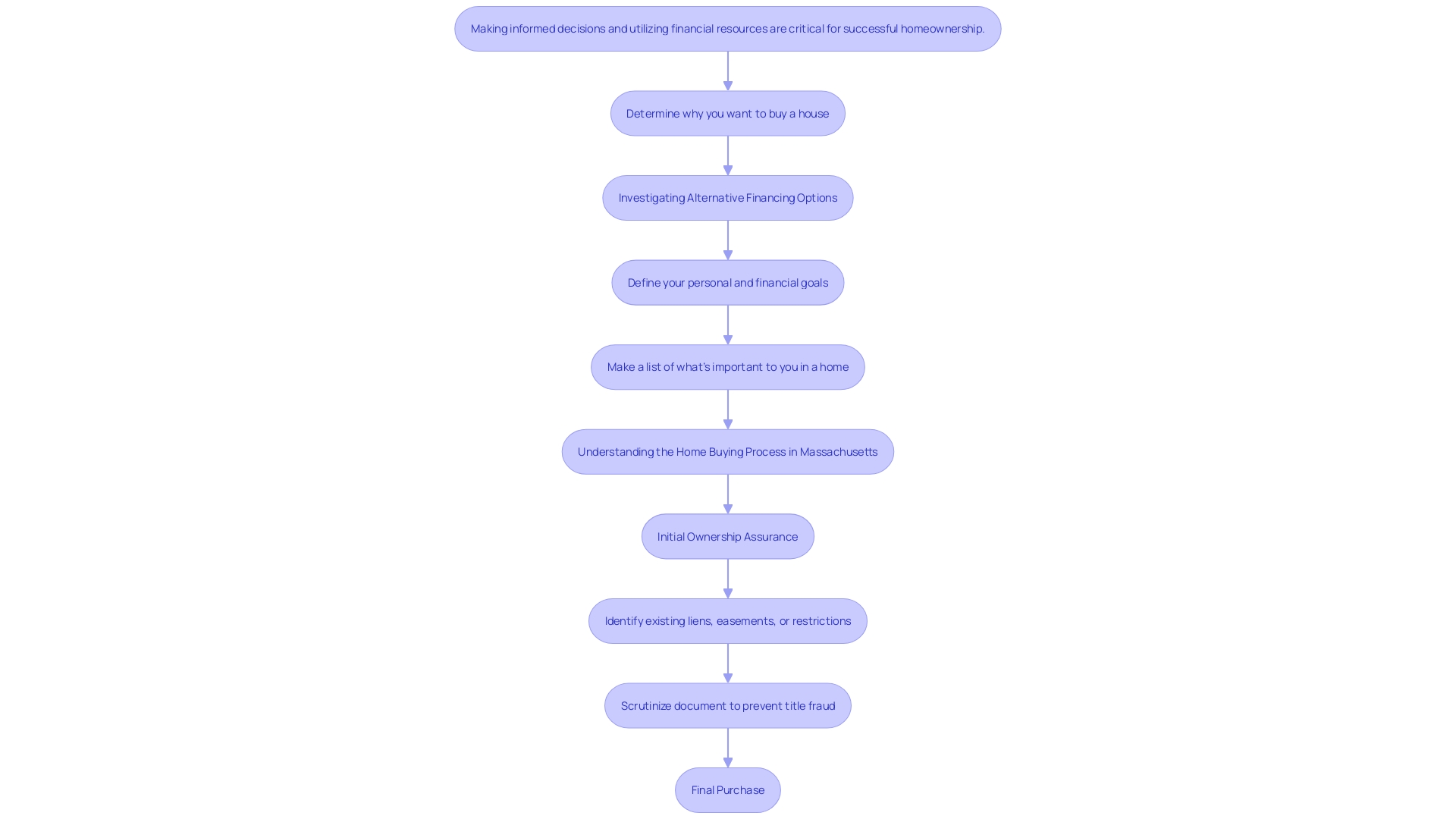

Introduction

In the intricate world of real estate transactions, the preliminary title commitment emerges as a crucial document that can significantly influence the homebuying experience. This foundational piece not only outlines the conditions for title insurance but also reveals vital information about the property, including any liens, easements, or restrictions that could impact ownership rights. As incidents of title fraud become increasingly prevalent, understanding the nuances of this commitment is essential for prospective buyers.

