Overview

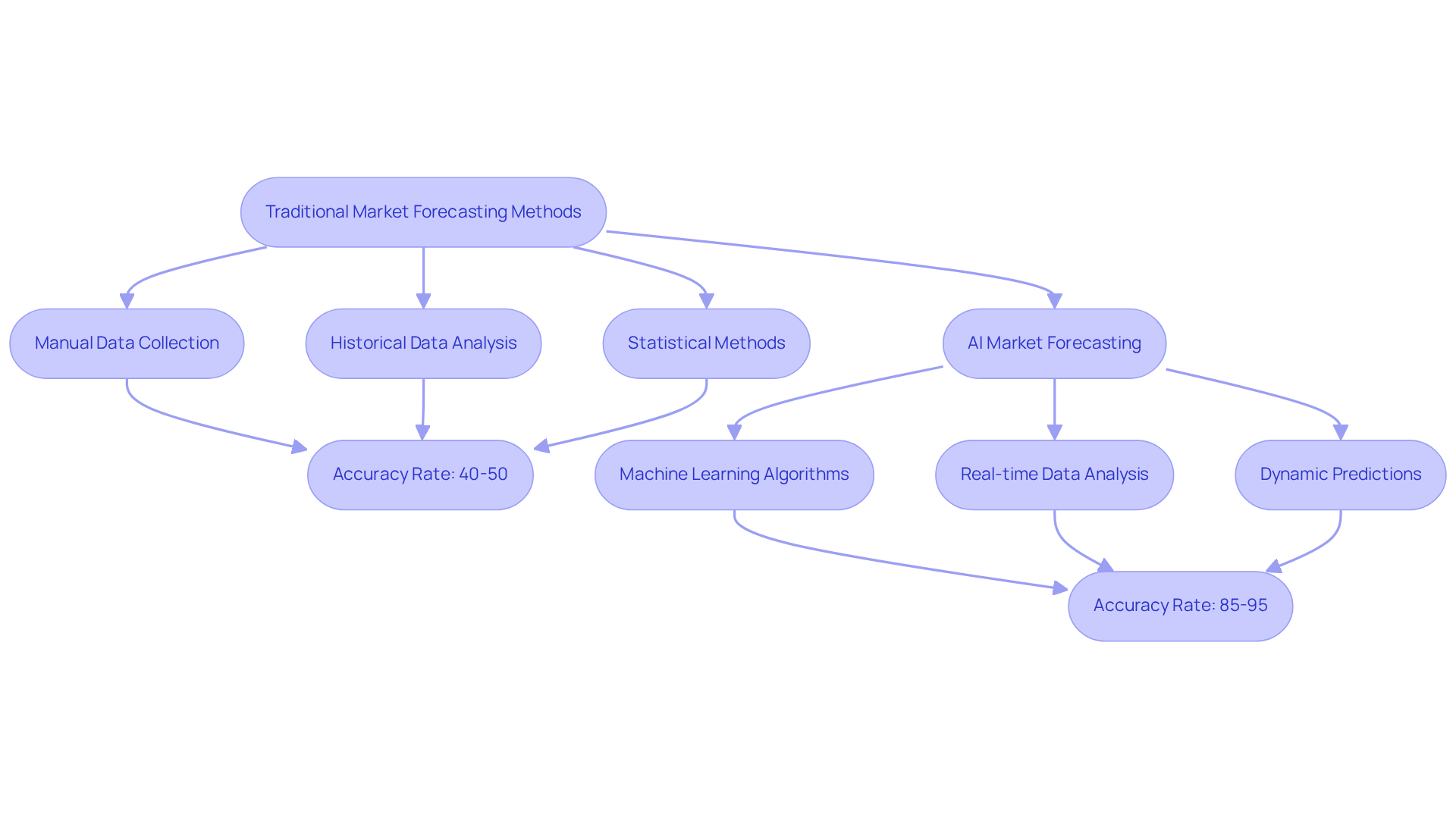

The article investigates the comparative advantages of AI over traditional market forecasting methods, asserting that AI markedly enhances accuracy, speed, and adaptability in predictions. It substantiates this claim with compelling evidence: organizations leveraging AI report accuracy rates ranging from 85% to 95% for cash flow estimates. This represents a significant improvement compared to the 40% to 50% accuracy typically associated with conventional methods. Additionally, AI facilitates faster processing times and generates notable cost savings.

