Introduction

In the intricate world of real estate transactions, title and escrow companies play indispensable roles in ensuring both the legitimacy and security of property ownership transfers. Title companies delve deep into property histories, scrutinizing public records to verify ownership and uncover potential issues such as liens, boundary disputes, or fraud. Their meticulous research safeguards buyers and lenders, providing title insurance to protect against future claims.

Escrow companies, acting as neutral third parties, manage the financial elements of these transactions, holding funds and documents until all contractual obligations are met. This collaboration between title and escrow companies is crucial for a seamless closing process, ensuring that every step is handled with precision and care. As the real estate landscape evolves, particularly with increasing instances of wire fraud, the synergy between these entities becomes even more vital, highlighting their role in protecting the interests of all parties involved in property transactions.

What is a Title Company?

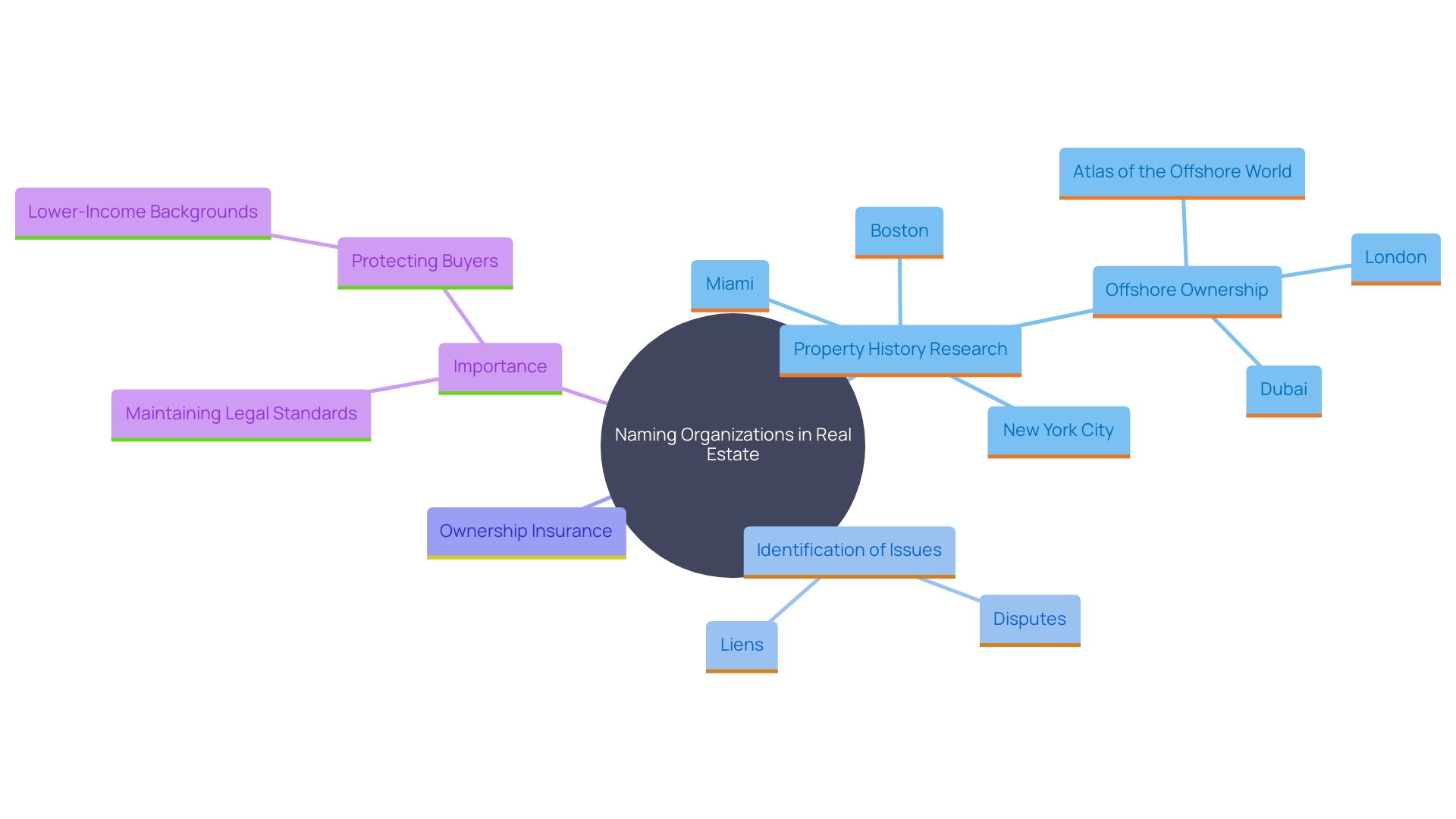

A naming organization is essential to , guaranteeing the authenticity and transparency of property ownership. They conduct meticulous research on , examining public records to confirm ownership and identify potential issues such as liens, boundary disputes, or even fraud. For instance, the Riverside Abstract case highlighted the importance of after their involvement in a fraudulent scheme surfaced. also evaluate adherence to local regulations to avoid future .

Additionally, organizations provide , protecting purchasers and financiers from potential claims on the property. This protection is particularly vital for lower-income buyers who might otherwise struggle to defend their ownership rights against unexpected disputes. The sector, represented by organizations like ALTA, actively participates in legal examination and advocacy to maintain these standards and ensure the ongoing reliability and credibility of insurance services. Ownership insurance continues to be a fundamental aspect in safeguarding property investments, highlighting the essential function of ownership firms in the wider property network.