By meticulously reviewing this document, homebuyers can identify potential legal complications and financial risks, equipping themselves with the knowledge needed to navigate a complex market. The importance of this proactive approach cannot be overstated, as it serves to safeguard investments and ensure a smoother transaction process.

Understanding the Importance of Your Preliminary Title Commitment

The initial ownership assurance plays a crucial role in the home buying process, serving as a foundational document that outlines the conditions under which a property insurance policy will be issued. This critical document provides homebuyers with essential insights regarding the real estate, disclosing any existing liens, easements, or restrictions that may impact ownership rights. With the increasing prevalence of , as evidenced by cases like that of Craig Adams, who discovered that a false warranty deed had been filed against his multi-million dollar home, understanding the significance of the title guarantee has never been more crucial. Adams, despite being current on his mortgage and taxes, found himself facing the unsettling reality of not owning a home he still resided in. Such scenarios highlight the importance of scrutinizing the dedication for any encumbrances that may not be apparent during a casual property inspection. By thoroughly examining the document of ownership, homebuyers can proactively recognize possible legal issues and financial dangers, allowing them to make informed choices in a complex real estate environment. This document acts as a safeguard against unexpected challenges, ensuring that buyers are well-informed about any potential issues before finalizing their purchase.

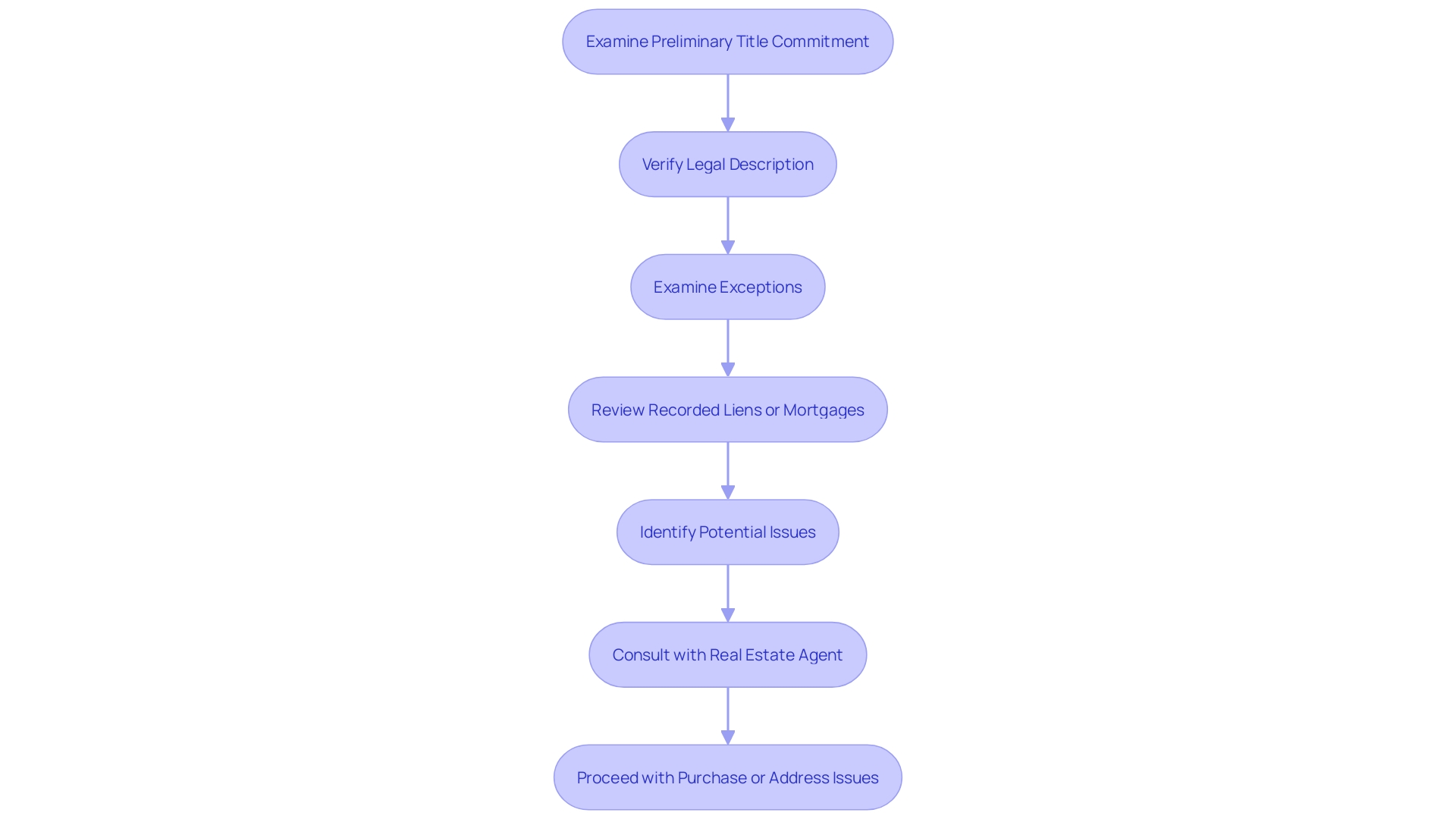

Key Insights to Look for in Your Title Commitment

When examining a , it is crucial for homebuyers to focus on several fundamental components that can significantly influence their transaction. The legal description of the asset is of paramount importance; any inaccuracies can lead to ownership disputes that may linger long after the purchase is finalized. Therefore, verifying that the legal description aligns perfectly with the asset being acquired is essential.

Equally important is the examination of the exceptions listed in the commitment. This section delineates any claims, rights, or encumbrances that may affect the asset, such as easements or other restrictions. Understanding these exceptions aids investors in evaluating potential risks and liabilities linked to their investment.

Additionally, purchasers should meticulously review any recorded liens or mortgages associated with the property. These financial obligations must be resolved prior to closing, as they could impede the transfer of clear ownership and lead to unexpected financial burdens for the new owner.

By paying close attention to these elements, homebuyers can proactively identify potential issues early in the purchasing process. This vigilance not only facilitates a smoother transaction but also empowers buyers to negotiate better terms, especially in a market where they may leverage their position due to an increase in inventory and reduced competition. As the housing market continues to change, maintaining diligence during the document review process is more crucial than ever.