Introduction

The landscape of market forecasting is evolving at an unprecedented pace, propelled by the rise of artificial intelligence (AI) and its remarkable capacity to process vast amounts of data with speed and accuracy. As businesses strive to navigate increasingly complex market dynamics, understanding the comparative effectiveness of AI versus traditional forecasting methods has become essential. This article explores the advantages AI offers—enhanced precision, efficiency, and adaptability—while also addressing the inherent challenges associated with its implementation.

Can AI truly outperform conventional techniques, or do traditional methods still retain their relevance in certain scenarios?

Understanding AI and Traditional Market Forecasting Methods

Conventional market prediction techniques primarily rely on historical data and statistical methods, such as time series analysis, regression models, and qualitative assessments. These methods often necessitate manual data collection and analysis, which can be labor-intensive and prone to human error. In contrast, using AI for market forecasting employs machine learning algorithms capable of analyzing extensive datasets to uncover patterns and trends. AI systems adeptly manage real-time data, adapt to new information, and refine their predictions over time, making them significantly more dynamic than traditional approaches.

For instance, while conventional methods might depend on a fixed set of variables, AI can incorporate a broader range of factors, including market sentiment and external economic indicators, leading to more nuanced predictions. Businesses that are using AI for market forecasting report accuracy rates ranging from 85% to 95% for short-term cash flow estimates, which is a substantial improvement over conventional methods that typically achieve only 40% to 50% accuracy. Furthermore, organizations utilizing predictive analytics for cash flow planning have experienced an enhancement in forecast accuracy, increasing from 40% to 50% to 65% to 85%.

A notable case study is Zara, which is known for using AI for market forecasting, resulting in a reduction of prediction errors by 20% to 50% compared to traditional techniques. This exemplifies how AI not only boosts prediction accuracy but also enhances overall business performance. As AI technology continues to evolve, using AI for market forecasting is expected to expand, offering organizations a powerful tool to navigate the complexities of modern economies more effectively than ever.