Services Provided by a Title Company

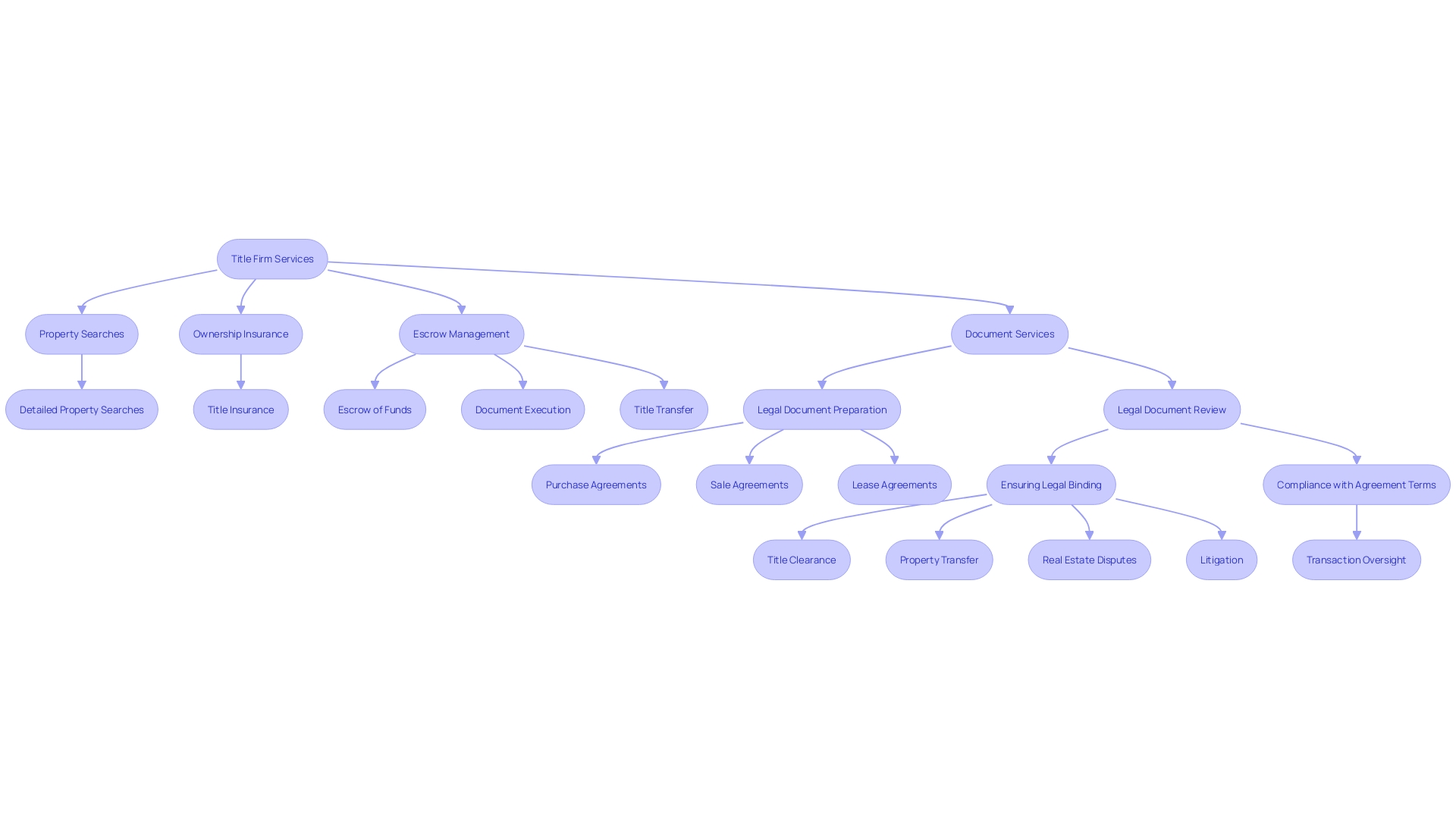

Title firms offer a crucial for seamless real estate dealings. One of their main roles is performing detailed property searches, examining the history of the asset to reveal any possible concerns. Organizations in the real estate sector also provide ownership insurance, an essential protection against ownership flaws, guaranteeing that purchasers and lenders are shielded from unexpected claims.

Alongside these services, property firms play a crucial role in the closing process. They oversee the escrow of funds, ensuring all documents are properly executed and that ownership is transferred seamlessly from seller to buyer. This coordination is vital in facilitating secure property ownership and mitigating risks associated with real estate transactions.

Furthermore, document services frequently broaden their offerings to encompass notary functions and the arrangement of essential legal papers, guaranteeing adherence to all regulatory standards. Innovations like the SingleSource Attorney Conclusion of Title (ACT®) have further enhanced the efficiency and cost-effectiveness of these processes. ACT® merges the power of a legal ownership assessment with summarized ownership proof, presenting a feasible substitute for conventional ownership insurance and delivering substantial savings to property owners.

The sector of property ownership documentation remains dynamic, shaped by regulatory frameworks that differ across states, emphasizing the necessity for firms in this field to stay informed about the latest legal requirements. Staying informed about industry news and utilizing innovative products like ACT® can enable title firms to better assist their clients and maneuver through the competitive environment efficiently.

What is an Escrow Company?