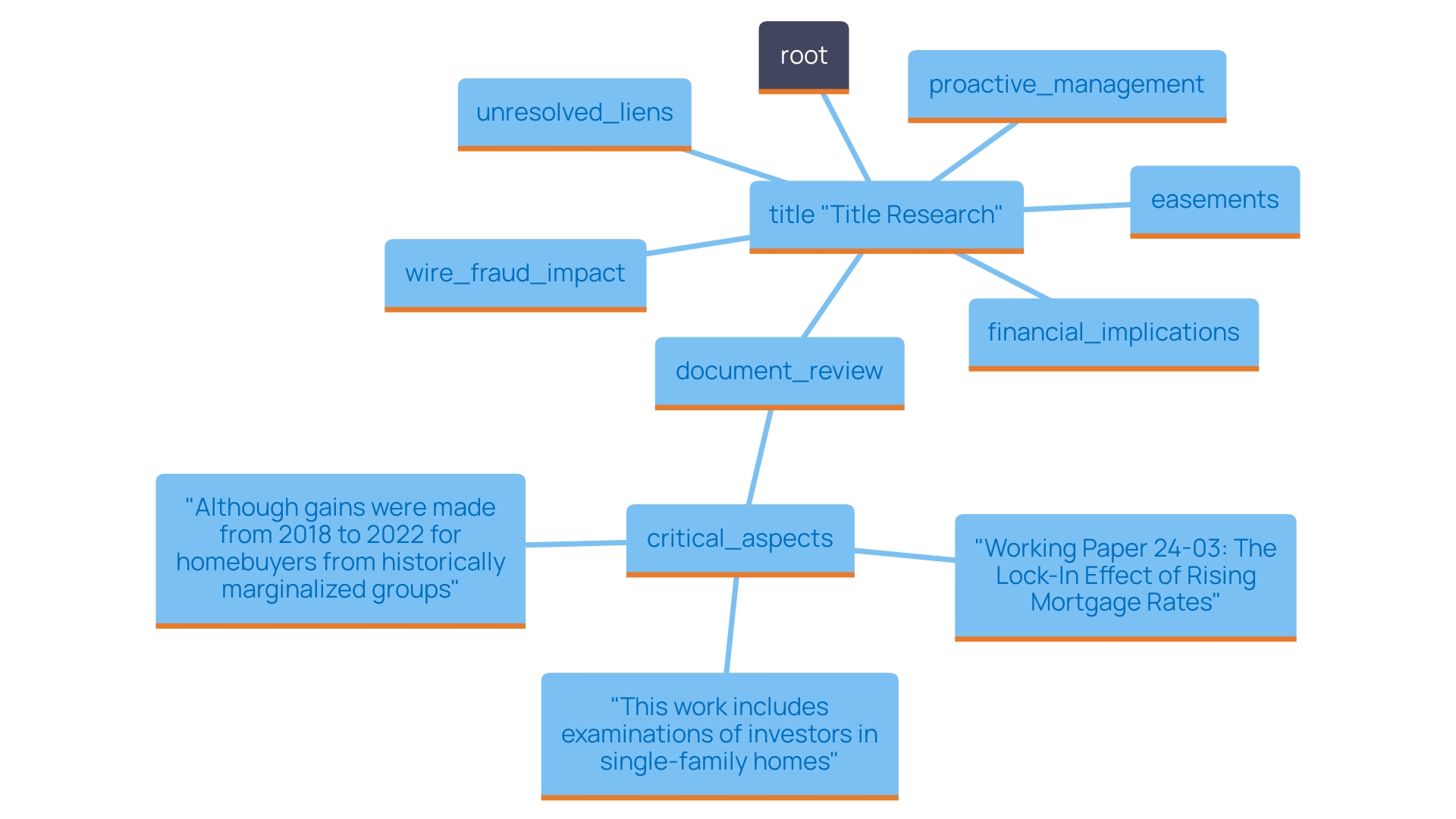

Avoiding Common Pitfalls in Title Research

In today's challenging real estate landscape, the significance of comprehensive title research cannot be overstated. Many homebuyers, in their eagerness to secure a residence, often neglect this critical aspect, leading to potentially costly oversights. For instance, unresolved liens can linger unnoticed, posing significant risks if not addressed prior to closing. Additionally, misunderstandings regarding easements might restrict how an individual intends to utilize their property, potentially diminishing its value and functionality. By diligently reviewing the preliminary commitment, buyers are empowered to identify these issues early, preventing complications that could derail the transaction process.

Proactive management of ownership issues is essential, especially as the market grapples with increasing instances of wire fraud and financial losses that have surged in recent months. Such threats have necessitated a shift in operations for real estate and escrow firms, prompting many to diversify their services in response to a sluggish housing market. This year, for example, a typical homebuyer would have allocated over 40% of their earnings towards mortgage payments, an unprecedented figure that illustrates the financial strain in the current climate.

Addressing title-related challenges is not merely a formality; it is a crucial step that can mean the difference between a successful transaction and a protracted delay. With the real estate market evolving rapidly, understanding these reinforces the necessity of careful document review. As we transition into 2024, ensuring that ownership research is thorough and accurate will not only facilitate smoother closings but also safeguard against the disruptions that can arise from overlooked ownership issues.

