Introduction

Title indemnity insurance plays a pivotal role in the realm of real estate, providing essential protection for property owners and lenders alike. As transactions grow increasingly complex, the potential for title defects—such as undisclosed heirs or errors in public records—can pose significant risks. This specialized insurance not only safeguards against financial losses stemming from these issues but also fosters confidence in property investments, thereby stabilizing the real estate market.

Understanding the nuances of title indemnity insurance, including its coverage, costs, and common misconceptions, is crucial for stakeholders navigating the intricacies of property ownership and financing.

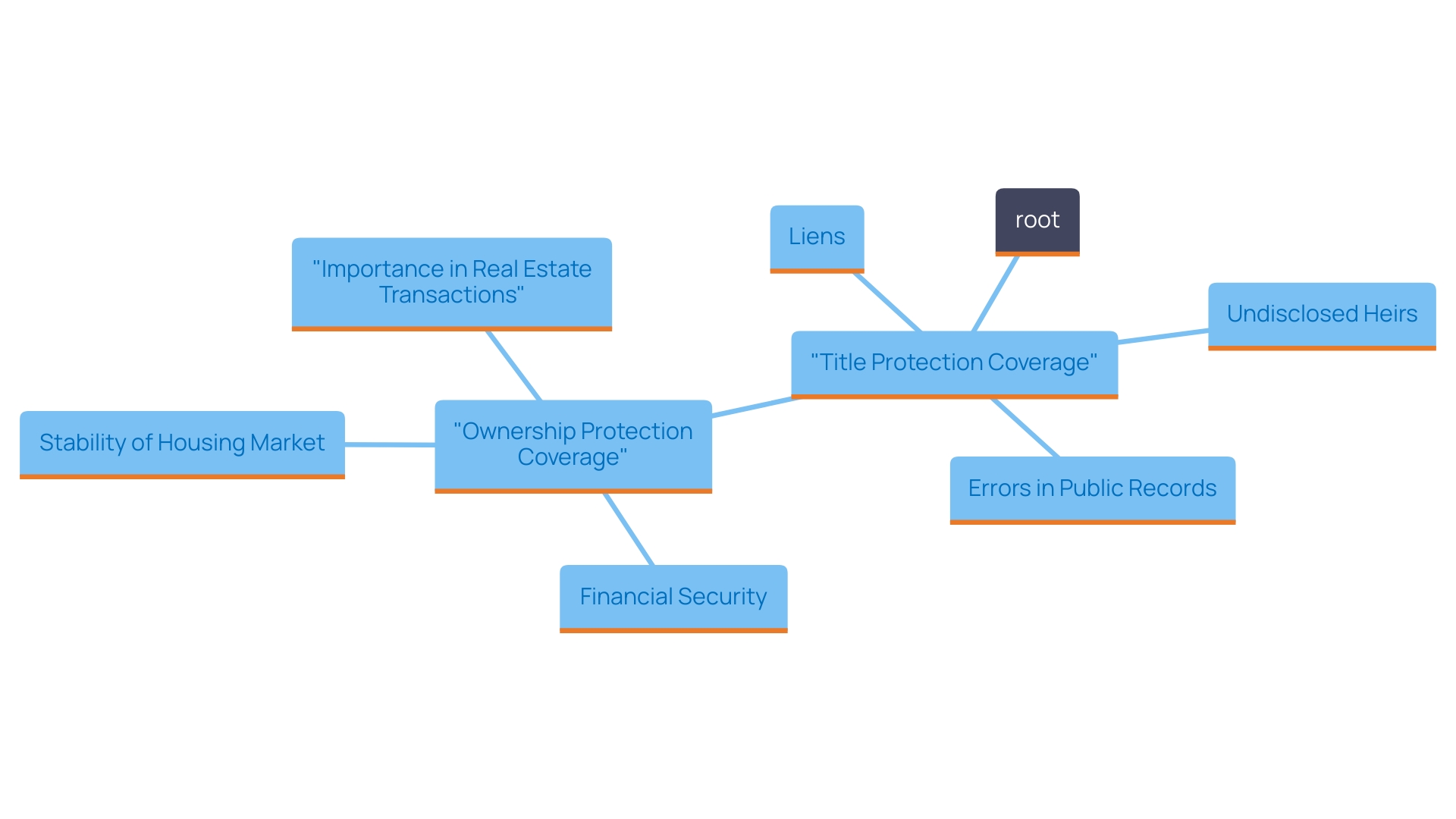

Understanding Title Indemnity Insurance: Definition and Importance

Title protection coverage is a specialized type of coverage that safeguards asset owners and lenders from losses caused by flaws in the ownership records of a real estate. Such defects may include issues like:

