Overview

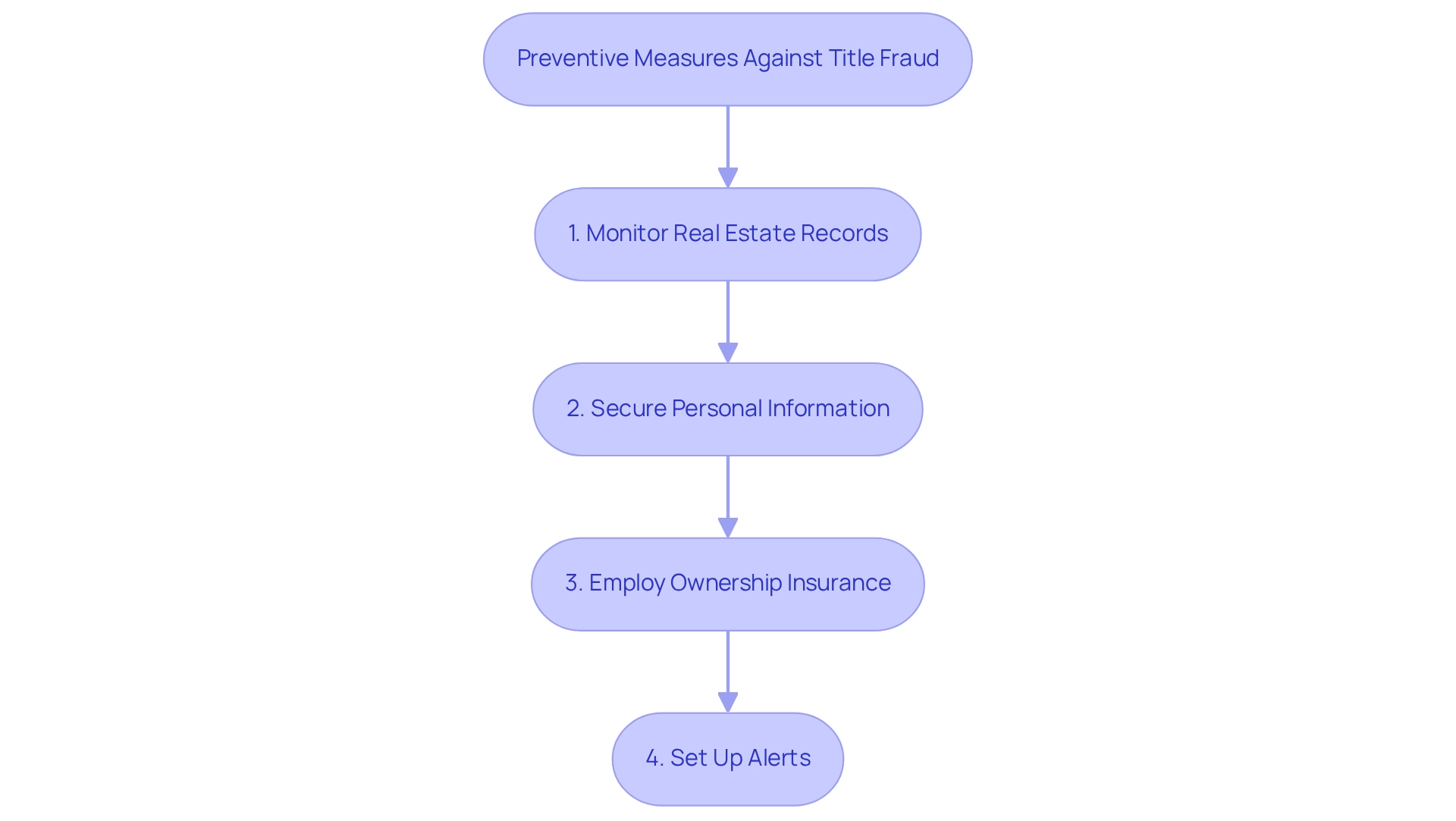

To effectively avoid title fraud, homeowners must implement strategies that include:

- Regularly monitoring real estate records

- Securing personal information

- Investing in ownership insurance

- Setting up alerts for title modifications

These proactive measures are essential for safeguarding property ownership and minimizing the risks associated with title deception. Furthermore, leveraging technology and engaging in continuous education on fraud trends significantly enhances these efforts. By adopting these strategies, homeowners not only protect their assets but also gain peace of mind in an increasingly complex real estate environment.

