Introduction

In the intricate landscape of real estate transactions, the role of title company underwriters emerges as a cornerstone of security and reliability. Tasked with the critical responsibility of assessing and managing risks associated with title insurance, these professionals ensure that property titles are legitimate and free from encumbrances that could jeopardize ownership. As the title insurance industry faces mounting challenges, including a significant decline in premium revenue and increasing claims, the expertise of underwriters becomes ever more vital.

Their meticulous evaluations not only safeguard the interests of buyers and lenders but also reinforce the integrity of the entire real estate process. With advancements in technology poised to reshape underwriting practices, understanding the evolving responsibilities and challenges faced by these professionals is essential for anyone involved in real estate.

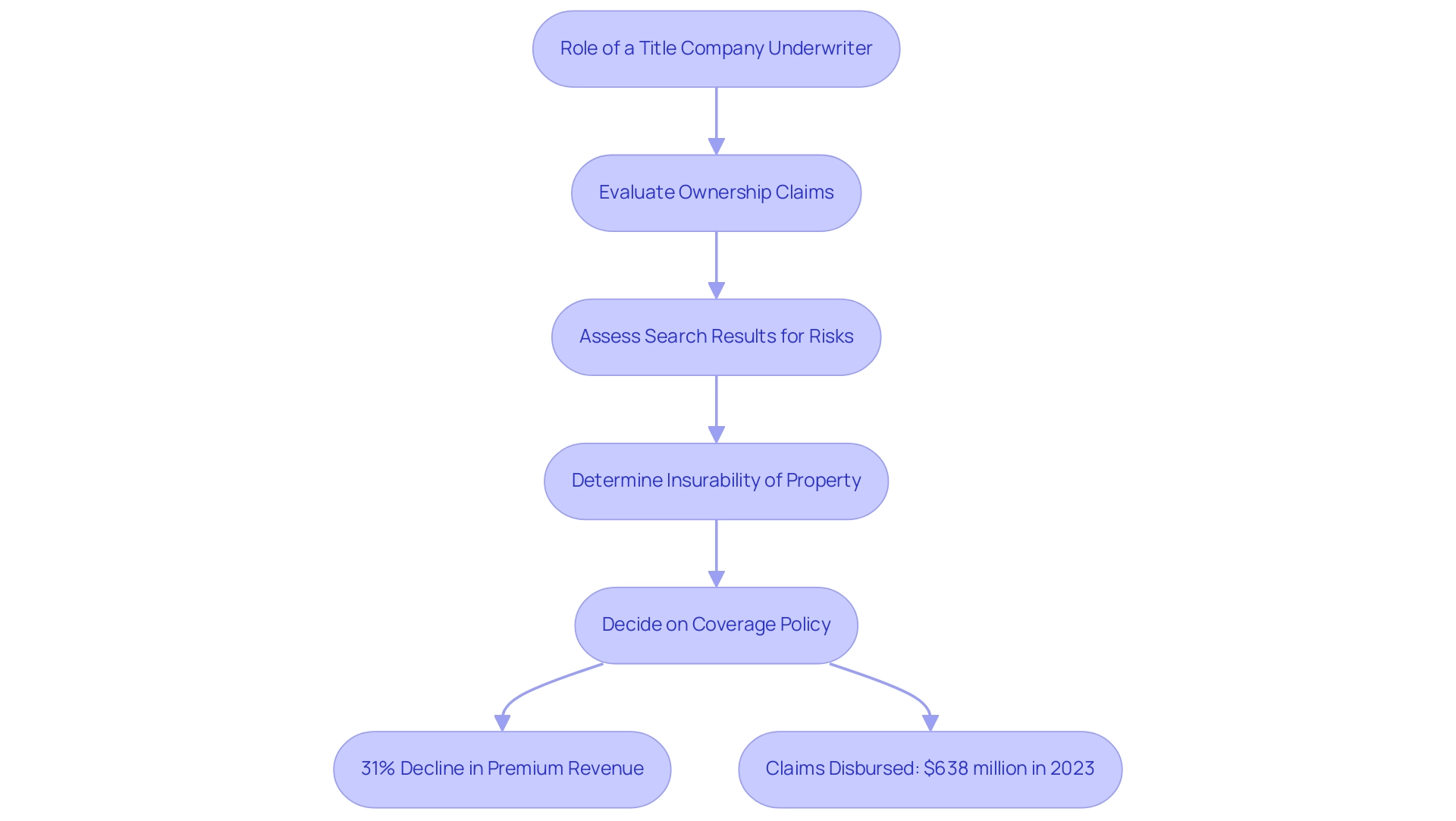

Defining the Role of a Title Company Underwriter

A firm underwriter is a specialized expert responsible for evaluating and overseeing the risks linked with property coverage in real estate dealings. Their role is crucial in verifying that the ownership claim to a property is legitimate and free from legal encumbrances that could affect possession. This involves meticulously assessing the search results for ownership, determining the insurability of the property, and deciding whether to issue a coverage policy. The reported a 31% decline in premium revenue for the insurance sector in 2023 compared to 2022, while claims disbursed rose by roughly 7%, emphasizing the growing difficulties insurers encounter.