- Undisclosed heirs

- Liens

- Errors in public records

These issues can affect ownership rights. The significance of ownership protection coverage cannot be emphasized enough, as it offers financial security and reassurance to parties engaged in real estate dealings. By reducing the risk of unexpected claims related to ownership, ownership protection coverage enhances trust in real estate investments, ultimately bolstering the stability of the housing market.

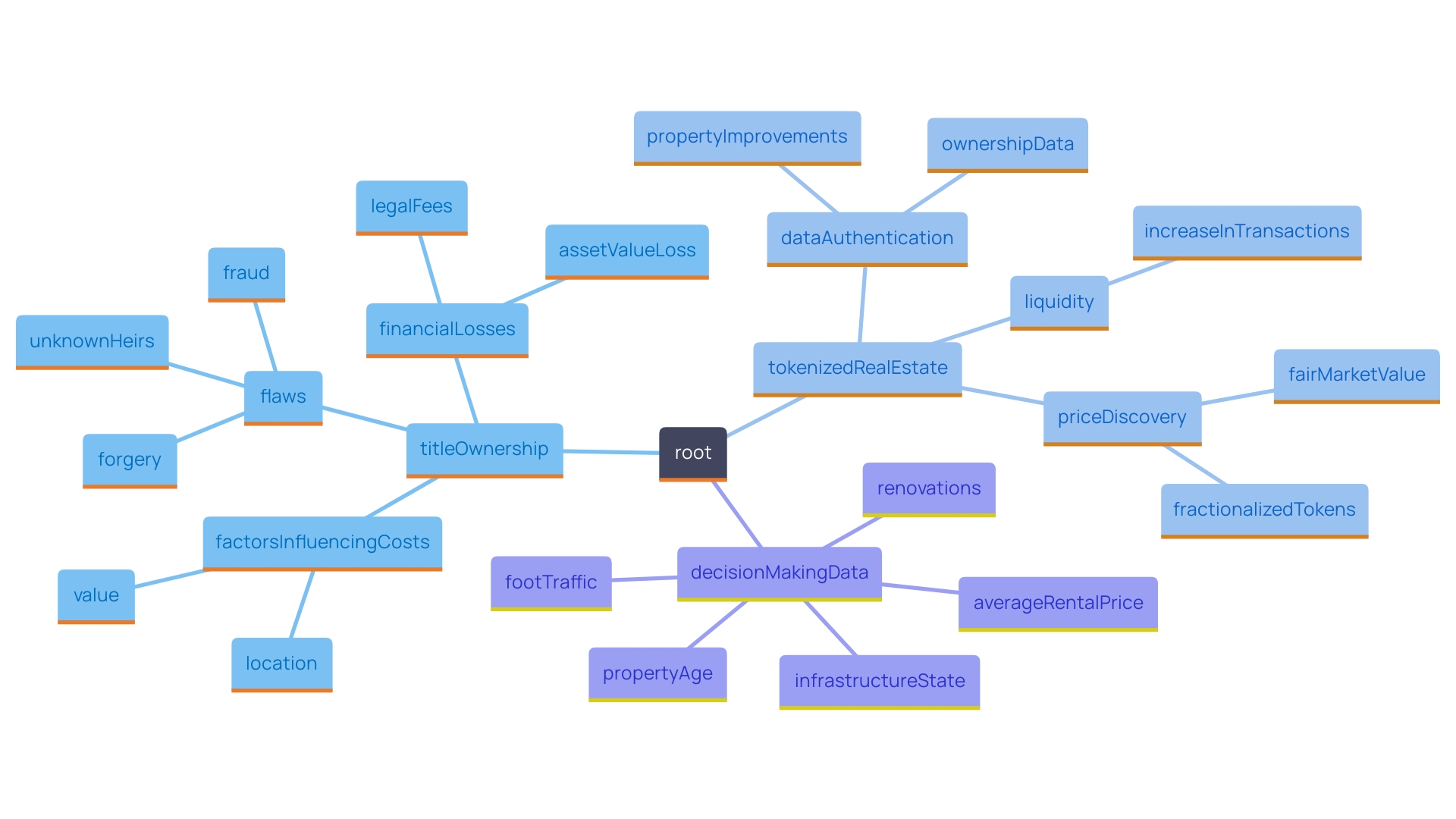

Coverage and Costs: What You Need to Know About Title Indemnity Insurance

Title protection coverage typically addresses various flaws that can impact ownership, such as:

