Overview

A title house is a crucial legal document in real estate that establishes ownership and protects the rights of property owners, detailing aspects such as the asset description, owner names, and any claims against the property. The article emphasizes the importance of clear ownership records to avoid disputes during transactions and highlights various ownership structures, title insurance, and the title search process as essential components in ensuring secure and transparent property ownership.

Introduction

In the intricate world of real estate, the significance of house titles cannot be overstated. These essential legal documents not only confirm property ownership but also serve as a protective shield against disputes and claims that could jeopardize one’s investment.

As the landscape of property ownership evolves, understanding the nuances of house titles—from their definitions and various ownership structures to the critical role of title insurance—becomes imperative for buyers, sellers, and real estate professionals alike.

This article delves into the complexities of house titles, exploring the processes involved in ensuring clear ownership and the legal considerations that arise during significant life changes, ultimately highlighting the importance of informed decision-making in safeguarding property rights.

Understanding House Titles: Definition and Significance

A residence document is a crucial legal record that outlines possession and acts as conclusive evidence of possession. It includes essential details such as the description of the asset, the names of the owners, and any claims or encumbrances associated with the asset. Comprehending the is essential, as it not only verifies possession but also .

In the realm of real estate transactions, the existence of a clear ownership document is essential; it assures prospective buyers that the asset is devoid of disputes and encumbrances, which . Recent legal developments highlight this significance, as can lead to significant challenges in property transactions. For example, the consent order mandating Bayport to pay $69,443.10 to servicemembers underscores the financial consequences of ownership disputes.

Furthermore, the case study of United States v. Pacific Mercantile Bank demonstrates real-world effects of discrimination in mortgage loan pricing, emphasizing the significance of in safeguarding all stakeholders. Furthermore, the recent settlement agreement in United States v. requires adjustments in mortgage loan policies, highlighting the necessity for transparency in ownership records to avoid future disputes. This sentiment reflects the broader implications of clarity in property identification, emphasizing the need for transparent records to protect all stakeholders in real estate.