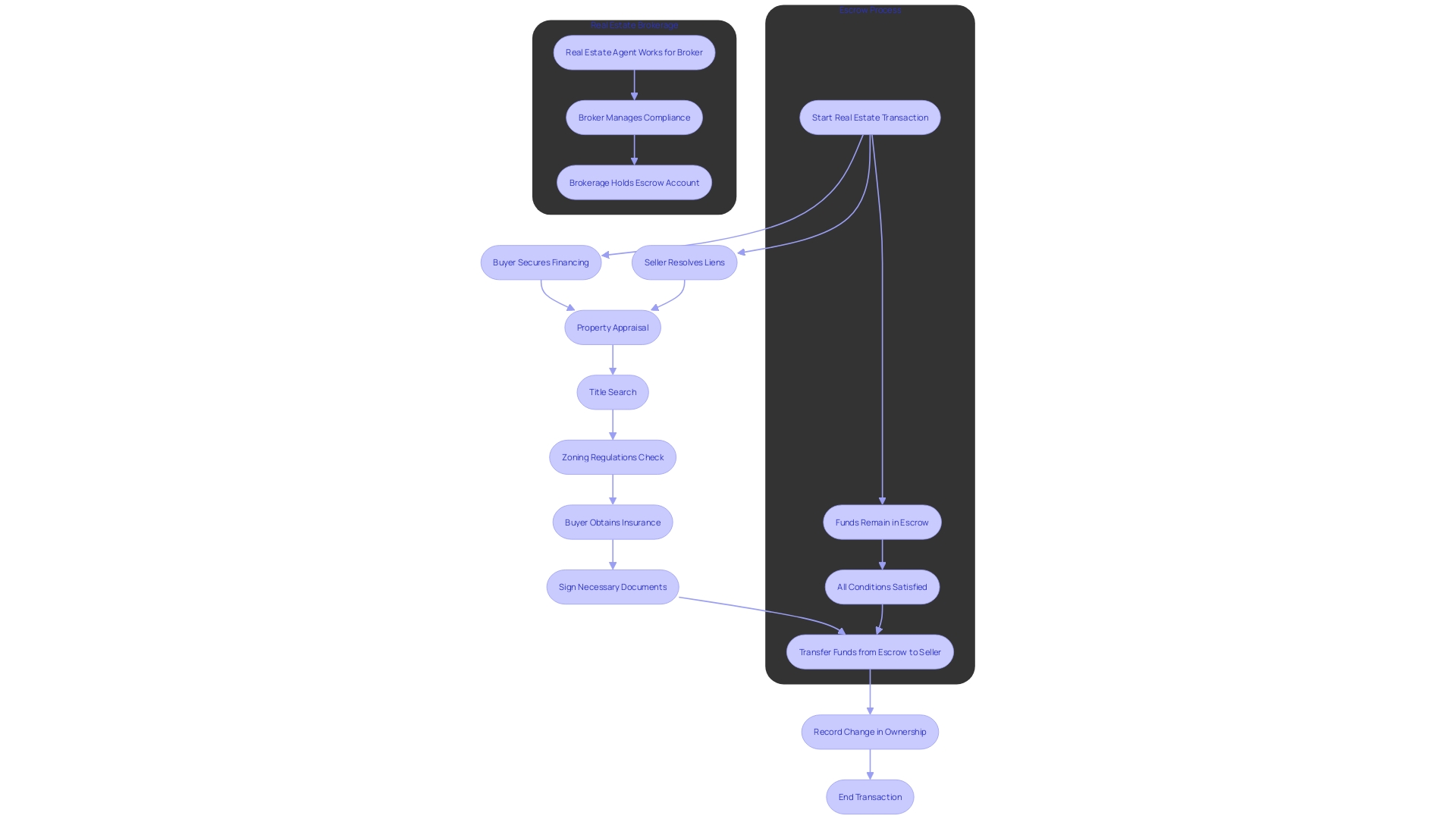

A neutral third entity operates as a mediator that retains funds and documents associated with a real estate deal until all contractual responsibilities are met. This impartiality is crucial in ensuring that both the buyer and seller meet their respective responsibilities before the disbursement of funds and occur. By managing the distribution of funds and maintaining , deposit companies help reduce risks for all parties involved.

The function of a is essential for safeguarding the interests of all transaction stakeholders. For example, lenders gain advantages from trust accounts as they guarantee that are paid and insurance is upheld, safeguarding the lender's investment. Mortgage expert Luke Skar explains that lenders perform a financial analysis annually to verify the correct amounts are collected, highlighting the meticulous nature of this process.

, such as those in Massachusetts, take on the responsibility of ensuring a of funds and documents. They safely hold the variables involved in the transaction until all conditions outlined in the escrow agreement are met, coordinating with lenders, reviewing contracts, and verifying title information. This level of diligence provides throughout the transaction, as observed by property experts.

'The case of vertical integration in property, discussed at the Qualia’s 2024 Future of Property Summit, illustrates the trend towards simplifying the home buying process.'. Firms such as Compass and One Real Title are merging various phases of the transaction to foster greater connectivity among stakeholders, thus improving the effectiveness and transparency of the process. This approach not only simplifies the closing process but also creates cost and operational efficiencies, highlighting the evolving strategies within the industry to improve the home buying experience.