Paul G. Mackey of the American Land Title Association observed that the industry disbursed over $638 million in claims in 2023, an increase from $596 million in 2022. This emphasizes the significance of precise risk evaluation and decision-making by those assessing to safeguard the interests of buyers, lenders, and the title company itself. An example of the complexities underwriters navigate can be seen in WFG National Title Insurance Company (FL), which has a suggested maximum risk of $41,200,000, demonstrating the significant financial stakes involved.

In 2023, high interest rates slowed property transactions, further complicating the underwriter's task of maintaining the balance between risk and premium revenue. These professionals are essential to the estate process, ensuring that all parties involved are safeguarded from potential disputes and financial losses. As the industry moves into 2024, updates in practices are expected to focus on enhancing risk assessment methodologies and integrating technology to streamline processes. The significance of coverage in property transactions cannot be exaggerated, as it offers crucial protection against unexpected claims and disagreements, emphasizing the necessity for careful underwriting practices. For instance, insurers often perform comprehensive reviews of property histories and legal documents to identify potential risks, thereby ensuring that the insurance provided is robust and dependable.

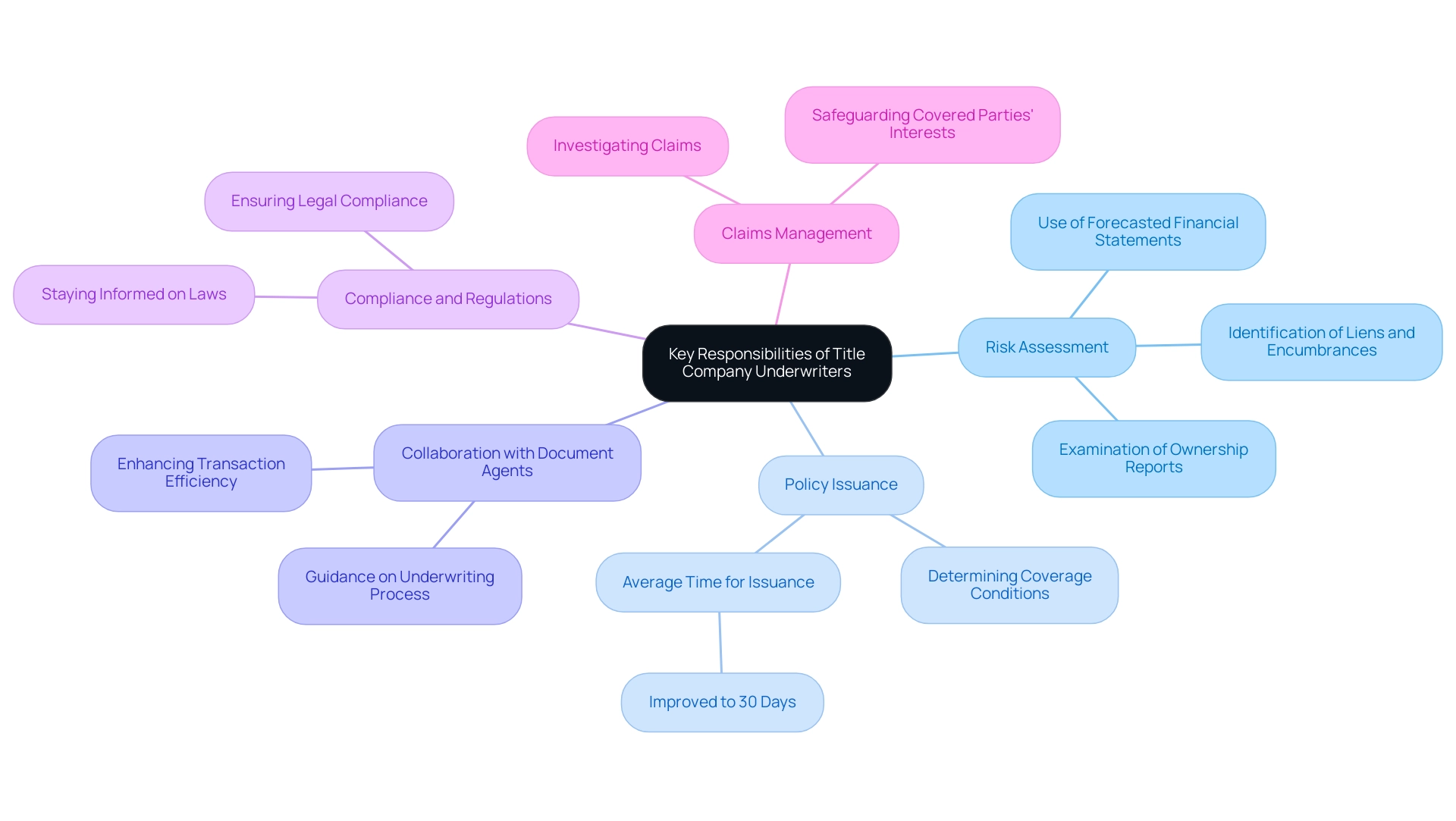

Key Responsibilities of Title Company Underwriters

Title company underwriters play a pivotal role in the real estate transaction process, with several key responsibilities:

- Risk Assessment: Underwriters meticulously examine ownership reports and public records to identify potential risks associated with ownership, liens, or other encumbrances. For instance, they may analyze historical property records to uncover undisclosed liens or easements that could affect ownership. This step is crucial in determining the insurability of a deed. The platform's ability to provide forecasted financial statements helps organizations make informed decisions, ensuring a thorough risk assessment process.

- Policy Issuance: Based on their assessments, underwriters determine whether to issue a coverage policy and under what conditions. This decision impacts both buyers and lenders, defining the coverage provided in the event of future claims. Recent trends indicate that the average time taken for insurance policy issuance has improved significantly, with some companies reporting reductions to as little as 30 days, attributed to integrated systems and improved responsiveness, as seen with Asteron Life's 20% increase in new business.

- Collaboration with Document Agents: Underwriters work closely with document agents to ensure all necessary documentation is collected and reviewed. They provide guidance on the underwriting process and support agents in addressing any issues. This collaborative effort enhances the overall efficiency and accuracy of the transaction.

