Overview

The article emphasizes the critical need for effective tools in resolving unreleased mortgage issues, underscoring the importance of addressing these complications within real estate transactions. It introduces several methods, including:

- The utilization of document curative services

- Leveraging Parse AI's advanced tools

- Direct communication with financial institutions

- Seeking legal assistance

These strategies not only streamline the resolution process but also mitigate the risks associated with unreleased loans, ultimately fostering a more secure and efficient transaction environment.

Introduction

Unreleased mortgage issues pose significant roadblocks in real estate transactions, often arising from administrative oversights or lender errors that result in legal encumbrances on property titles. For real estate professionals, navigating these complexities is essential not only for ensuring smooth closings but also for safeguarding the interests of both buyers and sellers. As the market encounters increasing challenges—such as rising home loan delinquency rates and the potential for fraud—the urgency to address unreleased loans becomes paramount. How can industry players effectively leverage innovative tools and strategies to resolve these issues and maintain transaction integrity?

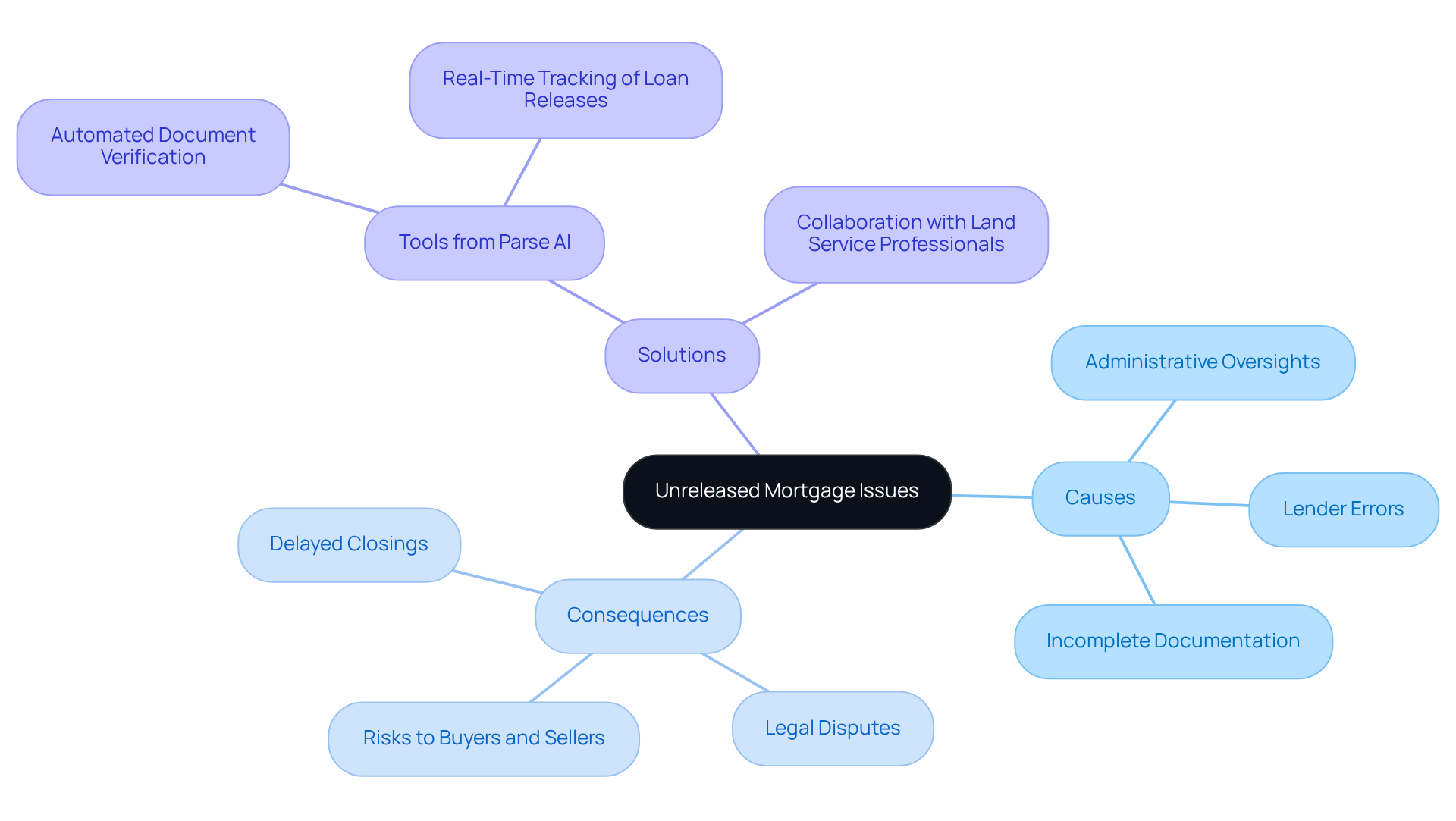

Understand Unreleased Mortgage Issues

Unreleased loans, or deeds of trust, represent legal encumbrances on a property's title that have not been properly discharged. These complications often arise from administrative oversights, processing mistakes, or lenders' failures to provide a release after the loan has been settled. For real estate professionals, understanding these issues is crucial, as they can significantly complicate property transactions, delay closings, and potentially lead to legal disputes. An unreleased loan remains enforceable, posing risks to both buyers and sellers. Common causes include incomplete documentation and lender errors, which can hinder the smooth progression of real estate deals. Understanding these factors enables professionals to manage and address unresolved loan challenges effectively by using tools for resolving unreleased mortgage issues, ensuring a smoother transaction process in 2025.

