Overview

Pooling in oil and gas is the practice of consolidating multiple mineral rights or leasehold interests into a single operational unit, aimed at enhancing extraction efficiency and managing resources effectively. This collaborative approach—whether voluntary or mandatory—not only improves production rates and reduces costs but also presents challenges.

Potential disputes among landowners and legal complexities arise, making a thorough understanding of pooling agreements essential for stakeholders in the industry. Thus, grasping the intricacies of pooling is crucial for maximizing benefits while navigating the associated risks.

Introduction

Pooling in the oil and gas industry serves as a cornerstone for efficient resource management, allowing multiple mineral rights to be combined into a single operational unit. This practice not only enhances extraction efficiency but also fosters collaboration among landowners, enabling them to share costs and negotiate better lease terms.

However, the complexities of pooling agreements raise critical questions about control, profit distribution, and the potential for disputes. Furthermore, stakeholders must navigate these challenges while maximizing the benefits of pooling in a landscape marked by both opportunity and risk.

Define Pooling in Oil and Gas

What is pooling in oil and gas refers to a critical practice of consolidating multiple mineral rights or leasehold interests into a single operational unit, thereby enhancing extraction efficiency. This arrangement may occur voluntarily, where mineral rights owners mutually agree to combine their interests, or involuntarily, as mandated by regulatory authorities when certain acreage requirements are not satisfied. The operational unit, commonly referred to as a 'pool' or 'drilling unit,' facilitates coordinated drilling efforts and improved asset management.

For instance, resource-sharing agreements can vary in format; some allow landowners to share expenses related to exploration and production, while others may involve statutory collaboration, necessitating participation under specific circumstances. This cooperative approach not only aids in meeting drilling permit standards but also enhances production effectiveness by enabling managers to oversee resources across a broader area.

Industry leaders underscore what is pooling in oil and gas as a necessity for maximizing production rates and minimizing operational costs. Ryan Moore, Founder and CEO of Pheasant Energy, asserts, 'What is pooling in oil and gas is a vital practice in the oil and gas industry.' By merging interests, property owners can negotiate more favorable lease terms and access experienced operators, ultimately resulting in improved recovery rates and reduced risk. Nevertheless, potential drawbacks, such as loss of control over mineral rights and disputes among landowners, must be carefully considered. Understanding what is pooling in oil and gas is essential for ensuring that all participants benefit from the shared assets, solidifying its role as a fundamental aspect of contemporary operations.