- Compliance and Regulations: Staying informed about relevant laws and regulations governing real estate transactions is essential for those evaluating risks. They ensure that all policies and practices comply with legal requirements, protecting both the company and its clients. This adherence to compliance is critical in maintaining the integrity of the underwriting process.

- Claims Management: In the event of a claim against a title protection policy, specialists play a crucial role in investigating and resolving the claim, safeguarding the interests of the covered parties. Effective claims management is essential for maintaining trust and reliability in the insurance provided.

Denpong Jesadaviriya, EVP of Life Operations at Thai Life Insurance, emphasizes the importance of innovation in this field, stating,

If you're ready to revolutionize how you do business, we should talk.

This sentiment resonates with the evolving responsibilities of those in the underwriting field, particularly in adopting new technologies and practices that enhance efficiency and accuracy. For instance, sponsorship underwriting, which entails financial backing for initiatives, especially in broadcasting, is crucial for maintaining operations and guaranteeing project feasibility.

Through these duties, company underwriters greatly enhance the security and dependability of property transactions, cultivating trust among purchasers, vendors, and financial institutions.

The Importance of Title Insurance in Real Estate Transactions

Title protection is a cornerstone of , providing essential safeguards to both buyers and lenders against potential losses arising from defects in ownership records. These defects can range from unpaid liens and undisclosed heirs to instances of fraud or clerical errors in public records.

For instance, there have been situations where purchasers encountered considerable monetary losses because of hidden liens on a property; coverage would address the legal expenses and any financial losses experienced, ensuring that the buyers are not left exposed.

Highlighting the critical nature of this coverage, IBISWorld emphasizes the human-verified data and analysis that underpin each industry report, reinforcing the reliability of the information used to assess risks. The coverage sector is divided into different product lines, with direct premiums being the largest segment, highlighting the varied offerings available to satisfy specific consumer needs.

Title protection ensures buyers can proceed confidently with their purchase, knowing their investment is secure. Furthermore, companies like Old Republic International Corporation are projected to maintain a robust profit margin of 11.5% in 2024, illustrating the financial stability and importance of the industry.

Recent population trends indicate that the distribution of property protection establishments is concentrated in the West, Southeast, and Southwest regions of the US, reflecting the demand for these essential services.

Specialists in the property sector stress that ownership protection is essential for safeguarding both purchasers and lenders, as it reduces risks linked to property ownership. Overall, property insurance remains essential in safeguarding real estate investments, providing peace of mind and financial security to all parties involved.