In this context, Parse AI stands out as a vital partner for real estate professionals. With extensive industry experience, Parse AI leverages cutting-edge technology and deep industry relationships to streamline the title research process. The platform provides specific tools for resolving unreleased mortgage issues, including automated document verification and real-time tracking of loan releases, which help in quickly identifying and addressing these problems. This dedication to innovation not only tackles the challenges of pending loans but also provides significant savings compared to conventional research techniques by minimizing the time and resources required for resolution. Furthermore, as the U.S. anticipates over 5.35 million home sales this year, addressing these challenges is more important than ever to maintain transaction integrity and protect all parties involved. Furthermore, with the current home loan delinquency rate in the U.S. at 3% and home loan fraud rising by 8.3% annually, the implications of unreleased loans are more significant than ever.

Identify Tools for Resolution

To effectively resolve unreleased mortgage issues, several tools and methods can be employed:

- Document Curative Services: Utilizing a document curative service simplifies the process of acquiring essential documentation from lenders and ensures that all legal obligations are fulfilled. Firms such as Harbinger Land offer curative services that guarantee clear ownership records and precise leasing for property and mineral owners.

- Parse AI's Advanced Tools: Employing Parse AI's machine learning tools expedites document processing and interpretation. Their platform includes a sample manager that allows for swift annotation of documents, enabling researchers to extract vital information effectively, which is crucial for utilizing tools for resolving unreleased mortgage issues. Furthermore, Parse AI offers powerful title research automation capabilities that enhance accuracy and speed in processing title documents.

- Direct Communication with Financial Institutions: Reaching out to the financial institution directly can often produce quicker results. Requesting a formal release or clarification on the status of the mortgage can help clear up misunderstandings.

- Legal Assistance: In situations where financial institutions are unresponsive, seeking legal counsel may be necessary. A lawyer focusing on real estate can provide guidance on how to proceed, including submitting a quiet claim action if needed.

- Documentation Review: Carefully examining all relevant documents, including the initial loan agreement and any communication with the lender, can assist in recognizing inconsistencies and strengthening your case for resolution.

For more information on how Parse AI can assist in streamlining your title research and document processing, consider exploring our tools for resolving unreleased mortgage issues or requesting a demo.