- Unknown heirs

- Incorrectly documented papers

- Fraud

- Forgery

The coverage is intended to safeguard against financial losses resulting from these defects, which may encompass:

- Legal fees incurred to settle disputes

- Compensation for loss of asset value

The expenses related to ownership protection can fluctuate greatly depending on elements like:

- Location

- Value

- The level of coverage sought

Typically, premiums are calculated as a one-time payment at the closing of a property transaction, and it is advisable for potential buyers to compare policies from different insurers to find the best coverage for their needs.

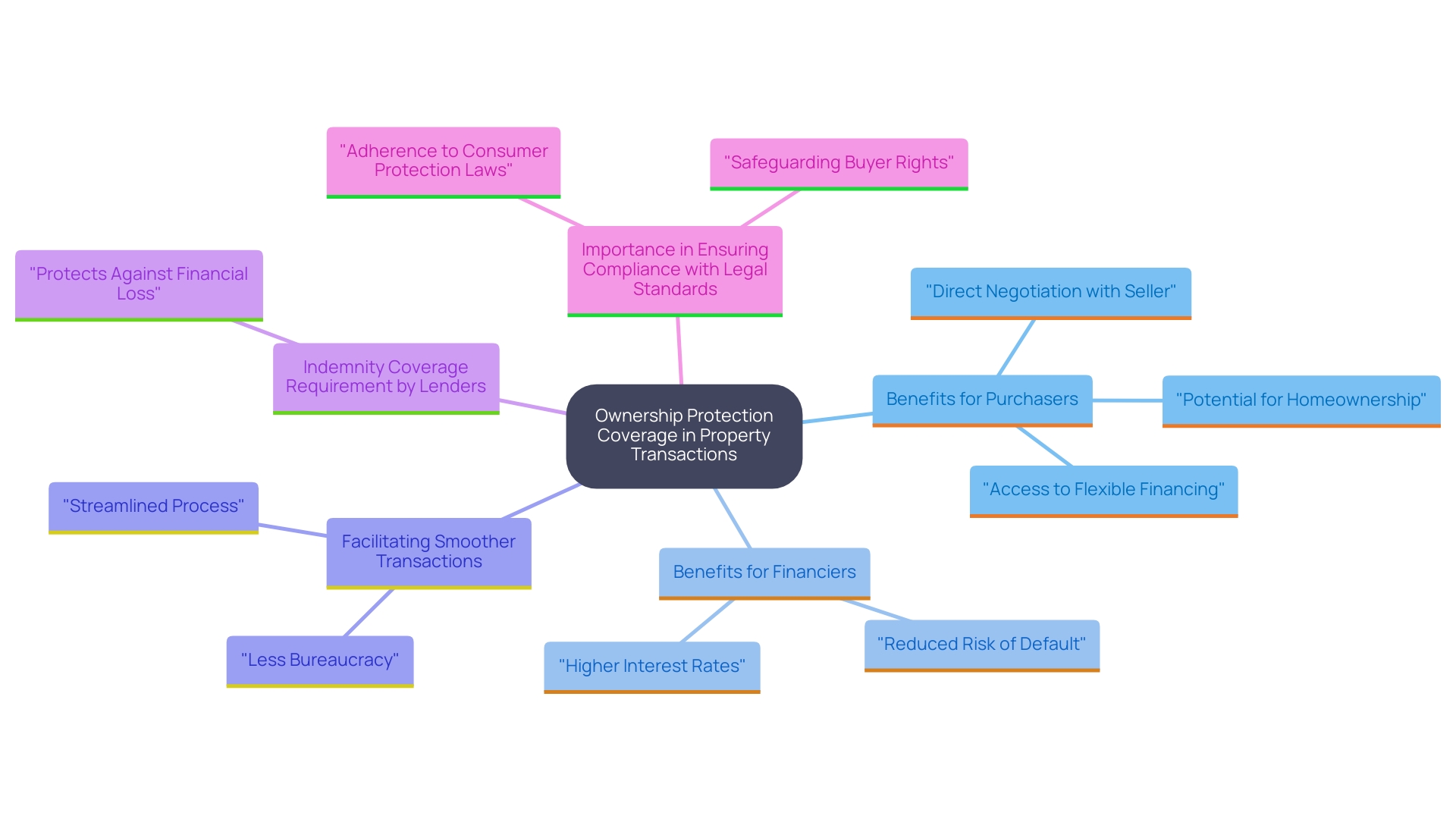

The Role of Title Indemnity Insurance in Real Estate Transactions

In property dealings, ownership protection coverage acts as an essential safeguard for both purchasers and financiers. By ensuring that potential ownership defects are covered, it allows for smoother transactions and builds trust between parties. Lenders frequently demand indemnity coverage as a condition for financing, as it safeguards their investment in the event of an ownership dispute. This coverage serves as a safety net, allowing buyers to proceed with confidence, knowing that they are protected against that could jeopardize their ownership rights. Furthermore, it plays a vital role in maintaining compliance with legal standards in property transactions, ensuring that all parties can fulfill their obligations without the threat of unforeseen ownership issues.