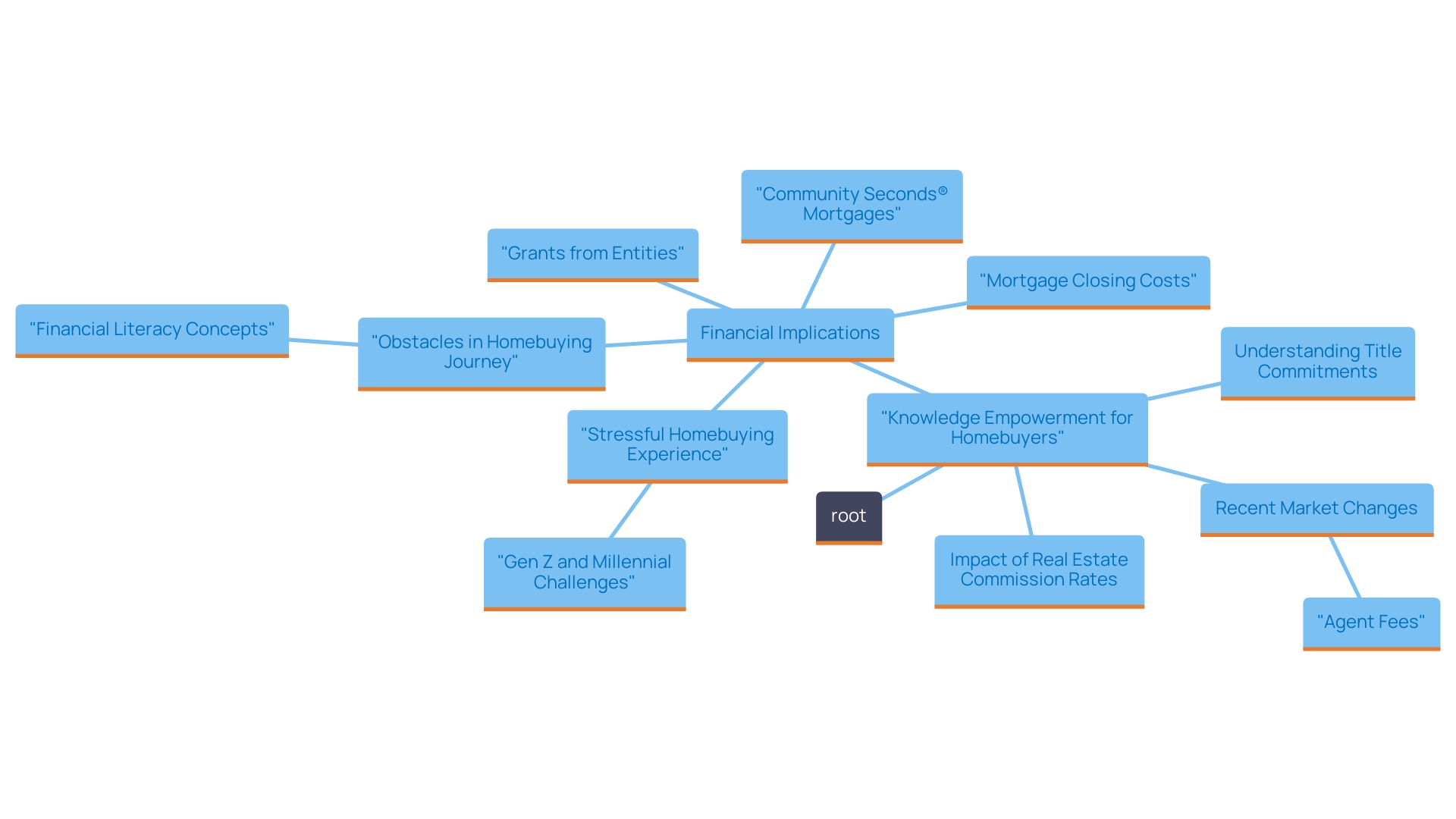

Empowering Homebuyers with Knowledge

In the realm of real estate transactions, knowledge serves as a powerful tool for homebuyers. By thoroughly engaging with the initial document, purchasers equip themselves with vital information that is important for navigating the often intricate realm of property ownership. This proactive stance not only instills confidence but also empowers purchasers to pose informed questions and negotiate terms more effectively.