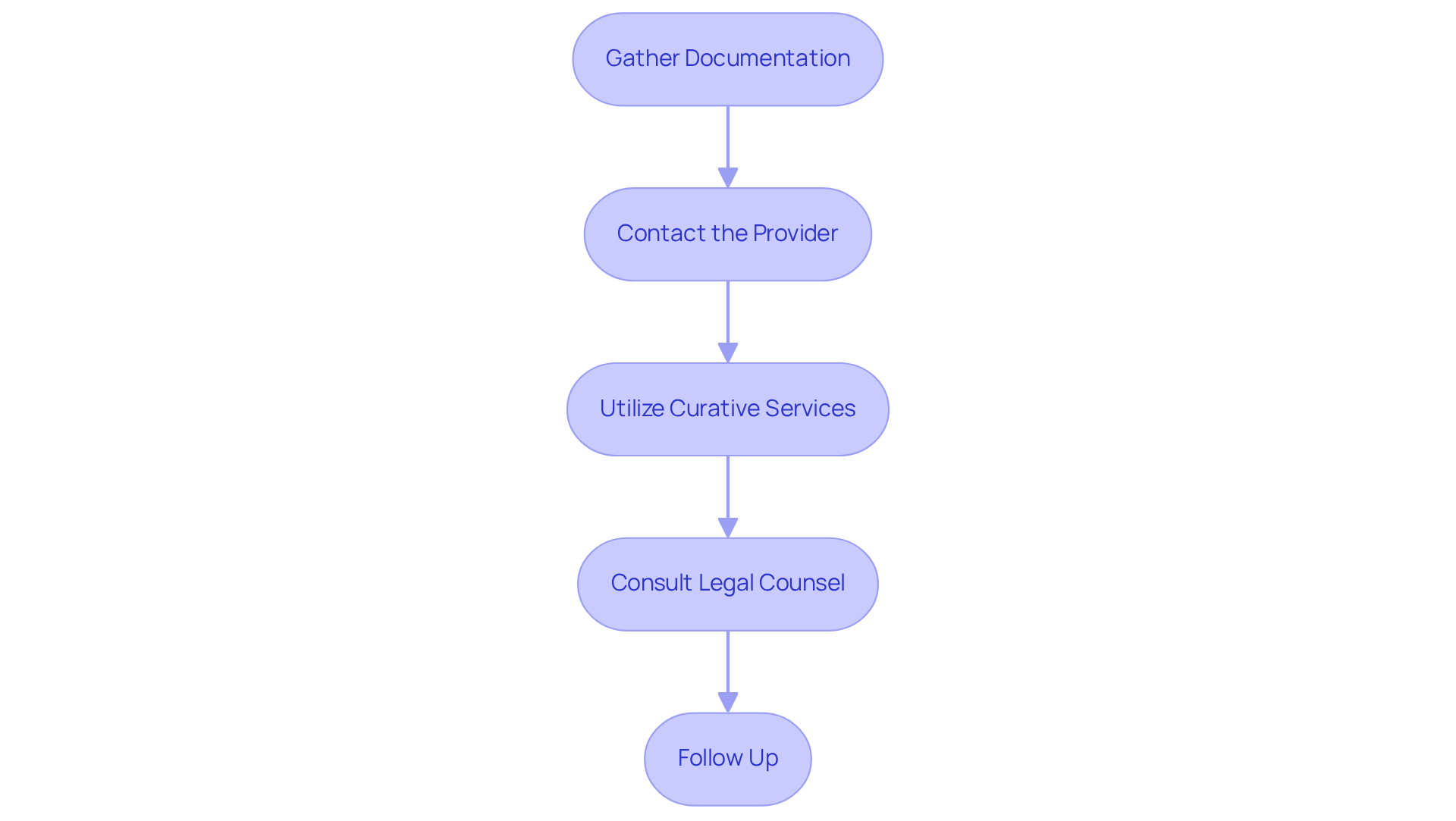

Implement Tools to Resolve Issues

To effectively implement the tools for resolving unreleased mortgage issues, adhere to the following steps:

- Gather Documentation: Compile all pertinent documents, including the mortgage agreement, payment records, and any correspondence with the financial institution. This comprehensive overview is crucial for understanding the situation. Key documents may encompass the original loan agreement, payment history, and any notifications received from the financial institution.

- Contact the Provider: Reach out to the provider through phone or email. Clearly explain the matter and formally request the release of the mortgage. Be ready to provide supporting documentation to bolster your request. Effective communication is essential; consider using a template for your correspondence that outlines your request clearly and concisely.

- Utilize Curative Services: If direct communication with the creditor proves ineffective, consider hiring a curative service for documentation. These experts can navigate the intricacies of title challenges and liaise with the financial institution on your behalf, simplifying the process. According to industry specialists, utilizing such services can considerably decrease the time required to address these problems.

- Consult Legal Counsel: Should the creditor remain unresponsive or complications arise, seek advice from a real estate attorney. They can assist you in determining the best course of action, including the possibility of initiating a quiet action to address ownership concerns. Legal counsel can provide insights into the average time it takes to resolve such matters, which can vary based on jurisdiction and complexity.

- Follow Up: Keep regular check-ins with the financing provider or service to ensure progress. Document all communications for future reference, as this can be invaluable in tracking the resolution process. Regular follow-ups can help keep your case on the lender's radar and may expedite the resolution.