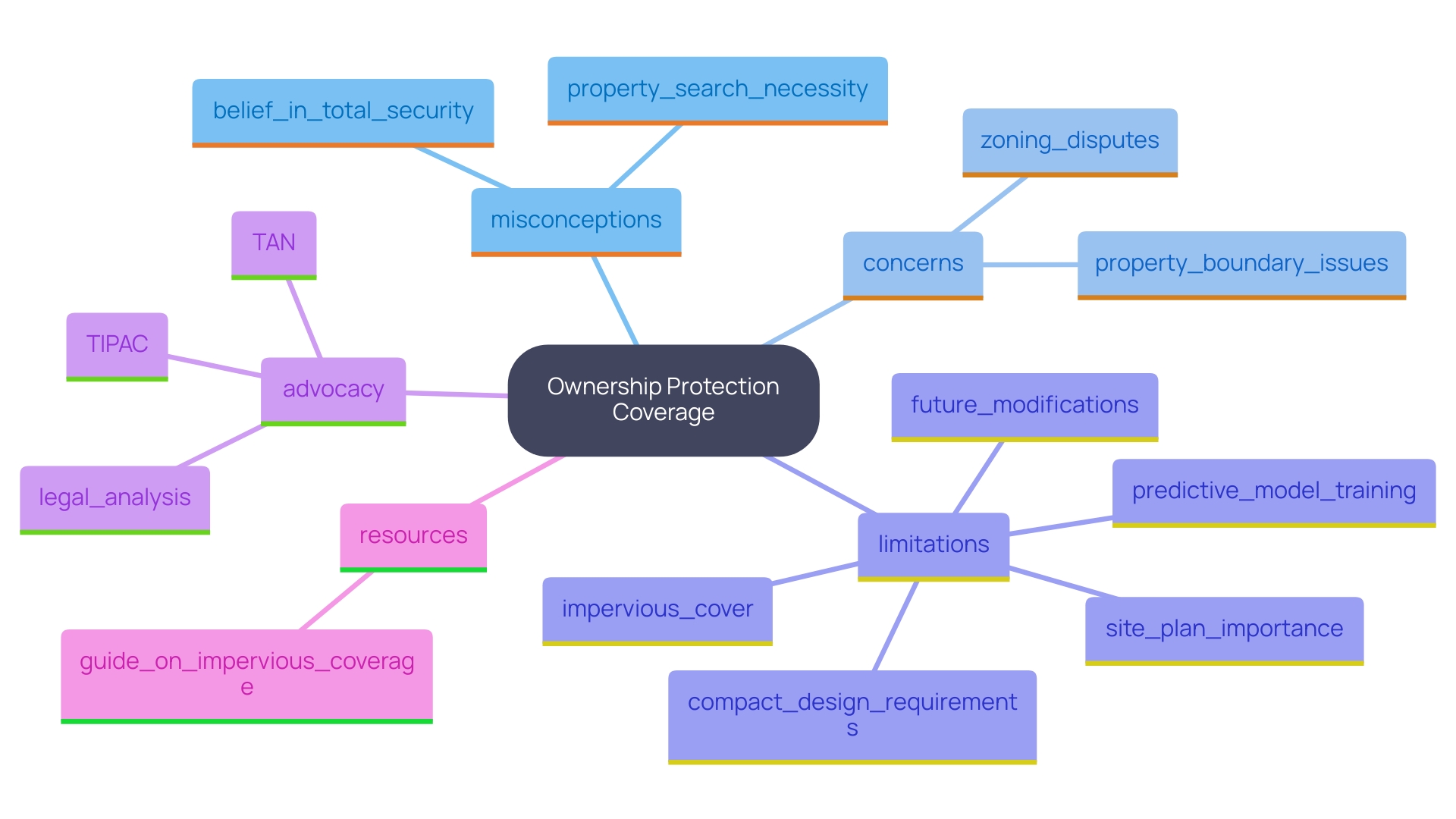

Common Misconceptions About Title Indemnity Insurance

Numerous misunderstandings exist around ownership protection coverage, with some thinking it ensures total security against all ownership problems. In reality, while property protection provides substantial coverage, it does not address every possible concern. For instance, it typically does not protect against claims arising from:

- Zoning disputes

- Issues related to property boundaries

Moreover, there is a notion that coverage for ownership protection is not needed if a detailed property search has been performed; however, even with extensive investigations, hidden flaws may still be present. Educating potential buyers and real estate professionals about these misconceptions is essential for making informed decisions regarding title indemnity insurance.

Conclusion

Title indemnity insurance is an indispensable component of real estate transactions, offering vital protection against potential title defects that could threaten ownership rights. It safeguards property owners and lenders alike, covering issues such as undisclosed heirs and errors in public records. This insurance not only mitigates financial risks but also instills confidence in property investments, thereby contributing to the overall stability of the real estate market.

Understanding the coverage and costs associated with title indemnity insurance is crucial for stakeholders. While the insurance provides substantial protection against various title defects, it is important to recognize its limitations. Misconceptions about the extent of coverage can lead to misunderstandings, emphasizing the need for education among potential buyers and real estate professionals.

In summary, title indemnity insurance is a critical tool in navigating the complexities of property ownership and financing. By fostering trust and facilitating smoother transactions, it allows all parties to engage with confidence, knowing they are protected against unforeseen legal claims. As the real estate landscape continues to evolve, the importance of title indemnity insurance remains clear, serving as a cornerstone for secure and stable property investments.

Frequently Asked Questions

What is title protection coverage?