How Title and Escrow Companies Work Together

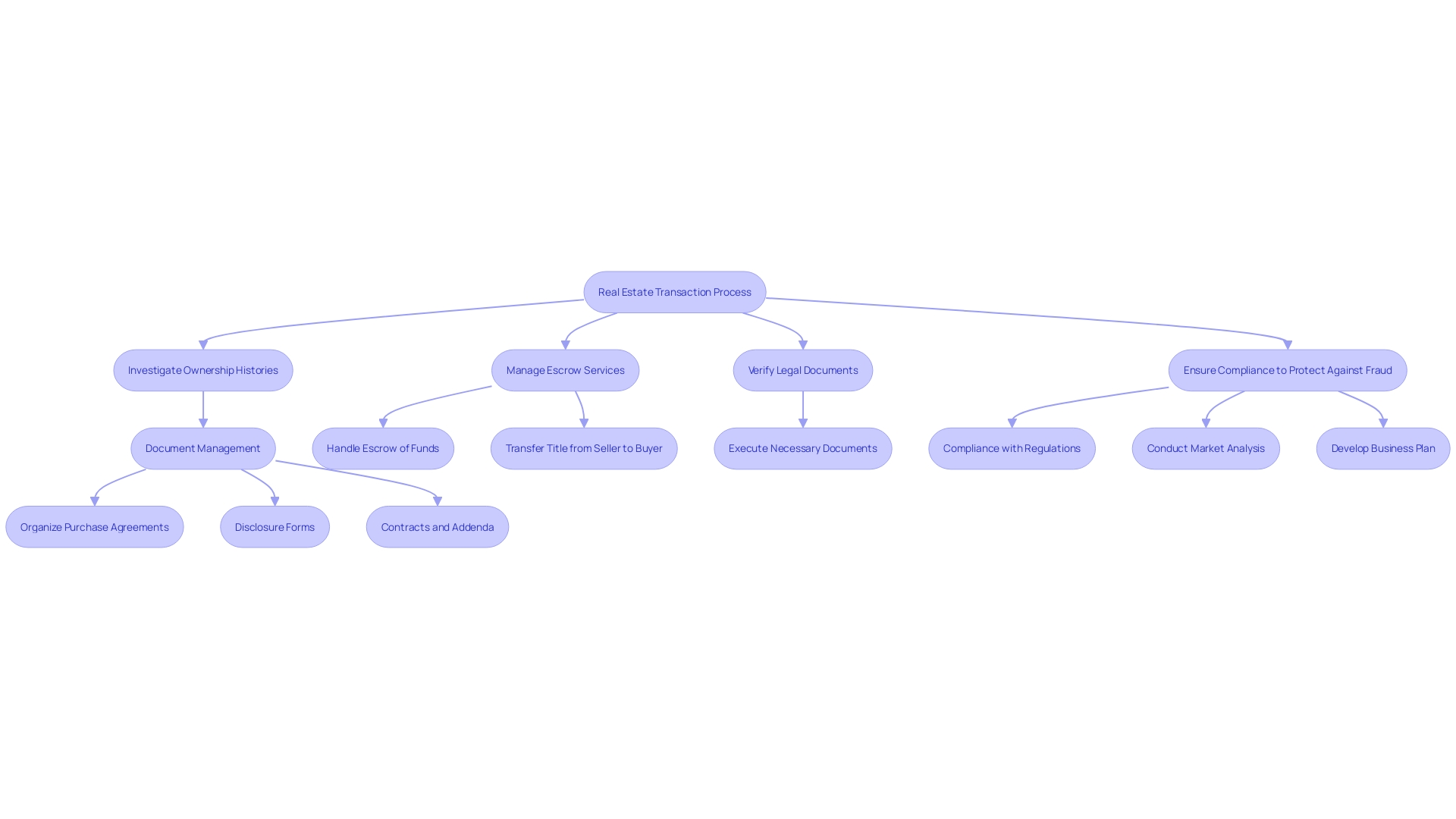

play pivotal roles in real estate transactions by ensuring a smooth and secure process from start to finish. Entities specializing in property transactions are accountable for investigating ownership histories to verify that there are no outstanding claims or liens on the asset, thereby offering insurance to safeguard against possible legal conflicts. Their meticulous work behind the scenes is crucial for maintaining the integrity and security of property ownership.

' of the transaction, overseeing the funds until all conditions of the sale are fulfilled.'. This includes ensuring that property taxes are paid and the property remains insured, safeguarding the lender's interests. Escrow agents collaborate with all parties involved, including lenders, to review contracts, conduct inspections, and confirm ownership information, providing transparency and peace of mind.

The is crucial for a . They ensure that funds are properly distributed, legal documents are signed, and all requirements are fulfilled, protecting the interests of buyers, sellers, and lenders alike. This partnership is especially significant in today's difficult market, where occurrences of wire fraud and financial losses have risen, compelling these organizations to adjust and assume new responsibilities to endure.

Recent industry challenges have highlighted the essential function of deed and settlement firms. For example, the situation concerning Riverside Abstract and other firms highlighted the significance of rigorous document verification procedures to avoid fraud. Despite not being named as defendants, their involvement in a mortgage fraud conspiracy brought significant scrutiny, emphasizing the need for rigorous compliance and due diligence.

In general, title and settlement firms are essential in property dealings, making certain that every phase is managed with accuracy and attention to safeguard all participants involved.