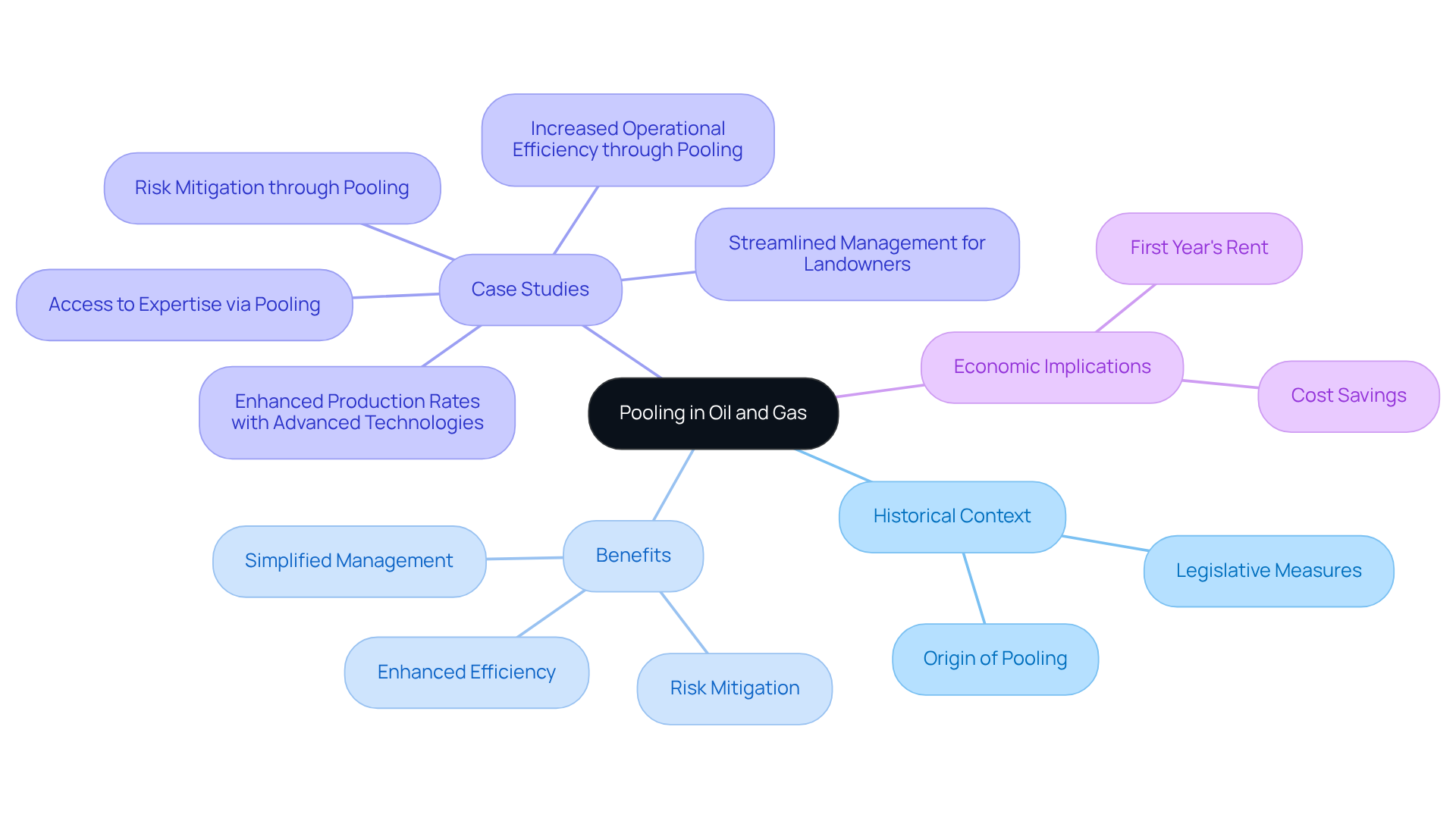

Explore the Historical Context and Significance of Pooling

In the context of oil and gas exploration, pooling in oil and gas refers to its origin in the early days, as it addressed the inefficiencies faced by companies managing fragmented land ownership. As the sector expanded, it became evident that consolidating mineral rights through collaboration could significantly enhance production efficiency and minimize material waste. Consequently, legislative measures were enacted across various jurisdictions to formalize resource-sharing agreements, enabling operators to combine resources and effectively share costs.

This historical evolution underscores the vital role of collaboration in facilitating large-scale oil and gas development, particularly in regions characterized by complex ownership arrangements. For instance, the initial year's rent for oil and gas leases typically stands at $1.50 per acre, illustrating the economic implications of collaborative agreements.

Case studies demonstrate that combining resources not only enhances operational efficiency but also mitigates risks for property owners by allowing them to distribute drilling and production risks across a broader area. Furthermore, resource consolidation simplifies oversight for property owners.

The case study titled 'Streamlined Management for Property Owners' exemplifies how resource sharing alleviates administrative burdens by enabling engagement with a single entity rather than managing multiple leases independently. Additionally, pooling resources grants landowners access to the expertise of seasoned operators, which is crucial for maximizing the potential of shared assets.

Overall, pooling in oil and gas development is of paramount significance, as it streamlines management processes and bolsters production capabilities, particularly through the establishment of shared units that consolidate separate tracts of land for collective development.