Challenges Faced by Title Company Underwriters

Title company assessors face various that can complicate their work. Some of these challenges include:

- Incomplete Records: Search results frequently uncover insufficient or contradictory documentation, complicating the ability of evaluators to determine the insurability of a property precisely.

- Legal Complexity: The intricacies of property law and the legal terminology used in ownership documents can present significant obstacles, necessitating that assessors possess a profound comprehension of legal principles.

- Technological Integration: As the field progresses, evaluators must adjust to emerging technologies, such as machine learning and optical character recognition, to enhance efficiency and precision in research.

- Market Fluctuations: Economic changes can impact property values and the overall real estate market, adding an additional layer of risk that underwriters must consider when evaluating ownership documents.

By recognizing these challenges, stakeholders can better appreciate the expertise and diligence required from company underwriters in ensuring secure real estate transactions.

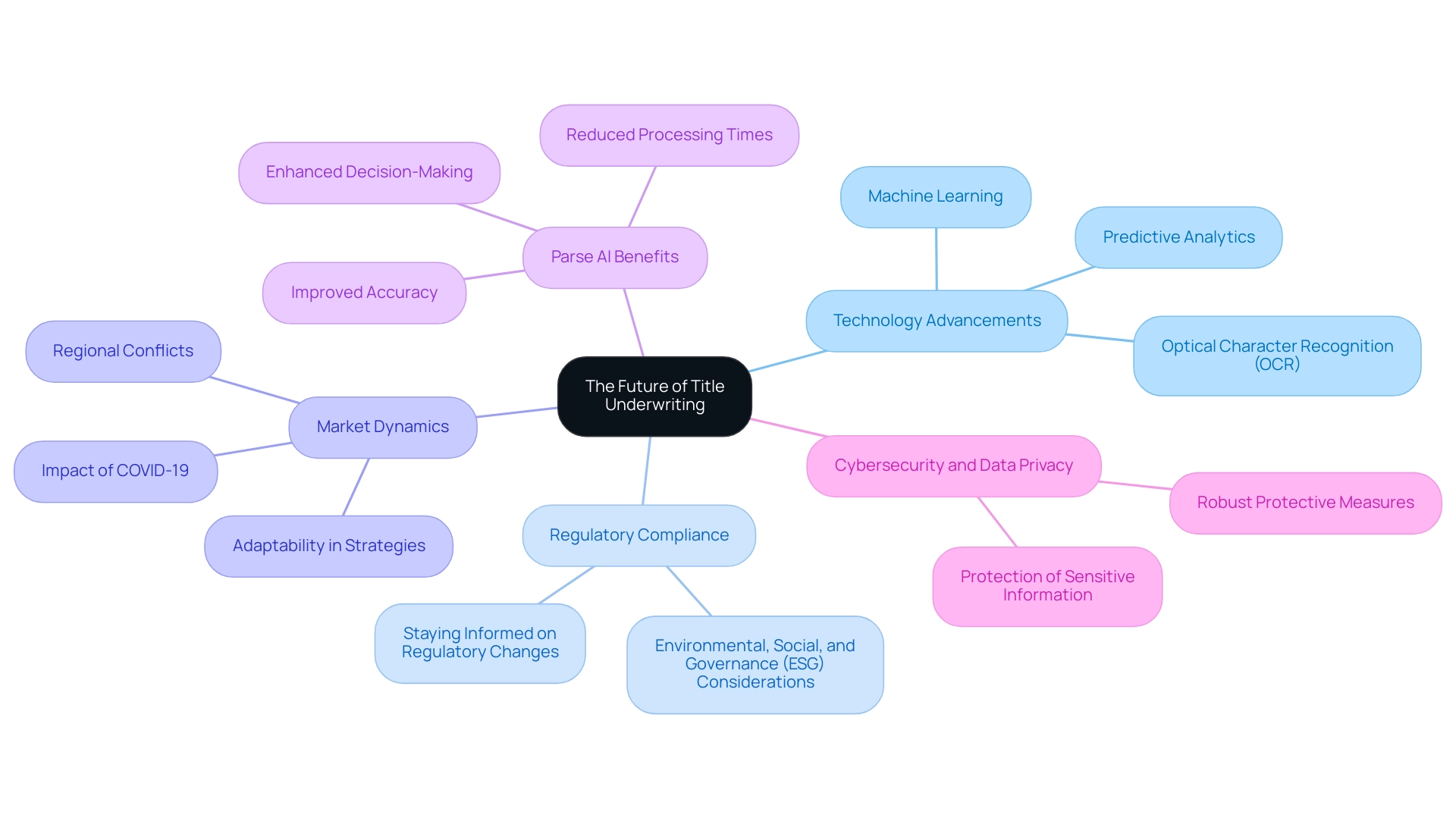

The Future of Title Underwriting

The future of insurance underwriting is on the brink of a significant transformation, driven by advancements in technology and evolving market dynamics. With the integration of advanced machine learning tools and optical character recognition (OCR) technologies, platforms like Parse AI are transforming the research process. These innovations allow underwriters to efficiently analyze extensive amounts of data, streamline courthouse document processing, and automate tasks to enhance accuracy and integrity in property transactions.