Introduction

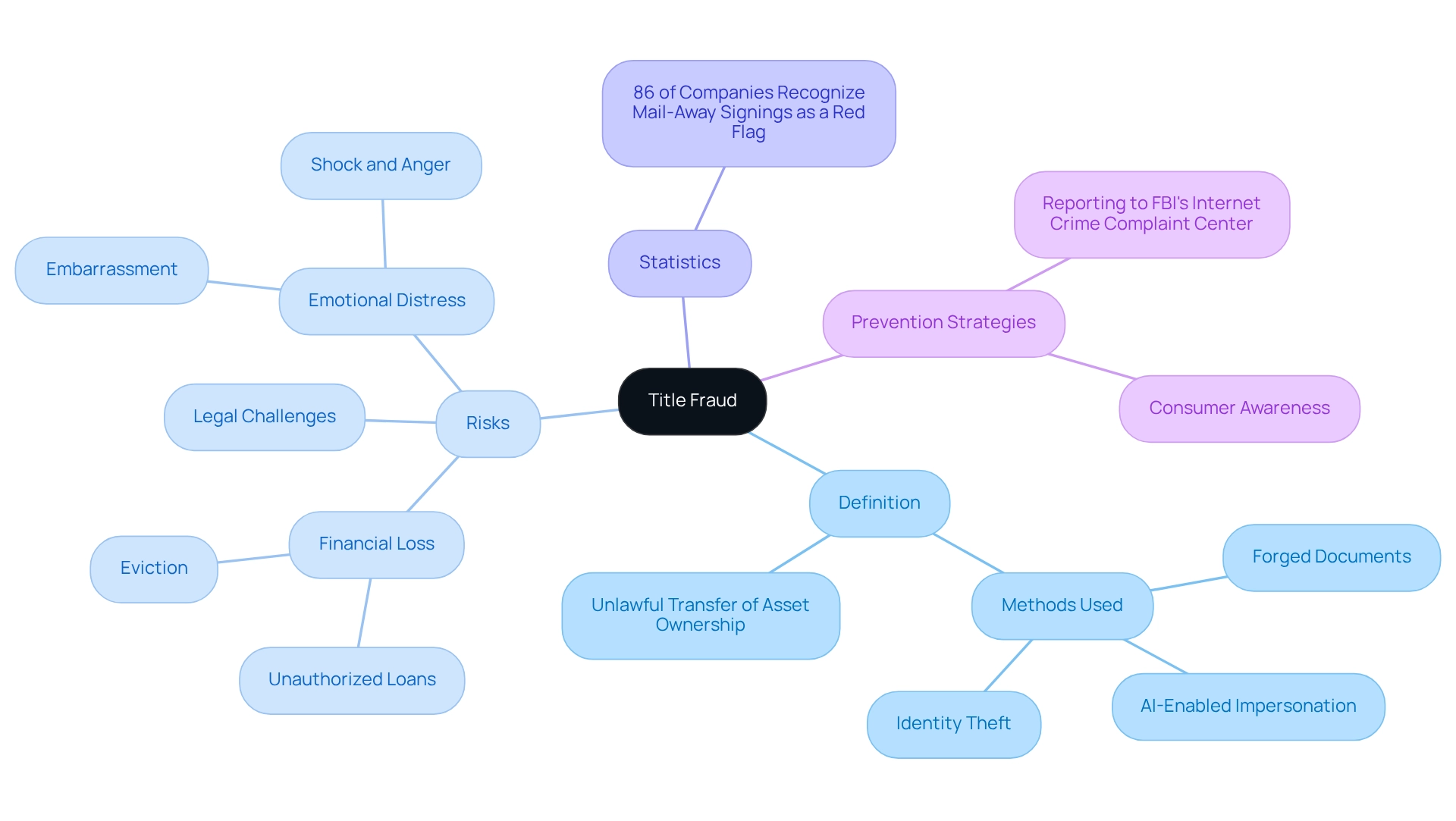

In an age where property ownership is increasingly threatened by sophisticated criminal tactics, understanding title fraud has never been more critical. This insidious crime—characterized by the illegal transfer of property ownership through methods such as forgery and identity theft—poses significant risks to unsuspecting homeowners. The implications of title fraud extend beyond mere financial loss; victims often confront complex legal battles and the emotional turmoil of potentially losing their homes.

Furthermore, as technology evolves, so too do the methods employed by fraudsters, making it essential for homeowners to stay informed and proactive. This article delves into the definition and risks of title fraud, outlines effective preventive measures, and highlights the importance of leveraging technology and education to safeguard property investments against this growing threat.