Advantages of AI in Market Forecasting

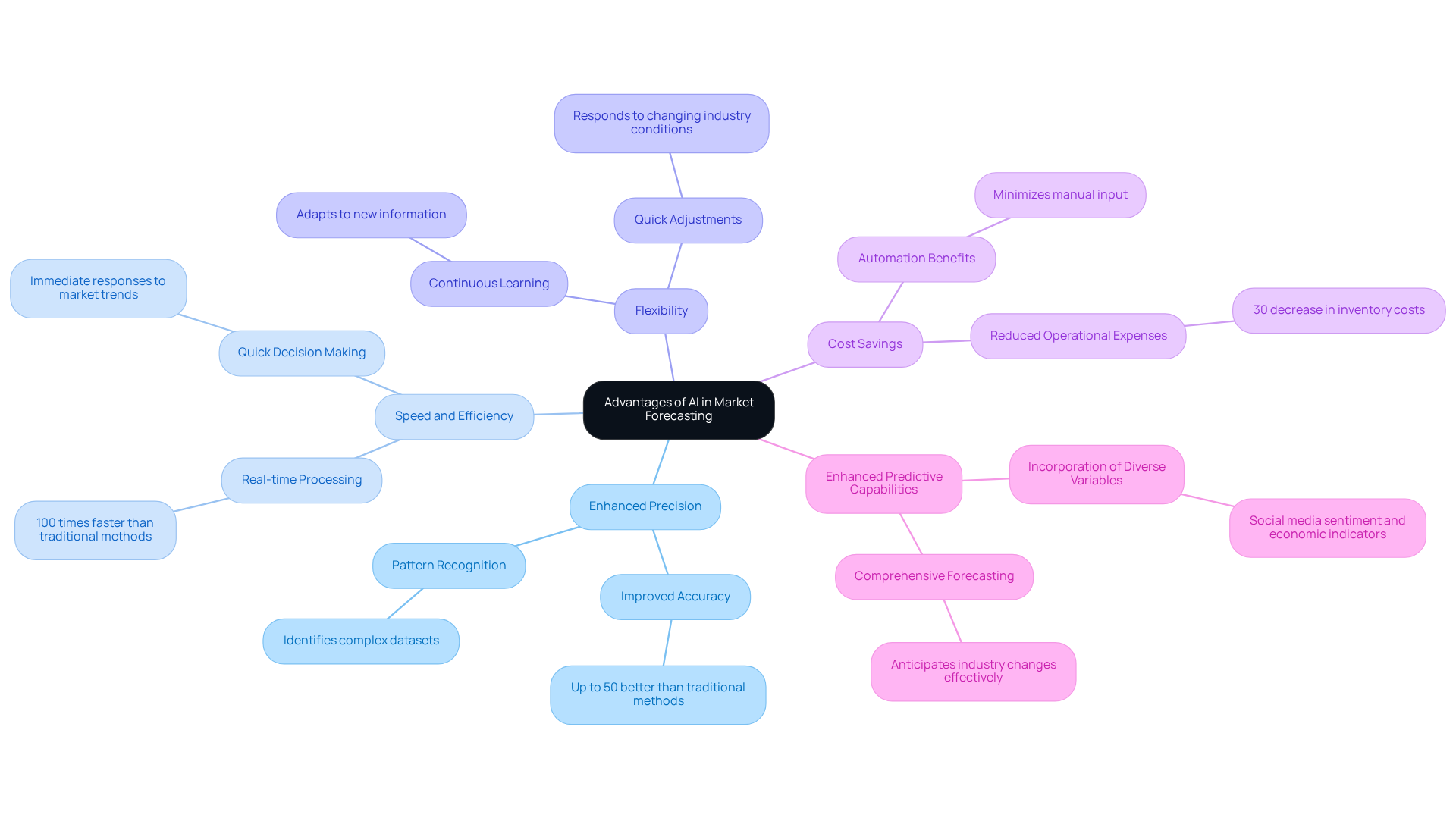

The advantages of using AI for market forecasting include enhanced precision, speed and efficiency, flexibility, cost savings, and improved predictive capabilities.

-

Enhanced Precision: AI algorithms excel at examining intricate datasets, revealing patterns that conventional techniques may overlook. Research indicates that using AI for market forecasting can enhance forecast accuracy by up to 50%, significantly outperforming traditional methods.

-

Speed and Efficiency: Capable of processing vast amounts of information in real-time, AI-driven financial tools operate up to 100 times faster than traditional methods, drastically reducing analysis time. This swift processing enables companies to make prompt decisions based on the most current industry trends, thereby improving their competitive advantage.

-

Flexibility: AI systems continuously learn from new information, allowing them to adjust their models in response to changing industry circumstances. This adaptability is crucial in volatile environments, where using AI for market forecasting can help achieve quick responses to mitigate risks and capitalize on opportunities.

-

Cost Savings: By automating data analysis and reducing the need for extensive manual input, AI significantly lowers operational expenses related to trend prediction. For instance, companies employing AI-driven predictions report up to a 30% decrease in inventory expenses, resulting in improved resource distribution and increased profitability.

-

Enhanced Predictive Capabilities: AI's ability to incorporate a broader range of variables, such as social media sentiment and economic indicators, leads to more comprehensive and nuanced forecasts. This holistic approach, using AI for market forecasting, enables businesses to anticipate changes in the industry more effectively, thereby driving informed decision-making.