Understanding the intricacies of the title commitment is particularly important in the context of heightened real estate commission rates in the U.S., which can reach as high as 6% of the sale price. Given that Americans collectively spend around $100 billion annually on real estate commissions, awareness of these costs can significantly influence an individual's financial decisions. For instance, a seller of a $1 million property might incur up to $60,000 in commissions, which is a substantial amount that is inherently factored into the final sales price.

Moreover, recent changes in the real estate market, such as the obligation of purchasers to cover their agent's fees in some instances, necessitate a deeper understanding of the financial implications of these transactions. With the ruling that sellers are no longer expected to pay the agent's fee for clients, purchasers could face an of the sale price, translating to $15,000 on a $500,000 home. This change highlights the significance of being well-informed about not just the document assurance, but also the broader financial environment of real estate transactions.

Ultimately, being equipped with knowledge about the title commitment and the intricate details of the real estate market not only safeguards a buyer's investment but also enhances their overall experience throughout the home buying journey.

Conclusion

The preliminary title commitment stands as a cornerstone in the homebuying process, providing essential insights that can safeguard against potential legal and financial pitfalls. By understanding the critical elements outlined in the commitment—such as the legal description, exceptions, and existing liens—homebuyers can proactively address any issues that may affect their ownership rights. This diligence not only facilitates smoother transactions but also empowers buyers to negotiate terms effectively in a competitive market.

In an environment where title fraud and financial risks are increasingly prevalent, the importance of thorough title research cannot be overstated. By recognizing common pitfalls, such as overlooked liens and misunderstandings regarding easements, buyers can prevent complications that could derail their transactions. As the real estate landscape evolves, maintaining a vigilant approach to title review will ensure that buyers are well-prepared to navigate the complexities of property ownership.

Ultimately, knowledge is the key to a successful homebuying experience. By engaging deeply with the preliminary title commitment and understanding the broader financial implications of real estate transactions, buyers can make informed decisions that protect their investments. As the market continues to shift, equipping oneself with this knowledge will not only enhance the homebuying journey but also instill confidence in navigating future transactions.

Frequently Asked Questions

What is the initial ownership assurance in the home buying process?

The initial ownership assurance is a foundational document that outlines the conditions under which a property insurance policy will be issued. It provides homebuyers with insights regarding the real estate, including any existing liens, easements, or restrictions that may impact ownership rights.

Why is the initial ownership assurance important?

It is crucial for identifying potential legal issues and financial risks associated with property ownership, helping buyers make informed choices and safeguarding against unexpected challenges during the home buying process.

What should homebuyers focus on when examining a preliminary title commitment?

Homebuyers should verify the legal description of the asset, review exceptions listed in the commitment, and check for any recorded liens or mortgages associated with the property.

What are the risks of neglecting title research in real estate transactions?

Neglecting title research can lead to unresolved liens, ownership disputes, and misunderstandings regarding easements, which may restrict property use and diminish its value.

How does the current real estate market affect the importance of title research?

The market has seen an increase in wire fraud and financial losses, making comprehensive title research essential to prevent complications and ensure successful transactions.

What financial implications should homebuyers be aware of regarding real estate commissions?

Homebuyers should understand that real estate commissions can significantly impact the total cost of a transaction, with rates reaching as high as 6% of the sale price, and recent changes may require them to cover their agent's fees.

How can knowledge about title commitment and the real estate market enhance a buyer's experience?

Being well-informed about the title commitment and associated costs equips buyers to navigate the process confidently, ask informed questions, and negotiate better terms, ultimately safeguarding their investment.