By following these steps, you can improve your chances of successfully addressing unresolved loan concerns with tools for resolving unreleased mortgage issues, ultimately leading to a more efficient title research process. As of 2025, Americans owe $12.61 trillion on their loans, emphasizing the necessity of tackling these concerns swiftly.

Troubleshoot Common Challenges

When addressing unresolved financing concerns, you may encounter several typical obstacles that the tools for resolving unreleased mortgage issues can help overcome. Here’s how to troubleshoot them:

- Non-Responsiveness of the Financial Institution: Should the financial institution fail to respond to your inquiries, escalate the issue by contacting a supervisor or utilizing formal channels, such as certified mail, to document your request. The home financing market has undergone significant changes, particularly post-COVID-19, resulting in an increased reliance on digital tools by financial institutions, which can sometimes lead to communication delays.

- Incomplete Documentation: Ensure that all required documents are submitted. If the lender requests additional information, respond promptly to prevent delays. Notably, 30% of homebuyers found the financing process more challenging than anticipated in 2022, underscoring the importance of thorough documentation.

- Legal Complications: In the event that legal matters arise, such as disputes regarding the legitimacy of the loan, consult your attorney without delay to explore your options.

- Time Delays: Be prepared for potential processing delays. Maintaining a detailed timeline of your communications and actions can help you stay organized and follow up effectively. Significantly, nearly 43% of loan applications do not finalize, highlighting the necessity of addressing these issues swiftly.

- Financial Implications: If resolving the issue incurs unexpected costs, discuss these with your attorney or title service to explore options for managing expenses. With the average monthly home loan payment in the U.S. at $2,300, it is crucial to understand the financial stakes involved.

By proactively addressing these challenges with tools for resolving unreleased mortgage issues, you can streamline the resolution process and minimize disruptions in your mortgage journey. As noted by Innovative Mortgage Brokers, tackling potential issues upfront significantly enhances your chances of achieving a successful resolution.

Conclusion

Addressing unreleased mortgage issues is essential for ensuring smooth property transactions and protecting the interests of all parties involved. These complications, often stemming from administrative oversights and lender errors, can lead to significant delays and legal disputes. By understanding the nature of these issues and employing effective tools, real estate professionals can navigate the complexities of unreleased loans and facilitate timely resolutions.

Throughout this discussion, various strategies for resolving these challenges have been outlined. These include:

- Leveraging document curative services

- Utilizing advanced tools like those offered by Parse AI

- Maintaining direct communication with financial institutions

- Seeking legal assistance

- Meticulously reviewing documentation

The importance of proactive troubleshooting, especially in the face of common obstacles, cannot be overstated, as it significantly enhances the chances of a successful resolution.

Ultimately, the resolution of unreleased mortgage issues is not merely a procedural necessity; it is a vital component of maintaining transaction integrity in the real estate market. With millions of home sales anticipated and rising financial complexities, the urgency to address these challenges effectively is paramount. By embracing the recommended tools and strategies, stakeholders can safeguard their investments and contribute to a more efficient and reliable mortgage landscape.

Frequently Asked Questions

What are unreleased mortgage issues?

Unreleased mortgage issues refer to legal encumbrances on a property's title that have not been properly discharged, often due to administrative oversights, processing mistakes, or lenders failing to provide a release after the loan has been settled.

Why is it important for real estate professionals to understand unreleased mortgage issues?

Understanding unreleased mortgage issues is crucial for real estate professionals as they can complicate property transactions, delay closings, and potentially lead to legal disputes. An unreleased loan remains enforceable, posing risks to both buyers and sellers.

What are common causes of unreleased mortgage issues?

Common causes include incomplete documentation and lender errors, which can hinder the smooth progression of real estate deals.

How can real estate professionals manage unreleased mortgage challenges?

Professionals can manage these challenges effectively by using tools for resolving unreleased mortgage issues, which help ensure a smoother transaction process.

How does Parse AI assist in resolving unreleased mortgage issues?

Parse AI assists by leveraging technology and industry relationships to streamline the title research process, providing tools such as automated document verification and real-time tracking of loan releases to quickly identify and address unreleased mortgage problems.

What benefits does Parse AI offer compared to conventional research techniques?

Parse AI offers significant savings by minimizing the time and resources required for resolution, making the process more efficient.

Why is addressing unreleased mortgage issues increasingly important in 2025?

With over 5.35 million home sales anticipated in the U.S. and rising home loan delinquency and fraud rates, addressing unreleased mortgage issues is vital to maintain transaction integrity and protect all parties involved.