Challenges and Limitations of AI Forecasting

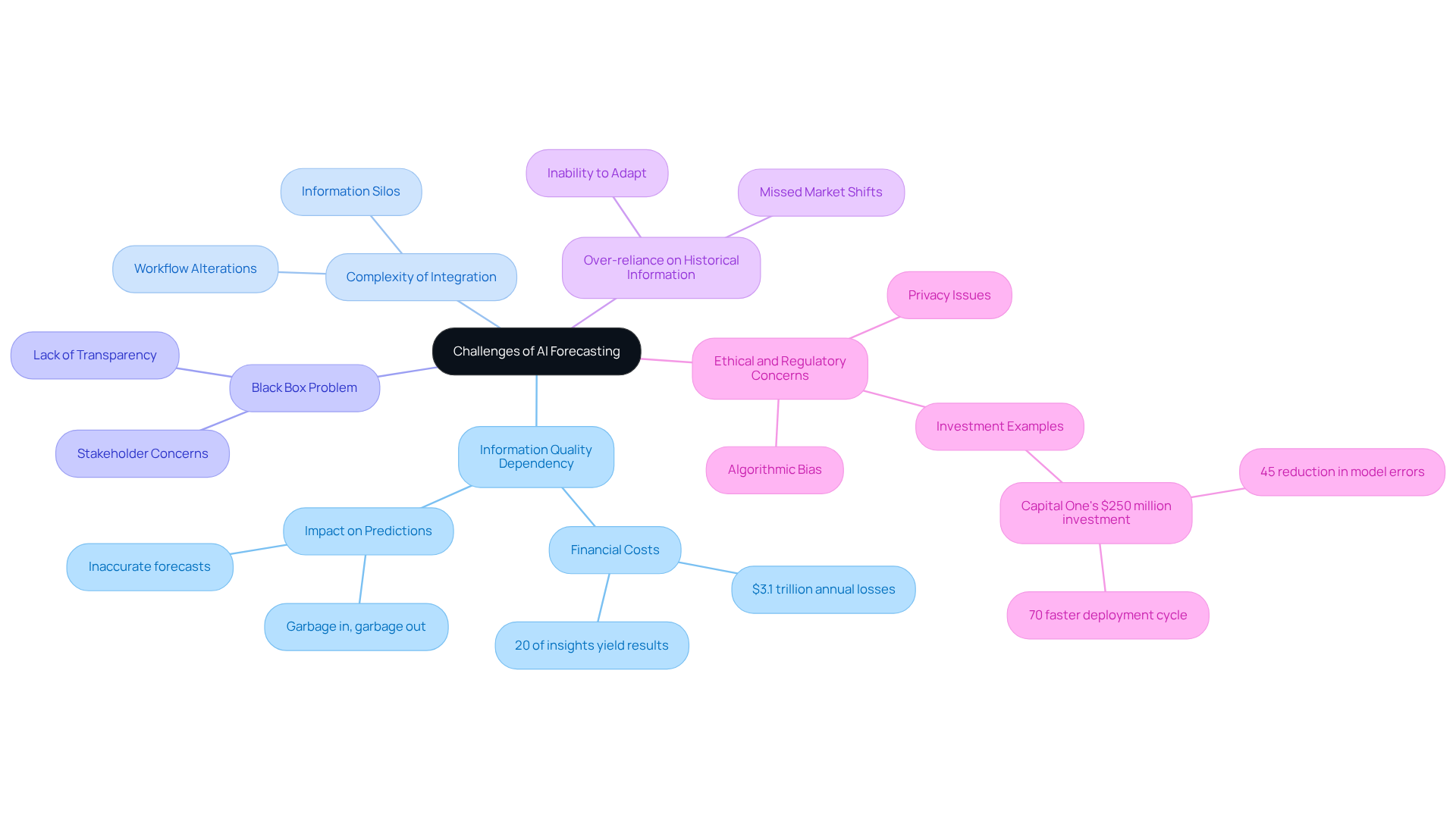

While AI presents notable advantages in market forecasting, it also faces several critical challenges:

-

Information Quality Dependency: The effectiveness of AI models hinges on the quality of the information they utilize. Flawed or irrelevant data can lead to inaccurate predictions, reinforcing the adage 'garbage in, garbage out.' Studies indicate that inadequate information quality costs U.S. companies approximately $3.1 trillion annually, underscoring the financial ramifications of neglecting information integrity. Furthermore, only 20% of analytics insights are expected to yield business results through 2022, illustrating the profound impact of information quality on business efficiency.

-

Complexity of Integration: Integrating AI systems into existing workflows can be complex, often requiring significant alterations to current processes and infrastructure. Organizations may encounter challenges related to information silos and inconsistent information standards, which can impede the timely implementation of AI solutions.

-

Black Box Problem: Many AI algorithms operate as 'black boxes,' obscuring the rationale behind their predictions. This lack of transparency raises concerns among stakeholders, particularly when decisions are founded on AI outputs that are difficult to interpret or validate.

-

Over-reliance on Historical Information: AI models frequently depend on historical data, which may not accurately reflect future market dynamics, especially in volatile environments. For example, models trained exclusively on past trends may overlook sudden shifts in consumer behavior or economic conditions, resulting in unreliable forecasts.

-

Ethical and Regulatory Concerns: The deployment of AI in prediction introduces ethical dilemmas concerning privacy and algorithmic bias. These issues can significantly affect decision-making processes and necessitate robust governance frameworks to ensure compliance with regulations and uphold stakeholder trust. Organizations like Capital One have demonstrated the importance of information quality by investing $250 million in quality infrastructure, leading to a 45% reduction in model errors and a 70% faster deployment cycle for new AI features.