Understand Title Fraud: Definition and Risks

Title deception involves the unlawful transfer of asset ownership by offenders, often executed through forged documents or identity theft. The implications of ownership deception are severe, resulting in significant financial losses, complex legal challenges, and the potential loss of one's home. Victims may face unauthorized loans against their property, leading to distressing outcomes such as eviction.

As we approach 2025, the landscape of title deception is evolving, with criminals adopting sophisticated tactics, including AI-enabled impersonation of real estate professionals, as highlighted in the report on cybercrime trends in . This development underscores the urgent need for enhanced security measures and vigilant consumer awareness.

Recent statistics reveal that 86% of companies recognize mail-away signings with unidentified notaries as a prevalent warning sign of deception, emphasizing the escalating risks in the current environment. The financial repercussions for homeowners can be devastating, resulting not only in monetary loss but also in emotional distress, as noted by experts like Jodi Cohen, who emphasize the profound personal toll on victims.

It is crucial for homeowners to understand these risks to learn how to avoid title fraud and implement proactive strategies against fraudulent activities. Individuals affected by deception are strongly encouraged to report incidents to the FBI's Internet Crime Complaint Center, highlighting the importance of taking decisive action against such offenses.

Implement Preventive Measures Against Title Fraud

To effectively prevent title fraud, homeowners must implement the following measures:

- Regularly Monitor Real Estate Records: Consistently check local real estate records online to identify any unauthorized alterations to your ownership. A substantial proportion of homeowners, roughly 30%, do not check their ownership documents consistently, making them susceptible to deception. Significantly, research has revealed that 28% of property companies have encountered seller impersonation deception attempts, highlighting the necessity of vigilance in oversight. Employing sophisticated machine learning tools from Parse AI can simplify this process by automating the identification of inconsistencies in property records, enabling faster reactions to potential misconduct.

- Secure Personal Information: Safeguard sensitive documents and personal information that could facilitate identity theft. Shredding documents containing personal data is a crucial step in protecting yourself from potential fraudsters. Additionally, implementing automated document processing solutions can help manage and secure these documents more effectively.

- Employ Ownership Insurance: Invest in ownership insurance to protect against possible losses arising from ownership defects, including deception. As Donald H. Layton observed, "it is reasonable to conclude that the overpricing could be up to ten times higher... than the current rates," emphasizing the financial implications of property fraud. Statistics show that property insurance can effectively prevent losses, providing peace of mind for homeowners. Furthermore, utilizing Parse AI's research automation improves the precision of searches, further reducing risks linked to defects.

- Set Up Alerts: Utilize alert services provided by numerous counties, which inform you of any modifications to your title. This proactive strategy enables quick measures in reaction to suspicious behavior, greatly minimizing the risk of deception and teaching individuals how to avoid title fraud. Parse AI's digital interface can facilitate , ensuring that homeowners receive timely notifications about their property status.

Considering recent research showing that 28% of document companies have faced seller impersonation deception attempts, these preventive measures are more essential than ever. Moreover, with the Treasury overseeing the insurance industry and considering possible reforms, it is crucial for homeowners to stay alert. By implementing these strategies, including the use of Parse AI's innovative solutions, homeowners can strengthen their defenses against ownership deception and safeguard their investments.

Leverage Technology for Effective Title Research

Utilizing technology is essential for enhancing the efficiency of research and understanding how to avoid title fraud. Effective strategies for leveraging technology include the following:

- Automated Document Searches: Employ platforms that facilitate automated document searches, enabling swift detection of discrepancies or issues within property records.

- Machine Learning Tools: Integrate machine learning algorithms to analyze patterns in document headings, which can assist in flagging potential deceit attempts with greater precision.

- Optical Character Recognition (OCR): Utilize OCR technology to digitize and extract information from paper documents, streamlining the management and review of record files.

- in specialized software that teaches you how to avoid title fraud by identifying anomalies in property transactions and providing alerts for potential fraud before it manifests.

The insurance sector is evolving to meet the demands of a digital landscape, with automation playing a pivotal role in enhancing efficiency and consumer protection. Recent advancements, such as expanded data coverage in Florida, illustrate the ongoing commitment to transparency and innovation in property research. As Kim Armstrong, Vice President of Product and Strategy at DataTrace, stated, "In addition to increased efficiency, the broader use of automation will help our industry address the challenge of an aging and evolving workforce." Furthermore, the implementation of Remote Online Notarization (RON) has demonstrated a reduction in the risk of document tampering and fraud during the closing process. By adopting these technologies, professionals can not only enhance their workflows but also contribute to a more secure and competitive insurance environment. Additionally, regulatory changes in insurance are focusing on ensuring that innovations benefit consumers through increased transparency and protection.