Different Ways to Hold a House Title: Ownership Structures Explained

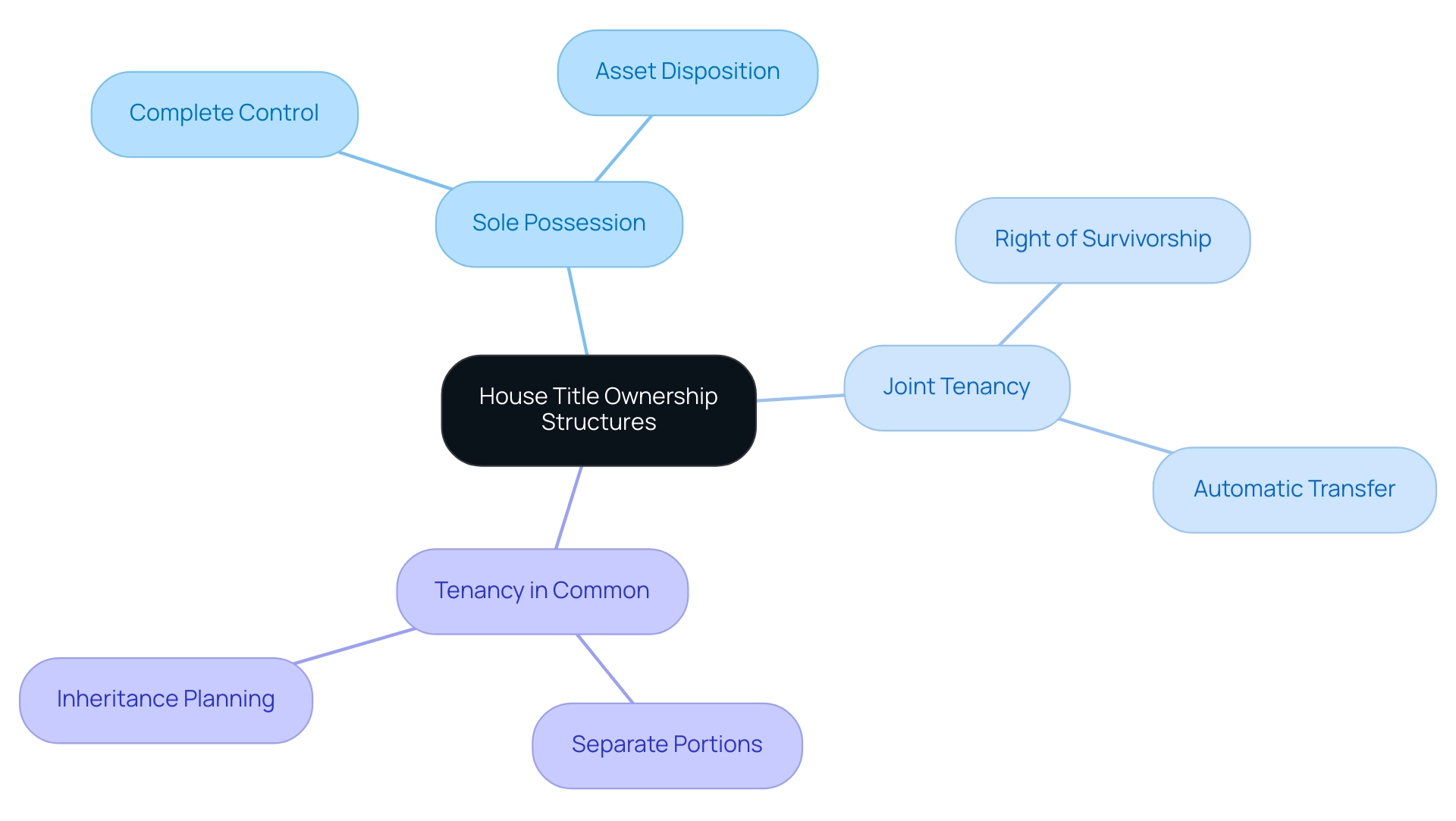

House documents can be held in different forms, each carrying unique legal consequences that significantly influence dynamics. The primary possession structures include:

- Sole possession

- Joint tenancy

- Tenancy in common

Sole possession signifies that one individual holds the title, granting them complete control over the asset and its disposition.

In contrast, sharing possession under the right of survivorship; this means that when one owner passes away, their automatically transfers to the remaining owner(s), ensuring . Tenancy in common permits several owners to possess separate portions of the asset, which can be passed on to heirs, providing adaptability in inheritance planning. For example, a residence such as 'The Alpine,' priced at $335,000 with 2,630 sq ft, illustrates how the structure of possession can affect .

Comprehending these control frameworks is vital for stakeholders in the real estate sector, as they can influence the asset's value and the consequences for legacy planning. Max Wahba, creator of Techsalerator, highlights the significance of asset possession information, pointing out that

is a valuable resource for real property experts, investors, marketers, and researchers looking for insights into asset possession and market trends.

Additionally, can assist in aligning property and financial plans with personal objectives, especially in managing the intricacies of property types.

As recent changes in joint tenancy laws continue to evolve, staying informed about these developments is essential for making astute property decisions. Furthermore, the increasing trend of utilizing cryptocurrency for emphasizes the necessity of comprehending in contemporary transactions. Methods such as converting crypto to cash or directly transferring it to sellers demonstrate the evolving landscape of asset ownership, making it imperative for stakeholders to stay abreast of these trends.

The Role of Title Insurance in Protecting Homeowners

serves as an essential protection for , shielding them from various possible problems that can arise with , including undiscovered liens, fraud, or mistakes in public records. When purchasing a asset, buyers generally obtain insurance to protect their investment from unexpected issues. This insurance not only covers legal expenses and losses resulting from ownership defects but also instills confidence in homeowners as they navigate real estate.

In a competitive real estate environment, where the average cost of insurance is a crucial consideration, the significance of this coverage is magnified. A recent report highlighted that the Combined Ratio for stands at 103.6%, indicating the industry's ongoing challenges and the necessity for tailored products that cater to unique risk needs. This statistic suggests that insurers are facing higher claims relative to their premiums, emphasizing the importance of developing specialized solutions to address specific risks.

Moreover, specialists highlight that plays a crucial role in ensuring , as it addresses the . As John Burns observed, despite increasing home prices and intense competition, it’s essential to comprehend the story surrounding the and its implications for homeowners.

The Title Search Process: Ensuring Clear Ownership

The is a crucial phase in real estate dealings, involving a thorough review of public records to verify ownership and uncover any existing claims or liens. This comprehensive review typically encompasses the title house's ownership history, outstanding mortgages, and potential legal disputes linked to the ownership. the efficiency and accuracy of their searches by leveraging (OCR), as exemplified by 's platform.

With features like and interactive labeling, Parse AI enables researchers to quickly extract and annotate essential information from document titles, streamlining runsheet creation. The interactive labeling feature enables users to create custom labels for data extraction, allowing for a tailored approach that enhances the accuracy of information retrieval. Automated data entry systems can reduce document retrieval time by up to 50%, thereby expediting the overall process.

However, it is essential to recognize that inaccurately scanned or manually inputted documents may not be indexed correctly, which can lead to . not only provides buyers with clear rights but also offers peace of mind by uncovering any potential issues that could jeopardize their investment. As emphasized by experts in the field, is crucial; inaccuracies due to manual input can lead to significant complications.