Identify Key Characteristics and Types of Pooling Agreements

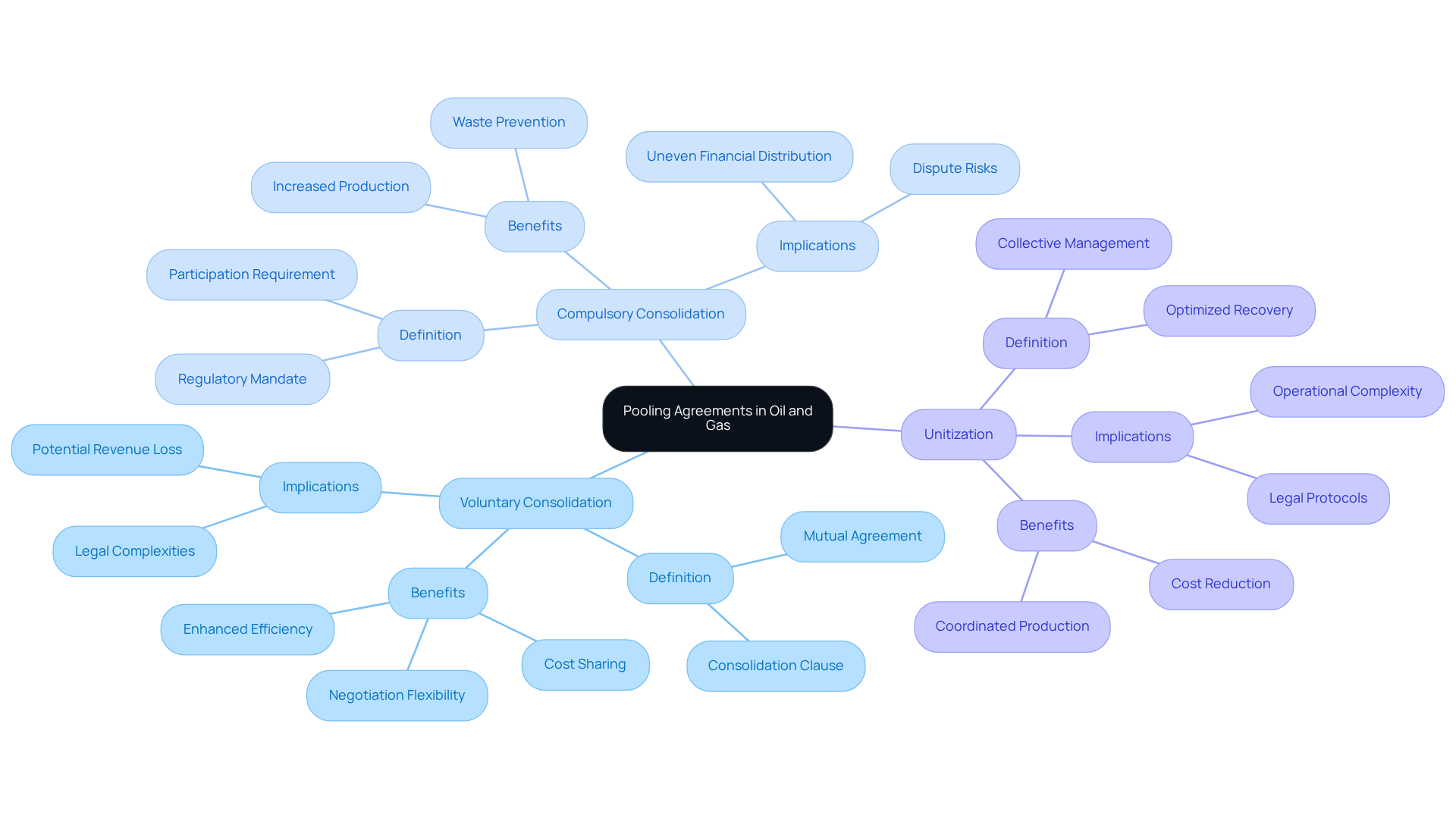

Agreements in the oil and gas sector are primarily classified into three categories:

- Voluntary consolidation

- Compulsory consolidation

- Unitization

Voluntary consolidation transpires when mineral rights owners mutually agree to merge their interests, typically encapsulated in a consolidation clause within a lease. This collaborative approach allows property owners to negotiate terms, share expenses, and improve extraction efficiency. Furthermore, what is pooling in oil and gas refers to the pooling of resources, which can lead to enhanced operational efficiency and financial savings due to shared assets, particularly benefiting property holders. For example, if a landowner contributes 10% of the pooled unit, they would receive 10% of the royalties generated from that unit.

Conversely, mandatory aggregation is imposed by regulatory authorities under specific conditions, mandating that all mineral owners within a designated area participate in extraction activities, regardless of individual agreement. This mechanism is crucial for boosting production and preventing material waste, while also addressing environmental risks associated with drilling activities. It is imperative for property owners to understand the legal complexities and risks of compulsory resource sharing, as disputes may arise from uneven distribution of financial benefits among property holders.

Unitization, while related, emphasizes the collective management of a reservoir, fostering coordinated production efforts across multiple leases. This arrangement is especially advantageous in optimizing recovery rates and reducing operational costs. Each type of shared use agreement carries distinct legal implications and operational protocols, making it essential for property owners and operators to comprehend these differences for effective asset management.