For instance, Parse AI's interactive labeling features allow users to annotate documents easily, ensuring that critical information is extracted swiftly and accurately. This capability, combined with full-text search and machine learning extraction, facilitates rapid identification of potential defects by analyzing historical data patterns, ultimately allowing for more informed decision-making.

Founded by professionals with over 50 years of industry experience, Parse AI was developed to address the challenges faced in confirming real property ownership. As we approach 2024, the insurance sector is set to witness further innovations, such as the integration of AI for predictive analytics and automated underwriting processes.

However, it remains crucial for risk assessors to stay abreast of regulatory changes and environmental, social, and governance (ESG) considerations to maintain compliance and competitiveness in this digital landscape. Moreover, heightened cybersecurity and data privacy concerns underscore the necessity for robust protective measures as digital transactions become the norm.

The recent report on the highlights the impacts of global challenges, including the COVID-19 pandemic and regional conflicts, emphasizing the importance of adaptability in strategies to ensure growth and stability. With these evolving dynamics, embracing technologies like those provided by Parse AI will be essential for underwriters to navigate challenges and seize opportunities in the market. The specific benefits of using Parse AI's services include improved accuracy and reduced processing times, making it an invaluable tool for modern title research.

Conclusion

In the realm of real estate transactions, the role of title company underwriters is indispensable, serving as the guardians of title integrity and security. Their meticulous risk assessments and policy issuance processes not only protect buyers and lenders but also uphold the overall reliability of the real estate market. As highlighted, the industry faces significant challenges, including declining premium revenues and increasing claims, which further underscore the critical nature of their work.

The responsibilities of underwriters extend beyond mere evaluations; they encompass collaboration with title agents, ensuring compliance with regulations, and managing claims effectively. These multifaceted roles reflect the complexity of the real estate landscape, where every decision can have far-reaching implications. The emphasis on technology integration and innovative practices is essential for adapting to market fluctuations and enhancing operational efficiency, allowing underwriters to navigate an increasingly intricate environment.

Looking ahead, the future of title underwriting promises transformative advancements driven by technology. The adoption of machine learning and data analytics tools will revolutionize risk assessment and streamline workflows, enabling underwriters to make more informed decisions swiftly. As the industry evolves, staying compliant with regulatory changes and addressing cybersecurity concerns will be paramount.

The ongoing commitment to excellence and adaptation will ensure that title company underwriters remain vital players in safeguarding property ownership, fostering trust among all stakeholders involved in real estate transactions.

Frequently Asked Questions

What is the role of a firm underwriter in real estate transactions?

A firm underwriter evaluates and oversees the risks associated with property coverage, ensuring that ownership claims are legitimate and free from legal encumbrances. They assess ownership search results, determine the insurability of the property, and decide whether to issue a coverage policy.

How has the insurance sector performed recently?

The American Land Title Association reported a 31% decline in premium revenue for the insurance sector in 2023 compared to 2022, while claims disbursed rose by approximately 7%. This indicates growing challenges for insurers.

What are the key responsibilities of title company underwriters?

Title company underwriters are responsible for risk assessment, policy issuance, collaboration with document agents, compliance with regulations, and claims management. They ensure thorough evaluations and maintain legal compliance to protect clients' interests.

Why is title protection important in real estate transactions?

Title protection safeguards buyers and lenders against potential losses from defects in ownership records, such as unpaid liens or fraud. It ensures that buyers can confidently proceed with their purchases, knowing their investments are secure.

What challenges do title company assessors face?

Assessors face challenges such as incomplete records, legal complexities, the need for technological integration, and market fluctuations. These factors complicate their ability to determine property insurability accurately.

How is technology transforming the insurance underwriting process?

Advancements in technology, including machine learning and optical character recognition, are streamlining the research process for underwriters. These tools enhance data analysis, automate tasks, and improve accuracy in property transactions.

What future developments are expected in insurance underwriting?

The insurance sector is expected to see further innovations, including the integration of AI for predictive analytics and automated underwriting processes. Staying updated on regulatory changes and cybersecurity concerns will also be crucial for underwriters.