Addressing these challenges is crucial for organizations aiming to achieve reliable results using AI for market forecasting, as the integration of high-quality data and clear processes is essential.

Comparative Effectiveness: AI vs. Traditional Methods in Market Applications

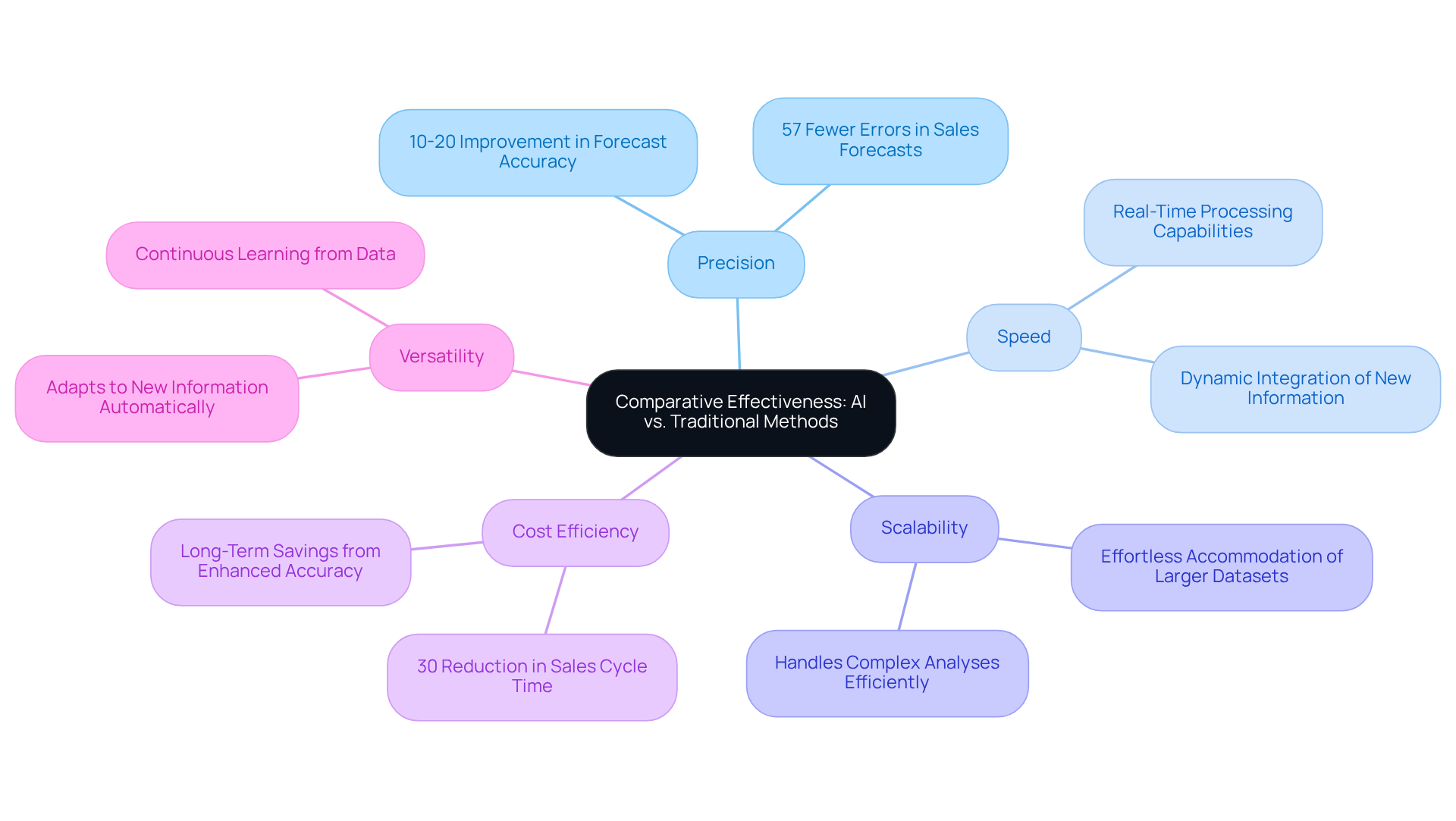

When evaluating the effectiveness of AI compared to traditional forecasting methods, several critical factors emerge:

-

Precision: AI consistently outperforms conventional approaches in accuracy, particularly in intricate environments with numerous variables. For instance, AI-driven models analyze consumer behavior patterns with greater precision than conventional statistical methods, leading to a reported 10-20% improvement in forecast accuracy for organizations adopting AI. Notably, companies leveraging AI report an average of 57% fewer errors in sales forecasts compared to those relying on spreadsheets.