Current trends reveal an increasing inclination towards voluntary collaboration agreements, as they afford greater flexibility and control to landowners. Nonetheless, the necessity for mandatory sharing remains critical in regions where extraction efficiency is of utmost importance. Expert opinions suggest that while voluntary collaboration fosters teamwork and tailored agreements, mandatory consolidation serves as a vital regulatory framework to ensure equitable participation and asset utilization among mineral rights holders. As Ryan Moore articulates, "By collaboratively combining their interests, mineral rights owners can negotiate with oil and gas companies, share expenses, and obtain interests/royalties." Understanding what is pooling in oil and gas, along with Texas regulations regarding it, is essential for compliance and effective asset management.

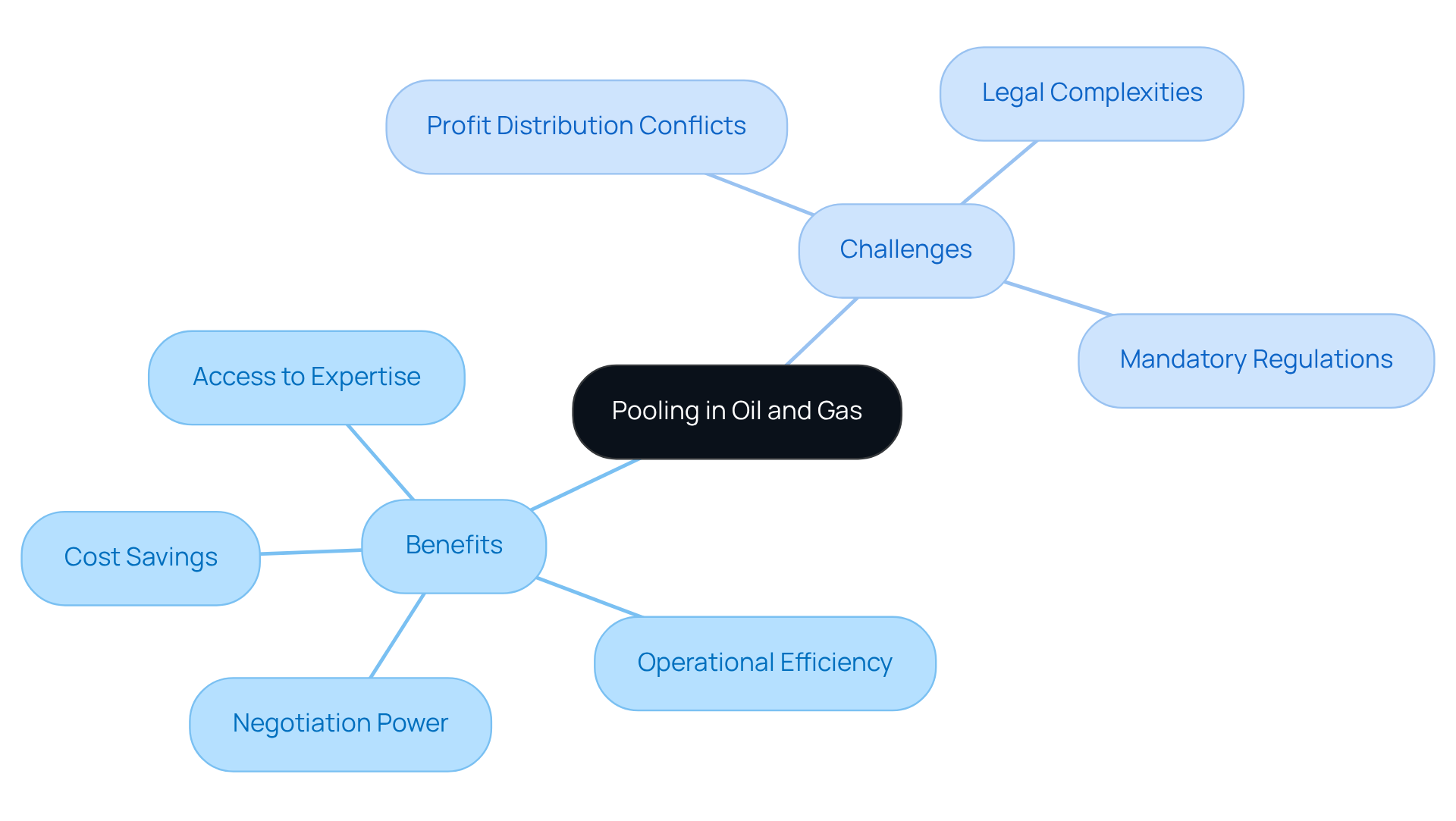

Analyze the Benefits and Challenges of Pooling

In the oil and gas industry, what is pooling in oil and gas refers to pooling agreements that offer numerous advantages, particularly in terms of cost savings achieved through shared exploration and drilling expenses. By consolidating resources, managers can notably reduce the number of wells drilled, thereby enhancing operational efficiency and minimizing environmental impacts. This collaborative approach not only empowers smaller landowners but also provides them with increased negotiation power and access to the expertise of seasoned operators. Pooling, which is what is pooling in oil and gas, typically occurs when a specific amount of total acreage is required to secure a drilling permit, making it an essential strategy within the industry.