Educate Yourself and Stay Informed on Title Fraud Trends

To effectively counteract deception regarding ownership, ongoing education and awareness of changing strategies employed by swindlers are essential. Here are several strategies to enhance your knowledge and vigilance:

- Stay Informed on Sector Updates: Consistently subscribe to trustworthy property and legal journals that provide news on ownership scams and emerging schemes. Staying informed about the latest trends is crucial, especially as payment redirection scams surged by 66.6% in 2024. Wire deception in property transactions remains a significant concern, with $145 million in reported losses last year, primarily due to business email compromise (BEC) schemes deceiving homebuyers, sellers, and property professionals.

- Attend Workshops and Seminars: Participate in educational events focused on title research and deception prevention. Consider attending the annual Title Fraud Prevention Conference or local seminars organized by property associations. These gatherings not only provide insights from industry experts but also foster a community of professionals dedicated to combating deception. Attendance at such workshops has shown a significant increase, reflecting a growing awareness of the issue.

- Join Professional Associations: Become an active member of organizations focused on property and ownership research. These organizations frequently offer vital resources, information on best practices, and networking opportunities that can enhance your understanding of document deception. They may also provide online monitoring tools to help you remain vigilant against potential threats.

- Network with Experts: Cultivate relationships with property agents, conveyancing firms, and legal specialists. Sharing experiences and insights can yield practical knowledge about the latest deception techniques and prevention strategies. Notably, a recent report indicated that 51.8% of property transactions in late 2023 exhibited risk signs for wire or document deception, underscoring the necessity of collaboration in addressing these vulnerabilities.

- Know What to Do if You Become a Victim: If you suspect that you have fallen victim to property deception, it is imperative to notify the authorities, , and seek legal assistance to reclaim your property. By implementing these strategies, you can significantly strengthen your defenses and learn how to avoid title fraud, contributing to a more secure real estate environment.

Conclusion

Understanding title fraud is essential for homeowners to protect their most significant investments. This article elucidates the definition and risks associated with title fraud, highlighting the serious financial and emotional repercussions that victims can face. As fraudsters evolve their tactics, including the use of advanced technology, it becomes increasingly critical for homeowners to remain vigilant and informed.

Preventive measures, such as:

- Regularly monitoring property records

- Securing personal information

- Investing in title insurance

- Setting up property alerts

are imperative to safeguard against potential fraud. Furthermore, leveraging technology through automated tools and fraud detection software enhances the effectiveness of title research, providing homeowners with the necessary resources to combat this growing threat.

Education and awareness are also key components in the fight against title fraud. By staying updated on industry news, attending relevant workshops, and networking with professionals, homeowners can better equip themselves to recognize and respond to fraudulent activities. The proactive steps outlined in this article empower homeowners to take control of their property security, ensuring that they are not only informed but also prepared to act should they ever encounter title fraud.

In conclusion, the fight against title fraud requires a multifaceted approach that combines vigilance, technology, and ongoing education. By understanding the risks and implementing effective preventive measures, homeowners can significantly reduce their vulnerability to this insidious crime. It is essential to remain proactive and engaged in safeguarding property investments, ultimately fostering a more secure real estate environment for all.

Frequently Asked Questions

What is title deception?

Title deception involves the unlawful transfer of asset ownership by offenders, often executed through forged documents or identity theft.

What are the implications of title deception?

The implications of title deception are severe, resulting in significant financial losses, complex legal challenges, and the potential loss of one's home.

How can title deception affect victims?

Victims may face unauthorized loans against their property, leading to distressing outcomes such as eviction.

How is the landscape of title deception changing?

As we approach 2025, criminals are adopting sophisticated tactics, including AI-enabled impersonation of real estate professionals, highlighting the need for enhanced security measures.

What warning signs indicate potential title deception?

Recent statistics reveal that 86% of companies recognize mail-away signings with unidentified notaries as a prevalent warning sign of deception.

What are the financial and emotional repercussions of title deception for homeowners?

The financial repercussions can be devastating, resulting in monetary loss and emotional distress for victims.

What steps should homeowners take to avoid title fraud?

Homeowners should understand the risks associated with title fraud and implement proactive strategies against fraudulent activities.

What should individuals do if they are affected by title deception?

Individuals affected by deception are strongly encouraged to report incidents to the FBI's Internet Crime Complaint Center.