The Importance of Title and Escrow in Real Estate Transactions

Title and settlement firms are vital to the , as they verify and securely manage all . These organizations instill confidence in buyers and sellers, making the process smoother and minimizing the potential for fraud or miscommunication. Their roles are particularly important in protecting buyers from inheriting previous owners’ debts or claims. For instance, the industry's essential news magazine reports that the housing market has slowed considerably, which has led to an increase in wire fraud and financial losses. have had to adapt to these challenges by taking on new lines of business to keep their doors open. Furthermore, they play an essential role in guaranteeing that property ownership is not challenged due to missed ownership searches, boundary line disputes, or fraud and forgery. As stated by First American Financial Corporation, a prominent supplier of ownership, settlement, and risk solutions, their groundbreaking proprietary technologies and unparalleled data assets are driving the digital evolution of the sector, further improving the security and efficiency of property transactions.

Benefits of Using a Combined Title and Escrow Company

Employing a joint agency for can greatly simplify the . By consolidating services into one entity, clients benefit from enhanced communication and efficiency, reducing the likelihood of errors or delays. Such integration provides cost reductions and a more coordinated experience, as both property searches and are managed under one roof, simplifying the overall process for buyers, sellers, and . In a challenging market, where wire fraud and have surged, adopting an integrated approach can be crucial for maintaining operational efficiency and ensuring compliance with regulatory requirements. This unified model has gained traction, evidenced by industry leaders like First American Financial Corporation, which has been recognized for its , leading digital transformation in the industry.

Conclusion

In the realm of real estate transactions, title and escrow companies serve as foundational pillars, ensuring the legitimacy and security of property ownership transfers. Title companies meticulously research property histories, confirming ownership and identifying potential issues such as liens and disputes. Their provision of title insurance is critical, safeguarding buyers and lenders from unforeseen claims, which is particularly vital for those who may not have the resources to defend against such challenges.

Escrow companies complement this process by acting as neutral third parties that manage the financial elements of transactions. By holding funds and documents until all contractual obligations are met, they mitigate risks for all parties involved. This coordination is essential for facilitating secure property ownership and ensuring that lenders' interests are protected throughout the transaction.

The synergy between title and escrow companies is indispensable for a seamless closing process. Their collaboration not only provides transparency and peace of mind but also enhances the overall efficiency of real estate transactions. As the industry faces increasing challenges such as wire fraud, the roles of these companies become even more critical.

By adapting to evolving market conditions and embracing innovative solutions, title and escrow companies continue to protect the interests of buyers, sellers, and lenders, reinforcing the integrity of the real estate landscape.

Frequently Asked Questions

What is the primary role of naming organizations in real estate?

Naming organizations ensure the authenticity and transparency of property ownership by conducting thorough research on property histories, examining public records, and identifying any potential issues such as liens, boundary disputes, or fraud.

Why is ownership insurance important?

Ownership insurance protects buyers and lenders from potential claims on the property, ensuring that they are safeguarded against unexpected ownership disputes, which is especially crucial for lower-income buyers.

What services do title firms provide in real estate transactions?

Title firms perform detailed property searches, assess ownership histories, offer ownership insurance, manage the escrow process, and ensure compliance with local regulations. They also provide document services, including notary functions and legal paperwork preparation.

How do escrow services facilitate real estate transactions?

Escrow services act as neutral third parties that hold funds and documents until all contractual obligations are met. They ensure that property taxes are paid and insurance is maintained, which protects the interests of lenders and provides peace of mind to all parties involved.

What are the benefits of using a neutral third party in a real estate deal?

Using a neutral third party helps to reduce risks by ensuring that both buyers and sellers meet their responsibilities before funds are disbursed and property is transferred. This enhances transparency and trust throughout the transaction process.

What challenges are title and escrow firms currently facing?

Title and escrow firms are dealing with increased instances of wire fraud and financial losses, prompting them to adapt by taking on new responsibilities and integrating services to improve operational efficiency and compliance.

How does the SingleSource Attorney Conclusion of Title (ACT®) improve the process?

ACT® combines legal ownership assessments with summarized ownership proof, providing an efficient alternative to conventional ownership insurance and delivering cost savings for property owners.

Why is compliance with regulatory standards crucial for title firms?

Compliance ensures that title firms avoid legal disputes and maintain the integrity of property transactions, particularly in light of recent scrutiny concerning fraudulent activities within the industry.

How has the integration of services impacted the real estate transaction process?

Integrating property management services into one entity enhances communication and efficiency, reduces errors and delays, and provides a more coordinated experience for buyers, sellers, and real estate professionals.

What organizations are involved in advocating for the title insurance sector?

Organizations like the American Land Title Association (ALTA) actively participate in legal examination and advocacy efforts to maintain standards and ensure the reliability of insurance services within the property sector.