Therefore, when choosing a company for closing services, property buyers should consider factors such as the provider's experience, reputation, technology use, , and , as these elements play a vital role in ensuring a smooth transaction. A reputable firm prioritizes transparency and effective communication, managing client expectations throughout the transaction. This commitment to excellence is echoed by the First National Title Insurance Company, which states, 'Together, we can build a partnership founded on trust, efficiency, and excellence.'

Parse AI was created by a group of energy, real estate, and technology professionals who have over 50 years of industry experience. By understanding the intricacies of the search process and the importance of selecting the appropriate provider, property buyers can make informed decisions and protect their investments.

Transferring House Titles: Legal Considerations During Life Changes

The transfer of is often necessitated by , including marriage, divorce, or the death of an owner. These transitions bring with them critical legal considerations that can profoundly influence and responsibilities. For instance, during a divorce, it is essential to change the title house of an asset to reflect the updated possession framework, ensuring that both parties' rights are recognized and safeguarded.

According to the NATIONAL ASSOCIATION OF REALTORS®, buyers typically anticipate residing in their homes for a median of 15 years, which highlights the significance of during such pivotal life events. Furthermore, in instances where an owner passes away, the title house must be appropriately transferred to heirs or beneficiaries, adhering to the stipulations outlined in a will or dictated by state laws. Life arrangements, while beneficial for simplifying asset transfer and avoiding probate delays, can introduce legal complexities, particularly regarding the rights of life tenants and remaindermen.

As highlighted in the case study on , while they provide significant benefits in terms of property transfer and potential tax implications, they also expose the life tenant to legal issues related to the remainderman and restrict the owner's ability to sell or mortgage the property. Understanding these is vital for maintaining clear ownership and ensuring compliance with relevant regulations, especially given the potential for legal challenges that can arise during resulting from life changes.

Conclusion

House titles are essential to property ownership, providing definitive proof that protects owners' rights and facilitates transactions. Understanding the key components of a house title and various ownership structures—such as sole ownership, joint tenancy, and tenancy in common—is crucial in the real estate market. Recent legal cases underscore the importance of clear title records, highlighting the need for transparency among stakeholders.

Title insurance serves as a vital safeguard, protecting homeowners from unforeseen issues that could jeopardize their investments. By obtaining title insurance, buyers can confidently navigate property ownership complexities, knowing they are shielded from potential legal disputes. Furthermore, the title search process is critical for confirming clear ownership, with advancements in technology improving the efficiency of this essential examination.

Life changes often require the transfer of house titles, introducing important legal considerations that must be addressed to protect ownership rights. Whether due to marriage, divorce, or the passing of an owner, understanding these implications is vital for ensuring compliance with regulations and maintaining clear ownership.

In conclusion, the complexities of house titles demand careful attention. By prioritizing clarity in title ownership, recognizing the importance of title insurance, and understanding the legal processes involved in title transfers, stakeholders can safeguard their investments and navigate the evolving landscape of property ownership with confidence.

Frequently Asked Questions

What is a residence document and why is it important?

A residence document is a legal record that outlines possession of an asset, serving as conclusive evidence of ownership. It includes details such as the asset description, owner names, and any claims or encumbrances. It is crucial for verifying possession and protecting the rights of the proprietor.

How does a clear ownership document affect real estate transactions?

A clear ownership document assures prospective buyers that the asset is free of disputes and encumbrances, facilitating a seamless transfer of ownership. Ambiguous property documents can lead to significant challenges, as highlighted by legal developments and disputes.

What are the different structures of property possession?

The primary possession structures include: 1. Sole possession: One individual holds the title, granting complete control. 2. Joint tenancy: Two or more individuals share possession with the right of survivorship, meaning the title transfers automatically upon an owner's death. 3. Tenancy in common: Multiple owners possess separate portions of the asset, which can be inherited.

How do these possession structures influence real estate?

The structure of possession can significantly affect the asset's value and legacy planning. Understanding these frameworks is vital for stakeholders in the real estate sector.

What role does asset owner data play in real estate?

Asset owner data is a valuable resource for real property experts, investors, marketers, and researchers, providing insights into asset possession and market trends.

Why is it important to stay informed about changes in joint tenancy laws?

Recent changes in joint tenancy laws can impact property decisions, making it essential for stakeholders to stay updated to make informed choices.

How is cryptocurrency influencing real estate transactions?

The increasing trend of using cryptocurrency for real estate acquisitions necessitates an understanding of property structures, as methods like converting crypto to cash or direct transfers to sellers are becoming more common.