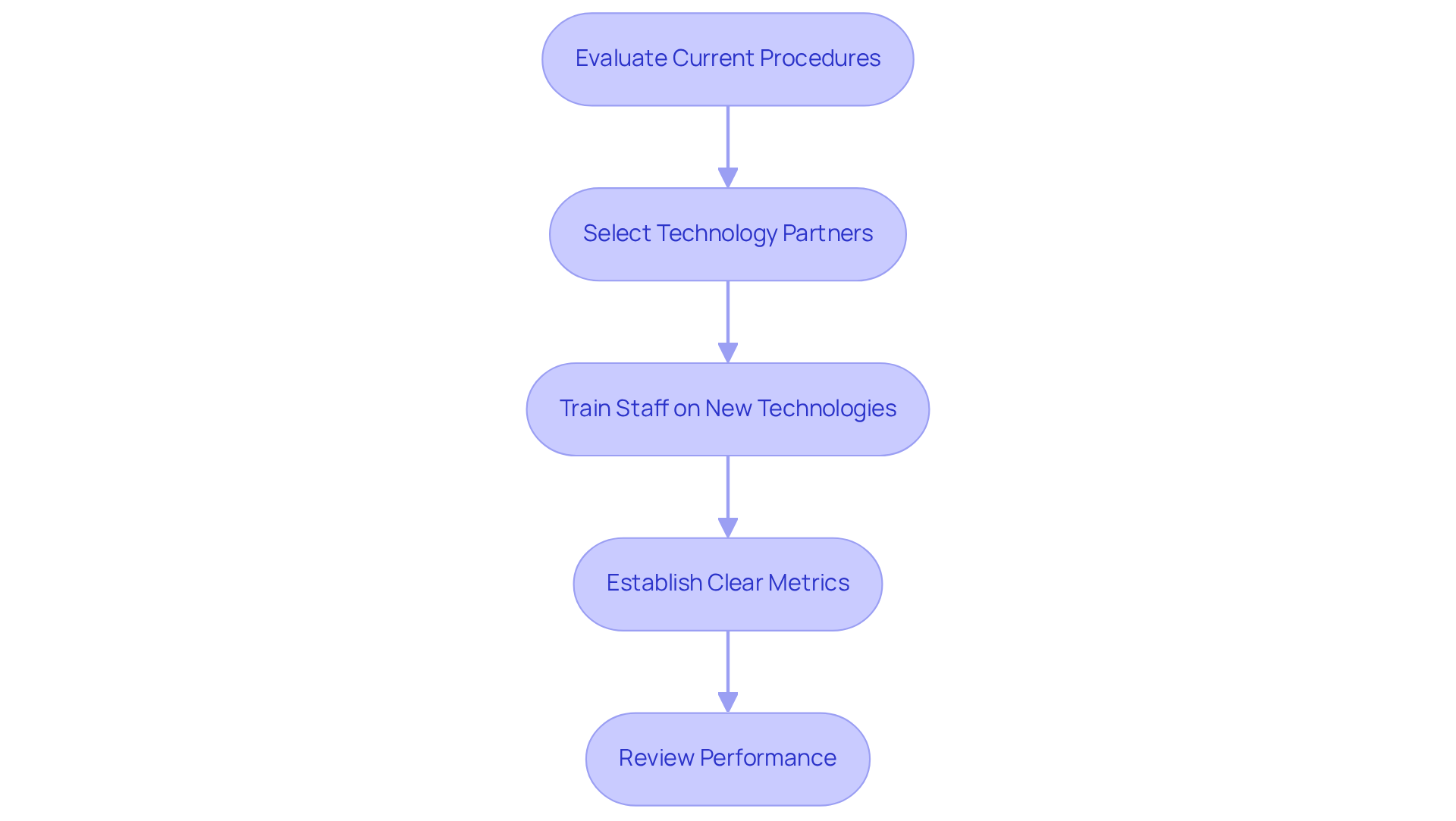

Implement Best Practices for Automation in Title Research

To effectively implement automated systems for lien removal tracking, organizations must adhere to several best practices. First and foremost, conducting a thorough evaluation of current procedures is crucial to pinpoint areas where mechanization can yield the most significant benefits. Research indicates that organizations leveraging smart technologies can potentially increase revenue by 20% while simultaneously reducing expenses by 30% within 18 months.

Furthermore, selecting the appropriate technology partners and tools is vital; organizations should prioritize solutions that ensure scalability and seamless integration with existing systems. For instance, ICICI Bank successfully reduced complaint resolution time from 12 hours to just 4 hours each day by employing technology, exemplifying the advantages of choosing the right tools.

Additionally, training staff on new technologies and processes is essential to facilitate smooth transitions and maximize user adoption. Establishing clear metrics for success and routinely reviewing performance can enable organizations to fine-tune their automation strategies over time.

By adhering to , companies can significantly enhance their lien tracking processes with automated systems for lien removal tracking, achieving greater efficiency and accuracy.

Conclusion

Implementing automated systems for lien removal tracking is essential for real estate professionals aiming to enhance operational efficiency and ensure compliance with legal obligations. By leveraging these technologies, organizations can streamline their processes, minimize errors, and ultimately deliver a clearer title during property transactions. The transformative power of automation not only simplifies the management of encumbrances but also contributes to improved customer satisfaction and reduced processing times.

Throughout this article, the significance of understanding lien removal fundamentals, the benefits of automation, and the integration of advanced technologies has been emphasized. From utilizing Robotic Process Automation to adopting machine learning and optical character recognition, these strategies collectively foster a more efficient claim management process. Best practices such as evaluating current procedures and providing staff training are crucial in maximizing the effectiveness of these systems.

As the landscape of real estate continues to evolve, embracing automated systems for lien removal tracking is not just an option but a necessity. By taking proactive steps to implement these strategies, organizations can position themselves for success, ultimately leading to smoother transactions and enhanced property management. The time to act is now—adopting these innovations will pave the way for a more efficient and accurate lien removal process, benefiting both professionals and clients alike.

Frequently Asked Questions

Why is tracking lien removal important?

Tracking lien removal is essential to ensure that encumbrances on properties are discharged promptly once the underlying obligations are fulfilled, helping to maintain clear property titles.

What types of encumbrances should be understood for lien removal?

It is important to understand various types of encumbrances, including mortgage and tax encumbrances, as they have different implications for property ownership.

How can claims affect property ownership?

Mortgage claims can hinder a homeowner's ability to refinance or sell their property, while tax claims may lead to foreclosure if unresolved. Properties with outstanding claims can also experience a decline in market value by as much as 20%.

What strategies can be used for effective debt oversight?

Utilizing automated systems for lien removal tracking, such as reQuire, can provide real-time updates on claim status, helping to mitigate risks of financial penalties or legal disputes due to delayed releases.

How do automated systems for lien removal tracking benefit real estate professionals?

Automated systems streamline workflows and enhance customer satisfaction by ensuring a clear title is delivered at closing, thereby facilitating smoother real estate transactions.

What should professionals do to avoid common pitfalls in lien removal?

Professionals should be well-informed about the specific legal requirements for release documents and maintain meticulous documentation throughout the lien removal process.