Nevertheless, the landscape of resource sharing is fraught with challenges. Conflicts may emerge among mineral rights owners concerning profit distribution and decision-making authority, especially when interests diverge. The legal complexities inherent in collaboration agreements can lead to disputes if terms are not articulated clearly. For instance, mandatory resource-sharing regulations may compel non-consenting property owners to obtain minimum royalties, complicating negotiations and relationships among stakeholders. Pooling agreements can be either voluntary or mandatory, contingent upon property holder consent, which adds another layer of complexity to the process.

Statistics indicate that collaboration can yield significant cost reductions, with managers benefiting from enhanced production rates and diminished administrative responsibilities. By streamlining management processes, collective arrangements allow property owners to engage with a single operator rather than managing multiple leases, thereby further amplifying their investments. Moreover, the amalgamation of resources can result in greater returns from mineral assets, rendering it an appealing choice for landowners. Understanding these dynamics, particularly the importance of thoroughly examining aggregation clauses and what is pooling in oil and gas, is crucial for stakeholders in the oil and gas industry to navigate the intricacies of collective agreements effectively. The Mineral Interest Pooling Act (MIPA) serves a pivotal role in safeguarding smaller operators while facilitating pooling, ensuring that the interests of all parties are duly considered.

Conclusion

Pooling in oil and gas serves as a fundamental mechanism for enhancing resource management and extraction efficiency by consolidating mineral rights or leasehold interests into cohesive operational units. This strategic practice facilitates coordinated drilling efforts and allows for improved asset management, ultimately leading to better production outcomes and reduced operational costs. As the industry evolves, understanding the nuances of pooling becomes essential for stakeholders aiming to navigate the complexities of mineral rights and collaborative agreements.

Key insights throughout the article highlight the historical context of pooling, illustrating its emergence as a solution to fragmented land ownership and inefficiencies in oil and gas exploration. Various types of pooling agreements—voluntary, compulsory, and unitization—offer distinct advantages, such as cost savings, enhanced negotiation power, and access to experienced operators. However, potential challenges, including disputes over profit distribution and decision-making authority, underscore the importance of clear legal frameworks and thorough examination of agreement terms.

In light of these insights, it is crucial for landowners and operators to embrace the collaborative nature of pooling in oil and gas. By leveraging the benefits of resource consolidation, stakeholders can optimize their investments and mitigate risks associated with drilling activities. As the industry continues to face evolving challenges and opportunities, proactive engagement in pooling agreements will remain vital for maximizing production efficiency and ensuring equitable participation among mineral rights holders.

Frequently Asked Questions

What is pooling in oil and gas?

Pooling in oil and gas refers to the practice of consolidating multiple mineral rights or leasehold interests into a single operational unit to enhance extraction efficiency.

How can pooling occur?

Pooling can occur voluntarily, when mineral rights owners mutually agree to combine their interests, or involuntarily, as mandated by regulatory authorities when certain acreage requirements are not met.

What is an operational unit in the context of pooling?

The operational unit formed through pooling is commonly referred to as a 'pool' or 'drilling unit,' which facilitates coordinated drilling efforts and improved asset management.

What are some benefits of pooling?

Pooling aids in meeting drilling permit standards, enhances production effectiveness, allows for resource-sharing agreements, and enables managers to oversee resources across a broader area.

Why do industry leaders emphasize the importance of pooling?

Industry leaders highlight pooling as a necessity for maximizing production rates and minimizing operational costs, allowing property owners to negotiate better lease terms and access experienced operators.

What are potential drawbacks of pooling?

Potential drawbacks include loss of control over mineral rights and disputes among landowners, which must be carefully considered by participants.

Why is understanding pooling important for participants?

Understanding pooling is essential for ensuring that all participants benefit from the shared assets, solidifying its role as a fundamental aspect of contemporary operations in the oil and gas industry.