-

Speed: The real-time processing abilities of AI allow businesses to respond to fluctuations much quicker than conventional approaches, which often require extensive collection and analysis periods. AI systems dynamically integrate new information, enabling faster modifications to predictions.

-

Scalability: AI systems are designed to scale effortlessly, accommodating larger datasets and more intricate analyses. In contrast, conventional approaches often struggle to handle growing information volumes, restricting their efficiency in swiftly changing environments.

-

Cost Efficiency: Although the initial investment in AI technology can be substantial, the long-term savings from reduced labor costs and enhanced accuracy typically outweigh these upfront expenses. Companies leveraging AI-powered revenue intelligence have reported a 30% reduction in sales cycle time, translating to significant cost savings. For instance, Danone decreased prediction error by 20% after adopting AI-driven analysis.

-

Versatility: AI's intrinsic ability to adjust to new information and changing commercial conditions provides a significant edge over conventional methods, which frequently require manual modifications to prediction models. This adaptability is essential in today's fast-moving business landscape, where dynamics can shift quickly. AI continuously learns from new data, refining its predictions as circumstances change.

In summary, although conventional prediction techniques have their advantages, the growing intricacy of market dynamics makes using AI for market forecasting a superior option for companies looking to enhance their predictive capabilities. As one industry expert noted, "Revenue growth in 2025 demands precision. AI forecasting isn't just a 'nice to have,' it's a competitive necessity.

Conclusion

The exploration of AI in market forecasting reveals a transformative potential that significantly surpasses traditional methods. By leveraging machine learning algorithms, businesses can harness real-time data to achieve unprecedented accuracy and adaptability in their predictions. This evolution in forecasting enhances decision-making and positions organizations to thrive in increasingly complex market environments.

Key advantages of AI, such as enhanced precision, speed, flexibility, cost savings, and improved predictive capabilities, underscore its value. Real-world examples, like Zara's substantial reduction in prediction errors, illustrate the tangible benefits of adopting AI-driven strategies. However, challenges accompany this technology, including data quality dependency, integration complexities, and ethical considerations that must be addressed.

Ultimately, the significance of embracing AI for market forecasting cannot be overstated. As industries evolve and consumer behaviors shift, organizations must prioritize innovative forecasting methods to remain competitive. The future of market predictions lies in the hands of those willing to adapt and invest in AI technologies, ensuring they are equipped to navigate the challenges and opportunities that lie ahead.

Frequently Asked Questions

What are traditional market forecasting methods based on?

Traditional market forecasting methods primarily rely on historical data and statistical techniques such as time series analysis, regression models, and qualitative assessments.

What are the limitations of conventional market prediction techniques?

Conventional methods often require manual data collection and analysis, which can be labor-intensive and prone to human error.

How does AI improve market forecasting compared to traditional methods?

AI employs machine learning algorithms to analyze extensive datasets, uncover patterns, manage real-time data, adapt to new information, and refine predictions over time, making them more dynamic than traditional approaches.

What types of data can AI incorporate for better predictions?

AI can incorporate a broader range of factors, including market sentiment and external economic indicators, leading to more nuanced predictions.

What accuracy rates do businesses report when using AI for market forecasting?

Businesses using AI for market forecasting report accuracy rates ranging from 85% to 95% for short-term cash flow estimates.

How does the accuracy of AI compare to conventional forecasting methods?

Conventional methods typically achieve only 40% to 50% accuracy, while AI significantly improves this accuracy.

What improvements have organizations seen in forecast accuracy when using predictive analytics?

Organizations utilizing predictive analytics for cash flow planning have seen forecast accuracy improve from 40% to 50% to 65% to 85%.

Can you provide an example of a company successfully using AI for market forecasting?

Zara is a notable example that uses AI for market forecasting, resulting in a reduction of prediction errors by 20% to 50% compared to traditional techniques.

What is the expected future of AI in market forecasting?

As AI technology continues to evolve, its use in market forecasting is expected to expand, providing organizations with a powerful tool to navigate the complexities of modern economies more effectively.