Title protection coverage is a specialized insurance that protects asset owners and lenders from losses due to flaws in real estate ownership records, such as undisclosed heirs, liens, and errors in public records.

Why is ownership protection coverage important?

It provides financial security and reassurance to parties involved in real estate transactions by reducing the risk of unexpected claims related to ownership, thereby enhancing trust in real estate investments and contributing to the stability of the housing market.

What types of flaws does title protection coverage address?

Title protection coverage addresses various flaws, including unknown heirs, incorrectly documented papers, fraud, and forgery.

What financial losses does ownership protection coverage safeguard against?

It safeguards against financial losses such as legal fees incurred to settle disputes and compensation for loss of asset value.

How are the costs of ownership protection coverage determined?

The costs can vary based on factors like location, property value, and the level of coverage sought. Typically, premiums are calculated as a one-time payment at the closing of a property transaction.

Should potential buyers compare policies for title protection coverage?

Yes, it is advisable for potential buyers to compare policies from different insurers to find the best coverage that suits their needs.

How does ownership protection coverage benefit both purchasers and financiers?

It acts as a safeguard in property dealings, ensuring coverage for potential ownership defects, which facilitates smoother transactions and builds trust. Lenders often require this coverage to protect their investment in case of ownership disputes.

Are there any misconceptions about ownership protection coverage?

Yes, common misconceptions include the belief that it provides total security against all ownership problems and that it is unnecessary if a detailed property search has been conducted. However, it does not cover issues like zoning disputes or property boundary problems, and hidden flaws may still exist despite thorough investigations.

Why is it important to educate buyers and real estate professionals about ownership protection coverage?

Educating them about the limitations and misconceptions of ownership protection coverage is essential for making informed decisions regarding title indemnity insurance.